Neo and Challenger Bank Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428458 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Neo and Challenger Bank Market Size

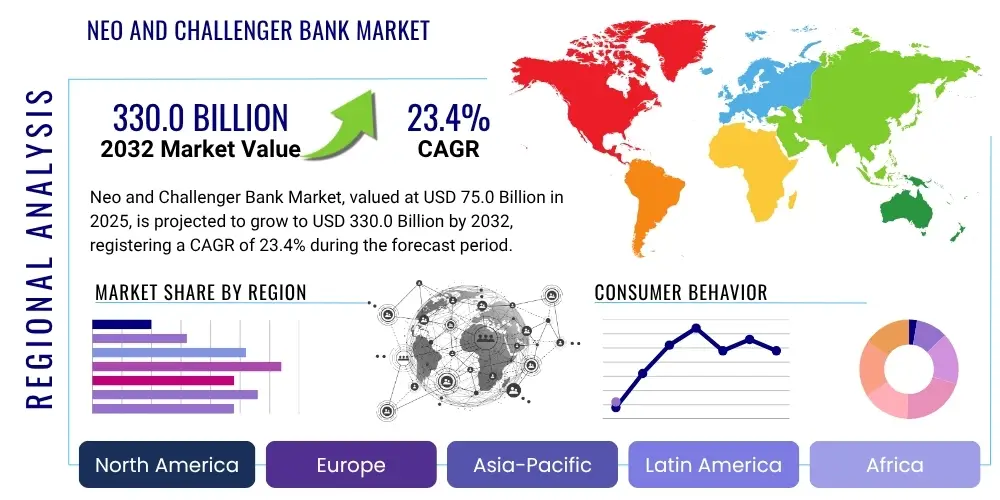

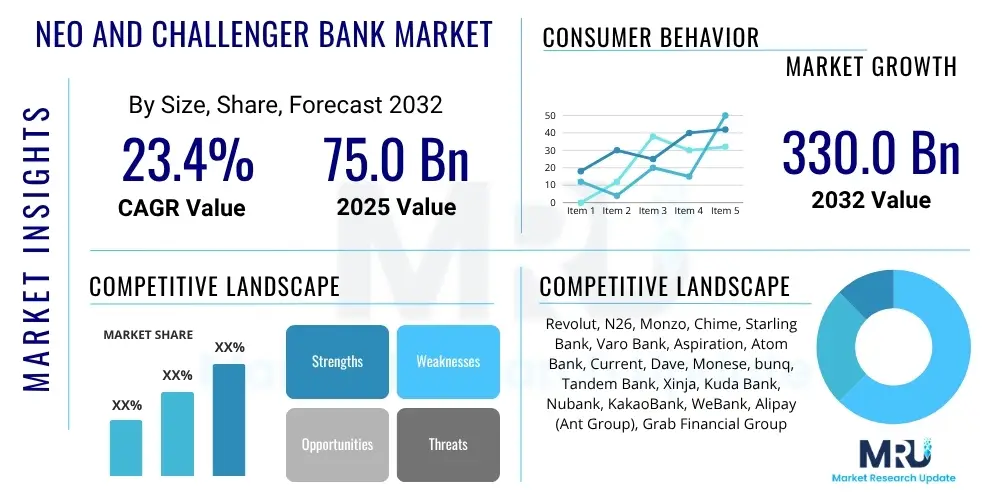

The Neo and Challenger Bank Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 23.4% between 2025 and 2032. The market is estimated at $75.0 Billion in 2025 and is projected to reach $330.0 Billion by the end of the forecast period in 2032.

Neo and Challenger Bank Market introduction

The Neo and Challenger Bank market represents a revolutionary shift in the financial services industry, characterized by digital-first financial institutions that leverage technology to offer banking services. These entities operate primarily online, often without physical branches, aiming to provide a more convenient, transparent, and user-centric banking experience. Unlike traditional banks, neo and challenger banks are typically built on modern tech stacks, allowing for agile product development and lower operational costs, which often translate into better rates or fewer fees for customers. This market is driven by increasing digital literacy, smartphone penetration, and a growing consumer demand for personalized and accessible banking solutions.

Products typically include current accounts, savings accounts, debit cards, and increasingly, specialized services such as lending, investment, and business banking solutions for Small and Medium Enterprises (SMEs). Major applications span personal finance management, cross-border payments, sophisticated budgeting tools, and secure digital transactions. The inherent benefits for users include 24/7 accessibility, highly intuitive mobile applications, personalized financial insights, faster transaction processing, and often superior customer support through digital channels. These banks are designed to cater to a digitally savvy generation, as well as underserved populations seeking modern banking solutions that traditional institutions often fail to provide efficiently.

Key driving factors fueling the market's expansion include the escalating global smartphone penetration, a growing demand for seamless digital experiences, dissatisfaction with the perceived inflexibility and high fees of incumbent banks, and supportive regulatory frameworks in many regions promoting fintech innovation. Furthermore, the inherent cost efficiencies of cloud-native infrastructure enable these banks to scale rapidly and offer competitive pricing, attracting a diverse customer base seeking modern, responsive, and affordable financial services. The emphasis on user experience and rapid feature deployment positions neo and challenger banks as significant disruptors within the global financial landscape, continually pushing the boundaries of conventional banking.

Neo and Challenger Bank Market Executive Summary

The Neo and Challenger Bank market is experiencing robust growth, primarily propelled by rapid technological advancements, evolving consumer expectations, and increasing digital adoption across various demographics. Business trends indicate a strong focus on niche market penetration, personalized service offerings, and the integration of advanced analytics to enhance customer satisfaction and operational efficiency. The ongoing acceleration of digital transformation, further fueled by global events, has cemented the relevance and necessity of digital-first banking models. Consolidation among smaller players and strategic partnerships with established fintechs are also emerging as key business strategies to expand market reach and service capabilities.

Regionally, Europe continues to lead the market, particularly with strong adoption in countries like the UK, Germany, and France, supported by progressive regulatory environments such as PSD2. The Asia Pacific region is demonstrating explosive growth, driven by a large unbanked population, high mobile-first adoption rates, and significant investments in fintech infrastructure, particularly in markets like India and Southeast Asia. North America shows consistent innovation, with challenger banks often targeting specific segments or offering specialized financial products. Latin America and the Middle East & Africa also present substantial opportunities due to large underserved populations and increasing government initiatives supporting digital financial inclusion.

Segmentation trends highlight the dominance of the retail banking segment, which continues to attract a vast user base through convenient current and savings accounts. However, the business banking segment, particularly catering to Small and Medium Enterprises (SMEs) and freelancers, is showing accelerated growth as these entities seek more flexible and digital-native financial tools. The market is also seeing increased adoption of Artificial Intelligence and Machine Learning for enhanced personalization and fraud detection, alongside a growing emphasis on open banking integration, which allows for seamless data exchange and the creation of comprehensive financial ecosystems. The competitive landscape remains dynamic, with new entrants continually challenging established players.

AI Impact Analysis on Neo and Challenger Bank Market

Common user questions regarding AI's impact on the Neo and Challenger Bank market often revolve around enhanced personalization, improved security, automated customer service, and overall operational efficiency. Users are curious about how AI can make their banking experience more intuitive, prevent fraud, and provide tailored financial advice. Concerns frequently include data privacy, algorithmic bias in lending decisions, and the potential for AI to depersonalize interactions. Based on these inquiries, the key themes are centered on AI's capacity to revolutionize customer interaction, streamline back-office operations, and bolster security measures, while also necessitating stringent ethical guidelines and robust data protection frameworks. Users expect AI to deliver superior service but demand transparency and fairness.

- Personalized product recommendations and financial advice powered by AI algorithms analyzing spending patterns.

- Advanced fraud detection and prevention systems using machine learning to identify anomalous transactions in real-time.

- Automated customer support via AI-driven chatbots and virtual assistants, providing instant query resolution 24/7.

- Enhanced credit scoring and risk assessment models, leveraging AI to evaluate a broader range of data points for fairer lending.

- Operational efficiency improvements through Robotic Process Automation (RPA) in back-office tasks like reconciliation and compliance.

- Data-driven insights for strategic decision-making, optimizing marketing campaigns and product development based on user behavior.

- Predictive analytics for anticipating customer needs and potential churn, allowing proactive engagement strategies.

DRO & Impact Forces Of Neo and Challenger Bank Market

The Neo and Challenger Bank market is fundamentally driven by the accelerating global adoption of digital technologies and an overwhelming consumer preference for seamless, user-centric financial services. These digital-first banks capitalize on the growing dissatisfaction with traditional banking models, offering enhanced convenience, lower fees, and superior mobile experiences. However, the market faces significant restraints, including complex and evolving regulatory landscapes that require substantial compliance efforts, alongside persistent challenges related to cybersecurity threats and the critical need to build and maintain customer trust without physical presence. These factors create a high barrier to entry and require continuous investment in robust security and compliance infrastructure.

Opportunities within this dynamic market are vast, particularly in addressing underserved customer segments such as freelancers, SMEs, and previously unbanked populations, where traditional banks often fall short. Emerging markets present fertile ground for growth due to their high smartphone penetration and relatively lower penetration of traditional banking services. Furthermore, the expansion of embedded finance, where banking services are integrated directly into non-financial platforms, offers new avenues for market penetration and collaboration. The ongoing innovation in niche product development, leveraging advanced data analytics and AI, enables these banks to create highly specialized offerings that cater to specific customer needs, further differentiating them from conventional financial institutions.

The impact forces shaping the Neo and Challenger Bank market are primarily technological advancements, which continuously redefine what is possible in digital banking, from AI-driven personalization to blockchain for secure transactions. Regulatory changes, such as open banking initiatives, profoundly influence market structure and competitive dynamics by fostering interoperability and innovation. Shifts in consumer behavior, particularly towards mobile-first interactions and a demand for instant gratification, directly impact product design and service delivery. Economic conditions, including interest rates and inflation, affect profitability and investment in fintech. Lastly, the intensely competitive landscape, with new entrants and evolving business models, constantly pushes banks to innovate and adapt, ensuring a continuous evolution of the market.

Segmentation Analysis

The Neo and Challenger Bank market is extensively segmented across various dimensions, reflecting the diverse operational models, target customer bases, and technological foundations that define these innovative financial institutions. This segmentation allows for a nuanced understanding of market dynamics, competitive positioning, and growth opportunities within specific niches. The primary segmentation criteria typically include the type of bank, the array of services offered, the specific end-users or customer demographics targeted, and the underlying technological stacks employed. Each segment exhibits unique growth drivers and challenges, underscoring the fragmented yet rapidly expanding nature of the digital banking ecosystem.

Understanding these segments is crucial for stakeholders to identify lucrative areas for investment, product development, and strategic partnerships. For instance, some neo banks might focus exclusively on retail consumers with basic current accounts, while others might specialize in lending for small businesses, leveraging advanced AI-driven credit assessment. The technological segmentation highlights the critical role of cloud computing for scalability, AI for personalization, and blockchain for security and efficiency in different banking processes. This granular analysis provides a roadmap for market participants to tailor their offerings effectively, penetrate specific customer groups, and differentiate themselves in an increasingly crowded and competitive digital finance landscape.

- Type:

- Neo Banks (fully digital, often without a traditional banking license, relying on partnerships)

- Challenger Banks (fully digital, hold a full banking license)

- Service:

- Payments (Current Accounts, Debit Cards, Money Transfers)

- Savings Accounts

- Lending (Personal Loans, SME Loans, Credit Cards)

- Investments (Robo-advisory, Micro-investing)

- Other Services (Budgeting Tools, Foreign Exchange, Insurance)

- End-User:

- Retail Customers (Individuals, Consumers)

- Business Customers (Small and Medium Enterprises (SMEs), Freelancers, Startups)

- Technology:

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain Technology

- Cloud Computing

- Open Banking APIs

- Biometrics and Advanced Security

Value Chain Analysis For Neo and Challenger Bank Market

The value chain for the Neo and Challenger Bank market is distinct from traditional banking, being heavily reliant on technology and partnerships across its upstream and downstream activities. Upstream, the value chain begins with technology infrastructure providers, including cloud service platforms (e.g., AWS, Microsoft Azure, Google Cloud) that offer scalable and secure computing resources, essential for the agile and cost-efficient operations of digital banks. This also encompasses providers of specialized fintech solutions such as KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance tools, advanced data analytics platforms, and AI/ML engines that power personalization and fraud detection. These upstream partners are critical enablers, providing the foundational technological backbone and specialized services that allow neo and challenger banks to operate without extensive in-house infrastructure.

Downstream, the value chain extends to various partnerships that enable a comprehensive financial ecosystem. This includes integration with established payment networks (e.g., Visa, Mastercard) for card issuance and transaction processing, collaboration with credit bureaus for accurate risk assessment, and alliances with other fintechs or third-party service providers for specialized offerings like insurance, investment platforms, or international remittances. The distribution channel for neo and challenger banks is overwhelmingly direct, primarily through highly intuitive mobile applications and web platforms, allowing for direct engagement with end-users. However, indirect channels are also emerging through strategic embedded finance partnerships, where banking services are integrated into non-financial applications or e-commerce platforms, reaching customers where they already are.

This dual approach to distribution, focusing on direct digital engagement while also exploring indirect integration points, underscores the market's adaptability. Direct channels emphasize a seamless user experience and proprietary brand building, leveraging the convenience of a mobile-first approach. Indirect channels, conversely, enable broader market penetration by making financial services ubiquitous and contextually relevant within other digital experiences. The lean operational model facilitated by this value chain allows neo and challenger banks to maintain lower operating costs compared to traditional banks, translating into more competitive pricing and higher efficiency. This interconnected ecosystem of technology providers, financial partners, and diverse distribution channels is fundamental to the agility, innovation, and growth of the Neo and Challenger Bank market.

Neo and Challenger Bank Market Potential Customers

The primary end-users and buyers of Neo and Challenger Bank services are diverse, encompassing a broad spectrum of individuals and businesses who prioritize digital convenience, cost efficiency, and enhanced user experience over traditional banking models. A significant segment comprises digitally native millennials and Generation Z, who are accustomed to mobile-first interactions and expect seamless, intuitive digital services in all aspects of their lives, including banking. These demographics often seek banking solutions that are easily accessible, transparent in fees, and offer personalized insights into their financial health. They are less bound by brand loyalty to traditional institutions and more open to innovative alternatives that align with their digital lifestyles and values.

Another rapidly growing customer segment includes Small and Medium Enterprises (SMEs), freelancers, and startups. These businesses often find traditional banks inflexible, slow, and expensive, especially concerning loan applications, cross-border payments, and day-to-day financial management. Neo and challenger banks cater to these needs by offering streamlined business accounts, integrated payment solutions, efficient lending products tailored for small businesses, and intuitive expense management tools. The agility and specialization offered by these digital banks provide significant advantages to entrepreneurs and small business owners seeking modern, efficient, and cost-effective financial partners that can scale with their operations without the bureaucratic hurdles of incumbent banks.

Furthermore, neo and challenger banks are increasingly attracting the unbanked and underbanked populations, particularly in emerging markets where access to traditional banking services is limited or prohibitive. By offering simple, low-cost accounts that can be opened and managed entirely through a smartphone, these digital banks play a crucial role in promoting financial inclusion. Migrants, individuals with irregular incomes, and those seeking basic financial services without extensive documentation requirements also form a substantial part of the potential customer base. The appeal lies in their accessibility, often lower fees, and simplified onboarding processes, making modern financial services available to a broader segment of the global population who may have previously been excluded from the formal banking system.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $75.0 Billion |

| Market Forecast in 2032 | $330.0 Billion |

| Growth Rate | 23.4% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Revolut, N26, Monzo, Chime, Starling Bank, Varo Bank, Aspiration, Atom Bank, Current, Dave, Monese, bunq, Tandem Bank, Xinja, Kuda Bank, Nubank, KakaoBank, WeBank, Alipay (Ant Group), Grab Financial Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neo and Challenger Bank Market Key Technology Landscape

The Neo and Challenger Bank market is fundamentally shaped by an advanced and evolving technology landscape, leveraging cutting-edge innovations to deliver their digital-first services. Cloud computing forms the bedrock of these operations, providing unparalleled scalability, flexibility, and cost efficiency. By hosting their infrastructure on public or private cloud platforms, these banks can rapidly deploy new features, manage fluctuating customer demands, and reduce the significant capital expenditure associated with traditional banking IT systems. This cloud-native approach enables them to operate with agility, a key differentiator against incumbent financial institutions burdened by legacy systems.

Artificial Intelligence (AI) and Machine Learning (ML) are central to enhancing customer experience and operational intelligence. These technologies power personalized financial advice, sophisticated fraud detection algorithms that identify suspicious activities in real-time, and intelligent chatbots for automated customer support. AI-driven analytics also provide deep insights into customer behavior, enabling targeted marketing, optimized product offerings, and more accurate credit risk assessments. Furthermore, Open Banking APIs (Application Programming Interfaces) are crucial, facilitating seamless integration with third-party fintech providers and enabling a richer ecosystem of services, from budgeting tools to investment platforms, fostering greater innovation and interoperability across the financial sector.

Beyond AI and cloud, other significant technologies include blockchain for enhanced security and transparency, particularly in cross-border payments and record-keeping, although its widespread adoption in core banking systems is still evolving. Biometric authentication (e.g., fingerprint, facial recognition) ensures robust security for user access and transactions, replacing traditional passwords. Robotic Process Automation (RPA) streamlines back-office operations, reducing manual errors and improving efficiency in tasks like data entry and compliance checks. These interconnected technologies collectively enable neo and challenger banks to offer a secure, highly personalized, efficient, and user-friendly banking experience that stands apart from conventional financial services.

Regional Highlights

- North America: Characterized by high fintech investment and a competitive landscape, with challenger banks often targeting specific demographics or niche financial needs, such as gig economy workers or sustainable banking. Rapid innovation in mobile-first experiences and embedded finance.

- Europe: A pioneering market for neo and challenger banks, driven by supportive regulations like PSD2 and strong consumer demand for digital banking in the UK, Germany, and the Nordic countries. High market penetration and a mature ecosystem with established players.

- Asia Pacific (APAC): Experiencing explosive growth due to a large unbanked population, high smartphone penetration, and a mobile-first consumer base. Significant markets include India, Southeast Asia, and China, with strong government support for digital transformation and financial inclusion initiatives.

- Latin America: Offers substantial opportunities for financial inclusion, with a rapidly growing number of digital-savvy consumers and SMEs. Countries like Brazil and Mexico are seeing significant adoption of neo banks, addressing gaps left by traditional banking infrastructure.

- Middle East and Africa (MEA): A nascent but rapidly expanding market, fueled by young, digitally literate populations and increasing government efforts to promote digital economies. Opportunities exist in bridging the financial inclusion gap and offering innovative solutions tailored to local market needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neo and Challenger Bank Market.- Revolut

- N26

- Monzo

- Chime

- Starling Bank

- Varo Bank

- Aspiration

- Atom Bank

- Current

- Dave

- Monese

- bunq

- Tandem Bank

- Xinja

- Kuda Bank

- Nubank

- KakaoBank

- WeBank

- Alipay (Ant Group)

- Grab Financial Group

Frequently Asked Questions

What defines a Neo or Challenger Bank?

Neo and Challenger Banks are digital-first financial institutions that operate primarily online, offering banking services through mobile apps and web platforms without physical branches. Neo banks typically partner with licensed banks, while challenger banks often hold their own full banking license.

How do these banks differ from traditional banks?

Neo and Challenger Banks differentiate themselves through a digital-only presence, lower operational costs, often leading to reduced fees, superior mobile-first user experiences, rapid product innovation, and personalized services driven by advanced technology like AI.

What are the main advantages for customers?

Customers benefit from 24/7 accessibility, intuitive mobile applications, personalized financial insights, faster transaction processing, often lower fees, and enhanced convenience compared to traditional banking services.

What are the primary risks or challenges they face?

Key challenges include navigating complex and evolving regulatory compliance, mitigating cybersecurity threats, building and maintaining customer trust without a physical presence, intense competition, and the constant need for capital investment to scale and innovate.

What is the future outlook for the Neo and Challenger Bank market?

The market is poised for continued strong growth, driven by increasing digital adoption, demand for personalized and efficient services, and expanding financial inclusion. Future trends include greater integration of AI, embedded finance, and targeted expansion into underserved and emerging markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Neo And Challenger Bank Market Size Report By Type (Neo Bank, Challenger Bank, Small Challenger, Large Challenger), By Application (Personal, Business), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Neo and Challenger Bank Market Size Report By Type (Neobanks, Challenger Banks), By Application (Personal Consumers, Business Organizations), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Neo and Challenger Bank Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Neo Bank, Challenger Bank), By Application (Personal, Business), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager