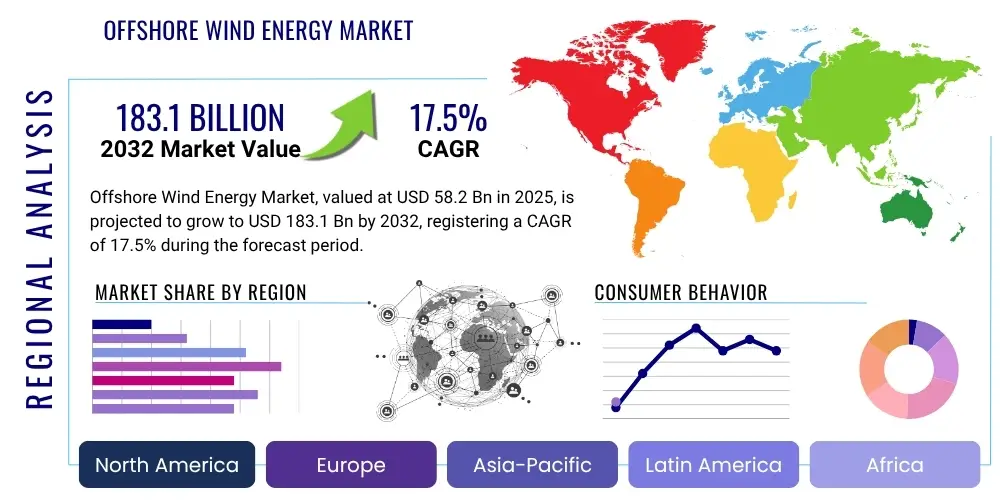

Offshore Wind Energy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429971 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Offshore Wind Energy Market Size

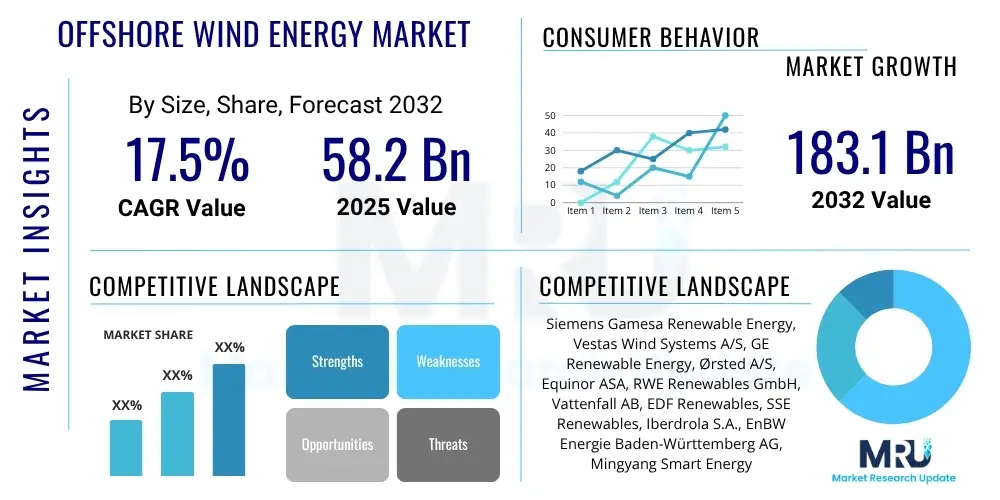

The Offshore Wind Energy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2025 and 2032. The market is estimated at USD 58.2 billion in 2025 and is projected to reach USD 183.1 billion by the end of the forecast period in 2032.

Offshore Wind Energy Market introduction

The global offshore wind energy market represents a critical frontier in the pursuit of sustainable and secure energy solutions, driven by an urgent need for decarbonization and enhanced energy independence. This sector involves the deployment of wind turbines in oceanic and other large bodies of water to harness powerful and consistent winds, offering a significantly higher capacity factor compared to onshore installations due to less turbulence and greater wind speeds. The increasing recognition of climate change impacts, coupled with advancements in turbine technology and installation methods, has propelled offshore wind into a central role in national energy strategies worldwide.

The product, offshore wind energy, encompasses the entire infrastructure required to generate electricity from marine wind resources. This includes advanced wind turbines specifically designed for harsh maritime conditions, robust foundation structures such as monopiles, jacket foundations, gravity base foundations, and increasingly, floating platforms for deeper waters. Electrical infrastructure, including subsea cables and offshore substations, is integral for transmitting the generated power back to onshore grids. These systems are engineered for maximum efficiency, durability, and minimal environmental footprint, continually evolving to meet growing demands and overcome technical challenges posed by the marine environment.

Major applications for offshore wind energy primarily revolve around large-scale electricity generation for national and regional grids, providing clean power to millions of homes and businesses. The benefits are extensive, including a substantial reduction in greenhouse gas emissions, diversification of energy supply, and the creation of numerous high-skilled jobs across the value chain. Driving factors for this market's expansion include ambitious governmental renewable energy targets, supportive policy frameworks like subsidies and tax incentives, technological breakthroughs reducing the levelized cost of energy (LCOE), and growing corporate demand for green electricity through power purchase agreements. The sheer scale and consistency of offshore wind make it an indispensable component of the future global energy mix.

Offshore Wind Energy Market Executive Summary

The offshore wind energy market is undergoing rapid transformation, characterized by several key business trends including industry consolidation, increasing turbine sizes, and the emergence of floating offshore wind technologies. Major players are engaging in strategic partnerships and joint ventures to manage the immense capital requirements and technological complexities of large-scale projects, fostering a more collaborative yet competitive landscape. There is a growing emphasis on optimizing project lifecycle costs through innovations in installation, operation, and maintenance (O&M) strategies, alongside a burgeoning interest in integrating offshore wind with green hydrogen production to maximize energy utilization and create new market pathways. The industry is also witnessing significant investments in port infrastructure and supply chain development to support the deployment of next-generation turbines and projects further offshore.

Regionally, Europe remains the undisputed leader in installed offshore wind capacity, particularly the North Sea basin, with the United Kingdom, Germany, Denmark, and the Netherlands at the forefront of development and innovation. However, the Asia Pacific region, led by China, Taiwan, South Korea, and Japan, is experiencing the most dynamic growth, fueled by aggressive government targets, vast coastal populations, and significant investment. North America, particularly the United States, is emerging as a critical growth market with substantial federal and state-level policy support, aiming to unlock its considerable offshore wind potential, especially along the East Coast. Latin America, the Middle East, and Africa are in nascent stages, with exploratory projects and policy frameworks beginning to take shape, indicating future expansion beyond established markets.

Segment-wise, fixed-bottom foundations, predominantly monopiles and jacket foundations, continue to dominate the market due to their proven reliability and cost-effectiveness in shallow to medium depths. However, floating offshore wind technology is poised for exponential growth, addressing the limitations of fixed structures in deeper waters and opening up vast new resource areas globally. The trend towards larger, more powerful turbines, now routinely exceeding 10 MW and approaching 18 MW or more, is driving down the LCOE and improving project economics, requiring corresponding advancements in manufacturing capabilities and installation vessels. The market is also seeing differentiation by capacity, with utility-scale projects forming the bulk, but niche developments exploring smaller, modular solutions for specific grid needs or island communities. The increasing demand from various end-users, especially utilities and industrial consumers seeking stable, renewable baseload power, continues to shape segment development and investment patterns.

AI Impact Analysis on Offshore Wind Energy Market

User questions related to AI's impact on the offshore wind energy market frequently revolve around how artificial intelligence can enhance operational efficiency, reduce costs, improve predictive maintenance, optimize energy yield, and facilitate smart grid integration. Concerns often focus on the complexity of AI implementation, data security, and the need for skilled personnel to leverage these advanced technologies effectively. Expectations are high for AI to revolutionize various aspects of the lifecycle, from resource assessment and turbine design to construction, operation, and decommissioning, ultimately driving down the levelized cost of energy and making offshore wind even more competitive.

- AI optimizes wind resource assessment and micrositing, improving project efficiency by precisely predicting wind patterns and selecting optimal turbine locations.

- Predictive maintenance using AI-driven analytics reduces downtime and operational costs by forecasting equipment failures before they occur, enabling proactive intervention.

- AI enhances turbine performance through real-time adjustments to blade pitch and yaw, maximizing energy capture and extending asset lifespan.

- Smart grid integration is facilitated by AI algorithms that forecast generation, manage load balancing, and optimize power flow, ensuring grid stability and efficiency.

- AI-powered remote monitoring and autonomous inspection using drones and robotics improve safety and efficiency of O&M activities in challenging offshore environments.

- Supply chain and logistics are streamlined by AI, optimizing procurement, transportation, and installation schedules for complex offshore projects.

- Environmental impact assessment and monitoring benefit from AI analysis of vast datasets, ensuring compliance and minimizing ecological disruption.

DRO & Impact Forces Of Offshore Wind Energy Market

The offshore wind energy market is propelled by a confluence of powerful drivers, primarily the global imperative to combat climate change through decarbonization and the urgent need for enhanced energy security in many nations. Government policies, including ambitious renewable energy targets, robust subsidy schemes, and supportive regulatory frameworks, are creating a favorable investment climate. Significant technological advancements, such as larger and more efficient turbines, innovative foundation designs, and improved installation techniques, are continuously driving down the levelized cost of energy (LCOE), making offshore wind an increasingly economically attractive option compared to conventional power sources. Growing corporate demand for clean energy and increased public awareness regarding environmental sustainability further accelerate market adoption. These forces collectively underscore the strategic importance of offshore wind in the global energy transition.

Despite strong tailwinds, the market faces notable restraints and challenges. The enormous upfront capital expenditure required for offshore wind projects, spanning from development to installation, represents a significant barrier, often requiring complex financing structures and substantial public funding support. Grid infrastructure limitations, including the need for extensive upgrades and new transmission lines to accommodate large-scale offshore generation, pose considerable bottlenecks. Environmental concerns related to marine ecosystems, avian migration, and potential impacts on commercial fishing require meticulous planning and mitigation strategies, often leading to protracted permitting processes. Additionally, the inherent complexities of operating in harsh marine environments, including extreme weather conditions and logistics, contribute to higher operational and maintenance costs compared to onshore alternatives. Supply chain constraints, especially for specialized vessels and components, can also lead to project delays and cost overruns.

Opportunities for growth are abundant and diverse, with floating offshore wind technology emerging as a transformative avenue, unlocking access to deeper waters and vastly expanding the addressable resource potential globally. The integration of offshore wind with green hydrogen production offers a promising pathway to further decarbonize heavy industries and transportation sectors, creating new demand centers and revenue streams. Developing markets, particularly in Asia Pacific and increasingly in North America, present substantial untapped potential for new project development and technological diffusion. Furthermore, ongoing innovation in areas like artificial intelligence for predictive maintenance, advanced materials for turbine components, and improved energy storage solutions will enhance project performance and economic viability. Strategic collaborations across industries, from oil and gas to maritime, also offer synergistic opportunities for leveraging existing expertise and infrastructure.

Segmentation Analysis

The offshore wind energy market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation helps in analyzing market trends, identifying growth opportunities, and understanding the competitive landscape across different technological, locational, and application-based dimensions. Each segment reflects specific technological approaches, operational considerations, or market demands that shape investment and development strategies within the industry.

- By Component

- Turbine (Blades, Nacelle, Tower, Generator)

- Substructure (Monopile, Jacket, Gravity Based, Floating)

- Electrical Infrastructure (Substations, Transformers, Switchgears)

- Cables (Export Cables, Inter-Array Cables)

- Other Components (Foundations, Grid Connection)

- By Location

- Shallow Water (Up to 30m depth)

- Transitional Water (30m to 60m depth)

- Deep Water (Greater than 60m depth)

- By Foundation Type

- Fixed Bottom (Monopile, Jacket, Gravity Base, Tripod)

- Floating (Semi-Submersible, Spar, Tension Leg Platform)

- By Capacity

- Up to 5 MW

- 5 MW to 8 MW

- Above 8 MW

- By End-Use

- Utilities

- Industrial

- Commercial

- Other (e.g., Green Hydrogen Production)

Value Chain Analysis For Offshore Wind Energy Market

The value chain for the offshore wind energy market is complex and highly integrated, spanning from raw material extraction to electricity distribution. The upstream segment involves a critical network of suppliers providing essential raw materials such as steel, copper, and composite materials, alongside specialized manufacturers producing high-value components. These include large-scale turbine components like blades, nacelles (housing the generator and gearbox), towers, and various electrical components such as transformers and switchgears. The intricate manufacturing processes require high precision and advanced engineering, often involving a global supply chain due to the scale and specialized nature of these parts. Key players in this phase are crucial for setting the technological standards and ensuring the quality and reliability of the entire system.

Moving downstream, the value chain encompasses project development, engineering, procurement, and construction (EPC) activities, followed by installation, operation, and maintenance (O&M). Project developers play a pivotal role in identifying suitable sites, securing permits, arranging financing, and managing the overall project lifecycle. EPC contractors are responsible for the detailed design, procurement of components, and construction of the offshore wind farm. Specialized marine vessels and installation crews are essential for deploying massive turbines and foundations in challenging offshore conditions. Post-installation, dedicated O&M providers ensure the long-term efficiency and reliability of the wind farm through continuous monitoring, scheduled maintenance, and timely repairs, often utilizing advanced technologies like drones, robotics, and AI-driven analytics to optimize performance and minimize downtime.

Distribution channels for offshore wind energy are predominantly direct, involving long-term power purchase agreements (PPAs) between wind farm operators and national utilities, independent power producers (IPPs), or large industrial consumers. These agreements ensure a stable revenue stream for developers and a reliable supply of clean electricity for off-takers. Indirect channels include the broader economic benefits generated by the industry, such as job creation in manufacturing, construction, and services, local economic development in coastal communities, and advancements in maritime logistics and engineering. The intricate interplay between direct energy sales and indirect economic contributions highlights the multifaceted impact of the offshore wind sector on national economies and energy landscapes. Efficient grid integration through robust transmission infrastructure is also a critical aspect of effectively distributing the generated power.

Offshore Wind Energy Market Potential Customers

The primary potential customers and end-users of offshore wind energy are national and regional utility companies. These entities are responsible for generating, transmitting, and distributing electricity to residential, commercial, and industrial consumers within their service territories. Utilities increasingly seek stable, large-scale, and reliable sources of renewable energy to meet escalating power demand, comply with stringent government mandates for decarbonization, and reduce their reliance on fossil fuels. The predictable and high-capacity factor of offshore wind makes it an attractive asset for balancing grid stability and achieving long-term sustainability goals, making utilities the cornerstone of demand for this market.

Beyond traditional utilities, independent power producers (IPPs) and large industrial consumers also represent significant potential customers. IPPs, often private companies, develop, own, and operate power generation facilities, selling the generated electricity to utilities or directly to end-users through power purchase agreements. These entities are driven by investment returns and portfolio diversification, with offshore wind offering attractive long-term prospects. Large industrial consumers, particularly those in energy-intensive sectors such as chemicals, manufacturing, data centers, and heavy industry, are increasingly seeking direct access to renewable energy to meet their corporate sustainability targets, reduce operational costs, and enhance their brand image. Direct procurement of offshore wind power through corporate PPAs allows them to lock in long-term energy prices and demonstrate commitment to environmental stewardship.

Furthermore, governmental energy agencies and public sector entities are emerging as key stakeholders, particularly in supporting grid modernization, developing strategic energy reserves, and pioneering innovative energy solutions. In some cases, governments may directly invest in or procure offshore wind energy to power public infrastructure, critical facilities, or to support national clean energy initiatives. The burgeoning sector of green hydrogen production also positions offshore wind as a critical input, with electrolyzer facilities becoming significant customers for dedicated offshore wind capacity. This diversification of end-users underscores the broad applicability and growing strategic importance of offshore wind energy in various economic and industrial segments globally, expanding beyond traditional electricity grids to new frontiers of sustainable energy use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 58.2 Billion |

| Market Forecast in 2032 | USD 183.1 Billion |

| Growth Rate | CAGR 17.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, GE Renewable Energy, Ørsted A/S, Equinor ASA, RWE Renewables GmbH, Vattenfall AB, EDF Renewables, SSE Renewables, Iberdrola S.A., EnBW Energie Baden-Württemberg AG, Mingyang Smart Energy Group Limited, Goldwind Science and Technology Co. Ltd., Mitsubishi Heavy Industries, Ltd., Nexans S.A., Prysmian Group, Jan De Nul Group, DEME Group, Van Oord, Boskalis. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offshore Wind Energy Market Key Technology Landscape

The offshore wind energy market is characterized by a rapidly evolving technological landscape focused on enhancing efficiency, reducing costs, and expanding operational capabilities into more challenging environments. A central theme is the continuous increase in turbine size and power output, with commercial turbines now routinely exceeding 14 MW and prototypes reaching 18 MW or more. These larger turbines feature longer blades and optimized aerodynamics, designed to capture more energy from stronger offshore winds, thereby significantly improving the capacity factor and lowering the levelized cost of energy (LCOE) for new projects. This trend necessitates advancements in manufacturing processes, materials science for blade construction, and the development of specialized heavy-lift installation vessels capable of handling these monumental components.

Another pivotal technological development is the maturation and deployment of floating offshore wind foundations. Unlike traditional fixed-bottom structures, which are limited to water depths of around 60 meters, floating platforms such as semi-submersibles, spars, and tension leg platforms enable access to deeper waters where wind resources are often more abundant and consistent. This innovation unlocks vast new maritime areas for wind farm development globally, particularly in regions with narrow continental shelves like the coasts of Japan, the US West Coast, and parts of Europe. Alongside foundation technology, advancements in mooring systems, dynamic subsea cables, and robust connection technologies are crucial for the reliable operation of floating wind farms, which are still in their early commercialization phase but hold immense future potential.

Digitalization and smart technologies are profoundly transforming the operational and maintenance (O&M) aspects of offshore wind. The integration of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) enables predictive maintenance strategies, real-time performance optimization, and autonomous inspections using drones and robotic systems. Digital twins, virtual models of physical wind farms, allow operators to simulate performance, identify potential issues, and optimize asset management remotely, significantly reducing the need for costly and hazardous human intervention offshore. Furthermore, advanced high-voltage direct current (HVDC) transmission systems are becoming essential for efficiently transmitting power over long distances from remote offshore wind farms to onshore grids, minimizing energy losses and enhancing grid stability. The development of power-to-X solutions, such as green hydrogen production directly from offshore wind, represents an emerging technological frontier that could further diversify the market's applications and value proposition.

Regional Highlights

- Europe: The global leader in offshore wind, particularly in the North Sea and Baltic Sea. Countries like the United Kingdom, Germany, Denmark, and the Netherlands boast significant installed capacity, mature supply chains, and robust policy support. Europe is also a hub for innovation, pioneering larger turbines, floating offshore wind, and grid integration solutions, driven by ambitious decarbonization targets set by the European Union.

- Asia Pacific (APAC): The fastest-growing region, led by China, which holds the largest installed capacity globally. Taiwan, South Korea, Japan, and Vietnam are rapidly expanding their offshore wind sectors, backed by strong government incentives, vast coastal populations, and increasing energy demands. The region faces challenges in supply chain development and deep-water installation but offers immense future potential.

- North America: An emerging market with substantial untapped potential, particularly along the U.S. East Coast. Federal and state-level commitments, like those in Massachusetts, New York, and New Jersey, are catalyzing significant investment. Canada is also exploring its offshore wind resources, with emphasis on both fixed-bottom and floating technologies to address varying ocean depths.

- Latin America: In nascent stages, with countries like Brazil, Colombia, and Chile conducting resource assessments and developing regulatory frameworks. While significant potential exists, particularly for floating offshore wind due to deeper waters, project development faces hurdles related to policy stability, financing, and infrastructure.

- Middle East and Africa (MEA): A region with long-term potential, especially with burgeoning interest in green hydrogen production which could be powered by offshore wind. Countries like Saudi Arabia, UAE, and South Africa are exploring pilot projects and assessing their extensive coastlines for viable offshore wind developments, though widespread deployment is still some years away.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offshore Wind Energy Market.- Siemens Gamesa Renewable Energy S.A.

- Vestas Wind Systems A/S

- GE Renewable Energy

- Ørsted A/S

- Equinor ASA

- RWE Renewables GmbH

- Vattenfall AB

- EDF Renewables

- SSE Renewables

- Iberdrola S.A.

- EnBW Energie Baden-Württemberg AG

- Mingyang Smart Energy Group Limited

- Goldwind Science and Technology Co. Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Nexans S.A.

- Prysmian Group

- Jan De Nul Group

- DEME Group

- Van Oord

- Boskalis

Frequently Asked Questions

What is offshore wind energy?

Offshore wind energy refers to electricity generated by wind turbines located in large bodies of water, typically oceans or seas. These turbines harness stronger, more consistent winds found offshore, offering higher energy yields and often enabling larger scale projects compared to onshore wind farms.

What are the main benefits of offshore wind energy?

Key benefits include reduced carbon emissions, enhanced energy security, high capacity factors due to stronger winds, stable power generation, and significant job creation. Offshore wind also minimizes land use concerns and can be scaled to meet substantial electricity demands.

What challenges does the offshore wind market face?

Major challenges include high upfront capital costs, complex permitting processes, potential environmental impacts on marine ecosystems, limitations of existing grid infrastructure, and the logistical complexities of installation and maintenance in harsh marine environments.

How is technology advancing in offshore wind?

Technological advancements are focused on increasing turbine size and efficiency, developing floating foundation technologies for deeper waters, and leveraging digitalization with AI/ML for predictive maintenance and optimized operations. HVDC transmission systems are also improving grid integration for remote projects.

Which regions are leading in offshore wind development?

Europe, particularly the North Sea countries (UK, Germany, Denmark), is currently the global leader in installed capacity and technological innovation. However, the Asia Pacific region, led by China, Taiwan, and South Korea, is experiencing the fastest growth, while North America is emerging as a significant new market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Offshore Wind Energy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fixed Offshore Wind Energy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Offshore Wind Energy Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Upto 1 MW, 1-3 MW, 3-5 MW, 5 MW and Above), By Application (Shallow Water, Transitional Water, Deep Water), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager