Oil & Gas Wastewater Recovery Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431127 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Oil & Gas Wastewater Recovery Systems Market Size

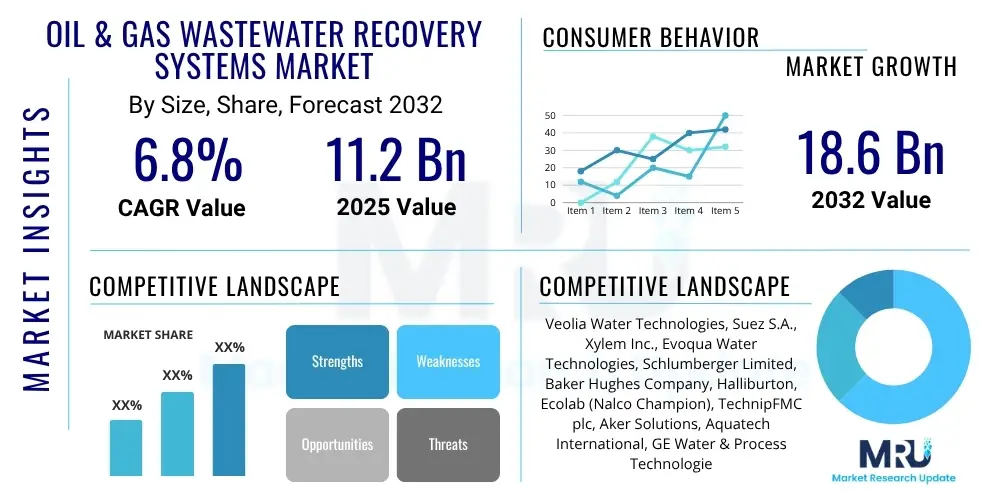

The Oil & Gas Wastewater Recovery Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $11.2 billion in 2025 and is projected to reach $18.6 billion by the end of the forecast period in 2032.

Oil & Gas Wastewater Recovery Systems Market introduction

The Oil & Gas Wastewater Recovery Systems Market encompasses technologies and services designed to treat and reuse the vast quantities of water generated during oil and gas exploration, production, and refining activities. This includes produced water, fracking flowback, and process water, which often contain complex mixtures of hydrocarbons, dissolved solids, heavy metals, and chemicals. The primary objective of these systems is to minimize environmental impact, reduce fresh water consumption, ensure compliance with stringent regulatory standards, and optimize operational costs associated with wastewater disposal.

Key product descriptions within this market range from advanced physical separation units like membrane filtration (Reverse Osmosis, Ultrafiltration) and media filtration, to chemical treatment processes such as coagulation, flocculation, and oxidation. Biological treatment methods, including anaerobic and aerobic bioreactors, are also crucial for removing organic contaminants. Major applications span across the entire oil and gas value chain, including upstream exploration and production sites, midstream transportation infrastructure, and downstream refining and petrochemical operations. The benefits derived from these systems are substantial, offering significant environmental stewardship through reduced discharge of pollutants and conservation of finite freshwater resources.

Driving factors for market growth include increasingly strict environmental regulations globally, coupled with escalating water scarcity issues in many oil and gas producing regions. Technological advancements in water treatment, such as more efficient membranes and automated systems, are making recovery processes more cost-effective and scalable. Furthermore, the industry's growing focus on sustainability and corporate social responsibility (CSR) initiatives significantly propels the adoption of these recovery systems. The increasing operational costs associated with traditional wastewater disposal methods, such as deep well injection, further incentivizes operators to invest in recovery and reuse technologies, highlighting the economic viability alongside environmental benefits.

Oil & Gas Wastewater Recovery Systems Market Executive Summary

The Oil & Gas Wastewater Recovery Systems Market is experiencing robust growth driven by a confluence of environmental imperatives, regulatory pressures, and economic efficiencies. Business trends indicate a shift towards integrated and modular solutions, offering scalability and adaptability to diverse operational needs, alongside a growing emphasis on lifecycle service contracts rather than one-time equipment sales. Companies are increasingly leveraging digital technologies to enhance system performance, monitoring, and predictive maintenance, moving towards more intelligent and autonomous wastewater management systems.

Regional trends reveal dynamic growth across key oil and gas producing areas. North America, particularly due to the shale revolution, is a significant market, driven by high volumes of produced water and stringent disposal regulations. The Middle East and Africa region is witnessing substantial investment due to increasing oil and gas activities and severe water scarcity challenges, making water reuse a critical operational strategy. Asia Pacific's emerging economies and expanding energy sectors are also contributing to market expansion as new infrastructure projects incorporate advanced wastewater treatment solutions from their inception.

Segment trends underscore a rising demand for advanced filtration and separation technologies, especially membrane-based systems, which offer high efficiency in removing complex contaminants. There is also a notable trend towards Zero Liquid Discharge (ZLD) systems, particularly in water-stressed regions, as industries aim to maximize water reuse and eliminate wastewater discharge. Furthermore, the integration of automation and data analytics into recovery systems is becoming paramount, enabling operators to optimize treatment processes, reduce chemical consumption, and improve overall operational reliability and cost-effectiveness across various application segments.

AI Impact Analysis on Oil & Gas Wastewater Recovery Systems Market

Users frequently inquire about how artificial intelligence can revolutionize the efficiency, reliability, and cost-effectiveness of oil and gas wastewater recovery. Common themes include the application of AI in optimizing treatment processes, predicting equipment failures, enhancing real-time monitoring capabilities, and making data-driven operational decisions. There is significant interest in how AI can address the complexities of varying wastewater compositions, reduce chemical usage, and contribute to more sustainable and compliant operations. The expectation is that AI will transform wastewater management from reactive to proactive, improving overall environmental performance and reducing operational downtime.

- AI enables predictive maintenance of recovery systems, minimizing unplanned downtime and reducing repair costs.

- Real-time data analysis via AI optimizes chemical dosing and process parameters, improving treatment efficiency and reducing operational expenses.

- AI-driven sensor networks provide continuous water quality monitoring, ensuring compliance with environmental regulations.

- Machine learning algorithms can identify patterns in wastewater composition, allowing for adaptive treatment strategies.

- Autonomous control systems, powered by AI, enhance operational safety and reduce human intervention requirements.

- Improved resource management through AI, particularly for energy and water consumption within recovery processes.

- Enhanced decision-making capabilities for operators through AI-generated insights and recommendations.

- Simulation and modeling of complex treatment scenarios using AI to design more effective and resilient systems.

DRO & Impact Forces Of Oil & Gas Wastewater Recovery Systems Market

The Oil & Gas Wastewater Recovery Systems Market is profoundly shaped by a dynamic interplay of drivers, restraints, and opportunities, all underscored by significant impact forces. Key drivers include the global tightening of environmental regulations, mandating stricter discharge limits and promoting water reuse. Escalating water scarcity in numerous oil and gas producing regions further compels operators to adopt recovery systems to ensure operational continuity and reduce reliance on freshwater sources. The economic benefits of reduced wastewater disposal costs and the potential for water reuse in operations also serve as strong motivators. Continuous technological advancements, making treatment processes more efficient and cost-effective, consistently drive market growth and innovation.

However, the market faces several restraints that could impede its trajectory. High capital investment required for installing advanced wastewater recovery infrastructure presents a significant barrier, especially for smaller operators. The operational complexities involved in managing diverse and often highly contaminated wastewater streams necessitate specialized expertise and ongoing maintenance, adding to the operational burden. Fluctuations in crude oil and natural gas prices directly impact investment decisions in new projects and upgrades, introducing an element of market volatility. Furthermore, the lack of skilled personnel capable of operating and maintaining sophisticated recovery systems can pose a challenge in certain regions.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The increasing adoption of Zero Liquid Discharge (ZLD) solutions offers a premium segment for companies aiming for maximal water recovery and minimal environmental footprint. The ongoing digitalization and integration of IoT (Internet of Things) with wastewater systems present avenues for enhanced monitoring, control, and optimization. Emerging markets in Latin America, Africa, and parts of Asia, with their growing energy demands and nascent regulatory frameworks, represent untapped potential. Government incentives for sustainable practices and investments in green technologies further open doors for market participants. The collective impact forces, including stringent regulatory pressure, rapid technological advancements, heightened environmental concerns, and fluctuating economic conditions, necessitate continuous adaptation and innovation within the industry.

Segmentation Analysis

The Oil & Gas Wastewater Recovery Systems Market is comprehensively segmented to provide a detailed understanding of its diverse components and evolving dynamics. This segmentation helps in analyzing market trends, identifying growth pockets, and understanding the varying needs of different applications and end-users within the global oil and gas industry. The market is primarily divided based on the type of technology employed for treatment, the specific application areas within the oil and gas sector, the operational environment (onshore or offshore), and the geographical regions where these systems are deployed.

Understanding these segments allows market participants to tailor their offerings to specific demands, from highly advanced membrane systems for ultra-pure water recovery to robust conventional treatment units for bulk contaminant removal. The distinct requirements of upstream operations, dealing with highly saline produced water, differ significantly from those in downstream refining, which often involve process water with diverse chemical contaminants. Similarly, the challenges and solutions for onshore facilities are different from those for space-constrained and environmentally sensitive offshore platforms, necessitating specialized recovery systems. This multi-dimensional segmentation provides a granular view of the market, essential for strategic planning and competitive positioning.

- By Technology

- Membrane Filtration (Reverse Osmosis, Ultrafiltration, Microfiltration, Nanofiltration)

- Chemical Treatment (Coagulation, Flocculation, Oxidation, Precipitation)

- Biological Treatment (Aerobic, Anaerobic)

- Thermal Treatment (Evaporation, Crystallization)

- Adsorption

- Ion Exchange

- Electrocoagulation

- Others (e.g., Flotation, Centrifugation)

- By Application

- Upstream (Exploration & Production, Produced Water Treatment)

- Midstream (Pipeline & Storage Water Treatment)

- Downstream (Refining & Petrochemical Process Water Treatment)

- By End-Use

- Onshore Facilities

- Offshore Platforms

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Oil & Gas Wastewater Recovery Systems Market

The value chain for the Oil & Gas Wastewater Recovery Systems Market begins with extensive upstream activities focused on research and development, where innovative technologies for water treatment are conceived and refined. This stage also includes the meticulous sourcing of raw materials, such as specialized membranes, filtration media, chemicals, and various components required for the construction of advanced treatment units. Suppliers of these raw materials, often from the chemical, materials science, and manufacturing sectors, form a critical part of the initial value creation process. Their ability to provide high-quality, cost-effective, and sustainably produced inputs directly impacts the final product's performance and market viability.

Moving downstream, the value chain encompasses the manufacturing and assembly of complex wastewater recovery systems, ranging from modular units to large-scale, custom-engineered plants. This involves precision engineering, system integration, and quality assurance processes to ensure the reliability and efficiency of the final products. Following manufacturing, these systems are then distributed to end-users through various channels. Direct distribution, where manufacturers sell directly to major oil and gas companies, is common for large, bespoke projects, allowing for close collaboration and customization. Alternatively, a network of distributors and local agents provides market reach, logistical support, and regional expertise, particularly for smaller or standardized systems.

Engineering Procurement and Construction (EPC) firms play a crucial indirect role, often acting as intermediaries by designing, procuring, and constructing entire wastewater treatment facilities for oil and gas clients. These firms frequently integrate solutions from multiple technology providers. Post-installation, the value chain extends to after-sales services, including commissioning, maintenance, spare parts supply, and operational support. These services are vital for ensuring the long-term performance and efficiency of the recovery systems. The entire value chain is characterized by a high degree of technical expertise, capital intensity, and a strong emphasis on regulatory compliance and environmental performance, driven by the critical nature of water management in the oil and gas industry.

Oil & Gas Wastewater Recovery Systems Market Potential Customers

Potential customers for Oil & Gas Wastewater Recovery Systems primarily consist of entities operating within the various segments of the petroleum industry, ranging from upstream exploration and production to midstream transportation and downstream refining and petrochemical processing. These end-users are driven by regulatory compliance, operational efficiency, cost reduction, and sustainability goals. Exploration and production (E&P) companies represent a significant customer base, requiring solutions for treating produced water and hydraulic fracturing flowback, which are generated in substantial volumes and often contain complex contaminants.

Refineries and petrochemical plants, falling under the downstream sector, constitute another vital segment of potential buyers. These facilities generate process wastewater contaminated with hydrocarbons, chemicals, and other impurities from their various operations. They seek advanced recovery systems to meet stringent discharge limits, reduce freshwater intake, and sometimes reuse treated water in their cooling towers or other processes. Midstream companies, involved in the transportation and storage of oil and gas, also require wastewater treatment for water generated from pipeline maintenance and storage facilities.

Beyond direct oil and gas operators, potential customers also include specialized water treatment service providers and Engineering, Procurement, and Construction (EPC) firms that undertake large-scale infrastructure projects. These service providers act as intermediaries, offering comprehensive wastewater management solutions to the oil and gas industry, often incorporating various recovery systems as part of a broader service offering. Their role is to deliver integrated solutions, handle the complexity of operations, and ensure compliance, making them key influencers and buyers within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $11.2 Billion |

| Market Forecast in 2032 | $18.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Water Technologies, Suez S.A., Xylem Inc., Evoqua Water Technologies, Schlumberger Limited, Baker Hughes Company, Halliburton, Ecolab (Nalco Champion), TechnipFMC plc, Aker Solutions, Aquatech International, GE Water & Process Technologies (SUEZ), Pall Corporation, Alfa Laval, Pentair plc, Ovivo, MBR Technology, Saltworks Technologies, Water Treatment Services, ProSep Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil & Gas Wastewater Recovery Systems Market Key Technology Landscape

The Oil & Gas Wastewater Recovery Systems Market is characterized by a dynamic and evolving technology landscape, driven by the need for more efficient, cost-effective, and environmentally sustainable solutions. Membrane separation technologies form a cornerstone of this landscape, with Reverse Osmosis (RO), Ultrafiltration (UF), Microfiltration (MF), and Nanofiltration (NF) being widely adopted for their ability to remove dissolved solids, suspended solids, and various contaminants with high precision. These technologies are crucial for achieving high-quality treated water suitable for reuse or safe discharge, making them essential in applications such as produced water treatment and industrial process water purification.

Advanced Oxidation Processes (AOPs), including UV/H2O2, ozonation, and Fenton's reagent, are gaining traction for their effectiveness in breaking down complex organic pollutants that are resistant to conventional biological or physical treatments. Electrocoagulation is another innovative technology utilized for its ability to remove suspended solids, heavy metals, and emulsified oils through electrochemical reactions, often resulting in compact footprints and reduced sludge volumes. Biological treatment methods, both aerobic and anaerobic, continue to be foundational for degrading organic matter, with advancements in bioreactor designs and microbial consortia enhancing their performance and applicability to diverse wastewater streams.

Beyond these core treatment technologies, the integration of digitalization and smart solutions is transforming the market. The Internet of Things (IoT) and advanced sensor technologies provide real-time data on water quality and system performance, enabling proactive monitoring and control. Automation and Artificial Intelligence (AI) are increasingly employed for process optimization, predictive maintenance, and remote operation, leading to improved operational efficiency, reduced human error, and lower operating costs. These technological advancements collectively contribute to developing more robust, resilient, and adaptive wastewater recovery systems that can effectively meet the stringent demands of the modern oil and gas industry, while also addressing evolving environmental challenges.

Regional Highlights

- North America: This region is a dominant force in the Oil & Gas Wastewater Recovery Systems Market, primarily fueled by the extensive shale oil and gas activities in the United States and Canada. The vast volumes of produced water and hydraulic fracturing flowback necessitate robust and efficient treatment solutions. Stringent environmental regulations and a strong emphasis on water conservation further drive the adoption of advanced recovery systems, making it a hub for technological innovation and investment.

- Europe: Characterized by stringent environmental protection policies and a strong focus on circular economy principles, Europe represents a mature market. While traditional oil and gas exploration is less extensive than in other regions, the emphasis on industrial wastewater reuse and sustainable practices in refining and petrochemical sectors drives demand for high-quality recovery solutions. Innovations in ZLD and energy-efficient treatment technologies are particularly prominent.

- Asia Pacific (APAC): The APAC region is poised for significant growth, driven by rapid industrialization, increasing energy demand, and expanding oil and gas exploration and production activities, particularly in countries like China, India, and Indonesia. Growing environmental awareness, coupled with developing regulatory frameworks, is pushing industries towards more responsible wastewater management, creating substantial opportunities for market players.

- Latin America: This region is experiencing steady growth in the oil and gas sector, with significant reserves in countries like Brazil, Mexico, and Argentina. The development of new onshore and offshore projects, alongside improving economic conditions, creates a demand for efficient wastewater recovery systems. Water scarcity issues in certain areas also contribute to the push for water reuse solutions in the industry.

- Middle East & Africa (MEA): The MEA region is a critical market, driven by its immense oil and gas reserves and the severe water scarcity prevalent in many parts of the Middle East. Desalination and highly efficient water reuse systems are paramount for operational sustainability. Increased exploration activities in Africa and large-scale projects in the Middle East necessitate advanced and robust wastewater recovery technologies to manage produced water and other industrial effluents effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil & Gas Wastewater Recovery Systems Market.- Veolia Water Technologies

- Suez S.A.

- Xylem Inc.

- Evoqua Water Technologies

- Schlumberger Limited

- Baker Hughes Company

- Halliburton

- Ecolab (Nalco Champion)

- TechnipFMC plc

- Aker Solutions

- Aquatech International

- GE Water & Process Technologies (SUEZ)

- Pall Corporation

- Alfa Laval

- Pentair plc

- Ovivo

- MBR Technology

- Saltworks Technologies

- Water Treatment Services

- ProSep Inc.

Frequently Asked Questions

What are the primary drivers of growth for the Oil & Gas Wastewater Recovery Systems Market?

The market is primarily driven by stricter environmental regulations, escalating global water scarcity, rising costs associated with traditional wastewater disposal methods, and continuous technological advancements in water treatment solutions.

Which technologies are most significant in oil & gas wastewater recovery?

Key technologies include advanced membrane filtration (RO, UF), chemical treatment, biological treatment, thermal processes, and increasingly, digitalization through IoT, AI, and automation for enhanced efficiency and monitoring.

How do governmental regulations influence the market for wastewater recovery?

Governmental regulations significantly impact the market by setting stringent discharge limits, mandating water reuse, and imposing penalties for non-compliance, thereby compelling oil and gas operators to invest in sophisticated recovery systems.

What is the role of Zero Liquid Discharge (ZLD) in this sector?

ZLD systems play a crucial role by enabling complete reuse of treated wastewater and eliminating liquid discharge, which is vital in water-stressed regions and for companies aiming to achieve maximal environmental sustainability and regulatory compliance.

Which geographical regions exhibit the strongest growth potential in this market?

North America (due to shale), Asia Pacific (rapid industrialization), and the Middle East & Africa (water scarcity, E&P growth) are identified as regions with the strongest growth potential, driven by specific regional demands and regulatory landscapes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager