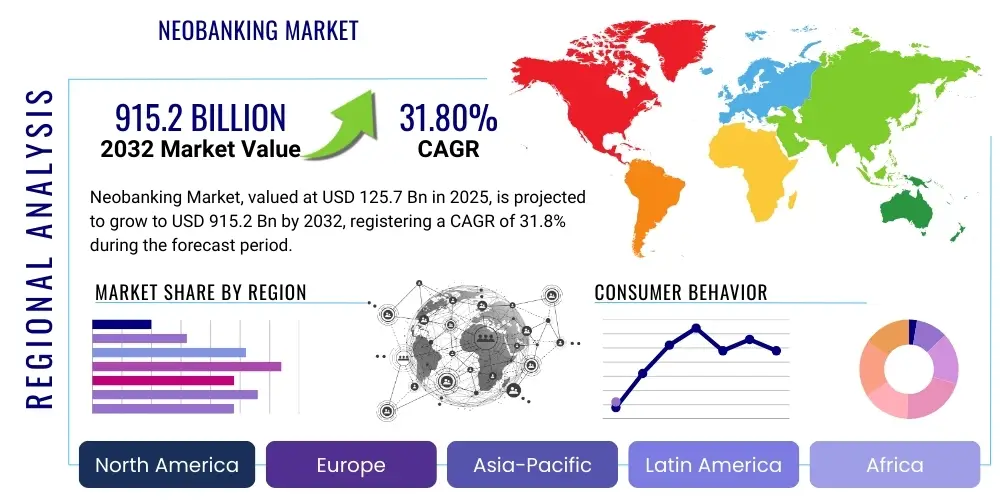

Neobanking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427807 | Date : Oct, 2025 | Pages : 244 | Region : Global | Publisher : MRU

Neobanking Market Size

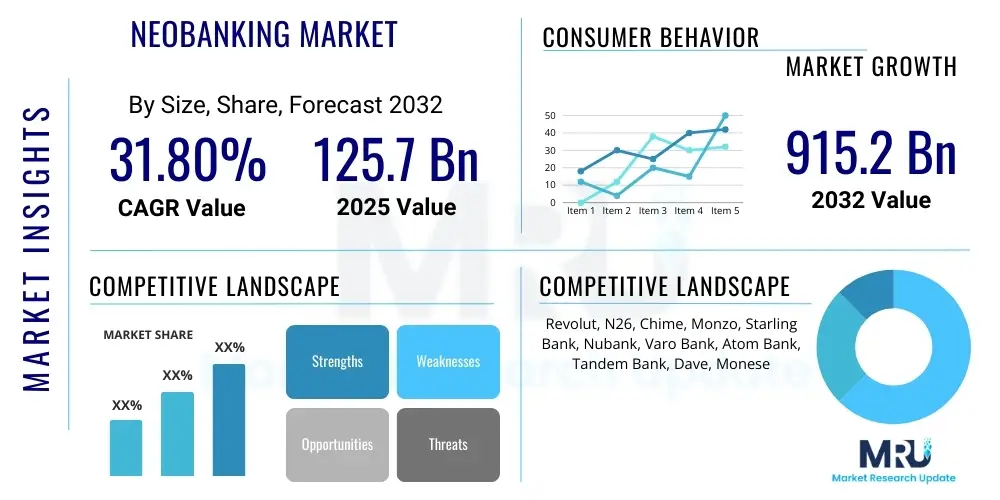

The Neobanking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 31.8% between 2025 and 2032. The market is estimated at USD 125.7 Billion in 2025 and is projected to reach USD 915.2 Billion by the end of the forecast period in 2032.

Neobanking Market introduction

The Neobanking Market represents a transformative shift in the financial services industry, offering a fully digital banking experience without traditional physical branches. These challenger banks leverage cutting-edge technology, including artificial intelligence, machine learning, and cloud computing, to provide agile, customer-centric, and cost-effective financial solutions. Neobanks typically offer a range of services such as current accounts, savings accounts, instant payment processing, international money transfers, and advanced budgeting tools, all accessible through intuitive mobile applications. Their core value proposition revolves around enhanced convenience, transparency, lower fees, and personalized services, catering particularly to tech-savvy individuals, millennials, Gen Z, and small to medium-sized enterprises (SMEs) seeking modern banking alternatives.

The product description of neobanking services extends beyond basic transactions, encompassing sophisticated financial management features like real-time spending insights, expense categorization, and savings goals automation. Major applications include everyday banking, cross-border payments, micro-lending, and specialized accounts for freelancers or digital nomads. The inherent benefits for users are numerous, including unparalleled accessibility, faster transaction processing, often superior exchange rates for international payments, and a generally more engaging user experience compared to traditional banks. For businesses, neobanks offer streamlined payroll, expense management, and integrated accounting solutions, often at a lower operational cost.

Several driving factors fuel the rapid expansion of the Neobanking Market. Foremost among these is the escalating demand for digital-first financial services, propelled by high smartphone penetration and the increasing comfort of consumers with online transactions. Regulatory initiatives like Open Banking frameworks, which encourage data sharing and collaboration within the financial ecosystem, have also significantly lowered barriers to entry for neobanks and fostered innovation. Furthermore, the dissatisfaction of many customers with the rigidity, high fees, and often outdated technology of incumbent banks has created a fertile ground for neobanks to capture market share. The ability of neobanks to offer highly personalized services and a seamless user experience, underpinned by advanced analytics, continues to be a major catalyst for their accelerated adoption globally.

Neobanking Market Executive Summary

The Neobanking Market is characterized by dynamic business trends, marked by aggressive customer acquisition strategies, diversification of service offerings, and increasing partnerships with established financial institutions and fintech companies. Neobanks are rapidly evolving from offering basic transactional services to comprehensive financial ecosystems that include credit products, investment opportunities, and even insurance, challenging traditional banks across multiple fronts. A significant trend involves the focus on profitability and sustainable business models, moving beyond pure growth at all costs, leading to consolidation and strategic acquisitions within the sector. Furthermore, the adoption of specialized niche strategies, targeting specific demographics or business types (e.g., freelancers, specific industry SMEs), is becoming more prevalent, allowing neobanks to carve out distinct market positions and address unmet needs more effectively.

Regionally, the market exhibits diverse growth patterns and competitive landscapes. Europe, particularly the UK and Germany, remains a pioneering hub for neobanking, benefiting from progressive regulatory environments and high digital adoption rates. The Asia-Pacific region, fueled by massive untapped populations and burgeoning digital economies in countries like India, Indonesia, and Singapore, is experiencing explosive growth, often driven by the need for financial inclusion. North America, while slower initially due to a more entrenched traditional banking system, is now seeing accelerated growth, with significant investment in challengers like Chime and Varo. Latin America, especially Brazil with players like Nubank, is a high-potential market due to a large unbanked or underbanked population and rapid smartphone adoption, offering fertile ground for neobanks to address significant market gaps.

In terms of segments, the retail neobanking segment continues to dominate, driven by individual consumers seeking modern, convenient, and low-cost banking solutions. However, the business neobanking segment, catering to SMEs, startups, and freelancers, is emerging as a critical growth area, offering tailored solutions for expense management, invoicing, and simplified accounting integrations. Technology-driven segments, such as those leveraging advanced analytics for personalized financial advice or AI for automated customer service, are also witnessing substantial investment and innovation. The rise of B2B2C models, where neobanks power embedded finance solutions for non-financial companies, represents another key segment trend, indicating a broader integration of neobanking capabilities across various industries and consumer touchpoints.

AI Impact Analysis on Neobanking Market

Users frequently inquire about how artificial intelligence is transforming the neobanking landscape, focusing on its ability to enhance personalization, improve security, automate operations, and expand accessibility. Key themes revolve around whether AI can make financial services more intuitive and tailored to individual needs, how it contributes to fraud prevention in a digital-only environment, and its role in streamlining customer interactions. There is also a strong interest in AIs capacity to facilitate better financial decision-making for consumers through advanced analytics and to extend banking services to underserved populations by refining credit assessment models. Expectations are high for AI to deliver a seamless, intelligent, and secure banking experience that surpasses traditional offerings.

- Enhanced Personalization: AI algorithms analyze spending patterns, income, and financial goals to offer tailored budgeting advice, personalized savings plans, and suitable product recommendations, making banking more relevant to individual customer lifestyles.

- Advanced Fraud Detection and Security: Machine learning models continuously monitor transactions for anomalies and suspicious activities in real-time, significantly improving the speed and accuracy of fraud detection and prevention, thereby bolstering the security posture of digital banking.

- Automated Customer Service: AI-powered chatbots and virtual assistants provide instant, 24/7 support for routine inquiries, transaction assistance, and basic problem-solving, freeing human agents for more complex issues and enhancing overall customer satisfaction.

- Credit Scoring and Financial Inclusion: AI can process alternative data sources to assess creditworthiness for individuals and small businesses with limited traditional credit histories, expanding access to financial services for previously underserved or unbanked populations.

- Operational Efficiency and Cost Reduction: AI automates back-office processes such as data entry, compliance checks, and reconciliation, leading to significant reductions in operational costs, improved accuracy, and faster processing times for various banking operations.

- Predictive Analytics for Risk Management: AI enables neobanks to predict potential financial risks, anticipate market trends, and make proactive decisions regarding investments, lending, and liquidity management, leading to more robust risk management frameworks.

- Seamless Onboarding and KYC: AI-driven solutions accelerate identity verification and Know Your Customer (KYC) processes through facial recognition, document scanning, and fraud checks, ensuring a faster, more secure, and compliant customer onboarding experience.

DRO & Impact Forces Of Neobanking Market

The Neobanking Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and a variety of Impact Forces that dictate its growth trajectory and competitive dynamics. Key drivers include the pervasive digital transformation across all sectors, the growing consumer demand for personalized and convenient financial services, and the inherent cost efficiencies of a branchless operating model. These factors push neobanks to innovate rapidly, leveraging technology to deliver superior user experiences and attract a customer base increasingly disenfranchised by the traditional banking landscape. The regulatory push for Open Banking and API-driven financial services further accelerates this shift, creating an environment ripe for new entrants and innovative solutions, while also fostering greater competition among both traditional and challenger banks.

Conversely, significant restraints temper the markets explosive growth. Primary among these are the stringent and evolving regulatory compliance requirements, particularly concerning anti-money laundering (AML) and Know Your Customer (KYC) regulations, which can be resource-intensive for digital-only entities. Cybersecurity threats and data privacy concerns represent persistent challenges, as consumer trust is paramount in financial services, and any breach can severely erode credibility. The intense competition from both established banks (who are increasingly digitalizing their offerings) and a multitude of other fintech startups creates pressure on profitability and customer acquisition costs. Furthermore, the inherent challenge of building widespread trust without a physical presence, combined with the perception of limited product offerings compared to full-service incumbent banks, can deter certain customer segments.

Despite these restraints, the Neobanking Market is replete with substantial opportunities. Expansion into emerging economies, where large unbanked or underbanked populations offer immense growth potential, represents a significant avenue for market penetration. The development of highly specialized niche offerings, targeting specific demographics such as freelancers, expatriates, or particular industry SMEs, allows neobanks to address underserved segments with tailored solutions. Integration with broader fintech ecosystems, leveraging blockchain technology for new payment rails or decentralized finance (DeFi) products, offers innovative pathways for service diversification and competitive differentiation. Strategic partnerships with non-financial entities to embed banking services into everyday consumer experiences also present novel growth opportunities, extending the reach and utility of neobanking solutions. These opportunities, when effectively capitalized upon, can help neobanks overcome existing barriers and solidify their long-term market positions.

Segmentation Analysis

The Neobanking Market is broadly segmented based on various attributes, including account type, application, end-user, and service model, reflecting the diverse needs and preferences within the financial services landscape. These segmentations provide a granular view of market dynamics, enabling neobanks to tailor their product offerings, marketing strategies, and operational models to specific target audiences. Understanding these segments is crucial for identifying untapped market potential, optimizing resource allocation, and developing competitive advantages in a rapidly evolving industry, ultimately driving product innovation and market penetration across different user categories and operational scales.

- Account Type:

- Retail Accounts: Focused on individual consumers for personal banking needs, including current accounts, savings, and personal loans.

- Business Accounts: Tailored for small and medium-sized enterprises (SMEs), startups, and freelancers, offering features like expense management, invoicing, and corporate cards.

- Application:

- Payments and Transfers: Core services enabling domestic and international money transfers, bill payments, and point-of-sale transactions.

- Savings and Investments: Features such as high-yield savings accounts, automated savings tools, and micro-investment platforms.

- Lending and Credit: Provision of personal loans, overdraft facilities, micro-loans for businesses, and credit-building products.

- Budgeting and Financial Management: Tools for expense tracking, categorization, financial insights, and goal setting.

- End-User:

- Millennials and Gen Z: Digitally native generations seeking seamless, mobile-first banking experiences and personalized financial tools.

- SMEs and Startups: Businesses requiring flexible, cost-effective, and integrated banking solutions for their operational needs.

- Unbanked and Underbanked Population: Individuals and communities lacking access to traditional banking services, for whom neobanks offer inclusive financial solutions.

- International Travelers and Expatriates: Users needing low-cost international transfers, multi-currency accounts, and easy access to funds abroad.

- Service Model:

- B2C (Business-to-Consumer): Neobanks directly serving individual customers.

- B2B (Business-to-Business): Neobanks offering financial infrastructure and services to other businesses.

- B2B2C (Business-to-Business-to-Consumer): Neobanks powering embedded finance solutions for non-financial brands to offer banking services to their own customers.

Neobanking Market Value Chain Analysis

The Neobanking Markets value chain is a complex ecosystem, starting with foundational technology providers and extending through the neobanks core operations to the ultimate end-users. At the upstream level, the value chain is dominated by critical technology infrastructure and service providers. These include cloud computing platforms such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, which provide the scalable and resilient IT backbone necessary for digital-only operations. Core banking software providers (e.g., Thought Machine, Mambu, Temenos) offer modular, API-driven systems that enable rapid product development and integration. Furthermore, identity verification and KYC/AML solution providers (e.g., Onfido, Jumio), payment processors, and data analytics firms are indispensable, ensuring compliance, security, and data-driven insights for the neobanks. These upstream partners are crucial for the creation of robust, secure, and efficient digital banking products, forming the bedrock upon which neobanks build their innovative services and ensuring regulatory adherence from the outset of the customer journey.

In the middle of the value chain lie the neobanks themselves, acting as orchestrators and direct service providers. Their primary activities include product development, where they design and iteratively refine their digital banking applications and service offerings. Customer acquisition and marketing are pivotal, involving sophisticated digital campaigns to attract new users and build brand loyalty. Operational aspects encompass customer support, risk management, and regulatory compliance. Neobanks leverage their agile, technology-driven structures to offer a seamless user experience, process transactions efficiently, and provide personalized financial advice. They differentiate themselves through intuitive mobile interfaces, low-fee structures, and a strong focus on customer engagement. This central segment is where value is packaged and delivered to the end-user, converting technological capabilities into tangible financial services that compete with, and often surpass, traditional banking offerings in terms of convenience and user satisfaction.

Downstream, the value chain culminates with the end-users and the distribution channels through which neobanking services are delivered. The primary end-users are individual consumers (retail customers), including millennials, Gen Z, and those seeking modern, convenient banking, as well as small to medium-sized enterprises (SMEs) and freelancers in need of flexible business banking solutions. Distribution is predominantly direct, via proprietary mobile applications and web platforms, which serve as the primary interface for all banking activities. This direct-to-consumer model allows neobanks to maintain full control over the customer experience and gather valuable first-party data. While direct digital channels are paramount, indirect distribution can also occur through partnerships where neobanking functionalities are embedded into third-party platforms or services, such as e-commerce sites or financial management apps, extending their reach and integrating banking into a broader digital lifestyle ecosystem for their potential customers.

Neobanking Market Potential Customers

The Neobanking Market targets a diverse yet specific spectrum of potential customers, primarily defined by their digital fluency, financial needs, and dissatisfaction with conventional banking models. Foremost among these are the digitally native generations, including Millennials and Generation Z, who expect seamless, intuitive, and mobile-first experiences in all aspects of their lives, including finance. These demographics value convenience, instant gratification, transparent pricing, and personalized insights that help them manage their finances effectively. They are less bound by brand loyalty to traditional institutions and are highly receptive to innovative solutions that offer a superior user experience and integrate well with their digital lifestyles. Neobanks cater to their preferences by providing real-time notifications, budgeting tools, and easy access to services directly from their smartphones, making banking a more integrated and engaging part of their daily routine.

Another significant segment of potential customers comprises small and medium-sized enterprises (SMEs), startups, and freelancers. These businesses often find traditional banking services to be cumbersome, expensive, and ill-suited to their agile operational needs. Neobanks offer tailored business accounts with features like simplified expense management, integrated invoicing, multi-user access, and streamlined payment processing, often at lower costs and with faster onboarding processes. The flexibility and scalability of neobanking solutions appeal to these entrepreneurial segments who prioritize efficiency, automation, and digital integration with their other business tools. For freelancers and sole proprietors, neobanks provide simple ways to separate personal and business finances, manage taxes, and receive payments quickly from international clients, addressing specific pain points that traditional banks often overlook or address inadequately.

Furthermore, the unbanked and underbanked populations, particularly in emerging markets, represent a massive untapped reservoir of potential customers. These individuals and communities often lack access to formal financial services due to geographical barriers, stringent credit requirements, or prohibitive fees imposed by traditional banks. Neobanks, with their low-cost, mobile-centric approach and innovative credit assessment models (leveraging alternative data), can offer inclusive financial services, bringing millions into the formal financial system. Additionally, international travelers and expatriates constitute a niche but valuable customer base, seeking multi-currency accounts, low-cost international transfers, and easy access to funds across borders without incurring exorbitant fees or complex procedures. Neobanks simplify cross-border finance, making them an attractive option for anyone living or working internationally, demonstrating their broad appeal across various demographics and financial circumstances.

Neobanking Market Key Technology Landscape

The Neobanking Market is fundamentally driven by a sophisticated and interconnected technology landscape that underpins its digital-first, agile, and customer-centric operational model. At the core is a reliance on cloud-native architectures, primarily utilizing public cloud platforms such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. This allows neobanks to achieve unparalleled scalability, cost-efficiency, and resilience, enabling them to handle massive transaction volumes and rapidly deploy new features without the heavy infrastructure investments associated with traditional banking. Complementing this, microservices architecture breaks down complex applications into smaller, independent, and easily manageable services, facilitating continuous deployment, faster development cycles, and enhanced system robustness, which are critical for staying competitive in a fast-paced fintech environment. This foundational infrastructure ensures that neobanks can respond quickly to market demands and maintain high service availability for their digitally-dependent customer base.

Application Programming Interfaces (APIs) are another cornerstone technology, enabling seamless integration with third-party services and fostering an open banking ecosystem. Neobanks extensively use APIs to connect with various fintech partners, payment processors, identity verification services, and even traditional banks, allowing for data exchange, service aggregation, and the creation of richer product offerings. This API-first approach not only streamlines operations but also enables neobanks to participate in embedded finance models, where banking services are seamlessly integrated into non-financial applications or platforms, extending their reach and utility. Furthermore, advanced data analytics and machine learning (ML) algorithms are pivotal for understanding customer behavior, personalizing financial advice, and developing sophisticated risk management and fraud detection systems. These technologies allow neobanks to move beyond generic offerings, providing highly customized experiences and proactive financial insights, thereby fostering deeper customer engagement and trust through intelligent data utilization.

Beyond these foundational elements, the technology landscape includes a growing adoption of artificial intelligence (AI) for automating customer service through intelligent chatbots and virtual assistants, which provide instant support and handle routine inquiries, improving operational efficiency. Blockchain technology is also gaining traction, particularly for secure cross-border payments, immutable transaction records, and the potential for new decentralized financial products, offering enhanced transparency and reduced intermediary costs. Biometric authentication (fingerprint, facial recognition) is widely implemented for enhanced security and a frictionless user experience, replacing traditional passwords. Mobile-first design principles and progressive web applications (PWAs) ensure that the user interface is intuitive, responsive, and accessible across various devices, reflecting the core principle of neobanking: putting the digital experience at the forefront of financial service delivery. These technological advancements collectively empower neobanks to offer a superior, more secure, and highly personalized banking experience that caters to the demands of the modern digital consumer.

Regional Highlights

- North America: The United States and Canada are experiencing robust growth, driven by increasing consumer demand for digital convenience, favorable regulatory innovations allowing challenger banks to operate, and significant venture capital investment in fintech. Key players like Chime and Varo Bank are expanding rapidly by targeting underserved segments and offering fee-free banking. The region emphasizes seamless user experience and integration with digital ecosystems.

- Europe: A mature and highly competitive neobanking market, particularly in the UK, Germany, and France, propelled by progressive Open Banking regulations and high smartphone penetration. Companies such as Revolut, N26, and Monzo have established strong footholds, offering multi-currency accounts, budgeting tools, and often expanding into credit and investment products. Regulatory clarity, though stringent, has fostered innovation.

- Asia-Pacific (APAC): Emerging as the fastest-growing region, APAC is characterized by a vast unbanked population, rapid digital adoption, and supportive government initiatives for digital finance in countries like India, Indonesia, and Singapore. Neobanks here often focus on financial inclusion, micro-lending, and integration with popular messaging and e-commerce platforms. Players like Razorpay X and Grab Financial are leveraging existing super-app ecosystems.

- Latin America (LATAM): This region presents immense opportunities due to a large underbanked population and high mobile penetration. Brazil, Mexico, and Colombia are leading the charge, with neobanks like Nubank achieving significant scale by offering accessible credit, simplified banking, and a strong customer-centric approach. Neobanks are crucial for expanding financial access and combating high fees from traditional banks.

- Middle East & Africa (MEA): Still nascent but demonstrating strong potential, particularly in the UAE, Saudi Arabia, and South Africa, driven by young, tech-savvy populations and government visions for digital transformation. Neobanks are addressing gaps in financial services, often focusing on remittances, SME banking, and Sharia-compliant financial products. Regulatory frameworks are evolving to support this growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neobanking Market.- Revolut

- N26

- Chime

- Monzo

- Starling Bank

- Nubank

- Varo Bank

- Atom Bank

- Tandem Bank

- Dave

- Monese

Frequently Asked Questions

What precisely is neobanking and how does it differ from traditional banking institutions?

Neobanking refers to a fully digital banking experience delivered without physical branches, primarily through mobile apps and web platforms. Unlike traditional banks that rely on brick-and-mortar networks and often legacy IT systems, neobanks leverage modern cloud-based technology, offering agile, customer-centric services, lower fees, and personalized financial insights through a seamless digital interface.

Are neobanks safe and how do they ensure the security of customer funds and data?

Yes, neobanks are generally considered safe. Many are regulated by financial authorities, holding full banking licenses or operating under the licenses of partner banks, ensuring deposits are protected up to a certain limit by government-backed insurance schemes (e.g., FDIC in the US, FSCS in the UK). They employ advanced security measures like biometric authentication, real-time fraud detection using AI, data encryption, and robust cybersecurity protocols to protect customer information and transactions.

What are the primary benefits of using a neobank over a traditional bank account?

The main benefits of neobanks include enhanced convenience with 24/7 mobile access, often lower or no monthly fees, real-time spending insights and budgeting tools, faster transaction processing, and superior exchange rates for international transfers. They also offer a more personalized user experience, quick account setup, and often specialized features tailored to specific customer needs, all within a modern, intuitive digital environment.

What types of services do neobanks typically offer, and who are their ideal customers?

Neobanks commonly offer current and savings accounts, instant payment processing, international money transfers, budgeting and expense tracking tools, and often micro-lending or credit-building products. Their ideal customers are primarily digitally native individuals (Millennials, Gen Z), small and medium-sized enterprises (SMEs), freelancers, and underserved populations seeking convenient, cost-effective, and technology-driven financial solutions.

What is the future outlook for the neobanking market, and how might it evolve?

The neobanking market is poised for continued robust growth, driven by increasing digital adoption and demand for personalized financial services. Future evolution is expected to include further diversification into specialized niche offerings (e.g., specific industries, sustainable banking), deeper integration with broader fintech and non-financial ecosystems (embedded finance), increased focus on profitability and sustainable business models, and potential consolidation among players as the market matures and competition intensifies globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager