Oil & Gas Analytics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429496 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Oil & Gas Analytics Market Size

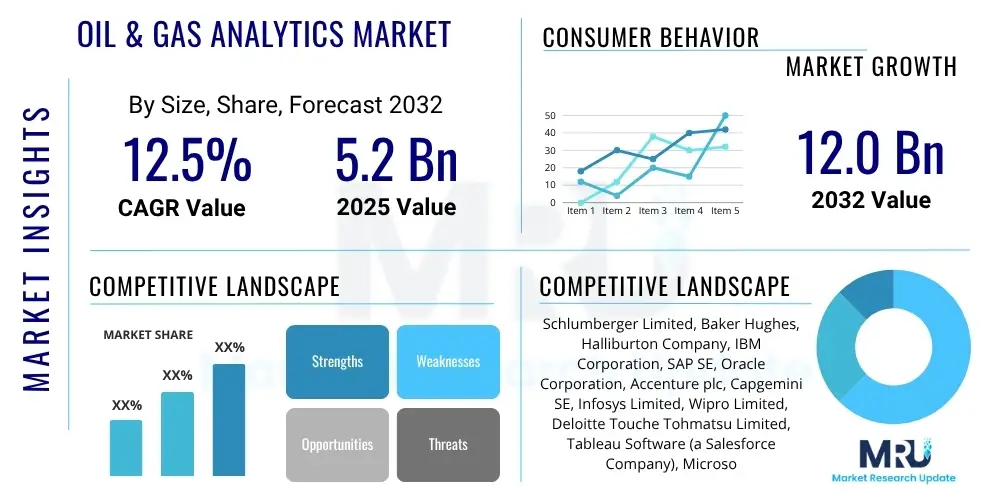

The Oil & Gas Analytics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 5.2 Billion in 2025 and is projected to reach USD 12.0 Billion by the end of the forecast period in 2032.

Oil & Gas Analytics Market introduction

The Oil & Gas Analytics Market represents a critical technological frontier within the global energy sector, dedicated to harnessing the immense volume of data generated across the entire hydrocarbon value chain. This sophisticated market encompasses a wide array of software platforms, analytical tools, and professional services meticulously designed to collect, process, analyze, and interpret complex data from diverse sources. From the initial stages of geological exploration and seismic surveys to drilling, production, refining, transportation, and retail distribution, advanced analytics empowers organizations to transform raw data into actionable insights. The fundamental goal is to optimize operational workflows, enhance strategic decision-making, mitigate inherent industry risks, and improve overall economic performance in a sector characterized by high capital expenditure and intricate operational complexities. This paradigm shift towards data-driven operations is pivotal for companies striving to maintain competitiveness and ensure long-term sustainability in an increasingly volatile global energy landscape.

The product landscape within the Oil & Gas Analytics Market is diverse, offering tailored solutions that address specific challenges unique to each segment. These include specialized software applications for reservoir modeling and simulation, real-time drilling optimization platforms, predictive maintenance solutions for critical infrastructure like pipelines and refineries, and advanced supply chain analytics for logistics and inventory management. Key benefits derived from the adoption of these analytical tools are manifold, encompassing significant reductions in operational costs through enhanced efficiency, minimized equipment downtime due to predictive failure analysis, improved safety records via proactive risk identification, and optimized resource allocation leading to increased production yields. The continuous integration of cutting-edge technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) is defining the next generation of analytical products, enabling unparalleled levels of data fidelity, processing speed, and accuracy in forecasting. These innovations collectively contribute to maximizing asset uptime, reducing operational expenditures, and fostering safer and more environmentally responsible working environments across all facets of the oil and gas industry.

The market's robust growth is primarily propelled by several powerful driving factors. Firstly, the exponential proliferation of data from interconnected assets, smart sensors, and digitalized operational processes has created an imperative for sophisticated analytical solutions to derive meaningful value from this information deluge. Secondly, the relentless demand for heightened operational efficiency and cost optimization, particularly in the face of fluctuating global commodity prices and increasing investor scrutiny, compels energy companies to adopt advanced analytics to identify inefficiencies and improve profitability. Thirdly, the imperative for stringent regulatory compliance, especially concerning environmental protection, emissions monitoring, and safety standards, necessitates the use of robust analytical tools for accurate reporting and proactive risk management. Finally, the broader industry trend towards digital transformation and the adoption of Industry 4.0 principles, coupled with a growing focus on sustainability and energy transition initiatives, are further accelerating the integration of analytics for optimizing renewable energy assets, carbon capture projects, and broader energy management strategies, solidifying the market's enduring strategic importance for the future of the energy sector.

Oil & Gas Analytics Market Executive Summary

The Oil & Gas Analytics Market is currently undergoing a profound transformation driven by several critical business trends that reflect the industry's pervasive shift towards digital operational models. A prominent trend is the accelerated adoption of cloud-based analytics platforms, offering unparalleled scalability, flexibility, and cost-effectiveness by moving away from traditional on-premise infrastructure. This facilitates collaborative data environments and enables remote operational insights, which are crucial for distributed assets. Furthermore, there is a discernible strategic pivot from descriptive and diagnostic analytics, which focus on understanding past events, towards more advanced predictive and prescriptive analytics. This evolution empowers organizations not only to forecast future outcomes with greater accuracy but also to recommend optimal, proactive interventions, thereby minimizing downtime, optimizing resource deployment, and enhancing overall operational resilience. The widespread integration of Industrial Internet of Things (IIoT) sensors, real-time data streaming technologies, and autonomous control systems continues to generate petabytes of actionable data, underscoring the indispensable role of sophisticated analytical processing in unlocking the full strategic and economic value of these digital investments.

Geographically, the Oil & Gas Analytics Market exhibits distinct patterns of growth and maturity. North America maintains a leading position, primarily due to its technologically advanced infrastructure, significant investments in shale gas and tight oil exploration and production, and a robust ecosystem of technology providers and early adopters in the United States and Canada. This region consistently leverages advanced analytical solutions for optimizing complex unconventional resource extraction. The Asia Pacific region is projected to emerge as the fastest-growing market during the forecast period, fueled by burgeoning energy demand, substantial new investments in both conventional and unconventional oil and gas projects across countries like China, India, Indonesia, and Australia, coupled with a strategic focus on modernizing existing energy infrastructure and enhancing operational efficiency. Simultaneously, the Middle East and Africa region demonstrates rapid expansion, with national oil companies (NOCs) and international operators investing heavily in digital technologies, including analytics, to maximize recovery from vast reserves, optimize complex production processes, and secure competitive advantages in global energy markets, often in collaboration with leading international technology partners.

Segmentation analysis reveals nuanced trends shaping the market. The software component, encompassing data management platforms, visualization tools, and specialized analytical applications, continues to command the largest market share, driven by the ongoing need for advanced algorithms and comprehensive data processing capabilities. However, the services segment, including consulting, implementation, integration, and ongoing support, is experiencing robust growth as the complexity of deploying sophisticated analytics solutions necessitates specialized expertise and tailored support. Upstream applications, particularly in seismic data interpretation, drilling optimization, and reservoir management, currently hold the predominant market share due to their direct impact on revenue generation, resource discovery, and cost control. Nevertheless, midstream applications, focusing on pipeline integrity, logistics, and storage optimization, alongside downstream applications such as refinery yield optimization, supply chain management, and retail analytics, are demonstrating accelerated adoption rates. This signifies a broadening of analytical investment across the entire oil and gas value chain, reflecting a holistic industry-wide commitment to data-driven operational excellence.

AI Impact Analysis on Oil & Gas Analytics Market

User inquiries frequently highlight the transformative potential of Artificial Intelligence (AI) across the Oil & Gas Analytics Market, focusing intently on its capacity to drive unprecedented levels of operational efficiency, bolster safety protocols, and unlock entirely new avenues for revenue generation and resource optimization. There is significant interest in how AI algorithms can revolutionize traditional approaches to predictive maintenance, dramatically reducing unplanned downtime for critical equipment through precise failure forecasting. Additionally, users are keen to understand AI's role in optimizing complex drilling and extraction processes, improving the accuracy and resolution of subsurface imaging, and enhancing reservoir characterization, all contributing to superior resource recovery and reduced operational expenditures. The discourse also often addresses the challenges associated with AI adoption, including the substantial upfront capital investment, the inherent complexity of seamlessly integrating AI models with diverse existing legacy infrastructure, the paramount need for high-quality, comprehensive, and well-curated datasets, and the persistent scarcity of highly skilled data scientists possessing deep domain-specific knowledge required for effective development, deployment, and ongoing refinement of these advanced analytical solutions. Despite these hurdles, expectations remain exceptionally high for AI to fundamentally reshape decision-making processes by providing deeper, more nuanced insights and automating a vast spectrum of complex analytical tasks, thereby fostering a more intelligent and responsive energy sector.

- Enhanced Predictive Maintenance: AI-powered algorithms meticulously analyze vast streams of sensor data, operational logs, and historical maintenance records to accurately predict potential equipment failures well in advance, enabling proactive intervention, minimizing unplanned downtime of critical assets, and significantly reducing overall maintenance costs across exploration, production, and refining facilities.

- Optimized Drilling and Completion Operations: AI models process intricate geological data, real-time drilling parameters, and subsurface imaging feedback to recommend optimal drilling paths, bit selection, and fluid compositions. This intelligence leads to vastly improved drilling efficiency, reduced non-productive time (NPT), enhanced wellbore stability, and ultimately, more cost-effective and safer well completions.

- Improved Reservoir Characterization and Simulation: Machine learning techniques are leveraged to analyze complex seismic data, well logs, core samples, and production history, generating more precise and dynamic models of subsurface reservoirs. This leads to superior understanding of hydrocarbon distribution, more accurate reserve estimation, optimized well placement strategies, and significantly higher recovery rates from existing fields.

- Automated Data Analysis and Pattern Recognition: AI automates the laborious processes of collecting, cleaning, processing, and interpreting colossal volumes of heterogeneous data from various sources. It excels at identifying subtle patterns, anomalies, and correlations that human analysts might miss, thereby accelerating insight generation from petabytes of operational, geological, and financial information across the entire value chain.

- Advanced Safety and Environmental Monitoring: AI-powered surveillance systems, drone-based inspections, and anomaly detection algorithms continuously monitor facilities for potential hazards, gas leaks, equipment malfunctions, and emissions. This capability significantly improves worker safety, ensures stringent environmental compliance, and allows for rapid response to critical incidents, minimizing environmental impact and regulatory penalties.

- Intelligent Supply Chain and Logistics Optimization: AI analyzes intricate logistics networks, real-time demand forecasts, market price fluctuations, and transportation constraints to optimize inventory management, procurement strategies, and the routing of equipment and resources. This results in substantial cost savings, reduced lead times, and enhanced efficiency across complex global supply chains.

- Fraud Detection and Cybersecurity Reinforcement: AI algorithms are highly effective in identifying unusual patterns and anomalies within financial transactions, operational data, and network traffic. This capability significantly bolsters fraud detection efforts, improves financial integrity, and strengthens the cybersecurity posture of critical energy infrastructure against increasingly sophisticated cyber threats by detecting and neutralizing malicious activities proactively.

- Remote Operations and Autonomous Systems: AI facilitates the development and control of autonomous robots, drones, and remotely operated vehicles (ROVs) for inspection, maintenance, and monitoring tasks in hazardous or inaccessible environments. This reduces human exposure to risk, improves operational continuity in challenging conditions, and enables more efficient asset management in remote locations.

- Real-time Production Optimization: AI systems analyze real-time production data from wells and processing facilities, automatically adjusting operational parameters such as pump speeds, choke settings, and gas lift rates. This continuous feedback loop ensures that production assets are operating at peak efficiency, maximizing hydrocarbon output and optimizing energy consumption.

- Energy Management and Efficiency Optimization: Within refineries and production facilities, AI algorithms optimize energy consumption by analyzing operational data, weather patterns, and market prices. This leads to significant reductions in utility costs, improved carbon footprints, and enhanced alignment with corporate sustainability goals.

- Quality Control and Product Stream Optimization: In downstream operations, AI is employed to monitor and analyze product streams in real-time, ensuring quality consistency, optimizing blending processes, and maximizing the yield of high-value products from crude oil refining processes. This directly impacts profitability and market competitiveness.

DRO & Impact Forces Of Oil & Gas Analytics Market

The Oil & Gas Analytics Market is profoundly shaped by a complex and ever-evolving interplay of internal drivers, inherent restraints, promising opportunities, and influential external impact forces. A foremost driver propelling market growth is the sheer, unprecedented volume and velocity of data generated from advanced sensor technologies, IoT devices, smart meters, and digitalized operational processes deployed across every segment of the energy value chain. Companies are increasingly recognizing that the ability to effectively process, analyze, and derive actionable insights from this big data is absolutely critical for achieving competitive advantage, operational excellence, and maximizing asset utilization in a highly demanding industry. Furthermore, the persistent and growing pressure to significantly reduce operational costs and enhance overall efficiency, particularly within a landscape characterized by volatile global commodity prices, serves as a powerful impetus for the widespread adoption of advanced analytics. These tools enable organizations to meticulously identify inefficiencies, streamline complex workflows, and make more informed, data-driven decisions that directly impact profitability. Concurrently, the global movement towards more stringent environmental regulations and the imperative for sustainable operational practices compel energy companies to leverage sophisticated analytics for precise emissions monitoring, early leak detection, and comprehensive compliance reporting, thereby ensuring operational integrity, safeguarding environmental stewardship, and maintaining their social license to operate.

Despite these compelling drivers, the market faces several formidable restraints that temper its full growth potential. A significant impediment is the substantial upfront capital investment required for implementing sophisticated analytics solutions, which includes not only the procurement of advanced software licenses and robust hardware infrastructure but also the considerable expense of hiring and training specialized personnel. This financial barrier can disproportionately impact smaller to medium-sized enterprises (SMEs) or financially constrained companies within the sector. Paramount among concerns are issues related to data security, privacy, and the protection of proprietary operational and geological information, particularly as companies increasingly move towards cloud-based platforms and integrated data ecosystems, necessitating the deployment of exceptionally robust cybersecurity frameworks. The industry also grapples with a critical and persistent shortage of highly skilled data scientists and analytics professionals who possess a nuanced understanding of both advanced data science methodologies and deep domain expertise specific to the intricate processes of oil and gas operations. This dual skill gap creates significant challenges in the effective development, accurate deployment, and efficient maintenance of sophisticated analytical models. Moreover, the inherent complexity of integrating cutting-edge analytics platforms with often diverse, siloed, and outdated legacy IT and operational technology (OT) infrastructure presents substantial technical, operational, and organizational hurdles that can delay or derail implementation efforts.

Notwithstanding these challenges, the Oil & Gas Analytics Market is rich with dynamic opportunities stemming from rapid technological advancements and the evolving strategic priorities of the energy industry. The continuous and rapid integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities offers immense potential for developing increasingly sophisticated predictive and prescriptive analytics solutions, enabling automated decision support, proactive problem-solving, and continuous process optimization across the value chain. The accelerating adoption of cloud-based analytics solutions continues to provide unparalleled flexibility, scalability, and cost-effectiveness, democratizing access to powerful analytical tools for a broader range of companies. Furthermore, the burgeoning demand for real-time analytics, which enables immediate operational adjustments and rapid response to dynamic conditions, along with the proliferation of advanced digital twin technologies for comprehensive virtual modeling, simulation, and predictive asset management, represent significant avenues for innovation and sustained market expansion. Crucially, the long-term global trend towards decarbonization, energy transition, and net-zero emissions targets presents substantial opportunities for analytics in optimizing renewable energy asset performance, enhancing the efficiency of carbon capture utilization and storage (CCUS) projects, and developing smart grid management solutions, thereby significantly broadening the traditional application scope beyond conventional hydrocarbon exploration and production.

- Drivers:

- Massive Data Proliferation: Exponential growth of heterogeneous data generated from IoT sensors, smart wells, seismic surveys, drones, and digitalized operations across the entire O&G value chain, creating an imperative for advanced analytics to extract value.

- Demand for Operational Efficiency and Cost Optimization: Persistent industry pressure to minimize operational expenditures, enhance asset utilization, and maximize profitability amidst volatile global oil and gas prices drives investment in analytics for process optimization, waste reduction, and resource allocation.

- Predictive Maintenance Imperatives: The critical need to reduce unplanned downtime of high-value equipment and extend asset lifecycles through proactive identification of potential failures using advanced predictive analytical models.

- Stringent Regulatory Compliance and ESG Focus: Increasing governmental regulations regarding environmental protection, emissions monitoring, safety standards, and ESG (Environmental, Social, and Governance) reporting mandates the use of analytics for accurate data collection, analysis, and compliance verification.

- Enhanced Decision-Making Capabilities: The strategic advantage derived from leveraging data-driven insights for more informed and timely decisions across exploration, production, supply chain, and commercial operations, reducing uncertainty and improving strategic planning.

- Global Digital Transformation Initiatives: Widespread adoption of Industry 4.0 principles and digital transformation strategies within the energy sector, integrating analytics as a foundational component for modernization and innovation.

- Optimization of Hydrocarbon Recovery: Continuous efforts to improve reservoir recovery rates, optimize well placement, and enhance production volumes from both conventional and unconventional resources through sophisticated analytical modeling.

- Improved Safety and Risk Management: Analytics tools provide capabilities for real-time risk assessment, hazard identification, and incident prediction, significantly enhancing worker safety and operational security.

- Restraints:

- High Initial Investment and Implementation Costs: The significant capital expenditure required for acquiring advanced analytics software, robust hardware infrastructure, and the costs associated with implementation, integration, and training.

- Data Security, Privacy, and Governance Concerns: Critical issues surrounding the protection of sensitive operational data, intellectual property, and ensuring compliance with data privacy regulations, particularly with cloud adoption and data sharing.

- Scarcity of Skilled Workforce: A persistent and significant shortage of data scientists, analytics experts, and engineers who possess a unique blend of both advanced analytical skills and deep domain knowledge specific to the oil and gas industry.

- Integration Challenges with Legacy Systems: The complexity and difficulty of seamlessly integrating modern analytics platforms with diverse, often siloed, and outdated legacy IT and operational technology (OT) infrastructure present significant technical hurdles.

- Data Quality and Harmonization Issues: Challenges in ensuring the cleanliness, accuracy, consistency, and interoperability of heterogeneous data sources, which are often fragmented across multiple systems and formats, impacting analytical reliability.

- Organizational Resistance to Change: Inertia within traditional organizational structures, cultural resistance to new technologies, and a lack of cross-functional collaboration can hinder successful analytics adoption and utilization.

- Lack of Standardized Data Models: Absence of universal industry standards for data collection, storage, and nomenclature complicates data integration and benchmarking across different assets and companies.

- Opportunity:

- Advanced AI and Machine Learning Integration: Expanding capabilities of AI/ML for more sophisticated predictive modeling, prescriptive recommendations, cognitive analytics, and automation of complex analytical tasks.

- Accelerated Cloud Computing Adoption: Growing preference for cloud-based platforms offering scalability, flexibility, reduced infrastructure costs, and enhanced accessibility for analytics deployment and data storage.

- Real-time Analytics and Edge Computing: Development and deployment of solutions for instantaneous data processing and analysis at the source (edge), enabling immediate operational insights and control, reducing latency and bandwidth demands.

- Proliferation of Digital Twin Technology: Expansion of digital twin applications for creating virtual replicas of physical assets, enabling comprehensive monitoring, predictive maintenance, simulation, and optimization throughout their lifecycle.

- Focus on Energy Transition and Decarbonization: Leveraging analytics to optimize performance of renewable energy assets, manage carbon capture utilization and storage (CCUS) projects, monitor emissions, and support broader sustainability initiatives within the energy mix.

- Geospatial Analytics and Satellite Imagery: Enhanced capabilities in integrating and analyzing geospatial data, satellite imagery, and drone data for improved exploration efficiency, environmental monitoring, and asset surveillance.

- Predictive Safety and Compliance Analytics: Opportunities to develop advanced analytical models specifically for predicting safety incidents, ensuring regulatory compliance, and proactively managing environmental risks.

- Impact Forces:

- Global Commodity Price Volatility: Fluctuations in crude oil and natural gas prices significantly influence investment cycles, operational budgets, and the pace of technology adoption within the industry.

- Geopolitical Instability and Supply Chain Disruptions: Regional conflicts, trade disputes, and global events can impact energy supply, operational security, and the reliability of supply chains, influencing analytical needs for resilience.

- Evolving Environmental Regulations and Climate Policies: Increasingly stringent environmental protection laws, climate change policies, and carbon pricing mechanisms drive demand for analytics in emissions tracking, reporting, and sustainable operations.

- Rapid Technological Advancements: Continuous innovation in data processing technologies, storage solutions, advanced algorithms, and computing hardware constantly reshapes the capabilities and offerings within the analytics market.

- Shifts in Global Energy Demand and Consumption Patterns: Changes in industrial activity, population growth, and the accelerating transition towards alternative energy sources influence the long-term demand for oil and gas, impacting analytical investment strategies.

- Economic Growth and Industrial Development: Broader macroeconomic trends and the health of industrial sectors globally directly affect the demand for energy products, thereby influencing the investment appetite for efficiency-enhancing technologies like analytics.

- Cybersecurity Threat Landscape: The increasing sophistication of cyber threats targeting critical energy infrastructure necessitates robust analytical solutions for threat detection, prevention, and incident response.

Segmentation Analysis

The Oil & Gas Analytics Market is meticulously segmented across a multi-dimensional framework, providing an intricate and comprehensive understanding of its underlying structure, prevailing growth trajectories, and the nuanced demands of its diverse stakeholders. These segmentation categories are strategically designed to enable a granular examination of market characteristics by specific solution components offered, the predominant deployment models utilized, the specialized applications within the extensive oil and gas value chain, the functional business areas requiring analytical support, and the sophisticated technological methodologies employed. Such a detailed and exhaustive segmentation approach is absolutely critical for various stakeholders, including technology providers, investors, and industry operators, to accurately identify lucrative market niches, precisely tailor their product development strategies, and effectively target distinct customer segments with highly specialized analytical offerings. This ensures that the solutions developed are optimally aligned with the unique operational requirements, strategic objectives, and inherent challenges prevalent across the multifaceted and complex global energy industry.

Delving deeper into the segmentation, the market can be broadly categorized by its foundational components, primarily differentiating between robust software solutions and essential professional services. Software forms the technological backbone, encompassing platforms for data management, advanced visualization tools, predictive modeling applications, and specialized geospatial analytics. The services segment provides the crucial human expertise and support necessary for successful implementation, seamless integration with existing systems, ongoing operational optimization, and comprehensive training. Further segmentation by deployment model distinguishes between traditional on-premise installations, which offer maximum data control, and rapidly growing cloud-based solutions, which provide unparalleled scalability, flexibility, and remote accessibility, often with hybrid models gaining traction. Application-based segmentation highlights the critical operational areas where analytics are deployed, ranging from upstream activities such as exploration, drilling, and production optimization, through midstream operations like pipeline integrity management and logistics, to downstream processes including refinery optimization and retail analytics. Each segment presents unique data challenges and demands highly specialized analytical capabilities.

- By Component:

- Software:

- Data Management & Integration Platforms: Solutions for data ingestion, cleaning, transformation, storage (data lakes, data warehouses), and ensuring data quality and governance across diverse sources.

- Visualization & Reporting Tools: Dashboards, interactive reports, and geospatial mapping tools for presenting complex analytical insights in an intuitive and understandable format for decision-makers.

- Predictive & Prescriptive Analytics Software: Applications employing AI/ML algorithms to forecast future trends (e.g., equipment failure, production decline) and recommend optimal actions for desired outcomes.

- Geospatial Analytics Software: Tools for analyzing location-based data, satellite imagery, and geological surveys to optimize exploration, pipeline routing, and environmental monitoring.

- Simulation & Modeling Tools: Software for simulating reservoir behavior, drilling scenarios, and refinery processes to predict outcomes and optimize operational strategies.

- Services:

- Consulting Services: Expertise offered in strategy development, solution assessment, roadmap creation, and best practices for analytics implementation and data governance.

- Implementation & Integration Services: Professional assistance for deploying analytics platforms, integrating them with existing IT/OT systems, and ensuring seamless data flow across the enterprise.

- Support & Maintenance Services: Ongoing technical support, system updates, troubleshooting, and performance monitoring to ensure the continuous operation and optimization of analytics solutions.

- Managed Analytics Services: Outsourced management of analytics infrastructure and operations, including data scientists and analysts, allowing clients to focus on core business.

- Training & Education: Programs designed to equip client personnel with the necessary skills to effectively use, interpret, and manage analytics tools and insights.

- Software:

- By Deployment:

- On-Premise: Analytics solutions hosted and managed within an organization's own data centers, offering maximum control over data security and infrastructure.

- Cloud-Based: Solutions

Report Attributes Report Details Market Size in 2025 USD 5.2 Billion Market Forecast in 2032 USD 12.0 Billion Growth Rate 12.5% CAGR Historical Year 2019 to 2023 Base Year 2024 Forecast Year 2025 - 2032 Segments Covered - By Component: Software (Data Management & Integration Platforms, Visualization & Reporting Tools, Predictive & Prescriptive Analytics Software, Geospatial Analytics Software, Simulation & Modeling Tools); Services (Consulting Services, Implementation & Integration Services, Support & Maintenance Services, Managed Analytics Services, Training & Education).

- By Deployment: On-Premise, Cloud-Based, Hybrid Cloud.

- By Application: Upstream (Exploration Analytics, Drilling & Completion Optimization, Production Optimization, Reservoir Management, Asset Performance Management); Midstream (Pipeline Integrity & Monitoring, Storage & Inventory Optimization, Logistics & Transportation Analytics, Risk Management); Downstream (Refinery Optimization, Supply Chain & Logistics Analytics, Marketing & Sales Analytics, Retail & Distribution Optimization, Asset Maintenance).

- By Business Function: Operations & Field Optimization, Finance & Risk Management, Supply Chain & Logistics, Human Resources & Workforce Management, Health, Safety, & Environment (HSE).

- By Technology/Analytics Type: Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, Prescriptive Analytics, Cognitive Analytics.

Key Companies Covered Schlumberger Limited, Baker Hughes, Halliburton Company, IBM Corporation, SAP SE, Oracle Corporation, Accenture plc, Capgemini SE, Infosys Limited, Wipro Limited, Deloitte Touche Tohmatsu Limited, Tableau Software (a Salesforce Company), Microsoft Corporation, Amazon Web Services (AWS), Google Cloud, Palantir Technologies Inc., Siemens AG, GE Digital, Cisco Systems Inc., Cognite AS, KPMG LLP, SAS Institute Inc., Seeq Corporation, Petrolink International, Rockwell Automation Inc. Regions Covered North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) Enquiry Before Buy Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy Oil & Gas Analytics Market Key Technology Landscape

Regional Highlights

- North America: This region holds a commanding and dominant market share in the Oil & Gas Analytics Market, primarily attributed to the pervasive technological adoption within its extensive shale plays, a highly mature and sophisticated oil and gas infrastructure, and substantial, ongoing investments in comprehensive digital transformation initiatives by major energy companies across both the United States and Canada. The region benefits significantly from a vibrant ecosystem of cutting-edge research and development, a highly skilled technical workforce, and robust regulatory frameworks that actively support the application of advanced analytics for achieving paramount operational efficiency and ensuring stringent environmental compliance. The rapid pace of innovation and willingness to integrate new technologies make it a global leader in data-driven energy operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil & Gas Analytics Market.- Schlumberger Limited: A global technology company providing software, services, and equipment to the energy industry, with a strong focus on digital and analytics solutions for exploration and production.

- Baker Hughes: An energy technology company offering a broad portfolio of products and services, including advanced analytics for reservoir optimization, drilling, and production.

- Halliburton Company: A leading provider of products and services to the energy industry, known for its digital solutions and analytics platforms for upstream operations and asset management.

- IBM Corporation: A global technology and consulting company providing AI-powered analytics solutions, cloud platforms, and consulting services tailored for the oil and gas sector.

- SAP SE: A multinational software corporation offering enterprise resource planning (ERP) solutions integrated with advanced analytics for supply chain, finance, and asset management in energy companies.

- Oracle Corporation: A global leader in enterprise software and cloud services, providing databases, middleware, and analytics platforms used extensively in the oil and gas industry for data management and decision support.

- Accenture plc: A global professional services company offering extensive consulting, technology, and operations services, including specialized digital and analytics strategies for the energy sector.

- Capgemini SE: A global leader in consulting, technology services, and digital transformation, providing tailored analytics solutions and services to oil and gas clients for operational efficiency.

- Infosys Limited: An Indian multinational information technology company that provides business consulting, information technology, and outsourcing services, with a strong focus on digital transformation and analytics for energy clients.

- Wipro Limited: A leading global information technology, consulting, and business process services company that delivers digital transformation solutions, including analytics, to the oil and gas industry.

- Deloitte Touche Tohmatsu Limited: A global professional services network offering audit, consulting, financial advisory, risk advisory, tax, and legal services, with expertise in digital and analytics strategy for energy clients.

- Tableau Software (a Salesforce Company): A leading interactive data visualization software company, widely used in the oil and gas industry for business intelligence and intuitive data exploration.

- Microsoft Corporation: A technology giant providing cloud computing services (Azure), AI/ML platforms, and analytics tools that are increasingly adopted by oil and gas companies for digital transformation.

- Amazon Web Services (AWS): The world's most comprehensive and broadly adopted cloud platform, offering a vast array of services, including advanced analytics, AI/ML, and IoT solutions for the energy sector.

- Google Cloud: A suite of cloud computing services that runs on the same infrastructure Google uses internally, offering robust capabilities for big data analytics, AI, and machine learning for energy enterprises.

- Palantir Technologies Inc.: A software company specializing in big data analytics, particularly known for its platforms that integrate and analyze massive, disparate datasets for complex decision-making in various industries, including energy.

- Siemens AG: A global technology powerhouse with a strong presence in industrial automation and digitalization, offering solutions like MindSphere (an industrial IoT platform) and specialized analytics for energy infrastructure.

- GE Digital: The software division of General Electric, focusing on industrial IoT, asset performance management, and operations optimization software, including analytics specifically for oil and gas.

- Cisco Systems Inc.: A global technology conglomerate providing networking hardware, software, and telecommunications equipment, with solutions for industrial IoT connectivity and data infrastructure relevant to analytics.

- Cognite AS: A global industrial AI software company enabling full-scale digital transformation by making data accessible to people and applications across the industrial world, including oil and gas.

- KPMG LLP: A multinational professional services network, part of the Big Four accounting organizations, offering advisory services including data analytics and digital strategy for the energy sector.

- SAS Institute Inc.: A leading provider of business analytics software and services, known for its advanced analytics, business intelligence, and data management solutions applicable to oil and gas operations.

- Seeq Corporation: A software company that provides advanced analytics applications for process manufacturing companies, including oil and gas, enabling engineers and subject matter experts to rapidly analyze industrial data.

- Petrolink International: A global provider of digital technology services for the oil and gas industry, specializing in real-time data acquisition, management, visualization, and analytics.

- Rockwell Automation Inc.: A global leader in industrial automation and digital transformation, offering solutions that integrate operational technology (OT) data with IT systems for enhanced analytics and control in energy facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager