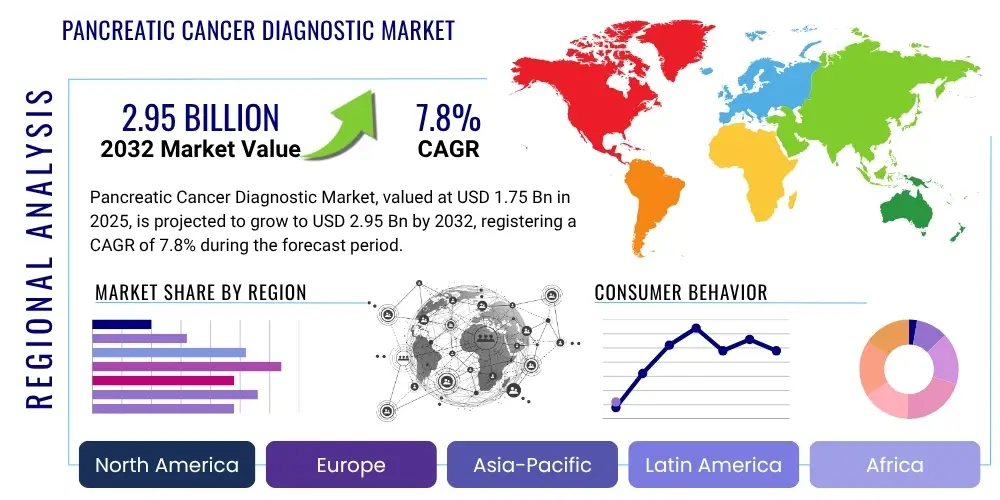

Pancreatic Cancer Diagnostic Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430937 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Pancreatic Cancer Diagnostic Market Size

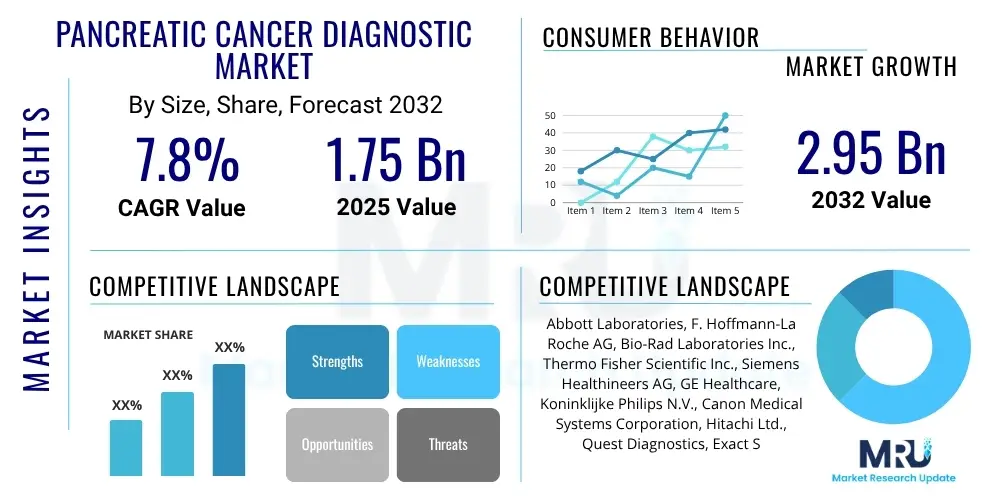

The Pancreatic Cancer Diagnostic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $1.75 billion in 2025 and is projected to reach $2.95 billion by the end of the forecast period in 2032.

Pancreatic Cancer Diagnostic Market introduction

The Pancreatic Cancer Diagnostic Market encompasses a range of medical technologies and services aimed at detecting and characterizing pancreatic cancer. Pancreatic cancer remains one of the most aggressive and lethal forms of cancer, with a significantly low five-year survival rate, primarily due to its late diagnosis. This market is driven by the critical need for earlier detection methods, improved diagnostic accuracy, and personalized treatment strategies for patients globally. The advanced diagnostic tools available, including sophisticated imaging techniques, innovative biomarker tests, and molecular analyses, are pivotal in enhancing the clinical management of this challenging disease, offering opportunities for more timely interventions and potentially better patient outcomes.

The product portfolio within this market includes various modalities such as advanced imaging technologies like CT scans, MRI, PET scans, and endoscopic ultrasound (EUS), alongside an expanding array of biomarker tests that utilize blood, urine, or tissue samples to identify specific proteins or genetic markers associated with pancreatic cancer. Major applications span from screening high-risk populations, particularly those with a family history or specific genetic predispositions, to confirming diagnoses, staging the disease, guiding treatment decisions, and monitoring for recurrence. The primary benefits of these diagnostic advancements include the potential for significantly earlier detection, which is crucial for successful surgical resection, and the facilitation of tailored therapeutic approaches, thereby reducing morbidity and mortality rates associated with this cancer. Furthermore, the market is experiencing robust growth fueled by several key driving factors. These include a global increase in pancreatic cancer incidence, attributed to aging populations and lifestyle changes, coupled with a surge in research and development activities focused on non-invasive diagnostic tools and highly sensitive biomarkers.

Technological innovations, particularly in molecular diagnostics and artificial intelligence, are also profoundly influencing the market landscape, enabling the development of more precise and accessible diagnostic solutions. Increased awareness among healthcare professionals and the public regarding the symptoms and risks of pancreatic cancer, alongside supportive government initiatives and funding for cancer research, are further propelling market expansion. The continuous pursuit of diagnostic excellence and the unmet clinical need for effective early detection strategies underscore the vital importance and dynamic nature of the Pancreatic Cancer Diagnostic Market.

Pancreatic Cancer Diagnostic Market Executive Summary

The Pancreatic Cancer Diagnostic Market is undergoing transformative changes, marked by significant business trends that underscore its growth trajectory and strategic evolution. A prominent trend is the increasing focus on mergers, acquisitions, and collaborations among key market players, driven by the desire to consolidate technological expertise, expand product portfolios, and enhance market reach. This strategic consolidation enables companies to pool resources for high-cost R&D efforts, particularly in the complex and challenging field of pancreatic cancer detection. Furthermore, there is a notable shift towards developing non-invasive diagnostic methods, such as liquid biopsies, which offer less burdensome and potentially earlier detection options compared to traditional invasive procedures. This pursuit of minimal invasiveness is a key innovation driver, attracting substantial investment and fostering a competitive landscape centered on advanced molecular diagnostics. Additionally, the integration of artificial intelligence and machine learning algorithms into diagnostic imaging and biomarker analysis represents a pivotal business trend, aiming to improve diagnostic accuracy, reduce human error, and accelerate the diagnostic workflow, thereby addressing critical unmet needs in early cancer identification.

Regionally, the market exhibits diverse growth patterns influenced by healthcare infrastructure, regulatory environments, and cancer incidence rates. North America and Europe currently represent the dominant markets, largely due to their well-established healthcare systems, significant healthcare expenditures, robust research funding, and high adoption rates of advanced diagnostic technologies. These regions are at the forefront of innovation, with numerous clinical trials and product launches contributing to market leadership. Conversely, the Asia Pacific region is projected to witness the fastest growth rate during the forecast period. This accelerated growth is primarily attributable to a rapidly expanding patient pool, improving healthcare access and infrastructure, increasing awareness about cancer diagnostics, and rising disposable incomes that enable greater investment in advanced medical technologies. Latin America, the Middle East, and Africa are also emerging as significant markets, driven by a growing focus on healthcare modernization and increasing international collaborations aimed at improving cancer care. Each region presents unique opportunities and challenges, necessitating tailored market penetration and development strategies.

Segmentation trends within the Pancreatic Cancer Diagnostic Market highlight specific areas of high growth and innovation. The imaging segment, encompassing modalities such as CT, MRI, and EUS, continues to hold a substantial market share due to its indispensable role in initial diagnosis, staging, and monitoring. However, the biomarker segment, including circulating tumor DNA (ctDNA), CA 19-9, and other protein markers, is experiencing rapid growth. This surge is fueled by ongoing research leading to the discovery of novel, highly specific biomarkers that promise earlier and more accurate detection, even in asymptomatic stages. The increasing sophistication of molecular diagnostics is enabling the development of multi-analyte tests that combine various biomarkers to enhance diagnostic sensitivity and specificity, representing a significant trend. Moreover, the end-user landscape is evolving, with diagnostic centers and specialty clinics playing an increasingly crucial role alongside traditional hospital settings, driven by the demand for specialized and efficient diagnostic services. These segmental shifts reflect the market's dynamic response to technological advancements and the pressing need for improved pancreatic cancer diagnostic solutions.

AI Impact Analysis on Pancreatic Cancer Diagnostic Market

Common user questions regarding AI's impact on the Pancreatic Cancer Diagnostic Market frequently revolve around its potential to enhance early detection accuracy, improve patient outcomes, reduce diagnostic errors, and streamline clinical workflows. Users often inquire about how AI can overcome the challenges of current diagnostic methods, such as the subtle nature of early-stage pancreatic cancer on imaging and the limitations of existing biomarkers. Concerns about data privacy, the need for robust validation, and the integration of AI solutions into existing healthcare IT infrastructure are also prevalent. Expectations are high for AI to provide personalized risk assessments, identify novel biomarkers, and ultimately contribute to a significant improvement in the survival rates of pancreatic cancer patients.

- Enhanced image analysis: AI algorithms can analyze complex radiological images (CT, MRI, EUS) with greater speed and precision, identifying subtle anomalies indicative of early-stage pancreatic cancer that might be missed by the human eye. This leads to earlier detection and more accurate staging.

- Early detection and risk stratification: Machine learning models, trained on vast datasets of patient demographics, genetic information, and medical histories, can predict an individual's risk of developing pancreatic cancer, enabling targeted screening programs for high-risk populations and facilitating proactive interventions.

- Biomarker discovery and validation: AI accelerates the identification of novel biomarkers by analyzing large-scale proteomic and genomic data, allowing for the development of more sensitive and specific liquid biopsies and other non-invasive tests for detection and monitoring.

- Pathology augmentation: AI-powered tools assist pathologists in analyzing biopsy slides, improving the detection of cancerous cells, quantifying tumor characteristics, and reducing diagnostic variability, thus enhancing the accuracy and consistency of pathological diagnoses.

- Personalized treatment planning: By integrating AI with patient-specific diagnostic data, including genetic profiles and tumor characteristics, clinicians can receive AI-driven recommendations for the most effective therapeutic strategies, moving towards truly personalized medicine for pancreatic cancer.

- Workflow optimization and efficiency: AI automates routine tasks, reduces turnaround times for diagnostic tests, and integrates data from various sources (imaging, lab results, patient records), leading to more efficient diagnostic pathways and better resource utilization in healthcare settings.

DRO & Impact Forces Of Pancreatic Cancer Diagnostic Market

The Pancreatic Cancer Diagnostic Market is shaped by a complex interplay of drivers, restraints, and opportunities, with various impact forces influencing its trajectory. A primary driver is the increasing global incidence of pancreatic cancer, directly correlating with an aging population and lifestyle factors such as obesity and smoking. This rising disease burden necessitates more effective and accessible diagnostic tools. Significant technological advancements, particularly in molecular diagnostics, liquid biopsies, and advanced imaging techniques, represent another powerful driver, continuously pushing the boundaries of early detection and diagnostic accuracy. Furthermore, increasing research and development investments by pharmaceutical and biotechnology companies, alongside government funding and philanthropic initiatives, are fueling the discovery of novel biomarkers and innovative diagnostic platforms. Heightened awareness campaigns for pancreatic cancer, coupled with a growing emphasis on early diagnosis for improved patient outcomes, also contribute significantly to market expansion. These synergistic forces underscore the urgent clinical need and the industry's response to develop better solutions.

Despite these powerful drivers, several restraints pose challenges to market growth. The high cost associated with advanced diagnostic procedures and technologies, including complex imaging equipment and sophisticated molecular tests, can limit their accessibility, especially in developing regions. Furthermore, the lack of skilled healthcare professionals proficient in operating and interpreting these advanced diagnostic tools can hinder adoption rates. Stringent regulatory approval processes for novel diagnostic devices and biomarkers also contribute to extended market entry timelines and increased development costs, creating barriers for innovators. Another significant restraint is the limited reimbursement policies in some healthcare systems, which can restrict patient access to cutting-edge diagnostics. The inherent difficulty in detecting pancreatic cancer early due to its often asymptomatic nature and deep anatomical location also presents a clinical challenge that no current diagnostic modality has fully overcome, limiting widespread screening effectiveness. These restraints collectively necessitate strategic initiatives to reduce costs, enhance professional training, and streamline regulatory pathways.

Opportunities within the Pancreatic Cancer Diagnostic Market are abundant and diverse, promising future growth and innovation. The advent of liquid biopsy technologies, which allow for non-invasive cancer detection and monitoring through blood tests, represents a paradigm shift with immense potential for early diagnosis, recurrence monitoring, and personalized treatment selection. The integration of artificial intelligence and machine learning into diagnostic imaging and biomarker analysis offers a significant opportunity to enhance diagnostic accuracy, predict disease progression, and identify high-risk individuals more effectively. The expansion into emerging markets, particularly in Asia Pacific, Latin America, and Africa, where healthcare infrastructure is improving and cancer incidence is rising, presents untapped growth avenues for diagnostic solution providers. Furthermore, the development of point-of-care (POC) diagnostic devices could dramatically improve accessibility and timeliness of testing, especially in resource-limited settings. Collaborations between academic institutions, industry players, and research organizations are also creating opportunities for accelerated innovation and the translation of research findings into clinically applicable diagnostic tools. These opportunities, if strategically capitalized upon, can transform the diagnostic landscape for pancreatic cancer.

Segmentation Analysis

The Pancreatic Cancer Diagnostic Market is comprehensively segmented based on various critical parameters including product type, end user, and test type, providing a granular view of its diverse landscape. This segmentation allows for a detailed understanding of market dynamics, growth drivers, and competitive strategies across different facets of the diagnostic pipeline. The product type segment differentiates between imaging modalities, biopsy techniques, and biomarker tests, each playing a distinct role in the diagnostic pathway. The end user segmentation clarifies which healthcare settings primarily utilize these diagnostic tools, highlighting the distribution and application of services across the healthcare continuum. The test type category distinguishes between laboratory-developed tests and commercially available in vitro diagnostic kits, reflecting different regulatory and commercial approaches to diagnostic offerings. Each segment is characterized by unique technological advancements, clinical utility, and market adoption rates, influencing the overall market structure and future growth trajectories.

- By Product Type:

- Imaging:

- Computed Tomography (CT) Scans

- Magnetic Resonance Imaging (MRI)

- Positron Emission Tomography (PET) Scans

- Endoscopic Ultrasound (EUS)

- Transabdominal Ultrasound

- Biopsy:

- Endoscopic Ultrasound Guided Fine Needle Aspiration (EUS-FNA)

- Percutaneous Biopsy

- Surgical Biopsy

- Biomarkers:

- Carbohydrate Antigen 19-9 (CA 19-9)

- Carcinoembryonic Antigen (CEA)

- Circulating Tumor DNA (ctDNA)

- MicroRNAs (miRNAs)

- Exosomes

- Protein Biomarkers (e.g., specific protein panels)

- Genetic Mutations (e.g., KRAS, TP53, BRCA)

- Imaging:

- By End User:

- Hospitals

- Diagnostic Centers

- Specialty Clinics (Oncology Clinics)

- Academic and Research Institutions

- Ambulatory Surgical Centers

- By Test Type:

- Laboratory Developed Tests (LDTs)

- In Vitro Diagnostic (IVD) Kits

Value Chain Analysis For Pancreatic Cancer Diagnostic Market

The value chain for the Pancreatic Cancer Diagnostic Market spans from the research and development of novel diagnostic technologies to their ultimate delivery and application in patient care. Upstream activities primarily involve raw material suppliers, including manufacturers of reagents, antibodies, enzymes, and other biochemical components essential for biomarker assays, as well as suppliers of sophisticated components for imaging equipment like detectors, sensors, and software. This stage also includes technology developers specializing in genomics, proteomics, and advanced imaging algorithms, who are crucial for foundational innovation. These upstream entities drive the scientific breakthroughs and manufacturing capabilities that underpin the entire diagnostic ecosystem, ensuring the quality and supply of core elements required for diagnostic product development.

Midstream in the value chain, diagnostic product developers and manufacturers play a pivotal role. These companies convert raw materials and technological concepts into market-ready diagnostic kits, imaging systems, and analytical platforms. This phase involves extensive research, product design, clinical trials, regulatory approval processes, and large-scale manufacturing. These entities invest heavily in validating the sensitivity, specificity, and reliability of their diagnostic solutions, ensuring they meet rigorous clinical and regulatory standards before reaching healthcare providers. Their efficiency and innovation directly impact the availability and quality of diagnostic tools in the market, bridging the gap between scientific discovery and practical clinical application.

Downstream activities encompass the distribution channels and the end-users who apply these diagnostic products. Distribution can be direct, where manufacturers sell directly to large hospital networks or research institutions, or indirect, involving third-party distributors, wholesalers, and specialized medical supply companies who handle logistics, sales, and technical support. These channels ensure that diagnostic tools are effectively delivered to various healthcare settings globally. End-users include hospitals, specialized diagnostic centers, oncology clinics, and academic and research institutions, where diagnoses are performed, and patient management decisions are made. These stakeholders, including healthcare professionals like oncologists, radiologists, and pathologists, are the ultimate beneficiaries and implementers of the diagnostic solutions, directly impacting patient outcomes and influencing market demand through their adoption patterns and clinical requirements.

Pancreatic Cancer Diagnostic Market Potential Customers

The primary potential customers and end-users of products and services within the Pancreatic Cancer Diagnostic Market are diverse, reflecting the multi-faceted nature of healthcare delivery and research. Hospitals, particularly large university hospitals and regional medical centers with comprehensive oncology departments, represent a significant customer segment. These institutions require a full spectrum of diagnostic tools, from advanced imaging modalities and biopsy equipment to sophisticated biomarker testing capabilities, to manage the complex needs of pancreatic cancer patients from initial diagnosis through treatment and follow-up. Their demand is driven by patient volume, the need for integrated care pathways, and their role as centers for advanced medical procedures and research.

Specialized diagnostic centers and independent laboratories also constitute a crucial customer base. These facilities often focus on providing high-throughput and specialized testing services, including molecular diagnostics and advanced biomarker panels, for referrals from primary care physicians and specialists. Their efficiency, expertise, and ability to offer a broad range of tests make them indispensable for confirming diagnoses and guiding personalized treatment plans. As healthcare systems evolve, the decentralization of some diagnostic services to these specialized centers helps to improve access and reduce wait times for patients, contributing to their growing importance in the market.

Furthermore, academic and research institutions are significant consumers of advanced diagnostic technologies, particularly those involved in clinical trials and the discovery of novel biomarkers and therapeutic targets. These institutions require cutting-edge equipment and reagents for fundamental research, translational studies, and the validation of new diagnostic approaches. Their role in advancing scientific knowledge and developing the next generation of diagnostic tools makes them key stakeholders. Additionally, private clinics, particularly those specializing in gastroenterology or oncology, and government healthcare programs that prioritize cancer screening and early detection, represent growing segments of potential customers, each with specific procurement needs and patient populations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.75 Billion |

| Market Forecast in 2032 | $2.95 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, F. Hoffmann-La Roche AG, Bio-Rad Laboratories Inc., Thermo Fisher Scientific Inc., Siemens Healthineers AG, GE Healthcare, Koninklijke Philips N.V., Canon Medical Systems Corporation, Hitachi Ltd., Quest Diagnostics, Exact Sciences Corporation, Guardant Health, Myriad Genetics Inc., Veracyte Inc., NeoGenomics Laboratories Inc., MDxHealth, Sysmex Corporation, Becton, Dickinson and and Company, Agilent Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pancreatic Cancer Diagnostic Market Key Technology Landscape

The Pancreatic Cancer Diagnostic Market is characterized by a rapidly evolving technology landscape, driven by the imperative for earlier, more accurate, and less invasive detection methods. Advanced imaging techniques form a cornerstone of this landscape, with innovations in multiparametric MRI (mpMRI), contrast-enhanced ultrasound (CEUS), and hybrid PET/MRI systems offering improved visualization of pancreatic lesions and enhanced tissue characterization. These technologies provide greater detail and functional information, helping clinicians differentiate between malignant and benign conditions more effectively. Developments in endoscopic ultrasound (EUS) with fine-needle aspiration (FNA) continue to refine tissue sampling procedures, increasing diagnostic yield and safety. The continuous enhancement of resolution, speed, and analytical capabilities in imaging remains a critical area of technological focus.

Molecular diagnostics represent another pivotal area, particularly with the emergence of next-generation sequencing (NGS) and liquid biopsy technologies. NGS platforms enable comprehensive genomic profiling of tumors, identifying specific mutations and genetic alterations that can serve as diagnostic and prognostic markers. Liquid biopsies, utilizing circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), exosomes, and microRNAs (miRNAs) isolated from blood, offer a non-invasive approach for early cancer detection, recurrence monitoring, and real-time assessment of treatment response. These technologies are poised to revolutionize screening and surveillance strategies, allowing for detection at much earlier stages when intervention is most effective. The integration of highly sensitive immunoassay technologies for detecting protein biomarkers like CA 19-9, often combined with other markers in multi-analyte panels, further enhances diagnostic precision.

Furthermore, artificial intelligence (AI) and machine learning (ML) are becoming transformative forces across the diagnostic spectrum. AI algorithms are being developed to assist radiologists in image analysis, improving the detection of subtle lesions, classifying tumors, and predicting prognosis from imaging data. In pathology, AI-powered tools aid in the automated analysis of biopsy slides, enhancing accuracy and efficiency. For biomarker discovery and analysis, ML algorithms can process vast amounts of omics data to identify novel diagnostic signatures and improve the predictive power of existing biomarkers. These AI-driven innovations aim to overcome the inherent challenges of pancreatic cancer diagnosis by providing more robust, data-driven insights and supporting clinicians in making more informed decisions, ultimately leading to better patient outcomes.

Regional Highlights

- North America: This region holds a dominant share in the pancreatic cancer diagnostic market, driven by advanced healthcare infrastructure, high healthcare expenditure, significant R&D investments, and the presence of leading diagnostic technology manufacturers. The United States and Canada are at the forefront, with high adoption rates of innovative diagnostic solutions and a strong focus on personalized medicine and early detection programs.

- Europe: The European market is characterized by increasing government initiatives for cancer screening, a growing aging population, and improving awareness about pancreatic cancer symptoms. Countries like Germany, the United Kingdom, and France contribute significantly, benefiting from robust research funding, a well-developed regulatory framework, and a strong emphasis on integrating advanced imaging and molecular diagnostics into clinical practice.

- Asia Pacific (APAC): Expected to exhibit the fastest growth, the APAC region is propelled by a large and expanding patient pool, improving healthcare access and infrastructure, and rising disposable incomes. Countries such as China, India, Japan, and South Korea are investing heavily in healthcare modernization and adopting advanced diagnostic technologies, making it a lucrative market for future growth.

- Latin America: This region is an emerging market, driven by increasing awareness, improving healthcare facilities, and a rising incidence of chronic diseases, including cancer. While still developing, countries like Brazil and Mexico are showing increased adoption of advanced diagnostic techniques, supported by growing foreign investments and collaborations aimed at enhancing cancer care capabilities.

- Middle East and Africa (MEA): The MEA region presents significant growth potential, fueled by increasing healthcare expenditure, a rising prevalence of cancer, and government initiatives to improve healthcare infrastructure. Developing economies in this region are gradually adopting advanced diagnostic technologies, although challenges related to accessibility and affordability persist, making it a market with evolving opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pancreatic Cancer Diagnostic Market.- Abbott Laboratories

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- GE Healthcare

- Koninklijke Philips N.V.

- Canon Medical Systems Corporation

- Hitachi Ltd.

- Quest Diagnostics

- Exact Sciences Corporation

- Guardant Health

- Myriad Genetics Inc.

- Veracyte Inc.

- NeoGenomics Laboratories Inc.

- MDxHealth

- Sysmex Corporation

- Becton, Dickinson and Company

- Agilent Technologies Inc.

- QIAGEN N.V.

Frequently Asked Questions

Analyze common user questions about the Pancreatic Cancer Diagnostic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary methods for diagnosing pancreatic cancer?

The primary methods for diagnosing pancreatic cancer involve a combination of imaging techniques, such as CT, MRI, and endoscopic ultrasound (EUS) with fine-needle aspiration (FNA), alongside biomarker tests like CA 19-9. These methods are crucial for initial detection, staging, and confirming the diagnosis through tissue analysis.

How is AI transforming pancreatic cancer diagnostics?

Artificial intelligence is transforming pancreatic cancer diagnostics by enhancing the accuracy and speed of image analysis, aiding in the discovery of novel biomarkers, improving risk stratification for early detection, and optimizing diagnostic workflows. AI helps identify subtle patterns in medical images and complex data, leading to more precise and timely diagnoses.

What are liquid biopsies and their role in pancreatic cancer diagnosis?

Liquid biopsies are non-invasive tests that analyze biological fluids, primarily blood, for circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), or exosomes. In pancreatic cancer diagnosis, they play a crucial role in early detection, monitoring disease progression, detecting recurrence, and guiding personalized treatment strategies, offering a less invasive alternative to tissue biopsies.

What are the main challenges in early detection of pancreatic cancer?

The main challenges in early detection of pancreatic cancer include its often asymptomatic nature in early stages, its deep anatomical location making it difficult to visualize, and the lack of highly sensitive and specific screening tools for the general population. This often leads to diagnosis at advanced stages, limiting treatment options.

Which regions are showing significant growth in the pancreatic cancer diagnostic market?

The Asia Pacific region is showing the most significant growth in the pancreatic cancer diagnostic market, driven by increasing cancer incidence, improving healthcare infrastructure, and rising awareness. North America and Europe currently hold larger market shares due to established healthcare systems and high adoption of advanced technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager