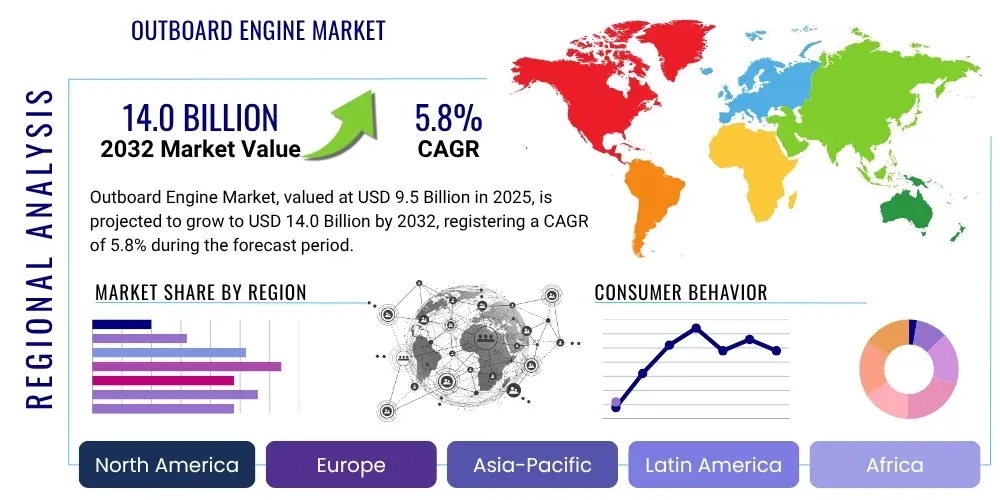

Outboard Engine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429330 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Outboard Engine Market Size

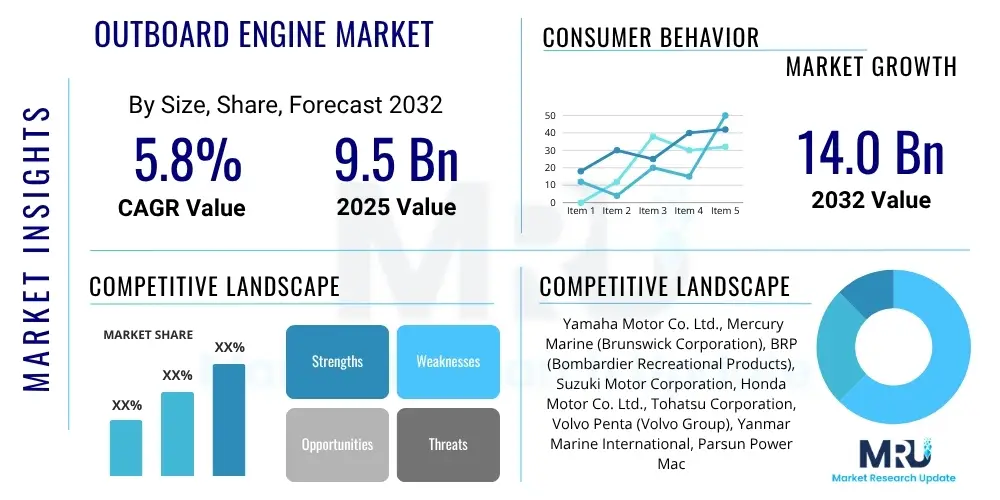

The Outboard Engine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 9.5 Billion in 2025 and is projected to reach USD 14.0 Billion by the end of the forecast period in 2032.

Outboard Engine Market introduction

The Outboard Engine Market encompasses the global industry involved in the manufacturing, distribution, and sale of self-contained units that include the engine, gearbox, and propeller, designed to be affixed to the outside of the transom of a boat. These engines provide propulsion for a wide array of watercraft, ranging from small recreational fishing boats and tenders to larger commercial vessels and pontoons. Their popularity stems from their versatility, ease of installation, maintenance, and the ability to tilt or remove the engine for shallow water operation or storage.

Key applications for outboard engines are diverse, spanning recreational boating activities such as fishing, water sports, cruising, and leisure, as well as commercial uses including transportation, fishing fleets, governmental patrol boats, and rescue operations. The fundamental benefits of outboard engines include their efficient power-to-weight ratio, superior maneuverability, and the ability to free up valuable interior space within the boat compared to inboard engine setups. They also offer greater accessibility for servicing and repair, contributing to their widespread adoption across various marine sectors.

Driving factors propelling the growth of this market include increasing participation in recreational boating activities globally, a rising disposable income in emerging economies, continuous technological advancements leading to more fuel-efficient and environmentally friendly engines, and the expanding demand for compact and versatile propulsion systems. Furthermore, product innovation focusing on electric and hybrid outboard solutions is opening new avenues for market expansion, addressing evolving consumer preferences and regulatory pressures concerning emissions.

Outboard Engine Market Executive Summary

The global Outboard Engine Market is experiencing robust growth, primarily driven by a resurgence in recreational boating activities and significant technological advancements aimed at improving fuel efficiency and reducing environmental impact. Business trends indicate a strong move towards sustainability, with manufacturers heavily investing in electric and hybrid propulsion systems to cater to a growing segment of eco-conscious consumers and to comply with stringent environmental regulations. Furthermore, the market is witnessing a consolidation among key players, alongside strategic partnerships focused on innovation and expanding distribution networks. The aftermarket for parts and services also presents a substantial opportunity, fueled by a large installed base of engines requiring regular maintenance and upgrades.

Regionally, North America continues to dominate the market due to its established boating culture, extensive waterways, and high disposable incomes, which support a vibrant recreational marine industry. Europe also holds a significant market share, with countries like Scandinavia and the Mediterranean region showing consistent demand, particularly for leisure and professional fishing boats. The Asia Pacific region is emerging as a high-growth market, propelled by increasing economic prosperity, a growing middle class, and developing marine tourism infrastructure in countries such as China, Japan, and Australia. Latin America and the Middle East & Africa also contribute to market growth, albeit at a slower pace, driven by localized demand for commercial and leisure boating.

In terms of segmentation, the market observes diverse trends across different categories. The 4-stroke engine segment currently holds the largest share due to its superior fuel efficiency, lower emissions, and quieter operation, aligning with modern consumer preferences. However, the electric outboard engine segment is projected to exhibit the highest CAGR, driven by technological innovations in battery life, motor efficiency, and a global push towards decarbonization in transportation. The recreational application segment remains the largest end-user, while the commercial sector, particularly for small-scale fishing and logistics, provides a stable demand base. Advancements in engine horsepower, particularly in the mid-to-high power range, are catering to larger recreational boats and professional applications, reflecting evolving consumer requirements for performance and capability.

AI Impact Analysis on Outboard Engine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Outboard Engine Market frequently revolve around themes of enhanced performance, predictive maintenance, autonomous operation, and optimized user experience. Common questions address how AI can contribute to more intelligent engine management systems, what role it plays in improving fuel efficiency, and its potential in developing self-docking or autonomous boating features. Consumers and industry professionals alike express interest in AI's capacity to personalize boating experiences, offer real-time diagnostics, and integrate with broader smart marine ecosystems. There's also a considerable focus on the safety implications of AI-driven systems and the potential for AI to streamline manufacturing processes and supply chain management within the outboard engine industry.

The prevailing concerns often include the reliability and security of AI systems in critical marine applications, the potential for job displacement due to automation, and the ethical considerations surrounding autonomous vessel operations. Users seek clarity on the level of AI integration currently available and what future advancements are realistically anticipated within the next decade. Expectations are high for AI to deliver substantial improvements in operational efficiency, reduce the environmental footprint of marine propulsion, and make boating more accessible and enjoyable through intelligent assistance systems. Furthermore, there is an anticipation for AI to transform after-sales service and support through remote diagnostics and AI-powered troubleshooting, thereby minimizing downtime and enhancing customer satisfaction.

Overall, the key themes indicate a strong user demand for AI to serve as an enabler for smarter, safer, and more sustainable outboard engine solutions. This includes leveraging AI for predictive analytics to anticipate maintenance needs, optimize engine performance based on real-time environmental conditions, and facilitate the development of advanced navigation and safety features. The market is keenly observing how AI can move beyond basic automation to provide truly intelligent, adaptive, and interconnected marine propulsion systems that meet both performance expectations and environmental mandates, while addressing concerns about cost, complexity, and cybersecurity vulnerabilities.

- AI-driven predictive maintenance systems extending engine lifespan and reducing downtime.

- Optimized fuel efficiency through AI algorithms adjusting engine parameters in real-time based on water conditions, load, and speed.

- Enhanced navigation and safety features via AI-powered collision avoidance and intelligent routing.

- Development of autonomous and semi-autonomous docking assistance for improved ease of use.

- Personalized boating experiences through AI learning user preferences for speed, acceleration, and specific operational modes.

- Integration with smart marine ecosystems for seamless connectivity and data exchange.

- AI in manufacturing processes for quality control, design optimization, and supply chain efficiency.

- Remote diagnostics and troubleshooting enabled by AI for faster and more accurate service.

- AI-enhanced noise and vibration reduction for a quieter and smoother boating experience.

DRO & Impact Forces Of Outboard Engine Market

The Outboard Engine Market is significantly influenced by a dynamic interplay of driving forces, inherent restraints, and emerging opportunities, all contributing to its evolving landscape. A primary driver is the escalating global interest in recreational boating, fueled by rising disposable incomes, increased leisure time, and a growing desire for outdoor activities. This is further complemented by advancements in marine tourism infrastructure worldwide. Simultaneously, continuous innovation in engine technology, particularly focusing on enhanced fuel efficiency, reduced emissions, and improved power output, stimulates consumer upgrades and new purchases. The shift towards sustainable boating practices and the subsequent demand for electric and hybrid outboard engines also serves as a potent growth catalyst, driven by both consumer preference and increasingly stringent environmental regulations.

However, several restraints pose challenges to market expansion. The high initial cost of advanced outboard engines, especially those featuring electric propulsion or high horsepower, can deter potential buyers. Economic downturns and volatility in fuel prices directly impact consumer spending on discretionary items like boats and engines, leading to sales fluctuations. Stringent environmental regulations, while driving innovation, can also increase manufacturing costs and create compliance complexities for smaller players. Furthermore, the limited charging infrastructure for electric outboards in remote boating locations currently acts as a significant impediment to their broader adoption, despite their environmental benefits. The market is also susceptible to the availability and cost of raw materials, which can affect production capacity and pricing strategies.

Despite these challenges, numerous opportunities abound for market participants. The rapidly expanding market for electric and hybrid outboards presents a substantial growth avenue, particularly as battery technology improves and charging infrastructure expands. There is also a significant opportunity in developing smart, connected outboard engines that integrate with marine electronics and offer advanced telematics and diagnostic capabilities. The growing demand for smaller, more portable outboards for tenders and inflatable boats offers a niche for innovation. Furthermore, geographical expansion into emerging markets in Asia Pacific and Latin America, where boating cultures are developing and disposable incomes are rising, represents a lucrative long-term prospect. The aftermarket for parts, accessories, and specialized maintenance services also continues to provide a stable revenue stream, adaptable to technological advancements.

Segmentation Analysis

The Outboard Engine Market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation facilitates targeted market strategies and product development by categorizing engines based on their operational characteristics, power output, fuel source, and intended applications. The primary dimensions for analysis include fuel type, engine type, horsepower range, and application, each revealing distinct consumer preferences and industry trends. These segments not only reflect the technological evolution within marine propulsion but also the varying demands of a broad spectrum of end-users, from casual recreational enthusiasts to professional mariners. Understanding these distinctions is crucial for manufacturers, distributors, and investors aiming to capitalize on specific market niches and respond effectively to shifting demand patterns.

- By Fuel Type:

- Gasoline Outboard Engines

- Electric Outboard Engines

- Propane Outboard Engines

- Diesel Outboard Engines

- By Engine Type:

- 2-Stroke Outboard Engines

- 4-Stroke Outboard Engines

- Electric Outboard Engines

- By Horsepower:

- Less than 10 HP

- 10-50 HP

- 50-100 HP

- 100-200 HP

- More than 200 HP

- By Application:

- Recreational (e.g., fishing, water sports, cruising)

- Commercial (e.g., transportation, professional fishing, patrol)

- Military (e.g., special operations, tenders)

- By Boat Type:

- Fishing Boats

- Pontoon Boats

- Runabouts

- Yachts and Large Cruisers (as tenders)

- Inflatable Boats

- Kayaks and Canoes (with small outboards)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Outboard Engine Market

The value chain for the Outboard Engine Market is a complex and interconnected network, beginning with the upstream activities of raw material sourcing and component manufacturing, progressing through the core production process, and culminating in downstream distribution and after-sales service. Upstream analysis involves the procurement of essential raw materials such as aluminum alloys for engine blocks, various metals for crankshafts and propellers, and specialized plastics and composites for casings and other components. Suppliers of electronic control units (ECUs), fuel injection systems, ignition systems, and various other intricate parts form a critical part of this initial stage. The efficiency and reliability of these upstream suppliers directly influence the quality, cost, and lead time of the final outboard engine, making robust supply chain management paramount for manufacturers.

The midstream of the value chain is dominated by the core manufacturing and assembly processes undertaken by major outboard engine producers. This stage involves precision engineering, casting, machining, and the intricate assembly of thousands of components into a functional and reliable propulsion system. Research and development activities, including engine design, performance optimization, noise reduction, and the integration of advanced technologies like fuel injection, electric propulsion, and smart diagnostics, are central to value creation here. Quality control, testing, and compliance with international marine safety and environmental standards are also integral parts of this phase, ensuring product integrity and market acceptance. Manufacturing facilities are often highly automated, leveraging advanced robotics and lean production principles to maximize efficiency and maintain competitive pricing.

Downstream activities encompass the distribution, sales, and after-sales support of outboard engines. Distribution channels are typically a mix of direct and indirect approaches. Direct channels involve manufacturers selling directly to large boat builders (OEMs) for factory-installed packages, or through their own flagship stores and online platforms for certain models. Indirect channels, which are more prevalent, involve a vast network of independent dealers, distributors, and marine retailers who stock, sell, and service outboard engines to end-users. These dealers often provide expert advice, installation services, and crucial after-sales support, including maintenance, repairs, and spare parts. The effectiveness of these distribution networks is critical for market penetration and customer satisfaction, requiring strong partnerships and consistent training to ensure brand representation and service quality. After-sales service and parts availability are significant contributors to customer loyalty and brand reputation.

Outboard Engine Market Potential Customers

The Outboard Engine Market caters to a diverse range of potential customers, broadly categorized into recreational users, commercial operators, and governmental/military entities, each with distinct needs, purchasing behaviors, and usage patterns. Recreational users constitute the largest segment of end-users, encompassing individuals and families who own boats for leisure activities such as fishing, water sports (e.g., wakeboarding, tubing), cruising, and general relaxation on the water. This segment values features like reliability, fuel efficiency, ease of operation, quiet performance, and increasingly, environmentally friendly options like electric outboards. Their purchasing decisions are often influenced by brand reputation, dealer support, aesthetic appeal, and the specific requirements of their boat type and intended activities. They are also keen on technological advancements that enhance convenience, safety, and the overall boating experience.

Commercial operators represent another significant customer base, including professional fishermen, charter boat services, marine tour operators, water taxi services, and small logistics companies operating on inland waterways or coastal areas. For these customers, factors such as durability, ruggedness, low total cost of ownership (TCO) including fuel and maintenance, consistent performance under heavy loads, and widespread service availability are paramount. Downtime directly translates to lost revenue, making reliability and quick access to parts and service critical considerations. They often purchase higher horsepower engines and may have specific requirements for engine configuration to suit their commercial vessel types and operational demands, emphasizing longevity and robust construction for continuous heavy use.

Governmental and military agencies also serve as important buyers of outboard engines, procuring them for patrol boats, search and rescue operations, border security, special forces tenders, and scientific research vessels. Their requirements are typically stringent, focusing on extreme reliability, performance in harsh conditions, stealth capabilities (for military applications), specific power output for high-speed pursuits or heavy lifting, and compatibility with specialized equipment. Durability, minimal maintenance needs, and secure supply chains for parts are crucial. Furthermore, the burgeoning segment of rental operators, marine schools, and yacht clubs also constitutes a significant customer base, requiring durable, easy-to-maintain engines that can withstand frequent and varied use by multiple operators, emphasizing ease of operation and robust construction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 9.5 Billion |

| Market Forecast in 2032 | USD 14.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yamaha Motor Co. Ltd., Mercury Marine (Brunswick Corporation), BRP (Bombardier Recreational Products), Suzuki Motor Corporation, Honda Motor Co. Ltd., Tohatsu Corporation, Volvo Penta (Volvo Group), Yanmar Marine International, Parsun Power Machine (Suzhou) Co., Ltd., Hidea Power Machinery Co., Ltd., Lehr Inc., Torqeedo GmbH, ePropulsion Technology Co. Ltd., Pure Watercraft, Cox Powertrain, Seven Marine (part of Volvo Penta), Ilmor Marine, OXE Marine AB, CIMCO Marine AB (now OXE Marine), EVOY AS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outboard Engine Market Key Technology Landscape

The Outboard Engine Market is undergoing a significant technological transformation, driven by demands for increased performance, fuel efficiency, reduced emissions, and enhanced user experience. One of the most critical technological advancements has been the widespread adoption of Electronic Fuel Injection (EFI) systems, replacing older carbureted designs. EFI provides precise control over fuel delivery, leading to improved fuel economy, lower emissions, easier cold starts, and more consistent engine performance across varying conditions. This technology is foundational for meeting modern environmental regulations and consumer expectations for reliable and efficient operation. Alongside EFI, advanced engine control units (ECUs) are becoming more sophisticated, allowing for intricate engine management, self-diagnostics, and seamless integration with other marine electronics, such as GPS, fish finders, and multifunction displays.

Another pivotal area of innovation is in the development of 4-stroke engine technology, which has largely superseded 2-stroke engines in many segments due to its superior fuel efficiency, quieter operation, and significantly lower emissions. Modern 4-stroke outboards feature advanced valvetrain designs, variable camshaft timing, and sophisticated exhaust gas recirculation (EGR) systems to further optimize combustion and minimize environmental impact. Furthermore, there is a growing focus on lightweight materials, such as aluminum alloys and composite plastics, in engine construction to improve power-to-weight ratios, enhance maneuverability, and contribute to overall boat performance. This material innovation also aids in corrosion resistance, extending the lifespan of engines in harsh marine environments, a crucial factor for both recreational and commercial users.

The most disruptive technological trend is the rapid emergence and development of electric and hybrid outboard engines. Driven by global sustainability initiatives and consumer demand for cleaner, quieter propulsion, these systems leverage advanced battery technologies (e.g., lithium-ion), high-efficiency electric motors, and sophisticated power management systems. Innovations in battery density and charging infrastructure are continually pushing the boundaries of range and usability for electric outboards. Hybrid systems, which combine an electric motor with a traditional internal combustion engine, offer a bridge solution, providing extended range and flexibility. Beyond propulsion, "smart" technologies are integrating telematics, GPS, remote monitoring, and even AI-powered diagnostic and predictive maintenance capabilities, transforming outboard engines into highly connected and intelligent marine systems that offer unparalleled convenience, safety, and operational insights to boat owners.

Regional Highlights

- North America: Dominates the outboard engine market due to a deeply entrenched recreational boating culture, extensive coastlines and inland waterways, and high disposable incomes. The region showcases significant demand for both high-horsepower engines for larger vessels and smaller, portable outboards for tenders and fishing. Environmental regulations are also driving demand for more efficient and lower-emission engines, including electric options.

- Europe: Holds a substantial market share, particularly driven by countries in Scandinavia, the Mediterranean, and the UK. Recreational boating, yachting, and commercial fishing are key application areas. The region is a frontrunner in adopting electric and hybrid outboard solutions due to strong environmental awareness and regulatory push for decarbonization in marine transport.

- Asia Pacific (APAC): Emerging as the fastest-growing region, propelled by rising economic prosperity, increasing leisure activities, and developing marine tourism infrastructure in countries like China, Japan, Australia, and Southeast Asian nations. While traditional gasoline outboards dominate, there is a growing interest in electric models, especially for inland waterways and eco-tourism.

- Latin America: Exhibits steady growth, primarily driven by commercial fishing, transportation on rivers and coastal areas, and a nascent but growing recreational boating sector. Brazil and Mexico are key markets, with demand focused on durable and reliable engines suitable for diverse operational conditions.

- Middle East & Africa (MEA): Shows gradual market expansion, primarily influenced by coastal commercial activities, nascent recreational boating in specific areas, and governmental applications for patrol and security. Investment in marine infrastructure and tourism development is expected to further stimulate demand in the coming years.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outboard Engine Market.- Yamaha Motor Co. Ltd.

- Mercury Marine (Brunswick Corporation)

- BRP (Bombardier Recreational Products)

- Suzuki Motor Corporation

- Honda Motor Co. Ltd.

- Tohatsu Corporation

- Volvo Penta (Volvo Group)

- Yanmar Marine International

- Parsun Power Machine (Suzhou) Co., Ltd.

- Hidea Power Machinery Co., Ltd.

- Lehr Inc.

- Torqeedo GmbH

- ePropulsion Technology Co. Ltd.

- Pure Watercraft

- Cox Powertrain

- Seven Marine (part of Volvo Penta)

- Ilmor Marine

- OXE Marine AB

- CIMCO Marine AB (now OXE Marine)

- EVOY AS

Frequently Asked Questions

What is an outboard engine?

An outboard engine is a self-contained unit comprising the engine, gearbox, and propeller, designed to be affixed to the outside of the transom of a boat. It provides propulsion and steering capabilities, making it a popular choice for various watercraft due to its versatility and ease of maintenance.

What are the primary types of outboard engines available?

The primary types of outboard engines are categorized by fuel type (Gasoline, Electric, Propane, Diesel) and engine cycle (2-Stroke, 4-Stroke, Electric). 4-Stroke gasoline engines are currently the most common, while electric outboards are rapidly gaining popularity for their environmental benefits.

How is AI impacting the outboard engine market?

AI is transforming the outboard engine market by enabling predictive maintenance, optimizing fuel efficiency, enhancing navigation and safety features, and facilitating autonomous docking. It also contributes to personalized user experiences and improved manufacturing processes, driving smarter and more efficient marine propulsion.

What factors are driving the growth of the outboard engine market?

Key growth drivers include increasing global participation in recreational boating, rising disposable incomes, continuous technological advancements leading to more fuel-efficient and eco-friendly engines, and the growing demand for sustainable propulsion solutions like electric outboards.

Which regions are key players in the outboard engine market?

North America is the dominant market due to its established boating culture and high consumer spending. Europe also holds a significant share, while the Asia Pacific region is emerging as the fastest-growing market, driven by economic development and increasing marine tourism.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Outboard Engine Market Size By Regional (Europe, North America, South America, Asia Pacific, Middle East And Africa), Industry Growth Opportunity, Price Trends, Competitive Shares, Market Statistics and Forecasts 2025 - 2032

- Fast Rescue Boats Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Inboard Engine Type, Outboard Engine Type), By Application (Ships, Offshore Installations, Coast Guard Service, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager