Oil & Gas Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431189 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Oil & Gas Pumps Market Size

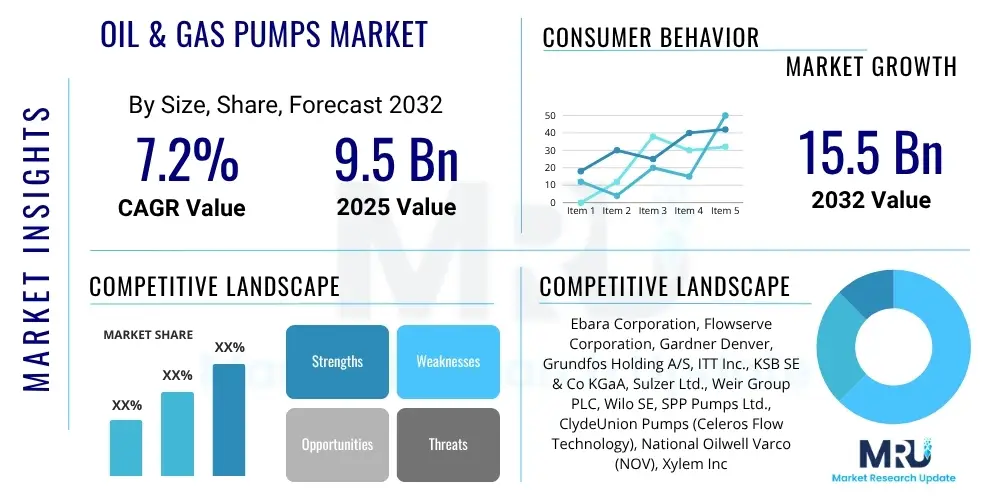

The Oil & Gas Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at $9.5 Billion in 2025 and is projected to reach $15.5 Billion by the end of the forecast period in 2032.

Oil & Gas Pumps Market introduction

The Oil & Gas Pumps Market is a vital segment within the broader energy infrastructure, providing essential equipment for the extraction, processing, and transportation of crude oil, natural gas, and refined petroleum products. These pumps are engineered to handle a wide range of fluids, pressures, and temperatures, operating in some of the most demanding environments across the upstream, midstream, and downstream sectors. The reliability and efficiency of these pumps directly impact operational continuity, safety, and overall productivity in the oil and gas industry, making them indispensable components in global energy supply chains.

The product portfolio in this market includes a diverse array of pump types, such as centrifugal pumps, positive displacement pumps (e.g., reciprocating, rotary), and specialized pumps for specific applications like multiphase pumping or submersible operations. Each type is designed with unique characteristics to meet stringent industry standards for performance, durability, and compliance with environmental regulations. Major applications span from crude oil transfer at wellheads and boosting pressure in pipelines to chemical injection in refineries and handling corrosive fluids in petrochemical plants, underscoring their versatility.

The benefits derived from advanced oil and gas pumps include enhanced operational efficiency, reduced maintenance costs through robust designs, improved safety protocols, and a minimized environmental footprint through leak prevention and energy-efficient designs. Key driving factors for market growth include the steady global demand for energy, significant investments in new exploration and production activities, the expansion of pipeline networks, and the modernization of existing infrastructure. Furthermore, technological advancements in pump design, materials, and digital integration are continuously improving pump performance and extending their operational lifespan, contributing to their sustained demand.

Oil & Gas Pumps Market Executive Summary

The Oil & Gas Pumps Market is experiencing dynamic shifts influenced by global energy demands, technological innovations, and evolving environmental regulations. Business trends indicate a strong focus on digitalization, with manufacturers integrating IoT and AI for predictive maintenance and remote monitoring, aiming to enhance operational uptime and efficiency. Consolidation among key players and strategic partnerships are also prominent, as companies seek to expand their technological capabilities and market reach. The drive towards decarbonization and energy transition is prompting R&D into more energy-efficient and low-emission pump solutions, even within the traditional oil and gas sectors, signaling a long-term shift in product development.

Regional trends highlight robust growth in emerging economies, particularly in Asia Pacific and the Middle East, driven by increasing energy consumption, substantial upstream investments, and infrastructure development projects. North America continues to be a significant market due to its mature oil and gas industry and ongoing shale exploration activities, though growth here is moderated by a greater emphasis on optimizing existing assets. Europe, while a mature market, is seeing increased demand for pumps in refining and petrochemical applications, alongside a strong push for pumps that comply with strict environmental and safety standards.

Segment trends reveal a sustained demand for centrifugal pumps across all applications due to their high flow rates, while positive displacement pumps remain critical for high-pressure, low-flow applications and precision dosing. Upstream applications are witnessing growth driven by unconventional resource development and offshore projects, necessitating specialized multiphase and high-pressure pumps. The midstream sector is investing in high-capacity pumps for new pipeline infrastructure, and the downstream sector is focused on upgrading pumps in refineries and petrochemical plants to improve efficiency and meet stringent environmental compliance. The aftermarket services segment is also growing, driven by the need for maintenance, repair, and upgrades of the extensive installed pump base.

AI Impact Analysis on Oil & Gas Pumps Market

Common user questions regarding AI's impact on the Oil & Gas Pumps Market often revolve around how artificial intelligence can enhance pump performance, reduce operational costs, and improve safety and reliability. Users are keen to understand the practical applications of AI in predictive maintenance, real-time monitoring, and optimizing pump operations. There is also significant interest in how AI can help address environmental concerns by reducing energy consumption and minimizing downtime, thus preventing potential spills or inefficiencies. Expectations are high for AI to deliver greater automation, smarter decision-making, and a proactive approach to asset management, transforming the traditional maintenance paradigm into a more data-driven and predictive model.

- Predictive maintenance and anomaly detection: AI algorithms analyze sensor data (vibration, temperature, pressure, flow) to predict potential pump failures before they occur, enabling proactive maintenance and reducing unplanned downtime.

- Operational efficiency optimization: AI-powered systems can analyze operational data to recommend optimal pump speeds, configurations, and schedules, leading to reduced energy consumption and improved throughput.

- Enhanced safety and environmental compliance: AI monitors pump conditions to detect leaks, unusual operating patterns, or potential risks, triggering alerts and enabling immediate action to prevent accidents or environmental damage.

- Remote monitoring and control: AI facilitates advanced remote monitoring capabilities, allowing operators to oversee pump performance from centralized locations, providing crucial insights and enabling rapid response to issues.

- Digital twins for performance simulation: AI contributes to the development and real-time updating of digital twins for pumps, simulating their performance under various conditions to optimize design, identify potential issues, and train operators.

- Supply chain and inventory management: AI can optimize spare parts inventory for pumps by predicting demand based on historical failure rates and operational schedules, ensuring parts are available when needed without excessive stocking.

DRO & Impact Forces Of Oil & Gas Pumps Market

The Oil & Gas Pumps Market is shaped by a complex interplay of drivers, restraints, opportunities, and competitive forces. Key drivers propelling market growth include the increasing global demand for energy, necessitating continuous investment in oil and gas exploration, production, and processing infrastructure. Furthermore, the expansion of unconventional oil and gas resources, such as shale gas and tight oil, along with significant offshore developments, mandates the deployment of specialized, high-performance pumping solutions. Technological advancements leading to more efficient, durable, and intelligent pumps also act as a strong driver, improving operational performance and reducing lifecycle costs for end-users.

Conversely, the market faces several significant restraints. Volatility in crude oil and natural gas prices can lead to delays or cancellations of major upstream and midstream projects, directly impacting pump demand. Stringent environmental regulations and increasing global pressure to transition towards renewable energy sources pose long-term challenges, potentially slowing down investments in new fossil fuel infrastructure. High capital expenditure requirements for advanced pumping systems and the complexity of maintenance in harsh operating environments also contribute to market restraints, particularly for smaller operators.

Opportunities within the market largely stem from the ongoing digital transformation within the oil and gas industry. The adoption of IoT, AI, and advanced analytics for predictive maintenance, asset performance management, and remote monitoring of pumps presents a substantial avenue for growth. Moreover, the increasing focus on upgrading aging infrastructure and optimizing existing assets to extend their lifespan and improve efficiency creates demand for advanced retrofit solutions and aftermarket services. The development of pumps for carbon capture, utilization, and storage (CCUS) projects and for hydrogen transportation also represents emerging opportunities as the energy transition progresses. The impact forces, such as competitive rivalry, are intensifying as global and regional players vie for market share, often through technological differentiation and strategic alliances. Buyer power is moderate, driven by the need for reliable, high-performance solutions but also by price sensitivity in a cost-conscious industry. Supplier power is influenced by the specialized nature of pump components and intellectual property. The threat of new entrants is relatively low due to high capital requirements, stringent industry standards, and the need for specialized engineering expertise. The threat of substitutes for pumps within the core oil and gas extraction and transportation functions remains limited, although the broader energy transition introduces long-term substitution threats from renewable energy sources reducing overall fossil fuel demand.

Segmentation Analysis

The Oil & Gas Pumps Market is meticulously segmented to reflect the diverse applications, technological requirements, and operational environments prevalent across the industry. This segmentation provides a granular view of market dynamics, enabling stakeholders to understand specific demand patterns, identify growth areas, and tailor product offerings effectively. The market is primarily categorized by pump type, application, power source, and material, each with distinct characteristics and market drivers.

- By Pump Type

- Centrifugal Pumps

- Single Stage

- Multi-Stage

- Submersible

- Axial Flow

- Mixed Flow

- Positive Displacement Pumps

- Reciprocating Pumps

- Piston Pumps

- Plunger Pumps

- Diaphragm Pumps

- Rotary Pumps

- Gear Pumps

- Lobe Pumps

- Screw Pumps

- Vane Pumps

- Reciprocating Pumps

- Specialty Pumps

- Multiphase Pumps

- Progressive Cavity Pumps

- Dosing/Metering Pumps

- Centrifugal Pumps

- By Application

- Upstream

- Drilling

- Well Completion

- Artificial Lift

- Crude Oil Transfer

- Water Injection

- Midstream

- Pipeline Transportation

- Storage & Terminal Operations

- Gas Processing

- Downstream

- Refining & Petrochemicals

- Chemical Processing

- Offloading & Loading

- Upstream

- By Power Source

- Electric Motor Driven

- Engine Driven (Diesel, Gas)

- Hydraulic Driven

- Steam Driven

- By Material

- Cast Iron

- Stainless Steel

- Duplex & Super Duplex Stainless Steel

- Non-Metallic (e.g., Composites)

- Exotic Alloys (e.g., Hastelloy, Monel)

- By End-Use Industry

- Oil Exploration & Production

- Refineries

- Chemical & Petrochemical

- Pipeline Operators

- Offshore Platforms

Value Chain Analysis For Oil & Gas Pumps Market

The value chain for the Oil & Gas Pumps Market begins with upstream activities involving the sourcing and processing of raw materials such as various grades of steel, cast iron, specialty alloys, and non-metallic composites from suppliers. These materials are crucial for manufacturing robust pump components designed to withstand harsh operating conditions. Component manufacturing, including precision machining of impellers, casings, shafts, and seals, constitutes the next critical stage, where specialized suppliers often provide high-quality, durable parts that meet exact specifications for pump integrity and performance.

The midstream segment of the value chain involves the assembly, testing, and final manufacturing of pumps by OEMs (Original Equipment Manufacturers). This stage includes rigorous quality control and adherence to international industry standards and certifications. Once manufactured, pumps are distributed to end-users through various channels. Direct distribution involves sales directly from manufacturers to large oil and gas companies, EPC (Engineering, Procurement, and Construction) contractors, or major project developers, often accompanied by extensive technical support and customization services.

Indirect distribution channels typically involve a network of authorized distributors, agents, and local representatives who cater to a broader customer base, including smaller operators, and provide regional support, spare parts, and localized maintenance services. Post-sale, the downstream activities encompass installation, commissioning, maintenance, repair, and overhaul (MRO) services, as well as the supply of spare parts. These aftermarket services are critical for ensuring the longevity and efficient operation of pumps throughout their lifecycle, contributing significantly to revenue streams for manufacturers and service providers. The value chain is characterized by strong relationships between manufacturers, component suppliers, and end-users, driven by the need for high reliability and specialized technical expertise.

Oil & Gas Pumps Market Potential Customers

Potential customers for oil and gas pumps represent a broad spectrum of entities involved in every stage of the hydrocarbon value chain, from initial exploration to final distribution and processing. These end-users are primarily driven by the need for reliable, efficient, and durable pumping solutions that can handle diverse fluids under challenging environmental and operational conditions. Their purchasing decisions are influenced by factors such as pump performance, energy efficiency, compliance with safety and environmental regulations, and total cost of ownership, including maintenance and spare parts availability.

The primary buyers include major international oil companies (IOCs) and national oil companies (NOCs) that engage in large-scale upstream exploration and production activities, both onshore and offshore. These companies require a wide range of pumps for drilling, artificial lift, water injection, and crude oil transfer. Engineering, Procurement, and Construction (EPC) firms also represent significant customers, as they integrate pumping systems into large-scale oil and gas projects, including new refineries, pipelines, and processing plants, often procuring pumps on behalf of their clients.

Furthermore, pipeline operators are crucial customers for high-capacity transfer pumps and booster pumps used in midstream transportation networks. Refining and petrochemical complexes, operating in the downstream sector, consistently demand specialized pumps for handling various refined products, chemicals, and corrosive agents throughout their intricate processes. Drilling contractors, chemical injection service providers, and maintenance and overhaul companies also form a vital part of the customer base, seeking pumps and related services for their specific operational needs and aftermarket support requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $9.5 Billion |

| Market Forecast in 2032 | $15.5 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ebara Corporation, Flowserve Corporation, Gardner Denver, Grundfos Holding A/S, ITT Inc., KSB SE & Co KGaA, Sulzer Ltd., Weir Group PLC, Wilo SE, SPP Pumps Ltd., ClydeUnion Pumps (Celeros Flow Technology), National Oilwell Varco (NOV), Xylem Inc., Bosch Rexroth AG, Baker Hughes, Schlumberger Limited, Dover Corporation (Wilden Pump & Engineering LLC), Metso Outotec (Minpro Pumps), NETZSCH Pumpen & Systeme GmbH, Verder Liquids. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil & Gas Pumps Market Key Technology Landscape

The Oil & Gas Pumps Market is at the forefront of technological innovation, driven by the continuous need for enhanced efficiency, reliability, and safety in challenging operating environments. One of the primary technological trends is the integration of smart pump technologies, which incorporate sensors, IoT (Internet of Things) connectivity, and advanced control systems. These smart pumps enable real-time monitoring of critical parameters such as vibration, temperature, pressure, and flow rates, allowing for condition-based monitoring and predictive maintenance. This shift from reactive to proactive maintenance significantly reduces unscheduled downtime and optimizes operational costs.

Another pivotal area is the development of advanced materials. Manufacturers are increasingly utilizing duplex and super duplex stainless steels, exotic alloys like Hastelloy and Monel, and high-performance non-metallic composites. These materials offer superior corrosion resistance, abrasion resistance, and mechanical strength, crucial for handling aggressive fluids and extending pump lifespan in demanding applications such as sour gas processing or offshore environments. The adoption of these materials also contributes to reducing the overall weight of pump components, which can simplify installation and maintenance.

Furthermore, digital twin technology is gaining traction, allowing for virtual representations of physical pumps that can simulate real-world performance. This technology, often coupled with AI and machine learning, enables engineers to optimize pump designs, predict operational behaviors, and troubleshoot issues without physical intervention. The advancement in multiphase pumping technology is also significant, permitting the simultaneous transportation of oil, gas, and water without prior separation, thereby reducing the need for costly and complex separation facilities, especially in offshore and unconventional resource developments. These technological strides are fundamentally transforming pump design, operation, and maintenance practices across the oil and gas value chain.

Regional Highlights

- North America: A mature but highly dynamic market, driven by extensive shale gas and tight oil production, coupled with significant investments in midstream infrastructure. The region benefits from technological leadership and a strong emphasis on operational efficiency and digital integration in pump systems.

- Europe: Characterized by stringent environmental regulations and a focus on advanced technology. Demand is sustained by upgrades to aging infrastructure, growth in downstream petrochemicals, and a rising emphasis on energy efficiency and pumps for new energy transition applications like CCUS.

- Asia Pacific (APAC): The fastest-growing market, propelled by rapidly increasing energy demand from industrialization and urbanization in countries like China, India, and Southeast Asia. Significant investments in new exploration, production, and refining capacities are driving robust pump procurement.

- Latin America: A region with substantial offshore oil and gas reserves, particularly in Brazil, and emerging unconventional resources. This drives demand for specialized pumps for deepwater and challenging onshore operations, alongside infrastructure development.

- Middle East and Africa (MEA): A major oil and gas producing region with ongoing large-scale upstream and midstream projects. Continuous investments in expanding production capacity and export infrastructure, along with a focus on optimizing operations, are key drivers for pump market growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil & Gas Pumps Market.- Ebara Corporation

- Flowserve Corporation

- Gardner Denver (part of Ingersoll Rand)

- Grundfos Holding A/S

- ITT Inc.

- KSB SE & Co KGaA

- Sulzer Ltd.

- Weir Group PLC

- Wilo SE

- SPP Pumps Ltd.

- ClydeUnion Pumps (Celeros Flow Technology)

- National Oilwell Varco (NOV)

- Xylem Inc.

- Bosch Rexroth AG

- Baker Hughes

- Schlumberger Limited

- Dover Corporation (Wilden Pump & Engineering LLC)

- Metso Outotec (Minpro Pumps)

- NETZSCH Pumpen & Systeme GmbH

- Verder Liquids

Frequently Asked Questions

What are the primary drivers for the Oil & Gas Pumps Market growth?

The market is primarily driven by increasing global energy demand, significant investments in new oil and gas exploration and production projects, expansion of midstream infrastructure like pipelines, and continuous technological advancements improving pump efficiency and reliability.

How do oil price fluctuations impact the Oil & Gas Pumps Market?

Oil price volatility directly affects investment decisions in new projects. Sustained low oil prices can lead to reduced capital expenditure, project delays, or cancellations, consequently impacting the demand for new pumps and related equipment across the industry.

What role does digitalization play in the Oil & Gas Pumps Market?

Digitalization, through IoT, AI, and advanced analytics, is transforming the market by enabling predictive maintenance, real-time remote monitoring, and operational optimization. This leads to improved asset performance, reduced downtime, and enhanced safety for pump systems.

Which regions are expected to show the highest growth in the Oil & Gas Pumps Market?

Asia Pacific (APAC) is projected to exhibit the highest growth, fueled by rising energy consumption, rapid industrialization, and substantial investments in new oil and gas infrastructure across countries like China, India, and Southeast Asia.

What are the key technological advancements in oil and gas pumps?

Key technological advancements include smart pumps with IoT connectivity for real-time monitoring, development of advanced materials for enhanced durability, adoption of digital twin technology for performance simulation, and specialized multiphase pumping solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager