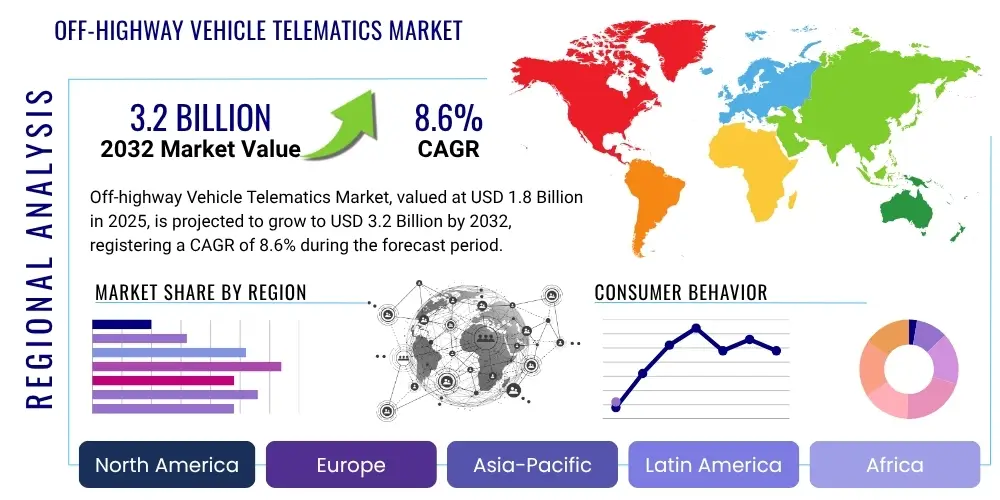

Off-highway Vehicle Telematics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429186 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Off-highway Vehicle Telematics Market Size

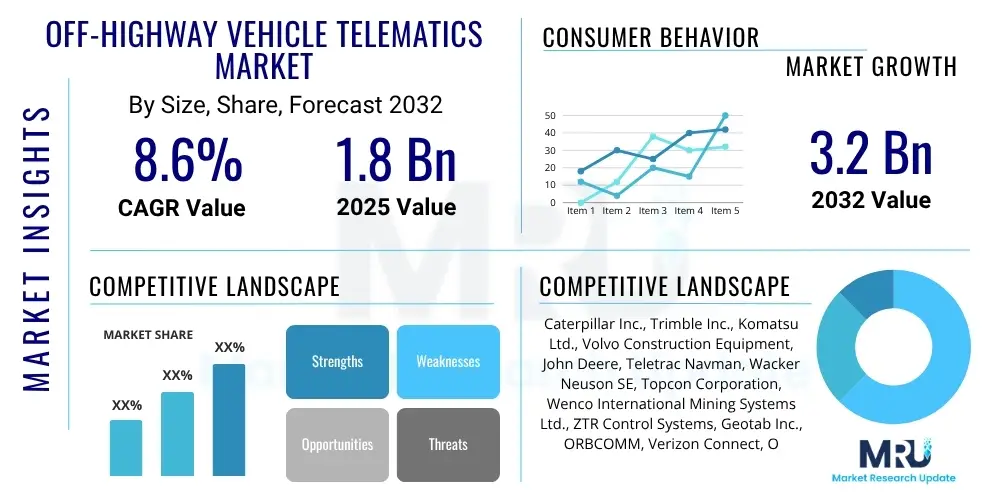

The Off-highway Vehicle Telematics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.6% between 2025 and 2032. The market is estimated at USD 1.8 Billion in 2025 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2032.

Off-highway Vehicle Telematics Market introduction

The Off-highway Vehicle Telematics market is a specialized segment within the broader telematics industry, focusing on the application of telecommunication and informatics technologies to non-road-going vehicles and heavy equipment. This sector encompasses a wide array of machinery used across critical industries such as construction, mining, agriculture, forestry, and material handling. The fundamental objective is to collect, transmit, and analyze data from these assets in real-time, providing actionable insights that improve operational efficiency, safety, and overall asset management. The integration of robust hardware with advanced software platforms forms the core of these solutions, designed to withstand the harsh operating conditions prevalent in off-highway environments.

The product portfolio within this market typically includes ruggedized telematics control units (TCUs) equipped with Global Positioning System (GPS) receivers, various sensors (e.g., for engine diagnostics, fuel levels, hydraulics, and operator behavior), and communication modules (cellular, satellite, or hybrid). These hardware components are intrinsically linked to sophisticated cloud-based software platforms that offer features such as real-time vehicle tracking, geofencing, remote diagnostics, fuel consumption monitoring, maintenance scheduling, and performance reporting. Major applications of off-highway telematics extend from optimizing fleet deployment and managing complex project timelines in construction to enhancing safety protocols in hazardous mining environments and improving yield management in precision agriculture.

The benefits derived from the adoption of off-highway telematics are extensive and directly contribute to improved business outcomes. These include significant enhancements in operational efficiency by reducing idle times, optimizing equipment utilization, and streamlining logistics; substantial improvements in safety through continuous monitoring of machine health and operator behavior, enabling proactive intervention to prevent accidents. Furthermore, telematics plays a crucial role in cost reduction by facilitating predictive maintenance, thereby minimizing unexpected breakdowns and extending the lifespan of valuable assets, alongside providing robust theft recovery capabilities. Key driving factors propelling market growth are the increasing global demand for infrastructure development, stricter environmental and safety regulations, the pressing need for sustainable resource management, and continuous technological advancements in connectivity and data analytics, including the proliferation of 5G networks and sophisticated AI capabilities.

Off-highway Vehicle Telematics Market Executive Summary

The Off-highway Vehicle Telematics market is witnessing a dynamic period of expansion, underpinned by a global push for enhanced operational efficiency and asset intelligence across capital-intensive industries. Current business trends indicate a strong momentum towards integrated solutions that combine hardware, software, and services into a unified ecosystem, often delivered through flexible subscription-based models. This shift reduces the initial capital outlay for end-users and encourages broader adoption. Strategic collaborations between telematics providers and original equipment manufacturers (OEMs) are becoming increasingly common, leading to factory-installed solutions that offer seamless integration and streamlined data flow from the point of vehicle production. Moreover, the industry is seeing a heightened focus on data security and privacy as the volume and sensitivity of transmitted operational data continue to grow, prompting providers to invest in robust cybersecurity measures.

Geographically, market development exhibits distinct patterns. North America and Europe stand as mature markets characterized by high penetration rates, sophisticated technological infrastructure, and robust regulatory environments that actively promote telematics for compliance, safety, and environmental stewardship. These regions are at the forefront of adopting advanced analytics, machine learning, and AI-driven insights to maximize the value extracted from telematics data. In contrast, the Asia Pacific region is rapidly emerging as a primary growth engine, fueled by unprecedented infrastructure development, accelerated industrialization, and the widespread adoption of mechanization in agriculture, particularly in rapidly developing economies like China, India, and Southeast Asian nations. Latin America and the Middle East & Africa also demonstrate significant growth potential, driven by substantial investments in mining and construction and nascent agricultural modernization initiatives, despite facing challenges related to economic volatility and connectivity infrastructure in some remote areas.

Analysis of market segmentation reveals significant trends. The software and services components are increasingly gaining market share relative to hardware, reflecting the growing value placed on data interpretation, actionable insights, and ongoing support rather than just data collection. Advanced analytics, real-time diagnostics, and remote asset control functionalities within software platforms are highly sought after. By application, the construction and mining sectors continue to be the largest consumers of telematics solutions, leveraging these technologies for precise asset tracking, optimized fleet utilization, and rigorous safety compliance on large-scale projects. The agriculture sector is experiencing accelerated growth, propelled by the demand for precision farming techniques, efficient farm machinery management, and sustainable land use practices. This evolution underscores a market moving towards more intelligent, integrated, and application-specific telematics offerings.

AI Impact Analysis on Off-highway Vehicle Telematics Market

User inquiries frequently explore how Artificial Intelligence (AI) is transforming the Off-highway Vehicle Telematics market, highlighting a collective interest in its capabilities to elevate operational performance, enhance predictive maintenance, and foster the development of autonomous heavy machinery. Stakeholders are particularly keen on understanding AI's role in processing the immense volumes of data generated by telematics systems, converting raw sensor outputs and operational logs into clear, actionable intelligence. Key themes consistently emerging include the potential for AI to automate routine decision-making processes, optimize complex logistics and scheduling, and provide unprecedented levels of insight into equipment health and operator efficiency. However, there are also common concerns about the computational demands of AI, the necessity for robust data privacy frameworks, and the challenges associated with integrating AI solutions seamlessly into existing legacy systems and training the workforce for these advanced capabilities.

- Predictive Maintenance Enhancement: AI algorithms analyze historical and real-time sensor data from engines, hydraulics, and other components to accurately predict potential failures before they occur, enabling proactive servicing and significantly reducing unplanned downtime.

- Operational Efficiency Optimization: AI applications optimize fleet routing, task allocation, and fuel consumption by analyzing operational patterns, environmental factors, and project requirements, leading to reduced operational costs and improved productivity.

- Facilitation of Autonomous Operations: AI is fundamental to the development and safe operation of autonomous and semi-autonomous off-highway vehicles, processing complex environmental data, enabling perception, decision-making, and control in dynamic worksite conditions.

- Advanced Data Analytics and Insights: Leveraging machine learning, AI transforms vast telematics datasets into comprehensive performance dashboards and actionable reports, identifying trends, anomalies, and opportunities for process improvement.

- Enhanced Safety and Risk Management: AI systems monitor operator behavior, detect fatigue or unsafe practices, and can predict hazardous situations, issuing real-time alerts or even initiating automated safety responses to prevent accidents.

- Resource Allocation and Demand Forecasting: AI models can forecast equipment demand based on project schedules, weather patterns, and historical data, optimizing the allocation of machinery and personnel across multiple sites.

- Improved Cybersecurity Posture: AI-driven threat detection systems analyze network traffic and data patterns for anomalies, providing a stronger defense against cyberattacks on telematics infrastructure and sensitive operational data.

- Optimized Fuel Management: AI analyzes engine performance, load, and operator habits to recommend adjustments that lead to significant fuel savings and reduced emissions.

DRO & Impact Forces Of Off-highway Vehicle Telematics Market

The Off-highway Vehicle Telematics market is propelled by a robust set of driving factors. Foremost among these is the escalating global imperative for operational efficiency and productivity across capital-intensive industries like construction, mining, and agriculture. Companies are continuously seeking ways to maximize the utilization of their expensive machinery, minimize downtime, and optimize resource allocation, all of which are directly addressed by telematics solutions. Furthermore, increasingly stringent government regulations pertaining to vehicle safety, emissions control, and environmental impact necessitate advanced monitoring and reporting capabilities that telematics inherently provides. For instance, compliance with emissions standards often requires precise fuel consumption and engine performance data. The rising cost of fuel and the broader emphasis on sustainability also compel businesses to adopt telematics to monitor and reduce fuel consumption, thereby lowering operational expenses and contributing to environmental goals.

Conversely, the market faces significant restraints that can impede its growth trajectory. The substantial initial investment required for the procurement and installation of telematics hardware and software can be a considerable barrier, particularly for smaller and medium-sized enterprises (SMEs) with limited capital budgets. Concerns surrounding data security and the privacy of sensitive operational data, including asset locations, performance metrics, and operator behavior, represent another critical challenge; organizations are hesitant to adopt solutions without robust cybersecurity assurances. Moreover, the lack of standardized communication protocols and interoperability between telematics systems from different vendors or across various OEM equipment can create integration complexities, hindering seamless fleet management. A persistent shortage of skilled labor capable of effectively deploying, managing, and interpreting the vast amounts of data generated by telematics systems further adds to the adoption challenges, particularly in developing regions.

Despite these challenges, numerous opportunities are emerging that are poised to accelerate market expansion. Continuous advancements in connectivity technologies, notably the ongoing rollout of 5G networks and the increasing viability of low-earth orbit (LEO) satellite constellations, promise more ubiquitous, faster, and reliable data transmission even from the most remote operational sites. The burgeoning integration of Artificial Intelligence (AI) and Machine Learning (ML) into telematics platforms is creating unprecedented capabilities for predictive analytics, real-time decision support, and the eventual realization of fully autonomous off-highway vehicles. Furthermore, the rapid economic growth and massive infrastructure development projects underway in emerging markets, particularly across Asia Pacific and Latin America, present vast untapped potential for telematics providers. These opportunities are continuously shaped by broader impact forces, including rapid technological innovation, evolving global trade policies, fluctuating commodity prices impacting heavy industry investments, and geopolitical stability, all of which influence the pace and direction of market development for off-highway vehicle telematics solutions globally.

Segmentation Analysis

The Off-highway Vehicle Telematics market is meticulously segmented to provide a granular understanding of its complex structure and diverse customer requirements. This detailed segmentation allows market participants to identify niche opportunities, tailor product development, and refine their go-to-market strategies. The primary dimensions for segmentation typically include the type of technology employed for communication, the components comprising the telematics system, the specific industry applications, and the categories of vehicles utilizing these solutions. Each segment exhibits unique characteristics, growth drivers, and competitive landscapes, reflecting the specialized demands of the off-highway sector.

For instance, segmentation by technology distinguishes between cellular-based telematics, which relies on established mobile networks, and satellite-based telematics, essential for operations in remote areas without cellular coverage. Hybrid systems combine both for maximum reliability. The component segmentation differentiates between the physical hardware (e.g., tracking devices, sensors), the software platforms (for data processing, analytics, and user interfaces), and the services offered (e.g., installation, training, data analysis, and support). This highlights the growing importance of value-added software and services in enhancing data utility. Application-based segmentation underscores the specific operational needs of sectors like construction, mining, and agriculture, where telematics solutions are customized to address unique challenges such as fleet coordination, safety compliance, or yield optimization. Finally, vehicle type segmentation categorizes solutions based on whether they are deployed on heavy equipment (e.g., excavators), light equipment (e.g., skid steer loaders), or specialized agricultural machinery (e.g., smart tractors), allowing for targeted product design and marketing efforts. This comprehensive approach to segmentation is crucial for navigating the multifaceted demands of the off-highway vehicle telematics landscape.

- By Technology:

- Cellular Telematics (2G/3G for basic tracking, 4G/LTE for higher data rates, emerging 5G for ultra-low latency and massive connectivity)

- Satellite Telematics (for remote areas lacking terrestrial network coverage, offering global reach)

- Hybrid Telematics (combining cellular and satellite for optimized connectivity and cost-efficiency)

- By Component:

- Hardware (Telematics Control Units (TCUs), GPS receivers, various sensors (fuel, engine, hydraulic, proximity), modems, displays, antennas)

- Software (Fleet Management Software, Asset Tracking Software, Predictive Maintenance Software, Diagnostic & Performance Monitoring Software, Safety Management Systems, Geofencing applications)

- Services (Consulting & Integration Services, Data Analytics & Reporting Services, Installation & Maintenance Services, Cloud Hosting & Managed Services, Training & Support)

- By Application:

- Construction (large-scale civil engineering, commercial building, road construction, material transport)

- Mining (surface and underground mining operations, quarry management, mineral extraction)

- Agriculture (precision farming, crop management, livestock tracking, farm machinery optimization)

- Forestry (logging operations, timber transport, equipment tracking in remote forest areas)

- Material Handling (forklift fleets, warehouse equipment management, port operations)

- Logistics and Transportation (off-road segments for specialized cargo, remote site deliveries)

- By Vehicle Type:

- Heavy Equipment (Excavators, Wheel Loaders, Dozers, Graders, Articulated Dump Trucks, Cranes, Pavers)

- Light Equipment (Skid Steer Loaders, Compact Track Loaders, Backhoe Loaders, Mini Excavators)

- Agricultural Machinery (Tractors, Harvesters, Sprayers, Seeders, Combines)

- Other Specialty Vehicles (Waste Management Vehicles, Snow Groomers, Airport Ground Support Equipment)

Value Chain Analysis For Off-highway Vehicle Telematics Market

The value chain of the Off-highway Vehicle Telematics market is an intricate network spanning from fundamental component manufacturing to final end-user application, highlighting the collaborative efforts required to deliver comprehensive solutions. The upstream segment of this value chain involves specialized suppliers of core hardware and software components. This includes manufacturers of high-precision GPS modules, various types of sensors (e.g., accelerometers, gyroscopes, fuel level, pressure, temperature), ruggedized communication modules (cellular and satellite), and microcontrollers or embedded processors that form the intelligence of the telematics control units. Additionally, software developers specializing in operating systems for embedded devices, firmware, and fundamental cloud infrastructure components contribute to the foundational technology stack, ensuring robust data acquisition and initial processing capabilities.

Moving further downstream, the value chain encompasses solution providers and system integrators who are responsible for designing, assembling, and often customizing complete telematics systems. These entities procure components from upstream suppliers, develop proprietary software applications for data visualization, analytics, and fleet management, and then integrate these elements into a cohesive, functional system tailored for specific off-highway vehicle types or industry applications. Their role is critical in ensuring interoperability between diverse hardware and software elements and in providing a user-friendly interface for end-users. This stage often involves rigorous testing and certification to meet industry standards and harsh environmental operating conditions, ensuring the reliability and accuracy of the telematics data.

The final stages of the value chain involve the distribution and deployment of these telematics solutions to end-users. Distribution channels can be broadly categorized as direct and indirect. Direct sales typically involve telematics solution providers engaging directly with large fleet operators, major construction companies, or mining corporations, offering customized solutions, extensive support, and long-term service contracts. Indirect channels are prevalent through strategic partnerships with Original Equipment Manufacturers (OEMs) who integrate telematics systems as a standard or optional feature at the factory level. This channel often provides a seamless, pre-installed solution for customers purchasing new equipment. Furthermore, a network of independent dealers, distributors, and service providers play a crucial role in installation, maintenance, and localized support, particularly for aftermarket solutions or for smaller enterprises. The value created at the end of the chain is realized by end-users through enhanced operational insights, improved safety, reduced costs, and optimized asset performance, translating directly into their business profitability and sustainability.

Off-highway Vehicle Telematics Market Potential Customers

The Off-highway Vehicle Telematics market targets a broad spectrum of potential customers who operate heavy machinery and specialized vehicles in environments beyond public road networks. These end-users are characterized by their significant investment in capital equipment and a pressing need to maximize asset utilization, improve operational efficiency, enhance safety, and minimize operational costs. Their core business functions are inherently reliant on the performance and availability of their off-highway fleets, making telematics a crucial tool for competitive advantage and sustainable operations. The diversity of their operational contexts, from remote mines to bustling construction sites, necessitates adaptable and robust telematics solutions.

Primary customer segments include large-scale construction companies involved in major infrastructure projects, commercial and residential development, and earthmoving operations globally. These firms leverage telematics for precise asset tracking across multiple job sites, managing project timelines, optimizing material flow, and ensuring safety compliance for heavy equipment like excavators, bulldozers, and cranes. Similarly, mining corporations, encompassing both surface and underground operations, represent a critical customer base. They utilize telematics to monitor highly expensive machinery, track production metrics, manage fuel consumption in remote and often hazardous locations, and ensure the safety of their workforce, directly impacting their profitability and regulatory compliance.

Beyond construction and mining, the agriculture sector is rapidly emerging as a significant market for off-highway telematics, driven by the global trend towards precision farming and smart agriculture. Agricultural enterprises, from expansive corporate farms to technologically advanced smaller holdings, adopt telematics for optimizing tractor and harvester performance, managing irrigation systems, monitoring crop health, and enhancing the efficiency of field operations. Other important customer groups include forestry companies managing logging and timber transport equipment, material handling companies overseeing forklift fleets in warehouses and ports, and an increasing number of equipment rental firms that benefit immensely from real-time tracking, usage monitoring, and predictive maintenance scheduling for their rented assets. Government entities and municipal departments also represent a growing segment, employing telematics for public works fleets, waste management vehicles, and emergency service equipment to ensure efficient and accountable operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2032 | USD 3.2 Billion |

| Growth Rate | 8.6% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Trimble Inc., Komatsu Ltd., Volvo Construction Equipment, John Deere, Teletrac Navman, Wacker Neuson SE, Topcon Corporation, Wenco International Mining Systems Ltd., ZTR Control Systems, Geotab Inc., ORBCOMM, Verizon Connect, Omnitracs, Inmarsat Global Limited, MiX Telematics, Stoneridge, Inc., Actia Group, Continental AG, Bosch GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Off-highway Vehicle Telematics Market Key Technology Landscape

The Off-highway Vehicle Telematics market is underpinned by a sophisticated and rapidly evolving array of technologies designed to provide robust data acquisition, reliable communication, and intelligent data processing capabilities. At its foundation, Global Positioning System (GPS) technology remains indispensable for accurate real-time location tracking, geofencing, and historical route analysis of off-highway assets. This is complemented by an extensive suite of embedded sensors, including accelerometers for motion detection, gyroscopes for orientation, fuel level sensors, engine diagnostic sensors (OBD-II/J1939), hydraulic pressure sensors, and proximity sensors, all continuously collecting vital operational data from the machinery itself.

Communication technologies form the backbone for data transmission from the field to central monitoring platforms. This primarily includes cellular networks (2G, 3G, 4G/LTE, and increasingly 5G for its high bandwidth and low latency) which offer widespread coverage in developed areas. For operations in remote or inaccessible regions, satellite communication systems (e.g., Inmarsat, Iridium, or emerging LEO satellite constellations) provide essential global connectivity. The data collected and transmitted is then typically managed and stored within secure cloud computing environments, offering scalable infrastructure, robust data backup, and accessibility from anywhere. This cloud-based approach facilitates the integration of telematics data with other enterprise systems like ERP or maintenance management platforms.

The intelligence layer of the telematics landscape is significantly enhanced by advanced data analytics, machine learning (ML), and artificial intelligence (AI) algorithms. These technologies are crucial for processing vast volumes of raw telematics data, identifying patterns, predicting equipment failures (predictive maintenance), optimizing operational workflows, and generating actionable insights for fleet managers and operators. For example, ML models can analyze fuel consumption patterns to identify inefficiencies or predict component wear. Furthermore, the integration of the Internet of Things (IoT) principles enables a cohesive ecosystem where multiple sensors and devices communicate seamlessly, providing a comprehensive view of asset health and performance. Cybersecurity measures, including data encryption, secure authentication, and robust network security, are also becoming paramount to protect sensitive operational data from breaches and ensure the reliability and integrity of the entire telematics system against evolving cyber threats. The continuous evolution and convergence of these technologies are driving the market towards more intelligent, autonomous, and highly efficient off-highway operations.

Regional Highlights

- North America: This region stands as a dominant force in the Off-highway Vehicle Telematics market, characterized by high adoption rates across construction, mining, and agriculture sectors. The market here is driven by a strong focus on operational efficiency, stringent safety regulations, and a mature technological infrastructure that supports advanced telematics solutions. The presence of major OEMs and innovative technology providers fosters continuous R&D and product development, leading to sophisticated integrated systems. Investments in smart cities and precision agriculture further accelerate market expansion.

- Europe: Europe represents another significant market, distinguished by its proactive approach to environmental sustainability, emissions reduction targets (e.g., EU Stage V), and strict worker safety standards. These regulations compel industries to adopt telematics for compliance monitoring and operational optimization. Countries such as Germany, the UK, and France are leading in implementing advanced fleet management, predict

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager