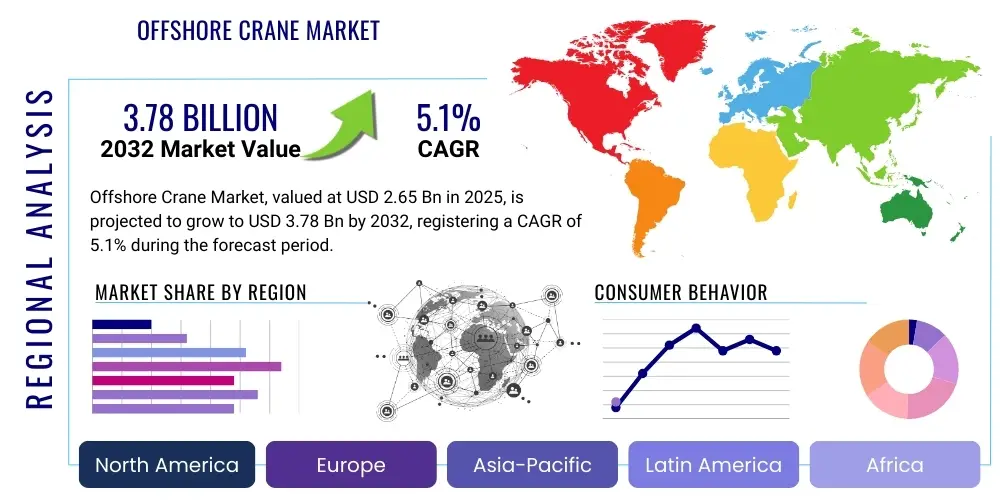

Offshore Crane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427465 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Offshore Crane Market Size

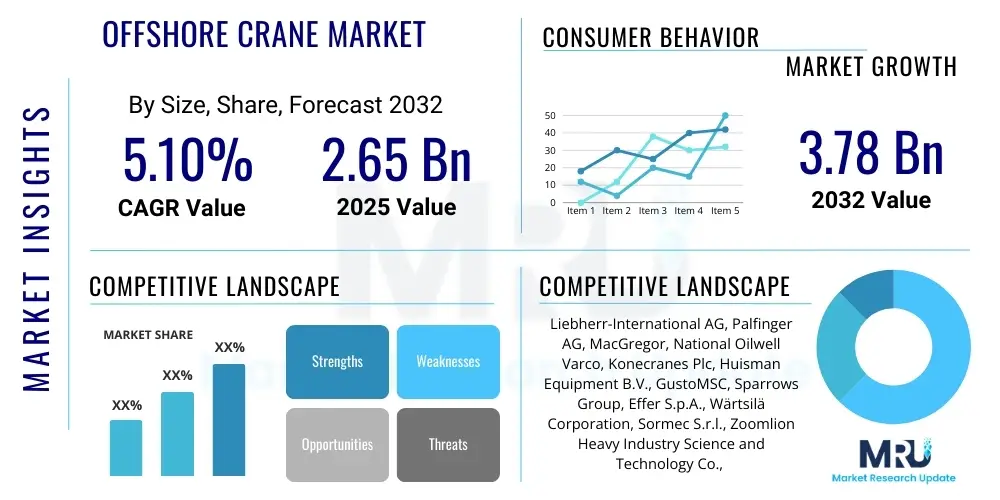

The Offshore Crane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% between 2025 and 2032. The market is estimated at USD 2.65 Billion in 2025 and is projected to reach USD 3.78 Billion by the end of the forecast period in 2032.

Offshore Crane Market introduction

The Offshore Crane Market encompasses a vital segment of the global marine and energy industries, providing essential heavy lifting and material handling capabilities for a diverse range of offshore operations. These specialized cranes are engineered to operate in harsh marine environments, enduring extreme weather conditions, corrosive saltwater, and dynamic vessel movements, ensuring operational continuity and safety for complex tasks. They are integral to the exploration, production, and maintenance activities within the oil and gas sector, as well as the rapidly expanding offshore wind energy industry, and various marine construction projects.

Key applications for offshore cranes span from installing foundational components for offshore wind turbines, deploying subsea infrastructure for oil and gas fields, and facilitating the transfer of personnel and supplies between vessels and fixed platforms, to decommissioning old structures. The inherent benefits of these systems include enhanced operational efficiency, improved safety protocols through advanced control systems, and the ability to execute precision lifts in challenging conditions. The market is primarily driven by escalating global energy demand, significant investments in offshore renewable energy, and the continuous need for maintenance and upgrades of existing offshore infrastructure, alongside exploration efforts in new deepwater and ultra-deepwater fields.

Offshore Crane Market Executive Summary

The Offshore Crane Market is experiencing robust expansion, primarily fueled by global business trends pivoting towards sustainable energy and persistent demand for hydrocarbon resources. A significant business trend involves the rapid growth of the offshore wind energy sector, which necessitates large-capacity, high-performance cranes for turbine installation, maintenance, and foundation deployment. Simultaneously, deepwater and ultra-deepwater oil and gas exploration and production continue to demand sophisticated lifting solutions for subsea equipment and platform construction. The market is also seeing a drive towards digitalization, automation, and remote operation capabilities to enhance safety, efficiency, and reduce operational costs across all segments.

From a regional perspective, Asia-Pacific emerges as a dominant force, driven by substantial investments in offshore wind farms, particularly in China, South Korea, and Taiwan, alongside ongoing oil and gas projects in Southeast Asia and Australia. Europe maintains its leadership in offshore wind technology and deployment, especially in the North Sea, pushing innovation in crane design for larger turbines. North America, particularly the Gulf of Mexico, continues to be a crucial market for oil and gas activities, including decommissioning, while new opportunities are emerging with its nascent offshore wind development. The Middle East and Africa regions contribute significantly due to their extensive oil and gas reserves, necessitating continuous infrastructure development and maintenance.

Segment-wise, the market is broadly categorized by crane type, lifting capacity, application, and end-user. The demand for heavy-lift cranes is particularly pronounced, driven by the increasing size of offshore wind turbines and complex oil and gas installations. The offshore wind application segment is projected to exhibit the highest growth rate, overshadowing traditional oil and gas applications, though the latter remains a substantial market component. Technological advancements, such as hybrid power systems, advanced motion compensation, and intelligent control systems, are key trends influencing product development and market competitive dynamics, enabling safer and more efficient operations in increasingly challenging environments.

AI Impact Analysis on Offshore Crane Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize offshore crane operations, with common themes centering on enhanced automation, predictive maintenance capabilities, improved safety protocols, and the potential for autonomous decision-making in complex lifting scenarios. Key concerns often revolve around the reliability of AI in critical operations, cybersecurity risks associated with networked systems, and the implications for human roles in offshore environments. Expectations are high for AI to significantly boost efficiency, reduce downtime, and provide advanced analytics for operational optimization, ultimately leading to more resilient and cost-effective offshore projects.

- Predictive maintenance through AI algorithms analyzing sensor data to forecast equipment failures, minimizing downtime and maintenance costs.

- Enhanced automation and semi-autonomous operations, allowing for precision lifting and optimized load handling, reducing human error.

- Real-time data analysis and decision support for crane operators, improving situational awareness and operational safety in dynamic marine conditions.

- Optimized route planning and collision avoidance systems, particularly in multi-crane or congested operational areas.

- Remote operation capabilities with AI-assisted controls, enabling offshore operations to be monitored and managed from onshore control centers, improving safety and reducing personnel exposure.

- AI-driven anomaly detection for structural integrity and equipment health monitoring, extending asset lifespan.

- Adaptive control systems that utilize AI to compensate for vessel motion and environmental variables, enhancing lift stability and accuracy.

DRO & Impact Forces Of Offshore Crane Market

The Offshore Crane Market is propelled by several key drivers. Foremost among these is the surging global demand for energy, which fuels both the expansion of offshore renewable energy projects, particularly wind farms, and sustained investment in offshore oil and gas exploration and production. The increasing size and complexity of offshore wind turbines necessitate larger and more capable cranes for installation and maintenance. Furthermore, the global trend towards deepwater and ultra-deepwater oil and gas extraction requires advanced lifting equipment capable of operating in extreme depths and harsh conditions. Decommissioning activities for aging offshore infrastructure also create a consistent demand for specialized heavy-lift cranes, ensuring responsible environmental stewardship.

However, the market faces significant restraints. Volatility in global oil and gas prices can directly impact investment decisions, leading to project delays or cancellations that curtail demand for new cranes. The high capital expenditure associated with purchasing and deploying offshore cranes, combined with substantial operational and maintenance costs, presents a barrier to entry and expansion. Stringent environmental regulations and escalating safety standards, while necessary, add complexity and cost to design and operational phases. Additionally, supply chain disruptions, skilled labor shortages, and geopolitical uncertainties can introduce considerable challenges, affecting production timelines and market stability.

Opportunities within this market are abundant. The rapid advancement of floating offshore wind technology opens up vast new oceanic areas for energy generation, creating demand for innovative crane solutions adapted for floating substructures. The integration of robotics, advanced automation, and digitalization offers avenues for improving efficiency, safety, and reducing operational expenditure. Emerging frontier regions for oil and gas exploration and production, combined with the continuous need for maintenance and upgrades of existing assets, further present long-term growth prospects. The development of hybrid power systems and more energy-efficient crane designs aligns with sustainability goals and can lead to operational cost reductions, enhancing market attractiveness. The impact forces acting on the market are multifaceted, encompassing regulatory pressures for stricter emissions and safety standards, the pervasive influence of technological innovation driving efficiency and capabilities, economic cycles affecting investment, and environmental concerns pushing for greener and more responsible offshore operations.

Segmentation Analysis

The Offshore Crane Market is comprehensively segmented based on various operational and structural characteristics, allowing for a detailed understanding of market dynamics and specialized demand patterns. This segmentation helps in analyzing specific industry needs, technological requirements, and market penetration strategies across different applications and end-user categories. The primary segments include differentiations by crane type, which dictates operational flexibility and reach; by lifting capacity, reflecting the scale of projects undertaken; by application, identifying the key industries served; and by end-user, pinpointing the direct beneficiaries and purchasers of these sophisticated systems.

Each segment caters to distinct operational demands within the offshore environment. For instance, different crane types are optimized for specific tasks, such as rigid boom cranes for heavy, stable lifts or knuckle boom cranes for versatility and precision in confined spaces. Lifting capacities range from light service cranes for personnel transfer to ultra-heavy-lift cranes crucial for large-scale offshore wind turbine installation or platform module integration. The application segment clearly delineates the market’s reliance on the oil and gas sector versus the burgeoning offshore wind and marine construction industries. Understanding these segmentations is critical for manufacturers, service providers, and investors to identify lucrative niches and develop targeted solutions that meet evolving industry requirements.

- By Type:

- Fixed Cranes (Kingpost, Pedestal)

- Mobile Cranes (Crawler Cranes on Barges)

- Knuckle Boom Cranes

- Stiff Boom Cranes

- Lattice Boom Cranes

- Telescopic Boom Cranes

- By Lifting Capacity:

- Light Duty (Below 50 Metric Tons)

- Medium Duty (50-500 Metric Tons)

- Heavy Duty (Above 500 Metric Tons)

- By Application:

- Oil and Gas (Drilling, Production, Decommissioning)

- Offshore Wind Energy (Installation, Maintenance, Decommissioning)

- Marine (Shipbuilding, Salvage, Port Operations)

- Subsea Construction

- By End-User:

- Exploration and Production (E&P) Companies

- Drilling Contractors

- Engineering, Procurement, and Construction (EPC) Contractors

- Vessel Owners/Operators

- Offshore Wind Farm Developers

- Government and Defense

Offshore Crane Market Value Chain Analysis

The value chain for the Offshore Crane Market is a complex network of interconnected activities, beginning from the conceptual design and raw material sourcing, extending through manufacturing, assembly, distribution, installation, and finally, ongoing operational support and maintenance. Upstream analysis involves the procurement of high-grade steel, specialized hydraulic components, advanced electronics, and control systems from a diverse array of suppliers. These foundational inputs are critical, as the performance and longevity of offshore cranes heavily depend on the quality and robustness of their constituent parts. Relationships with these upstream suppliers are often long-term, built on trust and a shared understanding of stringent industry standards and certification requirements.

Midstream activities are dominated by specialized offshore crane manufacturers and component integrators who design, engineer, and fabricate these complex machinery systems. This stage involves significant research and development to incorporate new technologies, improve lifting capacities, enhance safety features, and comply with evolving regulatory landscapes. Manufacturing processes demand precision engineering, advanced welding techniques, and rigorous testing regimes to ensure the cranes can withstand the harsh offshore environment. Distribution channels can be direct from manufacturers to large end-users or involve specialized marine equipment distributors who offer localized sales, support, and integration services, particularly for smaller projects or specific regional markets.

Downstream analysis focuses on the end-users and the deployment of offshore cranes. This includes engineering, procurement, and construction (EPC) contractors who integrate cranes into larger offshore projects, drilling contractors utilizing cranes on rigs, and offshore vessel owners or operators who equip their fleet with lifting solutions. Direct sales often characterize transactions with major oil and gas companies or large offshore wind developers due to the bespoke nature and high value of these assets. Indirect channels might involve rental companies or third-party service providers who lease cranes or offer specialized lifting operations to smaller clients, providing flexibility and reducing upfront capital expenditure for some operators. Post-sale services, including maintenance, spare parts supply, upgrades, and decommissioning support, form a critical part of the downstream value chain, ensuring the long-term operational efficiency and safety of the installed crane fleet.

Offshore Crane Market Potential Customers

The primary potential customers for offshore cranes are diverse, encompassing major players across the energy, marine, and construction sectors, each with distinct requirements for heavy lifting and material handling capabilities in challenging offshore environments. End-users typically include large multinational oil and gas companies, national oil companies, and independent E&P firms that operate offshore drilling rigs, production platforms, and floating production storage and offloading (FPSO) vessels. These entities require cranes for installing subsea equipment, maintaining platform infrastructure, and transferring personnel and supplies, making reliability and robust performance paramount.

Another rapidly growing segment of potential customers consists of offshore wind farm developers and utility companies. As the world transitions towards renewable energy, these developers are undertaking massive projects that necessitate high-capacity, specialized cranes for the installation of massive wind turbine components, foundations, and associated electrical infrastructure. Marine construction companies and EPC contractors also represent a significant customer base, as they are responsible for the execution of large-scale offshore projects, including port expansions, bridge construction, and subsea pipeline installations, all of which require powerful and precise lifting solutions.

Furthermore, naval defense organizations and government agencies may acquire offshore cranes for naval vessel support, salvage operations, and various strategic marine infrastructure projects. Vessel owners and operators, including those managing heavy-lift vessels, supply vessels, and specialized construction vessels, are also key purchasers, as cranes are integral to their operational capabilities. Service providers specializing in offshore maintenance, repair, and overhaul (MRO) also represent an indirect customer base, often leasing or purchasing cranes to support their service contracts across the offshore industry.

Offshore Crane Market Key Technology Landscape

The offshore crane market is continuously evolving, driven by advancements in engineering, automation, and digital technologies aimed at enhancing safety, efficiency, and reliability in increasingly demanding marine environments. A significant technological trend is the development and integration of advanced control systems, which utilize sophisticated sensors, real-time data processing, and precise hydraulic or electric drives to achieve superior load control and motion compensation. These systems are crucial for mitigating the effects of vessel heave, pitch, and roll, allowing for accurate and stable lifts even in high sea states. Innovations in anti-sway technology and active heave compensation (AHC) are becoming standard, enabling operations in weather conditions that would traditionally cause significant downtime.

Another crucial aspect of the technology landscape involves digitalization and remote monitoring capabilities. Modern offshore cranes are equipped with comprehensive sensor arrays that collect vast amounts of operational data, including load weights, boom angles, wind speeds, and machinery health. This data is fed into integrated management systems, often cloud-based, allowing for remote diagnostics, performance monitoring, and predictive maintenance. This shift towards smart cranes facilitates proactive maintenance schedules, reduces unexpected breakdowns, and optimizes asset utilization, contributing significantly to operational cost reductions and enhanced safety by allowing for remote expert oversight without requiring physical presence on site.

Furthermore, advancements in materials science and power systems are shaping the future of offshore cranes. The use of high-strength, lightweight materials in crane construction allows for increased lifting capacities and extended reach without significantly increasing the crane’s overall weight, which is critical for vessel stability and fuel efficiency. Hybrid and electric power systems are gaining traction, offering reduced emissions, lower fuel consumption, and quieter operation compared to traditional diesel-hydraulic systems. These environmentally friendly options align with global sustainability goals and regulatory pressures for cleaner offshore operations. Automation and semi-autonomous functions, often leveraging AI and machine learning, are also emerging, promising to reduce human intervention in routine or hazardous tasks, thereby improving operational efficiency and safety margins.

Regional Highlights

- Asia-Pacific: This region stands as the dominant and fastest-growing market, primarily fueled by extensive investments in offshore wind energy in countries like China, Taiwan, South Korea, and Vietnam. Significant oil and gas exploration and production activities in Southeast Asia (e.g., Malaysia, Indonesia) and Australia further bolster demand for offshore cranes. The regions rapid industrialization and increasing energy demand drive its market leadership.

- Europe: A mature yet highly innovative market, Europe is at the forefront of offshore wind technology and deployment, especially in the North Sea. Countries such as the UK, Germany, and the Netherlands lead in developing larger, more efficient offshore wind farms, necessitating advanced heavy-lift cranes. The region also maintains demand for oil and gas infrastructure maintenance and decommissioning projects.

- North America: The Gulf of Mexico remains a critical hub for deepwater oil and gas exploration and production, creating consistent demand for high-capacity offshore cranes for drilling, production, and decommissioning activities. Additionally, the nascent but rapidly expanding offshore wind market along the East Coast of the US is poised to become a significant growth driver in the forecast period.

- Middle East and Africa: Characterized by substantial offshore oil and gas reserves, this region presents a steady market for offshore cranes used in new field developments, platform installations, and ongoing maintenance. Countries like Saudi Arabia, UAE, Qatar, and Nigeria are key contributors to the market, driven by sustained investment in hydrocarbon extraction.

- South America: Brazil’s pre-salt oil and gas fields drive considerable demand for deepwater offshore cranes. Other countries like Guyana are emerging as significant players in offshore energy, attracting investments in new projects and thus fostering market growth, albeit with some volatility linked to commodity prices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offshore Crane Market.- Liebherr-International AG

- Palfinger AG

- MacGregor (Cargotec Corporation)

- National Oilwell Varco (NOV)

- Konecranes Plc

- Huisman Equipment B.V.

- GustoMSC (NOV company)

- Sparrows Group

- Effer S.p.A. (PM Group)

- Wärtsilä Corporation

- Sormec S.r.l.

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Terex Corporation

- Tadano Ltd.

- TTS Group ASA (now part of MacGregor)

Frequently Asked Questions

What are the primary drivers of the Offshore Crane Market?

The Offshore Crane Market is primarily driven by the expanding global offshore wind energy sector, increased investments in deepwater and ultra-deepwater oil and gas exploration and production, and the growing demand for decommissioning aging offshore infrastructure. Technological advancements enhancing efficiency and safety also contribute significantly.

How does AI impact offshore crane operations?

AI significantly impacts offshore crane operations by enabling predictive maintenance, improving operational safety through real-time data analysis and decision support, facilitating advanced automation for precision lifts, and optimizing logistics. This leads to reduced downtime, lower operational costs, and enhanced overall efficiency.

Which regions are leading the growth in the Offshore Crane Market?

Asia-Pacific is currently the dominant and fastest-growing region, driven by extensive offshore wind investments and ongoing oil and gas activities. Europe also maintains a strong market presence due to its leadership in offshore wind technology, while North America remains crucial for oil and gas and emerging offshore wind projects.

What types of offshore cranes are most in demand?

Demand is high for heavy-duty fixed cranes and specialized mobile cranes capable of high lifting capacities to support the installation of large offshore wind turbines and complex oil and gas platforms. Knuckle boom cranes are also in demand for their versatility and precision in various marine and subsea construction tasks.

What are the main challenges faced by the Offshore Crane Market?

Key challenges include the volatility of oil and gas prices affecting investment, high capital and operational costs, stringent environmental regulations, and the need for continuous technological upgrades to meet evolving safety standards and operational demands in harsh marine environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager