Nonwoven Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430614 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Nonwoven Packaging Market Size

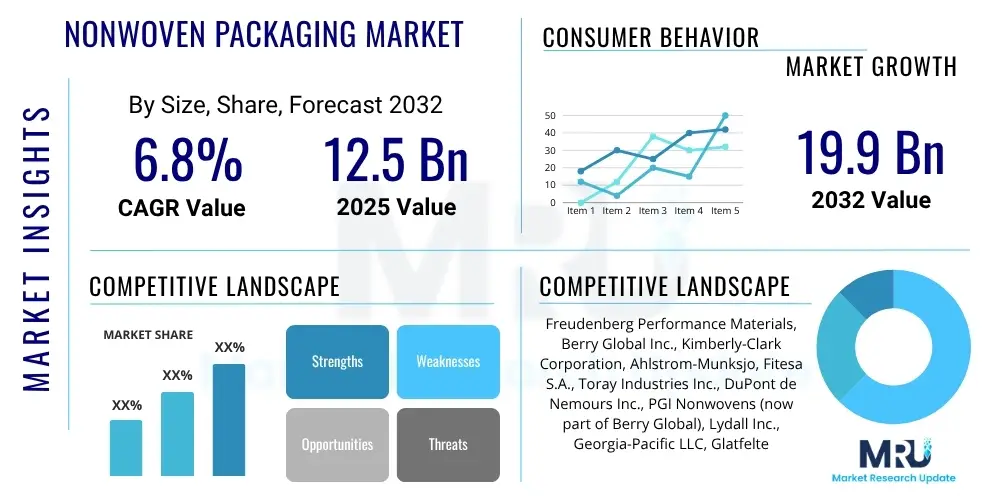

The Nonwoven Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $12.5 billion in 2025 and is projected to reach $19.9 billion by the end of the forecast period in 2032.

Nonwoven Packaging Market introduction

The Nonwoven Packaging Market encompasses a diverse range of packaging solutions manufactured from nonwoven fabrics. These materials are engineered sheet or web structures bonded together by entangling fibers or filaments mechanically, thermally, or chemically, rather than weaving or knitting. Unlike traditional woven textiles, nonwovens offer unique properties such as breathability, liquid repellency, resilience, stretch, softness, strength, bacterial barrier, and sterility, making them highly versatile for various packaging applications. The product description highlights their ability to combine functionality with cost-effectiveness, providing protective and often sustainable alternatives to conventional packaging materials. Their light weight and durability contribute to reduced transportation costs and enhanced product protection.

Major applications of nonwoven packaging span across numerous industries. In healthcare and medical sectors, they are critical for sterile packaging, surgical drapes, and medical device wraps due to their excellent barrier properties and hygiene standards. The food and beverage industry utilizes nonwovens for tea bags, coffee pods, and fresh produce bags, leveraging their breathability and filtration capabilities. Furthermore, personal care and hygiene products, industrial protective packaging, and promotional bags extensively adopt nonwovens for their soft texture, strength, and aesthetic appeal. The versatility extends to consumer goods packaging, where they offer robust and aesthetically pleasing solutions that resonate with environmentally conscious consumers.

The benefits of nonwoven packaging are multifaceted, including enhanced product protection, often superior hygiene, and a reduced environmental footprint compared to some traditional plastics. These materials are frequently lightweight, which contributes to lower shipping emissions and costs. Driving factors for market growth include the increasing demand for sustainable and eco-friendly packaging solutions as regulatory pressures and consumer preferences shift towards greener alternatives. The expansion of e-commerce, which necessitates durable and protective packaging, along with heightened awareness of health and hygiene, particularly in the post-pandemic era, further propels the adoption of nonwoven materials in packaging applications. Innovations in material science are also leading to nonwovens with improved performance characteristics, driving their market penetration.

Nonwoven Packaging Market Executive Summary

The Nonwoven Packaging Market is poised for significant growth, driven by evolving business trends that emphasize sustainability, operational efficiency, and enhanced product protection. Companies are increasingly investing in research and development to produce biodegradable and recyclable nonwoven materials, aligning with global environmental objectives and consumer demand for eco-conscious products. Furthermore, the burgeoning e-commerce sector is a major catalyst, requiring robust yet lightweight packaging solutions that can withstand the rigors of transit while minimizing shipping costs. The shift towards automated production processes and smart packaging integration also represents a key business trend, enhancing manufacturing precision and supply chain visibility.

Regional trends indicate that the Asia Pacific (APAC) region is expected to maintain its dominance in the Nonwoven Packaging Market, attributed to rapid industrialization, increasing disposable income, and a growing population that fuels demand across various end-use industries, particularly in hygiene and personal care. North America and Europe also demonstrate substantial growth, driven by stringent environmental regulations, advanced technological adoption, and a strong emphasis on sustainable packaging practices. Latin America, the Middle East, and Africa are emerging as high-potential markets, characterized by improving economic conditions and expanding manufacturing capabilities, leading to a rise in demand for efficient and protective packaging solutions.

Segment trends reveal a strong impetus towards spunbond and meltblown technologies due to their cost-effectiveness and versatile performance characteristics, especially in medical and hygiene applications. Material-wise, polypropylene continues to be a leading choice, though there is a noticeable pivot towards bio-based and recyclable polymers like PLA and recycled polyester in response to sustainability mandates. The healthcare and medical segment is projected to experience robust growth, driven by an aging global population and increased healthcare expenditure, necessitating sterile and reliable packaging. Concurrently, the food and beverage and personal care sectors are expanding their adoption of nonwovens for their functional and aesthetic benefits, pushing innovation in barrier properties and consumer appeal.

AI Impact Analysis on Nonwoven Packaging Market

Common user questions regarding AI's impact on the Nonwoven Packaging Market frequently revolve around how artificial intelligence can enhance manufacturing efficiency, reduce costs, and contribute to sustainability efforts. Users are keen to understand the practical applications of AI in optimizing production lines, improving material utilization, and predicting market demand. There is significant interest in AI's role in quality control, supply chain management, and the potential for developing innovative packaging designs. Concerns often include the initial investment required for AI integration, the need for specialized skill sets, and the ethical implications of data privacy in an increasingly automated and data-driven industry. Expectations are high for AI to deliver substantial improvements in operational agility, waste reduction, and the creation of more personalized and responsive packaging solutions.

- AI can optimize production processes by monitoring machinery performance, predicting maintenance needs, and adjusting parameters in real-time to enhance output and reduce downtime.

- Predictive analytics powered by AI can forecast demand more accurately, leading to optimized inventory management, reduced overproduction, and minimized waste throughout the supply chain.

- AI-driven vision systems can significantly improve quality control by identifying defects in nonwoven materials or finished packaging with greater precision and speed than manual inspection.

- Smart packaging solutions can integrate AI for features like temperature monitoring, freshness indicators, and anti-counterfeiting measures, enhancing product safety and consumer trust.

- AI algorithms can analyze vast datasets to identify optimal material combinations and design configurations for specific packaging requirements, accelerating product development cycles.

- Supply chain management benefits from AI through intelligent route optimization, real-time tracking, and risk assessment, improving logistical efficiency and resilience.

- Resource optimization in manufacturing, such as efficient energy usage and raw material consumption, can be guided by AI systems, contributing to sustainability goals.

DRO & Impact Forces Of Nonwoven Packaging Market

The Nonwoven Packaging Market is significantly shaped by a combination of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating demand for sustainable and environmentally friendly packaging materials, spurred by heightened consumer awareness and stringent global regulations aiming to curb plastic waste. The rapid expansion of the e-commerce sector further amplifies this demand, as nonwovens offer durable, lightweight, and often reusable options for shipping and product protection. Additionally, the growing focus on hygiene and health, particularly in the healthcare and personal care industries, drives the adoption of nonwoven packaging due to its superior barrier properties and sterility. The cost-effectiveness and versatility of nonwoven materials in various applications also contribute to their increasing market penetration.

Despite robust growth drivers, the market faces several significant restraints. One major challenge is the volatility in raw material prices, particularly for petrochemical-derived polymers like polypropylene and polyester, which can impact manufacturing costs and profit margins. Regulatory complexities and varying standards across different regions regarding nonwoven definitions, recyclability, and biodegradability present hurdles for market players aiming for global expansion. Furthermore, the limited recyclability of certain nonwoven types, especially those with multiple layers or specific treatments, poses an environmental concern and a barrier to broader adoption in circular economy initiatives. The significant capital investment required for establishing or upgrading nonwoven manufacturing facilities can also deter new entrants and limit smaller players.

Opportunities within the Nonwoven Packaging Market are substantial and diverse. The development of biodegradable and compostable nonwoven materials, such as those made from PLA or natural fibers, offers a promising avenue for sustainable product innovation and market differentiation. The integration of smart packaging technologies, including RFID tags, QR codes, and sensors, presents opportunities to enhance traceability, consumer engagement, and product security. Emerging economies in Asia Pacific, Latin America, and Africa represent high-growth markets due to increasing industrialization, rising disposable incomes, and an expanding consumer base demanding modern packaging solutions. Additionally, advancements in nonwoven manufacturing technologies, such as improved bonding techniques and multi-layer composites, are creating new possibilities for high-performance and specialized packaging applications.

External impact forces play a critical role in shaping the market landscape. Environmental regulations, such as bans on single-use plastics and mandates for recycled content, directly influence material selection and innovation strategies within the nonwoven packaging industry. Shifting consumer preferences towards eco-friendly and convenient packaging options exert significant pressure on manufacturers to adapt and innovate. Technological advancements, including improvements in nonwoven production processes and material science, continuously drive product development and performance enhancements. Geopolitical factors and trade policies can impact raw material supply chains and market access, influencing regional dynamics and investment decisions. The global economic climate also affects consumer spending and industrial production, thereby influencing overall demand for packaging materials.

Segmentation Analysis

The Nonwoven Packaging Market is comprehensively segmented based on various factors including material type, technology, and application, providing a detailed understanding of its diverse landscape. This segmentation allows for precise analysis of market dynamics, growth drivers, and competitive strategies within each category. The variety of materials used, from synthetic polymers to natural fibers, reflects the industry's continuous effort to balance performance, cost-effectiveness, and environmental sustainability. Similarly, different manufacturing technologies impart unique properties to nonwoven fabrics, catering to specific packaging requirements across a wide range of end-use sectors. Understanding these segments is crucial for identifying growth pockets and tailoring product offerings to specific market needs.

The material segmentation highlights the dominance of conventional polymers while also showcasing the rapid growth of sustainable alternatives. Technology segmentation underscores the established and emerging methods of nonwoven fabric production, each optimized for different applications and performance attributes. The application segment provides insight into the primary end-user industries driving demand, from high-stakes medical packaging to everyday consumer goods. The interplay between these segments often dictates innovation and market trends, with a constant push towards more efficient, functional, and eco-friendly solutions. This granular analysis is essential for market players to develop targeted strategies and capitalize on emerging opportunities across the nonwoven packaging value chain.

- By Material

- Polypropylene (PP)

- Polyethylene (PE)

- Polyester (PET)

- Rayon

- Polylactic Acid (PLA)

- Bi-Component Fibers

- Wood Pulp

- Other Materials (e.g., Nylon, Acrylic, Jute, Hemp)

- By Technology

- Spunbond

- Meltblown

- Spunlace

- Needle Punch

- Thermal Bonding

- Chemical Bonding

- Airlaid

- Wetlaid

- By Application

- Food & Beverage Packaging

- Healthcare & Medical Packaging (e.g., sterilization wrap, medical device packaging)

- Personal Care & Hygiene Packaging (e.g., wipes packaging, cosmetic bags)

- Industrial Packaging (e.g., protective covers, wraps, bags)

- Consumer Goods Packaging (e.g., shopping bags, gift bags, textile packaging)

- Agriculture Packaging (e.g., crop covers, protective bags)

- Building & Construction Packaging

- Other Applications

Value Chain Analysis For Nonwoven Packaging Market

The value chain for the Nonwoven Packaging Market commences with the upstream activities involving the sourcing and processing of raw materials. This stage primarily includes petrochemical companies that supply polymers such as polypropylene, polyethylene, and polyester, as well as manufacturers of natural fibers like wood pulp and rayon. Suppliers of specialty chemicals, binders, and additives also form a crucial part of the upstream segment, providing essential components that impart specific properties to the nonwoven fabrics. Additionally, manufacturers of specialized machinery required for nonwoven fabric production, including spunbond, meltblown, and spunlace lines, are key upstream stakeholders. The quality and cost of these raw materials and machinery significantly influence the subsequent stages of the value chain.

The midstream segment of the value chain is dominated by nonwoven fabric manufacturers who convert raw materials into various types of nonwoven sheets or rolls using different technologies. These manufacturers are responsible for the core production processes, including fiber preparation, web formation, and bonding, to create fabrics with desired characteristics such as strength, softness, barrier properties, and breathability. Following this, converters play a vital role by transforming these nonwoven fabrics into finished packaging products like bags, wraps, liners, and pouches. This conversion often involves cutting, printing, lamination, and sealing processes tailored to specific end-user requirements, adding significant value to the material.

The downstream analysis focuses on the distribution channels and end-users of nonwoven packaging products. Distribution can occur through both direct and indirect channels. Direct channels involve nonwoven manufacturers or converters selling directly to large-scale end-users such as major food and beverage companies, pharmaceutical firms, or retail chains. This approach allows for customized solutions and closer relationships with key clients. Indirect channels include a network of distributors, wholesalers, and specialized packaging suppliers who cater to smaller businesses, regional markets, and diverse industries. These intermediaries play a crucial role in market penetration and ensuring widespread availability of nonwoven packaging solutions across various geographical locations and customer segments. The final consumption of these products by industries like healthcare, food, personal care, and industrial manufacturing completes the value chain, driving continuous demand and innovation.

Nonwoven Packaging Market Potential Customers

The Nonwoven Packaging Market serves a broad spectrum of potential customers across diverse industries, each with specific requirements and demands for packaging solutions. End-users in the healthcare and medical sector represent a significant customer base, including hospitals, clinics, pharmaceutical companies, and medical device manufacturers. These customers prioritize sterile, hygienic, and highly protective packaging for surgical instruments, medical disposables, and pharmaceutical products, where nonwovens offer superior barrier properties against contaminants and bacteria. The emphasis on patient safety and regulatory compliance drives their procurement decisions, making nonwoven packaging an indispensable component in their operations.

Another large segment of potential customers is found within the food and beverage industry, encompassing food processing companies, beverage manufacturers, restaurants, and retail grocery chains. For these buyers, nonwoven packaging is utilized for applications such as tea bags, coffee filter pods, fresh produce wraps, and disposable food containers. Key purchasing criteria for this sector include food safety, breathability, moisture control, and the ability to extend shelf life while maintaining product quality. The growing demand for convenience foods and sustainable packaging options further positions nonwovens as an attractive solution for these customers.

Furthermore, the personal care and hygiene industry forms a substantial customer base, including manufacturers of cosmetics, toiletries, baby care products, and adult incontinence products. These companies utilize nonwoven packaging for wet wipes containers, cosmetic pouches, promotional bags, and protective wraps due to the materials' softness, liquid absorbency, and aesthetic versatility. Industrial manufacturers and consumer goods companies also constitute significant potential customers, requiring nonwoven packaging for protective covers, wraps for electronic goods, automotive components, and durable shopping bags. The increasing adoption of e-commerce platforms also drives demand from online retailers and logistics providers who need lightweight, durable, and protective packaging solutions for shipping various products to consumers globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $12.5 Billion |

| Market Forecast in 2032 | $19.9 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freudenberg Performance Materials, Berry Global Inc., Kimberly-Clark Corporation, Ahlstrom-Munksjo, Fitesa S.A., Toray Industries Inc., DuPont de Nemours Inc., PGI Nonwovens (now part of Berry Global), Lydall Inc., Georgia-Pacific LLC, Glatfelter Corporation, Mitsui Chemicals Inc., Asahi Kasei Corporation, Johns Manville, Lenzing AG, TWE Group, PFNonwovens a.s., First Quality Nonwovens, AVGOL Nonwovens, Union Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nonwoven Packaging Market Key Technology Landscape

The Nonwoven Packaging Market is characterized by a dynamic and evolving technological landscape, driven by the need for improved performance, cost efficiency, and enhanced sustainability. Spunbond technology remains a cornerstone, widely utilized for its ability to produce strong, durable, and cost-effective fabrics, particularly from polypropylene and polyester. This process involves extruding molten polymer, spinning it into continuous filaments, and then laying them randomly onto a conveyor belt before bonding them together, often through thermal or mechanical means. Its versatility makes it suitable for various packaging applications requiring high tensile strength and tear resistance, such as protective wraps and shopping bags. Innovations in spunbond focus on finer denier fibers and optimized bonding patterns to achieve better softness and barrier properties.

Meltblown technology is another critical process, primarily known for producing very fine fibers with excellent filtration capabilities and barrier properties, making it invaluable for medical and hygiene packaging. In this method, molten polymer is extruded through tiny nozzles into a high-velocity air stream, which attenuates the filaments into microfibers that are then collected on a screen to form a web. Advances in meltblown technology are concentrated on improving uniformity, reducing fiber size for enhanced barrier performance, and developing multi-layer composites that combine meltblown layers with spunbond layers to achieve superior functional properties. These composites are increasingly prevalent in sterilization wraps and protective apparel packaging, offering a balance of strength and filtration.

Beyond spunbond and meltblown, other significant technologies include spunlace (hydroentanglement), which uses high-pressure water jets to entangle fibers, resulting in soft, strong, and absorbent fabrics ideal for wipes and personal care packaging. Needle punch technology mechanically bonds fibers through needling, creating dense and robust fabrics often used in industrial packaging and protective covers. Thermal bonding and chemical bonding methods are also employed to impart specific properties, such as stiffness or liquid repellency. The key technological trends include the development of bio-based and biodegradable nonwoven production processes, the integration of advanced coating and lamination techniques for enhanced barrier functions, and the incorporation of smart material technologies like sensor integration for intelligent packaging solutions. These innovations are continuously pushing the boundaries of what nonwoven packaging can achieve in terms of performance, functionality, and environmental footprint.

Regional Highlights

The Nonwoven Packaging Market exhibits distinct regional dynamics, reflecting varying levels of economic development, regulatory frameworks, consumer preferences, and industrial growth across different geographies. Asia Pacific (APAC) stands out as the largest and fastest-growing market, primarily driven by rapid urbanization, increasing disposable incomes, and the booming manufacturing sector in countries like China, India, Japan, and South Korea. The region's significant population base and expanding end-use industries, particularly healthcare, hygiene, food and beverage, and e-commerce, fuel substantial demand for nonwoven packaging solutions. Investments in advanced manufacturing facilities and a growing emphasis on sustainable packaging further contribute to APAC's market leadership. The sheer scale of industrial output and consumer consumption in this region makes it a pivotal hub for nonwoven packaging innovation and adoption.

North America and Europe represent mature markets with strong growth attributed to stringent environmental regulations, a high adoption rate of advanced packaging technologies, and a consumer base that increasingly demands sustainable and convenient packaging. In North America, the emphasis on product safety, hygiene, and the robust e-commerce sector are key drivers. European countries, particularly Germany, France, and the UK, are at the forefront of sustainable packaging initiatives, promoting the use of recyclable and biodegradable nonwovens. These regions also benefit from established research and development infrastructure, fostering innovation in high-performance nonwoven materials and sophisticated packaging designs. The healthcare and personal care sectors are particularly strong contributors to demand in these developed economies.

Latin America, the Middle East, and Africa (MEA) are emerging markets for nonwoven packaging, characterized by significant growth potential due to improving economic conditions, increasing industrialization, and a rising awareness of hygiene and packaged goods. Countries like Brazil, Mexico, Saudi Arabia, and South Africa are witnessing expanding consumer bases and a greater demand for modern retail and healthcare infrastructure, translating into increased opportunities for nonwoven packaging. While currently smaller in market share compared to APAC, North America, and Europe, these regions are expected to experience accelerated growth as manufacturing capabilities expand, supply chains develop, and local demand for packaged products continues to surge. The adoption of nonwoven solutions is often linked to improvements in living standards and the availability of diverse product offerings.

- North America: Strong demand from healthcare and e-commerce, driven by advanced technological adoption and focus on product safety.

- Europe: Leading the charge in sustainable packaging, high penetration in personal care and medical sectors, supported by strict environmental regulations.

- Asia Pacific (APAC): Dominant market with rapid growth due to industrialization, large consumer base, and expanding hygiene and food industries, particularly in China and India.

- Latin America: Emerging market with increasing industrial output and rising consumer demand for packaged goods, offering significant growth opportunities.

- Middle East and Africa (MEA): Growing awareness of hygiene and product safety, coupled with expanding retail and healthcare sectors, fostering market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nonwoven Packaging Market.- Freudenberg Performance Materials

- Berry Global Inc.

- Kimberly-Clark Corporation

- Ahlstrom-Munksjo

- Fitesa S.A.

- Toray Industries Inc.

- DuPont de Nemours Inc.

- PGI Nonwovens (now part of Berry Global)

- Lydall Inc.

- Georgia-Pacific LLC

- Glatfelter Corporation

- Mitsui Chemicals Inc.

- Asahi Kasei Corporation

- Johns Manville

- Lenzing AG

- TWE Group

- PFNonwovens a.s.

- First Quality Nonwovens

- AVGOL Nonwovens

- Union Industries

Frequently Asked Questions

What are the primary benefits of using nonwoven materials in packaging?

Nonwoven materials offer several key benefits for packaging, including excellent breathability, liquid repellency, durability, softness, and superior barrier properties against bacteria and contaminants. They are often lightweight, contributing to reduced shipping costs and a lower environmental footprint, and can be designed to be reusable or compostable, aligning with sustainability goals.

Which industries are the largest consumers of nonwoven packaging?

The largest consumers of nonwoven packaging are the healthcare and medical industry, for sterile wraps and medical device packaging; the personal care and hygiene sector, for wipes and cosmetic bags; and the food and beverage industry, for tea bags and produce wraps. The e-commerce and consumer goods sectors are also significant and growing end-users.

What are the main drivers for the growth of the Nonwoven Packaging Market?

Key growth drivers include increasing consumer and regulatory demand for sustainable and eco-friendly packaging solutions, the rapid expansion of the e-commerce sector requiring protective yet lightweight materials, and heightened global awareness regarding hygiene and product safety, particularly in medical and personal care applications.

What role does technology play in the Nonwoven Packaging Market?

Technology plays a crucial role by enabling the production of nonwovens with enhanced performance characteristics, such as improved barrier properties, strength, and softness. Innovations in spunbond, meltblown, and spunlace technologies, along with the development of biodegradable materials and smart packaging integration, drive market expansion and product differentiation.

What are the major challenges facing the Nonwoven Packaging Market?

Major challenges include the volatility of raw material prices, particularly for petrochemical-based polymers, which impacts production costs. Additionally, regulatory complexities surrounding recyclability and biodegradability, alongside the significant capital investment required for manufacturing facilities, pose hurdles for market growth and development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager