Oral Solid Dosage Contract Manufacturing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429208 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Oral Solid Dosage Contract Manufacturing Market Size

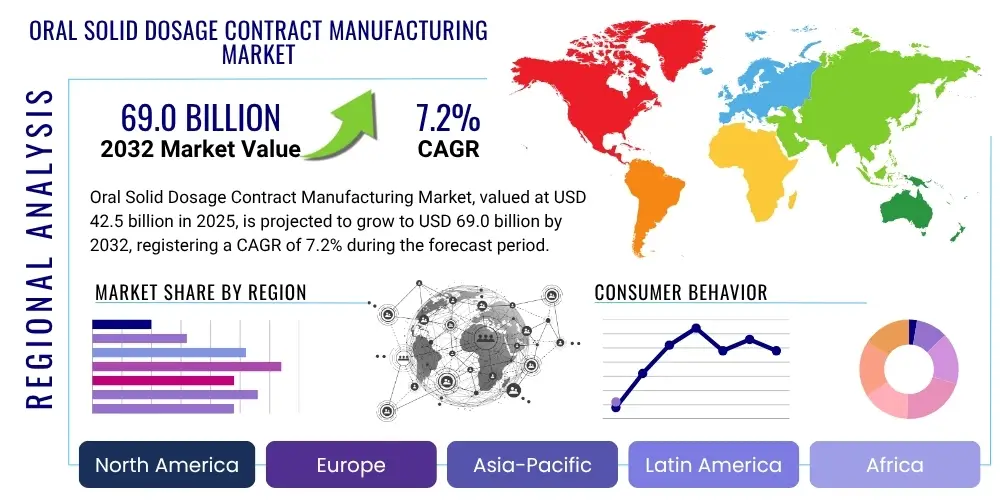

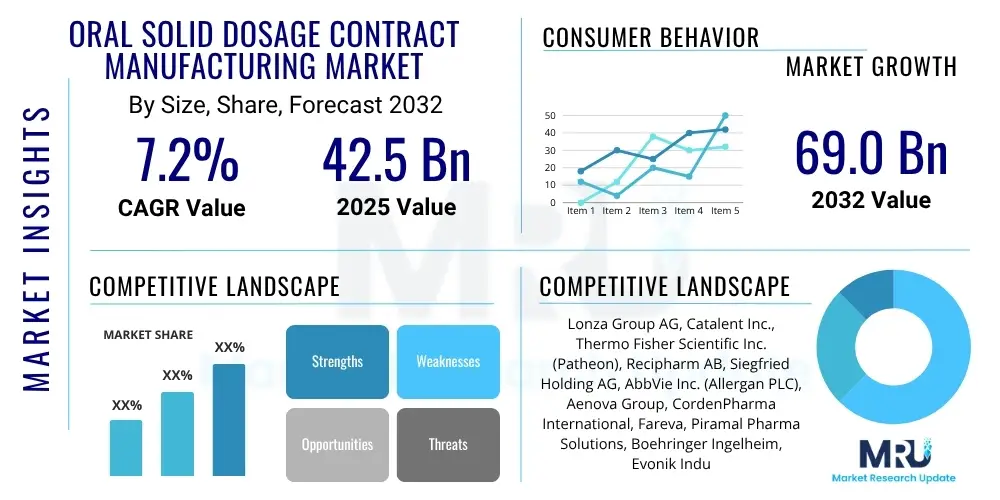

The Oral Solid Dosage Contract Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at $42.5 billion in 2025 and is projected to reach $69.0 billion by the end of the forecast period in 2032.

Oral Solid Dosage Contract Manufacturing Market introduction

The Oral Solid Dosage (OSD) Contract Manufacturing Market encompasses the outsourcing of various stages of manufacturing oral pharmaceutical products such as tablets, capsules, and powders to third-party contract manufacturing organizations (CMOs). These products represent the most common and patient-preferred drug delivery method due to their ease of administration, cost-effectiveness, and stability. CMOs provide specialized expertise, advanced technologies, and regulatory compliance, enabling pharmaceutical companies to focus on core competencies like research and development, while efficiently scaling production.

Major applications of OSD contract manufacturing span a vast range of therapeutic areas, including oncology, cardiology, central nervous system disorders, diabetes, pain management, and infectious diseases, among others. The benefits for pharmaceutical companies include reduced capital expenditure, accelerated time to market, access to niche manufacturing capabilities for complex formulations, and enhanced operational flexibility. This strategic partnership allows clients to leverage economies of scale and specialized equipment without significant upfront investment, optimizing their supply chain and risk management strategies.

Driving factors for the market's robust growth include the increasing global demand for pharmaceutical products, a surge in drug development activities, and the growing trend of pharmaceutical companies outsourcing non-core activities. Furthermore, the rising prevalence of chronic diseases, the need for cost-efficient manufacturing solutions, and the development of advanced drug delivery systems, such as modified-release formulations and high-potency active pharmaceutical ingredients (APIs), are significantly contributing to market expansion. The shift towards personalized medicine also necessitates flexible and specialized manufacturing capabilities that CMOs are well-positioned to provide.

Oral Solid Dosage Contract Manufacturing Market Executive Summary

The Oral Solid Dosage Contract Manufacturing Market is experiencing dynamic growth driven by several key business trends. Pharmaceutical companies are increasingly adopting outsourcing strategies to mitigate risks, reduce operational costs, and access cutting-edge technologies that would be financially prohibitive to maintain in-house. This has led to a demand for integrated services from CMOs, encompassing everything from formulation development and clinical trial material production to commercial manufacturing and packaging. The market is also seeing a rise in specialized services for complex and high-potency drugs, as well as an emphasis on continuous manufacturing processes for improved efficiency and quality.

Regionally, the market exhibits diverse growth patterns. North America and Europe continue to hold significant market shares due to the presence of numerous large pharmaceutical companies, extensive R&D investments, and well-established regulatory frameworks. However, the Asia Pacific region is rapidly emerging as a dominant force, driven by lower manufacturing costs, increasing government support for the pharmaceutical sector, a growing pool of skilled labor, and expanding domestic markets. Latin America, the Middle East, and Africa also present nascent opportunities, with increasing healthcare expenditure and a rising need for affordable medicines contributing to their market potential.

Segmentation trends indicate a strong demand for modified-release formulations, which offer enhanced patient compliance and therapeutic benefits. Tablets and capsules remain the most prevalent dosage forms, though the market for specialized powders and granules is also expanding. By application, oncology and cardiovascular diseases represent substantial segments due to the high incidence and ongoing development of new therapies. End-user analysis reveals that small and mid-sized pharmaceutical and biotech companies are major drivers of outsourcing, relying on CMOs for comprehensive manufacturing solutions, while large pharmaceutical companies increasingly utilize CMOs for capacity expansion and specialized production needs.

AI Impact Analysis on Oral Solid Dosage Contract Manufacturing Market

Common user questions regarding AI's impact on the Oral Solid Dosage Contract Manufacturing Market frequently revolve around how artificial intelligence can optimize existing processes, enhance quality control, and accelerate drug development timelines. Users are keen to understand the practical applications of AI in improving manufacturing efficiency, predicting potential issues, and ensuring compliance with stringent regulatory standards. There is significant interest in AI's role in predictive maintenance, real-time process monitoring, and data-driven decision-making, while also acknowledging potential challenges such as data integration complexities, the need for specialized skill sets, and the initial investment required for AI adoption.

The integration of AI into OSD contract manufacturing holds the potential to revolutionize several aspects of the industry. From optimizing raw material procurement and inventory management to refining formulation development and predicting process deviations, AI algorithms can provide unprecedented levels of insight and control. This leads to more efficient resource utilization, reduced waste, and ultimately, a more cost-effective manufacturing paradigm. Moreover, AI's ability to analyze vast datasets can significantly enhance risk assessment and mitigation strategies, ensuring higher product quality and greater operational resilience.

- AI driven predictive maintenance of equipment reduces downtime and operational costs.

- Enhanced quality control through real-time data analysis and anomaly detection.

- Optimized process parameters for improved yield and consistent product quality.

- Accelerated R&D by simulating formulations and predicting drug stability.

- Streamlined supply chain management and inventory optimization using AI forecasts.

- Improved regulatory compliance through automated data collection and reporting.

DRO & Impact Forces Of Oral Solid Dosage Contract Manufacturing Market

The Oral Solid Dosage Contract Manufacturing Market is significantly shaped by a confluence of drivers, restraints, and opportunities, alongside various impact forces. Key drivers propelling the market include the escalating global demand for pharmaceuticals, especially given the rising prevalence of chronic and infectious diseases requiring long-term medication. Pharmaceutical companies are increasingly focusing on their core competencies of drug discovery and marketing, leading them to outsource manufacturing to specialized CMOs that offer expertise, advanced technologies, and economies of scale. The growing number of new drug approvals and the need for cost-efficient production further fuel this outsourcing trend. Additionally, the development of more complex and specialized oral solid dosage forms, such as high-potency active pharmaceutical ingredients (HPAPIs) and modified-release formulations, necessitates the advanced capabilities often found in CMOs.

However, the market also faces considerable restraints. The pharmaceutical industry is highly regulated, and CMOs must adhere to stringent Good Manufacturing Practices (GMP) and evolving global regulatory standards, which can be complex and costly to implement and maintain. High capital investments required for advanced manufacturing equipment, cleanroom facilities, and sophisticated quality control systems pose a barrier for new entrants and can limit the expansion capabilities of smaller CMOs. Intellectual property concerns, confidentiality issues, and the need for robust quality agreements between pharma companies and CMOs also represent significant challenges. Furthermore, managing complex global supply chains and ensuring consistent quality across different manufacturing sites can be a logistical hurdle.

Opportunities for growth in the market are abundant, particularly in the realm of advanced manufacturing technologies like continuous manufacturing, 3D printing, and hot-melt extrusion, which offer enhanced efficiency, flexibility, and the ability to produce personalized medicines. The expansion into emerging markets, such as those in Asia Pacific and Latin America, provides significant untapped potential due to their growing healthcare expenditures and increasing demand for accessible medicines. The rising demand for biosimilars and generics also presents a lucrative opportunity for CMOs capable of cost-effective, high-volume production. Furthermore, CMOs that offer integrated services, including formulation development, analytical services, and packaging, are poised for greater success by providing comprehensive solutions to their clients. The overall impact forces on the market are strong and positive, primarily driven by demographic shifts, healthcare infrastructure improvements, and continuous innovation in drug development, all of which underscore the indispensable role of OSD contract manufacturing.

Segmentation Analysis

The Oral Solid Dosage Contract Manufacturing Market is comprehensively segmented across several dimensions including product type, dosage form, application, and end-user. This granular segmentation provides a detailed understanding of market dynamics, identifies key growth areas, and highlights specific demands within the pharmaceutical outsourcing landscape. Each segment is influenced by distinct factors, allowing for targeted strategic planning and development within the industry. Analyzing these segments helps stakeholders identify market niches, understand competitive positioning, and anticipate future trends in OSD manufacturing services.

The product type segmentation differentiates between immediate release and modified release formulations, each with unique manufacturing complexities and therapeutic applications. Dosage form segmentation delves into the specific types of oral solids, such as various tablet forms, capsule types, and powdered preparations. Application segmentation categorizes the market based on the therapeutic areas served, reflecting the prevalence of specific diseases and the intensity of drug development efforts in those fields. Finally, end-user segmentation distinguishes between different types of pharmaceutical clients, recognizing their varying needs for manufacturing scale, expertise, and service integration. This multi-faceted approach ensures a holistic view of the market's structure and operational characteristics.

- Product Type:

- Immediate Release

- Modified Release (Extended Release, Delayed Release, Pulsatile Release)

- Dosage Form:

- Tablets (Uncoated Tablets, Coated Tablets, Effervescent Tablets, Chewable Tablets, Orally Disintegrating Tablets)

- Capsules (Hard Gelatin Capsules, Soft Gelatin Capsules)

- Powders/Granules (Sachets, Oral Powders for Reconstitution)

- Application:

- Oncology

- Cardiology

- Central Nervous System (CNS) Disorders

- Diabetes

- Pain Management

- Infectious Diseases

- Respiratory Diseases

- Gastrointestinal Disorders

- Others

- End User:

- Big Pharmaceutical Companies

- Small and Mid-sized Pharmaceutical Companies

- Biotech Companies

- Generic Drug Manufacturers

- Virtual Pharmaceutical Companies

Value Chain Analysis For Oral Solid Dosage Contract Manufacturing Market

The value chain for the Oral Solid Dosage Contract Manufacturing Market begins with upstream activities, primarily involving the sourcing and supply of critical raw materials, including Active Pharmaceutical Ingredients (APIs), excipients, and packaging components. Key upstream suppliers are chemical manufacturers, specialized ingredient providers, and packaging solution companies. These suppliers play a crucial role in ensuring the quality, purity, and timely delivery of materials that directly impact the final product's efficacy and safety. Strong relationships with reliable upstream partners are essential for CMOs to maintain consistent production schedules and regulatory compliance.

Further along the value chain, CMOs represent the core manufacturing stage, converting raw materials into finished oral solid dosage forms. This involves a range of complex processes such as formulation development, blending, granulation, compression, encapsulation, coating, and packaging. CMOs leverage their specialized equipment, technical expertise, and quality management systems to meet client specifications and regulatory requirements. After manufacturing, the downstream activities involve the distribution of these finished pharmaceutical products. This stage includes logistics, warehousing, and transportation to ensure products reach their intended markets efficiently and safely.

Distribution channels in the OSD contract manufacturing market can be broadly categorized into direct and indirect methods. Direct distribution typically involves the CMO shipping finished products directly to the client pharmaceutical company, which then manages its own sales and distribution network to wholesalers, pharmacies, and healthcare providers. Indirect distribution, on the other hand, involves intermediaries such as third-party logistics (3PL) providers, specialized pharmaceutical distributors, or master distributors who handle the storage and delivery of products on behalf of the client. The choice of distribution channel often depends on the client's global reach, supply chain capabilities, and regulatory requirements of the target markets. Both models require robust cold chain management, security, and traceability protocols to maintain product integrity and ensure patient safety.

Oral Solid Dosage Contract Manufacturing Market Potential Customers

The primary potential customers for Oral Solid Dosage Contract Manufacturing services are pharmaceutical and biotechnology companies of varying sizes, all seeking to leverage external expertise and capacity for their drug production needs. Large pharmaceutical corporations, despite often possessing extensive in-house manufacturing capabilities, frequently outsource OSD production to manage peak demands, access specialized technologies for complex formulations, or reduce capital expenditure by divesting non-core assets. Their outsourcing decisions are often strategic, aimed at optimizing their global supply chains, mitigating risks, and accelerating market entry for new drugs.

Small and mid-sized pharmaceutical companies and emerging biotech firms represent another significant customer segment. These companies typically lack the substantial capital investment required for establishing and maintaining their own manufacturing facilities, making CMOs an indispensable partner. They rely on CMOs for comprehensive services ranging from early-stage formulation development and clinical trial material production to commercial-scale manufacturing, benefiting from the CMOs' regulatory expertise, quality systems, and advanced equipment. This allows them to bring innovative therapies to market without the burden of extensive manufacturing infrastructure.

Furthermore, generic drug manufacturers are increasingly utilizing OSD contract manufacturing services to achieve cost efficiencies and rapid market entry for their products. CMOs offer the capability to produce high volumes of generic drugs at competitive prices while adhering to strict quality standards. Virtual pharmaceutical companies, which operate without their own research, development, or manufacturing infrastructure, are entirely dependent on CMOs for bringing their drug candidates to fruition. Additionally, academic institutions involved in drug discovery and specialized nutraceutical companies also form part of the expanding customer base, seeking contract manufacturers with the flexibility and scientific rigor required for their unique product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $42.5 billion |

| Market Forecast in 2032 | $69.0 billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group AG, Catalent Inc., Thermo Fisher Scientific Inc. (Patheon), Recipharm AB, Siegfried Holding AG, AbbVie Inc. (Allergan PLC), Aenova Group, CordenPharma International, Fareva, Piramal Pharma Solutions, Boehringer Ingelheim, Evonik Industries AG, Fuji Pharma Co. Ltd., WuXi AppTec, Vetter Pharma-Fertigung GmbH & Co. KG, Dishman Carbogen Amcis Ltd., Sanofi, Merck KGaA, Takeda Pharmaceutical Company Limited, Pfizer CentreOne |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oral Solid Dosage Contract Manufacturing Market Key Technology Landscape

The Oral Solid Dosage Contract Manufacturing Market is characterized by a rapidly evolving technological landscape, driven by the need for increased efficiency, improved product quality, and the ability to handle increasingly complex drug formulations. Continuous manufacturing, which involves an uninterrupted process from raw material feeding to final product discharge, is gaining significant traction due to its potential to reduce manufacturing time, cost, and footprint, while enhancing product consistency and quality control. This paradigm shift from traditional batch processing offers considerable advantages in terms of process optimization and regulatory compliance, particularly for high-volume products.

Beyond continuous manufacturing, other advanced technologies are playing a pivotal role. Hot-melt extrusion (HME) and spray drying are critical for improving the solubility and bioavailability of poorly soluble active pharmaceutical ingredients (APIs), enabling the development of more effective drug products. Furthermore, 3D printing, also known as additive manufacturing, is emerging as a promising technology for producing personalized medicines and complex dosage forms with precise control over drug release profiles. This technology offers unprecedented flexibility in design and can cater to small batch sizes, which is increasingly relevant for orphan drugs and personalized therapies.

Automation, digitalization, and the integration of data analytics and Artificial Intelligence (AI) are transforming the operational aspects of OSD contract manufacturing. Automated systems minimize human error, increase throughput, and ensure greater process consistency. Digitalization facilitates seamless data capture, real-time monitoring, and electronic batch record management, improving traceability and regulatory reporting. The application of advanced analytics and AI allows for predictive maintenance, process optimization, and proactive quality control, ultimately leading to more robust and efficient manufacturing processes. Additionally, specialized coating technologies, such as enteric coatings and extended-release coatings, continue to be essential for tailoring drug release kinetics and protecting sensitive APIs, further highlighting the advanced technical capabilities required in this market.

Regional Highlights

- North America: This region holds a substantial share of the Oral Solid Dosage Contract Manufacturing Market, driven by a well-established pharmaceutical industry, significant R&D investments, and a high demand for advanced therapies. The presence of numerous large pharmaceutical companies and a strong outsourcing trend contribute to its market dominance. Stringent regulatory frameworks and a focus on quality further bolster the market's growth, pushing CMOs to invest in cutting-edge technologies and expertise.

- Europe: Europe represents another major hub for OSD contract manufacturing, characterized by robust pharmaceutical innovation, a highly skilled workforce, and a strong regulatory environment. Countries like Germany, France, and the UK are key players, with a strong focus on high-quality manufacturing and specialized services for complex formulations. The region benefits from significant investments in biotechnological research and development, fostering a demand for sophisticated contract manufacturing solutions.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for Oral Solid Dosage Contract Manufacturing. This growth is primarily attributed to lower operating costs, increasing government support for the pharmaceutical sector, a vast patient population, and a growing emphasis on affordable healthcare. Countries such as India and China are emerging as manufacturing powerhouses, attracting investments due to their strong manufacturing capabilities, availability of skilled labor, and favorable regulatory policies aimed at boosting local production and exports.

- Latin America: This region exhibits emerging opportunities in the OSD contract manufacturing market, driven by increasing healthcare expenditure, expanding access to medicines, and growing pharmaceutical markets in countries like Brazil and Mexico. While still developing compared to more mature markets, the region offers potential for CMOs looking to expand their global footprint and serve local pharmaceutical needs.

- Middle East and Africa (MEA): The MEA region is a nascent but promising market, spurred by rising chronic disease prevalence, improving healthcare infrastructure, and government initiatives to enhance domestic pharmaceutical production. Untapped potential exists for contract manufacturers willing to navigate diverse regulatory landscapes and cater to specific regional health demands, often focusing on essential and generic medicines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oral Solid Dosage Contract Manufacturing Market.- Lonza Group AG

- Catalent Inc.

- Thermo Fisher Scientific Inc. (Patheon)

- Recipharm AB

- Siegfried Holding AG

- AbbVie Inc. (Allergan PLC)

- Aenova Group

- CordenPharma International

- Fareva

- Piramal Pharma Solutions

- Boehringer Ingelheim

- Evonik Industries AG

- Fuji Pharma Co. Ltd.

- WuXi AppTec

- Vetter Pharma-Fertigung GmbH & Co. KG

- Dishman Carbogen Amcis Ltd.

- Sanofi

- Merck KGaA

- Takeda Pharmaceutical Company Limited

- Pfizer CentreOne

Frequently Asked Questions

What are the primary benefits of outsourcing Oral Solid Dosage (OSD) manufacturing?

Outsourcing OSD manufacturing offers pharmaceutical companies specialized expertise, reduced capital expenditure, accelerated time to market, enhanced scalability for production, and access to advanced technologies and regulatory compliance support without significant internal investment.

How does the OSD contract manufacturing market address complex drug formulations?

CMOs leverage advanced technologies such as hot-melt extrusion, spray drying, and specialized coating techniques to effectively handle complex formulations, including poorly soluble drugs, high-potency active pharmaceutical ingredients (APIs), and various modified-release profiles.

What regulatory challenges exist in Oral Solid Dosage contract manufacturing?

Regulatory challenges involve adhering to diverse global Good Manufacturing Practices (GMP) and evolving standards, managing complex documentation, ensuring data integrity across processes, and navigating varying regional drug approval processes, all requiring robust quality management systems.

Which regions are driving the growth of the Oral Solid Dosage contract manufacturing market?

Asia Pacific, particularly India and China, is a significant growth driver due to lower manufacturing costs and increasing pharmaceutical R&D investment. North America and Europe also maintain strong market shares driven by established pharmaceutical industries and ongoing outsourcing trends.

What impact do personalized medicine and orphan drugs have on OSD contract manufacturing?

Personalized medicine and orphan drugs increase demand for flexible, small-batch manufacturing capabilities and specialized expertise in unique formulations. This prompts CMOs to invest in adaptable technologies and services tailored for these niche, high-value markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager