Organic Dyes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430217 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Organic Dyes Market Size

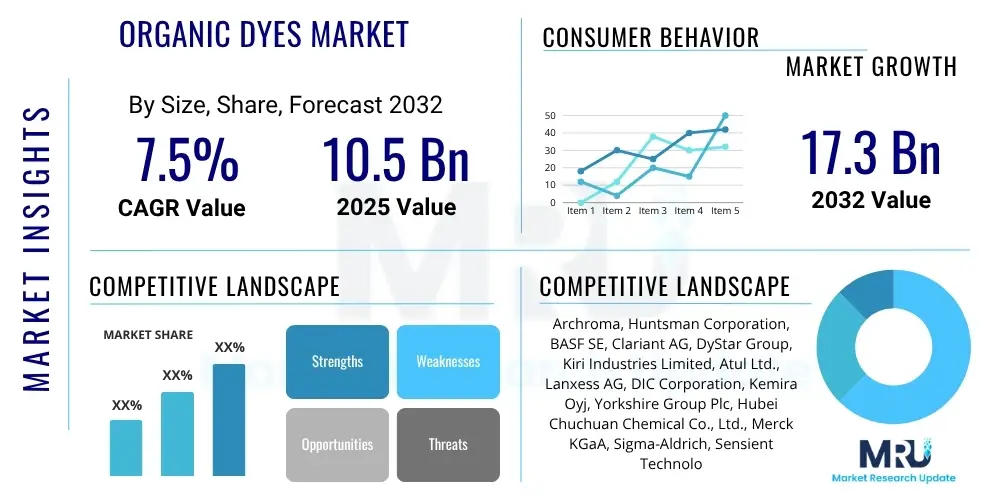

The Organic Dyes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at $10.5 Billion in 2025 and is projected to reach $17.3 Billion by the end of the forecast period in 2032.

Organic Dyes Market introduction

The Organic Dyes Market constitutes a critical segment of the global specialty chemicals industry, providing sophisticated coloring agents essential for myriad industrial applications. These dyes are molecular compounds characterized by their ability to absorb specific wavelengths of light and transmit or reflect others, thereby imparting vivid color to various substrates. Distinguished from pigments by their solubility in the application medium, organic dyes penetrate materials, ensuring excellent colorfastness, vibrancy, and a broad spectrum of achievable hues. Historically rooted in natural sources, the market has predominantly shifted towards synthetic organic dyes due to their cost-effectiveness, consistency, and expanded color palette. However, a significant resurgence and innovation in natural and bio-based organic dyes are currently shaping the industry's sustainable future, driven by heightened environmental awareness and regulatory pressures across the globe. This dynamic market is crucial for enhancing the aesthetic appeal and perceived value of a vast array of consumer and industrial products, ranging from everyday apparel to advanced technical textiles and specialized coatings, underscoring its indispensable role in modern manufacturing.

The product portfolio within the organic dyes market is exceptionally diverse, encompassing a wide range of chemical classes, each designed for specific performance characteristics and application requirements. Key types include azo dyes, known for their versatility and wide color range; anthraquinone dyes, recognized for their superior lightfastness and heat resistance; phthalocyanine dyes, celebrated for their brilliant blue and green shades and excellent stability; and triphenylmethane dyes, which offer intense, bright colors. Other important categories comprise reactive dyes, which chemically bond with textile fibers, and disperse dyes, tailored for hydrophobic synthetic fibers. The benefits derived from organic dyes are extensive, including their ability to produce deep, rich colors that are difficult to achieve with inorganic alternatives, their excellent dyeing properties across different fiber types, and their contribution to product differentiation through diverse color aesthetics. These attributes make organic dyes indispensable for industries that prioritize visual appeal, durability, and functional performance in their end products, maintaining consistent demand for innovative and high-quality coloring solutions.

The major applications of organic dyes span critical sectors of the global economy. The textile industry remains the largest consumer, leveraging organic dyes for cotton, wool, silk, polyester, and nylon to produce everything from fashion apparel and home furnishings to high-performance sportswear and automotive interiors. Beyond textiles, organic dyes are extensively used in the leather industry to enhance the color and finish of various leather goods, in the paper industry for coloring paper, cardboard, and specialty papers, and in the plastics sector for integrated coloration of polymers used in consumer electronics, automotive parts, and packaging. The paints and coatings industry utilizes organic dyes to formulate vibrant and durable finishes for vehicles, buildings, and industrial equipment, while the printing inks industry relies on them for everything from newspapers to high-quality digital prints. Furthermore, high-purity, certified organic dyes find applications in the food and beverage industry for coloring edible products, and in the pharmaceutical and cosmetics sectors for drug coatings, personal care items, and decorative cosmetics. The driving factors behind this expansive market include rising global population and urbanization, increasing disposable incomes in developing economies leading to higher consumption of dyed products, evolving fashion trends, technological advancements in dyeing machinery, and a persistent focus on product innovation to meet specific end-user demands for both aesthetics and sustainability.

- Market Intro: Global industry providing soluble organic coloring agents for diverse applications.

- Product Description: Molecular compounds imparting vivid color, superior to pigments in penetration and fastness; types include azo, anthraquinone, phthalocyanine, triphenylmethane, reactive, and disperse dyes.

- Major Applications: Dominantly textiles, leather, paper, plastics, paints and coatings, printing inks, food and beverages, pharmaceuticals, and cosmetics.

- Benefits: High color vibrancy, excellent colorfastness (light, wash), broad hue spectrum, strong aesthetic appeal, functional integration in materials.

- Driving factors: Industrial growth, rising global population and disposable income, evolving fashion trends, technological advancements, increasing demand for product aesthetics and differentiation, sustainability initiatives.

Organic Dyes Market Executive Summary

The Organic Dyes Market is currently demonstrating robust expansion, primarily fueled by the unwavering growth of key end-use industries such as textiles, packaging, and automotive, especially within rapidly industrializing economies. A defining business trend is the pronounced industry-wide pivot towards sustainable manufacturing practices and the intensive development of eco-friendly dye formulations. Leading market players are allocating substantial investments into research and development initiatives, aiming to innovate non-toxic, biodegradable, and water-efficient dyes that effectively address escalating global environmental regulations and cater to a discerning consumer base increasingly prioritizing sustainable products. The competitive landscape is also marked by strategic consolidation activities, including mergers and acquisitions, as major chemical corporations strive to broaden their product portfolios, enhance geographical footprint, and optimize supply chain efficiencies, thereby solidifying their market dominance and fostering economies of scale in a highly competitive global arena.

Regionally, the market dynamics present a varied picture with distinct growth drivers. The Asia Pacific (APAC) region continues its undisputed leadership in the organic dyes market, primarily propelled by its vast and rapidly expanding textile and manufacturing sectors, with countries like China, India, Vietnam, and Bangladesh acting as significant production and consumption hubs. This dominance is further amplified by a substantial consumer population, rising disposable incomes, and comparatively lower operational costs, which collectively attract significant foreign direct investment into the region’s chemical and manufacturing industries. In contrast, mature markets such as Europe and North America are characterized by their pioneering efforts in sustainable dye innovations, advanced regulatory compliance, and a strong demand for high-performance, specialized, and environmentally responsible coloring solutions. These regions are setting benchmarks for eco-labeling and chemical management, influencing global best practices. Meanwhile, Latin America and the Middle East and Africa (MEA) are emerging as promising growth territories, experiencing increased demand driven by ongoing industrialization, infrastructural development, and the diversification of their respective manufacturing bases, although these regions often contend with developing regulatory frameworks and a reliance on imported advanced dye technologies.

An in-depth analysis of segmentation trends reveals a persistent reliance on synthetic organic dyes for their cost-effectiveness, consistency in color reproduction, and wide functional applicability, although the segment of natural organic dyes is experiencing considerable resurgence due to heightened environmental consciousness and their suitability for niche premium applications. Among synthetic varieties, azo dyes continue to command a significant market share owing to their synthetic ease and extensive color range, even as continuous innovation focuses on developing safer, non-carcinogenic alternatives. Anthraquinone and phthalocyanine derivatives are seeing increased uptake in specialized, high-performance applications demanding exceptional light and weather fastness. From an application perspective, the textile industry remains the perennial largest consumer; however, significant growth is now being observed in sectors like food and beverage, pharmaceuticals, and cosmetics, where strict regulatory approvals and consumer safety are paramount. Furthermore, the advent and rapid adoption of digital textile printing technologies are creating a burgeoning demand for specialized digital printing dyes, signifying a technological shift that mandates agile product development and advanced dye formulations optimized for precise and efficient application, reshaping the future landscape of dye consumption patterns.

- Business Trends: Escalating focus on sustainability, extensive R&D into eco-friendly and non-toxic dye formulations, strategic market consolidation through M&A, and optimization of global supply chains for resilience and efficiency.

- Regional Trends: Asia Pacific (APAC) maintaining market dominance due to manufacturing prowess; Europe and North America leading in sustainable innovation and regulatory compliance for high-performance dyes; Latin America and MEA exhibiting promising growth fueled by industrialization.

- Segments trends: Continued prevalence of synthetic dyes with a growing emphasis on natural and bio-based alternatives; prominent growth in textile applications alongside significant expansion into food, pharmaceutical, and cosmetic sectors; rising demand for digital printing specific dyes reflecting technological shifts.

AI Impact Analysis on Organic Dyes Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the organic dyes market frequently probe its capacity to fundamentally transform processes ranging from molecular discovery to advanced manufacturing and intricate supply chain logistics. Stakeholders are particularly keen on understanding how AI algorithms can substantially accelerate the ideation and development of novel dye molecules endowed with superior properties, dramatically curtailing the exhaustive time and significant capital expenditure traditionally associated with research and development cycles. Furthermore, considerable interest is directed towards AI's potential to optimize operational efficiencies and enhance the sustainability profile of dyeing and finishing processes. While the prospective benefits are widely acknowledged, concerns often surface regarding the substantial initial investment required for the seamless integration of sophisticated AI systems, the imperative for a highly skilled workforce proficient in managing and interpreting AI outputs, and the broader socioeconomic implications, including potential workforce displacement. Despite these considerations, there are widespread expectations for AI to be instrumental in driving predictive analytics for discerning market trends, enabling personalized and precise dye formulations, and establishing smarter, real-time quality control mechanisms, all of which are anticipated to culminate in more efficient, compliant, and innovatively driven dye production paradigms.

The integration of advanced Artificial Intelligence within the organic dyes market is poised to introduce profoundly transformative changes, directly addressing longstanding industry challenges and unlocking unprecedented avenues for innovation. AI's most impactful application lies in accelerating the discovery and design of new dye molecules. By leveraging machine learning models, AI can analyze colossal datasets of chemical structures, synthesis pathways, spectroscopy results, and performance metrics to predict molecular properties and reactivity with remarkable accuracy. This capability enables chemists to virtually screen millions of potential dye candidates, identify optimal structures for desired colorfastness, toxicity profiles, and environmental biodegradability, and then prioritize only the most promising compounds for physical synthesis and testing. This 'in silico' approach drastically reduces the reliance on traditional, labor-intensive, and often costly experimental trial-and-error methodologies, thereby shortening development cycles, reducing raw material waste, and facilitating the rapid introduction of safer and more effective dyes to the market. Furthermore, AI-driven simulations can meticulously model complex molecular interactions and predict dye behavior under various environmental conditions, empowering manufacturers to design highly stable and vibrant dyes precisely tailored for specific applications, thus pushing the very boundaries of chemical engineering and material science in the pursuit of superior coloring solutions.

Beyond the realm of molecular discovery, AI is progressively exerting a significant influence across the manufacturing operations and intricate supply chain management of organic dyes. In manufacturing facilities, AI-powered systems are being deployed to dynamically optimize production parameters, such as reaction temperatures, pressures, and reagent concentrations, thereby maximizing yield, minimizing energy consumption, and ensuring unwavering product consistency and quality. Machine learning algorithms facilitate predictive maintenance by analyzing sensor data from machinery to anticipate and prevent equipment failures, significantly reducing unscheduled downtime and operational costs. For the supply chain, AI is revolutionizing demand forecasting by processing historical sales data, seasonal trends, and external economic indicators with unprecedented accuracy. This enhanced foresight allows for optimized inventory management, streamlined logistics, and improved responsiveness to sudden market fluctuations, ensuring that the right dyes are available at the right time, thereby reducing waste and enhancing overall supply chain resilience. The holistic integration of AI tools promises to usher in a new era of agility, efficiency, and environmental consciousness within the organic dyes industry, fostering a more adaptive and technologically advanced future for global dye production and distribution networks.

- Accelerated R&D: AI expedites the discovery and design of novel dye molecules by predicting properties and optimizing chemical structures, significantly reducing time and cost.

- Process Optimization: AI enhances manufacturing efficiency, minimizes waste, and ensures consistent product quality through real-time monitoring and predictive control of production parameters.

- Supply Chain Management: AI improves demand forecasting accuracy, optimizes inventory levels, and streamlines logistics, leading to greater supply chain resilience and responsiveness.

- Sustainable Dye Development: AI assists in the design of eco-friendly dyes with reduced toxicity and environmental impact, supporting green chemistry initiatives.

- Quality Control and Assurance: AI-driven systems provide advanced, real-time quality monitoring and anomaly detection, ensuring higher product standards.

- Predictive Maintenance: AI leverages sensor data to forecast equipment failures, minimizing downtime and optimizing maintenance schedules in manufacturing plants.

- Personalized Formulations: AI allows for the rapid development of custom dye formulations tailored to specific customer or application requirements.

DRO & Impact Forces Of Organic Dyes Market

The Organic Dyes Market operates within a dynamic framework influenced by a complex interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory and strategic direction. A primary driver for market expansion is the consistently escalating demand from a multitude of end-use industries, most notably textiles, plastics, and coatings. These sectors are experiencing significant growth globally, particularly within burgeoning economies fueled by population expansion, rapid urbanization, and steadily increasing disposable incomes. The intrinsic advantages offered by organic dyes, such as their unparalleled color vibrancy, exceptional fastness properties against light and washing, and broad applicability across diverse substrates, continue to reinforce their indispensable utility and drive widespread market adoption. Moreover, ongoing technological advancements in advanced dyeing processes and the relentless development of high-performance, functional dyes specifically engineered for specialized, high-value applications further act as potent catalysts for sustained market expansion, pushing the boundaries of what is chemically and aesthetically possible.

However, the market also contends with formidable restraints that necessitate strategic navigation. Paramount among these are the increasingly stringent global environmental regulations governing the production, usage, and disposal of synthetic dyes. These regulations, often addressing concerns over toxic effluents, non-biodegradable waste, and potential health hazards associated with certain chemical compounds, impose considerable compliance burdens and drive up operational costs for manufacturers. The inherent volatility in the prices of critical raw materials, predominantly petrochemical derivatives, represents another significant challenge, directly impacting production costs, profit margins, and long-term investment planning. Furthermore, intense competition from alternative coloring technologies, including inorganic pigments and advanced digital printing methods that bypass traditional dyeing, can limit market penetration in specific niche applications. The substantial capital expenditure required for establishing and maintaining state-of-the-art dye manufacturing facilities, coupled with the critical need for highly specialized technical expertise and adherence to complex safety standards, also acts as a significant barrier to entry, potentially hindering market diversification and the emergence of new innovative players.

Despite these significant challenges, the Organic Dyes Market is replete with substantial opportunities that promise lucrative avenues for growth and innovation. The surging global consumer and industrial preference for eco-friendly and sustainably produced products is a powerful catalyst fostering intensive research and development into natural organic dyes and bio-based synthetic alternatives. This trend is opening entirely new market segments and driving the adoption of green chemistry principles throughout the value chain. Groundbreaking advancements in fields such as nanotechnology and biotechnology are offering unprecedented prospects for developing novel dyes with highly enhanced functionalities, including superior UV resistance, integrated antimicrobial properties, and even 'smart' color-changing capabilities responsive to external stimuli. The rapid ascent of digital textile printing technology, demanding highly specialized and precise organic dyes, represents a particularly high-growth segment. Additionally, the expanding application scope within rigorously regulated yet high-growth sectors like food and beverage, pharmaceuticals, and cosmetics, driven by stringent safety approvals and escalating consumer demand for colored products, presents significant potential for market players to strategically diversify their portfolios, capture new market share, and leverage the unique, safe properties of advanced organic dyes. These opportunities encourage continuous innovation and strategic repositioning within the industry.

- Drivers:

- Exponential growth in end-use industries (textiles, plastics, coatings).

- Increasing global population and rising disposable incomes in developing regions.

- Superior aesthetic properties (vibrancy, color depth) and functional characteristics (fastness).

- Continuous technological advancements in dye synthesis and application methodologies.

- Evolving consumer preferences for colorful and durable products.

- Growing demand for specialized and high-performance functional dyes.

- Restraints:

- Strict and evolving environmental regulations concerning dye production and effluent management.

- Significant volatility in the prices of key petrochemical-derived raw materials.

- Intensified competition from inorganic pigments and emerging alternative coloring technologies.

- High capital investment and advanced technical expertise required for advanced manufacturing.

- Public and regulatory concerns over the toxicity and biodegradability of certain synthetic dyes.

- Supply chain disruptions affecting raw material availability and logistics.

- Opportunities:

- Accelerated demand for natural and bio-based organic dyes driven by sustainability trends.

- Breakthrough innovations in nanotechnology and biotechnology leading to 'smart' and functional dyes.

- Rapid expansion of digital textile printing necessitating specialized dye formulations.

- Diversification into high-growth, highly regulated applications: food, cosmetics, pharmaceuticals.

- Development of advanced dyes with enhanced properties like UV protection, antimicrobial features, and thermochromism.

- Emergence of new markets in sustainable and eco-certified products.

- Impact Forces:

- Global regulatory shifts towards stricter environmental protection and chemical safety.

- Escalating consumer preference for transparent, sustainable, and ethically produced goods.

- Rapid technological disruption in chemical synthesis, material science, and digital application methods.

- Macroeconomic trends including industrialization in emerging markets and global trade policies.

- Intensified focus on supply chain resilience, raw material sourcing, and localized production capabilities.

Segmentation Analysis

The Organic Dyes Market is meticulously segmented across various crucial parameters, including the chemical type of the dye, its specific end-use application, and its fundamental source (natural or synthetic). This detailed segmentation provides an invaluable framework for a granular understanding of the intricate market dynamics, evolving consumer preferences, and significant technological shifts occurring within specific sub-sectors. Each identified segment, whether defined by chemical composition, industrial utility, or origin, exhibits distinct growth drivers, faces unique operational challenges, and is profoundly influenced by regional regulatory environments, the availability and cost of raw materials, and the highly specialized requirements of end-users. A thorough analysis of these segments is indispensable for all market stakeholders seeking to identify nascent opportunities, craft highly targeted strategic initiatives, and continuously optimize their product portfolios to ensure sustained growth, foster innovation, and maintain a robust competitive advantage in an increasingly complex and interconnected global market for coloring agents. This comprehensive categorization vividly reflects the vast chemical diversity and unparalleled functional versatility inherent in modern organic coloring agents, enabling precise market positioning.

Categorization by type reveals several dominant classes of organic dyes that define the market landscape. Azo dyes, characterized by the presence of one or more azo groups (-N=N-), historically command the largest market share due to their synthetic ease, cost-effectiveness, and ability to produce a broad spectrum of intense colors. However, increasing global scrutiny over certain carcinogenic azo compounds has spurred continuous innovation towards safer alternatives and stringent regulatory compliance. Anthraquinone dyes, derived from anthraquinone, are highly valued for their exceptional lightfastness, heat resistance, and good fastness properties, making them indispensable for demanding applications such as automotive textiles and high-performance coatings. Phthalocyanine dyes, typically brilliant blue and green, are renowned for their outstanding stability, excellent tinting strength, and resistance to environmental degradation. Triphenylmethane dyes offer extremely bright and intense shades, particularly in blues and greens, though their lightfastness can sometimes be moderate. Other significant categories encompass highly reactive dyes, which form covalent bonds with fibers for superior wet fastness, disperse dyes specifically designed for hydrophobic synthetic fibers, and vat dyes known for their exceptional fastness properties for cellulosic materials, each catering to highly specialized industrial needs and advanced textile processing techniques, reflecting a continuous evolution in chemical engineering.

From an application standpoint, the textile industry remains the cornerstone of organic dye consumption, utilizing an extensive array of dyes to color natural fibers like cotton, wool, and silk, as well as synthetic fibers such as polyester, nylon, and acrylic, for everything from fashion apparel to technical textiles and home furnishings. The leather industry constitutes another substantial customer base, employing organic dyes to impart rich and deep, durable colors to hides and skins, which are subsequently transformed into premium footwear, sophisticated garments, luxurious upholstery, and a wide array of fashion accessories. The paper and pulp industry forms a critical customer segment, employing organic dyes for the coloration of diverse paper products, including printing papers, sustainable packaging materials, and a variety of specialty papers, where shade uniformity, light stability, and stringent environmental compatibility are paramount. Furthermore, the paints and coatings industry utilizes organic dyes to formulate vibrant, durable, and weather-resistant finishes for automotive applications, industrial machinery, and architectural surfaces. Printing inks, essential for everything from high-volume newspapers and magazines to sophisticated digital media, packaging, and graphic arts, represent another major application, demanding dyes with high color intensity, excellent printability, and rapid drying characteristics. In the plastics industry, organic dyes are crucial for integrated coloration of polymer compounds used in consumer goods, automotive components, and construction materials, where superior heat stability, migration resistance, and optimal dispersion characteristics within polymer matrices are critical. In more specialized, highly sensitive sectors, the food and beverage industry employs certified food-grade organic dyes for product coloration, while the pharmaceutical and cosmetics sectors utilize high-purity, extensively tested dyes for drug coatings, personal care items, and decorative cosmetic products, with strict regulatory approvals, non-toxicity, and guaranteed safety requirements unequivocally dictating product selection. This exceptionally broad customer base profoundly underscores the pervasive and evolving demand for high-quality organic dyes in contemporary manufacturing and consumer goods production across the globe.

- By Type:

- Azo Dyes: Largest segment, versatile, wide color range, ongoing development of safer alternatives.

- Anthraquinone Dyes: Excellent lightfastness and heat resistance, suitable for demanding applications.

- Phthalocyanine Dyes: Superior stability, brilliant blue and green hues, high tinting strength.

- Triphenylmethane Dyes: Intense, bright shades, moderate fastness properties, used for specific vibrant colors.

- Other Dyes:

- Indigo Dyes: Natural or synthetic, known for denim coloration.

- Sulfur Dyes: Cost-effective, good fastness, used for dark shades on cellulosic fibers.

- Reactive Dyes: Form covalent bonds with fibers, excellent wet fastness, used for cotton, rayon.

- Disperse Dyes: Suitable for hydrophobic synthetic fibers (polyester, nylon), good fastness.

- Vat Dyes: Exceptional colorfastness, used for heavy-duty textiles.

- By Application:

- Textiles: Dominant segment, for natural and synthetic fibers across apparel, home, and technical textiles.

- Leather: Coloring hides and skins for footwear, garments, and accessories.

- Paper: Coloring printing paper, packaging, and specialty papers.

- Paints and Coatings: Automotive, industrial, and architectural finishes.

- Inks: Printing inks for commercial, digital, and packaging applications.

- Food and Beverages: Certified food coloring for various edible products.

- Plastics: Integrated coloration of polymers in consumer goods, automotive, and construction.

- Pharmaceuticals: Drug coatings, medical diagnostics, and identification.

- Cosmetics: Makeup, personal care products, and hair dyes.

- Others: Agricultural products, photography, wood stains, detergents.

- By Source:

- Natural Organic Dyes: Derived from plants, insects, or minerals; growing demand due to sustainability trends.

- Synthetic Organic Dyes: Chemically synthesized; dominant due to cost-effectiveness, consistency, and wider color range.

Value Chain Analysis For Organic Dyes Market

The value chain for the Organic Dyes Market represents a complex, multi-stage network of interconnected activities that collectively add value to the product, from the initial sourcing of fundamental raw materials to the ultimate application of the dyes in final consumer goods. This intricate chain meticulously outlines the sequential processes, participants, and strategic relationships that define the industry’s operational framework. A comprehensive understanding of each distinct stage—encompassing upstream suppliers, midstream manufacturers, and downstream distributors and end-users—is critically important for market participants. Such an analysis allows for the precise identification of key cost drivers, potential operational bottlenecks, critical areas for process optimization, and strategic opportunities for collaboration and vertical integration. Furthermore, embedding principles of efficiency, environmental stewardship, and social responsibility at every point along this value chain is becoming increasingly vital, not only for maintaining market competitiveness but also for ensuring strict adherence to evolving global regulatory standards and meeting heightened stakeholder expectations for sustainable production practices.

The upstream segment of the value chain is primarily concerned with the meticulous procurement and processing of primary raw materials and essential chemical intermediates that form the foundational building blocks of organic dyes. These critical inputs are predominantly derived from petrochemical sources, including crucial compounds such as benzene, naphthalene, anthracene, toluene, and various derivatives like aniline, naphthol, and phenol. Manufacturers specializing in these fundamental commodity chemicals constitute the initial and pivotal link in the value chain, supplying the necessary precursors to organic dye producers. The consistent quality, reliable availability, and inherent price volatility of these petrochemical-derived raw materials exert a profound and direct impact on the production costs, overall operational efficiencies,

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $10.5 Billion |

| Market Forecast in 2032 | $17.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archroma, Huntsman Corporation, BASF SE, Clariant AG, DyStar Group, Kiri Industries Limited, Atul Ltd., Lanxess AG, DIC Corporation, Kemira Oyj, Yorkshire Group Plc, Hubei Chuchuan Chemical Co., Ltd., Merck KGaA, Sigma-Aldrich, Sensient Technologies Corporation, Chromatech Incorporated, Mitsubishi Chemical Corporation, Toyo Ink SC Holdings Co., Ltd., Sanyo Color Works, Ltd., Kyung-In Synthetic Corporation (KISCO) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

- Green Chemistry Principles: Implementation of sustainable synthetic routes, enzymatic catalysis, solvent-free reactions, and bio-based dye production to minimize environmental footprint.

- Nanotechnology in Dyes: Development of 'smart dyes' and functionalized nanoparticles with enhanced properties such as superior UV protection, antimicrobial activity, self-cleaning capabilities, and thermochromism.

- Digital Printing Technologies: Formulation of highly specialized reactive, acid, and disperse dyes optimized for industrial inkjet textile printing, ensuring precise color reproduction, efficiency, and reduced water usage.

- Advanced Process Control and Automation: Integration of automation, AI, and machine learning for real-time optimization of reaction conditions, quality monitoring, predictive maintenance, and overall operational efficiency in dye manufacturing.

- Bio-based Dye Synthesis: Intensive research into microbial fermentation, enzymatic processes, and plant extraction methods for developing renewable, biodegradable, and non-toxic dye sources.

- Functional Dyes: Creation of dyes with capabilities extending beyond mere coloration, including properties like photochromism, electrochromism, conductivity, and enhanced durability for specific applications.

- High-Throughput Screening: Use of automated platforms and computational chemistry for rapid screening and development of new dye molecules, accelerating R&D cycles.

Regional Highlights

Europe and North America collectively represent mature and highly developed markets, distinguished by exceedingly stringent environmental regulations, a pervasive emphasis on sustainability, and a strong demand for high-performance, specialized, and certified organic dyes. These regions are at the vanguard of innovation in green chemistry, pioneering the development of bio-based dyes, and driving advancements in specialized applications such as high-tech textiles, advanced automotive coatings, and premium consumer goods. The demand profile in these markets is typically for premium-grade, certified dyes characterized by low environmental impact, superior technical properties, and adherence to rigorous eco-labeling standards. Concurrently, Latin America and the Middle East and Africa (MEA) are emerging as promising growth territories for the organic dyes market. This growth is predominantly fueled by ongoing industrialization, significant urbanization, and the emergence of a burgeoning middle class, which collectively contribute to an increasing consumer base and diversifying manufacturing activities. Investments in critical infrastructure and local manufacturing capabilities are steadily rising in these regions, leading to a corresponding increase in the demand for various organic dyes. However, these markets often face challenges related to developing their own comprehensive regulatory standards regarding dye usage and effluent treatment, and may exhibit a greater reliance on imports for advanced dye technologies and specialized formulations. These distinct and evolving regional landscapes necessitate highly tailored market entry strategies, localized product development, and adaptive supply chain solutions for manufacturers and suppliers aiming for sustainable success in the global organic dyes industry.

- North America: Characterized by a strong focus on high-performance, specialty, and eco-friendly dyes; operates under stringent environmental regulations; mature market with steady innovation and demand for premium products.

- Europe: A global leader in sustainable dye technology, green chemistry, and circular economy initiatives; features a robust regulatory environment; high demand for certified, non-toxic, and environmentally benign dyes.

- Asia Pacific (APAC): The largest global market for both production and consumption, primarily driven by expansive textile and manufacturing industries in China, India, and Southeast Asia; increasing focus on environmental compliance and green solutions amid rapid industrial growth.

- Latin America: An emerging market experiencing significant industrial growth and urbanization; increasing demand from expanding textile, plastics, and automotive sectors; developing regulatory frameworks and growing local production capabilities.

- Middle East and Africa (MEA): Exhibiting promising growth fueled by diversification of economies, industrialization, and infrastructure development; increasing local demand for dyes, though often reliant on imports for advanced chemical technologies and specialized products.

- Impact of Regional Policies: Local trade agreements, environmental protection acts, and chemical safety regulations significantly influence market access, production costs, and product portfolios in each region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Dyes Market.- Archroma

- Huntsman Corporation

- BASF SE

- Clariant AG

- DyStar Group

- Kiri Industries Limited

- Atul Ltd.

- Lanxess AG

- DIC Corporation

- Kemira Oyj

- Yorkshire Group Plc

- Hubei Chuchuan Chemical Co., Ltd.

- Merck KGaA

- Sigma-Aldrich

- Sensient Technologies Corporation

- Chromatech Incorporated

- Mitsubishi Chemical Corporation

- Toyo Ink SC Holdings Co., Ltd.

- Sanyo Color Works, Ltd.

- Kyung-In Synthetic Corporation (KISCO)

Frequently Asked Questions

What are organic dyes and how do they differ from pigments?

Organic dyes are soluble molecular compounds that chemically bond with or dissolve into the substrate, imparting vibrant, lasting color through absorption of light. Unlike pigments, which are insoluble particles that coat surfaces, dyes penetrate materials, offering superior color depth and fastness properties such as washfastness and lightfastness.

Which industries are the primary consumers of organic dyes?

The primary consumers of organic dyes are the textile industry (for apparel, home furnishings, technical textiles), followed by leather, paper, plastics, paints and coatings, printing inks, and specialized applications in the food and beverage, pharmaceutical, and cosmetics sectors. Each industry has specific requirements for dye properties.

What are the key factors driving growth in the Organic Dyes Market?

Key growth drivers include the continuous expansion of major end-use industries globally, particularly in emerging economies, increasing consumer demand for aesthetically appealing and durable products, ongoing technological advancements in dye chemistry and application, and a rising focus on sustainable and eco-friendly dye solutions.

What are the main challenges faced by the organic dyes industry?

The main challenges include stringent and evolving global environmental regulations concerning dye production and effluent disposal, the significant volatility of petrochemical-derived raw material prices, intense competition from alternative coloring technologies, and the substantial capital investment required for advanced manufacturing and R&D.

How is technology, especially AI, transforming the Organic Dyes Market?

Technology, particularly AI, is transforming the market by accelerating the discovery and design of novel dye molecules through predictive modeling, optimizing manufacturing processes for efficiency and sustainability, and enhancing supply chain management. AI also contributes to the development of 'smart' and functional dyes with advanced properties and facilitates real-time quality control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager