Orthopedic Surgical Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429927 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Orthopedic Surgical Robots Market Size

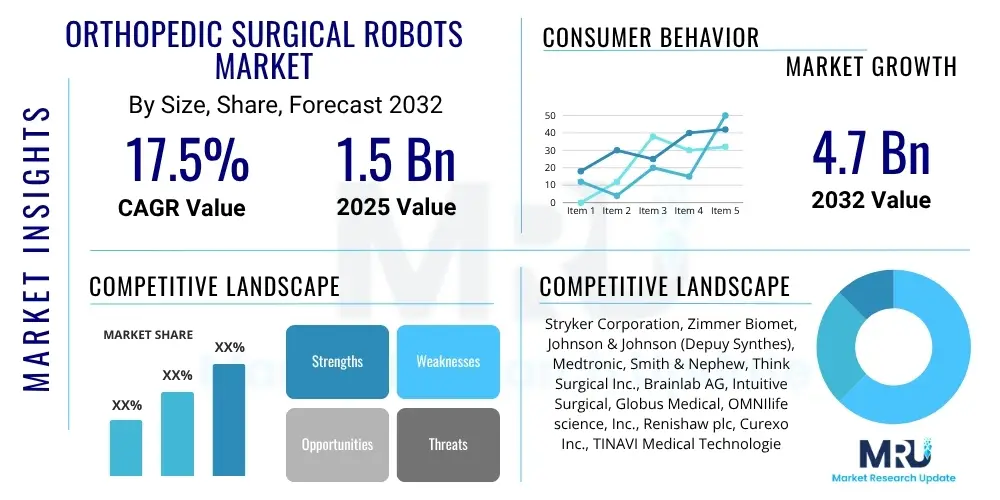

The Orthopedic Surgical Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2025 and 2032. The market is estimated at $1.5 Billion in 2025 and is projected to reach $4.7 Billion by the end of the forecast period in 2032.

Orthopedic Surgical Robots Market introduction

The Orthopedic Surgical Robots Market encompasses advanced robotic systems designed to assist surgeons in performing orthopedic procedures with enhanced precision, accuracy, and predictability. These systems are transforming traditional surgical approaches by integrating sophisticated technologies such as artificial intelligence, advanced imaging, and haptic feedback. The product category includes fully autonomous and semi-autonomous robotic platforms, along with specialized instruments, accessories, and comprehensive service agreements that ensure operational efficiency and clinical support. Major applications span a wide range of orthopedic interventions, predominantly focusing on knee and hip replacements, but also extending to spine surgery, trauma care, and other complex joint reconstructions. The core benefits delivered by these robotic platforms include significantly improved surgical outcomes through minimized human error, reduced invasiveness, smaller incisions, less blood loss, and faster patient recovery times, ultimately leading to higher patient satisfaction and reduced hospital stays. The market's growth is primarily driven by an aging global population, the escalating prevalence of degenerative orthopedic conditions, increasing demand for minimally invasive surgical techniques, continuous technological advancements in robotics and AI, and the rising awareness among both patients and healthcare providers regarding the tangible advantages offered by robotic assistance in orthopedic surgery.

Orthopedic Surgical Robots Market Executive Summary

The Orthopedic Surgical Robots Market is experiencing robust expansion, propelled by significant business trends that prioritize technological innovation, strategic collaborations, and global market penetration. Industry leaders are increasingly investing in research and development to integrate cutting-edge AI, machine learning, and advanced imaging capabilities, enhancing the efficacy and versatility of robotic platforms. This innovation-driven environment fosters a competitive landscape where mergers, acquisitions, and partnerships are common strategies to consolidate market share, expand product portfolios, and access new geographical territories. The increasing adoption of value-based care models is also compelling manufacturers to focus on cost-effectiveness and demonstrate clear economic benefits, alongside superior clinical outcomes, for healthcare systems. From a regional perspective, North America and Europe currently represent the largest market shares due to advanced healthcare infrastructure, high awareness, and favorable reimbursement policies, with significant innovation hubs and early adoption rates. However, the Asia Pacific region is rapidly emerging as a high-growth market, driven by increasing healthcare expenditure, a burgeoning medical tourism sector, improving access to advanced medical technologies, and rising prevalence of orthopedic conditions within its large and aging population. Latin America and the Middle East & Africa are also demonstrating nascent but accelerating growth, characterized by increasing investments in healthcare infrastructure and a growing demand for advanced surgical solutions.

Segmentation trends within the orthopedic surgical robots market reveal a continued dominance of knee and hip replacement applications, which benefit immensely from robotic precision in implant positioning and alignment, thereby reducing revision rates and improving long-term patient mobility. The spine surgery segment is witnessing a particularly rapid uptake, as robotic guidance offers unparalleled accuracy in pedicle screw placement and fusion procedures, addressing critical safety concerns associated with traditional open surgery. Trauma surgery, while a smaller segment, is also gaining traction, with robots assisting in complex fracture reductions and fixation. In terms of product types, the demand for robotic systems remains central, complemented by a growing need for specialized instruments, consumables, and comprehensive service offerings, including maintenance and training, which contribute significantly to recurring revenue streams. End-user analysis highlights hospitals as the primary adopters, leveraging these technologies to enhance surgical capacity, attract patients, and improve operational efficiencies. However, there is a discernible trend towards the increasing adoption in Ambulatory Surgical Centers (ASCs), especially for less complex, high-volume procedures, driven by cost-containment efforts and patient preference for outpatient settings. This shift indicates a broader acceptance and integration of robotic technology across various healthcare delivery models, suggesting a market poised for diversified growth across multiple dimensions.

AI Impact Analysis on Orthopedic Surgical Robots Market

Users frequently inquire about how Artificial Intelligence is transforming surgical accuracy, streamlining procedural workflows, and enhancing patient personalization in the orthopedic robotic domain. There is a strong interest in understanding AI's role in preoperative planning, intraoperative guidance, and post-operative analysis, alongside concerns about data privacy, the economic implications of AI integration, and the evolving skill sets required for surgeons. Users also seek clarity on whether AI-powered robots will eventually replace human surgeons or serve as collaborative tools, as well as the regulatory frameworks governing these advanced technologies. The overarching theme reflects both optimism for unprecedented precision and efficiency, coupled with a cautious approach towards the ethical and practical challenges of deployment. The impact of AI on Orthopedic Surgical Robots is profound, extending from preoperative diagnostics and planning to intraoperative execution and post-operative rehabilitation. AI algorithms can analyze vast datasets of patient anatomies, surgical outcomes, and imaging scans to create highly personalized surgical plans, predicting potential complications and optimizing implant placement with unparalleled accuracy. This predictive capability significantly reduces variability in surgical results and enhances the overall safety profile of complex orthopedic procedures. Furthermore, AI contributes to real-time decision support during surgery, where machine learning models can process live sensor data from the robot and the patient, providing dynamic guidance to the surgeon, adapting to unexpected anatomical variations, and ensuring optimal execution of the surgical plan. This intelligent assistance transforms the surgeon's role into a supervisory capacity, leveraging robotic precision while maintaining critical human oversight and judgment, ultimately improving the consistency and quality of care delivered.

Beyond precision and guidance, AI is instrumental in streamlining workflow efficiencies within the operating room. Through advanced computer vision and machine learning, AI-powered robots can identify anatomical landmarks, automate routine tasks, and optimize instrument pathways, thereby reducing surgical time and minimizing the physical burden on surgeons. This operational enhancement not only boosts throughput but also contributes to better resource utilization within healthcare facilities. The integration of AI also facilitates comprehensive post-operative monitoring and analysis. By collecting and interpreting data from wearable sensors and follow-up examinations, AI can track patient recovery progress, identify early signs of complications, and personalize rehabilitation protocols. This continuous feedback loop provides invaluable insights for both patients and clinicians, allowing for adaptive care pathways and long-term outcome improvements. The data generated from thousands of AI-assisted surgeries also fuels continuous learning and refinement of the robotic systems themselves, enabling manufacturers to iteratively improve their algorithms and hardware, driving a cycle of innovation that promises increasingly sophisticated and effective orthopedic robotic solutions in the future. However, addressing the ethical implications, data security concerns, and ensuring robust regulatory frameworks for AI in surgery remains paramount for widespread adoption and public trust.

- Enhanced preoperative planning: AI algorithms analyze imaging data (CT, MRI) to create precise 3D patient models, enabling customized surgical strategies and implant selection.

- Intraoperative guidance and real-time decision support: AI assists surgeons with dynamic navigation, tissue recognition, and predictive analytics, optimizing trajectory and execution during surgery.

- Predictive analytics for outcomes: AI models forecast patient-specific outcomes, complications, and recovery trajectories based on extensive data analysis, enabling personalized patient care pathways.

- Automation of routine tasks: AI-powered robots can automate repetitive or highly precise surgical steps, freeing surgeons to focus on critical decision-making.

- Personalized patient care: AI facilitates tailored implant positioning and rehabilitation protocols, optimizing functional recovery and long-term results.

- Improved surgeon training: AI provides simulation environments and performance feedback, accelerating the learning curve for surgeons utilizing robotic platforms.

- Data-driven post-operative monitoring: AI analyzes recovery data from sensors and follow-ups to track progress and flag potential issues, enabling proactive intervention.

DRO & Impact Forces Of Orthopedic Surgical Robots Market

The Orthopedic Surgical Robots Market is influenced by a dynamic interplay of drivers, restraints, opportunities, and competitive impact forces that collectively shape its growth trajectory and strategic direction. A primary driver is the global demographic shift towards an aging population, which inherently increases the prevalence of age-related degenerative orthopedic conditions such as osteoarthritis, necessitating a greater number of joint replacement surgeries. Concurrently, the rising patient demand for minimally invasive surgical procedures, driven by benefits such as reduced pain, smaller scars, shorter hospital stays, and faster recovery, strongly favors the adoption of robotic assistance. Continuous advancements in robotic technology, including improvements in haptic feedback, computer vision, and AI integration, further enhance the precision, safety, and versatility of these systems, making them increasingly attractive to surgeons and healthcare institutions. Favorable reimbursement policies in key markets also play a crucial role, mitigating the high initial capital investment costs for hospitals and encouraging wider adoption. The increasing awareness among healthcare professionals and patients about the superior outcomes achievable with robotic surgery is another significant impetus, fostering a positive market environment.

Despite these strong drivers, the market faces several notable restraints. The exceptionally high initial capital cost associated with acquiring orthopedic robotic systems represents a substantial barrier to entry for many healthcare facilities, particularly smaller hospitals and those in developing economies, necessitating robust financial planning and investment justification. Moreover, the implementation of these complex technologies requires extensive training and a significant learning curve for surgical teams, which can be time-consuming and expensive. Stringent regulatory approval processes for new robotic devices and software updates can also delay market entry and innovation dissemination, posing challenges for manufacturers. Concerns related to data privacy and cybersecurity, especially with AI-integrated systems processing sensitive patient information, add another layer of complexity. Furthermore, the potential for mechanical failure, though rare, and the ongoing maintenance costs associated with these sophisticated machines, can be deterrents to widespread adoption. The scarcity of adequately trained surgeons and support staff proficient in robotic-assisted surgery also limits the pace of market expansion.

Opportunities within the Orthopedic Surgical Robots Market are abundant and diverse. Emerging economies, particularly in Asia Pacific and Latin America, present significant untapped markets where improving healthcare infrastructure and increasing affordability of advanced medical treatments can drive substantial growth. The ongoing development of smaller, more cost-effective, and versatile robotic systems, including miniature and collaborative robots, could expand applications beyond major joints to extremity surgeries and outpatient settings, making the technology accessible to a broader range of facilities and patients. The deeper integration of Augmented Reality (AR) and Virtual Reality (VR) with robotic platforms offers enhanced visualization and simulation capabilities for surgical planning and training. Personalized medicine, leveraging patient-specific data and 3D printing for custom implants guided by robots, represents a transformative opportunity for optimizing individual patient outcomes. The expansion of robotic surgery into ambulatory surgical centers (ASCs) for appropriate procedures also presents a compelling growth avenue, driven by efficiency and cost-containment goals. The competitive landscape is characterized by moderate to high intensity of rivalry, with established players continuously innovating and new entrants seeking niches. The bargaining power of buyers, primarily large hospital networks and Group Purchasing Organizations (GPOs), remains significant due to high acquisition costs and the potential for bulk purchases. The bargaining power of suppliers, particularly for specialized components and software, is moderate but can increase with unique technological offerings. The threat of new entrants is moderate to low due to high capital requirements, extensive R&D, and regulatory hurdles, while the threat of substitutes, such as traditional open surgery or less invasive manual techniques, is declining but still present, particularly for simpler procedures or in resource-limited settings.

Segmentation Analysis

The Orthopedic Surgical Robots Market is systematically segmented across various dimensions to provide a detailed understanding of its complex dynamics, identify key growth areas, and assess competitive landscapes. These segmentations typically include analyses by product, application, end-user, and robotic type, each revealing distinct market characteristics and opportunities. The product segment differentiates between the core robotic systems themselves, the indispensable instruments and accessories required for their operation, and the crucial services encompassing maintenance, training, and software updates that ensure sustained functionality and clinical proficiency. The application segment delineates the primary orthopedic procedures benefiting from robotic assistance, with knee and hip replacements forming the largest share, complemented by rapidly growing segments such as spine and trauma surgeries. This granular view allows stakeholders to pinpoint the most impactful areas of technological development and market penetration. Furthermore, the end-user segmentation classifies market demand based on the type of healthcare facility adopting these technologies, primarily hospitals and ambulatory surgical centers, each with unique needs and adoption drivers. Finally, the market is also segmented by the level of autonomy offered by the robots, distinguishing between fully autonomous systems and more commonly used semi-autonomous, surgeon-controlled platforms. Understanding these segmentations is critical for strategic planning, product development, and targeted market efforts within the orthopedic robotic industry.

The dominance of knee and hip replacement applications within the market segmentation underscores the profound impact robotic systems have had on improving the precision and longevity of these common procedures. Robotic guidance minimizes common issues like malalignment and implant loosening, which are significant causes of revision surgeries in traditional methods. As such, these segments continue to attract substantial investment in R&D, leading to iterative improvements in planning software, haptic feedback mechanisms, and instrument design. The rapid growth observed in the spine surgery segment is particularly noteworthy; the inherent complexity and risk associated with spinal procedures make robotic precision incredibly valuable for pedicle screw placement, decompression, and fusion, where even minor deviations can have severe neurological consequences. This segment is expected to continue its upward trajectory as more surgeons become proficient and technology advances further. The increasing acceptance of orthopedic robotic surgery in ambulatory surgical centers (ASCs) reflects a broader shift towards outpatient care models for suitable procedures, driven by cost efficiencies and patient preferences. ASCs offer a streamlined environment for scheduled surgeries, and the integration of robotic platforms in these settings suggests a maturation of the technology, making it more accessible and economically viable beyond traditional hospital environments. This ongoing evolution across segments highlights the adaptive nature of the market and its potential for continued diversification and expansion.

- By Product

- Robotic Systems: Core hardware platforms comprising the main robotic arm, navigation unit, and control console.

- Instruments & Accessories: Specialized surgical tools, sterile drapes, cutting guides, bone preparation tools, and disposables specific to robotic procedures.

- Services: Installation, maintenance contracts, software upgrades, technical support, and comprehensive surgeon and staff training programs.

- By Application

- Knee Replacement: Total Knee Arthroplasty (TKA), Partial Knee Arthroplasty (PKA).

- Hip Replacement: Total Hip Arthroplasty (THA).

- Spine Surgery: Pedicle screw placement, spinal fusion, deformity correction.

- Trauma Surgery: Complex fracture reduction and fixation.

- Others: Shoulder replacement, ankle fusion, deformity correction, limb lengthening.

- By End-User

- Hospitals: Large academic medical centers, community hospitals, specialty orthopedic hospitals.

- Ambulatory Surgical Centers (ASCs): Outpatient facilities performing scheduled surgeries.

- By Robotic Type

- Fully Autonomous Robots: Systems capable of performing surgical tasks independently once programmed.

- Semi-Autonomous (Surgeon-Controlled) Robots: Systems that assist and guide the surgeon, with the surgeon maintaining direct control over the critical surgical steps.

Value Chain Analysis For Orthopedic Surgical Robots Market

The value chain for the Orthopedic Surgical Robots Market is complex and multi-faceted, encompassing various stages from component manufacturing to patient care delivery, highlighting the intricate network of suppliers, producers, distributors, and end-users. Upstream analysis involves the sourcing of highly specialized components and raw materials, including precision mechanics, advanced sensors, sophisticated imaging systems, high-performance computing units, and proprietary software algorithms. Key suppliers in this segment include manufacturers of robotic arms, control systems, specialized motors, haptic feedback devices, and medical-grade materials, all contributing to the foundational technology. These components are then integrated by orthopedic robotic system manufacturers who undertake extensive research, development, and rigorous testing to assemble the final robotic platforms. The downstream analysis focuses on the distribution and implementation of these systems, where manufacturers either employ direct sales forces to engage with large hospital networks and academic institutions or utilize third-party distributors to reach a broader base of smaller hospitals and ambulatory surgical centers. This distribution network is crucial for market penetration and ensuring widespread availability. Both direct and indirect distribution channels are vital; direct channels allow for closer relationships with key opinion leaders and provide immediate feedback for product refinement, while indirect channels through medical device distributors can leverage existing sales networks and local market expertise. The entire chain culminates in the end-user facilities where surgeons and medical staff undergo intensive training to proficiently operate these robots, ultimately delivering enhanced surgical outcomes to patients. This value chain also incorporates post-sales services such as maintenance, technical support, and software updates, which are essential for the long-term operational success and value proposition of robotic surgical systems.

Orthopedic Surgical Robots Market Potential Customers

The primary potential customers and end-users for products and services within the Orthopedic Surgical Robots Market are diverse, yet share a common objective of enhancing surgical precision, improving patient outcomes, and optimizing operational efficiencies in orthopedic care. At the forefront are large academic medical centers and university hospitals, which frequently serve as early adopters of cutting-edge technology due to their research mandates, high patient volumes, and substantial capital budgets. These institutions are driven by the desire to offer the most advanced treatments, attract top surgical talent, and position themselves as leaders in medical innovation. Community hospitals also represent a significant customer segment, increasingly investing in robotic systems to stay competitive, improve quality metrics, and cater to local patient demand for advanced, minimally invasive procedures. The ability of robotic systems to enhance consistency and reduce complication rates is particularly attractive to these facilities. Furthermore, specialized orthopedic clinics and centers, which focus exclusively on musculoskeletal care, are prime candidates for adoption, as these technologies directly align with their core mission of providing highly specialized and effective orthopedic interventions. Beyond traditional hospital settings, Ambulatory Surgical Centers (ASCs) are rapidly emerging as a crucial customer segment. As healthcare shifts towards outpatient models for suitable procedures, ASCs are seeking technologies that can deliver high-volume, cost-effective surgeries with excellent outcomes and quick patient turnaround times, making robotic systems an increasingly viable investment for this growing sector. Government healthcare institutions and military hospitals also constitute an important customer base, driven by mandates to provide advanced medical care to their beneficiaries, often with dedicated funding for technological upgrades. Ultimately, the buyers are the healthcare institutions themselves, but the influence of orthopedic surgeons, hospital administrators, and even patient preference for robotic-assisted surgery significantly drives the purchasing decisions within these customer groups, seeking to leverage robotics for better patient care, improved surgical ergonomics, and enhanced institutional reputation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.5 Billion |

| Market Forecast in 2032 | $4.7 Billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Zimmer Biomet, Johnson & Johnson (Depuy Synthes), Medtronic, Smith & Nephew, Think Surgical Inc., Brainlab AG, Intuitive Surgical, Globus Medical, OMNIlife science, Inc., Renishaw plc, Curexo Inc., TINAVI Medical Technologies Co., Ltd., Amplitude Surgical, Synaptive Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Orthopedic Surgical Robots Market Key Technology Landscape

The Orthopedic Surgical Robots Market is defined by a dynamic and continuously evolving technology landscape, where innovation drives enhanced precision, safety, and versatility in surgical procedures. At the core of these advancements is the pervasive integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, which empower robotic systems with sophisticated capabilities such as predictive analytics for preoperative planning, real-time intraoperative decision support, and adaptive control during surgery. These AI components enable robots to learn from vast datasets, optimize surgical trajectories, and provide highly personalized guidance. Computer vision technology, often coupled with AI, plays a crucial role in accurate anatomical mapping, instrument tracking, and collision avoidance, ensuring precise navigation within the surgical field. Haptic feedback systems are increasingly vital, allowing surgeons to "feel" the interaction between surgical tools and tissue through the robotic interface, mimicking the tactile sensation of traditional surgery and enhancing control and safety. Furthermore, the incorporation of Augmented Reality (AR) and Virtual Reality (VR) technologies provides surgeons with immersive visualization tools for surgical planning and intraoperative overlays, offering enhanced anatomical understanding and greater surgical confidence. Advanced robotics, including miniaturized robots and collaborative robotic arms, are expanding the range of procedures that can be performed robotically and facilitating integration into smaller operating environments. Cloud computing enables secure data storage, remote diagnostics, and collaborative learning across multiple robotic systems globally, fostering continuous improvement. Advanced imaging modalities, such as intraoperative CT and MRI, are increasingly being fused with robotic systems to provide real-time, high-resolution anatomical data, leading to more accurate resections and implant placements. The convergence of these diverse technologies is rapidly transforming orthopedic surgery, moving towards a future characterized by unprecedented levels of precision, personalization, and efficiency in patient care.

Regional Highlights

The Orthopedic Surgical Robots Market exhibits distinct regional dynamics, influenced by varying healthcare infrastructures, regulatory landscapes, economic conditions, and demographic trends. Each region presents unique opportunities and challenges for market penetration and growth, necessitating tailored strategies for manufacturers and service providers. North America, driven by the United States and Canada, holds the largest market share globally, attributed to its advanced healthcare systems, high prevalence of orthopedic conditions, strong investment in research and development, and favorable reimbursement policies for robotic-assisted surgeries. The region also benefits from a high level of patient and physician awareness regarding the benefits of these advanced technologies, alongside the presence of numerous key market players and innovators. Europe follows closely, with countries like Germany, the UK, France, and Italy leading in adoption due to robust healthcare spending, an aging population, and an increasing focus on improving surgical outcomes. The presence of well-established medical device companies and a strong regulatory framework further support market growth in this region. However, bureaucratic healthcare systems and cost-containment pressures in some European countries can moderate the pace of adoption.

- North America: Dominant market share driven by advanced healthcare infrastructure, high adoption rates of innovative technologies, strong R&D investments, and favorable reimbursement policies, particularly in the United States and Canada.

- Europe: Second-largest market, characterized by an aging population, increasing prevalence of orthopedic disorders, and robust healthcare spending in countries such as Germany, the UK, France, and Italy. Focus on improving surgical precision and reducing revision rates.

- Asia Pacific (APAC): Fastest-growing region, fueled by rising healthcare expenditures, improving access to advanced medical technologies, growing medical tourism, and a rapidly expanding geriatric population in countries like China, Japan, India, and South Korea. Government initiatives to modernize healthcare infrastructure also contribute significantly.

- Latin America: An emerging market with increasing investment in healthcare infrastructure and a growing demand for advanced surgical options. Countries like Brazil and Mexico are leading the adoption, albeit from a smaller base, with opportunities for market expansion as economic conditions improve.

- Middle East and Africa (MEA): Nascent but steadily growing market, driven by increasing healthcare spending, development of medical tourism hubs, and efforts to modernize healthcare facilities in countries such as UAE, Saudi Arabia, and South Africa. Challenges include varying levels of healthcare access and regulatory complexities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Orthopedic Surgical Robots Market.- Stryker Corporation

- Zimmer Biomet

- Johnson & Johnson (Depuy Synthes)

- Medtronic

- Smith & Nephew

- Think Surgical Inc.

- Brainlab AG

- Intuitive Surgical

- Globus Medical

- OMNIlife science, Inc.

- Renishaw plc

- Curexo Inc.

- TINAVI Medical Technologies Co., Ltd.

- Amplitude Surgical

- Synaptive Medical

- Exactech, Inc.

- Microsure BV

- Mako Surgical Corp. (a Stryker company)

- Naviswiss AG

- Orthosensor, Inc. (a Zimmer Biomet company)

Frequently Asked Questions

What are the primary benefits of orthopedic surgical robots?

Orthopedic surgical robots offer enhanced precision and accuracy in implant placement, leading to improved surgical outcomes, reduced complication rates, and increased implant longevity. They enable minimally invasive procedures, resulting in less blood loss, smaller incisions, reduced post-operative pain, and faster patient recovery times. These systems also provide real-time guidance and feedback to surgeons, standardizing procedures and potentially lowering the need for revision surgeries.

How does AI contribute to orthopedic robot efficiency?

AI significantly enhances orthopedic robot efficiency by enabling advanced preoperative planning, where algorithms analyze imaging data for personalized surgical strategies. During surgery, AI provides real-time decision support and dynamic guidance, adapting to anatomical variations. It also helps automate routine tasks, streamline workflows, and offers predictive analytics for outcomes, optimizing resource utilization and improving overall operational flow in the operating room.

What challenges exist in adopting orthopedic surgical robots?

Key challenges include the high initial capital cost of purchasing robotic systems, which can be a barrier for many healthcare facilities. Extensive training requirements for surgeons and support staff, along with a steep learning curve, also pose significant hurdles. Furthermore, stringent regulatory approval processes, ongoing maintenance costs, and concerns regarding data privacy and cybersecurity with integrated AI systems present additional complexities for widespread adoption.

Which applications are most common for these robots?

The most common applications for orthopedic surgical robots include total knee replacement and total hip replacement surgeries, where robotic precision significantly improves implant alignment and positioning. The market is also seeing rapid growth in spine surgery, particularly for pedicle screw placement and spinal fusion, due to the high demand for accuracy in these delicate procedures. Other emerging applications include trauma surgery and various extremity procedures.

What is the future outlook for the orthopedic surgical robots market?

The future outlook for the orthopedic surgical robots market is highly positive, driven by continuous technological advancements, increasing demand for minimally invasive procedures, and a growing aging population globally. Integration of AI, AR/VR, and miniaturized robotics is expected to expand applications and accessibility. Market growth will also be fueled by increasing adoption in emerging economies and ambulatory surgical centers, leading to sustained innovation and wider utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager