Offshore Marine Emission Control Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428283 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Offshore Marine Emission Control Systems Market Size

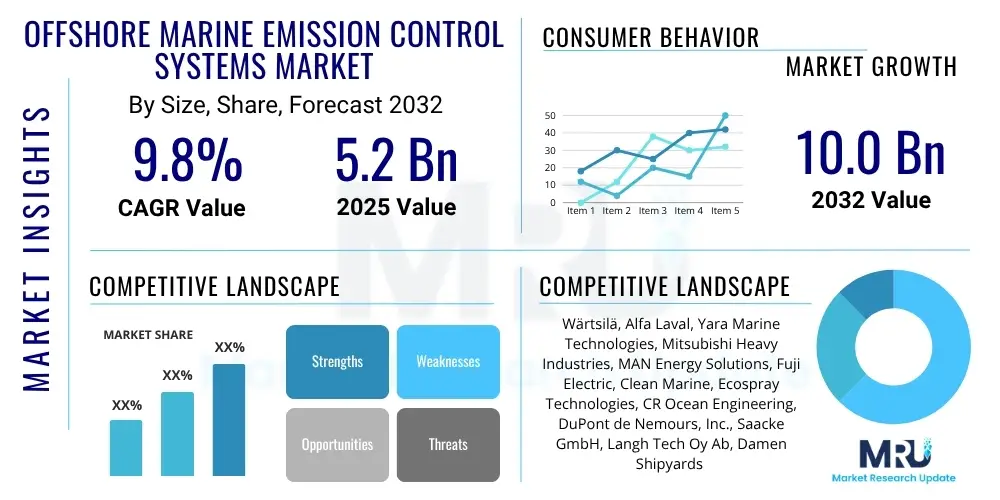

The Offshore Marine Emission Control Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2032. The market is estimated at USD 5.2 billion in 2025 and is projected to reach USD 10.0 billion by the end of the forecast period in 2032.

Offshore Marine Emission Control Systems Market introduction

The offshore marine emission control systems market encompasses a wide array of advanced technologies and solutions designed to mitigate harmful pollutants emitted by marine vessels operating in international and coastal waters. This critical sector addresses the urgent need to comply with increasingly stringent environmental regulations set forth by international bodies such as the International Maritime Organization (IMO) and various regional authorities. Products in this market include Exhaust Gas Cleaning Systems (EGCS), commonly known as scrubbers, which remove sulfur oxides (SOx) from exhaust gases; Selective Catalytic Reduction (SCR) systems, which reduce nitrogen oxides (NOx) emissions; and Exhaust Gas Recirculation (EGR) systems, also targeting NOx reduction. Additionally, the market is rapidly expanding to include solutions for alternative fuels like Liquefied Natural Gas (LNG), methanol, and ammonia, which inherently produce fewer emissions.

The major applications for these systems span across a diverse fleet of marine vessels, including large container ships, crude oil tankers, bulk carriers, cruise liners, ferries, and offshore support vessels. These systems are essential for both new vessel constructions and retrofitting existing fleets to meet current and future emission standards, such as the IMO 2020 sulfur cap and upcoming NOx Tier III regulations for Emission Control Areas (ECAs). The primary benefits derived from the adoption of these technologies are substantial reductions in air pollution, including particulate matter, SOx, and NOx, leading to improved air quality in port cities and coastal regions. This also translates into significant operational advantages for shipping companies, ensuring compliance, avoiding penalties, and enhancing corporate social responsibility profiles.

Several driving factors are propelling the growth of this market. Foremost among these is the escalating global focus on environmental sustainability and climate change, necessitating stricter controls on marine pollution. Regulatory pressures, particularly the continuous evolution of IMO standards, are a primary catalyst, forcing maritime operators to invest in compliant technologies. Furthermore, growing public awareness regarding the environmental impact of shipping activities, coupled with technological advancements making emission control systems more efficient and cost-effective, contribute significantly to market expansion. The increasing adoption of alternative marine fuels, driven by both environmental concerns and fluctuating conventional fuel prices, also creates new demand for integrated emission reduction solutions.

Offshore Marine Emission Control Systems Market Executive Summary

The offshore marine emission control systems market is experiencing robust growth, primarily driven by a tightening global regulatory landscape and a concerted industry push towards decarbonization and environmental sustainability. Business trends indicate a significant surge in demand for retrofit installations as older vessels are brought into compliance with the IMO 2020 sulfur cap and upcoming NOx Tier III requirements. Concurrently, newbuild orders increasingly incorporate advanced emission control technologies and dual-fuel capabilities, favoring LNG and other alternative fuels. Strategic partnerships and collaborations among technology providers, shipyards, and marine operators are becoming more prevalent, aimed at developing integrated and cost-effective solutions. Research and development efforts are concentrated on enhancing system efficiency, reducing operational costs, and developing multi-pollutant reduction technologies, alongside the integration of smart monitoring and predictive maintenance solutions.

Regional trends highlight Europe and Asia Pacific as the leading markets due to their extensive shipping routes, stringent environmental regulations, and significant maritime industry presence. European countries, particularly those bordering the North Sea and Baltic Sea Emission Control Areas, have been early adopters and innovators in emission control technologies. Asia Pacific, driven by major shipbuilding nations like China, South Korea, and Japan, represents a substantial market for both new installations and retrofits, buoyed by expanding trade volumes and a growing awareness of air quality issues. North America also presents a strong market, especially with the expansion of its ECAs and stricter controls in port areas. Developing regions are also witnessing increased adoption as global shipping standards become uniformly applied, prompting investments in emission reduction technologies to ensure international trade compliance.

Segmentation trends within the market reveal a diversified landscape. By system type, Exhaust Gas Cleaning Systems (EGCS) continue to hold a significant share, particularly hybrid scrubbers offering operational flexibility. However, Selective Catalytic Reduction (SCR) systems are gaining traction due to tightening NOx regulations, especially for newbuilds. The shift towards alternative fuels, notably LNG, is accelerating, leading to a rising demand for integrated LNG fuel gas supply systems and engines capable of dual-fuel operation. In terms of vessel type, container ships and bulk carriers represent large segments due to their sheer numbers and significant fuel consumption, making emission compliance a critical operational imperative. The retrofit segment currently dominates applications as shipowners upgrade existing fleets, but newbuild installations are projected to increase steadily as future regulations take effect and as the maritime industry renews its global fleet with more environmentally conscious designs.

AI Impact Analysis on Offshore Marine Emission Control Systems Market

User questions surrounding the impact of AI on the Offshore Marine Emission Control Systems Market frequently revolve around its potential to enhance efficiency, reduce operational costs, and improve regulatory compliance. Users are keen to understand how artificial intelligence can optimize the performance of existing emission control technologies, predict maintenance needs, and intelligently manage fuel consumption to minimize environmental impact. There is significant interest in AI's role in real-time data analysis from sensors within scrubbers, SCRs, and engine systems, to identify patterns, detect anomalies, and make autonomous adjustments for optimal emission reduction. Concerns also exist regarding data security, the complexity of integrating AI with legacy systems, and the initial investment required for AI-powered solutions. The maritime industry is looking for clear pathways to leverage AI for more sustainable and economically viable shipping operations.

Artificial intelligence is poised to revolutionize the offshore marine emission control systems market by introducing unprecedented levels of optimization, predictive capabilities, and autonomous operation. Its ability to process vast amounts of data from diverse sources, including engine performance, fuel quality, weather conditions, and emission sensor readings, allows for a holistic approach to environmental compliance. This leads to more precise control over emission abatement processes, ensuring that vessels operate within regulatory limits while simultaneously optimizing fuel efficiency. The proactive insights generated by AI can significantly reduce the risk of non-compliance and avoid costly penalties, enhancing the operational resilience of maritime assets.

- AI-driven Predictive Maintenance: Enables proactive servicing of emission control systems, reducing downtime and costly unplanned repairs by forecasting component failures.

- Real-time Performance Optimization: AI algorithms continuously analyze sensor data to adjust system parameters (e.g., scrubber water flow, SCR catalyst injection) for peak emission reduction efficiency and fuel economy.

- Enhanced Regulatory Compliance: AI systems can monitor emissions in real-time against dynamic regulatory requirements, providing alerts and automated adjustments to maintain compliance across varying operational zones.

- Fuel Consumption Optimization: By integrating with voyage planning and engine management systems, AI can optimize route selection and propulsion settings to minimize emissions and fuel burn.

- Data-driven Operational Insights: Provides deep analytics on system performance, fuel quality impact, and operational patterns, supporting better decision-making for fleet managers.

- Autonomous System Management: Potential for self-regulating emission control systems that automatically adapt to changing conditions without manual intervention, improving consistency and reliability.

- Simulation and Digital Twins: AI can power digital twins of vessels and their emission control systems, allowing for virtual testing of operational scenarios and system upgrades before physical implementation.

DRO & Impact Forces Of Offshore Marine Emission Control Systems Market

The Offshore Marine Emission Control Systems market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces shaping its trajectory. The primary driver is the relentless tightening of global environmental regulations, particularly those mandated by the International Maritime Organization (IMO), such as the IMO 2020 sulfur cap and the upcoming NOx Tier III requirements for Emission Control Areas (ECAs). These regulations compel shipowners to invest in compliant technologies to avoid significant penalties and ensure access to key trading routes. Additionally, growing public and corporate pressure for environmental sustainability and corporate social responsibility (CSR) initiatives encourages proactive adoption of green shipping practices. Technological advancements, making emission control solutions more efficient, compact, and affordable, further fuel market growth, alongside the increasing adoption of alternative fuels like LNG, methanol, and ammonia, which necessitate integrated emission management systems.

Despite the strong drivers, several restraints pose challenges to market expansion. The high upfront capital expenditure associated with purchasing and installing emission control systems, such as scrubbers or SCR units, remains a significant barrier for many shipowners, especially smaller operators. This is often coupled with the additional operational costs, including maintenance, energy consumption, and the disposal of waste products from some systems. Uncertainty surrounding future regulatory frameworks and potential shifts in compliance technologies can lead to hesitation in investment decisions. Furthermore, the limited availability of bunkering infrastructure for alternative fuels like LNG, methanol, and ammonia in many ports, though improving, continues to be a bottleneck for wider adoption of these inherently cleaner options. The complexity of integrating new systems into existing vessel designs and the need for specialized crew training also represent practical hurdles.

Opportunities within the market are abundant and diverse. The burgeoning demand for retrofitting existing global fleets to meet current and future regulations presents a massive market segment for technology providers. The continuous innovation in system design, leading to more compact, energy-efficient, and cost-effective solutions, opens new avenues for market penetration. The development and increasing acceptance of alternative marine fuels offer a long-term growth opportunity, as these fuels necessitate new or adapted emission control strategies. Furthermore, the potential for digital transformation, including the integration of AI, IoT, and advanced analytics for predictive maintenance, real-time optimization, and enhanced compliance monitoring, can unlock significant value. The growing focus on holistic vessel efficiency and decarbonization targets provides opportunities for integrated solutions that combine emission reduction with fuel efficiency improvements and energy management, positioning the market for sustained growth beyond mere regulatory compliance.

Segmentation Analysis

The Offshore Marine Emission Control Systems Market is comprehensively segmented based on various critical parameters, including system type, fuel type, vessel type, and application. This granular segmentation provides a detailed understanding of market dynamics, enabling stakeholders to identify key growth areas and tailor their strategies. Each segment reflects specific technological approaches, operational requirements, and end-user needs within the diverse maritime industry. The market's evolution is heavily influenced by how these segments interact with evolving regulations and technological advancements, from traditional exhaust gas cleaning systems to emerging alternative fuel solutions. Understanding these distinctions is crucial for analyzing market share, competitive landscapes, and future investment opportunities across the global maritime sector.

- By System Type

- Exhaust Gas Cleaning Systems (EGCS) / Scrubbers

- Open-loop Scrubbers: Utilize seawater to remove SOx, discharging wash water back into the sea after treatment.

- Closed-loop Scrubbers: Recirculate wash water, treating and storing sludge onboard, ideal for environmentally sensitive areas.

- Hybrid Scrubbers: Offer the flexibility to operate in either open or closed-loop mode, adapting to different regulatory zones.

- Selective Catalytic Reduction (SCR) Systems: Employ a catalyst and reducing agent (e.g., urea) to convert NOx into harmless nitrogen and water vapor.

- Exhaust Gas Recirculation (EGR) Systems: Reduce NOx by recirculating a portion of the exhaust gas back into the engine cylinders, lowering combustion temperatures.

- Liquefied Natural Gas (LNG) Fuel Systems: Include LNG storage tanks, regasification units, and associated piping for dual-fuel engines, reducing SOx, NOx, and particulate matter significantly.

- Alternative Fuel Systems (Methanol, Ammonia, Hydrogen): Emerging technologies for future sustainable shipping, involving specialized storage, bunkering, and engine adaptations.

- Other Advanced Emission Control Systems: May include carbon capture technologies, innovative particulate matter filters, and new generation abatement solutions.

- Exhaust Gas Cleaning Systems (EGCS) / Scrubbers

- By Fuel Type

- Heavy Fuel Oil (HFO): Requires extensive emission control systems, primarily scrubbers, to meet sulfur limits.

- Marine Gas Oil (MGO): Naturally lower in sulfur content, often used in ECAs or by vessels not equipped with scrubbers.

- Liquefied Natural Gas (LNG): A clean-burning alternative fuel significantly reducing SOx, NOx, and particulate matter emissions.

- Methanol: An emerging alternative fuel offering lower emissions and easier storage compared to LNG.

- Ammonia: A promising carbon-free fuel, currently in developmental stages, posing challenges related to toxicity and infrastructure.

- Hydrogen: A highly clean fuel, primarily under research for marine applications due to storage and production complexities.

- Hybrid/Multi-fuel Systems: Designed to operate on a combination of fuels, providing operational flexibility and enhanced compliance.

- By Vessel Type

- Tankers: Including crude oil tankers, product tankers, and chemical tankers, requiring robust emission control due to their operational routes and cargo.

- Bulk Carriers: Large vessels transporting dry bulk commodities, significant contributors to marine emissions.

- Container Ships: High-speed, large capacity vessels that operate on frequent schedules, making emission compliance critical.

- Cruise Ships: Vessels with strict environmental standards due to passenger health and reputation, often operating in sensitive coastal areas.

- Ferries: Operating on fixed routes, often in coastal and inland waterways, facing local emission regulations.

- Offshore Support Vessels (OSVs): Including platform supply vessels, anchor handling tug supply vessels, and subsea construction vessels, operating in environmentally sensitive offshore zones.

- Naval Vessels: Increasingly adopting emission control for environmental stewardship and operational efficiency.

- Ro-Ro Ships: Roll-on/roll-off vessels transporting vehicles, requiring flexible emission solutions.

- General Cargo Ships: Smaller, versatile vessels often operating in regional trade, still subject to international regulations.

- By Application

- Newbuilds: Installation of emission control systems during the construction phase of new vessels, often integrating solutions into the overall ship design.

- Retrofits: Installation of emission control systems on existing vessels to bring them into compliance with current or future regulations, a significant market driver.

Value Chain Analysis For Offshore Marine Emission Control Systems Market

The value chain for the Offshore Marine Emission Control Systems Market is intricate, involving a diverse range of stakeholders from raw material suppliers to end-users, each playing a crucial role in the production, distribution, and utilization of these complex technologies. The upstream segment of the value chain is characterized by the procurement of essential raw materials and components. This includes specialized metals and alloys for system fabrication, advanced catalysts for SCR units, chemicals like urea and caustic soda for neutralizing agents, and sophisticated electronic components for control and monitoring systems. Key suppliers in this stage are metallurgical companies, chemical producers, and electronics manufacturers. The quality and availability of these upstream inputs directly impact the performance, cost-effectiveness, and reliability of the final emission control systems, underscoring the importance of robust supply chain management.

Moving downstream, the value chain encompasses the design, manufacturing, and assembly of the emission control systems themselves. This segment is dominated by specialized engineering firms and technology providers who leverage extensive R&D to innovate and produce state-of-the-art scrubbers, SCR systems, EGR units, and alternative fuel systems. Shipyards play a pivotal role here, as they are often responsible for the integration and installation of these systems onto both newbuilds and existing vessels during retrofit projects. This requires close collaboration between system manufacturers and shipyards to ensure seamless integration and optimal performance. After-sales services, including maintenance, spare parts supply, and technical support, form another critical part of the downstream value chain, ensuring the long-term operational efficiency and compliance of the installed systems. These services are often provided directly by the original equipment manufacturers (OEMs) or through authorized service partners globally.

Distribution channels for offshore marine emission control systems are primarily direct, involving direct sales from manufacturers to shipowners, fleet operators, and shipyards. Given the highly technical nature and custom requirements of these systems, direct engagement facilitates detailed technical discussions, custom solutions, and comprehensive project management. Indirect channels may involve engineering procurement and construction (EPC) companies who manage large-scale shipbuilding or retrofit projects and integrate emission control systems as part of a broader solution. Agents and regional distributors also play a role in certain geographies, especially for facilitating sales and after-sales support in remote or niche markets. The choice of distribution channel often depends on the scale of the project, the geographical reach of the manufacturer, and the established relationships within the maritime industry, with a strong emphasis on direct technical consultancy and long-term customer relationships to ensure successful implementation and continued compliance.

Offshore Marine Emission Control Systems Market Potential Customers

The potential customers for Offshore Marine Emission Control Systems represent a broad spectrum of the maritime industry, all united by the imperative to comply with environmental regulations and enhance their operational sustainability. At the forefront are global shipping companies and fleet operators, who manage extensive fleets of cargo vessels, including container ships, bulk carriers, and tankers. These entities are under immense pressure to retrofit their existing fleets and ensure that new additions are equipped with the latest emission reduction technologies. Compliance is not just a regulatory obligation but also a strategic business decision, influencing port access, operational costs, and corporate reputation. Their purchasing decisions are driven by factors such as system reliability, upfront costs, operational expenditure (OPEX), ease of integration, and the system's ability to provide long-term regulatory certainty.

Another significant customer segment comprises offshore oil and gas operators. Companies involved in exploration, production, and support activities for offshore platforms utilize a variety of offshore support vessels (OSVs) such as platform supply vessels, anchor handling tugs, and seismic survey vessels. These vessels often operate in environmentally sensitive areas and are subject to specific regional and national emission standards in addition to IMO regulations. The demand from this segment is driven by the need to maintain environmental licenses, ensure operational continuity, and align with corporate sustainability goals. The robustness and reliability of emission control systems are paramount for these customers, given the challenging operating environments offshore and the critical nature of their support operations.

Furthermore, cruise lines and ferry operators constitute a crucial customer base, particularly due to their operations in coastal waters, sensitive marine environments, and densely populated port areas. Public perception and stringent local regulations significantly influence their investment in advanced emission control systems, including scrubbers and alternative fuel solutions. These operators prioritize solutions that minimize visible pollution, reduce noise, and ensure a comfortable experience for passengers, all while upholding a strong environmental image. Finally, shipyards and naval forces also represent important customers. Shipyards purchase these systems for integration into newbuild projects, acting as key partners for technology providers. Naval forces, increasingly focused on environmental stewardship and operating under unique logistical constraints, are also adopting emission control systems for their fleets, driven by a combination of regulatory compliance and national sustainability objectives. The diverse needs of these customer groups necessitate flexible and adaptable emission control solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.2 billion |

| Market Forecast in 2032 | USD 10.0 billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wärtsilä, Alfa Laval, Yara Marine Technologies, Mitsubishi Heavy Industries, MAN Energy Solutions, Fuji Electric, Clean Marine, Ecospray Technologies, CR Ocean Engineering, DuPont de Nemours, Inc., Saacke GmbH, Langh Tech Oy Ab, Damen Shipyards Group, Hyundai Heavy Industries, TotalEnergies, GE Power, ExxonMobil, Shell, Caterpillar, KSOE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offshore Marine Emission Control Systems Market Key Technology Landscape

The Offshore Marine Emission Control Systems market is characterized by a dynamic and evolving technological landscape, driven by the continuous pursuit of cleaner shipping and compliance with increasingly stringent environmental regulations. Exhaust Gas Cleaning Systems (EGCS), commonly known as scrubbers, remain a cornerstone technology, with ongoing innovations focusing on improving efficiency, reducing footprint, and managing wash water. Advances in scrubber technology include more compact designs, hybrid systems offering operational flexibility between open and closed-loop modes, and smart control systems that optimize performance based on real-time operational data. Materials science plays a crucial role in developing corrosion-resistant components and catalysts that ensure longevity and reliability in harsh marine environments, reducing maintenance burdens and extending service intervals.

Selective Catalytic Reduction (SCR) systems are another vital technology, particularly for reducing nitrogen oxides (NOx) emissions, especially as IMO Tier III regulations become more widespread. Technological advancements in SCR include the development of highly efficient catalysts that operate at lower temperatures, reducing the energy penalty, and compact designs suitable for integration into engine rooms with limited space. Innovations also extend to urea injection systems, ensuring precise dosage and optimal atomization for maximum NOx conversion efficiency, alongside robust monitoring systems to ensure continuous compliance. The integration of advanced sensor technologies and real-time analytics with SCR systems allows for adaptive control, optimizing performance across varying engine loads and operational conditions.

Beyond traditional abatement technologies, the market is experiencing a significant shift towards alternative fuel systems, with Liquefied Natural Gas (LNG) at the forefront. The technology landscape for LNG includes advanced cryogenic storage tanks, sophisticated fuel gas supply systems (FGSS) that manage the regasification and delivery of LNG to dual-fuel engines, and robust bunkering solutions. Emerging alternative fuels like methanol and ammonia are driving innovation in engine design, fuel storage, and bunkering infrastructure, necessitating the development of new safety protocols and emission monitoring specific to these fuels. Furthermore, the broader adoption of digitalization, including the Internet of Things (IoT) for remote monitoring, big data analytics for operational insights, and Artificial Intelligence (AI) for predictive maintenance and performance optimization, is transforming the technological landscape, enabling smarter, more efficient, and more compliant emission control solutions across the entire marine fleet.

Regional Highlights

- North America: The North American market is significantly influenced by the US and Canadian Emission Control Areas (ECAs) along their coasts, mandating strict sulfur and NOx limits. This has driven early adoption of scrubbers and SCR systems, particularly for vessels operating within these zones. The region also sees increasing interest in LNG as a marine fuel, supported by developing bunkering infrastructure in key ports like Houston and Vancouver. Regulatory initiatives, combined with a focus on port air quality, are key drivers.

- Europe: Europe stands as a pioneering region in marine emission control, largely due to the stringent regulations in the Baltic Sea and North Sea ECAs. Countries like Norway, Germany, and the Netherlands have been at the forefront of adopting and developing advanced technologies, including hybrid scrubbers, SCR systems, and LNG propulsion. Strong governmental support for green shipping initiatives, a robust maritime research ecosystem, and significant port activity contribute to its leading market position.

- Asia Pacific (APAC): The APAC region represents the largest and fastest-growing market, driven by its immense shipbuilding capacity, vast shipping traffic, and growing environmental concerns in major economies like China, Japan, South Korea, and Singapore. China's domestic ECAs and its role as a global manufacturing hub for emission control components are significant. South Korea and Japan, with their major shipyards, are key players in integrating these systems into newbuilds, while Singapore serves as a crucial bunkering and maritime technology hub, actively promoting LNG and future fuels.

- Latin America: This region is experiencing a gradual increase in the adoption of emission control systems, primarily driven by international shipping routes and the need for vessels to comply with global standards to access major trade partners. Countries like Brazil and Mexico are seeing growth, particularly in their offshore oil and gas sectors, which require environmentally compliant support vessels. Development of local regulations and infrastructure for alternative fuels is still nascent but progressing.

- Middle East and Africa (MEA): The MEA region is emerging as a market for offshore marine emission control systems, largely due to its strategic position on major shipping lanes, expanding oil and gas industry, and increasing focus on environmental stewardship, especially in the UAE and Saudi Arabia. Investment in new port infrastructure and the development of alternative fuel bunkering facilities are expected to accelerate market growth, as the region aligns with global maritime environmental standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offshore Marine Emission Control Systems Market.- Wärtsilä

- Alfa Laval

- Yara Marine Technologies

- Mitsubishi Heavy Industries

- MAN Energy Solutions

- Fuji Electric

- Clean Marine

- Ecospray Technologies

- CR Ocean Engineering

- DuPont de Nemours, Inc.

- Saacke GmbH

- Langh Tech Oy Ab

- Damen Shipyards Group

- Hyundai Heavy Industries

- TotalEnergies

- GE Power

- ExxonMobil

- Shell

- Caterpillar

- KSOE (Korea Shipbuilding & Offshore Engineering)

Frequently Asked Questions

What are Offshore Marine Emission Control Systems?

Offshore Marine Emission Control Systems are advanced technologies and solutions installed on marine vessels to reduce harmful pollutants like sulfur oxides (SOx) and nitrogen oxides (NOx) emitted from their engines. These systems help ships comply with international and regional environmental regulations, such as those set by the International Maritime Organization (IMO).

Why are these systems important for the maritime industry?

These systems are crucial for ensuring environmental compliance, avoiding penalties, and improving air quality in port areas and coastal regions. They enable ships to operate sustainably, enhance corporate social responsibility, and future-proof vessels against tightening global emission standards, contributing to cleaner oceans and a healthier planet.

What are the main types of Offshore Marine Emission Control Systems?

The primary types include Exhaust Gas Cleaning Systems (EGCS), also known as scrubbers (open-loop, closed-loop, hybrid), which remove SOx; Selective Catalytic Reduction (SCR) systems, which reduce NOx; and Exhaust Gas Recirculation (EGR) systems, also for NOx reduction. Additionally, systems for alternative fuels like LNG are increasingly important.

How do global regulations impact the Offshore Marine Emission Control Systems market?

Global regulations, particularly IMO 2020 for sulfur content and IMO Tier III for NOx emissions in Emission Control Areas (ECAs), are the primary drivers of this market. These mandates compel shipowners to invest in compliant technologies for both newbuilds and retrofits, directly stimulating demand and technological innovation in the sector.

What role does AI play in the future of marine emission control?

AI is set to revolutionize marine emission control by enabling predictive maintenance, real-time performance optimization, and enhanced regulatory compliance. AI-driven systems can analyze vast data streams to autonomously adjust parameters for maximum efficiency, minimize fuel consumption, and provide proactive insights, leading to more sustainable and cost-effective operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager