Occupancy Sensors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431243 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Occupancy Sensors Market Size

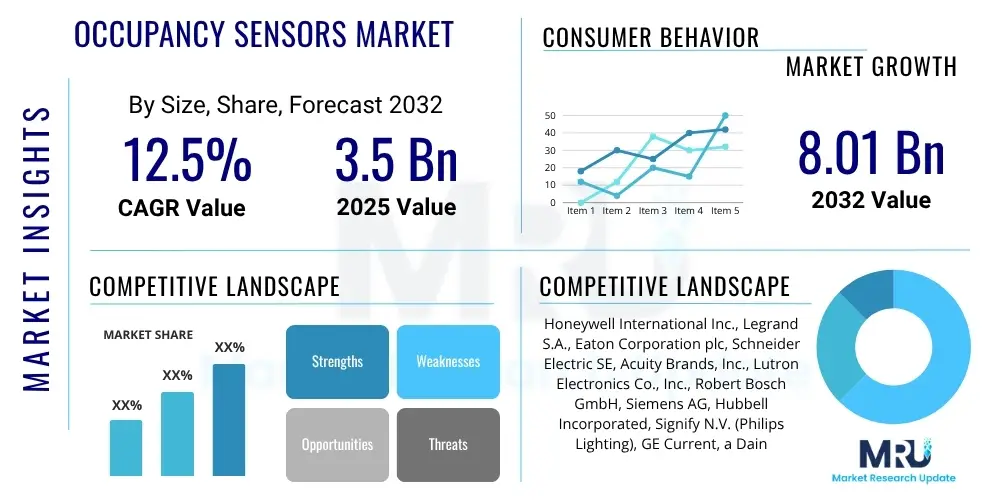

The Occupancy Sensors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 3.5 Billion in 2025 and is projected to reach USD 8.01 Billion by the end of the forecast period in 2032.

Occupancy Sensors Market introduction

The Occupancy Sensors Market encompasses a diverse range of devices designed to detect the presence or absence of people in a given area, primarily for automated control of building systems. These intelligent devices utilize various sensing technologies to determine if a space is occupied, subsequently triggering actions such as turning lights on or off, adjusting heating, ventilation, and air conditioning (HVAC) systems, or activating security alarms. This core functionality drives significant benefits across multiple sectors, making them integral components of modern smart buildings and energy management strategies.

Occupancy sensors, often described as the "eyes" of a smart building, offer a compelling value proposition by enhancing energy efficiency, improving occupant comfort, and bolstering security. By preventing unnecessary operation of electrical and mechanical systems in vacant areas, they drastically reduce energy consumption and operational costs. Their major applications span commercial offices, educational institutions, healthcare facilities, residential buildings, and industrial spaces, where precise control over environmental conditions and resource allocation is paramount. The increasing global emphasis on energy conservation, coupled with the rapid adoption of smart building technologies and the integration of IoT ecosystems, serves as a primary driver for the sustained growth and innovation within this market, making occupancy sensors a critical investment for future-proof infrastructure.

Occupancy Sensors Market Executive Summary

The Occupancy Sensors Market is experiencing robust expansion driven by global trends towards energy efficiency, smart infrastructure development, and advanced automation. Business trends indicate a strong shift towards integrating these sensors with broader building management systems (BMS) and Internet of Things (IoT) platforms, fostering a more interconnected and responsive environment. Companies are investing in research and development to enhance sensor accuracy, reduce false positives, and develop more sophisticated analytics capabilities, moving beyond simple presence detection to understanding occupancy patterns and spatial utilization. The increasing demand for wireless and battery-less solutions further shapes market dynamics, promoting easier installation and greater flexibility in deployment.

Regionally, North America and Europe continue to be significant markets, characterized by stringent energy regulations and early adoption of smart building technologies, with a strong focus on retrofitting existing commercial and institutional buildings. The Asia Pacific region is poised for the most rapid growth, fueled by rapid urbanization, significant investments in smart city projects, and the construction of new commercial and residential complexes, particularly in developing economies like China and India. Emerging markets in Latin America, the Middle East, and Africa are also showing promising growth, driven by infrastructure development and increasing awareness of energy conservation benefits. These regions present substantial opportunities for market players to introduce cost-effective and scalable occupancy sensor solutions tailored to local needs and regulatory frameworks.

Segmentation trends highlight the increasing prominence of dual-technology sensors, which combine Passive Infrared (PIR) and ultrasonic sensing to improve accuracy and reduce false detections. Wired solutions still dominate larger commercial installations due to reliability, but wireless connectivity is rapidly gaining traction, especially in retrofit projects and residential applications, leveraging technologies like Zigbee, Z-Wave, and Bluetooth. The commercial end-use segment remains the largest revenue contributor, primarily due to large-scale deployments in offices, retail, and hospitality. However, the residential sector is demonstrating accelerated growth, propelled by the proliferation of smart home ecosystems and consumer demand for convenience and energy savings, reflecting a broadening application landscape for occupancy sensing technologies.

AI Impact Analysis on Occupancy Sensors Market

User inquiries regarding AI's impact on the Occupancy Sensors Market frequently revolve around how artificial intelligence can enhance the traditional functionalities of these devices, specifically concerning accuracy, predictive capabilities, and integration with broader smart building ecosystems. Users often express curiosity about AI's role in minimizing false triggers, optimizing energy consumption beyond basic on/off controls, and enabling more personalized environmental settings. Furthermore, questions arise concerning data privacy implications as AI-powered sensors collect more granular information about human presence and activity, alongside the potential for these systems to contribute to more sophisticated security or space utilization analytics. There is a general expectation that AI will transform occupancy sensors from simple detection tools into intelligent, proactive components of smart infrastructure, capable of learning patterns and making autonomous, data-driven decisions.

- Enhanced Detection Accuracy: AI algorithms process sensor data to filter out environmental noise and non-human movements, significantly reducing false positives and negatives.

- Predictive Occupancy: Machine learning models analyze historical occupancy patterns and real-time data to predict future occupancy, enabling proactive control of building systems like HVAC and lighting.

- Personalized Environment Control: AI-driven systems learn individual or group preferences to automatically adjust temperature, lighting levels, and ventilation for optimal comfort and productivity.

- Dynamic Space Utilization: AI provides insights into how spaces are used, informing facility management about optimal layouts, cleaning schedules, and resource allocation.

- Advanced Energy Optimization: Beyond simple on/off, AI integrates occupancy data with other building metrics to achieve more granular, adaptive, and efficient energy management strategies.

- Integration with Smart Systems: AI acts as a central intelligence layer, allowing occupancy sensors to seamlessly communicate and coordinate with security systems, access control, and emergency services.

- Behavioral Analytics: AI can identify subtle behavioral patterns related to occupancy, offering deeper insights into human movement and interaction within a space for improved design and operations.

DRO & Impact Forces Of Occupancy Sensors Market

The Occupancy Sensors Market is significantly shaped by a combination of key drivers, restraints, and opportunities, all influenced by various impact forces that determine its trajectory. The primary drivers include the escalating global demand for energy-efficient buildings and the widespread adoption of smart building and home automation technologies. Regulatory mandates and government incentives promoting sustainable building practices also play a crucial role, alongside the growing awareness among consumers and businesses regarding the operational cost savings and environmental benefits offered by these sensors. Furthermore, the integration of occupancy sensors with IoT platforms and advanced analytics is expanding their utility beyond simple presence detection, creating more sophisticated and value-added applications.

However, the market also faces considerable restraints, such as the relatively high initial installation costs, particularly for comprehensive, integrated systems in existing structures. Technical challenges, including the potential for false triggers due to environmental factors or inaccurate calibration, can deter adoption. Concerns over data privacy and security, especially with more intelligent and interconnected sensor systems, present a significant hurdle for widespread acceptance. Moreover, a lack of standardization across different manufacturers and technologies can lead to interoperability issues and increased complexity during system integration, which can slow down market penetration and consumer confidence.

Despite these challenges, numerous opportunities exist for market growth and innovation. The increasing demand for wireless and battery-less sensor technologies offers avenues for easier deployment and reduced maintenance, particularly in retrofitting applications. The ongoing development and integration of artificial intelligence and machine learning capabilities into occupancy sensors promise enhanced accuracy, predictive analysis, and personalized control, opening up new applications in areas like detailed space utilization analytics and advanced security. Furthermore, emerging markets in Asia Pacific, Latin America, and the Middle East and Africa present vast untapped potential due to rapid urbanization, significant infrastructure development, and a growing focus on energy conservation, offering substantial long-term growth prospects for market players.

Segmentation Analysis

The Occupancy Sensors Market is broadly segmented based on various factors including technology, connectivity, coverage area, application, and end-use. This segmentation provides a granular view of the market dynamics, helping to understand specific demands, competitive landscapes, and growth opportunities within each category. Each segment addresses distinct needs and preferences of end-users, reflecting the diverse applications and technological advancements driving market expansion.

- By Technology:

- Passive Infrared (PIR)

- Ultrasonic

- Dual-Technology (PIR + Ultrasonic)

- Microwave

- Others (e.g., LiDAR, Camera-based)

- By Connectivity:

- Wired

- Wireless (e.g., Zigbee, Z-Wave, Bluetooth, Wi-Fi)

- By Coverage Area:

- Small Area

- Mid Area

- Large Area

- By Application:

- Lighting Control

- HVAC Control

- Security and Surveillance

- Smart Home

- Space Utilization and Management

- Others

- By End Use:

- Commercial (Offices, Retail, Hospitality, Education, Healthcare)

- Residential

- Industrial

- Government and Public Infrastructure

Value Chain Analysis For Occupancy Sensors Market

The value chain for the Occupancy Sensors Market commences with upstream activities involving the sourcing of raw materials and components, such as semiconductors, infrared detectors, ultrasonic transducers, microcontrollers, and plastic casings, from specialized suppliers. Semiconductor manufacturers and electronic component providers form a critical part of this initial stage, providing the essential building blocks for sensor devices. Research and development efforts at this stage focus on miniaturization, power efficiency, and enhanced detection capabilities, laying the foundation for advanced sensor technologies. The quality and cost-effectiveness of these upstream inputs directly influence the final product's performance and market competitiveness.

Midstream activities involve the design, manufacturing, and assembly of the occupancy sensors by Original Equipment Manufacturers (OEMs). These manufacturers integrate various components, develop proprietary algorithms for detection, and ensure the sensors meet specific performance standards and certifications. This stage often includes significant investment in automation and quality control to produce reliable and durable products. Following manufacturing, the sensors move into the distribution phase, which can be categorized into direct and indirect channels. Direct distribution typically involves OEMs selling directly to large commercial clients or system integrators for large-scale projects, allowing for customized solutions and direct technical support. Indirect distribution relies on a network of distributors, wholesalers, and retail partners who supply to smaller businesses, individual contractors, and the residential market, providing broader market reach and localized availability.

Downstream activities involve the installation, integration, and end-use of occupancy sensors. System integrators play a crucial role here, combining sensors with building management systems, lighting control systems, and HVAC systems to create comprehensive smart building solutions. Installers are responsible for the physical deployment and calibration of the sensors, ensuring optimal performance. Finally, the end-users—comprising commercial building owners, facility managers, homeowners, and industrial operators—utilize these sensors to achieve energy savings, improve occupant comfort, and enhance security. Post-sales services, including maintenance, upgrades, and technical support, complete the value chain, ensuring long-term operational efficiency and customer satisfaction, and feeding back insights for future product development.

Occupancy Sensors Market Potential Customers

The primary potential customers and end-users of occupancy sensors span a diverse range of sectors, all seeking to optimize resource utilization, enhance operational efficiency, and improve environmental control within their spaces. Commercial establishments, including office buildings, retail stores, hotels, and educational institutions, represent a significant segment, driven by the need for substantial energy savings through automated lighting and HVAC control in varied occupancy settings. These entities benefit from reduced operational costs and improved sustainability profiles, which are increasingly important for corporate responsibility and compliance with green building standards. The ability of sensors to provide data on space utilization also appeals to facility managers looking to optimize floor plans and resource allocation.

The residential sector, particularly smart homeowners and developers of multi-family dwellings, constitutes another rapidly growing customer base. Here, occupancy sensors integrate with smart home ecosystems to offer enhanced convenience, security, and personalized comfort, automatically adjusting lighting, climate control, and security systems based on presence. As smart home technology becomes more accessible and interconnected, the demand for occupancy sensors in this segment is set to escalate. Industrial facilities, including factories, warehouses, and manufacturing plants, also leverage these sensors for controlling lighting in large, infrequently accessed areas, enhancing safety, and managing energy in production environments, thereby contributing to operational efficiency and worker safety.

Furthermore, the public sector, encompassing government buildings, municipal facilities, and public infrastructure projects, represents a substantial customer segment, often driven by mandates for energy efficiency and smart city initiatives. Healthcare facilities, such as hospitals and clinics, utilize occupancy sensors not only for energy management but also for monitoring patient movement in certain areas and optimizing staff responses. The hospitality industry employs these sensors to automate room functions and enhance guest experience while simultaneously managing energy consumption. The broad applicability of occupancy sensors across these varied end-user categories underscores their fundamental role in modern infrastructure management and energy conservation efforts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.5 Billion |

| Market Forecast in 2032 | USD 8.01 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Legrand S.A., Eaton Corporation plc, Schneider Electric SE, Acuity Brands, Inc., Lutron Electronics Co., Inc., Robert Bosch GmbH, Siemens AG, Hubbell Incorporated, Signify N.V. (Philips Lighting), GE Current, a Daintree Company, Leviton Manufacturing Co., Inc., Crestron Electronics, Inc., ABB Ltd., STMicroelectronics N.V., Texas Instruments Inc., Pyronix Ltd., Douglas Lighting Controls (Universal Lighting Technologies), Echelon Corporation, Wattstopper (Legrand) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Occupancy Sensors Market Key Technology Landscape

The Occupancy Sensors Market is characterized by a dynamic and evolving technology landscape, continuously driven by innovation to enhance accuracy, reliability, and integration capabilities. Passive Infrared (PIR) sensors remain a foundational technology, detecting changes in infrared radiation emitted by moving bodies, making them highly effective for motion-based detection. Ultrasonic sensors complement PIR by emitting high-frequency sound waves and detecting changes in their reflection patterns, useful for detecting minor movements and ensuring coverage in areas with obstructions. The combination of these two in dual-technology sensors significantly reduces false triggers by requiring both motion and presence detection, offering superior performance in complex environments. Beyond these established methods, microwave sensors are gaining traction for their ability to detect movement through non-metallic objects, offering broader coverage, albeit with potential for higher sensitivity to external movements.

Emerging and advanced technologies are further transforming the market. LiDAR (Light Detection and Ranging) technology, though typically more expensive, offers highly precise presence detection and even counting capabilities, making it suitable for advanced space utilization analytics. Camera-based vision systems, coupled with artificial intelligence and machine learning algorithms, are enabling sophisticated occupancy detection, people counting, and even activity recognition, moving beyond simple presence to understanding how spaces are used. The integration of AI and ML is pivotal, allowing sensors to learn occupancy patterns, adapt to environmental changes, and minimize false detections. This enhances predictive capabilities for systems like HVAC and lighting, leading to more granular and efficient control based on anticipated occupancy.

Connectivity plays a critical role, with wireless technologies like Zigbee, Z-Wave, Bluetooth Mesh, and Wi-Fi HaLow gaining prominence for their flexibility, ease of installation, and scalability, especially in retrofit projects and smart home applications. These wireless protocols facilitate seamless communication between sensors and central control systems, often leveraging cloud computing for data storage, processing, and advanced analytics. Furthermore, advancements in low-power electronics and energy harvesting technologies are enabling the development of battery-less sensors, reducing maintenance needs and environmental impact. The convergence of these technologies is fostering the creation of highly intelligent, interconnected, and adaptive occupancy sensing solutions that are integral to modern smart buildings and IoT ecosystems, pushing the boundaries of energy management, security, and occupant comfort.

Regional Highlights

- North America: This region stands as a mature and significant market for occupancy sensors, driven by stringent energy efficiency regulations, a high adoption rate of smart home and building automation technologies, and a strong focus on sustainable building practices. The presence of major technology providers and a robust infrastructure for IoT integration further propels market growth. Early adoption in commercial, industrial, and residential sectors for energy management and security applications is a key characteristic.

- Europe: Europe is another dominant market, characterized by proactive government initiatives and directives aimed at reducing carbon emissions and promoting energy conservation in buildings. Countries like Germany, the UK, and France are leading the way in implementing smart building solutions, with occupancy sensors being a critical component. High awareness among consumers and businesses regarding energy costs and environmental impact contributes to steady market expansion and demand for advanced, integrated solutions.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate in the occupancy sensors market, primarily due to rapid urbanization, increasing industrialization, and significant investments in smart city projects across countries like China, India, Japan, and South Korea. The burgeoning construction sector, coupled with a growing focus on energy efficiency in new commercial and residential developments, creates immense opportunities for market players. Rising disposable incomes and the increasing penetration of smart home devices also contribute to the accelerating demand.

- Latin America: This region represents an emerging market for occupancy sensors, with growing awareness about energy conservation and the benefits of smart building technologies. Countries like Brazil, Mexico, and Argentina are witnessing increased investments in infrastructure development and commercial construction, which, along with government initiatives to promote energy efficiency, are fostering market growth. While adoption rates are lower compared to developed regions, the market is poised for steady expansion.

- Middle East and Africa (MEA): The MEA region is experiencing gradual but significant growth, driven by ambitious smart city projects, especially in the GCC countries (e.g., UAE, Saudi Arabia) and increasing construction activities. The focus on diversifying economies away from oil and gas, coupled with large-scale commercial and hospitality developments, creates a fertile ground for occupancy sensor adoption. Energy management and enhanced security are key drivers in this region, with a rising demand for integrated building management solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Occupancy Sensors Market.- Honeywell International Inc.

- Legrand S.A.

- Eaton Corporation plc

- Schneider Electric SE

- Acuity Brands, Inc.

- Lutron Electronics Co., Inc.

- Robert Bosch GmbH

- Siemens AG

- Hubbell Incorporated

- Signify N.V. (Philips Lighting)

- GE Current, a Daintree Company

- Leviton Manufacturing Co., Inc.

- Crestron Electronics, Inc.

- ABB Ltd.

- STMicroelectronics N.V.

- Texas Instruments Inc.

- Pyronix Ltd.

- Douglas Lighting Controls (Universal Lighting Technologies)

- Echelon Corporation

- Wattstopper (Legrand)

Frequently Asked Questions

What are the primary benefits of using occupancy sensors?

Occupancy sensors primarily offer significant energy savings by automatically turning off lights and adjusting HVAC systems in unoccupied spaces. They also enhance occupant comfort by ensuring systems operate only when needed, improve security, and provide valuable data for space utilization analysis, leading to optimized facility management.

How do different types of occupancy sensors detect presence?

Passive Infrared (PIR) sensors detect body heat and movement. Ultrasonic sensors emit sound waves and detect changes in their reflection. Dual-technology sensors combine both PIR and ultrasonic to minimize false triggers. Microwave sensors use microwave radiation to detect motion, even through some non-metallic barriers, offering broader coverage.

In which environments are occupancy sensors most effective?

Occupancy sensors are highly effective in commercial buildings such as offices, conference rooms, classrooms, restrooms, and corridors. They are also increasingly used in residential smart homes, industrial warehouses, and public infrastructure to manage lighting, HVAC, and security systems efficiently based on real-time occupancy.

What role does AI play in the advancement of occupancy sensor technology?

AI significantly enhances occupancy sensors by improving detection accuracy, enabling predictive occupancy capabilities, and allowing for personalized environmental control. AI algorithms analyze patterns to reduce false triggers, optimize energy consumption more intelligently, and facilitate seamless integration with broader smart building management systems for advanced analytics.

Are there any privacy concerns associated with the use of occupancy sensors?

Generally, basic occupancy sensors detect only presence and motion, not individual identities, thus posing minimal privacy concerns. However, advanced systems incorporating camera-based vision or highly granular data collection may raise questions about data usage and anonymity. Reputable manufacturers ensure data privacy and adherence to regulations by focusing on aggregate data and anonymization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager