Online Powersports Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430423 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Online Powersports Market Size

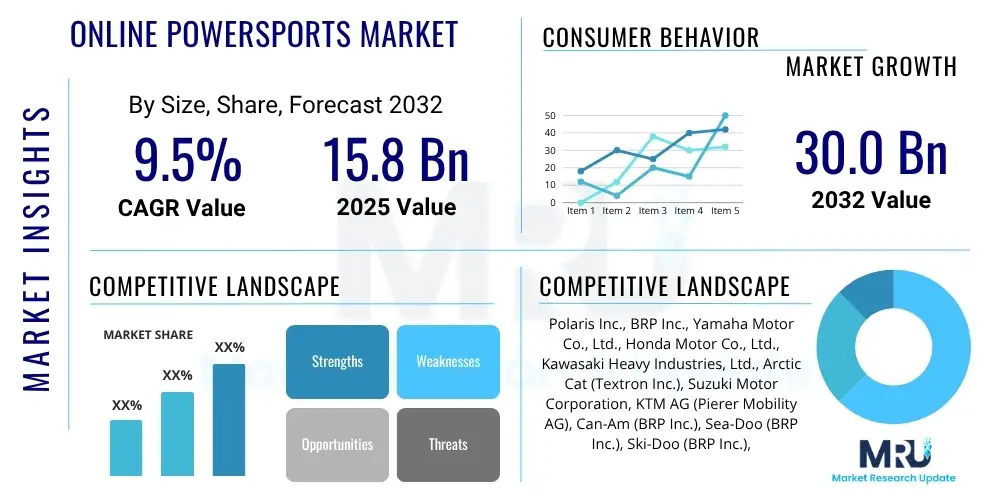

The Online Powersports Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 15.8 Billion in 2025 and is projected to reach USD 30.0 Billion by the end of the forecast period in 2032.

Online Powersports Market introduction

The Online Powersports Market encompasses the digital sale and distribution of a wide array of recreational and utility vehicles, along with their associated parts, accessories, and apparel, through e-commerce platforms and brand-specific websites. This market includes everything from All-Terrain Vehicles (ATVs), Utility Task Vehicles (UTVs), motorcycles, dirt bikes, snowmobiles, and personal watercraft to an extensive catalog of aftermarket components, riding gear, and maintenance services, all accessible via online channels. The primary objective is to offer consumers a convenient, comprehensive, and competitive shopping experience for their powersports needs.

Major applications for powersports vehicles span recreational activities such as trail riding, racing, hunting, and watersports, as well as utility tasks in agriculture, construction, and property management. The inherent benefits of online purchasing, including broader product selection, competitive pricing, direct-to-consumer models, and the convenience of doorstep delivery, significantly drive market adoption. Key driving factors fueling this growth include the continuous expansion of e-commerce infrastructure, increasing digital literacy among consumers, a growing global interest in outdoor recreational activities, and rising disposable incomes that enable investment in leisure pursuits.

Online Powersports Market Executive Summary

The Online Powersports Market is experiencing robust growth driven by escalating digital adoption, enhanced e-commerce capabilities, and a persistent consumer demand for outdoor adventure and utility vehicles. Business trends highlight a significant shift towards direct-to-consumer (D2C) sales models by original equipment manufacturers (OEMs), alongside the proliferation of specialized online retailers offering extensive product catalogs and personalized shopping experiences. The market benefits from advanced logistics solutions tailored for larger items and sophisticated digital marketing strategies that effectively reach niche consumer segments.

Regionally, North America and Europe continue to dominate the market due to established powersports cultures, high disposable incomes, and advanced e-commerce penetration. However, the Asia Pacific region is rapidly emerging as a high-growth area, propelled by increasing urbanization, rising middle-class spending, and a growing interest in recreational activities. Latin America and the Middle East & Africa also present significant opportunities as internet penetration expands and consumers gain access to a wider range of products previously unavailable locally.

Segment-wise, the market sees strong performance across all categories, with parts and accessories exhibiting particularly high growth due to the necessity of maintenance, customization, and performance upgrades. The online sale of new and used vehicles is also expanding, facilitated by virtual showrooms, comprehensive product specifications, and streamlined financing options. Apparel and gear segments are benefiting from fashion trends, safety awareness, and specialized niche markets, all contributing to the overall upward trajectory of the online powersports retail landscape.

AI Impact Analysis on Online Powersports Market

User inquiries regarding AI's impact on the Online Powersports Market frequently center on how artificial intelligence can personalize the shopping experience, streamline operational efficiencies, and enhance post-purchase support. Common questions revolve around predictive analytics for inventory, AI-driven recommendations for parts and gear, virtual assistance for customer service, and the use of machine learning to optimize logistics and detect fraud. Users are also keen to understand how AI can assist in the visualization of products, such as configuring vehicles or trying on gear virtually, and how it might lead to more proactive maintenance and smarter accessory suggestions based on riding habits.

The overarching themes emerging from these user concerns include the expectation of a more tailored and efficient buying journey, concerns about data privacy as personalization increases, and the potential for AI to resolve common pain points like identifying compatible parts or diagnosing simple vehicle issues remotely. There is a clear anticipation that AI will transform the discovery phase of shopping, making it easier for consumers to find exactly what they need, even if they are unsure of the technical specifications. Additionally, there are expectations for AI to empower retailers with better forecasting tools, allowing for optimal stock levels and reduced waste.

Ultimately, users expect AI to bridge the gap between the online and physical shopping experience by offering immersive tools and intelligent support, thereby making the purchase of complex and often expensive powersports items less daunting. The technology is seen as a key enabler for deep customization, improved customer loyalty through highly relevant interactions, and a significant driver for operational excellence throughout the entire value chain. The influence of AI is anticipated to permeate every aspect, from initial customer interaction to final delivery and beyond.

- Enhanced Personalization: AI algorithms analyze browsing history, purchase patterns, and user profiles to provide highly relevant product recommendations for vehicles, parts, and apparel.

- Predictive Analytics: AI is used to forecast demand, optimize inventory management, and predict maintenance needs for vehicles, allowing for proactive customer service and supply chain efficiency.

- Improved Customer Service: AI-powered chatbots and virtual assistants provide instant support, answer FAQs, guide customers through product selection, and streamline troubleshooting processes.

- Virtual Try-On and Configuration: Augmented Reality (AR) and Virtual Reality (VR) tools, often AI-enhanced, allow customers to visualize powersports vehicles in their environment or virtually "try on" gear, improving purchase confidence.

- Optimized Logistics and Supply Chain: AI algorithms improve route planning, warehouse automation, and delivery scheduling, crucial for large and heavy powersports items, reducing costs and delivery times.

- Fraud Detection and Cybersecurity: AI models identify suspicious transactions and protect customer data, enhancing the security of online purchases and building trust.

- Targeted Marketing: AI enables precise segmentation of customer bases and personalized ad campaigns, leading to higher conversion rates and more effective marketing spend.

- Market Trend Analysis: AI processes vast amounts of market data to identify emerging trends, competitor strategies, and shifting consumer preferences, informing strategic business decisions.

- Dynamic Pricing: AI systems can adjust product prices in real-time based on demand, competitor pricing, inventory levels, and other market factors to maximize revenue.

DRO & Impact Forces Of Online Powersports Market

The Online Powersports Market is primarily driven by the expanding global e-commerce infrastructure, which provides unparalleled convenience, access to a broader product selection, and competitive pricing transparency for consumers. The increasing digital literacy and comfort with online transactions among various demographics further fuel this growth. Rising disposable incomes, particularly in emerging economies, coupled with a surging interest in outdoor recreational activities and adventure sports, contribute significantly to the demand for powersports vehicles and their associated accessories. Moreover, sophisticated digital marketing techniques enable retailers to reach niche audiences more effectively, driving purchase intent and brand loyalty.

However, the market faces several significant restraints. The high shipping costs associated with large and heavy powersports vehicles and major components can deter potential buyers. The inability for customers to physically inspect or test-drive vehicles before purchase online presents a challenge, often leading to hesitations. Complex and costly return logistics for bulky items, combined with potential regulatory hurdles specific to online vehicle sales across different jurisdictions, also act as impediments. Furthermore, cybersecurity concerns regarding payment information and personal data, along with the absence of immediate hands-on customization options available at physical dealerships, can limit online adoption.

Opportunities for growth are abundant, particularly in emerging markets where powersports penetration is lower but incomes are rising. The integration of advanced technologies like Augmented Reality (AR) and Virtual Reality (VR) for immersive product experiences offers a chance to overcome the lack of physical inspection. The expansion of aftermarket parts and accessories, coupled with the potential for subscription models for certain services or gear, opens new revenue streams. Direct-to-consumer (D2C) strategies allow brands to build stronger customer relationships and control their brand narrative, while strategic partnerships with logistics providers can mitigate shipping challenges. The market is also influenced by the bargaining power of buyers, who benefit from vast online choices, and suppliers, who can leverage digital platforms for direct sales, alongside the threat of new specialized online retailers and substitute leisure activities.

Segmentation Analysis

The Online Powersports Market is broadly segmented based on various factors including vehicle type, product type, application, and sales channel, providing a granular view of market dynamics and consumer preferences. This detailed segmentation enables businesses to tailor their strategies, product offerings, and marketing efforts to specific niches within the expansive powersports ecosystem. Understanding these segments is crucial for identifying growth opportunities and addressing the diverse needs of the global consumer base, ranging from thrill-seekers and recreational riders to utility users and competitive athletes.

- By Vehicle Type

- ATVs (All-Terrain Vehicles)

- UTVs (Utility Task Vehicles) Side-by-Side

- Motorcycles (Street, Off-Road Dirt Bikes, Cruisers)

- Snowmobiles

- Personal Watercraft (PWCs)

- Other Powersports Vehicles (e.g., Go-Karts, Scooters)

- By Product Type

- Vehicles (New, Used)

- Parts & Accessories (Performance, Maintenance, Customization)

- Apparel & Gear (Helmets, Jackets, Boots, Goggles, Protective Gear)

- Services (Extended Warranties, Insurance, Financing, Virtual Diagnostics)

- By Application

- Recreational (Trail Riding, Watersports, Snow Sports, Touring)

- Utility (Farm, Construction, Landscaping, Hunting)

- Racing and Performance Sports

- Military and Defense

- By Sales Channel

- OEM Websites (Manufacturer Direct)

- Third-Party E-commerce Platforms (e.g., Amazon, eBay, dedicated powersports marketplaces)

- Authorized Dealer Websites (Online presence of traditional dealerships)

- Specialty Online Retailers

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Online Powersports Market

The value chain for the Online Powersports Market begins with upstream activities involving raw material procurement, component manufacturing, and the assembly of powersports vehicles by OEMs. This stage includes suppliers of engines, chassis, electronics, and specialized materials. Manufacturers focus on R&D, design, production, and initial warehousing. Efficient supply chain management at this level is critical for cost control, quality assurance, and timely delivery of finished products to the next stage of the value chain.

Midstream, the emphasis shifts to inventory management, marketing, and the establishment of distribution networks. For online channels, this involves integrating with e-commerce platforms, setting up secure payment gateways, and managing digital catalogs. Downstream activities are centered on reaching the end-consumer. This includes online retailers, whether they are OEM-direct websites, large third-party marketplaces, or specialized powersports e-commerce sites. Key downstream players also include logistics and fulfillment services that handle warehousing, packaging, and delivery, especially critical for large and bulky items, alongside after-sales support and customer service.

Distribution channels in the online powersports market are primarily categorized as direct and indirect. Direct channels involve manufacturers selling directly to consumers through their own branded websites, offering greater control over pricing, branding, and customer experience. Indirect channels encompass sales through third-party e-commerce platforms, authorized dealer websites, and specialized online retailers. These channels provide broader market reach and often leverage existing logistics infrastructures. The interplay between these channels shapes market competition and consumer accessibility, with an increasing trend towards hybrid models that combine the benefits of both direct and indirect selling strategies to optimize reach and service.

Online Powersports Market Potential Customers

The potential customers for the Online Powersports Market are incredibly diverse, encompassing a wide spectrum of demographics and psychographics, primarily united by a passion for outdoor activities, adventure, and performance. These end-users or buyers range from recreational enthusiasts seeking thrill and leisure to professionals requiring robust vehicles for utility and work-related tasks. A significant segment includes adventure seekers who engage in trail riding, off-roading, snow sports, and watersports, often prioritizing performance, durability, and customization options for their vehicles and gear.

Another key customer group consists of utility-focused buyers, such as farmers, ranchers, land managers, and construction workers, who rely on powersports vehicles like ATVs and UTVs for heavy-duty tasks, transportation in challenging terrains, and improved operational efficiency. These customers typically value reliability, hauling capacity, and practical features over pure speed. Additionally, competitive racers and sports enthusiasts form a crucial niche, investing in high-performance vehicles, specialized parts, and advanced safety gear to gain an edge in competitive events and extreme sports. This segment often seeks cutting-edge technology and brand-specific components.

Beyond these primary groups, there is a growing segment of urban and suburban residents who purchase powersports vehicles for weekend recreation, personal mobility, or as a hobby. This group is often influenced by lifestyle trends and brand image, and they appreciate the convenience and variety offered by online purchasing channels. The continuous expansion of interest in outdoor pursuits and the increasing accessibility of diverse powersports products online ensures a broad and evolving customer base for the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.8 Billion |

| Market Forecast in 2032 | USD 30.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Polaris Inc., BRP Inc., Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Arctic Cat (Textron Inc.), Suzuki Motor Corporation, KTM AG (Pierer Mobility AG), Can-Am (BRP Inc.), Sea-Doo (BRP Inc.), Ski-Doo (BRP Inc.), Cycle Gear (Comoto Holdings), Rocky Mountain ATV/MC, RevZilla (Comoto Holdings), Parts Unlimited, Western Power Sports (WPS), Motorsport.com, eBay Motors, Amazon, Walmart. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Powersports Market Key Technology Landscape

The Online Powersports Market heavily relies on a sophisticated technology landscape to facilitate seamless transactions and enhance the overall customer experience. Central to this are robust e-commerce platforms that provide scalable, secure, and user-friendly interfaces for browsing extensive product catalogs, managing orders, and processing payments. These platforms are often integrated with advanced Content Management Systems (CMS) for rich product descriptions, high-resolution images, and video content, along with Customer Relationship Management (CRM) systems to manage customer interactions and support. Secure payment gateways are paramount for ensuring transactional safety, building consumer trust in a market dealing with high-value items.

Beyond the foundational e-commerce infrastructure, inventory management systems (IMS) and warehouse management systems (WMS) play a critical role in tracking stock levels, optimizing storage, and ensuring efficient order fulfillment, particularly for diverse and often bulky powersports products. Logistics optimization software is essential for managing shipping costs and delivery times, which are significant considerations for this market. Furthermore, data analytics and business intelligence tools provide crucial insights into customer behavior, sales trends, and market performance, enabling retailers to make data-driven decisions regarding pricing, promotions, and product sourcing. These analytical capabilities are vital for maintaining a competitive edge and responding swiftly to market shifts.

Emerging technologies are also significantly shaping the online powersports landscape. Augmented Reality (AR) and Virtual Reality (VR) are increasingly being adopted to create immersive virtual showrooms, allowing customers to visualize vehicles in 3D, customize configurations, and even "try on" apparel virtually, thereby addressing the challenge of remote inspection. Artificial Intelligence (AI) and machine learning (ML) are being deployed for personalized product recommendations, AI-powered chatbots for instant customer support, and predictive maintenance alerts. Blockchain technology is also being explored for supply chain transparency and combating counterfeit parts. Cybersecurity measures, including advanced encryption and fraud detection systems, remain vital to protect sensitive customer data and maintain transactional integrity in this high-value market segment.

Regional Highlights

North America stands as a dominant force in the Online Powersports Market, primarily due to a deeply ingrained culture of outdoor recreation, high disposable incomes, and well-established e-commerce infrastructure. The United States and Canada are key contributors, boasting a large consumer base keen on ATVs, UTVs, motorcycles, and snowmobiles for both leisure and utility. Robust dealer networks, coupled with aggressive online strategies by major OEMs and specialized retailers, ensure high product availability and competitive pricing. The region also benefits from a mature logistics framework capable of handling the delivery of large and heavy powersports equipment efficiently. Consumer preferences lean towards diverse product types, from high-performance racing machines to comfortable touring vehicles, supported by a strong aftermarket for parts and accessories.

Europe represents another significant market, characterized by diverse regulatory landscapes and varying national preferences. Countries like Germany, the UK, France, and Italy are leading the adoption of online powersports sales, driven by their passion for motorcycling, trail riding, and water sports. The European market benefits from a strong manufacturing base and a growing interest in electric powersports vehicles, which are increasingly sold online. While logistical challenges can exist across borders, the expanding presence of pan-European e-commerce platforms and improved cross-border shipping solutions are facilitating growth. Consumers in this region often prioritize performance, European design aesthetics, and adherence to stringent environmental standards, which online retailers must effectively communicate.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, albeit from a lower base, propelled by rapid economic development, increasing urbanization, and a burgeoning middle class with rising disposable incomes. Countries like China, India, Australia, and Japan are at the forefront of this growth. While motorcycles have historically dominated the market, there is a rising demand for ATVs, UTVs, and personal watercraft for recreational purposes, especially among younger demographics. The expansion of internet penetration and smartphone usage, coupled with the development of sophisticated local e-commerce platforms, is making online powersports purchases more accessible. Infrastructure improvements and a growing interest in adventure tourism are further catalyzing market expansion across the diverse geographies of APAC.

- North America: Dominant market share due to high disposable income, established powersports culture, extensive trail systems, and advanced e-commerce infrastructure. Key countries include the United States and Canada, showing strong demand for ATVs, UTVs, motorcycles, and snowmobiles.

- Europe: Significant market driven by a strong leisure culture, diverse landscapes for riding, and a growing interest in premium and electric powersports vehicles. Germany, the UK, France, and Italy are prominent, with increasing online sales for motorcycles, quads, and watercraft.

- Asia Pacific (APAC): Fastest-growing region, fueled by economic growth, rising disposable incomes, urbanization, and increasing participation in outdoor recreational activities. China, India, Japan, and Australia are key markets, with an expanding consumer base for motorcycles, ATVs, and personal watercraft.

- Latin America: Emerging market with substantial growth potential, supported by improving economic conditions, increased internet penetration, and a cultural affinity for outdoor adventure. Brazil and Mexico are leading the way, with a rising demand for motorcycles and utility vehicles.

- Middle East & Africa (MEA): Gradually expanding market, influenced by infrastructure development, tourism initiatives, and a growing interest in recreational activities among younger populations. The UAE, Saudi Arabia, and South Africa are key contributors, particularly for desert riding vehicles and watercraft.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Powersports Market.- Polaris Inc.

- BRP Inc.

- Yamaha Motor Co., Ltd.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Arctic Cat (Textron Inc.)

- Suzuki Motor Corporation

- KTM AG (Pierer Mobility AG)

- Can-Am (BRP Inc.)

- Sea-Doo (BRP Inc.)

- Ski-Doo (BRP Inc.)

- Cycle Gear (Comoto Holdings)

- Rocky Mountain ATV/MC

- RevZilla (Comoto Holdings)

- Parts Unlimited

- Western Power Sports (WPS)

- Motorsport.com

- eBay Motors

- Amazon

- Walmart

Frequently Asked Questions

What drives the growth of the Online Powersports Market?

The Online Powersports Market is driven by factors such as the increasing penetration of e-commerce, the convenience and wider product selection offered by online channels, rising disposable incomes, and a growing global interest in outdoor recreational activities and adventure sports. Digital marketing and improved logistics for bulky items also contribute significantly to its expansion.

What are the main challenges faced by online powersports retailers?

Key challenges for online powersports retailers include high shipping costs for large vehicles and parts, the inability for customers to physically inspect or test-drive products before purchase, complex return logistics for bulky items, ensuring secure online transactions, and adapting to varied regional regulations governing vehicle sales.

How is technology transforming online powersports sales?

Technology is transforming online powersports sales through the adoption of AR/VR for virtual showrooms and product visualization, AI for personalized recommendations and customer service via chatbots, advanced data analytics for market insights and inventory optimization, and robust e-commerce platforms that offer seamless shopping experiences and secure payment gateways.

Which regions show the most promising growth in this market?

While North America and Europe remain dominant, the Asia Pacific (APAC) region is projected to be the fastest-growing market due to rapid economic development, increasing disposable incomes, and growing internet and smartphone penetration. Latin America and parts of the Middle East & Africa also present significant emerging growth opportunities.

What types of products are most commonly purchased online in the powersports sector?

In the online powersports sector, parts and accessories, including performance upgrades, maintenance items, and customization components, are highly popular. Apparel and gear, such as helmets, jackets, and protective equipment, also see strong online sales. While vehicles are purchased online, smaller, frequently needed items constitute a large portion of online transactions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager