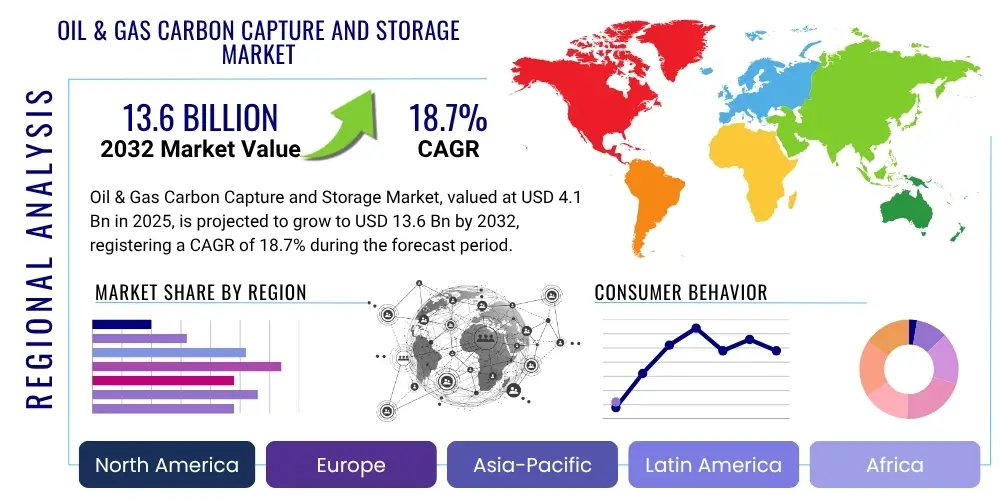

Oil & Gas Carbon Capture and Storage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429492 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Oil & Gas Carbon Capture and Storage Market Size

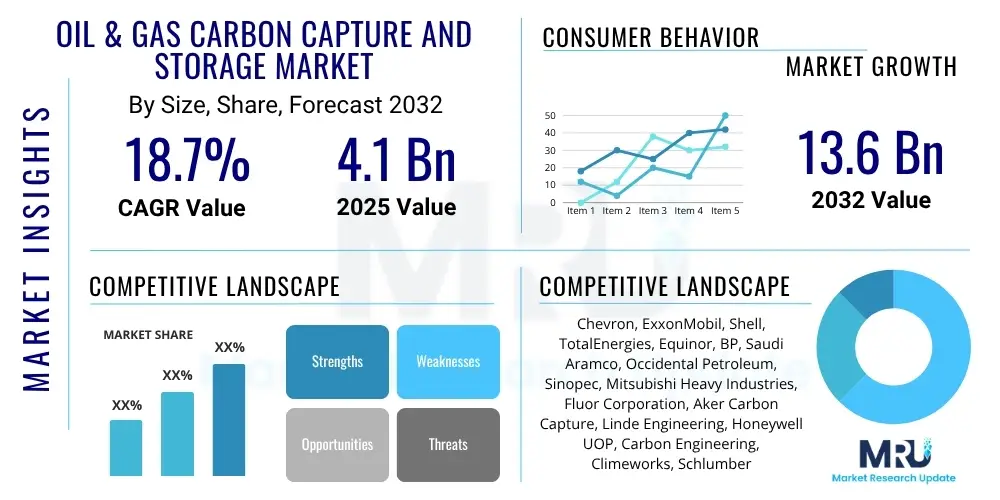

The Oil & Gas Carbon Capture and Storage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.7% between 2025 and 2032. The market is estimated at $4.1 Billion in 2025 and is projected to reach $13.6 Billion by the end of the forecast period in 2032.

Oil & Gas Carbon Capture and Storage Market introduction

The Oil & Gas Carbon Capture and Storage (CCS) market encompasses technologies and processes designed to capture carbon dioxide (CO2) emissions from industrial sources, particularly within the oil and gas sector, and transport them to geological formations for permanent storage. This critical climate mitigation strategy involves the separation of CO2 from exhaust gases or process streams, its compression, transportation, and subsequent injection into deep underground geological reservoirs, preventing its release into the atmosphere. Key technologies include post-combustion, pre-combustion, and oxy-fuel combustion capture, alongside advanced transportation methods like pipelines and shipping, and storage in saline aquifers, depleted oil and gas reservoirs, or enhanced oil recovery (EOR) operations.

The primary objective of CCS is to significantly reduce greenhouse gas emissions from hard-to-abate sectors, thereby contributing to global decarbonization goals. Major applications for CCS in the oil and gas industry include natural gas processing, refining operations, and power generation facilities associated with upstream and downstream activities. Beyond direct emissions reduction, CCS offers benefits such as the production of blue hydrogen, which is hydrogen produced from fossil fuels with CO2 emissions captured, and the potential for enhanced oil recovery, where injected CO2 helps extract more crude oil while being stored underground.

Driving factors for the adoption of CCS in the oil and gas market are multifaceted, stemming from increasing regulatory pressures, stringent climate policies aimed at net-zero emissions, and the growing demand for sustainable energy solutions. Carbon pricing mechanisms, tax incentives, and government funding for large-scale CCS projects are creating a more favorable economic landscape for investment. Furthermore, the oil and gas industry's existing infrastructure, expertise in subsurface geology, and project management capabilities position it uniquely to scale CCS deployment, leveraging its resources to manage the complex logistics of carbon capture, transport, and storage, while simultaneously enhancing its environmental sustainability profile.

Oil & Gas Carbon Capture and Storage Market Executive Summary

The Oil & Gas Carbon Capture and Storage (CCS) market is experiencing robust expansion, driven by global imperatives for decarbonization and escalating regulatory frameworks. Key business trends include substantial investments by major oil and gas companies in developing and deploying large-scale CCS projects, often in partnership with technology providers and industrial emitters. There is a notable shift towards establishing integrated carbon capture hubs and industrial clusters, which optimize infrastructure sharing for CO2 transport and storage. Furthermore, technological advancements in capture efficiency and cost reduction are fostering greater commercial viability, alongside a growing focus on utilizing captured CO2 for value-added products, such as in enhanced oil recovery (EOR) or synthetic fuels, beyond just permanent geological storage.

Regionally, North America, particularly the United States and Canada, leads the market due to supportive policy environments like the 45Q tax credit, abundant geological storage sites, and a mature oil and gas industry infrastructure. Europe is also a significant player, with countries like Norway, the UK, and the Netherlands pioneering integrated CCS projects and cross-border CO2 transportation networks, propelled by ambitious climate targets and substantial public funding. The Asia Pacific region is emerging rapidly, with China and Australia investing heavily in CCS to decarbonize their large industrial bases and address energy security concerns. Latin America and the Middle East are also exploring CCS opportunities, often linked to natural gas processing and blue hydrogen initiatives, indicating a global uptake of this critical technology.

Segmentation trends reveal significant growth in post-combustion capture technologies due to their applicability to existing industrial facilities, while pre-combustion and oxy-fuel combustion methods are gaining traction for new builds or specific industrial processes. The service segment is witnessing expansion across the entire value chain, from engineering and project development to operation and monitoring of capture, transport, and storage infrastructure. Application-wise, enhanced oil recovery (EOR) remains a significant driver, providing an economic incentive for CCS, but industrial decarbonization (cement, steel, chemicals) and blue hydrogen production are rapidly becoming prominent application areas, diversifying the market's growth vectors beyond traditional EOR projects and solidifying CCS as a versatile tool for industrial emissions abatement.

AI Impact Analysis on Oil & Gas Carbon Capture and Storage Market

Users frequently inquire about how artificial intelligence (AI) can enhance the efficiency and economic viability of carbon capture and storage (CCS) operations within the oil and gas industry. Common questions revolve around AI's role in optimizing capture processes, predicting geological storage integrity, managing complex CO2 transportation networks, and reducing overall operational costs. Stakeholders are particularly interested in AI's capacity to provide predictive analytics for equipment maintenance, improve decision-making in real-time, and accelerate the discovery and characterization of suitable CO2 storage sites. The overarching expectation is that AI will act as a pivotal enabler for scaling CCS technologies by making them more reliable, cost-effective, and environmentally secure, thereby addressing some of the industry's most significant challenges.

AI's influence extends across the entire CCS value chain, offering transformative potential from initial design through to long-term monitoring. In the capture phase, AI algorithms can optimize sorbent regeneration, manage energy consumption in solvent-based systems, and fine-tune process parameters to maximize CO2 separation efficiency while minimizing operational expenditures. Machine learning models can analyze vast datasets from sensor networks to predict equipment failures, schedule predictive maintenance, and identify anomalies in CO2 capture rates, ensuring continuous and efficient operation. This capability is crucial for maintaining high capture rates and reducing downtime, which are critical for the economic performance of CCS facilities.

For CO2 transportation and storage, AI provides advanced tools for network optimization, risk assessment, and environmental monitoring. AI-powered simulations can model fluid flow in pipelines, predict pressure drops, and optimize compression needs, leading to more efficient and safer transportation. In geological storage, AI algorithms can analyze seismic data, well logs, and reservoir characteristics to identify optimal injection sites, predict CO2 plume migration, and assess long-term storage integrity. Furthermore, AI-driven monitoring systems can process satellite imagery, drone data, and in-situ sensor readings to detect potential CO2 leaks with greater accuracy and speed, enhancing safety and compliance. The integration of AI tools promises to unlock new levels of efficiency, safety, and scalability for the Oil & Gas Carbon Capture and Storage market.

- AI-driven process optimization for enhanced CO2 capture efficiency and reduced energy consumption.

- Predictive maintenance analytics for CCS equipment, minimizing downtime and operational costs.

- Machine learning models for optimizing CO2 transportation networks and pipeline integrity management.

- Advanced seismic data analysis for improved geological site characterization and storage capacity assessment.

- Real-time monitoring and anomaly detection for CO2 leakage prevention and environmental safety.

- AI-powered simulations for accurate prediction of CO2 plume migration within geological reservoirs.

- Robotics and autonomous systems for inspection and maintenance in hazardous CCS environments.

- Data analytics platforms for optimizing project planning, risk management, and regulatory compliance.

DRO & Impact Forces Of Oil & Gas Carbon Capture and Storage Market

The Oil & Gas Carbon Capture and Storage (CCS) market is significantly shaped by a dynamic interplay of drivers, restraints, opportunities, and competitive impact forces. Primary drivers include increasingly stringent global climate policies, such as carbon pricing mechanisms and net-zero emissions targets, which mandate the decarbonization of industrial operations. Government incentives, including tax credits like the 45Q in the U.S. and direct funding for CCS projects in Europe, significantly reduce the financial burden on operators, accelerating adoption. The growing demand for enhanced oil recovery (EOR), where captured CO2 is utilized to boost crude oil production, provides a dual economic benefit and an additional revenue stream for CCS projects, making them more attractive for oil and gas companies seeking to extend asset life and improve recovery rates. Furthermore, mounting corporate sustainability goals and investor pressure for environmental, social, and governance (ESG) performance compel energy companies to invest in CCS technologies, demonstrating commitment to a lower-carbon future.

Despite these strong drivers, the market faces considerable restraints. The high capital expenditure (CAPEX) required for constructing capture facilities, transportation infrastructure, and storage sites remains a significant barrier to entry and expansion. Operational expenses (OPEX), particularly the energy intensity of some capture technologies, also contribute to the economic challenges. Public perception issues, including concerns about the safety of CO2 storage and pipeline integrity, can lead to local opposition and project delays. Furthermore, regulatory uncertainty and the lack of a standardized global framework for CO2 accounting, liability, and cross-border transport create complexities for project developers. The availability of suitable geological storage sites, while abundant in some regions, can be a localized restraint, along with the technical complexities of reservoir characterization and long-term monitoring, adding layers of risk and cost.

Opportunities in the CCS market are substantial, particularly in the burgeoning blue hydrogen economy, where natural gas is reformed into hydrogen with associated CO2 emissions captured and stored, offering a low-carbon fuel source. The development of industrial CCS hubs and clusters, where multiple emitters share common CO2 transport and storage infrastructure, promises significant economies of scale and reduced individual project costs, fostering wider adoption across various heavy industries like cement, steel, and chemicals. International collaboration and knowledge sharing initiatives are crucial for standardizing best practices and accelerating technological advancements. Finally, continuous innovation in capture technologies, such as direct air capture (DAC) and novel sorbents, along with advancements in storage monitoring and verification, present long-term opportunities for improved efficiency and cost-effectiveness, expanding the addressable market and strengthening the overall viability of CCS as a cornerstone of global decarbonization efforts, allowing the oil and gas sector to play a key role in the energy transition.

Segmentation Analysis

The Oil & Gas Carbon Capture and Storage (CCS) market is highly segmented, reflecting the diverse technologies, services, applications, and end-use industries involved in decarbonization efforts. This segmentation allows for a granular understanding of market dynamics, identifying specific areas of growth, technological preference, and strategic investment. The market is primarily categorized by the capture technology employed, the type of service offered, the specific application of the captured CO2, the end-use industry driving demand, the method of capture, and the geological storage type utilized. This multi-dimensional approach highlights the complexity and integrated nature of the CCS value chain, from initial CO2 separation to its final secure sequestration.

Understanding these segments is crucial for stakeholders, as it informs investment decisions, policy formulation, and technological development roadmaps. For instance, the choice of capture technology often depends on the CO2 concentration in the emissions stream and the specific industrial process. Post-combustion capture is widely applicable to existing facilities, while pre-combustion is ideal for integrated gasification combined cycle (IGCC) power plants or hydrogen production. Service segmentation emphasizes the expertise required at each stage, from engineering and project management to long-term monitoring. Application segmentation reveals the economic drivers, distinguishing between projects focused purely on emissions reduction and those offering co-benefits like enhanced oil recovery, which often provide a stronger business case for early adoption.

Further granularity in segmentation by end-use industry, capture method, and storage type provides a comprehensive view of market demand and supply. Heavy industries and power generation are key consumers of CCS services, while specific capture methods like absorption and adsorption dominate due to their maturity. The choice of storage type, whether saline aquifers or depleted reservoirs, depends on geological suitability and regulatory frameworks, impacting project feasibility and regional deployment patterns. This detailed segmentation analysis is vital for identifying niche opportunities, tailoring technological solutions, and developing targeted market strategies that address the unique requirements and challenges across the varied landscape of the Oil & Gas Carbon Capture and Storage market, ultimately supporting the global transition to a low-carbon economy.

- Technology

- Post-Combustion

- Pre-Combustion

- Oxy-Fuel Combustion

- Direct Air Capture (DAC)

- Service

- Capture

- Transportation

- Storage

- Monitoring

- Application

- Enhanced Oil Recovery (EOR)

- Industrial Processes (Cement, Steel, Chemicals)

- Power Generation

- Blue Hydrogen Production

- End-Use Industry

- Oil & Gas

- Power Generation

- Heavy Industry

- Chemical & Petrochemical

- Capture Method

- Absorption

- Adsorption

- Membrane Separation

- Cryogenic Separation

- Storage Type

- Saline Aquifers

- Depleted Oil & Gas Reservoirs

- Coal Seams

- Basalt Formations

Value Chain Analysis For Oil & Gas Carbon Capture and Storage Market

The value chain for the Oil & Gas Carbon Capture and Storage (CCS) market is intricate, encompassing several distinct stages from initial research and development to long-term geological storage and monitoring. Upstream activities in this value chain involve fundamental research into novel capture materials and processes, engineering design, and the manufacturing of specialized equipment such as absorption columns, compressors, and pumps. This segment also includes the exploration and characterization of potential geological storage sites, requiring extensive geological surveys, seismic imaging, and reservoir modeling to assess capacity, injectivity, and containment integrity. Key players in the upstream segment include technology developers, engineering firms, equipment manufacturers, and geological consultancies specializing in subsurface analysis and site selection for CO2 storage. Their role is critical in laying the foundational technological and geological groundwork for successful CCS projects.

Midstream activities primarily focus on the transportation of captured CO2 from emission sources to storage sites. This typically involves the construction and operation of dedicated CO2 pipelines, which are the most cost-effective method for large volumes over long distances. Alternatively, for smaller volumes or geographically dispersed sources, shipping CO2 via specialized tankers can be employed. This stage requires significant infrastructure investment and expertise in pipeline engineering, safety management, and regulatory compliance for hazardous material transport. The midstream segment also includes CO2 compression facilities located at the capture site to prepare the CO2 for pipeline transport, ensuring it meets the necessary pressure and purity specifications for efficient and safe conveyance to the injection points, bridging the gap between capture and permanent storage.

Downstream activities in the CCS value chain center on the injection and long-term storage of CO2, as well as associated monitoring, verification, and reporting (MV&R). This involves drilling injection wells, operating injection facilities, and continuously monitoring the subsurface CO2 plume to ensure containment and assess any potential environmental impacts. The downstream also includes any utilization aspects, such as Enhanced Oil Recovery (EOR), where CO2 is injected into depleted oil reservoirs to increase oil production while being stored. Distribution channels for CCS services are primarily direct, involving engineering, procurement, and construction (EPC) contractors, specialized CCS project developers, and major oil and gas companies acting as project integrators and operators. Indirect channels may include technology licensing agreements between innovators and project developers, or consulting services provided by environmental and engineering firms, supporting various stages of project development and operation. The comprehensive integration of these upstream, midstream, and downstream elements is essential for the successful deployment and long-term viability of CCS projects, mitigating industrial emissions and advancing global decarbonization.

Oil & Gas Carbon Capture and Storage Market Potential Customers

The primary potential customers and end-users of the Oil & Gas Carbon Capture and Storage (CCS) market are entities responsible for significant industrial CO2 emissions that face increasing regulatory pressure and corporate sustainability mandates. This broadly includes the upstream, midstream, and downstream segments of the oil and gas industry itself, particularly natural gas processing plants, refineries, and offshore oil and gas production facilities that need to manage process emissions. Additionally, power generation companies, especially those operating natural gas-fired power plants, represent a substantial customer base as they seek to decarbonize their electricity production in response to climate change policies and the transition to cleaner energy sources. These companies are driven by the need to maintain operational licenses, avoid carbon taxes, and enhance their public image.

Beyond the direct energy sector, heavy industries constitute another critical segment of potential customers. This includes cement manufacturing, steel production, and various chemical and petrochemical industries, which are characterized by high process emissions that are challenging to abate through conventional means. These industries are increasingly exploring CCS as a viable pathway to reduce their carbon footprint and meet evolving environmental standards. For these sectors, CCS offers a critical solution for "hard-to-abate" emissions where alternative clean technologies are not yet commercially mature or economically feasible. Their adoption of CCS is often spurred by government incentives, cross-industry collaborations, and the strategic importance of maintaining competitive advantage in a decarbonizing global economy.

Furthermore, emerging sectors like blue hydrogen production are rapidly becoming significant potential customers for CCS. As the world transitions towards a hydrogen economy, producing hydrogen from natural gas with simultaneous carbon capture and storage offers a cost-effective and scalable pathway to low-carbon hydrogen. Oil and gas companies, leveraging their existing infrastructure and expertise, are well-positioned to serve this growing demand. Lastly, governments and public utilities, often acting as facilitators or direct investors in large-scale infrastructure projects, can also be considered indirect customers, as they create the regulatory and financial frameworks that enable CCS project development and drive demand from industrial emitters. The diverse range of these customers highlights the expansive reach and crucial role of CCS across multiple industrial and energy sectors aiming for sustainable operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.1 Billion |

| Market Forecast in 2032 | $13.6 Billion |

| Growth Rate | 18.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chevron, ExxonMobil, Shell, TotalEnergies, Equinor, BP, Saudi Aramco, Occidental Petroleum, Sinopec, Mitsubishi Heavy Industries, Fluor Corporation, Aker Carbon Capture, Linde Engineering, Honeywell UOP, Carbon Engineering, Climeworks, Schlumberger, Baker Hughes, Halliburton, Worley |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil & Gas Carbon Capture and Storage Market Key Technology Landscape

The technological landscape of the Oil & Gas Carbon Capture and Storage (CCS) market is diverse and continuously evolving, driven by efforts to enhance efficiency, reduce costs, and broaden applicability across various emission sources. At the core are capture technologies, primarily categorized into post-combustion, pre-combustion, and oxy-fuel combustion. Post-combustion capture, typically using amine-based solvents, is favored for retrofitting existing facilities due to its ability to separate CO2 from flue gases after fuel combustion. Pre-combustion capture involves converting fuel into a syngas before combustion, from which CO2 is separated, often used in integrated gasification combined cycle (IGCC) power plants or hydrogen production. Oxy-fuel combustion burns fuel in a pure oxygen environment, producing a highly concentrated CO2 stream that simplifies capture. Emerging technologies like Direct Air Capture (DAC) are also gaining traction, offering the potential to remove CO2 directly from the atmosphere, providing a significant long-term solution for hard-to-abate or diffuse emissions, though at a higher current cost.

Beyond capture, the technology landscape encompasses advanced solutions for CO2 transportation and geological storage. For transportation, the dominant technology remains high-pressure pipelines, which require specialized materials and sophisticated control systems to ensure safe and efficient flow of compressed CO2. Research is ongoing into improving pipeline integrity, developing smart monitoring systems, and exploring alternative transport methods like shipping for regions lacking extensive pipeline networks. In terms of storage, the focus is on identifying and characterizing suitable geological formations, including deep saline aquifers, depleted oil and gas reservoirs, and unmineable coal seams. Technologies for reservoir characterization, such as seismic imaging and well logging, are crucial for assessing storage capacity, injectivity, and long-term containment, ensuring the safe and permanent sequestration of CO2 far beneath the Earth's surface.

Furthermore, the market relies heavily on sophisticated monitoring, verification, and reporting (MV&R) technologies to track the injected CO2 plume, detect potential leaks, and ensure regulatory compliance. This includes various subsurface monitoring techniques like seismic surveys, geochemical sampling, and pressure gauges, alongside surface monitoring tools such as remote sensing (e.g., satellite and drone-based technologies) and atmospheric sensors. Innovations in data analytics, artificial intelligence, and machine learning are being integrated into these monitoring systems to process vast amounts of data, predict CO2 behavior, and enhance the accuracy and reliability of leak detection. These technological advancements across the entire CCS value chain are vital for de-risking projects, building public confidence, and achieving the large-scale deployment necessary to meet ambitious global decarbonization targets, making CCS a cornerstone technology in the energy transition narrative.

Regional Highlights

The global Oil & Gas Carbon Capture and Storage (CCS) market exhibits significant regional variations in terms of deployment, policy support, and investment, reflecting diverse energy landscapes and decarbonization priorities. North America stands as a dominant region, primarily driven by robust policy frameworks like the 45Q tax credit in the United States, which provides substantial financial incentives for CO2 capture and sequestration. The region benefits from extensive geological storage potential, particularly in the Gulf Coast and Western Canada Sedimentary Basin, coupled with a mature oil and gas industry that possesses the necessary infrastructure and expertise. Major projects in the U.S. and Canada are focused on decarbonizing industrial clusters and leveraging CCS for enhanced oil recovery (EOR), establishing a strong foundation for future growth and large-scale deployment, making it a global leader in CCS project development and implementation.

Europe represents another key region, characterized by ambitious climate targets and significant public funding for CCS initiatives. Countries like Norway, the United Kingdom, and the Netherlands are at the forefront of developing integrated CCS value chains, including large-scale CO2 transport networks (e.g., Northern Lights project) and offshore storage sites in the North Sea. European policies, such as the EU Emissions Trading System (ETS) and dedicated funding mechanisms, create strong economic drivers for industrial emitters to adopt CCS. The region is actively exploring cross-border collaboration and the establishment of shared CO2 infrastructure to achieve economies of scale and accelerate decarbonization across various industrial sectors, emphasizing the critical role of CCS in meeting its stringent environmental commitments and ensuring energy security.

The Asia Pacific (APAC) region is rapidly emerging as a significant market for CCS, propelled by the immense industrial output and energy demands of countries like China, Australia, and Japan. While still in earlier stages compared to North America and Europe, APAC nations are increasingly recognizing CCS as essential for meeting their national emissions reduction targets. Australia, with its vast geological storage potential and substantial fossil fuel industries, is investing in large-scale projects, particularly for LNG and industrial decarbonization. China is developing pilot and demonstration projects, focusing on industrial applications and coal-fired power plants, driven by its commitment to peak emissions before 2030 and achieve carbon neutrality by 2060. These regions highlight the diverse approaches and growing global commitment to CCS as a vital tool for achieving a sustainable energy future.

- North America: Leads with strong government incentives (e.g., U.S. 45Q tax credit), extensive geological storage, and active EOR projects.

- Europe: Driven by ambitious climate targets, significant public funding, and pioneering integrated CCS projects, especially in the North Sea region.

- Asia Pacific (APAC): Emerging market with high industrial emissions, growing investment from China and Australia, focusing on heavy industry and power generation decarbonization.

- Middle East and Africa (MEA): Increasing interest in CCS for natural gas processing, blue hydrogen production, and EOR, leveraging vast oil and gas resources.

- Latin America: Developing market with potential for CCS in oil and gas operations and industrial decarbonization, particularly in Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil & Gas Carbon Capture and Storage Market.- Chevron

- ExxonMobil

- Shell

- TotalEnergies

- Equinor

- BP

- Saudi Aramco

- Occidental Petroleum

- Sinopec

- Mitsubishi Heavy Industries

- Fluor Corporation

- Aker Carbon Capture

- Linde Engineering

- Honeywell UOP

- Carbon Engineering

- Climeworks

- Schlumberger

- Baker Hughes

- Halliburton

- Worley

Frequently Asked Questions

What is Carbon Capture and Storage (CCS) in the context of oil and gas?

Carbon Capture and Storage (CCS) in oil and gas refers to technologies that capture CO2 emissions from oil and gas operations or associated industrial facilities, transport it, and inject it deep underground into geological formations for permanent, secure storage, preventing its release into the atmosphere.

What are the primary drivers for the growth of the Oil & Gas CCS market?

Key drivers include stringent global climate policies, carbon pricing mechanisms, government incentives (e.g., tax credits), growing demand for decarbonization, and the economic benefits derived from Enhanced Oil Recovery (EOR) using captured CO2.

What are the main challenges hindering the widespread adoption of CCS in the oil and gas sector?

Major challenges include high capital and operational costs, the need for extensive infrastructure development, geological risks associated with storage, public perception issues regarding safety, and ongoing regulatory uncertainties and the absence of harmonized global frameworks.

How does AI impact the efficiency and cost-effectiveness of CCS projects?

AI enhances CCS efficiency by optimizing capture processes, enabling predictive maintenance, improving geological site characterization for storage, optimizing CO2 transportation networks, and providing advanced real-time monitoring and leakage detection, ultimately reducing costs and risks.

Which regions are leading in Oil & Gas CCS deployment and why?

North America (especially the U.S. and Canada) and Europe (e.g., Norway, UK, Netherlands) are leading due to strong policy support, significant government incentives, abundant geological storage capacity, and established oil and gas industry infrastructure and expertise.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager