P2P Payment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430828 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

P2P Payment Market Size

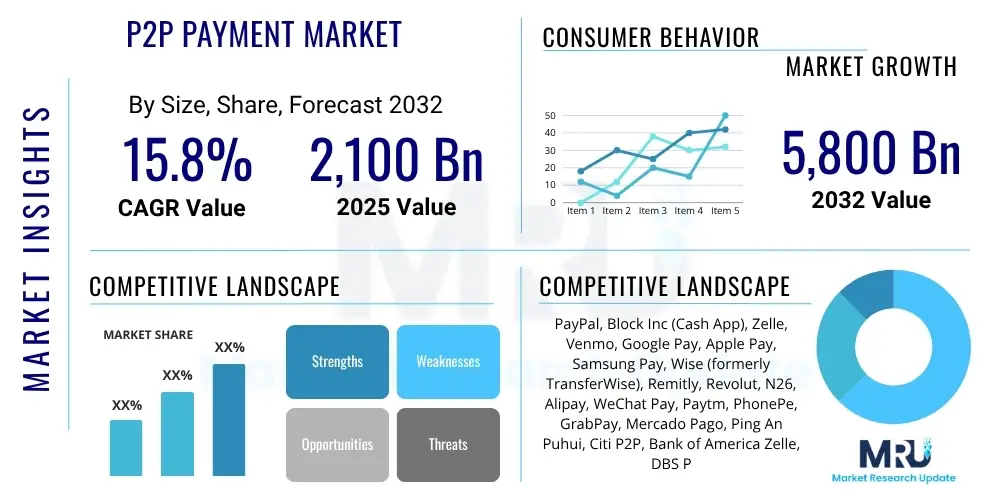

The P2P Payment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2025 and 2032. The market is estimated at $2,100 Billion in 2025 and is projected to reach $5,800 Billion by the end of the forecast period in 2032.

P2P Payment Market introduction

The P2P Payment Market encompasses digital systems facilitating direct fund transfers between individuals via platforms such as mobile apps, online banking portals, and social media integrations. These services offer instantaneous or near-instantaneous transactions, bypassing traditional banking intermediaries for direct consumer-to-consumer exchanges. Product descriptions often emphasize user-friendly interfaces, robust security, and no-fee or low-fee transaction models, making them highly attractive for everyday financial interactions. This market segment is characterized by its accessibility, frequently requiring only a recipient's phone number or email address to initiate a transfer.

Major applications for P2P payment systems are diverse and deeply integrated into daily life. These include common scenarios such as splitting dinner bills among friends, contributing to group gifts, sharing household expenses like rent or utilities with roommates, and sending monetary support to family members, both domestically and internationally. Beyond personal exchanges, these platforms are increasingly utilized by individuals for informal payments for small services, participating in collective fundraisers, or making quick donations. Their utility spans various social and financial contexts, proving invaluable for managing shared costs and immediate financial needs, enhancing social connectivity through simplified money exchange.

The proliferation of P2P payments is underpinned by compelling benefits and powerful driving factors. Users are primarily attracted to the unparalleled convenience, enabling transactions anytime, anywhere, directly from mobile devices. The speed of transfers, often processed in real-time, is a significant advantage, eliminating delays. Economically, many P2P services offer low-to-no transaction fees for standard transfers, making them cost-effective. Key driving forces for market growth include accelerating global smartphone adoption, increasing internet penetration, and the broader societal shift towards a cashless economy. Furthermore, growing demand for financial inclusion in underserved populations, the rise of e-commerce, and the rapid expansion of the gig economy further fuel the need for efficient, accessible, and user-friendly digital payment solutions, particularly among younger, digitally native generations expecting seamless digital interactions.

P2P Payment Market Executive Summary

The P2P Payment Market is currently undergoing an era of accelerated expansion, propelled by significant shifts in business trends that prioritize digital transformation and user-centric financial services. A prominent business trend involves strategic collaborations and competitive innovation, where agile fintech companies either partner with established financial institutions or directly challenge them with innovative, mobile-first solutions. There is also a distinct movement towards expanding P2P functionalities beyond simple money transfers, integrating features such as budgeting tools, investment options, and loyalty programs to create comprehensive digital financial ecosystems. This convergence aims to increase user stickiness and capture a larger share of consumers' financial activities, intensifying the competitive landscape and driving continuous technological advancements.

Regionally, the market exhibits diverse growth patterns and levels of maturity. North America and Europe represent highly saturated markets characterized by sophisticated digital infrastructures, high smartphone adoption, and a strong preference for secure, convenient mobile payment solutions. These regions see continuous innovation focused on enhancing user experience, improving security, and integrating P2P services within broader digital lifestyle platforms. In stark contrast, the Asia Pacific (APAC) region stands out as a high-growth market, largely driven by its enormous mobile internet user base, particularly in countries like China and India, where super-apps integrate P2P payments with social media, e-commerce, and other daily services. This region also benefits from government initiatives promoting digital payments and addressing financial inclusion.

Segmentation trends reveal an increasing emphasis on diversifying transaction types and payment models. While domestic P2P transfers remain the bedrock, cross-border P2P payments are emerging as a critical growth segment, driven by global migration patterns and demand for affordable, rapid international remittances. Furthermore, the market is bifurcating between traditional bank-centric models, leveraging existing customer trust and regulatory compliance, and non-bank models, primarily fintech apps and social media platforms, excelling in user experience and rapid innovation. The proliferation of mobile-first platforms continues to dominate, with integrated social media platforms blurring lines between communication and commerce, allowing users to send and receive money seamlessly within existing digital social graphs, reflecting evolving consumer financial behavior and digital integration.

AI Impact Analysis on P2P Payment Market

Users consistently express interest in how Artificial Intelligence will fundamentally reshape the P2P Payment Market, frequently posing questions related to enhanced security, proactive fraud detection, and personalized user experiences. The central themes emerging from these inquiries revolve around the expectation that AI will deliver safer and significantly more efficient transactions, minimize financial risks, and provide a highly intuitive and tailored service. While anticipating these benefits, users also voice concerns regarding data privacy, the ethical implications of AI-driven decision-making, and the potential for algorithmic bias in transaction approvals or risk assessments. They keenly expect AI to offer intelligent solutions that go beyond current capabilities, making their financial interactions both smarter and more trustworthy.

The common expectations are that AI will play a pivotal role in streamlining various operational aspects of P2P payments. Users anticipate AI will improve the accuracy and speed of customer support through advanced chatbots and virtual assistants, resolving queries and disputes more effectively. There is also a strong belief that AI will enable platforms to offer personalized financial insights, such as budgeting recommendations or savings alerts, based on individual spending habits, thereby fostering better financial management. Furthermore, the ability of AI to detect and alert users to unusual or suspicious spending patterns in real-time is a highly valued feature, aimed at preventing unauthorized transactions and enhancing the overall security posture of P2P platforms, thus building greater confidence among users.

- Enhanced fraud detection through sophisticated machine learning algorithms capable of analyzing vast datasets of transaction patterns, identifying anomalies, and predicting potential fraudulent activities with high accuracy in real-time.

- Personalized user experiences by leveraging AI to analyze individual spending behaviors, offering tailored financial insights, smart budgeting tools, and customized product recommendations that align with user preferences and financial goals.

- Automated and intelligent customer service via AI-powered chatbots and virtual assistants, providing instant support, resolving common queries, guiding users through transactions, and escalating complex issues efficiently.

- Predictive analytics for optimizing liquidity management for payment providers, forecasting transaction volumes, and anticipating peak usage times to ensure system stability and efficient fund availability.

- Improved security protocols including advanced biometric authentication methods (facial recognition, voice recognition) and behavioral biometrics, significantly reducing the risk of unauthorized access and enhancing transaction security.

- Streamlined compliance and regulatory reporting processes by automating the analysis of financial data, identifying potential risks, and ensuring adherence to complex financial regulations and anti-money laundering (AML) guidelines.

- Dynamic risk assessment for cross-border transactions, using AI to evaluate various factors like sender and receiver history, geo-location, and transaction size, to mitigate currency, regulatory, and credit risks effectively.

- Development of AI-driven financial advisors integrated directly into P2P platforms, offering proactive advice on savings, investments, and debt management, transforming P2P apps into holistic financial management tools.

- Optimized resource allocation and operational efficiency for payment providers by using AI to analyze operational data, predict system loads, and automate routine tasks, leading to reduced operational costs and improved service reliability.

DRO & Impact Forces Of P2P Payment Market

The P2P Payment Market's trajectory is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, all operating under the continuous pressure of various Impact Forces. Foremost among the drivers is the pervasive global adoption of smartphones, coupled with ever-expanding internet accessibility, which together form the essential digital backbone for P2P service delivery. The inherent convenience, speed, and ease of use offered by these platforms strongly appeal to modern consumers seeking frictionless financial interactions. Furthermore, the accelerating global trend towards cashless transactions, spurred by urbanization and digitalization initiatives, significantly boosts P2P adoption. A critical driver, particularly in developing regions, is the imperative for financial inclusion, providing accessible digital financial services to previously unbanked or underbanked populations, thus empowering economic participation.

Conversely, the market faces significant restraints that temper its growth and necessitate continuous mitigation efforts. Cybersecurity remains a paramount concern, with persistent threats such as phishing attacks, malware, and sophisticated data breaches potentially eroding user trust and demanding substantial investments in advanced security infrastructure. The fragmented and evolving regulatory landscape across different countries and regions presents considerable challenges, particularly for providers seeking to expand internationally, as compliance requirements vary widely and can be onerous. Issues surrounding interoperability between different P2P platforms and traditional banking systems also create friction, limiting the seamless flow of funds across diverse ecosystems. Moreover, market fragmentation, characterized by a multitude of competing services, can sometimes lead to consumer confusion and slower overall market consolidation.

Despite these challenges, abundant opportunities exist for sustained growth and innovation within the P2P Payment Market. The expansion into cross-border P2P payments represents a substantial opportunity, particularly through leveraging advanced technologies like blockchain and distributed ledger technology to significantly reduce transaction costs, accelerate settlement times, and enhance transparency for international remittances. Integrating P2P functionalities more deeply with social media and e-commerce platforms can unlock new avenues for user engagement and diversify revenue streams, creating holistic digital experiences. Furthermore, there is immense potential in catering to underserved markets by developing localized solutions and offering value-added services such as micro-lending, personal finance management tools, or loyalty programs integrated within P2P apps. The key impact forces continually shaping this market include rapid technological advancements (e.g., AI, blockchain, biometrics), evolving global regulatory frameworks demanding greater consumer protection and data security, shifts in consumer behavior towards greater digital convenience and financial autonomy, and an intensely competitive environment that mandates constant innovation and differentiation among market participants.

Segmentation Analysis

The P2P Payment Market is meticulously segmented to provide a granular and comprehensive understanding of its diverse operational models, technological foundations, and end-user demographics. This detailed segmentation is crucial for market participants to identify niche opportunities, craft targeted marketing strategies, and tailor product development to specific market demands. By breaking down the market into its constituent components, stakeholders can gain clearer insights into growth drivers, competitive landscapes, and the evolving preferences of various user groups, facilitating informed strategic decision-making and fostering innovation across the ecosystem.

Each segmentation category offers distinct perspectives on market dynamics. For instance, segmenting by transaction type clarifies the differing operational and regulatory requirements for domestic versus cross-border payments, highlighting the specific challenges and opportunities within international fund transfers. Similarly, distinguishing between bank-centric and non-bank payment models illuminates the competitive advantages and inherent structures of traditional financial institutions versus agile fintech innovators. Understanding these segmentations helps in assessing market maturity, identifying emerging trends, and forecasting future growth trajectories across the broad spectrum of P2P payment services.

- By Transaction Type: This segment differentiates between local and international money transfers, each with unique regulatory and logistical complexities.

- Domestic P2P Payments: Transfers occurring within the borders of a single country, typically faster and often free or low-cost.

- Cross-border P2P Payments: International transfers, often involving currency conversion, higher fees, and more stringent regulatory compliance.

- By Payment Model: Categorizes platforms based on their operational and infrastructural backing.

- Bank-centric Model: P2P services offered directly by traditional financial institutions, leveraging existing banking infrastructure and customer trust (e.g., Zelle).

- Non-bank Model: Services provided by fintech companies, technology firms, or social media platforms, often characterized by agile development and diverse features (e.g., PayPal, Venmo, Alipay).

- By End-User: Identifies the primary beneficiaries and users of P2P payment services.

- Consumers: Individuals using P2P for personal expenses, bill splitting, gifting, and transfers to family and friends.

- Small Businesses: Including freelancers and micro-businesses utilizing P2P for receiving payments for goods/services or managing informal operational expenses.

- By Platform: Classifies services based on the primary interface or medium through which transactions are conducted.

- Mobile Applications: Dedicated smartphone apps (iOS, Android) offering primary access and features.

- Web-based Platforms: Services accessible via desktop or mobile web browsers.

- Integrated Social Media Platforms: P2P functionalities embedded within popular social networking applications.

- By Technology: Highlights the underlying technologies enabling P2P transactions.

- NFC (Near Field Communication): For contactless payments, often used in mobile wallets.

- QR Code: Quick Response code scanning for initiating payments, prevalent in APAC.

- UPI (Unified Payments Interface): An instant real-time payment system developed in India, popular for its interoperability.

- Mobile Wallets: Digital wallets storing payment information for various transactions.

- Blockchain based: Utilizing distributed ledger technology for enhanced security, transparency, and often lower costs in cross-border transfers.

Value Chain Analysis For P2P Payment Market

The value chain for the P2P Payment Market is a complex ecosystem of interconnected activities, beginning with critical upstream components that provide the foundational technology and infrastructure. This initial stage involves a diverse set of technology providers, including cloud computing service giants offering scalable and secure server infrastructure, API development firms enabling seamless integration between disparate systems, and data analytics companies that supply the tools for processing and understanding vast amounts of transaction data. Additionally, cybersecurity solution providers are crucial upstream partners, offering advanced threat detection, encryption, and fraud prevention technologies. These entities collectively ensure the robust, secure, and performant technological backbone upon which all P2P services rely, providing the essential capabilities for large-scale digital financial operations.

The midstream segment of the value chain is occupied by the P2P payment service providers themselves, which include traditional banks, innovative fintech startups, and major technology companies with integrated payment features. At this stage, core activities encompass product development, focusing on intuitive user interface and experience design, alongside intensive marketing and customer acquisition strategies to build and retain a user base. This segment is also responsible for transaction processing, compliance with financial regulations, risk management, and maintaining the payment network infrastructure. Distribution channels are predominantly digital, leveraging app stores (such as Apple App Store and Google Play Store) for mobile application downloads, direct-to-consumer websites for web-based platforms, and strategic integrations within popular social media and e-commerce ecosystems, forming both direct and indirect routes to market penetration.

Finally, the downstream activities center around the end-users—individuals, small businesses, and freelancers—who are the ultimate consumers of P2P payment services. This stage involves how users interact with the platforms, including the initiation and reception of payments, management of transaction histories, and utilization of any integrated financial management tools. Post-transaction support, such as customer service, dispute resolution mechanisms, and continuous security monitoring, forms a crucial part of ensuring user satisfaction and trust. The overall efficiency and success of the P2P payment market are contingent upon the seamless collaboration and optimized performance across all these value chain components, from the raw technological inputs to the final user experience, driving continuous innovation and adaptation to evolving market demands and consumer behaviors.

P2P Payment Market Potential Customers

Potential customers for the P2P Payment Market primarily encompass a broad spectrum of individuals and, increasingly, small businesses engaging in informal transactions. This includes tech-savvy millennials and Gen Z, who are early adopters of digital technologies and show a strong preference for mobile-first solutions over traditional cash or banking methods for everyday financial interactions. These users leverage P2P platforms extensively for splitting shared expenses, contributing to group purchases, sending money to friends and family, and managing micro-transactions, valuing the speed, ease, and often cost-free nature of these services that seamlessly integrate into their digital lifestyles and social circles.

Beyond younger demographics, the appeal of P2P payments extends to older generations who are increasingly embracing digital tools for financial management, valuing the simplicity and robust security features offered by established platforms for secure and straightforward money transfers to relatives or service providers. A significant segment of potential customers also includes immigrants and expatriates who utilize P2P services for sending international remittances, attracted by the competitive exchange rates, lower transaction fees, and significantly faster transfer times compared to traditional wire transfer services, bridging geographical divides for financial support. Furthermore, in developing and emerging economies, P2P solutions serve as crucial conduits for financial inclusion, providing essential banking-like services to populations with limited access to formal financial institutions, thereby empowering economic participation and enhancing financial literacy.

Moreover, the burgeoning gig economy, alongside freelancers and micro-businesses, represents a substantial and expanding segment of potential customers for P2P payment solutions. These entrepreneurs and small-scale operators increasingly rely on P2P platforms for receiving payments for services rendered, managing small-scale vendor payouts, and facilitating expense reimbursements, all without the complexities and overheads typically associated with traditional commercial payment systems. The simplicity, instantaneous nature, and often lower transaction costs of P2P platforms make them an ideal tool for managing the fluid and often informal financial transactions characteristic of these business models, making them a crucial demographic for future market growth and product feature innovation within the P2P payment ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2,100 Billion |

| Market Forecast in 2032 | $5,800 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PayPal, Block Inc (Cash App), Zelle, Venmo, Google Pay, Apple Pay, Samsung Pay, Wise (formerly TransferWise), Remitly, Revolut, N26, Alipay, WeChat Pay, Paytm, PhonePe, GrabPay, Mercado Pago, Ping An Puhui, Citi P2P, Bank of America Zelle, DBS PayLah!, Kakao Pay, LINE Pay, M-Pesa |

| Regions Covered | North America (United States, Canada, Mexico), Europe (United Kingdom, Germany, France, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Rest of Asia Pacific), Latin America (Brazil, Argentina, Rest of Latin America), Middle East, and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

P2P Payment Market Key Technology Landscape

The P2P Payment Market is fundamentally propelled by a rapidly evolving and sophisticated technological landscape, continuously innovating to deliver superior transaction speed, fortified security, and enhanced user convenience. At its core, advanced mobile application technology serves as the primary gateway, capitalizing on the ubiquitous capabilities of smartphones for intuitive and on-the-go fund transfers. These applications are underpinned by robust cloud computing infrastructures, which provide the essential scalability, flexibility, and reliability required to process vast and ever-increasing volumes of real-time transactions globally. Furthermore, sophisticated APIs (Application Programming Interfaces) are critical enablers, fostering seamless interoperability and integration between diverse P2P platforms, traditional banking systems, and a multitude of third-party financial and social services, thereby cultivating a truly interconnected digital financial ecosystem.

Security is a paramount concern within the P2P payment ecosystem, driving the adoption of cutting-edge security technologies. End-to-end encryption protocols are standard, meticulously safeguarding sensitive user data and transaction details from unauthorized access. Advanced biometric authentication methods, including fingerprint and facial recognition, are increasingly integrated into mobile applications, offering a highly secure and convenient alternative to traditional password-based logins, significantly reducing the risk of account compromise. Furthermore, sophisticated fraud detection systems, powered by state-of-the-art machine learning and artificial intelligence algorithms, continuously analyze intricate transaction patterns in real-time to proactively identify and prevent suspicious activities, offering robust protection against financial fraud and bolstering user trust. Tokenization further reinforces transaction security by replacing sensitive payment card data with unique, randomly generated identifiers.

The technological landscape is also being reshaped by emerging innovations poised to redefine P2P payments. Blockchain and distributed ledger technologies (DLT) are gaining considerable traction, particularly for facilitating cross-border P2P transactions, promising to dramatically reduce operational costs, accelerate settlement times, and enhance transparency by decentralizing verification processes and minimizing reliance on intermediaries. Near Field Communication (NFC) technology enables swift, contactless payments at physical points of sale and between proximate devices, while QR code scanning provides an equally efficient payment initiation method, especially prevalent in Asian markets. Moreover, the global movement towards Open Banking, exemplified by regulatory frameworks such as Europe's PSD2, is fostering greater data sharing and API-driven innovation, paving the way for more integrated, personalized, and value-added P2P payment solutions that seamlessly blend with broader financial management and digital lifestyle services, thereby creating a truly expansive and dynamic payment environment.

Regional Highlights

- North America: This region represents a highly mature and competitive P2P payment market, characterized by extensive smartphone penetration and a robust digital infrastructure. Key players like Zelle, Venmo, and Square Cash App dominate, offering diverse services from bank-backed instant transfers to social-centric payment apps. Innovation is continuous, focusing on enhancing user experience, integrating with other financial services, and reinforcing security protocols. Regulatory bodies actively work to balance innovation with consumer protection and data privacy, shaping a dynamic and evolving landscape.

- Europe: The European P2P payment market is significantly influenced by regulatory frameworks such as the Payment Services Directive 2 (PSD2), which has fostered open banking and encouraged competition among payment service providers. This has led to the proliferation of instant payment schemes and the rise of challenger banks and fintechs offering highly integrated P2P functionalities. Countries like the UK, Germany, and the Nordics show particularly high adoption rates, driven by a strong preference for digital payments and continuous innovation in user-friendly, secure platforms. Cross-border P2P is also growing, supported by intra-European integration efforts.

- Asia Pacific (APAC): Recognized as the fastest-growing P2P payment market globally, APAC is defined by its mobile-first approach and the dominance of 'super-apps' like Alipay and WeChat Pay in China, and Paytm and PhonePe in India. This explosive growth is fueled by massive mobile internet penetration, rapid urbanization, and a large unbanked population that has leapfrogged traditional banking directly to mobile money solutions. Governments across the region are actively promoting digital payments to foster financial inclusion and stimulate economic growth, making it a hub for innovation and widespread adoption.

- Latin America: This region is experiencing rapid growth in the P2P payment sector, largely driven by increasing smartphone adoption, a young tech-savvy population, and significant efforts toward financial inclusion. Local fintechs, alongside global players, are addressing previously underserved segments by offering accessible and mobile-centric payment solutions that often bypass cumbersome traditional banking systems. Countries like Brazil (with Pix) and Mexico are at the forefront, showcasing strong domestic innovation and a growing appetite for convenient digital financial tools to improve daily economic transactions and remittances.

- Middle East and Africa (MEA): The MEA region is a burgeoning market for P2P payments, with mobile money solutions playing a transformative role in providing essential financial services to populations with limited access to formal banking infrastructure. Government initiatives aimed at digital transformation, coupled with increased investment in digital infrastructure, are key growth drivers. Nations like the UAE and Kenya are leading innovators, with services like M-Pesa demonstrating the profound impact of mobile-based P2P transfers on financial accessibility and economic empowerment, particularly in rural and remote areas. The region is poised for continued strong growth as digital literacy increases and infrastructure improves.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the P2P Payment Market.- PayPal Holdings, Inc.

- Block Inc. (Cash App)

- Zelle (Early Warning Services, LLC)

- Venmo (a PayPal service)

- Google Pay (Alphabet Inc.)

- Apple Pay (Apple Inc.)

- Samsung Pay (Samsung Electronics Co., Ltd.)

- Wise Plc (formerly TransferWise)

- Remitly Global, Inc.

- Revolut Ltd.

- N26 GmbH

- Alipay (Ant Group Co., Ltd.)

- WeChat Pay (Tencent Holdings Ltd.)

- Paytm (One97 Communications Ltd.)

- PhonePe Pvt. Ltd.

- GrabPay (Grab Holdings Inc.)

- Mercado Pago (MercadoLibre Inc.)

- Ping An Puhui (Ping An Insurance (Group) Company of China, Ltd.)

- Citi P2P (Citigroup Inc.)

- Bank of America Zelle (Bank of America Corporation)

- DBS PayLah! (DBS Bank Ltd.)

- Kakao Pay Corp.

- LINE Pay Corporation

- M-Pesa (Safaricom Plc.)

Frequently Asked Questions

What is P2P payment and what are its primary benefits and applications?

P2P payment, or person-to-person payment, is a digital method enabling individuals to directly transfer money to one another using an online application or service, typically via a mobile device. Users link their bank account or debit card to the P2P app, select a recipient (often by phone number or email), specify the amount, and send the funds. Primary benefits include unparalleled convenience, allowing transactions anytime and anywhere; significant speed, with transfers frequently processed instantly; and often lower or no transaction fees for standard transfers, making it a highly efficient and cost-effective alternative to traditional methods. Applications range from splitting bills among friends and contributing to group gifts to sending money to family members and making informal payments for small services, deeply integrating into daily financial life.

How secure are P2P payment services, and what essential precautions should users take?

Most reputable P2P payment services implement robust security measures, including advanced encryption protocols to meticulously protect sensitive financial data, sophisticated fraud detection algorithms that continuously analyze transaction patterns in real-time, and multi-factor authentication (MFA) to prevent unauthorized account access. While generally highly secure, users must remain vigilant to protect themselves. Essential precautions include diligently verifying the recipient's identity (e.g., phone number, email, or username) before sending money, employing strong and unique passwords for their accounts, enabling all available security features like MFA, and exercising extreme caution against phishing scams or unsolicited payment requests that could lead to fraudulent activity or accidental transfers.

What are the typical costs associated with P2P payments, and when might fees apply?

The cost structure for P2P payments can vary significantly across different platforms. Many services offer standard transfers for free when funds are sourced directly from a linked bank account or debit card, making them an attractive option for everyday use. However, users might incur specific fees under certain conditions. These can include charges for instant transfers (where applicable), for transactions funded by credit cards (often subject to cash advance fees charged by the card issuer, not the P2P service), or for cross-border payments which typically involve currency conversion charges and potentially higher transaction fees due to international processing. It is crucial for users to carefully review the specific fee schedule of their chosen P2P service to understand all potential costs before initiating any transfer.

Can P2P payments be reversed or cancelled once they have been sent?

Generally, P2P payments are designed to be instant and irreversible once initiated and authorized by the sender, mirroring the finality of a cash transaction. Once funds are successfully sent and the recipient has accepted them, it becomes very challenging, and often impossible, to cancel or reclaim the money directly through the P2P service provider itself. This inherent irreversibility underscores the critical importance of exercising extreme caution and diligently double-checking all recipient details, including names, phone numbers, and the exact amount, before confirming any P2P transaction. This vigilance is paramount to prevent errors, accidental transfers to unintended recipients, or falling victim to scams, as recourse after a confirmed payment is typically limited.

How is AI expected to influence the future development and features of P2P payments?

Artificial Intelligence is poised to profoundly impact the future development and features of P2P payments across multiple critical dimensions. It will significantly enhance fraud detection capabilities through advanced machine learning models that can identify and predict intricate fraudulent patterns with greater accuracy in real-time, thereby bolstering transaction security. AI will also drive hyper-personalization, offering users tailored financial insights, smart budgeting recommendations, and customized product suggestions based on their unique spending habits and financial goals. Furthermore, AI-powered chatbots and virtual assistants will automate and vastly improve customer support, providing instant, intelligent responses and streamlining dispute resolution. This integration will make P2P platforms not only more secure and efficient but also highly intuitive, personalized, and capable of anticipating user financial needs, transforming them into comprehensive digital financial companions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager