Offshore Drilling Waste Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430519 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Offshore Drilling Waste Management Market Size

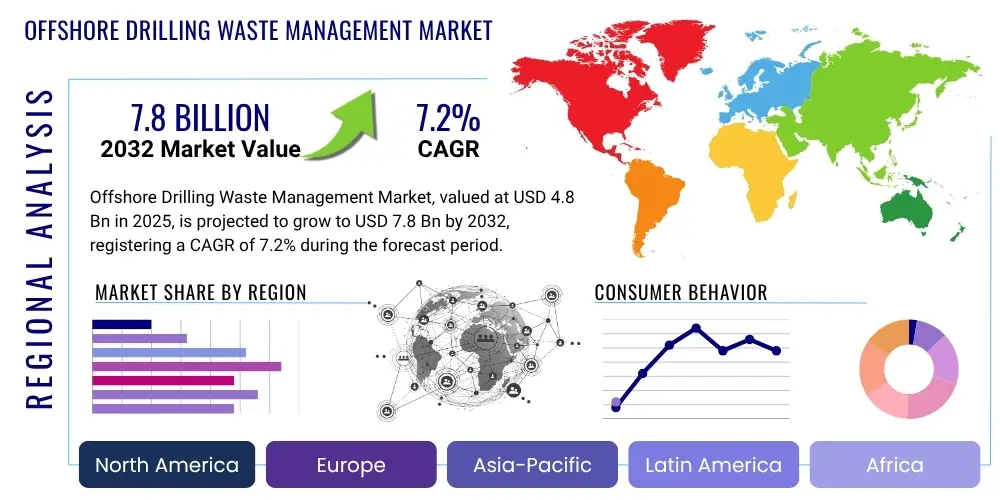

The Offshore Drilling Waste Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at USD 4.8 billion in 2025 and is projected to reach USD 7.8 billion by the end of the forecast period in 2032.

Offshore Drilling Waste Management Market introduction

The Offshore Drilling Waste Management Market encompasses a suite of services and technologies designed to handle and process waste generated during offshore oil and gas exploration and production activities. This includes managing drilling cuttings, produced water, drilling fluids, and other hazardous and non-hazardous materials in an environmentally responsible and compliant manner. The primary objective is to minimize environmental impact, ensure regulatory adherence, and enhance operational efficiency for offshore operators.

Product descriptions within this market involve advanced solids control equipment, cuttings treatment systems such as thermal desorption units and centrifuges, slop water treatment facilities, and integrated waste management solutions. Major applications are found across various offshore platforms, including jack-ups, semi-submersibles, drillships, and fixed platforms, supporting both shallow water and deepwater drilling operations. Benefits include reduced ecological footprints, compliance with increasingly strict international and national environmental regulations, and improved safety for personnel.

Key driving factors for market expansion include the global increase in offshore oil and gas exploration and production, particularly in deepwater and ultra-deepwater regions, and the continuous evolution of environmental protection mandates. Moreover, technological advancements in waste treatment processes and the rising focus on circular economy principles within the energy sector are significantly contributing to market growth.

Offshore Drilling Waste Management Market Executive Summary

The Offshore Drilling Waste Management Market is experiencing robust growth, primarily driven by escalating global energy demand, increased offshore exploration and production activities, and the imposition of stringent environmental regulations worldwide. Business trends indicate a strong emphasis on integrating advanced technologies, such as automation and digital solutions, to enhance waste treatment efficiency and reduce operational costs. There is also a notable trend towards comprehensive, integrated waste management solutions that offer end-to-end services, moving beyond mere disposal to include recycling and resource recovery. Furthermore, the market is witnessing strategic collaborations and mergers aimed at consolidating expertise and expanding service portfolios, reflecting a drive for greater efficiency and compliance.

Regional trends highlight significant growth in areas with active offshore drilling operations. Asia Pacific, driven by emerging economies and new discoveries, is poised for substantial expansion, while North America and Europe continue to be mature markets with a focus on regulatory compliance and technological adoption. The Middle East and Latin America are also demonstrating considerable potential due to increasing investments in offshore projects. These regional dynamics are influenced by varying regulatory frameworks, economic conditions, and the maturity of the offshore oil and gas sector within each geography. The global shift towards cleaner operations is also fostering regional investments in sustainable waste management practices.

Segment trends indicate a rising demand for advanced waste treatment technologies like thermal desorption and cuttings re-injection, driven by their effectiveness in minimizing environmental impact and maximizing resource recovery. The service type segment shows a strong inclination towards integrated waste management services, where providers offer a full spectrum of solutions from collection to disposal and recycling. Moreover, there is an increasing adoption of closed-loop systems designed to reuse drilling fluids and water, thereby reducing the overall volume of waste requiring external treatment. This strategic shift in segmentation reflects the industry’s commitment to sustainability and operational optimization, seeking solutions that offer both environmental benefits and cost efficiencies.

AI Impact Analysis on Offshore Drilling Waste Management Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the offshore drilling waste management sector, focusing on improving efficiency, enhancing safety, reducing operational costs, and ensuring more stringent environmental compliance. Key themes revolve around AI's capabilities in predictive analytics for equipment maintenance, optimizing waste segregation and treatment processes, and real-time environmental monitoring to prevent pollution. There are strong expectations that AI will enable more intelligent decision-making, automate repetitive tasks, and provide deeper insights into complex waste streams, leading to more sustainable and economically viable operations. Users are also concerned with the practical implementation challenges, data privacy, and the need for skilled personnel to leverage AI effectively in this specialized domain.

- Predictive maintenance for waste management equipment, reducing downtime and optimizing operational schedules.

- Real-time monitoring and analysis of waste streams for optimized segregation, treatment, and disposal decisions.

- Enhanced environmental compliance through AI-powered anomaly detection and predictive modeling of potential pollution events.

- Automated control systems for advanced waste treatment processes, improving efficiency and reducing human error.

- Optimized logistics and supply chain management for waste transportation and disposal, reducing costs and carbon footprint.

- Improved safety protocols through AI-driven risk assessment and early warning systems for hazardous waste handling.

- Data-driven insights for resource recovery and recycling initiatives, promoting a circular economy approach.

- Intelligent automation of routine data collection and reporting, ensuring accuracy and regulatory adherence.

DRO & Impact Forces Of Offshore Drilling Waste Management Market

The Offshore Drilling Waste Management Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form its Impact Forces. Drivers primarily include the sustained global demand for energy necessitating increased offshore oil and gas exploration and production, particularly in challenging deepwater environments. Concurrently, stringent and evolving environmental regulations, imposed by international bodies and national governments, compel operators to adopt sophisticated waste management solutions to minimize ecological footprints and avoid hefty penalties. Furthermore, continuous technological advancements in waste treatment processes, leading to more efficient and environmentally friendly methods, serve as a significant catalyst for market growth. These drivers collectively push the industry towards more sustainable and responsible practices.

However, several restraints temper this growth. The offshore drilling sector is characterized by high capital expenditures for advanced waste management infrastructure and equipment, posing a barrier to entry and investment, especially for smaller operators. Operational complexities associated with handling diverse waste streams in harsh marine environments, coupled with the inherent risks, contribute to increased costs and challenges. Moreover, the inherent volatility of global oil prices can significantly impact investment decisions in offshore projects, leading to project delays or cancellations that directly affect demand for waste management services. These restraints necessitate strategic planning and robust financial backing for market participants.

Opportunities within the market emerge from various fronts. The expansion into deepwater and ultra-deepwater drilling projects globally presents a demand for highly specialized and advanced waste management solutions. The increasing adoption of circular economy principles encourages resource recovery, reuse, and recycling of drilling waste components, opening new revenue streams and fostering innovation in waste-to-energy technologies. Furthermore, emerging markets with untapped offshore reserves, particularly in Africa and Southeast Asia, represent significant growth potential as new exploration activities commence. The overarching impact forces are shaped by regulatory pressures pushing for compliance, technological innovation driving efficiency, and economic volatility influencing investment cycles, all contributing to a dynamic and evolving market landscape.

Segmentation Analysis

The Offshore Drilling Waste Management Market is comprehensively segmented to provide a detailed understanding of its diverse components and growth trajectories. These segmentations allow for a granular analysis of market dynamics, revealing key areas of opportunity and challenge. The primary categories for segmentation typically include waste type, service type, application, and technology. Each segment plays a crucial role in shaping the overall market landscape, driven by specific operational requirements, environmental mandates, and technological advancements within the offshore oil and gas industry.

Understanding these segments is vital for stakeholders, including service providers, drilling operators, and regulatory bodies, to tailor strategies effectively. For instance, the demand for specific service types like drilling waste treatment or containment varies significantly based on the waste type generated, such as drilling muds or produced water. Similarly, the application in shallow versus deepwater environments often dictates the choice of technology, with more advanced and robust solutions typically deployed in challenging deepwater operations. This intricate segmentation analysis offers valuable insights into market trends and facilitates informed decision-making across the value chain.

- By Waste Type:

- Drilling Cuttings

- Drilling Fluids/Muds

- Produced Water

- Associated Wastes (e.g., Slop Oil, Hazardous Waste)

- By Service Type:

- Waste Treatment Services

- Thermal Desorption

- Cuttings Re-injection

- Dewatering

- Biological Treatment

- Chemical Treatment

- Waste Containment & Handling

- Storage Tanks

- Skips & Bins

- Vacuum Systems

- Waste Disposal Services

- Landfill

- Incineration

- Offshore Discharge (Permitted)

- Waste Monitoring & Compliance

- Environmental Consulting

- Data Analytics

- Integrated Waste Management

- Waste Treatment Services

- By Application:

- Shallow Water Drilling

- Deepwater Drilling

- Ultra-Deepwater Drilling

- By Platform Type:

- Jack-up Rigs

- Semi-submersible Rigs

- Drillships

- Fixed Platforms

- FPSO Vessels

- By Technology:

- Solids Control Equipment

- Cuttings Dryers

- Centrifuges

- Shale Shakers

- Slop Water Treatment Systems

- Waste Heat Recovery Systems

Value Chain Analysis For Offshore Drilling Waste Management Market

The value chain for the Offshore Drilling Waste Management Market begins with upstream analysis, which primarily involves the providers of specialized equipment, technology, and chemical additives essential for waste treatment. This includes manufacturers of shale shakers, centrifuges, thermal desorption units, and dewatering systems, as well as suppliers of flocculants, coagulants, and other treatment chemicals. These entities play a crucial role in the initial stages by developing and providing the foundational tools and materials necessary for effective waste processing. Their innovation in creating more efficient and environmentally friendly solutions directly impacts the quality and sustainability of waste management services further down the chain.

Midstream activities involve the core service providers who deploy these technologies and personnel at offshore drilling sites. These companies are responsible for the collection, handling, and initial treatment of various waste streams, including drilling cuttings, fluids, and produced water, directly on the rig or at nearshore facilities. They manage the logistics, operate the equipment, and ensure compliance with site-specific and international environmental regulations. Their expertise in executing complex treatment processes under challenging offshore conditions is paramount to the overall efficiency and effectiveness of the waste management operation. This segment typically involves specialized drilling waste management firms and integrated oilfield service companies.

Downstream analysis focuses on the final stages of waste processing and disposal, including transportation of treated or residual waste to onshore facilities for further treatment, recycling, or ultimate disposal. This can involve specialized logistics companies, waste disposal site operators (e.g., landfills, incinerators), and companies focused on converting waste into usable resources, such as energy or construction materials. The distribution channel predominantly involves direct contractual relationships between offshore operators and waste management service providers. Indirect channels might include sub-contracting agreements where a larger integrated service provider outsources specific treatment or disposal tasks to specialized third-party vendors. The entire value chain emphasizes a collaborative approach to minimize environmental impact and maximize resource recovery throughout the lifecycle of offshore drilling waste.

Offshore Drilling Waste Management Market Potential Customers

The primary potential customers and end-users in the Offshore Drilling Waste Management Market are significantly concentrated within the upstream oil and gas sector. This includes major international oil companies (IOCs) such as Shell, ExxonMobil, Chevron, BP, and TotalEnergies, which operate extensive offshore drilling and production portfolios globally. These companies are driven by the need to maintain operational efficiency, comply with stringent environmental regulations, and uphold their corporate social responsibility commitments, making robust waste management solutions indispensable for their offshore projects. Their vast operational scale and investment capabilities often lead to demand for integrated and technologically advanced waste management services.

Another crucial customer segment consists of national oil companies (NOCs) like Saudi Aramco, Petrobras, CNOOC, and Equinor, which often manage significant offshore assets within their respective countries or regions. These entities, while potentially influenced by national strategic objectives, also prioritize environmental stewardship and cost-effective operations, making them key buyers of offshore drilling waste management services. Their decisions are frequently tied to national energy policies and localized environmental mandates, requiring solutions that can adapt to diverse regulatory landscapes and operational contexts.

Furthermore, independent oil and gas companies, offshore drilling contractors, and specialized exploration and production (E&P) firms constitute a substantial portion of the market's clientele. Drilling contractors, who are directly responsible for operating the rigs and executing drilling programs, require effective waste management solutions to ensure smooth operations and compliance with contractual obligations. These diverse end-users collectively drive the demand for a wide range of services, from basic waste containment and disposal to sophisticated treatment and recycling technologies, underscoring the broad applicability and necessity of offshore drilling waste management across the industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.8 billion |

| Market Forecast in 2032 | USD 7.8 billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger Limited, Halliburton, Baker Hughes, NOV Inc., Veolia Environnement, SUEZ SA, Waste Management Inc., Aker Solutions, TWMA, National Oilwell Varco, Saipem, M-I SWACO, TETRA Technologies Inc., Newpark Resources Inc., Secure Energy Services Inc., Derrick Corporation, Oceaneering International Inc., TechnipFMC, Fluor Corporation, ChampionX |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offshore Drilling Waste Management Market Key Technology Landscape

The offshore drilling waste management market is characterized by a dynamic technology landscape, driven by the need for enhanced efficiency, environmental compliance, and cost-effectiveness. Key technologies employed include advanced solids control equipment such as high-performance shale shakers, decanting centrifuges, and cuttings dryers, which efficiently separate solids from drilling fluids, enabling fluid reuse and reducing waste volume. Thermal desorption units (TDUs) represent a significant advancement, capable of processing oil-contaminated drill cuttings by heating them to evaporate hydrocarbons, leaving behind clean solids that can be safely disposed of or repurposed. This technology is particularly valuable for its ability to recover valuable oil and water components from waste streams.

Another critical technology is cuttings re-injection, where drill cuttings, often mixed with water, are injected into dedicated disposal wells deep underground. This method provides an environmentally sound solution by permanently isolating the waste from the marine environment and minimizing surface footprint. For produced water, advanced treatment systems, including hydrocyclones, dissolved air flotation (DAF) units, and membrane filtration technologies, are employed to remove oil, suspended solids, and other contaminants before regulated discharge or reuse. These systems ensure that discharged water meets stringent environmental quality standards, reducing ecological impact.

Furthermore, digitalization and automation are increasingly becoming integral to the technology landscape. Remote monitoring systems, data analytics, and AI-powered platforms are being used to optimize waste treatment processes, predict equipment maintenance needs, and ensure real-time regulatory compliance. The integration of Internet of Things (IoT) sensors on waste management equipment facilitates continuous data collection, enabling operators to make informed decisions and improve overall operational efficiency. These technological innovations collectively contribute to a more sustainable, safe, and cost-effective approach to managing offshore drilling waste, pushing the industry towards closed-loop systems and waste-to-resource solutions.

Regional Highlights

- North America: This region, particularly the Gulf of Mexico, remains a mature but highly active offshore drilling area. It is characterized by stringent environmental regulations from bodies like the EPA and BSEE, driving demand for advanced waste management technologies such as cuttings re-injection and thermal desorption. The presence of major oil and gas companies and a robust service infrastructure further solidifies its market relevance.

- Europe: The North Sea, a historical hub for offshore activity, along with emerging areas in the Mediterranean, emphasizes strict environmental protection and a strong push towards decarbonization. Countries like Norway and the UK lead in adopting innovative, low-emission waste treatment solutions and circular economy principles in offshore operations, creating demand for sophisticated, compliant services.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by increasing energy demand from developing economies like China, India, and Vietnam, alongside significant offshore exploration activities in Southeast Asia and Australia. Less mature regulatory frameworks in some areas offer opportunities, while others, like Australia, have highly developed environmental standards, driving diverse technology adoption.

- Middle East and Africa (MEA): This region offers immense potential due to vast untapped offshore reserves and significant investments in new drilling projects, particularly in Saudi Arabia, UAE, Nigeria, and Angola. While environmental regulations are evolving, the sheer volume of offshore activity ensures a substantial market for comprehensive waste management solutions, with a growing focus on efficiency and cost optimization.

- Latin America: Countries like Brazil, Mexico, and Guyana are experiencing a boom in deepwater and ultra-deepwater discoveries, attracting significant international investment. This surge in exploration and production activities is directly translating into a high demand for advanced and reliable offshore drilling waste management services, driven by both operational needs and increasing local environmental scrutiny.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offshore Drilling Waste Management Market.- Schlumberger Limited

- Halliburton

- Baker Hughes

- NOV Inc.

- Veolia Environnement

- SUEZ SA

- Waste Management Inc.

- Aker Solutions

- TWMA

- National Oilwell Varco

- Saipem

- M-I SWACO (Schlumberger company)

- TETRA Technologies Inc.

- Newpark Resources Inc.

- Secure Energy Services Inc.

- Derrick Corporation

- Oceaneering International Inc.

- TechnipFMC

- Fluor Corporation

- ChampionX

Frequently Asked Questions

What is offshore drilling waste management?

Offshore drilling waste management involves the collection, treatment, and disposal of waste generated during offshore oil and gas exploration and production, including drilling cuttings, fluids, and produced water, to minimize environmental impact and comply with regulations.

What are the key technologies used in offshore drilling waste management?

Key technologies include solids control equipment (shale shakers, centrifuges), thermal desorption units, cuttings re-injection systems, dewatering units, and advanced produced water treatment systems, often integrated with digital monitoring and automation.

What are the main drivers for market growth?

The primary drivers are increasing offshore oil and gas exploration and production activities globally, stringent environmental regulations necessitating advanced waste treatment, and continuous technological advancements improving efficiency and sustainability.

Which regions are leading the offshore drilling waste management market?

North America and Europe are mature markets with high regulatory compliance, while Asia Pacific, Latin America, and the Middle East & Africa are expected to show significant growth due to increasing offshore investments and new discoveries.

How does AI impact offshore drilling waste management?

AI enhances predictive maintenance for equipment, optimizes waste segregation and treatment processes, improves real-time environmental monitoring, and automates data analysis for better compliance and operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager