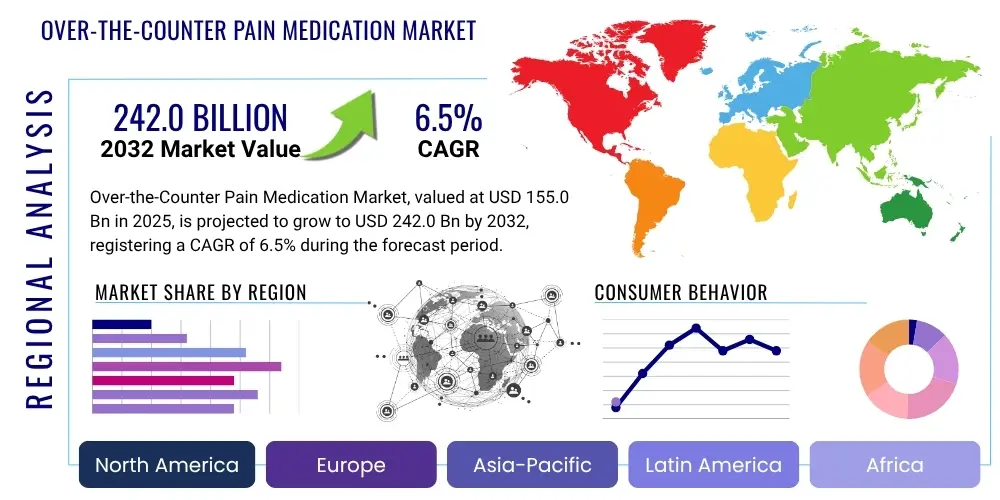

Over-the-Counter Pain Medication Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430099 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Over-the-Counter Pain Medication Market Size

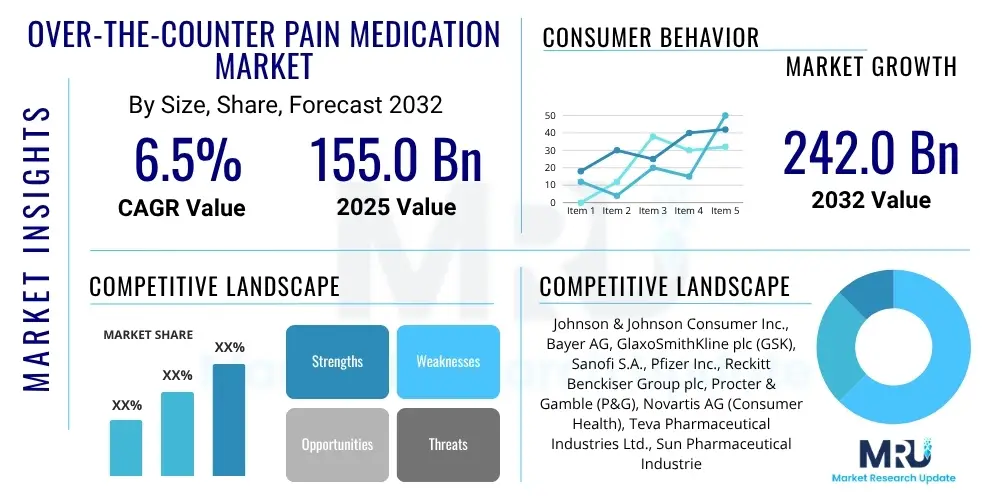

The Over-the-Counter Pain Medication Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at $155.0 billion in 2025 and is projected to reach $242.0 billion by the end of the forecast period in 2032.

Over-the-Counter Pain Medication Market introduction

The Over-the-Counter (OTC) Pain Medication market encompasses a wide array of non-prescription pharmaceutical products designed to alleviate various types of pain and discomfort, including headaches, muscle aches, arthritis, menstrual pain, and fever. These medications are readily available to consumers without the need for a doctor's prescription, making them a cornerstone of self-care and primary pain management. The product descriptions typically include analgesics such as Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) like ibuprofen and naproxen, acetaminophen, and salicylates, often available in multiple dosage forms like tablets, capsules, creams, gels, and patches. Major applications extend across acute pain relief for common ailments, chronic pain management for conditions like osteoarthritis, and symptomatic relief for fever and inflammation. The primary benefits driving consumer adoption are accessibility, affordability, convenience, and the ability for individuals to manage their minor health issues effectively and promptly, reducing the burden on healthcare systems. Key driving factors for market growth include a global aging population increasingly prone to chronic pain conditions, a growing consumer preference for self-medication due to rising healthcare costs and busy lifestyles, and continuous product innovation aimed at improved efficacy, safety, and novel delivery methods. Public health initiatives promoting self-care further bolster this market, alongside the expansion of distribution channels globally.

Over-the-Counter Pain Medication Market Executive Summary

The Over-the-Counter Pain Medication market is experiencing robust growth driven by evolving business trends, significant regional dynamics, and shifting segment preferences. Business trends indicate a strong move towards e-commerce and digital health platforms, which offer enhanced consumer access and personalized product recommendations, alongside increasing investment in research and development for innovative formulations, including combination therapies and those with natural active ingredients. Strategic alliances and mergers among key players are also prevalent as companies seek to consolidate market share and expand their product portfolios. Regional trends reveal a mature but steadily growing market in North America and Europe, characterized by high consumer awareness and established regulatory frameworks, while Asia Pacific, Latin America, and the Middle East & Africa are emerging as high-growth regions due to increasing disposable incomes, expanding healthcare infrastructure, and a burgeoning consumer base. Within segments, there is a notable rise in demand for topical pain relief solutions and specialized formulations catering to specific pain types, such as migraine or menstrual pain. Furthermore, the market observes a consistent demand for traditional oral analgesics, with ongoing efforts to enhance their safety profiles and reduce side effects. The prevalence of chronic conditions worldwide, coupled with the ease of availability and cost-effectiveness of OTC pain medications, continues to underpin this market's resilience and expansion, making it a vital component of global consumer health. These multifaceted trends collectively contribute to a dynamic and competitive market landscape, necessitating continuous adaptation and innovation from market participants to capitalize on emerging opportunities.

AI Impact Analysis on Over-the-Counter Pain Medication Market

User queries regarding the impact of Artificial Intelligence on the Over-the-Counter Pain Medication market frequently revolve around how AI can enhance product development, personalize treatment recommendations, optimize supply chains, and improve consumer engagement. Common concerns include the accuracy of AI-driven diagnostics for self-medication, data privacy associated with personalized health insights, and the potential for AI to influence regulatory oversight. Users often express expectations for AI to lead to more effective and safer OTC pain solutions, streamline the purchasing process, and offer better guidance on appropriate usage. The overarching theme is the desire for AI to empower consumers with more informed choices and simplify pain management, while also anticipating advancements in manufacturing efficiency and reducing time-to-market for new products. There is also significant interest in how AI could predict market demand and consumer behavior, allowing companies to tailor their offerings more precisely and efficiently. The integration of AI is seen as a pivotal shift that could revolutionize both the operational aspects and the consumer-facing elements of the OTC pain medication industry, fostering a more responsive and intelligent market environment.

- AI can accelerate drug discovery and formulation optimization for new OTC pain medications by analyzing vast datasets of chemical compounds and patient responses.

- Predictive analytics powered by AI can optimize supply chain management, ensuring timely availability of popular OTC products and minimizing stockouts.

- AI-driven platforms can offer personalized recommendations for OTC pain relief based on user profiles, symptoms, and medical history, enhancing treatment efficacy.

- AI chatbots and virtual assistants can provide instant customer support, answer common questions about product usage, and guide consumers in selecting appropriate pain medications.

- Manufacturing processes can be optimized through AI, leading to increased efficiency, reduced waste, and improved quality control in OTC pain medication production.

- AI tools can analyze real-world evidence and post-market surveillance data to identify potential adverse effects or efficacy issues more rapidly, improving product safety.

- Retail analytics and demand forecasting utilizing AI can help pharmacies and retailers manage inventory more effectively, catering to regional and seasonal needs.

- AI can assist in developing smart packaging solutions that provide dosage reminders or track adherence, improving patient compliance and outcomes.

DRO & Impact Forces Of Over-the-Counter Pain Medication Market

The Over-the-Counter Pain Medication market is significantly influenced by a complex interplay of driving forces, inherent restraints, and emerging opportunities, all shaped by broader impact forces. Key drivers include the global trend towards self-medication, particularly as healthcare costs rise and consumer awareness about minor ailment management increases. The expanding aging population, which is more susceptible to chronic pain conditions such as arthritis and back pain, further fuels demand for accessible pain relief. Additionally, continuous product innovation, leading to more effective formulations, diverse delivery methods (e.g., topical patches, effervescent tablets), and improved safety profiles, contributes substantially to market expansion. The ease of access through a vast network of distribution channels, from pharmacies to online platforms, also plays a crucial role in widespread adoption. These drivers create a fertile ground for market growth, encouraging both established players and new entrants to invest in product development and market penetration strategies.

However, the market also faces considerable restraints that temper its growth trajectory. Stringent regulatory frameworks govern the approval, marketing, and labeling of OTC medications, often requiring extensive clinical trials and post-market surveillance to ensure safety and efficacy, which can be costly and time-consuming. Concerns regarding the potential for misuse, abuse, and side effects associated with certain active ingredients (e.g., liver damage from excessive acetaminophen, gastrointestinal issues from NSAIDs) present a significant challenge, prompting public health warnings and stricter usage guidelines. Competition from prescription analgesics for more severe or persistent pain conditions, as well as from alternative therapies, also limits the market's full potential. The inherent limitations of OTC medications in treating severe chronic pain often necessitate professional medical intervention, thus diverting consumers from the OTC segment for complex cases. These restraints necessitate careful product development and responsible marketing strategies to maintain consumer trust and regulatory compliance.

Despite these challenges, numerous opportunities exist for market players to capitalize on evolving consumer needs and technological advancements. Emerging markets in Asia Pacific, Latin America, and Africa present significant untapped potential, driven by improving healthcare infrastructure, rising disposable incomes, and increasing urbanization. The development of novel formulations, including combination products that target multiple pain pathways, or those incorporating natural and herbal ingredients like CBD, appeals to a growing consumer segment seeking alternative and holistic pain management solutions. Furthermore, the integration of digital health solutions, such as mobile applications for pain tracking and dosage reminders, offers avenues for enhanced consumer engagement and adherence. The shift towards preventive healthcare and personalized medicine, albeit nascent in the OTC space, provides a long-term opportunity for product differentiation. Impact forces such as the bargaining power of buyers (driven by price sensitivity and brand loyalty) and suppliers (influenced by the availability of active pharmaceutical ingredients), the threat of new entrants (low barriers for generic drugs but high for novel formulations), the threat of substitutes (prescription drugs, alternative therapies), and intense competitive rivalry among established pharmaceutical giants all shape the strategic landscape for companies operating in this market.

Segmentation Analysis

The Over-the-Counter Pain Medication market is comprehensively segmented to provide a detailed understanding of its diverse components and consumer preferences. This segmentation allows for targeted marketing strategies, efficient product development, and a granular analysis of market dynamics across various product types, dosage forms, applications, and distribution channels. The market's complexity necessitates a multi-dimensional approach to categorization, reflecting the broad spectrum of pain conditions and consumer needs it addresses. Understanding these segments is crucial for stakeholders to identify growth pockets and tailor their offerings effectively, ensuring alignment with consumer demands and market trends. Each segment plays a vital role in defining the overall landscape, contributing to the market's resilience and continued expansion.

- Product Type

- NSAIDs (Nonsteroidal Anti-Inflammatory Drugs)

- Acetaminophen (Paracetamol)

- Salicylates (Aspirin)

- Opioids (Low-dose codeine combinations, where legally available OTC)

- Others (e.g., Capsaicin, Lidocaine, Herbal & Natural Pain Relief)

- Dosage Form

- Tablets

- Capsules

- Liquids (Syrups, Suspensions)

- Gels

- Sprays

- Patches

- Creams

- Suppositories

- Powders

- Application

- Headache

- Back Pain

- Arthritis

- Muscle Pain

- Menstrual Pain

- Fever

- Cold & Flu

- Migraine

- Dental Pain

- Other Chronic Conditions

- Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Supermarkets & Hypermarkets

- Online Pharmacies (E-commerce)

- Convenience Stores

Value Chain Analysis For Over-the-Counter Pain Medication Market

The value chain for the Over-the-Counter Pain Medication market begins with comprehensive upstream analysis, encompassing research and development (R&D) and the sourcing of raw materials. This initial stage involves pharmaceutical companies investing heavily in identifying new active pharmaceutical ingredients (APIs) or improving existing ones for enhanced efficacy and safety, alongside sourcing excipients from chemical manufacturers. The manufacturing process, which includes formulation, synthesis, and packaging, is a critical step, requiring adherence to stringent Good Manufacturing Practices (GMP) to ensure product quality and regulatory compliance. Companies often engage in proprietary manufacturing or outsource to contract manufacturing organizations (CMOs) to optimize cost and efficiency. This segment of the value chain is highly capital-intensive and requires significant technical expertise, forming the foundation of product availability and quality in the market.

Following manufacturing, the value chain progresses to the downstream analysis, focusing on distribution, marketing, and sales to reach the end consumer. The distribution channel is multifaceted, incorporating both direct and indirect routes. Direct distribution typically involves manufacturers selling directly to large retail chains or through their own e-commerce platforms, offering greater control over pricing and brand messaging. More commonly, indirect distribution channels are utilized, where products move through wholesalers and distributors who then supply to a vast network of retail pharmacies, hospital pharmacies, supermarkets, hypermarkets, and online pharmacies. These intermediaries play a crucial role in ensuring widespread product availability and market penetration across diverse geographical regions. Marketing and promotional activities are also integral at this stage, employing traditional advertising, digital marketing, and in-store promotions to influence consumer purchasing decisions and build brand loyalty.

The efficiency of the distribution network is paramount in the OTC pain medication market, given the impulse nature of many purchases and the need for immediate relief. Retail pharmacies remain a dominant channel, benefiting from pharmacist recommendations and consumer trust. However, the rise of online pharmacies has significantly impacted market dynamics, offering convenience, competitive pricing, and a broader product selection, thereby expanding consumer access, especially in remote areas. Supermarkets and hypermarkets also represent a substantial distribution channel due to their high foot traffic and ability to offer a wide range of consumer goods, including OTC medications. The seamless flow of products from manufacturers to various retail points, supported by effective marketing strategies, defines the ultimate success of an OTC pain medication in reaching its potential customers and fulfilling their demand for readily available and effective pain relief solutions. Each stage, from raw material sourcing to final consumer purchase, adds value and contributes to the overall accessibility and market presence of these essential health products.

Over-the-Counter Pain Medication Market Potential Customers

The primary potential customers for Over-the-Counter Pain Medication products are a broad and diverse demographic, encompassing individuals across all age groups and socio-economic strata who experience various forms of pain and discomfort. This vast end-user base includes adults suffering from common ailments such as headaches, migraines, muscle aches, and back pain, often seeking quick and convenient relief without the need for a physician's visit. A significant segment comprises the elderly population, who frequently contend with chronic conditions like arthritis, joint pain, and neuropathic pain, and often rely on OTC solutions for daily management due to their accessibility and lower cost compared to prescription alternatives. Children also constitute a vital customer segment, with parents and caregivers purchasing acetaminophen and ibuprofen formulations specifically designed for pediatric use to manage fever, cold symptoms, and minor aches.

Beyond general consumers, the market also targets specific groups such as athletes and physically active individuals who experience muscle soreness, sprains, and minor injuries requiring immediate pain relief. Individuals managing menstrual pain, dental pain, or symptomatic relief from cold and flu also regularly turn to OTC medications. Moreover, caregivers for patients with chronic illnesses often purchase these medications to manage associated discomfort. The growing trend of self-medication, driven by factors like rising healthcare costs, limited access to medical professionals in certain regions, and a desire for personal autonomy in health management, further expands the pool of potential customers. These consumers prioritize convenience, efficacy, and safety, making them receptive to product innovations that address these needs. The expansive nature of pain, being a universal human experience, ensures a consistently large and varied customer base for the OTC pain medication market, necessitating diverse product offerings and widespread distribution to meet their varied requirements effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $155.0 billion |

| Market Forecast in 2032 | $242.0 billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson Consumer Inc., Bayer AG, GlaxoSmithKline plc (GSK), Sanofi S.A., Pfizer Inc., Reckitt Benckiser Group plc, Procter & Gamble (P&G), Novartis AG (Consumer Health), Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Perrigo Company plc, Prestige Consumer Healthcare Inc., Church & Dwight Co., Inc., Purdue Pharma L.P., Apotex Inc., Mundipharma International Limited, Daiichi Sankyo Company, Limited, Takeda Pharmaceutical Company Limited, AstraZeneca PLC, Bristol-Myers Squibb Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Over-the-Counter Pain Medication Market Key Technology Landscape

The Over-the-Counter Pain Medication market is continuously evolving with significant advancements in its key technology landscape, primarily focused on enhancing drug delivery, improving formulation stability, and optimizing manufacturing processes. Advanced drug delivery systems represent a critical technological frontier, moving beyond traditional tablets and capsules to include sustained-release formulations, orally disintegrating tablets (ODTs), transdermal patches, and microneedle arrays. These innovations aim to provide quicker onset of action, prolonged pain relief, or targeted drug delivery, thereby improving patient compliance and therapeutic outcomes. For instance, transdermal patches deliver active ingredients directly through the skin, bypassing the digestive system and reducing systemic side effects, which is particularly beneficial for localized muscle and joint pain. Similarly, liquid gels and rapid-dissolve technologies are designed for faster absorption, offering more immediate relief for acute pain conditions. These advancements are crucial for differentiating products in a competitive market and addressing specific consumer needs for convenience and efficacy.

Furthermore, the market benefits from technological progress in bioinformatics, artificial intelligence (AI), and machine learning (ML), which are increasingly being leveraged in the research and development phase. AI and ML algorithms can analyze vast datasets to identify potential drug candidates, predict their efficacy and safety profiles, and optimize formulation compositions. This accelerates the drug discovery process and reduces the time and cost associated with bringing new OTC pain medications to market. Additionally, manufacturing technologies are experiencing transformation with the adoption of continuous manufacturing processes, which offer greater efficiency, consistency, and scalability compared to traditional batch manufacturing. Automated quality control systems, utilizing sensor technology and real-time data analysis, ensure that products consistently meet stringent regulatory standards. These technological integrations not only enhance the performance and safety of OTC pain medications but also drive operational excellence throughout the production cycle.

Another significant aspect of the technology landscape involves smart packaging solutions and digital health integration. Smart packaging can incorporate features such as dosage reminders, tamper-evident seals with digital verification, and QR codes linking to product information or educational content, enhancing patient safety and education. The proliferation of telemedicine and digital health platforms also influences the market, as consumers increasingly seek health information and recommendations online. While not directly a product technology, this digital shift necessitates that OTC pain medication providers integrate their offerings with online health resources, virtual consultations, and e-commerce platforms. This ensures that the products remain accessible and relevant in an increasingly digitalized healthcare ecosystem, enabling consumers to make informed choices and manage their pain effectively with the aid of technology. These varied technological advancements collectively propel the OTC pain medication market forward, shaping its future trajectory towards more personalized, efficient, and accessible pain management solutions for consumers worldwide.

Regional Highlights

- North America: This region holds a significant share of the global OTC pain medication market, driven by a high prevalence of chronic pain conditions, an aging population, and a strong consumer preference for self-medication. The presence of major pharmaceutical companies, advanced healthcare infrastructure, and high consumer awareness regarding various pain relief options contribute to its robust market growth. The U.S. and Canada are key contributors, characterized by established regulatory frameworks and continuous product innovation.

- Europe: Europe represents a mature market with steady growth, supported by an aging demographic and increasing awareness of pain management. Strict regulatory guidelines, particularly in countries like Germany, France, and the UK, ensure product safety and efficacy. The market is also influenced by a growing interest in natural and herbal pain remedies, alongside a strong emphasis on pharmacist recommendations for OTC products.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, increasing disposable incomes, and improving healthcare access in emerging economies like China, India, and Southeast Asian countries. The vast population base, coupled with a rising prevalence of lifestyle-related pain conditions, creates substantial demand. Government initiatives to promote self-care and the expansion of retail pharmacy networks further boost market expansion.

- Latin America: This region demonstrates growing potential due to increasing healthcare expenditure, a rising middle class, and improving economic conditions in countries such as Brazil, Mexico, and Argentina. Expanding access to healthcare services and a growing awareness of OTC pain management options contribute to market expansion, although regulatory landscapes can vary across nations.

- Middle East and Africa (MEA): The MEA market is still in its nascent stages but is experiencing gradual growth, driven by improving healthcare infrastructure, increasing health consciousness, and supportive government policies. The growing prevalence of chronic diseases and efforts to modernize retail pharmaceutical distribution channels are key factors contributing to market development in this region, particularly in countries like Saudi Arabia, UAE, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Over-the-Counter Pain Medication Market.- Johnson & Johnson Consumer Inc.

- Bayer AG

- GlaxoSmithKline plc (GSK)

- Sanofi S.A.

- Pfizer Inc.

- Reckitt Benckiser Group plc

- Procter & Gamble (P&G)

- Novartis AG (Consumer Health)

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Perrigo Company plc

- Prestige Consumer Healthcare Inc.

- Church & Dwight Co., Inc.

- Purdue Pharma L.P.

- Apotex Inc.

- Mundipharma International Limited

- Daiichi Sankyo Company, Limited

- Takeda Pharmaceutical Company Limited

- AstraZeneca PLC

- Bristol-Myers Squibb Company

Frequently Asked Questions

What is the projected growth rate for the Over-the-Counter Pain Medication market?

The Over-the-Counter Pain Medication market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032, reaching an estimated value of $242.0 billion by the end of the forecast period.

What are the primary types of OTC pain medications available?

The primary types of OTC pain medications include Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) like ibuprofen and naproxen, acetaminophen (paracetamol), and salicylates such as aspirin, alongside other specialized topical and combination formulations.

Which factors are driving the growth of the OTC Pain Medication market?

Key drivers include the increasing global aging population, rising prevalence of chronic pain conditions, growing consumer preference for self-medication, continuous product innovation, and the widespread accessibility of these products through diverse distribution channels.

What are the main distribution channels for OTC pain medications?

The main distribution channels include retail pharmacies, hospital pharmacies, supermarkets and hypermarkets, online pharmacies, and convenience stores, ensuring broad consumer access.

How is AI impacting the Over-the-Counter Pain Medication market?

AI is impacting the market by accelerating drug discovery, optimizing supply chains, enabling personalized product recommendations, and enhancing customer support through virtual assistants, leading to more efficient and user-centric pain management solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager