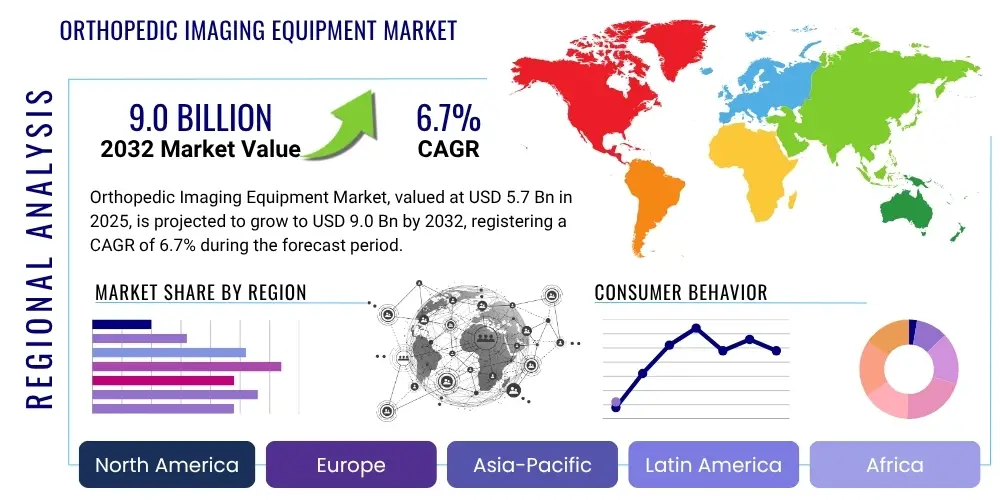

Orthopedic Imaging Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430002 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Orthopedic Imaging Equipment Market Size

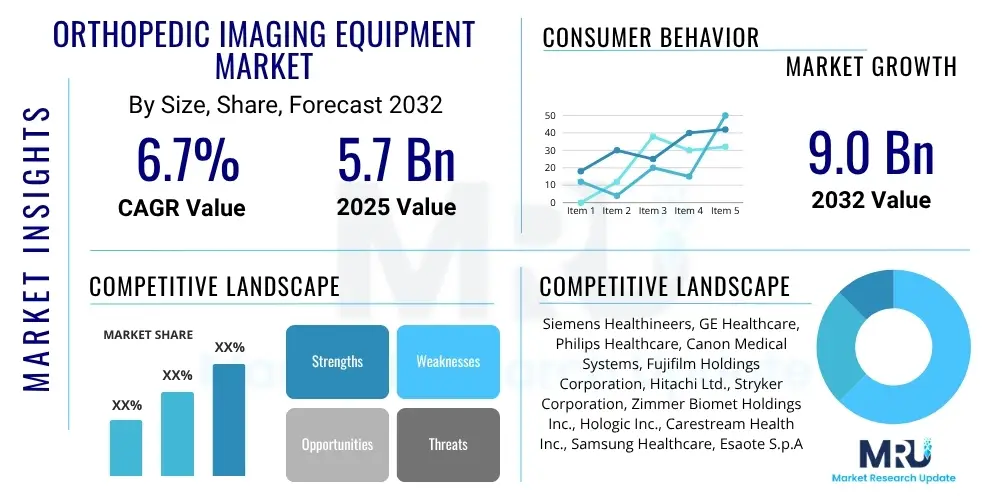

The Orthopedic Imaging Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032. The market is estimated at $5.7 Billion in 2025 and is projected to reach $9.0 Billion by the end of the forecast period in 2032.

Orthopedic Imaging Equipment Market introduction

The Orthopedic Imaging Equipment Market encompasses a broad range of medical devices and technologies designed to visualize and diagnose conditions affecting the musculoskeletal system. This vital sector provides advanced tools crucial for detecting fractures, assessing joint health, diagnosing degenerative diseases, evaluating sports injuries, and guiding surgical interventions. The market includes diverse modalities such as X-ray, Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Ultrasound, and Bone Densitometry (DEXA), each offering unique capabilities for specific diagnostic needs. These imaging solutions are indispensable in modern orthopedics, enabling healthcare professionals to make accurate diagnoses and formulate effective treatment plans, thereby significantly improving patient outcomes.

Products within this market range from conventional radiographic systems to highly sophisticated 3D imaging technologies, all designed to offer detailed insights into bone and soft tissue structures. X-ray remains a cornerstone for initial assessments due to its speed and cost-effectiveness in identifying bone pathologies. MRI excels in visualizing soft tissues like ligaments, tendons, and cartilage, while CT scans provide intricate cross-sectional images invaluable for complex fracture analysis and surgical planning. Ultrasound offers real-time dynamic imaging, particularly useful for soft tissue injuries and guided procedures, and DEXA is the gold standard for assessing bone mineral density and osteoporosis risk. The continuous evolution of these technologies, coupled with the integration of digital capabilities, has led to enhanced image quality, reduced radiation exposure, and improved workflow efficiency.

The major applications of orthopedic imaging equipment span across trauma and fracture management, joint diseases, spinal disorders, sports medicine, and reconstructive surgery. These devices offer numerous benefits, including non-invasive diagnostic capabilities, precise anatomical visualization, and the ability to monitor disease progression or healing. Key driving factors propelling market growth include a rapidly aging global population, which is more susceptible to orthopedic conditions, the increasing incidence of sports-related injuries, a rising prevalence of chronic musculoskeletal disorders such as osteoarthritis and osteoporosis, and ongoing technological advancements that make imaging faster, safer, and more accurate. Furthermore, growing healthcare expenditure and improved access to advanced diagnostic facilities in emerging economies are significantly contributing to market expansion.

Orthopedic Imaging Equipment Market Executive Summary

The Orthopedic Imaging Equipment Market is experiencing robust growth, driven by a confluence of demographic shifts, technological innovations, and expanding healthcare infrastructure. Business trends indicate a strong move towards digitalization, integration of artificial intelligence for enhanced diagnostics, and the development of portable and compact imaging systems to improve accessibility and workflow efficiency. Strategic collaborations, mergers, and acquisitions are also prominent, as companies seek to expand their product portfolios, geographic reach, and technological capabilities. The competitive landscape is characterized by established global players continuously innovating to meet evolving clinical demands, alongside emerging companies introducing specialized solutions.

Regional trends highlight North America as a dominant market, largely due to its advanced healthcare infrastructure, high prevalence of orthopedic conditions, and significant investment in research and development. Europe maintains a strong presence, driven by an aging population and well-established healthcare systems focusing on early diagnosis and treatment. However, the Asia Pacific region is projected to be the fastest-growing market, propelled by increasing healthcare expenditure, a rapidly expanding patient pool, rising medical tourism, and improving access to advanced diagnostic technologies. Latin America and the Middle East & Africa are also showing considerable potential, albeit from a lower base, as their healthcare systems develop and populations gain access to more sophisticated medical services.

Segment trends reveal a continued strong demand for traditional X-ray systems, particularly digital radiography, owing to their versatility and cost-effectiveness as a primary diagnostic tool. Magnetic Resonance Imaging (MRI) is witnessing substantial growth, especially for soft tissue and complex joint evaluations, with advancements in coil technology and field strengths enhancing diagnostic detail. Computed Tomography (CT) scans are increasingly utilized for detailed bone assessments, trauma, and surgical planning, benefiting from dose reduction techniques and faster scan times. Ultrasound is gaining traction for point-of-care diagnostics and guided procedures due to its portability and real-time capabilities, while Bone Densitometry (DEXA) remains essential for osteoporosis screening and monitoring in an aging demographic, underscoring the diverse and specialized needs of the orthopedic imaging sector.

AI Impact Analysis on Orthopedic Imaging Equipment Market

User inquiries about AI's impact on orthopedic imaging frequently center on its ability to enhance diagnostic accuracy, reduce interpretation time, and streamline clinical workflows. There is significant interest in how AI can assist in the early detection of subtle fractures, improve the consistency of readings, and potentially reduce inter-observer variability. Concerns often arise regarding the validation and regulatory approval of AI algorithms, data privacy, and the potential for AI to displace human radiologists rather than augment their capabilities. Users are also keen to understand the cost implications of integrating AI solutions and their accessibility in various healthcare settings, particularly how AI might democratize access to expert-level diagnostics.

The integration of Artificial Intelligence (AI) and machine learning algorithms is poised to profoundly transform the orthopedic imaging equipment market by revolutionizing image acquisition, processing, and interpretation. AI driven solutions are addressing key user concerns by offering superior image quality reconstruction, even from lower dose acquisitions, thereby enhancing patient safety. Furthermore, AI excels at automating repetitive tasks, such as measurement and anomaly detection, significantly reducing the workload on radiologists and orthopedic specialists, allowing them to focus on more complex cases. This not only boosts efficiency but also contributes to a more consistent and objective diagnostic process, ultimately leading to improved clinical decision-making and personalized patient care pathways.

AI's influence extends beyond mere diagnostics; it is also impacting surgical planning and post-operative evaluation. AI models can analyze large datasets of patient images to predict disease progression, identify patients at higher risk of complications, and optimize surgical approaches with greater precision. This predictive capability translates into more informed treatment strategies and better outcomes. While the industry is actively working to address regulatory challenges and ensure the robustness and ethical deployment of AI, the overarching expectation among users is that AI will make orthopedic imaging more accessible, efficient, and diagnostically powerful, fundamentally shifting the paradigm of musculoskeletal healthcare.

- Enhanced Diagnostic Accuracy: AI algorithms can detect subtle anomalies and patterns often missed by the human eye, improving the accuracy of fracture detection and early-stage disease identification.

- Automated Image Interpretation: AI tools automate measurements, annotations, and preliminary interpretations, significantly reducing reading times for radiologists and orthopedic surgeons.

- Workflow Optimization: AI assists in prioritizing urgent cases, streamlining image management, and integrating findings into electronic health records, leading to more efficient clinical workflows.

- Reduced Radiation Dose: AI-powered reconstruction techniques allow for high-quality images with lower radiation doses in CT and X-ray, enhancing patient safety.

- Predictive Analytics: AI can analyze longitudinal data to predict disease progression, treatment response, and identify patients at risk of complications, aiding in proactive patient management.

- Personalized Treatment Planning: AI contributes to highly individualized surgical planning by generating precise 3D models and simulations based on patient-specific anatomy and pathology.

- Quality Assurance: AI systems can perform automated quality checks on images, ensuring consistency and adherence to imaging protocols across different modalities and centers.

- Accessibility to Expert Insights: AI can make high-level diagnostic support available in remote or underserved areas, bridging gaps in specialist expertise.

- Augmented Reality (AR) and Virtual Reality (VR) Integration: AI can power AR/VR applications for surgical navigation and training, offering immersive and precise guidance.

DRO & Impact Forces Of Orthopedic Imaging Equipment Market

The Orthopedic Imaging Equipment Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its trajectory and impact forces. A primary driver is the accelerating global aging population, which naturally increases the prevalence of age-related musculoskeletal disorders such as osteoarthritis, osteoporosis, and degenerative spine conditions. Concurrently, the rising incidence of sports injuries and road accidents further fuels the demand for advanced diagnostic imaging. Technological advancements, including the development of higher resolution imaging modalities, faster scan times, and reduced radiation exposure, are continually improving diagnostic capabilities and driving market adoption. Moreover, increasing healthcare expenditure globally, particularly in developing economies, is expanding access to sophisticated orthopedic imaging solutions, allowing for earlier and more accurate diagnoses.

However, the market also faces considerable restraints that temper its growth. The high capital cost associated with advanced imaging equipment, such as MRI and high-end CT scanners, poses a significant barrier to adoption, especially for smaller healthcare facilities or those in resource-limited settings. Stringent regulatory approval processes, which vary by region, introduce delays and increase the cost of bringing new technologies to market. Concerns regarding radiation exposure from X-ray and CT scans, despite ongoing dose reduction efforts, remain a point of consideration for both patients and healthcare providers. Additionally, a persistent shortage of skilled radiologists, radiographers, and orthopedic specialists capable of operating and interpreting these complex imaging systems limits their optimal utilization.

Opportunities within the market largely revolve around technological innovation and geographic expansion. The integration of Artificial Intelligence (AI) and machine learning is creating new avenues for enhanced image analysis, automated diagnosis, and improved workflow efficiency, promising to unlock unprecedented levels of precision and speed. The emergence of portable and point-of-care imaging devices, particularly in ultrasound and compact X-ray systems, offers significant potential for expanding access to diagnostic services in remote areas and emergency settings. Furthermore, untapped potential in emerging markets, characterized by rapidly developing healthcare infrastructures and growing disposable incomes, represents a substantial growth opportunity for manufacturers. The increasing shift towards personalized medicine and minimally invasive orthopedic surgeries also necessitates more precise pre-operative planning and intra-operative guidance, thereby driving demand for advanced imaging capabilities that can integrate seamlessly with these evolving medical practices.

Segmentation Analysis

The Orthopedic Imaging Equipment Market is comprehensively segmented based on product type, application, and end-user, providing a granular view of market dynamics and consumer preferences. Each segment reflects distinct technological capabilities, clinical utility, and market demand patterns, collectively illustrating the diverse landscape of orthopedic diagnostics. Understanding these segmentations is crucial for manufacturers to tailor their product development, marketing strategies, and distribution channels to effectively address the specific needs of various healthcare providers and patient populations, ensuring optimized resource allocation and market penetration.

- By Product Type:

- X-ray Systems:

- Digital X-ray (DR)

- Computed Radiography (CR)

- Analog X-ray

- Portable X-ray Systems

- Fixed X-ray Systems

- Magnetic Resonance Imaging (MRI) Systems:

- High-field MRI (1.5T and 3T)

- Open MRI Systems

- Extremity MRI Systems

- Computed Tomography (CT) Systems:

- Multi-slice CT Scanners

- Cone Beam CT (CBCT) Scanners

- Ultrasound Systems:

- Diagnostic Ultrasound

- Portable Ultrasound

- Bone Densitometry (DEXA) Systems:

- Axial DEXA

- Peripheral DEXA

- X-ray Systems:

- By Application:

- Trauma and Fracture Management

- Spine Imaging

- Joint Replacement and Reconstruction

- Sports Medicine

- Orthopedic Oncology

- Rheumatology

- Degenerative Joint Diseases

- By End-User:

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers (ASCs)

- Orthopedic Clinics

- Research & Academic Institutes

Value Chain Analysis For Orthopedic Imaging Equipment Market

The value chain for the Orthopedic Imaging Equipment Market begins with extensive upstream activities, primarily involving the research and development of innovative imaging technologies and the procurement of highly specialized raw materials and components. This stage includes suppliers of advanced sensors, detectors, X-ray tubes, powerful magnets for MRI systems, and intricate electronic components. Software developers also play a critical role upstream, creating sophisticated image processing algorithms, AI solutions, and user interfaces that enhance the functionality and diagnostic capabilities of the equipment. Companies heavily invest in R&D to ensure their products meet evolving clinical needs, adhere to stringent regulatory standards, and offer competitive advantages in terms of image quality, speed, and safety.

Midstream activities in the value chain focus on the manufacturing and assembly of the complex imaging systems. This involves precision engineering, quality control, and the integration of various components into a cohesive and functional unit. Manufacturers often have specialized facilities for producing different modalities, adhering to strict manufacturing protocols to ensure reliability and performance. Following production, distribution channels become crucial for market reach. Direct sales forces are often employed for large, high-value systems to hospitals and major diagnostic centers, allowing for direct engagement, customization, and comprehensive after-sales support. Indirect channels involve a network of authorized distributors, resellers, and regional partners, especially for smaller equipment or in regions where direct presence is less feasible, ensuring broader market coverage.

The downstream segment of the value chain is centered around the end-users and the provision of after-sales services. Hospitals, diagnostic imaging centers, ambulatory surgical centers, and specialized orthopedic clinics are the primary consumers of orthopedic imaging equipment. Post-purchase, service and maintenance are paramount, as these complex machines require regular upkeep, calibration, and software updates to ensure optimal performance and longevity. This often includes technical support, spare parts supply, and training for clinical staff. The effectiveness of the distribution network, whether direct or indirect, significantly impacts market penetration and customer satisfaction. A robust distribution strategy, complemented by efficient after-sales support, is vital for building strong customer relationships and sustaining market presence in this highly specialized medical equipment sector.

Orthopedic Imaging Equipment Market Potential Customers

The primary potential customers for orthopedic imaging equipment are healthcare institutions and specialized medical facilities that require advanced diagnostic capabilities for musculoskeletal conditions. Hospitals, particularly large multi-specialty hospitals with dedicated orthopedic departments, represent the largest segment of buyers. These institutions have the patient volume, financial resources, and infrastructure to invest in a full suite of imaging modalities, including high-field MRI, multi-slice CT, and digital X-ray systems, to support comprehensive diagnostic and treatment services. They seek integrated solutions that offer high image quality, efficiency, and compatibility with their existing healthcare information systems, ensuring seamless patient care pathways from diagnosis through recovery.

Diagnostic imaging centers constitute another significant customer base. These standalone facilities specialize in providing a wide range of imaging services to patients referred by various clinicians. They often invest in advanced orthopedic imaging equipment to attract a broader patient demographic and offer specialized imaging protocols for complex orthopedic cases. The focus for these centers is on maximizing throughput, ensuring rapid and accurate reporting, and offering a comfortable patient experience. Their purchasing decisions are often influenced by equipment reliability, cost-effectiveness, and the ability to integrate with tele-radiology platforms for expert interpretation, which is vital for maintaining a competitive edge in a service-oriented environment.

Furthermore, ambulatory surgical centers (ASCs) and specialized orthopedic clinics are increasingly becoming important customers, particularly for more compact, portable, and procedure-specific imaging equipment. ASCs, which perform outpatient surgical procedures, require imaging for pre-operative planning and intra-operative guidance, often favoring systems that offer real-time visualization, such as portable X-ray (C-arms) and ultrasound. Orthopedic clinics, focused on specific musculoskeletal issues, may invest in extremity MRI, dedicated X-ray, or DEXA systems to serve their patient population efficiently. These customers prioritize ease of use, smaller footprints, and cost-efficiency, alongside high diagnostic quality, to enhance their specialized services and improve patient outcomes within their focused practice areas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $5.7 Billion |

| Market Forecast in 2032 | $9.0 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings Corporation, Hitachi Ltd., Stryker Corporation, Zimmer Biomet Holdings Inc., Hologic Inc., Carestream Health Inc., Samsung Healthcare, Esaote S.p.A., Shimadzu Corporation, Konica Minolta Inc., Planmed Oy, Orthoscan Inc., Swissray International Inc., CurveBeam LLC, EOS imaging, Medtronic plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Orthopedic Imaging Equipment Market Key Technology Landscape

The Orthopedic Imaging Equipment Market is continuously shaped by rapid advancements in imaging technology, which are geared towards improving diagnostic accuracy, enhancing patient safety, and streamlining clinical workflows. Digital radiography (DR) has largely replaced traditional film-based X-ray, offering instant image acquisition, superior image quality, and advanced post-processing capabilities that allow for precise visualization of bone structures with reduced radiation doses. The advent of flat panel detectors and advanced image reconstruction algorithms has further refined DR systems, making them indispensable for initial assessments in orthopedic diagnostics. Similarly, innovations in Computed Tomography (CT) include multi-slice and ultra-fast scanning capabilities, which provide highly detailed 3D anatomical views of complex fractures and joints, while iterative reconstruction techniques are significantly reducing radiation exposure, addressing a key concern for both patients and clinicians.

In the realm of Magnetic Resonance Imaging (MRI), the focus is on developing higher field strength systems (e.g., 3T and beyond) that deliver unparalleled soft tissue contrast and anatomical detail, essential for diagnosing ligament tears, cartilage damage, and early inflammatory conditions. Dedicated extremity MRI systems offer targeted imaging for limbs, reducing costs and scan times. Alongside hardware improvements, advanced MRI sequences and quantitative imaging techniques are providing functional information beyond pure anatomy, aiding in the assessment of tissue viability and disease progression. Ultrasound technology is also undergoing significant evolution, with high-resolution transducers and advanced elastography techniques enabling real-time assessment of soft tissue injuries, muscle tears, and guided interventional procedures, benefiting from its portability, non-ionizing nature, and cost-effectiveness.

Beyond the core imaging modalities, the technology landscape is being transformed by the integration of artificial intelligence (AI) and machine learning (ML) across the entire imaging pipeline. AI algorithms are increasingly being used for automated image interpretation, anomaly detection, predictive analytics, and dose optimization, enhancing the speed and accuracy of diagnosis. Cloud-based PACS (Picture Archiving and Communication Systems) and teleradiology platforms are facilitating remote image access and expert consultation, improving efficiency and accessibility. Furthermore, the development of cone-beam CT (CBCT) specifically for orthopedic applications, offering high-resolution 3D imaging of extremities with lower dose and smaller footprint, along with advancements in bone densitometry (DEXA) for precise osteoporosis screening and monitoring, underscores the dynamic and innovation-driven nature of the orthopedic imaging equipment market.

Regional Highlights

- North America: Dominant market share attributed to advanced healthcare infrastructure, high prevalence of orthopedic conditions, significant investments in R&D, and favorable reimbursement policies. The presence of key market players and a high adoption rate of technologically advanced imaging systems further solidify its leading position.

- Europe: A mature market characterized by an aging population, well-established healthcare systems, and a strong emphasis on early diagnosis and treatment of musculoskeletal disorders. Countries like Germany, the UK, and France are major contributors, driven by government healthcare spending and increasing awareness of orthopedic health.

- Asia Pacific (APAC): Expected to be the fastest-growing region due to rapidly improving healthcare infrastructure, increasing healthcare expenditure, a vast and aging patient population, and the rising prevalence of lifestyle-related orthopedic conditions. Emerging economies such as China, India, and Japan are at the forefront of this growth, supported by expanding medical tourism and favorable government initiatives.

- Latin America: An emerging market with growing investments in healthcare facilities and increasing awareness regarding diagnostic imaging. Brazil and Mexico are key countries, experiencing market growth driven by economic development and improving access to medical technologies, though facing challenges related to healthcare disparities.

- Middle East and Africa (MEA): Represents a nascent but promising market, propelled by increasing healthcare spending, modernization of medical facilities, and a rising demand for advanced diagnostic services in countries like Saudi Arabia, UAE, and South Africa. Challenges include political instability in some areas and varying levels of healthcare development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Orthopedic Imaging Equipment Market.- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Hitachi Ltd.

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Hologic Inc.

- Carestream Health Inc.

- Samsung Healthcare

- Esaote S.p.A.

- Shimadzu Corporation

- Konica Minolta Inc.

- Planmed Oy

- Orthoscan Inc.

- Swissray International Inc.

- CurveBeam LLC

- EOS imaging

- Medtronic plc

Frequently Asked Questions

What is orthopedic imaging equipment?

Orthopedic imaging equipment refers to specialized medical devices and technologies, such as X-ray, MRI, CT, Ultrasound, and DEXA, used to visualize, diagnose, and assess conditions affecting bones, joints, muscles, ligaments, and tendons within the musculoskeletal system.

What are the main types of orthopedic imaging technologies?

The main types include X-ray (digital and computed radiography), Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Ultrasound, and Bone Densitometry (DEXA), each offering unique diagnostic capabilities for various orthopedic conditions.

How is AI transforming orthopedic imaging?

AI is transforming orthopedic imaging by enhancing diagnostic accuracy, automating image interpretation, optimizing clinical workflows, reducing radiation exposure, and aiding in personalized treatment planning through advanced analytics and predictive modeling.

What factors are driving growth in the Orthopedic Imaging Equipment Market?

Key growth drivers include a rapidly aging global population, the increasing prevalence of orthopedic disorders like osteoarthritis and osteoporosis, a rise in sports injuries, continuous technological advancements, and increasing healthcare expenditure worldwide.

What are the primary challenges faced by the orthopedic imaging market?

The primary challenges include the high capital cost of advanced imaging equipment, stringent regulatory approval processes, concerns regarding patient radiation exposure, and a persistent shortage of skilled healthcare professionals to operate and interpret these complex systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager