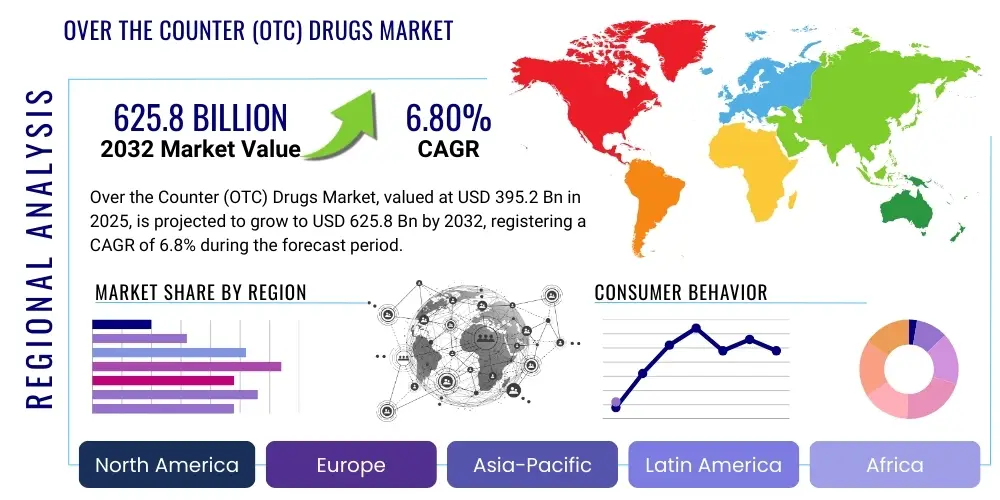

Over the Counter (OTC) Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427738 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Over the Counter (OTC) Drugs Market Size

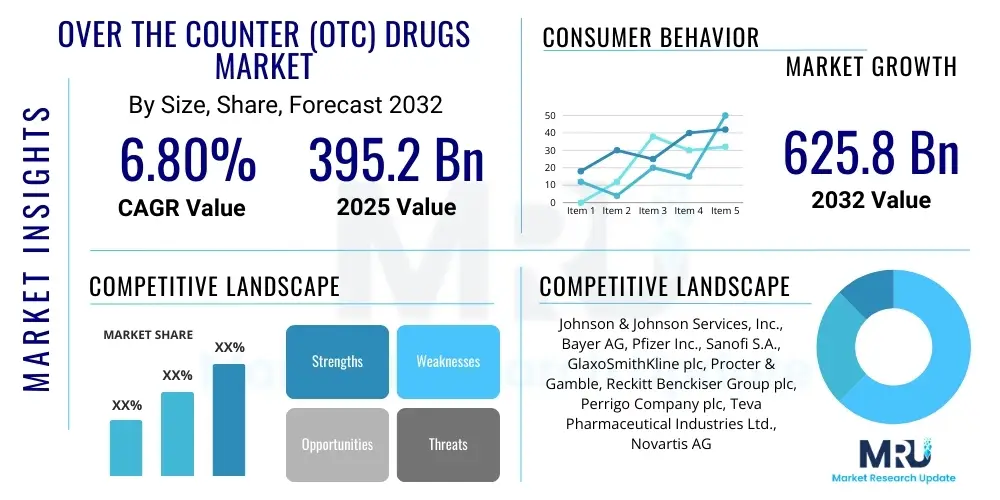

The Over the Counter (OTC) Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 395.2 Billion in 2025 and is projected to reach USD 625.8 Billion by the end of the forecast period in 2032.

Over the Counter (OTC) Drugs Market introduction

The Over the Counter (OTC) Drugs Market encompasses a broad category of pharmaceutical products that can be purchased directly by consumers without a prescription from a healthcare professional. These products are typically used for the self-treatment of common ailments, minor injuries, and chronic conditions that do not require immediate medical supervision. The market’s expansion is primarily driven by increasing healthcare costs, rising health awareness among consumers, and a growing preference for self-medication due to convenience and accessibility. OTC drugs are rigorously evaluated for safety, efficacy, and appropriate labeling by regulatory bodies to ensure consumer protection.

Product descriptions within this market span a vast array, including analgesics for pain relief, cough and cold preparations, digestive health products, dermatological treatments, vitamins and dietary supplements, and allergy medications. Major applications involve symptom management for common illnesses, preventative health, and the management of chronic conditions such as heartburn or mild arthritis. The benefits of OTC drugs are numerous, offering immediate relief, empowering individuals in their healthcare decisions, reducing the burden on healthcare systems, and providing cost-effective alternatives to prescription medications. They play a crucial role in public health by facilitating early intervention and symptomatic relief.

Key driving factors for the OTC drugs market include demographic shifts such as an aging global population prone to various ailments, the rising prevalence of chronic diseases, and increasing consumer engagement in personal health management. Furthermore, the ease of access through diverse distribution channels like pharmacies, supermarkets, and online platforms, coupled with aggressive marketing and product innovation by manufacturers, fuels market growth. The ongoing trend of prescription-to-OTC switches by regulatory bodies also contributes significantly, expanding the range of available non-prescription options and further solidifying the market’s trajectory.

Over the Counter (OTC) Drugs Market Executive Summary

The Over the Counter (OTC) Drugs Market is experiencing robust growth, driven by evolving consumer preferences for self-care and increasing accessibility. Business trends indicate a strong focus on product innovation, particularly in areas like personalized nutrition, natural and organic formulations, and digital health integration. Strategic mergers and acquisitions are prevalent as major pharmaceutical companies seek to consolidate market share and expand their product portfolios. E-commerce and direct-to-consumer models are gaining significant traction, transforming traditional distribution channels and offering new avenues for market penetration and consumer engagement, while also presenting challenges for regulatory oversight and consumer trust in online purchases.

Regionally, North America and Europe continue to dominate the market owing to established healthcare infrastructures, high consumer awareness, and significant expenditure on health and wellness products. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by its vast population, improving economic conditions, and increasing healthcare access and awareness in developing economies like China and India. Latin America and the Middle East & Africa also present considerable growth opportunities, driven by rising disposable incomes, urbanization, and the expanding presence of global OTC manufacturers. Localized product development and marketing strategies are key to success in these diverse regional landscapes, adapting to cultural nuances and specific health priorities.

Segmentation trends highlight several key areas of growth. By product type, the analgesics, cough and cold preparations, and digestive health segments maintain substantial shares, while vitamins and dietary supplements show accelerated growth due to increasing health consciousness. In terms of distribution channels, retail pharmacies remain foundational, but online pharmacies and e-commerce platforms are rapidly expanding their footprint, offering convenience and competitive pricing. The demographic shift towards an aging population also bolsters demand for specific OTC categories addressing age-related conditions, underscoring the need for tailored product development and targeted marketing efforts across various consumer segments and their unique health needs.

AI Impact Analysis on Over the Counter (OTC) Drugs Market

Common user questions regarding AIs impact on the Over the Counter (OTC) Drugs Market frequently revolve around how artificial intelligence can enhance product development, personalize treatment options, optimize supply chains, improve patient engagement through digital platforms, and potentially revolutionize diagnostics for self-care. Users are keen to understand if AI can lead to more effective and safer OTC medications, facilitate quicker access to information, and make self-medication more precise. Concerns often include data privacy, the accuracy of AI-driven recommendations, and the potential for over-reliance on technology in health decisions. There is a general expectation that AI will bring about significant efficiencies and innovation, ultimately empowering consumers with better health management tools and improving the overall efficacy and accessibility of OTC products.

- AI accelerates drug discovery and formulation by analyzing vast datasets for potential active ingredients and optimizing delivery methods, leading to more effective and targeted OTC solutions.

- Personalized medicine via AI algorithms can recommend specific OTC products and dosages based on individual health profiles, genetic predispositions, and historical data, enhancing treatment efficacy.

- Supply chain optimization through AI-driven predictive analytics ensures efficient inventory management, reduces stockouts, and improves distribution logistics, ensuring OTC products are readily available to consumers.

- AI-powered chatbots and virtual assistants provide immediate, accurate information about OTC drugs, dosage instructions, potential interactions, and side effect management, enhancing patient education and adherence.

- Advanced diagnostics, leveraging AI in wearable devices or mobile applications, can offer preliminary assessments for common ailments, guiding consumers towards appropriate OTC remedies or suggesting professional medical consultation.

- Consumer engagement is boosted through AI-driven personalized marketing, product recommendations, and tailored health content, fostering brand loyalty and informed purchasing decisions within the OTC space.

- Pharmacovigilance and post-market surveillance are significantly improved by AI, enabling faster detection and analysis of adverse events related to OTC drugs, thereby enhancing product safety and regulatory compliance.

DRO & Impact Forces Of Over the Counter (OTC) Drugs Market

The Over the Counter (OTC) Drugs Market is significantly influenced by a confluence of driving forces, restraints, and opportunities that collectively shape its trajectory. Key drivers include the global aging population, which naturally increases the incidence of chronic and age-related ailments amenable to self-treatment. Additionally, rising healthcare costs often push consumers towards more affordable and accessible OTC options, reducing reliance on expensive prescription medications and doctor visits. The growing consumer awareness and engagement in personal health management, fueled by readily available health information and digital platforms, empower individuals to take proactive roles in their well-being, directly contributing to the uptake of OTC products for preventative and symptomatic care. Furthermore, favorable regulatory environments in many regions, encouraging the switch of certain prescription drugs to OTC status, continually expands the markets product offerings and consumer choices, propelling sustained growth.

However, the market also faces notable restraints. Stringent regulatory approval processes for new OTC products, especially those involving prescription-to-OTC switches, can be time-consuming and costly, hindering rapid innovation and market entry. The potential for misuse or overdose of OTC medications due to inadequate consumer education or misinterpretation of labels poses significant public health concerns, leading to tighter restrictions and safety warnings. Moreover, the fierce competition within the market, characterized by numerous domestic and international players, often results in price wars and intense marketing expenditures, which can compress profit margins for manufacturers. The rise of alternative therapies and natural remedies, while sometimes complementing OTC products, also presents a competitive challenge by offering consumers different approaches to health management.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The burgeoning e-commerce sector offers unparalleled reach, allowing OTC products to be distributed to a wider demographic, particularly in remote areas, and catering to the convenience sought by modern consumers. Advances in technology, including artificial intelligence and data analytics, enable more personalized product development, targeted marketing campaigns, and efficient supply chain management, optimizing operations from manufacturing to point of sale. Moreover, the increasing demand for preventive health solutions and wellness products, alongside a growing focus on sustainable and natural ingredients, opens new product development avenues. Strategic collaborations between pharmaceutical companies and technology firms, or partnerships with digital health platforms, also represent significant opportunities to enhance consumer engagement, provide value-added services, and ultimately capture new market segments.

Segmentation Analysis

The Over the Counter (OTC) Drugs Market is comprehensively segmented to provide granular insights into its diverse components, facilitating a detailed understanding of market dynamics, consumer behavior, and competitive landscapes. These segmentations are typically based on product type, which categorizes drugs by their therapeutic area or application; dosage form, which addresses how the medication is administered; distribution channel, detailing where consumers purchase these products; and consumer demographics or indications, which identify the target users and their specific health needs. Each segment exhibits unique growth patterns and competitive characteristics, reflecting evolving consumer preferences and healthcare trends globally.

- By Product Type:

- Analgesics (Pain Relievers)

- Cough, Cold, and Flu Products

- Digestive Health Products (Antacids, Laxatives, Probiotics)

- Dermatological Products (Topical Antiseptics, Antifungals, Acne Treatments)

- Vitamins, Minerals, and Supplements (VMS)

- Weight Management and Wellbeing Products

- Ophthalmic Products

- Sleep Aids

- Oral Care Products

- First Aid Products

- Allergy, Asthma, and Sinus Products

- By Dosage Form:

- Tablets and Capsules

- Liquids and Suspensions

- Ointments, Creams, and Gels

- Sprays

- Patches

- Powders

- By Distribution Channel:

- Retail Pharmacies and Drug Stores

- Hospital Pharmacies

- Supermarkets and Hypermarkets

- Online Pharmacies and E-commerce Platforms

- Convenience Stores

- By Indication/Application:

- Pain Management

- Respiratory Conditions

- Digestive Disorders

- Skin Health

- Nutritional Deficiencies

- Allergies

- Sleep Disorders

- Oral Health

Over the Counter (OTC) Drugs Market Value Chain Analysis

The value chain for the Over the Counter (OTC) Drugs Market is a complex and multi-stage process, beginning with extensive research and development (R&D) to identify new compounds or adapt existing prescription drugs for OTC use, followed by raw material sourcing and active pharmaceutical ingredient (API) manufacturing. The upstream segment involves the discovery, synthesis, and production of these APIs, alongside the procurement of excipients and packaging materials from a global network of suppliers. Quality control and regulatory compliance are paramount at this stage, ensuring the purity and safety of all inputs. Manufacturers then formulate, produce, and package the final OTC products, often engaging in large-scale production to meet widespread consumer demand, leveraging economies of scale for cost efficiency.

Moving downstream, the distribution channel is a critical component, encompassing both direct and indirect routes to market. Direct distribution might involve manufacturers selling directly to large retail chains or through their own online platforms, offering greater control over pricing and branding. Indirect channels, which are more common, involve a network of wholesalers, distributors, and logistics providers that transport products from manufacturing facilities to a myriad of retail outlets. These outlets include traditional pharmacies and drug stores, supermarkets, hypermarkets, convenience stores, and a rapidly expanding ecosystem of online pharmacies and e-commerce platforms. Each channel presents unique challenges and opportunities, requiring tailored strategies for inventory management, marketing, and customer engagement to ensure widespread product availability and market penetration.

Post-distribution, the value chain extends to consumer purchase and consumption, supported by extensive marketing and promotional activities designed to inform and persuade buyers. Advertising, digital campaigns, and in-store promotions are vital for building brand awareness and differentiating products in a crowded market. The final stage involves post-market surveillance and pharmacovigilance, where manufacturers monitor product safety and efficacy after consumer use, collecting feedback and responding to any adverse events. This continuous feedback loop informs future R&D efforts and ensures ongoing regulatory compliance, enhancing consumer trust and contributing to the long-term sustainability and growth of the OTC drug market by ensuring product reliability and addressing evolving consumer needs.

Over the Counter (OTC) Drugs Market Potential Customers

The Over the Counter (OTC) Drugs Market targets a vast and diverse customer base, essentially encompassing the general population seeking convenient and affordable solutions for common health issues without the need for a physicians prescription. These potential customers include individuals across all age groups, from parents purchasing fever reducers for children to adults seeking relief from allergies, pain, or digestive discomfort, and seniors managing age-related conditions like joint pain or nutritional deficiencies. The common thread among these buyers is the desire for immediate access to treatments that address minor health concerns, facilitate self-care, and provide symptomatic relief, enabling them to maintain daily routines without significant disruption. The convenience of purchasing these products outside of a formal medical consultation is a primary driver for this broad appeal.

Beyond immediate symptomatic relief, another significant segment of potential customers includes those proactively managing their health and wellness. This group actively seeks OTC products such as vitamins, minerals, and dietary supplements to support overall health, boost immunity, or address specific nutritional gaps. Health-conscious individuals, fitness enthusiasts, and those looking to prevent illnesses rather than just treat them, form a growing demographic for these preventative and wellness-oriented OTC categories. This segment often relies on information from various sources, including online health platforms, trusted brands, and peer recommendations, emphasizing the importance of transparent product information and robust marketing strategies.

Furthermore, an increasing number of individuals managing chronic conditions, where self-care plays a supplementary role to professional medical advice, also represent key potential customers. For instance, individuals with mild hypertension might use OTC blood pressure monitors, or those with recurring heartburn might rely on specific antacids for symptom management. The shift towards greater self-reliance in healthcare, partly driven by rising medical costs and greater access to health information, continues to expand the pool of potential customers for OTC drugs. Manufacturers must therefore understand the diverse needs and motivations of these segments to develop targeted products and effective communication strategies that resonate with each group, building trust and demonstrating value.

Over the Counter (OTC) Drugs Market Key Technology Landscape

The Over the Counter (OTC) Drugs Market is increasingly leveraging a variety of advanced technologies to enhance product development, manufacturing efficiency, and consumer engagement. In the realm of product innovation, sophisticated drug delivery systems are a key focus, including sustained-release formulations, transdermal patches, and orally disintegrating tablets that improve patient compliance and therapeutic efficacy. Nanotechnology is also emerging, enabling the development of smaller, more potent active ingredients with improved bioavailability and reduced side effects, particularly relevant for topical applications and targeted pain relief. These advancements aim to create more effective, user-friendly, and differentiated OTC products that address specific consumer needs and offer competitive advantages in a crowded market.

On the manufacturing front, automation, robotics, and advanced process control systems are being widely adopted to enhance production efficiency, ensure consistent product quality, and reduce operational costs. Pharmaceutical 4.0 initiatives, incorporating elements of the Internet of Things (IoT) and artificial intelligence (AI) into manufacturing processes, allow for real-time monitoring, predictive maintenance, and optimized batch production, thereby minimizing waste and accelerating time to market. Additionally, blockchain technology is being explored to enhance supply chain transparency and traceability, combating counterfeiting and ensuring the authenticity and safety of OTC products from raw material sourcing to the consumers hands, bolstering consumer trust in the products origin and quality.

Beyond manufacturing, digital technologies are transforming consumer interaction and market reach. E-commerce platforms, mobile health applications, and AI-powered chatbots are pivotal for consumer education, personalized product recommendations, and convenient purchasing. Telehealth services and virtual consultations, while primarily for prescription drugs, also influence OTC usage by offering guidance on appropriate self-medication and when to seek professional help. Data analytics and machine learning are employed to understand consumer behavior, predict market trends, and personalize marketing campaigns, allowing manufacturers to respond rapidly to evolving demands. These technological integrations are not only improving the operational efficiency and safety of OTC products but are also fundamentally reshaping how consumers discover, purchase, and utilize them for their health and wellness needs.

Regional Highlights

- North America: Dominates the global OTC drugs market due to high healthcare expenditure, strong consumer awareness regarding self-medication, and the presence of major pharmaceutical companies. The U.S. remains the largest market, driven by a culture of self-care and a robust regulatory framework that supports prescription-to-OTC switches.

- Europe: A mature market characterized by a strong emphasis on preventative health and a well-established network of pharmacies. Germany, the UK, and France are key contributors, with growth fueled by an aging population and increasing demand for natural and alternative OTC remedies.

- Asia Pacific: Emerging as the fastest-growing region, propelled by large populations, rising disposable incomes, improving healthcare infrastructure, and increasing health awareness in countries like China, India, and Japan. Expansion of distribution channels, including online platforms, significantly contributes to market growth.

- Latin America: Exhibiting significant growth potential driven by urbanization, increasing access to healthcare, and a growing middle class. Brazil and Mexico are leading markets, with a rising demand for affordable health solutions and common ailment treatments.

- Middle East & Africa: A developing market with growth attributed to improving economic conditions, government initiatives to enhance healthcare access, and increasing health consciousness among consumers. The UAE and Saudi Arabia are key markets, showing a rising adoption of self-medication practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Over the Counter (OTC) Drugs Market.- Johnson & Johnson Services, Inc.

- Bayer AG

- Pfizer Inc.

- Sanofi S.A.

- GlaxoSmithKline plc (Haleon)

- Procter & Gamble

- Reckitt Benckiser Group plc

- Perrigo Company plc

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

Frequently Asked Questions

What defines an Over the Counter (OTC) drug?

An OTC drug is a medication that can be purchased directly by consumers without a prescription from a doctor. These drugs are approved by regulatory bodies for safe and effective use by the general public for self-treatment of common ailments.

What are the primary drivers of growth in the OTC drugs market?

Key drivers include rising healthcare costs, an aging global population, increasing consumer awareness and preference for self-medication, convenient accessibility through diverse distribution channels, and the ongoing trend of prescription-to-OTC switches.

How does e-commerce impact the Over the Counter (OTC) Drugs Market?

E-commerce significantly boosts market reach and convenience, allowing consumers to easily purchase OTC products online. It drives competitive pricing and enables personalized marketing, fundamentally reshaping traditional distribution and consumer purchasing habits.

What role does Artificial Intelligence (AI) play in the OTC market?

AI impacts the OTC market by accelerating drug discovery, enabling personalized product recommendations, optimizing supply chains, enhancing patient education through chatbots, and improving post-market surveillance for greater safety and efficacy.

Which regions are leading the global Over the Counter (OTC) Drugs Market?

North America and Europe currently lead the global OTC drugs market due to established healthcare systems and high consumer awareness. However, Asia Pacific is emerging as the fastest-growing region driven by its large population and improving economic conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager