Non-Laboratory-based Cannabis Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428211 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Non-Laboratory-based Cannabis Testing Market Size

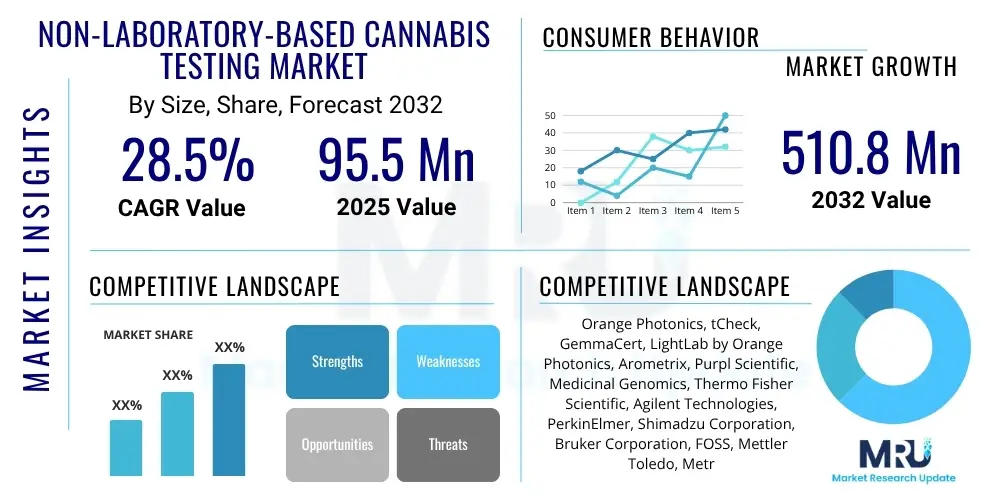

The Non-Laboratory-based Cannabis Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at USD 95.5 Million in 2025 and is projected to reach USD 510.8 Million by the end of the forecast period in 2032.

Non-Laboratory-based Cannabis Testing Market introduction

The Non-Laboratory-based Cannabis Testing Market represents a rapidly expanding segment within the broader cannabis industry, driven by the increasing demand for immediate, on-site analytical results. This market encompasses a range of portable and handheld devices, as well as test kits, designed to assess various parameters of cannabis products without requiring traditional, extensive laboratory infrastructure. These solutions provide cultivators, processors, dispensaries, and even consumers with the capability to perform quick quality control checks, ensuring product safety and compliance at various stages of the supply chain. The primary objective is to offer rapid insights into potency, terpene profiles, and contaminant levels, facilitating informed decision-making and enhancing operational efficiency.

Products within this market typically include portable spectrometers, handheld chromatography devices, rapid immunoassay kits, and biosensors. These innovative tools are engineered for ease of use, delivering results within minutes, which significantly reduces the turnaround time associated with sending samples to off-site analytical laboratories. Major applications span from quality assurance in cultivation facilities to ensuring compliance at retail points, helping to verify product claims and identify potential safety issues promptly. The ability to conduct preliminary testing on-site mitigates risks associated with product batches, streamlines inventory management, and allows for proactive intervention in case of discrepancies or contamination concerns.

The benefits derived from non-laboratory-based testing are multifaceted, including enhanced accessibility to testing, reduced operational costs for frequent checks, and improved speed in decision-making processes. Driving factors for this market's growth are primarily the global surge in cannabis legalization, both for medicinal and recreational purposes, which necessitates robust and efficient testing protocols. Furthermore, the rising awareness among consumers regarding product quality, safety, and accurate labeling is propelling the adoption of these convenient testing methods. Technological advancements, leading to more accurate, reliable, and user-friendly portable devices, also play a pivotal role in accelerating market expansion.

Non-Laboratory-based Cannabis Testing Market Executive Summary

The Non-Laboratory-based Cannabis Testing Market is experiencing robust growth, characterized by significant business trends towards decentralization of testing services and increasing adoption of point-of-use analytical solutions. Businesses across the cannabis value chain, from cultivation to retail, are investing in these technologies to ensure rapid quality control, maintain regulatory compliance, and enhance consumer trust. A key trend involves the integration of advanced analytical techniques, such as portable spectroscopy and miniaturized chromatography, into compact devices that offer laboratory-grade accuracy in a field-friendly format. This shift is driven by the need for agility in a fast-paced market and the desire to reduce the logistical complexities and costs associated with traditional lab testing. Furthermore, the market is witnessing a move towards more comprehensive on-site testing capabilities, encompassing not only potency but also critical contaminants like pesticides and heavy metals.

Regional trends indicate North America as the dominant market, largely due to early and widespread legalization of cannabis in the United States and Canada, coupled with well-established regulatory frameworks that mandate stringent testing. Europe is emerging as another significant market, with increasing medical cannabis programs and a growing acceptance of recreational use, prompting greater demand for rapid testing solutions to meet evolving regulations. Asia Pacific and Latin America, while smaller, are showing promising growth trajectories as more countries liberalize their cannabis policies and establish domestic industries. These regions are particularly attractive for non-laboratory solutions given the potential for logistical challenges and infrastructure gaps that traditional labs might face, making portable solutions a viable alternative for initial screening and quality checks.

Segmentation trends highlight several key areas of growth and innovation. By product type, portable analyzers and test kits are witnessing high demand due to their versatility and ease of use. In terms of application, potency testing remains foundational, but there is a growing emphasis on more advanced applications like terpene profiling and comprehensive contaminant screening, including pesticides and heavy metals, driven by stricter regulatory requirements and consumer preferences. End-user segments such as cannabis cultivators and dispensaries are pivotal, seeking immediate feedback to optimize growing conditions, ensure product consistency, and verify labels at the point of sale. The rapid evolution of technology, particularly in miniaturization and data integration, is enabling these devices to offer increasingly sophisticated analytical capabilities, fueling segment expansion.

AI Impact Analysis on Non-Laboratory-based Cannabis Testing Market

The integration of Artificial Intelligence (AI) into the Non-Laboratory-based Cannabis Testing Market is fundamentally transforming how quality control and compliance are managed. Common user questions often revolve around how AI can enhance the speed and accuracy of results from portable devices, the potential for predictive analytics in cultivation, and the automation of data interpretation. Users are keen to understand if AI can compensate for perceived limitations of non-lab testing, such as calibration drift or environmental interference, by providing more robust data analysis and error correction. There's also significant interest in AI's role in standardizing results across different devices and operators, ensuring consistency and reliability, which are critical for regulatory acceptance. The overarching expectation is that AI will make these devices smarter, more reliable, and capable of generating actionable insights beyond simple data points.

AI's influence is evident in several aspects, from improving the calibration and stability of handheld instruments to enabling more sophisticated data processing on-device or via cloud platforms. Machine learning algorithms can be trained on vast datasets of spectral or chromatographic information, allowing portable analyzers to identify specific cannabinoids, terpenes, or contaminants with higher precision, even in complex matrices. This eliminates much of the manual interpretation and expertise traditionally required, democratizing advanced testing capabilities. Furthermore, AI can contribute to adaptive learning systems that refine their accuracy over time as more data is collected, ensuring the devices remain effective and calibrated under varying field conditions.

Beyond individual device performance, AI is poised to impact market dynamics by fostering greater efficiency and data utility. Predictive analytics, powered by AI, can help cultivators anticipate ideal harvest times based on cannabinoid development patterns or identify early signs of nutrient deficiencies by correlating plant health with metabolite profiles obtained through rapid testing. This shifts the paradigm from reactive problem-solving to proactive management. Moreover, AI can aggregate and analyze data from multiple non-laboratory devices across a network, providing a holistic view of product quality and consistency throughout the supply chain, which is invaluable for large-scale operations and regulatory oversight. This capability elevates non-laboratory testing from a simple screening tool to a powerful data-driven decision-making asset.

- Enhanced accuracy and precision through machine learning algorithms for data interpretation.

- Automated calibration and self-correction mechanisms in portable devices.

- Predictive analytics for optimizing cultivation practices and anticipating product quality.

- Standardization of results across different devices and operators, improving data consistency.

- Faster data processing and generation of actionable insights from raw analytical data.

- Integration with cloud platforms for real-time data monitoring and trend analysis.

- Detection of subtle anomalies or contaminants that might be missed by manual interpretation.

DRO & Impact Forces Of Non-Laboratory-based Cannabis Testing Market

The Non-Laboratory-based Cannabis Testing Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, which collectively define the impact forces shaping its trajectory. A primary driver is the accelerating pace of cannabis legalization across various regions globally, leading to stringent regulatory requirements for product safety and quality assurance. This regulatory landscape necessitates readily available and efficient testing solutions at multiple points in the supply chain. Another crucial driver is the increasing demand for rapid, on-site results, driven by cultivators, processors, and dispensaries who need immediate feedback to optimize operations, ensure compliance, and maintain product consistency. The cost-efficiency of performing preliminary checks with non-laboratory solutions, compared to the higher costs and longer turnaround times of traditional lab testing, also acts as a powerful incentive for adoption, making testing more accessible to a wider range of market participants.

However, the market also faces considerable restraints that temper its growth. Chief among these is the perception and, in some cases, the reality of lower accuracy or reliability compared to sophisticated laboratory equipment. While non-laboratory devices have advanced significantly, some stakeholders remain skeptical about their ability to provide definitive, legally defensible results, especially for complex analyses like trace contaminant detection. Regulatory acceptance also presents a restraint; while many non-laboratory solutions are suitable for screening or quality control, not all jurisdictions accept their results for final compliance certification, still mandating accredited laboratory testing. Furthermore, the initial investment required for some advanced portable analyzers can be substantial for smaller businesses, despite the long-term cost savings, creating an adoption barrier. The need for trained personnel to operate and interpret results from these devices, even if simpler than lab equipment, is another factor.

Despite these restraints, significant opportunities exist that promise to propel the market forward. The continuous technological advancements in miniaturization, sensor technology, and AI integration are leading to devices that are increasingly accurate, user-friendly, and capable of a broader range of analyses. This innovation is expanding the addressable market and enhancing the utility of non-laboratory solutions. Emerging cannabis markets in developing regions, where traditional laboratory infrastructure may be nascent or limited, offer substantial growth opportunities for portable, self-contained testing solutions. Moreover, the increasing focus on consumer safety and transparent labeling across the globe is creating a robust demand for verification tools at the point of sale, where non-laboratory testing can play a pivotal role. The development of multi-analyte devices that can simultaneously detect various cannabinoids, terpenes, and contaminants in a single test offers significant convenience and value proposition.

The combined impact forces create a market dynamic where innovation is paramount. The push for convenience and speed, coupled with evolving regulatory landscapes, drives technological advancements aimed at overcoming accuracy and acceptance hurdles. This leads to a continuous cycle of product development, where manufacturers strive to deliver more reliable, robust, and versatile non-laboratory testing tools. The market is thus characterized by intense competition among solution providers, fostering a rapid pace of innovation that benefits end-users with more effective and accessible testing options. As regulatory bodies gain confidence in the capabilities of these portable systems, their acceptance for official compliance checks is likely to increase, further accelerating market expansion and cementing their role as indispensable tools in the cannabis industry.

Segmentation Analysis

The Non-Laboratory-based Cannabis Testing Market is meticulously segmented to provide a comprehensive understanding of its diverse components, allowing stakeholders to identify specific areas of growth, demand, and technological innovation. This segmentation facilitates a granular analysis of market dynamics, revealing how various product types, applications, end-users, and technologies contribute to the overall market landscape. Understanding these segments is crucial for strategic planning, product development, and market entry strategies for new participants. The market is defined by the tools and methodologies that enable on-site, rapid assessment of cannabis products, diverging significantly from traditional, centralized laboratory operations by prioritizing speed, portability, and convenience.

Each segment within this market addresses unique needs and pain points across the cannabis value chain. For instance, different product types cater to varying levels of testing complexity and user expertise, from simple, disposable test kits for basic screening to sophisticated portable analyzers for more detailed chemical profiling. Applications range from essential potency verification to critical contaminant screening, reflecting the multifaceted requirements for ensuring both product quality and consumer safety. Similarly, end-users, including cultivators, processors, dispensaries, and even individual consumers, each have distinct motivations and operational contexts for adopting non-laboratory testing solutions. The underlying technologies powering these devices are continually evolving, driving advancements in accuracy, speed, and analytical breadth, further diversifying the market landscape and creating new opportunities for specialized solutions tailored to specific testing challenges.

- By Product Type:

- Handheld Devices: Compact, portable instruments for immediate, on-site analysis, offering ease of use and rapid results.

- Portable Analyzers: More advanced, yet still mobile, instruments providing higher accuracy and a broader range of analytical capabilities than handheld devices.

- Test Kits: Disposable or reusable kits designed for specific tests, often utilizing colorimetric or immunoassay principles for quick qualitative or semi-quantitative results.

- Reagents: Chemical substances or mixtures used in conjunction with test kits or analyzers to facilitate the analytical process and enable detection of target analytes.

- By Application:

- Potency Testing: Measurement of cannabinoid concentrations (e.g., THC, CBD, CBG) to determine product strength and compliance.

- Terpene Profiling: Identification and quantification of terpenes, contributing to aroma, flavor, and entourage effect characteristics.

- Pesticide Screening: Detection of harmful pesticide residues to ensure product safety and regulatory compliance.

- Heavy Metal Detection: Analysis for toxic heavy metals (e.g., lead, mercury, arsenic, cadmium) which can accumulate in cannabis plants.

- Moisture Content: Assessment of water content in cannabis flower or products, crucial for preventing mold growth and ensuring product stability.

- Microbial Contaminants: Screening for harmful microorganisms such as bacteria (e.g., E. coli, Salmonella) and mold (e.g., Aspergillus).

- By End-User:

- Cannabis Cultivators: Utilize non-laboratory testing for optimizing growing conditions, quality control of harvests, and pre-screening before sending to labs.

- Processors: Employ rapid testing to monitor extraction efficiency, ensure consistent product formulations, and verify purity.

- Dispensaries: Use devices for verifying product labels, ensuring compliance at the point of sale, and boosting consumer confidence.

- Consumers: Adopt personal devices for verifying purchased products, checking home-grown cannabis, and ensuring personal safety.

- Regulatory Bodies: Utilize portable solutions for initial screenings during inspections, field investigations, and rapid enforcement actions.

- By Technology:

- Spectroscopy (NIR, Raman): Employs light interaction with samples to identify and quantify compounds based on their unique spectral fingerprints.

- Immunoassay: Utilizes antibody-antigen reactions for rapid detection of specific compounds or contaminants, often in kit format.

- Portable Chromatography (GC, HPLC): Miniaturized versions of gas or liquid chromatography for separating and analyzing complex mixtures of compounds.

- Biosensors: Devices that combine a biological component with a physicochemical detector to identify and measure target analytes with high sensitivity.

Value Chain Analysis For Non-Laboratory-based Cannabis Testing Market

A comprehensive value chain analysis for the Non-Laboratory-based Cannabis Testing Market elucidates the various stages involved in bringing these innovative testing solutions from conceptualization to the end-user, highlighting the critical interactions between different stakeholders. The upstream segment of the value chain is characterized by research and development activities, where specialized knowledge in analytical chemistry, engineering, and software development is crucial for creating robust and accurate portable devices and sophisticated test kits. This stage involves the procurement of high-quality components, advanced sensors, optical elements, microfluidic components, and specialized reagents from a diverse base of suppliers. Component manufacturers and chemical suppliers play a vital role, ensuring the availability of materials that meet stringent specifications for accuracy, sensitivity, and durability, which are paramount for the performance of non-laboratory testing solutions.

Midstream activities primarily focus on the manufacturing, assembly, and rigorous quality control of the non-laboratory testing devices and kits. This includes the precision engineering of handheld spectrometers, portable chromatographs, and biosensor platforms, as well as the formulation and packaging of chemical reagents and immunoassay strips. Companies in this segment must maintain high standards of manufacturing excellence and implement robust quality assurance protocols to ensure the reliability and consistency of their products. This stage also involves the development of user-friendly interfaces, data processing software, and connectivity solutions that are integral to the functionality and market appeal of these devices. The emphasis here is on miniaturization, power efficiency, and connectivity, allowing these devices to perform effectively in diverse field environments while providing accurate and interpretable results.

The downstream segment encompasses the distribution, marketing, sales, and post-sales support for non-laboratory cannabis testing solutions, reaching a wide array of end-users. Distribution channels can be direct, where manufacturers engage directly with large cultivators, processors, or regulatory bodies, offering specialized training and customized support. Indirect channels involve partnerships with distributors, resellers, and online platforms that specialize in scientific equipment, cannabis industry supplies, or consumer electronics, broadening market reach to smaller businesses and individual consumers. Effective marketing strategies are crucial to educate potential buyers about the benefits, capabilities, and proper usage of these technologies, addressing common concerns regarding accuracy and regulatory compliance. Post-sales support, including technical assistance, software updates, and maintenance services, is essential for ensuring customer satisfaction and fostering long-term relationships, which are critical in a market driven by rapidly evolving technology and dynamic regulatory landscapes.

Non-Laboratory-based Cannabis Testing Market Potential Customers

The Non-Laboratory-based Cannabis Testing Market serves a diverse and expanding base of potential customers, each with distinct needs and motivations for adopting rapid, on-site testing solutions. These end-users are primarily driven by the need for immediate feedback, cost-efficiency, and operational flexibility that traditional laboratory testing often cannot provide. Among the most significant customer segments are cannabis cultivators, who require constant monitoring of their crops to optimize growing conditions, manage nutrient inputs, and determine optimal harvest times. By testing cannabinoid and terpene levels throughout the growth cycle, cultivators can fine-tune their processes, ensure consistent product quality, and make informed decisions that impact yield and potency. Furthermore, pre-screening for contaminants like mold or heavy metals at the cultivation site can prevent costly losses of entire batches, making non-laboratory solutions an invaluable risk management tool.

Cannabis processors, including extractors, edible manufacturers, and infused product producers, represent another substantial customer group. These entities need to verify the potency and purity of raw materials before processing, monitor the efficiency of their extraction methods, and ensure the consistent dosage and safety of their final products. Rapid on-site testing allows processors to quickly adjust their methodologies, reduce waste, and ensure that their products meet strict internal quality standards and external regulatory requirements before they are sent to market or undergo more expensive laboratory-based compliance testing. The ability to perform quick checks at various stages of production minimizes the risk of producing non-compliant or unsafe products, which can have significant financial and reputational repercussions.

Beyond the core industry players, dispensaries and retail outlets are emerging as key potential customers, utilizing non-laboratory devices to verify product labels at the point of sale and address consumer inquiries regarding product claims. This enhances transparency and builds consumer trust, which is vital in a market where accurate labeling is frequently scrutinized. Individual consumers are also increasingly interested in personal testing devices to verify the quality and safety of products they purchase or cultivate for personal use, driven by health concerns and a desire for transparency. Lastly, regulatory bodies and law enforcement agencies are potential customers, employing portable devices for initial screenings during field inspections, identifying illicit products, or conducting rapid assessments to support enforcement actions, streamlining their operations and providing immediate preliminary results for investigations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 95.5 Million |

| Market Forecast in 2032 | USD 510.8 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Orange Photonics, tCheck, GemmaCert, LightLab by Orange Photonics, Arometrix, Purpl Scientific, Medicinal Genomics, Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, Shimadzu Corporation, Bruker Corporation, FOSS, Mettler Toledo, Metrohm AG, SPECTRAL ENZYMES, LGC Limited, Romer Labs, VICAM. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Non-Laboratory-based Cannabis Testing Market Key Technology Landscape

The technological landscape of the Non-Laboratory-based Cannabis Testing Market is characterized by continuous innovation aimed at enhancing accuracy, speed, and user-friendliness in portable and on-site analytical solutions. A cornerstone of this landscape is Spectroscopy, particularly Near-Infrared (NIR) and Raman Spectroscopy. NIR devices leverage the absorption of infrared light by organic compounds to identify and quantify cannabinoids, terpenes, and moisture content. These instruments are favored for their non-destructive nature, rapid analysis times, and ease of sample preparation, making them ideal for quick potency checks in the field or at dispensary counters. Raman spectroscopy, on the other hand, provides highly specific molecular fingerprinting, capable of identifying a wider range of compounds and detecting subtle differences in chemical composition, which is useful for authenticity checks and contaminant screening. Advances in miniaturization and computational power have made these spectroscopic techniques increasingly viable in handheld formats, delivering lab-grade insights outside traditional lab settings.

Another critical technological area involves Immunoassay-based methods, which are widely employed in rapid test kits. These kits typically utilize antibody-antigen reactions to detect specific target molecules, such as certain cannabinoids, pesticides, or microbial toxins. Lateral flow immunoassay (LFIA) strips, similar to home pregnancy tests, offer rapid, qualitative or semi-quantitative results and are highly cost-effective and simple to use. While generally less precise than spectroscopic or chromatographic methods, they provide excellent initial screening capabilities for a wide array of contaminants or specific compound classes. The ongoing research in developing more selective and sensitive antibodies, alongside multiplexing capabilities, is expanding the utility of immunoassay kits to simultaneously detect multiple analytes with improved accuracy, making them valuable tools for initial rapid assessments and field investigations.

Furthermore, miniaturized and portable Chromatography techniques, such as Gas Chromatography (GC) and High-Performance Liquid Chromatography (HPLC), are becoming increasingly relevant. While traditionally complex and benchtop-bound, innovations have led to more compact and field-deployable versions that retain a high degree of separation efficiency and detection sensitivity. Portable GC systems are excellent for analyzing volatile compounds like terpenes, while portable HPLC systems are adept at quantifying non-volatile cannabinoids. These portable chromatographic solutions offer a higher level of analytical rigor for on-site applications that demand greater specificity and quantification accuracy. The integration of advanced microfluidics and biosensors also represents a significant technological frontier. Biosensors combine biological recognition elements with electrochemical or optical transducers to detect specific analytes with high sensitivity and real-time response, holding immense promise for next-generation, ultra-portable, and highly specific contaminant detection and potency analysis, further broadening the capabilities of non-laboratory cannabis testing.

Regional Highlights

- North America: This region stands as the dominant market for non-laboratory cannabis testing, primarily driven by the progressive legalization of cannabis in the United States and Canada. Both countries have established robust regulatory frameworks that mandate extensive testing throughout the cannabis supply chain, fostering a strong demand for rapid and efficient on-site solutions. The U.S. market, with its patchwork of state-level regulations, sees significant adoption among cultivators, processors, and dispensaries seeking to maintain compliance and quality control without constant reliance on external laboratories. Canada, with its federally regulated recreational market, also presents a substantial opportunity for portable testing, especially in remote cultivation areas where access to traditional labs might be limited. The presence of key market players and a high level of technological innovation further solidifies North America's leading position.

- Europe: The European market is experiencing significant growth, fueled by the expansion of medical cannabis programs and the gradual easing of recreational cannabis policies in several countries. Nations like Germany, the Netherlands, and Switzerland are at the forefront of medical cannabis cultivation and processing, necessitating efficient quality control measures. As more European Union member states explore cannabis legalization, the demand for non-laboratory testing solutions is projected to rise sharply, driven by the need for quick, cost-effective screening tools to ensure product safety and adherence to diverse national regulations. Innovations in portable analytical devices are particularly appealing in a region with complex logistical landscapes and varying regulatory standards.

- Asia Pacific (APAC): The APAC region is an emerging, yet rapidly growing, market for non-laboratory cannabis testing, propelled by increasing interest in medical cannabis and industrial hemp cultivation across countries like Thailand, Australia, and New Zealand. While full recreational legalization is less prevalent, the developing medical and industrial sectors are creating a nascent demand for efficient quality control. The vast geographical spread and varying levels of infrastructure development in many APAC countries make portable, non-laboratory solutions particularly attractive for ensuring product consistency and compliance in remote cultivation sites or new processing facilities, reducing reliance on centralized laboratory infrastructure.

- Latin America: This region shows considerable potential, largely due to several countries, such as Uruguay, Colombia, and Mexico, embracing cannabis legalization for medicinal and, in some cases, recreational purposes. The establishment of large-scale cultivation and processing operations, particularly for export, drives the need for rigorous quality assurance. Non-laboratory testing devices are crucial for these emerging markets to implement efficient in-house quality control procedures, optimize production, and meet international export standards without incurring the delays and costs associated with traditional lab testing. The focus on establishing a reputable global presence for their cannabis products underscores the importance of reliable testing solutions.

- Middle East and Africa (MEA): The MEA region is at an early stage of market development but holds future promise, primarily driven by growing interest in medical cannabis and industrial hemp cultivation in specific nations. Countries exploring cannabis for medical or research purposes, such as Israel (a pioneer in cannabis research) and certain African nations with suitable climates for cultivation, are creating niche demands for testing. As regulatory frameworks evolve and the industry matures, portable testing solutions will play a vital role in establishing quality control and ensuring compliance in these nascent markets, offering accessible and immediate analytical capabilities where traditional lab infrastructure might be limited or in early development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Non-Laboratory-based Cannabis Testing Market.- Orange Photonics

- tCheck

- GemmaCert

- LightLab by Orange Photonics

- Arometrix

- Purpl Scientific

- Medicinal Genomics

- Thermo Fisher Scientific

- Agilent Technologies

- PerkinElmer

- Shimadzu Corporation

- Bruker Corporation

- FOSS

- Mettler Toledo

- Metrohm AG

- SPECTRAL ENZYMES

- LGC Limited

- Romer Labs

- VICAM

- Charm Sciences Inc.

Frequently Asked Questions

Analyze common user questions about the Non-Laboratory-based Cannabis Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is non-laboratory-based cannabis testing?

Non-laboratory-based cannabis testing refers to the use of portable and handheld devices or test kits to analyze cannabis products on-site, providing rapid results for parameters such as potency, terpenes, and contaminants, without the need for traditional, centralized laboratory equipment.

How accurate are non-laboratory cannabis testing devices compared to traditional labs?

While traditional laboratory testing (e.g., HPLC, GC-MS) is generally considered the gold standard for regulatory compliance, modern non-laboratory devices are continuously improving in accuracy and can provide highly reliable preliminary or screening results. Their precision varies by technology and analyte, but they are increasingly suitable for quality control and operational decision-making.

What types of cannabis products can be tested with non-laboratory solutions?

Non-laboratory solutions can test a wide range of cannabis products, including raw flower, concentrates, edibles, tinctures, and oils. The suitability often depends on the specific device or kit, with some being more versatile than others in handling different matrices.

Are non-laboratory test results accepted for regulatory compliance?

Currently, most jurisdictions still require results from accredited, third-party laboratories for final regulatory compliance and product labeling. However, non-laboratory tests are widely accepted for internal quality control, process optimization, pre-screening, and rapid verification purposes across the cannabis supply chain.

What are the primary benefits of using non-laboratory cannabis testing?

The key benefits include immediate results, enabling faster decision-making; reduced costs compared to frequent outsourced lab testing; increased operational flexibility and convenience; and enhanced quality control at various points of the cultivation, processing, and retail stages. These solutions empower businesses to proactively manage product quality and safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager