Offshore Support Vessel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428577 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Offshore Support Vessel Market Size

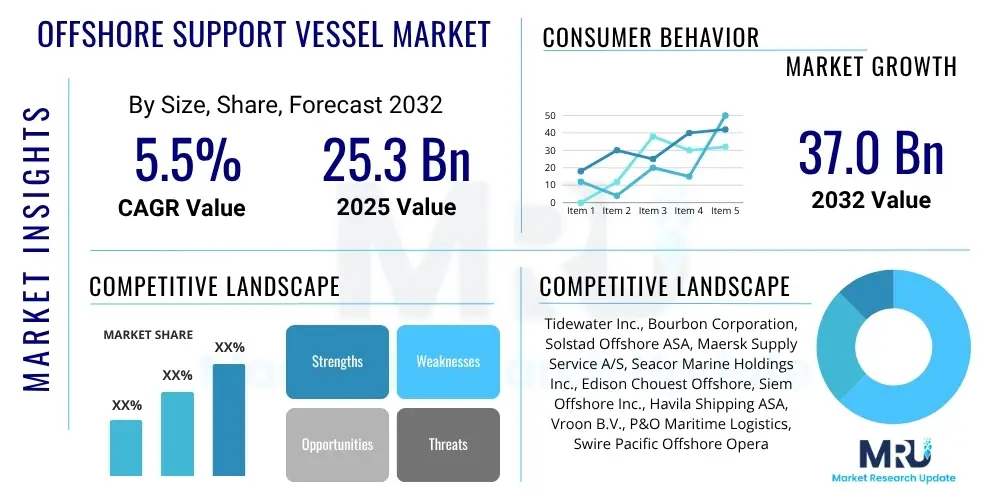

The Offshore Support Vessel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2032. The market is estimated at USD 25.3 Billion in 2025 and is projected to reach USD 37.0 Billion by the end of the forecast period in 2032.

Offshore Support Vessel Market introduction

The Offshore Support Vessel (OSV) market encompasses a specialized fleet of vessels designed to provide essential services and logistics to offshore oil and gas exploration, production, and increasingly, offshore renewable energy installations. These vessels are critical for the safe and efficient operation of offshore platforms, rigs, and wind farms, ensuring the continuous supply of personnel, materials, and equipment. The primary product in this market includes various vessel types such as Platform Supply Vessels (PSVs), Anchor Handling Tug Supply (AHTS) vessels, Offshore Construction Vessels (OCVs), Multipurpose Support Vessels (MSVs), and others, each tailored for specific operational requirements.

Major applications for OSVs extend across the entire offshore energy lifecycle, from initial exploration and drilling activities to production, maintenance, and eventual decommissioning. In the oil and gas sector, OSVs facilitate drilling rig moves, towage, anchor handling, and the transportation of drilling fluids, bulk materials, and fresh water. For the burgeoning offshore wind industry, these vessels are vital for turbine installation, cable laying, and ongoing maintenance. The inherent benefits of a robust OSV fleet include enhanced operational efficiency, improved safety standards through specialized equipment and highly trained crews, and the logistical backbone necessary for sustaining complex offshore operations in challenging marine environments.

Driving factors for the OSV market are multifaceted, primarily stemming from global energy demand and the resulting investments in both conventional and renewable offshore energy sources. The resurgence in offshore oil and gas exploration, particularly in deepwater and ultra-deepwater fields, coupled with the rapid expansion of offshore wind capacity worldwide, are key propellers. Additionally, technological advancements in vessel design, propulsion systems, and digital integration are contributing to more efficient, environmentally friendly, and capable OSVs, further stimulating market growth.

Offshore Support Vessel Market Executive Summary

The Offshore Support Vessel market is experiencing a period of strategic evolution, driven by a confluence of rising energy demand, the global energy transition, and advancements in maritime technology. Business trends indicate a shift towards fleet modernization, digital integration, and a growing emphasis on sustainability. Companies are investing in newbuilds and retrofits that feature hybrid propulsion, battery storage, and advanced automation to reduce fuel consumption and emissions, aligning with stricter environmental regulations and corporate ESG objectives. Consolidation among smaller players and strategic partnerships are also prominent, aimed at optimizing operational efficiencies and expanding service portfolios, particularly into the burgeoning offshore wind sector.

Regional trends highlight dynamic growth in certain geographies, while others maintain stable demand. The Asia Pacific region, particularly Southeast Asia and Australia, is poised for significant expansion due to increasing offshore oil and gas activity and ambitious renewable energy projects. Similarly, Latin America, spearheaded by Brazil and Guyana, continues to be a hotbed for deepwater E&P, driving demand for high-spec OSVs. Europe, with its mature North Sea oil and gas infrastructure, is increasingly pivoting towards offshore wind farm development and decommissioning activities, creating new niches for specialized OSV services. The Middle East and Africa regions demonstrate steady demand influenced by national oil company investments and ongoing field development projects.

Segment trends reveal a bifurcation in demand. High-specification PSVs and AHTS vessels, capable of supporting complex deepwater operations and offshore wind installations, are commanding higher utilization rates and day rates. There is also a growing demand for specialized vessels such as Subsea Support Vessels (SSVs) and crew transfer vessels (CTVs) for particular niche applications. Conversely, the market for older, lower-spec vessels faces challenges due to oversupply and reduced applicability for modern offshore projects. The shift towards multi-purpose vessels that can serve both oil and gas and renewable sectors is a key trend, offering operators greater flexibility and resilience against market fluctuations.

AI Impact Analysis on Offshore Support Vessel Market

Users frequently inquire about the transformative potential of Artificial Intelligence in the Offshore Support Vessel market, specifically concerning how AI can enhance operational efficiency, reduce costs, and improve safety. Key themes often revolve around the automation of routine tasks, predictive maintenance capabilities, optimization of vessel routes and fuel consumption, and the development of autonomous or semi-autonomous vessel operations. Concerns typically include the upfront investment required for AI integration, the complexity of data management, cybersecurity risks, and the potential impact on human employment. However, there is a strong expectation that AI will lead to significant performance improvements and enable more sustainable offshore operations, fundamentally reshaping how OSV services are delivered and managed.

- Enhanced predictive maintenance to minimize downtime and extend asset lifespans.

- Optimized route planning and fuel consumption through real-time data analysis and machine learning algorithms.

- Autonomous navigation and dynamic positioning capabilities, reducing human error and improving safety.

- Improved supply chain logistics and inventory management for offshore installations.

- Real-time monitoring of vessel performance and environmental conditions for proactive decision-making.

- Automation of repetitive tasks, allowing crews to focus on complex operations.

- Advanced collision avoidance and maritime security systems leveraging AI-powered sensors.

- Development of digital twins for virtual vessel simulation and crew training.

DRO & Impact Forces Of Offshore Support Vessel Market

The Offshore Support Vessel market is influenced by a dynamic interplay of drivers, restraints, and opportunities, all shaped by significant impact forces. Key drivers include the sustained global demand for energy, which necessitates ongoing offshore oil and gas exploration and production, especially in challenging deepwater environments. The accelerating global transition towards renewable energy sources is another powerful driver, with massive investments in offshore wind farms requiring extensive OSV support for construction, installation, and maintenance. Technological advancements promoting more efficient, safer, and environmentally friendly vessels also stimulate market growth, encouraging fleet modernization and specialized service offerings. Energy security concerns in various nations further underpin the need for domestic offshore resource development.

However, the market faces notable restraints that can impede its growth trajectory. Volatility in global oil and gas prices historically creates uncertainty and impacts investment decisions in offshore projects, directly affecting OSV demand and day rates. Stringent environmental regulations and increasing pressure to reduce carbon emissions compel operators to invest in costly upgrades or newbuilds, which can strain finances. Persistent oversupply of older, less capable vessels in certain market segments continues to depress day rates and utilization for non-specialized fleets. High operational costs, including fuel, maintenance, and crewing, also present a continuous challenge, requiring operators to seek greater efficiencies.

Opportunities within the OSV market are emerging from several directions. The burgeoning offshore wind sector presents a substantial growth avenue, driving demand for specialized construction, installation, and maintenance vessels. The increasing number of mature offshore oil and gas fields requiring decommissioning services offers a new, long-term revenue stream for OSVs equipped for such operations. Deepwater and ultra-deepwater exploration and production projects, which demand high-specification and technologically advanced vessels, represent premium market segments. Furthermore, the broader maritime industry's drive towards digitalization, automation, and remote operations offers opportunities for innovation and competitive differentiation. Geopolitical stability, global economic health, evolving environmental policies, and the pace of technological innovation are critical impact forces that continuously shape the market landscape.

Segmentation Analysis

The Offshore Support Vessel market is broadly segmented to reflect the diverse operational needs within the offshore energy industry. This segmentation allows for a granular understanding of market dynamics, specific demand patterns, and competitive landscapes across different vessel types, applications, water depths, and regional concentrations. The versatility of OSVs, from handling complex subsea operations to transporting critical supplies, necessitates these distinct categories to accurately analyze market trends and future growth opportunities.

- By Type

- Platform Supply Vessels (PSVs)

- Anchor Handling Tug Supply (AHTS) Vessels

- Offshore Construction Vessels (OCVs)

- Multipurpose Support Vessels (MSVs)

- Crew Transfer Vessels (CTVs)

- Standby Vessels

- Others (e.g., Well Intervention Vessels, Survey Vessels)

- By Application

- Oil & Gas Exploration & Production

- Offshore Wind Farm Development

- Subsea Construction

- Decommissioning

- Other Offshore Services

- By Water Depth

- Shallow Water

- Deepwater

- Ultra-Deepwater

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Offshore Support Vessel Market

The value chain for the Offshore Support Vessel market is complex, beginning with the design and construction of these highly specialized vessels. This upstream segment involves shipyards, naval architects, marine equipment manufacturers, and technology providers who supply engines, propulsion systems, dynamic positioning systems, and automation software. Research and development in this stage are crucial for introducing innovative designs that meet evolving operational demands and environmental regulations, leading to more fuel-efficient and capable vessels. Financing institutions also play a vital role here, providing the significant capital required for newbuilds and major upgrades.

The midstream segment primarily consists of OSV owners and operators, who acquire, manage, and charter these vessels to end-users. This involves intricate operational planning, crewing, maintenance, and compliance with international maritime safety and environmental standards. Chartering activities can be short-term or long-term, directly influencing the utilization rates and profitability of the fleet. Strategic decisions in fleet management, including vessel positioning, fuel bunkering, and port services, are critical for optimizing costs and maximizing vessel uptime. Effective asset management and adherence to strict regulatory frameworks are paramount in this stage.

The downstream segment involves the provision of OSV services to the ultimate end-users, which include international oil companies (IOCs), national oil companies (NOCs), offshore wind farm developers, and subsea construction contractors. These end-users utilize OSVs for a range of activities such as drilling support, rig moves, personnel transfer, supply logistics, subsea intervention, and renewable energy infrastructure installation and maintenance. Distribution channels primarily involve direct contractual agreements between OSV operators and end-users, often facilitated by brokers or tenders for large-scale projects. Indirect distribution can also occur through partnerships or sub-contracting arrangements, where a main contractor for an offshore project engages OSVs through third-party logistics providers. The efficiency and reliability of OSV services directly impact the overall success and cost-effectiveness of offshore energy projects, creating a strong link between the vessel operator and the client's operational continuity.

Offshore Support Vessel Market Potential Customers

The primary potential customers and end-users of Offshore Support Vessels are diverse entities operating within the global offshore energy sector. These include major international oil and gas companies (IOCs) such as Shell, ExxonMobil, Chevron, and BP, who require comprehensive logistical and operational support for their exploration, development, and production activities across various water depths. National oil companies (NOCs) like Petrobras, Saudi Aramco, Equinor, and ADNOC also represent significant buyers, particularly in their respective domestic offshore basins where they hold substantial assets and drive local content initiatives. These companies rely heavily on OSVs for rig moves, supply transportation, and emergency response capabilities.

Beyond traditional oil and gas, the rapidly expanding offshore renewable energy sector forms another critical customer base. Offshore wind farm developers and operators, including companies like Orsted, Siemens Gamesa, and Vestas, require specialized OSVs for turbine installation, cable laying, and ongoing operational maintenance. As the industry matures, demand for crew transfer vessels (CTVs) and service operation vessels (SOVs) specifically designed for wind farm support is growing rapidly. Subsea construction companies, involved in laying pipelines, installing subsea structures, and performing intervention tasks, also constitute a significant customer segment, requiring vessels equipped with advanced dynamic positioning and crane capabilities.

Furthermore, organizations involved in offshore decommissioning, a growing industry as older oil and gas infrastructure reaches its end of life, are becoming increasingly important customers for OSVs capable of supporting removal and environmental remediation efforts. Maritime logistics firms and engineering, procurement, and construction (EPC) contractors often charter OSVs as part of their broader project contracts, acting as intermediaries between vessel owners and the ultimate project owners. The specialized nature of offshore operations means that customers typically seek reliable partners with modern, well-maintained fleets and experienced crews to ensure safety, efficiency, and compliance with rigorous industry standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 25.3 Billion |

| Market Forecast in 2032 | USD 37.0 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tidewater Inc., Bourbon Corporation, Solstad Offshore ASA, Maersk Supply Service A/S, Seacor Marine Holdings Inc., Edison Chouest Offshore, Siem Offshore Inc., Havila Shipping ASA, Vroon B.V., P&O Maritime Logistics, Swire Pacific Offshore Operations (Pte) Ltd, Hornbeck Offshore Services, GulfMark Offshore, A.P. Moller – Maersk, Pacific Radiance Ltd., MMA Offshore Limited, Topaz Energy and Marine, DOF ASA, Nordic American Offshore Ltd., Otto Candies LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offshore Support Vessel Market Key Technology Landscape

The Offshore Support Vessel market is undergoing a significant technological transformation, driven by demands for greater efficiency, improved safety, reduced environmental impact, and enhanced operational capabilities in increasingly challenging offshore environments. Digitalization is at the forefront, with the widespread adoption of advanced vessel management systems, integrated navigation platforms, and real-time data analytics. These technologies enable proactive decision-making, optimize fuel consumption, and streamline complex logistical operations, moving towards a more data-driven operational paradigm. Remote monitoring and control capabilities are also becoming standard, allowing shore-based teams to oversee vessel performance and respond to incidents more effectively, thereby enhancing operational resilience.

Automation and autonomous features are rapidly gaining traction, particularly in areas like dynamic positioning (DP) systems, which ensure vessels maintain precise positions relative to offshore installations, and in predictive maintenance systems that utilize AI and machine learning. These systems analyze vast amounts of sensor data to anticipate equipment failures, enabling scheduled repairs and minimizing costly unplanned downtime. The push for decarbonization is also fueling innovation in propulsion technologies, with a growing number of OSVs adopting hybrid-electric power systems, battery energy storage solutions, and exploring alternative fuels such as LNG, methanol, and ammonia. These advancements not only reduce greenhouse gas emissions but also improve fuel efficiency and operational flexibility, aligning with global sustainability goals.

Furthermore, specialized equipment for specific applications continues to evolve. For deepwater operations, advanced subsea intervention systems, remotely operated vehicles (ROVs), and sophisticated lifting equipment are being integrated into multi-purpose OSVs. For the offshore wind sector, purpose-built vessels featuring walk-to-work gangways, specialized crane systems for turbine component handling, and comfortable accommodation for technicians are becoming commonplace. Connectivity solutions, including high-bandwidth satellite communication, are essential for supporting these advanced digital systems and ensuring seamless data flow between vessel, shore, and offshore assets. The convergence of these technological innovations is creating a new generation of OSVs that are smarter, greener, and more capable than ever before.

Regional Highlights

- North America: This region, particularly the Gulf of Mexico, remains a significant market for OSVs, driven by deepwater oil and gas exploration and production. The ongoing development of large-scale offshore wind projects on the East Coast is also fueling new demand for specialized installation and service vessels. Demand for high-specification PSVs and AHTS vessels capable of operating in challenging conditions is consistently strong.

- Europe: The North Sea historically dominates the European OSV market, though activity here is shifting from traditional oil and gas E&P towards decommissioning and a strong focus on offshore wind energy. Europe is a leader in developing advanced, low-emission OSVs and is experiencing robust growth in demand for vessels supporting wind farm construction and maintenance, particularly in the UK, Germany, and Norway.

- Asia Pacific (APAC): The APAC region is a high-growth market, propelled by increasing energy demand, new oil and gas discoveries in Southeast Asia (e.g., Indonesia, Malaysia, Vietnam) and Australia, and significant investments in offshore wind energy in countries like China, Taiwan, and Japan. The region benefits from a strong shipbuilding industry and growing domestic OSV fleets.

- Latin America: Brazil and Guyana are key drivers in Latin America, with substantial deepwater and ultra-deepwater oil discoveries attracting significant investments from international and national oil companies. This generates strong demand for high-spec AHTS and PSV vessels, particularly for long-term charters. Mexico also presents emerging opportunities with its reformed energy sector.

- Middle East and Africa (MEA): The Middle East maintains a steady demand for OSVs due to ongoing maintenance, brownfield expansion, and new field developments driven by national oil companies. Africa, particularly West Africa, is seeing renewed interest in offshore E&P, alongside emerging interest in offshore gas and limited renewable projects, providing a consistent market for various OSV types.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offshore Support Vessel Market.- Tidewater Inc.

- Bourbon Corporation

- Solstad Offshore ASA

- Maersk Supply Service A/S

- Seacor Marine Holdings Inc.

- Edison Chouest Offshore

- Siem Offshore Inc.

- Havila Shipping ASA

- Vroon B.V.

- P&O Maritime Logistics

- Swire Pacific Offshore Operations (Pte) Ltd

- Hornbeck Offshore Services

- GulfMark Offshore

- A.P. Moller – Maersk

- Pacific Radiance Ltd.

- MMA Offshore Limited

- Topaz Energy and Marine

- DOF ASA

- Nordic American Offshore Ltd.

- Otto Candies LLC

Frequently Asked Questions

What is an Offshore Support Vessel (OSV)?

An Offshore Support Vessel (OSV) is a specialized marine vessel designed to perform a range of services for offshore oil and gas exploration, production, and increasingly, offshore renewable energy installations. These services include transporting supplies, personnel, and equipment, as well as providing anchor handling, towing, and subsea construction support.

What drives the growth of the Offshore Support Vessel market?

Growth in the OSV market is primarily driven by global energy demand necessitating offshore oil and gas exploration and production, rapid expansion of the offshore wind energy sector, and technological advancements enhancing vessel efficiency, safety, and environmental performance.

What are the key types of Offshore Support Vessels?

Key types include Platform Supply Vessels (PSVs) for cargo and personnel transport, Anchor Handling Tug Supply (AHTS) vessels for rig moves and towing, Offshore Construction Vessels (OCVs) for subsea projects, and Multipurpose Support Vessels (MSVs) offering flexible services.

How is AI impacting the Offshore Support Vessel market?

AI is transforming the OSV market by enabling predictive maintenance, optimizing fuel consumption and route planning, enhancing safety through autonomous features, and improving overall operational efficiency, leading to cost reductions and more sustainable practices.

Which regions are key markets for Offshore Support Vessels?

Key regions include North America (Gulf of Mexico, East Coast offshore wind), Europe (North Sea, extensive offshore wind), Asia Pacific (Southeast Asia oil & gas, China/Taiwan offshore wind), and Latin America (Brazil, Guyana deepwater E&P).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager