Orthopedic Ambulatory Surgical Centers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427965 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Orthopedic Ambulatory Surgical Centers Market Size

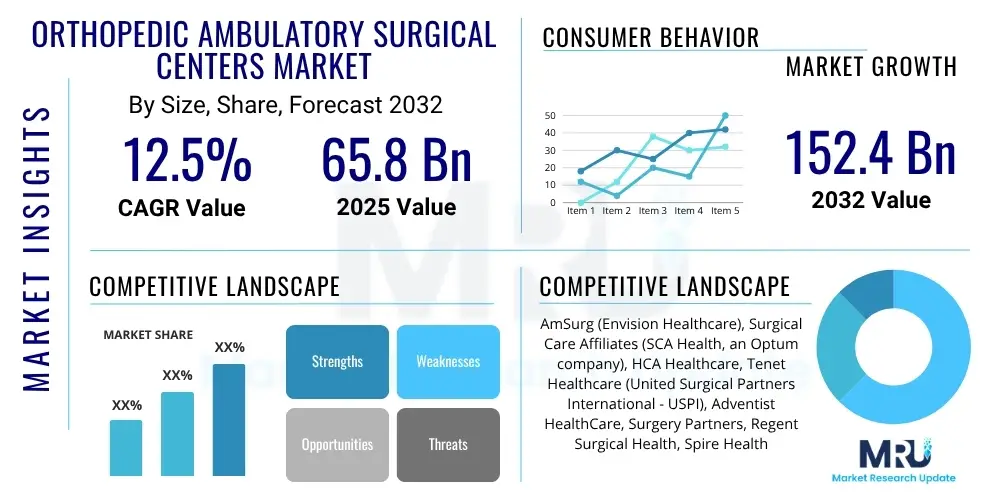

The Orthopedic Ambulatory Surgical Centers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 65.8 Billion in 2025 and is projected to reach USD 152.4 Billion by the end of the forecast period in 2032.

Orthopedic Ambulatory Surgical Centers Market introduction

The Orthopedic Ambulatory Surgical Centers (ASCs) market is a rapidly expanding segment within the broader healthcare industry, specializing in outpatient surgical procedures for various musculoskeletal conditions. These centers provide a cost-effective and convenient alternative to traditional hospital settings for elective orthopedic surgeries, driven by advancements in minimally invasive techniques, improved pain management protocols, and patient preference for faster recovery in a comfortable environment. The increasing prevalence of orthopedic conditions such as osteoarthritis, sports injuries, and spinal disorders across an aging global population significantly contributes to the escalating demand for orthopedic interventions performed in ASCs.

The product description within this market primarily encompasses a wide array of orthopedic surgical services, including but not limited to, joint arthroscopy, ligament reconstruction, fracture repair, and certain types of joint replacements. These services are delivered using state-of-the-art surgical equipment, advanced imaging technologies, and specialized rehabilitation support, ensuring high-quality patient care. Major applications span across sports medicine, trauma and fracture care, degenerative joint diseases, and corrective surgeries for congenital musculoskeletal issues. ASCs are increasingly becoming the preferred site for lower-risk, high-volume orthopedic procedures that do not necessitate an overnight hospital stay, thereby optimizing resource utilization and reducing healthcare expenditures.

The benefits associated with orthopedic ASCs are manifold, extending to both patients and healthcare providers. Patients experience reduced out-of-pocket costs, shorter wait times, personalized care, and a lower risk of hospital-acquired infections. For providers, ASCs offer greater operational efficiency, increased physician autonomy, and potentially higher patient satisfaction rates due to streamlined processes. Key driving factors propelling market growth include the shift towards value-based care models, favorable government reimbursement policies promoting outpatient settings, continuous technological innovations in surgical instruments and techniques, and a growing emphasis on patient-centric care. These elements collectively foster an environment conducive to the sustained expansion of the orthopedic ASC market globally, reshaping the landscape of orthopedic surgical delivery.

Orthopedic Ambulatory Surgical Centers Market Executive Summary

The Orthopedic Ambulatory Surgical Centers (ASCs) market is undergoing a significant transformation, marked by robust business trends that prioritize efficiency, cost-effectiveness, and patient experience. Consolidation activities, including mergers and acquisitions involving large healthcare systems and private equity firms, are prevalent as entities seek to scale operations, expand geographic reach, and leverage economies of scale. Furthermore, strategic partnerships between ASCs and device manufacturers are becoming more common, aiming to integrate supply chains and introduce advanced surgical technologies more rapidly. The increasing adoption of advanced data analytics and practice management software is optimizing scheduling, resource allocation, and patient flow, contributing to enhanced operational performance and profitability across the sector. Innovation in payment models, including bundled payments, is also driving providers to manage costs more effectively while maintaining high standards of care, further solidifying the business case for ASCs.

Regional trends indicate varied growth trajectories influenced by healthcare infrastructure, regulatory environments, and demographic factors. North America, particularly the United States, leads the market due to a well-established ASC network, high incidence of orthopedic conditions, and a favorable reimbursement landscape. Europe is witnessing steady growth, propelled by efforts to alleviate pressure on public healthcare systems and the increasing acceptance of outpatient procedures. The Asia Pacific region is emerging as a high-growth market, driven by rising healthcare expenditures, a burgeoning medical tourism sector, and improving access to advanced medical technologies in developing economies. Latin America and the Middle East & Africa also present significant opportunities, albeit with slower adoption rates, as healthcare reforms and investments in surgical infrastructure gradually increase, enhancing the accessibility and affordability of orthopedic care in these regions.

Segmentation trends within the orthopedic ASC market highlight dynamic shifts in procedure volume and facility ownership. By procedure type, joint replacement surgeries, especially total knee and hip arthroplasty, are increasingly migrating to ASCs, alongside a continued high volume of arthroscopic procedures and spine interventions. This migration is supported by innovations in pain management and surgical techniques that facilitate quicker recovery. In terms of facility ownership, physician-owned and hospital-physician joint venture ASCs remain dominant, but there is a growing trend towards corporate-owned or strategic partnership models, driven by the need for greater capital investment, administrative support, and access to broader networks. The demand for specialized orthopedic ASCs, focusing on specific body parts or conditions, is also on the rise, catering to niche patient populations and fostering centers of excellence. These trends underscore a market that is continually evolving to meet complex healthcare demands with greater specialization and efficiency.

AI Impact Analysis on Orthopedic Ambulatory Surgical Centers Market

The integration of Artificial Intelligence (AI) within Orthopedic Ambulatory Surgical Centers (ASCs) is a subject of intense discussion among stakeholders, with common user questions frequently revolving around the potential for enhanced diagnostic accuracy, streamlined operational efficiency, and personalized patient care pathways. Users are keen to understand how AI will impact surgical planning, real-time intraoperative guidance, and post-operative rehabilitation, alongside concerns about data privacy, the initial investment costs associated with AI implementation, and the necessity for specialized training among medical staff. Expectations are high regarding AI's ability to optimize resource utilization, reduce surgical complications, and ultimately improve patient outcomes in a cost-effective manner. There is also significant interest in AI's role in predictive analytics for patient risk stratification and optimizing inventory management within the fast-paced ASC environment, aiming for a future where intelligent systems augment human expertise rather than replace it.

- AI-powered diagnostic tools enhance imaging analysis for more precise orthopedic condition identification.

- Predictive analytics optimize surgical scheduling, reducing wait times and improving facility utilization.

- Robotic-assisted surgery, guided by AI, improves precision and reduces invasiveness of orthopedic procedures.

- AI algorithms personalize post-operative rehabilitation plans, leading to faster and more effective recovery.

- Intelligent inventory management systems reduce waste and ensure timely availability of surgical supplies.

- Machine learning models aid in patient risk stratification, identifying candidates suitable for ASC procedures.

- Virtual reality and augmented reality tools, often AI-enhanced, support surgeon training and intraoperative navigation.

DRO & Impact Forces Of Orthopedic Ambulatory Surgical Centers Market

The Orthopedic Ambulatory Surgical Centers (ASCs) market is propelled by a confluence of powerful drivers, key among them being the escalating demand for outpatient surgeries due to their inherent cost-effectiveness compared to traditional inpatient hospital settings. This cost advantage, combined with a patient preference for convenient, personalized care and faster recovery times outside of a hospital environment, significantly fuels market expansion. Technological advancements in minimally invasive surgical techniques, improved anesthesia protocols, and sophisticated pain management strategies enable a broader range of orthopedic procedures to be safely performed in an outpatient setting. Furthermore, supportive regulatory and reimbursement policies from government bodies and private payers increasingly favor ASCs, recognizing their potential to reduce overall healthcare expenditures and enhance access to specialized orthopedic care, thereby creating a robust framework for growth.

However, the market also faces notable restraints, including the significant capital investment required to establish and equip new ASCs with state-of-the-art surgical technology and infrastructure. Stringent regulatory complexities and varying licensing requirements across different regions can pose substantial barriers to entry and operational expansion. Intense competition from well-established hospital systems, which are increasingly developing their own outpatient surgical capabilities, represents another significant challenge, potentially fragmenting the patient base and increasing marketing pressures. The need for highly specialized surgeons and ancillary staff, coupled with ongoing challenges in talent acquisition and retention, can also limit the operational capacity and growth potential of some ASCs, especially in underserved areas. Addressing these restraints often requires strategic planning, robust financial backing, and adept navigation of the healthcare landscape.

Opportunities within the orthopedic ASC market are vast and continually evolving. There is significant potential for expansion into a wider array of complex orthopedic procedures, such as total joint replacements, as surgical techniques and patient selection criteria become more refined. The integration of advanced digital health solutions, including telehealth for pre- and post-operative consultations and remote patient monitoring, presents a substantial opportunity to enhance patient engagement and operational efficiency. Furthermore, geographic expansion into emerging markets, where healthcare infrastructure is developing and demand for specialized orthopedic care is growing, offers new avenues for market penetration. Strategic partnerships with orthopedic device manufacturers and health insurance providers can create synergistic benefits, fostering innovation, improving supply chain efficiencies, and developing more attractive bundled payment options. These opportunities suggest a dynamic future for orthopedic ASCs, where innovation and strategic collaboration will be key determinants of success, driving further market maturation and specialization.

Segmentation Analysis

The Orthopedic Ambulatory Surgical Centers market is comprehensively segmented to provide granular insights into its diverse components, facilitating a deeper understanding of market dynamics, growth drivers, and evolving trends. This segmentation allows stakeholders to identify specific areas of high growth, understand patient preferences, and tailor strategies to address distinct market needs. The market is primarily analyzed across several key dimensions, including the type of procedures performed, the ownership structure of the facilities, and the specific services offered within these centers. Each segment reflects unique operational characteristics, patient demographics, and competitive landscapes, all contributing to the overall market valuation and future trajectory of orthopedic ASCs. A thorough understanding of these segments is crucial for accurate market forecasting and strategic planning.

- By Procedure Type:

- Joint Replacement (Knee, Hip, Shoulder)

- Spine Surgeries (Lumbar Laminectomy, Cervical Foraminotomy, Minimally Invasive Fusions)

- Sports Medicine (ACL Reconstruction, Meniscus Repair, Rotator Cuff Repair)

- Arthroscopy (Knee Arthroscopy, Shoulder Arthroscopy, Ankle Arthroscopy)

- Fracture Repair (Open Reduction Internal Fixation, External Fixation)

- Foot & Ankle Procedures (Bunionectomy, Ankle Fusion)

- Hand & Wrist Procedures (Carpal Tunnel Release, Trigger Finger Release)

- Other Orthopedic Procedures

- By Facility Ownership:

- Physician-Owned ASCs

- Hospital-Owned ASCs

- Corporate/Strategic Partnership ASCs

- By Service Offering:

- Surgical Services

- Diagnostic Imaging (on-site X-ray, MRI, CT)

- Pain Management

- Rehabilitation Services

Value Chain Analysis For Orthopedic Ambulatory Surgical Centers Market

The value chain for the Orthopedic Ambulatory Surgical Centers (ASCs) market is intricate, commencing with the upstream activities that are foundational to surgical care delivery. This upstream segment primarily involves medical device manufacturers, pharmaceutical companies, and specialized equipment providers who supply critical implants, surgical instruments, anesthesia, and other consumable supplies necessary for orthopedic procedures. Key players in this stage focus on innovation, research and development to produce high-quality, advanced products that enhance surgical outcomes and patient safety. Effective supplier relationships, including robust procurement processes and supply chain management, are paramount for ASCs to ensure timely access to necessary materials, control costs, and maintain operational efficiency. This segment is characterized by strong negotiation power from manufacturers and distributors who supply specialized, often patented, medical technologies, influencing pricing and product availability for ASCs.

Moving downstream, the value chain encompasses the direct services provided by orthopedic ASCs, which involve patient consultation, surgical planning, the surgical procedure itself, post-operative care, and discharge. This stage requires highly skilled orthopedic surgeons, anesthesiologists, nurses, and administrative staff who collaborate to deliver a seamless patient experience. The success of this downstream segment hinges on clinical excellence, operational efficiency, and a patient-centric approach that prioritizes comfort and rapid recovery. Following the immediate post-operative phase, the value chain extends to rehabilitative services, including physical therapy and occupational therapy, which are crucial for full patient recovery and functional restoration. These services can be provided directly within the ASC or through partnerships with external rehabilitation clinics, ensuring comprehensive care continuity.

The distribution channel for orthopedic ASC services is multifaceted, involving both direct and indirect avenues to reach potential patients. Direct channels primarily include referrals from primary care physicians, sports medicine specialists, and other medical practitioners who recognize the specialized capabilities of orthopedic ASCs. ASCs also engage in direct-to-consumer marketing through digital platforms, community outreach programs, and physician liaison efforts to attract patients seeking elective orthopedic procedures. Indirect distribution involves partnerships with insurance providers, employer groups, and accountable care organizations (ACOs) that direct their members or beneficiaries to ASCs as part of their preferred provider networks. The effectiveness of these channels is crucial for patient acquisition and maintaining a consistent surgical volume. Moreover, the integration of telehealth services for initial consultations and follow-up appointments is increasingly becoming an important indirect channel, expanding access and convenience for patients while optimizing resource utilization for the ASC.

Orthopedic Ambulatory Surgical Centers Market Potential Customers

The primary potential customers and end-users of services provided by Orthopedic Ambulatory Surgical Centers (ASCs) are individuals suffering from a wide range of musculoskeletal conditions who require surgical intervention but do not necessitate an overnight hospital stay. This demographic largely comprises patients seeking elective procedures for chronic conditions such as osteoarthritis, where joint replacements (e.g., knee, hip, shoulder) are recommended to alleviate pain and restore mobility. Another significant segment includes individuals experiencing acute or chronic sports-related injuries, such as anterior cruciate ligament (ACL) tears, meniscus damage, or rotator cuff tears, who require arthroscopic or reconstructive surgeries to return to their athletic activities. The growing participation in sports and active lifestyles across all age groups contributes significantly to this customer base, requiring specialized and prompt orthopedic care.

Beyond these broad categories, the customer base also extends to individuals with spinal conditions amenable to outpatient surgery, such as certain types of laminectomies or discectomies, aiming to relieve nerve compression and associated pain. Patients requiring fracture repairs that can be managed without extensive hospitalization, as well as those undergoing foot, ankle, hand, or wrist procedures like bunionectomies or carpal tunnel releases, also represent a substantial pool of potential clients for orthopedic ASCs. The increasing elderly population, often afflicted with age-related degenerative joint diseases and an elevated risk of fractures, constitutes a critical and expanding segment, seeking less invasive and more convenient surgical options. These older adults often prioritize a quicker return to their home environment and appreciate the reduced infection risk associated with ASCs.

Furthermore, the "buyers" in this context also include healthcare payers, such as private health insurance companies, government-sponsored programs (like Medicare and Medicaid in the U.S.), and employer-sponsored health plans. These entities are increasingly channeling patients towards ASCs due to the lower cost of procedures compared to traditional hospitals, aligning with their objectives to reduce healthcare expenditures while maintaining quality of care. The value proposition of orthopedic ASCs, offering high-quality surgical outcomes at a more competitive price point, makes them an attractive option for these institutional buyers. Consequently, ASCs must maintain strong relationships with these payers, ensuring favorable reimbursement rates and inclusion in preferred provider networks to secure a steady stream of patients. This multi-faceted customer landscape necessitates a strategic approach to patient engagement, payer relations, and continuous improvement in service delivery to remain competitive and grow within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 65.8 Billion |

| Market Forecast in 2032 | USD 152.4 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AmSurg (Envision Healthcare), Surgical Care Affiliates (SCA Health, an Optum company), HCA Healthcare, Tenet Healthcare (United Surgical Partners International - USPI), Adventist HealthCare, Surgery Partners, Regent Surgical Health, Spire Healthcare, National Surgical Hospitals, Nueterra Capital, OrthoArizona, ProHealth Care, Shields Health Care Group, USMD Hospital at Arlington, Elite Healthcare, HOPCo (Healthcare Outcomes Performance Company), Compass Surgical Partners, ValueHealth, Covenant Surgical Partners, Pinnacle III |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Orthopedic Ambulatory Surgical Centers Market Key Technology Landscape

The Orthopedic Ambulatory Surgical Centers (ASCs) market is heavily reliant on an evolving technology landscape that continuously seeks to enhance surgical precision, improve patient outcomes, and optimize operational efficiencies. Minimally invasive surgical (MIS) instruments and techniques form the bedrock of many procedures performed in ASCs, allowing for smaller incisions, reduced blood loss, faster recovery times, and decreased post-operative pain. This includes advanced arthroscopic equipment, specialized scopes, and sophisticated hand tools that enable surgeons to perform complex joint and soft tissue repairs with exceptional accuracy. Furthermore, high-definition imaging systems, such as intraoperative fluoroscopy and real-time ultrasound, provide critical visual guidance during surgery, enhancing the safety and effectiveness of interventions, particularly for delicate spinal or joint procedures. The development and adoption of these MIS technologies are crucial for the continued migration of complex orthopedic surgeries to outpatient settings, directly impacting the growth trajectory of the market.

Robotics and navigation systems represent another transformative technological frontier in orthopedic ASCs. Robotic-assisted surgical platforms offer unparalleled precision in bone cutting, implant placement, and soft tissue balancing, particularly in joint replacement surgeries (e.g., total knee, hip, and shoulder arthroplasty). These systems leverage pre-operative imaging to create personalized surgical plans, which robots then execute with sub-millimeter accuracy, leading to improved implant longevity and patient satisfaction. Complementary navigation systems, utilizing optical or electromagnetic tracking, provide surgeons with real-time feedback on instrument position and anatomical landmarks, further reducing human error and enhancing surgical safety. While the initial capital investment for such advanced robotics can be substantial, the long-term benefits in terms of superior outcomes, reduced revision rates, and competitive differentiation make them increasingly attractive for leading orthopedic ASCs looking to attract high-acuity cases and provide cutting-edge care.

Beyond the surgical suite, digital health technologies and integrated management systems play a vital role in optimizing the entire patient journey and ASC operations. Electronic Health Records (EHRs) and practice management software streamline patient registration, scheduling, billing, and clinical documentation, ensuring efficient data flow and compliance. Telehealth platforms are increasingly utilized for pre-operative consultations, post-operative follow-ups, and remote patient monitoring, enhancing convenience for patients and extending the reach of care. Moreover, advanced pain management technologies, including nerve blocks, localized anesthetics, and non-opioid multimodal pain regimens, are critical for enabling outpatient recovery by effectively managing discomfort without prolonged hospitalization. The convergence of these diverse technologies, from precision surgical tools to digital health solutions, collectively defines the competitive edge of orthopedic ASCs, positioning them as innovative leaders in the delivery of modern orthopedic care.

Regional Highlights

- North America: Dominates the market due to robust healthcare infrastructure, high adoption of advanced surgical techniques, and favorable reimbursement policies, particularly in the United States. The region boasts a high volume of orthopedic procedures and a well-established network of ASCs, with significant investment in new facility development and technological integration, driving continuous growth and innovation in outpatient orthopedic care.

- Europe: Exhibits steady growth, driven by an aging population susceptible to orthopedic conditions, increasing healthcare expenditure, and efforts to shift procedures from inpatient to outpatient settings to reduce healthcare costs and waiting lists. Countries like Germany, the UK, and France are progressively adopting the ASC model, though regulatory frameworks and reimbursement structures vary, influencing the pace of market expansion across the continent.

- Asia Pacific (APAC): Emerges as the fastest-growing region, fueled by rising disposable incomes, improving access to advanced medical technologies, and a growing medical tourism industry. Countries such as China, India, and Japan are investing heavily in healthcare infrastructure, leading to the establishment of more specialized ASCs and increasing the accessibility of orthopedic surgical care to a larger patient base, particularly for elective procedures.

- Latin America: Shows nascent but promising growth, primarily in Brazil and Mexico, attributed to expanding private healthcare sectors and increasing awareness of outpatient surgical benefits. Challenges include varying levels of healthcare spending and regulatory hurdles, but ongoing investments in modern medical facilities and a rising demand for specialized care are paving the way for future market development in the region.

- Middle East and Africa (MEA): Represents a developing market with significant potential, driven by government initiatives to diversify economies and enhance healthcare services, especially in countries like Saudi Arabia and UAE. The region benefits from increasing healthcare infrastructure development and a growing influx of medical expertise, though the market is still in its early stages of widespread ASC adoption compared to more established regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Orthopedic Ambulatory Surgical Centers Market.- AmSurg (Envision Healthcare)

- Surgical Care Affiliates (SCA Health, an Optum company)

- HCA Healthcare

- Tenet Healthcare (United Surgical Partners International - USPI)

- Adventist HealthCare

- Surgery Partners

- Regent Surgical Health

- Spire Healthcare

- National Surgical Hospitals

- Nueterra Capital

- OrthoArizona

- ProHealth Care

- Shields Health Care Group

- USMD Hospital at Arlington

- Elite Healthcare

- HOPCo (Healthcare Outcomes Performance Company)

- Compass Surgical Partners

- ValueHealth

- Covenant Surgical Partners

- Pinnacle III

Frequently Asked Questions

What is an Orthopedic Ambulatory Surgical Center (ASC)?

An Orthopedic Ambulatory Surgical Center (ASC) is a specialized healthcare facility focused on providing outpatient surgical procedures for various musculoskeletal conditions. Patients receive care and are discharged on the same day, offering a cost-effective and convenient alternative to traditional hospital settings for elective orthopedic surgeries.

Which types of orthopedic procedures are commonly performed in ASCs?

Common procedures include joint arthroscopy (knee, shoulder, ankle), ligament reconstructions, fracture repairs, spinal procedures like laminectomy, and increasingly, total joint replacements (knee, hip, shoulder). The scope continues to expand due to advancements in surgical techniques and pain management.

What are the primary benefits of choosing an ASC for orthopedic surgery?

Patients often experience lower out-of-pocket costs, reduced risk of hospital-acquired infections, shorter wait times, and a more personalized, patient-centric care environment. The convenience of same-day discharge and a quicker return home are also significant advantages.

How does AI impact the Orthopedic Ambulatory Surgical Centers market?

AI enhances diagnostic accuracy, optimizes surgical planning and scheduling, and provides robotic assistance for improved surgical precision. It also aids in personalized rehabilitation plans and efficient inventory management, contributing to better outcomes and operational efficiency within ASCs.

What are the key drivers for growth in the Orthopedic ASC market?

Major drivers include the increasing demand for outpatient surgical alternatives, the cost-effectiveness of ASCs, continuous technological advancements in minimally invasive surgery, and favorable government and private payer reimbursement policies that encourage outpatient care settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager