Open Cycle Aeroderivative Gas Turbine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429569 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Open Cycle Aeroderivative Gas Turbine Market Size

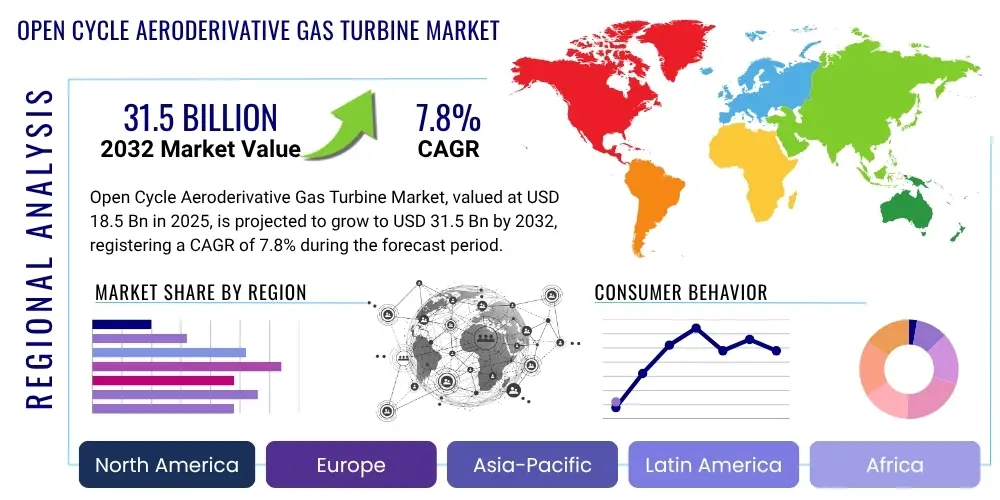

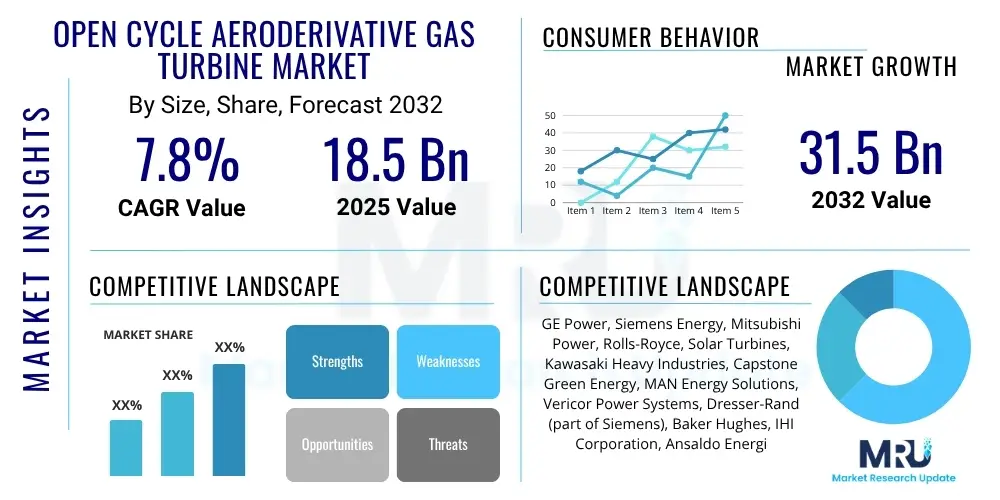

The Open Cycle Aeroderivative Gas Turbine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $18.5 Billion in 2025 and is projected to reach $31.5 Billion by the end of the forecast period in 2032.

Open Cycle Aeroderivative Gas Turbine Market introduction

The Open Cycle Aeroderivative Gas Turbine Market encompasses highly flexible and efficient gas turbines derived from aircraft jet engines, optimized for industrial and power generation applications. These turbines are characterized by their rapid start-up capabilities, compact design, and high power-to-weight ratio, making them ideal for applications requiring quick response times and operational flexibility. They operate in a simple open cycle, where air is drawn in, compressed, mixed with fuel and ignited, and the hot exhaust gases directly drive a turbine that generates power, subsequently vented to the atmosphere.

Major applications for Open Cycle Aeroderivative Gas Turbines include peaking power plants, where they provide rapid response to fluctuating electricity demand; distributed generation, offering reliable power closer to consumption points; oil and gas operations, providing mechanical drive for compressors and pumps or generating electricity for remote platforms; and various industrial uses requiring high-efficiency power generation. Their adaptability extends to co-generation and combined heat and power (CHP) systems when integrated with heat recovery solutions, though the primary focus in an open cycle configuration remains pure power generation.

The core benefits driving their adoption include superior operational flexibility, fuel efficiency, lower emissions compared to older thermal power plants for similar power output, and relatively quick installation times. These attributes are critical in today's evolving energy landscape, which increasingly demands grid stability, energy security, and reduced environmental impact. Key driving factors for market growth include the global energy transition necessitating flexible backup power for intermittent renewables, increasing demand for reliable and decentralized power solutions, and continued infrastructure development in emerging economies.

Open Cycle Aeroderivative Gas Turbine Market Executive Summary

The Open Cycle Aeroderivative Gas Turbine Market is experiencing robust growth, primarily driven by the global shift towards more dynamic and flexible power generation assets. Business trends indicate a strong emphasis on digital integration for enhanced operational efficiency and predictive maintenance, alongside a growing focus on fuel flexibility to accommodate hydrogen blends and other alternative fuels. The market is witnessing increased investment in modular and mobile power solutions, reflecting the need for rapid deployment and adaptable energy infrastructure. Strategic partnerships and acquisitions are also prevalent as key players seek to expand their technological capabilities and market reach, particularly in regions undergoing significant energy infrastructure upgrades and expansions.

Regionally, the market exhibits diverse growth patterns. Asia Pacific stands out as a high-growth region due to rapid industrialization, increasing electricity demand, and expanding oil and gas infrastructure. North America continues to be a significant market, driven by the replacement of aging power plants, abundant natural gas resources, and the integration of renewables requiring flexible backup. Europe, while prioritizing decarbonization, also sees demand for aeroderivative turbines to ensure grid stability and energy security, especially in scenarios where renewable generation is insufficient. Latin America and the Middle East and Africa are growing steadily, fueled by resource extraction projects and increasing urbanization requiring reliable power solutions.

Segment trends highlight the dominance of power generation applications, particularly peaking and distributed power, as grids become more complex and reliant on intermittent renewable sources. The oil and gas segment remains crucial, with aeroderivatives providing essential power and mechanical drive for upstream, midstream, and downstream operations. In terms of power output, the medium-sized turbine segment (50-150 MW) is showing significant traction due to its versatility and suitability for a wide range of industrial and utility applications. The push for lower carbon emissions is also driving demand for technologies that enable fuel flexibility, including the potential for hydrogen combustion or blends, influencing future product development and market dynamics across all segments.

AI Impact Analysis on Open Cycle Aeroderivative Gas Turbine Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the efficiency, reliability, and environmental performance of Open Cycle Aeroderivative Gas Turbines. Common themes include the application of AI for predictive maintenance to minimize downtime, optimizing operational parameters for fuel efficiency and emissions reduction, and improving integration with smart grids for better load management and faster response times. Users are keen to understand AI's role in extending asset life, reducing operational costs, and adapting turbines to handle diverse fuel types, particularly in the context of increasing renewable energy penetration and the demand for more agile power solutions. The overarching expectation is that AI will transform these highly engineered assets into even smarter, more autonomous, and environmentally conscious components of the energy infrastructure.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data from turbines to predict equipment failures before they occur, enabling proactive maintenance, reducing unplanned downtime, and extending asset life.

- Optimized Operational Efficiency: AI-driven control systems can continuously adjust turbine parameters (e.g., fuel-air mix, rotor speed) in real-time to maximize fuel efficiency, optimize power output, and minimize emissions under varying load conditions.

- Improved Grid Integration: AI facilitates seamless integration of aeroderivative gas turbines into smart grids by forecasting demand fluctuations, optimizing start-up and shutdown sequences, and providing rapid response to grid imbalances caused by intermittent renewables.

- Advanced Anomaly Detection: Machine learning models identify subtle deviations in performance or vibration patterns that indicate potential issues, allowing operators to address problems early and prevent catastrophic failures.

- Fuel Flexibility and Emission Reduction: AI can optimize combustion processes for different fuel blends, including natural gas, liquid fuels, and emerging hydrogen mixtures, ensuring efficient operation and helping to meet stringent environmental regulations.

- Automated Diagnostics and Troubleshooting: AI-powered diagnostic tools assist technicians in quickly identifying the root cause of issues, streamlining troubleshooting, and reducing repair times.

- Digital Twin Technology: AI contributes to the development and utilization of digital twins, creating virtual replicas of turbines for simulation, testing, and continuous optimization without impacting physical operations.

DRO & Impact Forces Of Open Cycle Aeroderivative Gas Turbine Market

The Open Cycle Aeroderivative Gas Turbine Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all shaped by various impact forces. The primary drivers stem from the global energy transition, which necessitates flexible and rapid-response power generation assets to complement intermittent renewable energy sources. The increasing demand for grid stability, coupled with the need for decentralized power solutions in remote locations and for industrial applications, further propels market growth. These turbines offer quick start-up and shutdown capabilities, making them ideal for peaking power and emergency backup, critical for modern grid resilience. Furthermore, the robust growth in the oil and gas sector, particularly for upstream and midstream operations requiring reliable mechanical drive and power generation, continues to underpin a substantial portion of the market demand, especially in developing regions.

However, the market faces several significant restraints. High initial capital expenditure for gas turbine installations can be a barrier for some investors, especially when compared to the declining costs of certain renewable technologies. Environmental concerns regarding greenhouse gas emissions, even with lower carbon footprints than older conventional power plants, lead to regulatory pressures and public scrutiny. Additionally, the market is exposed to the volatility of natural gas prices, which can impact operational costs and the overall economic viability of projects. Competition from alternative power generation technologies, including advanced battery storage solutions and more efficient combined cycle gas turbines, also poses a challenge to the market's expansion into certain applications.

Opportunities for growth are abundant and strategically focused on technological advancements and new applications. The development of turbines capable of running on hydrogen or hydrogen-natural gas blends presents a significant opportunity for future decarbonization, aligning with long-term climate goals. Continued advancements in digital technologies, such as AI-driven predictive maintenance and operational optimization, promise to enhance efficiency, reduce operational costs, and improve reliability. The expansion into niche markets like marine propulsion and micro-grid solutions further diversifies the application landscape. Lastly, investment in aging energy infrastructure upgrades globally, particularly in developed economies, offers a consistent replacement and modernization opportunity for aeroderivative units due to their efficiency and rapid deployment characteristics.

Segmentation Analysis

The Open Cycle Aeroderivative Gas Turbine market is meticulously segmented to reflect the diverse applications, power requirements, and operational considerations across various industries. This comprehensive segmentation allows for a granular analysis of market dynamics, identifying specific growth pockets and competitive landscapes within each category. Understanding these segments is crucial for stakeholders to tailor their product offerings, marketing strategies, and investment decisions, ensuring they effectively address the nuanced demands of different end-users and regional markets. The market can be broadly categorized by power output, application, end-use industry, and fuel type, each with distinct characteristics and growth trajectories influencing the overall market expansion.

- By Power Output

- Small (Less than 50 MW)

- Medium (50 MW to 150 MW)

- Large (Greater than 150 MW)

- By Application

- Power Generation

- Peaking Power

- Distributed Generation

- Emergency Backup

- Oil and Gas

- Upstream (Exploration and Production)

- Midstream (Pipelines and LNG)

- Downstream (Refineries and Petrochemicals)

- Industrial

- Manufacturing

- Process Industries

- Marine Propulsion

- Power Generation

- By End-Use Industry

- Utilities

- Independent Power Producers (IPPs)

- Oil and Gas Companies

- Industrial Facilities

- Commercial Businesses

- Defense and Marine Sector

- By Fuel Type

- Natural Gas

- Liquid Fuel (Diesel, Kerosene)

- Dual Fuel (Natural Gas & Liquid Fuel)

- Other (e.g., Syngas, Future Hydrogen Blends)

Value Chain Analysis For Open Cycle Aeroderivative Gas Turbine Market

The value chain for the Open Cycle Aeroderivative Gas Turbine Market begins with the upstream activities focused on raw material procurement and highly specialized component manufacturing. This phase involves sourcing advanced alloys like nickel-based superalloys for turbine blades, high-strength steels for casings, and ceramic matrix composites for hot gas path components. Key suppliers in this segment include specialty metal producers, forging companies, and advanced coating providers. The manufacturing of intricate components such as combustors, compressors, and power turbines demands precision engineering and high-tolerance machining, often involving a global network of specialized vendors. Research and development activities, particularly in materials science and combustion technology, are crucial at this stage to enhance efficiency and reduce emissions, setting the foundation for the turbine's performance characteristics.

Midstream activities primarily encompass the core manufacturing and assembly of the aeroderivative gas turbine units by original equipment manufacturers (OEMs). This involves integrating components from various suppliers, rigorous testing, and quality assurance processes to ensure the turbines meet stringent performance and reliability standards. OEMs often design and engineer the overall system, including the gas generator, power turbine, and auxiliary systems. This stage also includes system integration with generators, control systems, and exhaust systems, transforming the core turbine into a complete power generation package. These manufacturers often leverage their aerospace heritage, transferring advanced engineering and manufacturing techniques from aircraft engine production to industrial applications, ensuring robustness and high power density.

Downstream activities involve the distribution, installation, operation, and ongoing maintenance of the gas turbines. Distribution channels include direct sales from OEMs to large utility companies or independent power producers (IPPs), as well as sales through engineering, procurement, and construction (EPC) contractors who manage entire power plant projects. Regional distributors and agents play a role in smaller markets or for specific industrial applications. Post-sale services are critical, encompassing installation support, commissioning, maintenance, repair, and overhaul (MRO) services, and the supply of spare parts. Direct distribution allows OEMs to maintain close relationships with key clients, offering tailored solutions and ensuring high levels of customer service, while indirect channels leverage partnerships for broader market penetration and specialized project execution capabilities, making the entire value chain comprehensive and customer-centric.

Open Cycle Aeroderivative Gas Turbine Market Potential Customers

Potential customers for Open Cycle Aeroderivative Gas Turbines are diverse, spanning multiple sectors that prioritize operational flexibility, rapid power response, and high efficiency in specific applications. Utilities represent a significant customer base, particularly for grid stabilization, peaking power generation, and emergency backup, where the ability to quickly ramp up or down power output is paramount. As renewable energy penetration increases, utilities require agile thermal assets to compensate for the intermittency of wind and solar power, making aeroderivatives an attractive solution. Independent Power Producers (IPPs) also fall into this category, investing in these turbines for their own portfolios to provide flexible power to grids, often securing long-term power purchase agreements.

The oil and gas industry constitutes another core segment of potential customers, utilizing aeroderivative gas turbines for both mechanical drive and power generation across their extensive operations. Upstream companies leverage these turbines for powering compressors in natural gas extraction and processing, as well as for electricity generation in remote exploration and production sites. Midstream operators employ them for driving compressors in pipelines and for liquefaction processes in LNG plants. Downstream facilities, such as refineries and petrochemical complexes, use them for captive power generation and process heat, valuing their reliability and continuous operation under demanding conditions. The robust nature and compact design of these turbines are highly advantageous in challenging environments characteristic of the oil and gas sector.

Beyond utilities and oil and gas, various industrial facilities represent a growing customer segment. Large manufacturing plants and process industries often require reliable, high-quality power for their continuous operations, where power interruptions can result in significant financial losses. Aeroderivative gas turbines can serve as primary or backup power sources, sometimes integrated into combined heat and power (CHP) systems to maximize energy efficiency. Furthermore, commercial businesses requiring resilient power supply for critical infrastructure, such as data centers, may also consider these turbines for emergency or supplemental power. The defense and marine sectors also represent niche but significant buyers, deploying these turbines for naval propulsion and mobile power generation due to their compact footprint and rapid power delivery capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $18.5 Billion |

| Market Forecast in 2032 | $31.5 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Power, Siemens Energy, Mitsubishi Power, Rolls-Royce, Solar Turbines, Kawasaki Heavy Industries, Capstone Green Energy, MAN Energy Solutions, Vericor Power Systems, Dresser-Rand (part of Siemens), Baker Hughes, IHI Corporation, Ansaldo Energia, Pratt & Whitney Power Systems (part of Mitsubishi Heavy Industries), Centrax, Cummins Inc., Doosan Heavy Industries & Construction, Opra Turbines, Sinopec Group, BHEL (Bharat Heavy Electricals Limited) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Open Cycle Aeroderivative Gas Turbine Market Key Technology Landscape

The Open Cycle Aeroderivative Gas Turbine Market is continually shaped by advancements in several key technological areas aimed at improving performance, efficiency, environmental impact, and operational flexibility. One critical aspect is the ongoing development in advanced materials science, focusing on creating more durable, heat-resistant, and lightweight components. This includes the use of single-crystal superalloys for turbine blades, ceramic matrix composites (CMCs) for hot gas path components, and advanced thermal barrier coatings (TBCs). These materials allow turbines to operate at higher temperatures, directly translating into increased thermal efficiency and power output, while also extending the lifespan of critical parts and reducing maintenance intervals, which is vital for reducing the overall cost of ownership and enhancing reliability.

Another pivotal area is the evolution of combustion technology, driven by stringent environmental regulations and the imperative to reduce emissions. Manufacturers are heavily investing in developing lean-burn combustors, dry low emissions (DLE) systems, and water/steam injection techniques to minimize nitrogen oxides (NOx), carbon monoxide (CO), and unburnt hydrocarbon (UHC) emissions. A significant emerging trend is the research and development into fuel flexibility, specifically the capability to burn hydrogen or hydrogen-natural gas blends. This technological shift is crucial for positioning aeroderivative turbines as a viable solution in a decarbonized energy future, addressing climate concerns and aligning with global sustainability goals, thereby future-proofing the technology against evolving environmental policies and fuel availability.

Digitalization and control systems also play a transformative role in the modern aeroderivative gas turbine landscape. Advanced digital controls, integrated with Artificial Intelligence (AI) and the Internet of Things (IoT), enable real-time monitoring, predictive analytics, and automated optimization of turbine operations. This allows for precise control over performance, maximizing fuel efficiency, reducing operational costs, and preventing unscheduled downtime through early fault detection. Furthermore, advancements in modular design and packaging technologies are enhancing the ease and speed of deployment, making these turbines ideal for distributed power generation and rapid response applications. These technological innovations collectively contribute to the enhanced competitiveness and sustained relevance of open cycle aeroderivative gas turbines in the global energy market.

Regional Highlights

- North America: This region represents a mature yet dynamic market, driven by the need to replace aging power infrastructure, abundant and affordable natural gas supplies, and the increasing integration of intermittent renewable energy sources. Aeroderivative gas turbines are critical for grid stability, providing flexible peaking power and emergency backup. The robust oil and gas sector also creates demand for mechanical drive and power generation in exploration, production, and pipeline operations. Regulatory frameworks favoring natural gas as a bridge fuel further support market growth.

- Europe: The European market is characterized by a strong focus on decarbonization and energy security. While renewable energy targets are ambitious, aeroderivative gas turbines play a vital role in ensuring grid stability, especially during periods of low renewable output. The ongoing transition from coal and nuclear power plants, coupled with the need for flexible generation capacity, sustains demand. Investments in hydrogen infrastructure and the potential for hydrogen-blended fuels are key future growth drivers, particularly in countries committed to net-zero emissions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid industrialization, urbanization, and increasing energy demand across countries like China, India, and Southeast Asian nations. Infrastructure development projects, expanding manufacturing sectors, and growing populations are driving the need for reliable and efficient power generation. The significant oil and gas activities in certain parts of the region also contribute to demand for turbine solutions in both upstream and downstream applications.

- Latin America: This region demonstrates steady growth, fueled by investments in natural resource development, particularly oil and gas. Expanding industrial bases and increasing electricity consumption due to urbanization also drive demand for aeroderivative turbines for power generation and industrial applications. Energy infrastructure improvements and the pursuit of energy independence in various countries present opportunities for flexible power solutions.

- Middle East and Africa (MEA): The MEA region is a substantial market, primarily due to its vast oil and gas reserves and associated infrastructure projects. Aeroderivative turbines are extensively used for power generation in remote oil and gas fields, for driving compressors in pipelines, and for base load power in industrial complexes. Rapid economic development, diversification efforts away from solely oil-based economies, and increasing electrification rates in African nations further contribute to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Open Cycle Aeroderivative Gas Turbine Market.- GE Power

- Siemens Energy

- Mitsubishi Power

- Rolls-Royce

- Solar Turbines

- Kawasaki Heavy Industries

- Capstone Green Energy

- MAN Energy Solutions

- Vericor Power Systems

- Dresser-Rand (part of Siemens)

- Baker Hughes

- IHI Corporation

- Ansaldo Energia

- Pratt & Whitney Power Systems (part of Mitsubishi Heavy Industries)

- Centrax

- Cummins Inc.

- Doosan Heavy Industries & Construction

- Opra Turbines

- Sinopec Group

- BHEL (Bharat Heavy Electricals Limited)

Frequently Asked Questions

What is an Open Cycle Aeroderivative Gas Turbine?

An Open Cycle Aeroderivative Gas Turbine is a power generation system derived from aircraft jet engines, optimized for industrial use. It operates by drawing in air, compressing it, mixing it with fuel and igniting it, then directing the hot exhaust gases to drive a power turbine that generates electricity or mechanical power, with the exhaust gases vented directly to the atmosphere.

Why are aeroderivative gas turbines important for grid stability?

Aeroderivative gas turbines are crucial for grid stability due to their rapid start-up and shutdown capabilities, allowing them to quickly respond to fluctuations in electricity demand and compensate for the intermittency of renewable energy sources like wind and solar, ensuring a reliable power supply.

What are the primary applications of these turbines?

The primary applications include peaking power generation for utilities, distributed generation for localized power needs, mechanical drive for compressors and pumps in the oil and gas industry, and various industrial processes requiring efficient and flexible power solutions, including emergency backup.

How is AI impacting the Open Cycle Aeroderivative Gas Turbine Market?

AI is significantly impacting the market by enabling enhanced predictive maintenance, optimizing operational efficiency for fuel consumption and emissions, improving integration with smart grids, and facilitating automated diagnostics, leading to reduced downtime and lower operating costs.

What future fuel options are being explored for these turbines?

Future fuel options being actively explored include the use of hydrogen or hydrogen-natural gas blends. This development is crucial for decarbonization efforts, allowing aeroderivative turbines to align with long-term climate goals and meet increasingly stringent environmental regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager