Parametric Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428802 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Parametric Insurance Market Size

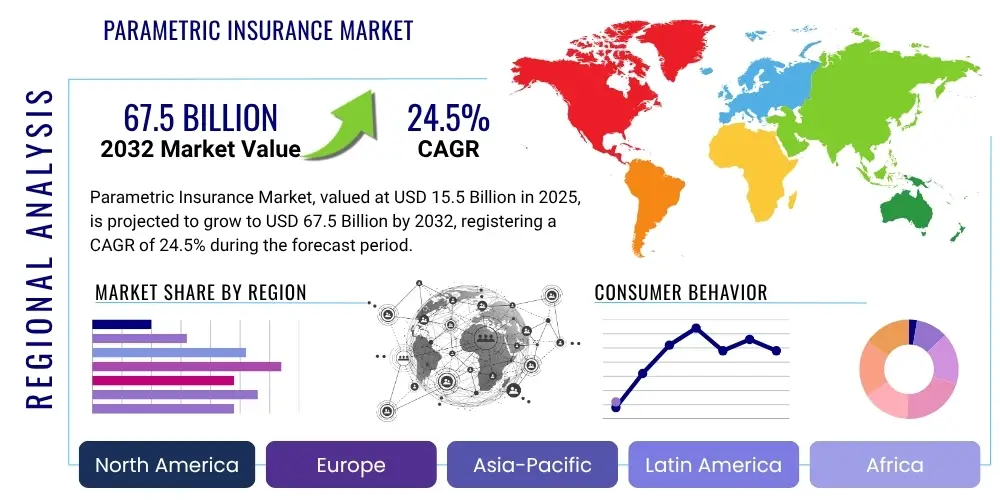

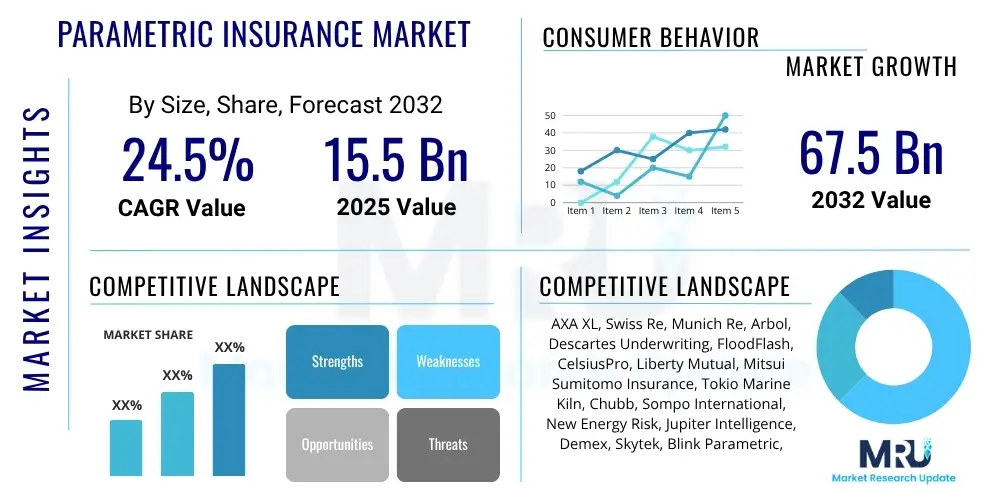

The Parametric Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.5% between 2025 and 2032. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 67.5 Billion by the end of the forecast period in 2032.

Parametric Insurance Market introduction

Parametric insurance represents an innovative approach to risk management, offering predefined payouts based on the occurrence and intensity of a specific, measurable event, rather than the traditional assessment of actual losses. This product is distinct for its simplicity, speed of payout, and transparency, primarily targeting risks like natural catastrophes, agricultural losses, and increasingly, cyber and supply chain disruptions. Its benefits include rapid claims processing, reduced administrative overhead, and minimized basis risk for policyholders. The market growth is significantly driven by escalating climate change impacts, advancements in data analytics, and the increasing demand for efficient risk transfer mechanisms in underserved or complex sectors.

The core principle of parametric insurance lies in its trigger-based mechanism. Instead of indemnifying actual damages, it pays out a predetermined sum if a specific parameter such as wind speed, rainfall amount, earthquake magnitude, or temperature crosses a predefined threshold. This eliminates the need for lengthy loss assessment, offering a swift financial injection to policyholders when they need it most. Products range from hurricane policies triggered by wind speeds at a specific location to drought insurance based on rainfall deficits recorded by weather stations, and even event cancellation insurance activated by predefined conditions affecting travel or gatherings.

Major applications of parametric insurance span across various sectors. In agriculture, it provides crucial protection against adverse weather conditions impacting crop yields and livestock. For infrastructure projects and municipalities, it offers swift recovery funds after natural disasters, ensuring business continuity and public service restoration. The travel and tourism industry leverages it for rapid compensation for weather-related disruptions like flight delays or cancellations. Key benefits include enhanced financial resilience for businesses and communities, a more predictable risk transfer cost, and accessibility for risks that are difficult to assess under traditional indemnity models. Driving factors include the increasing frequency and severity of extreme weather events, the proliferation of reliable data sources and sensing technologies, and the growing awareness among businesses and governments about the limitations of traditional insurance in certain complex or rapidly evolving scenarios.

Parametric Insurance Market Executive Summary

The Parametric Insurance Market is experiencing robust growth driven by increasing climate volatility, technological advancements, and a shift towards more agile risk transfer solutions across diverse industries. Key business trends include the emergence of specialized insurtech platforms, strategic partnerships between traditional insurers and data providers, and the expansion into new peril types beyond natural catastrophes. Regionally, North America and Europe currently dominate due to advanced infrastructure and sophisticated regulatory frameworks, while Asia Pacific is poised for significant expansion, fueled by increasing awareness and acute susceptibility to climate risks. Segment-wise, the market sees strong demand from agriculture, energy, and government entities, with a growing interest from small and medium-sized enterprises (SMEs) seeking simplified, efficient coverage solutions.

From a business perspective, the market is characterized by intense innovation in product design and delivery. Insurers are leveraging AI, machine learning, and satellite imagery to refine trigger mechanisms and enhance pricing accuracy. This has led to a proliferation of customizable parametric solutions, moving beyond standard offerings to address highly specific client needs, such as supply chain disruption coverage or particular event cancellation triggers. The competitive landscape is evolving rapidly, with new entrants specializing in data analytics and risk modeling challenging established players. This fosters a dynamic environment focused on efficiency, transparency, and faster policy deployment, ultimately enhancing the overall value proposition for clients.

Regional dynamics are significantly shaping market expansion. North America benefits from a mature insurance ecosystem and high adoption rates of advanced technologies, particularly in agriculture and property protection against perils like hurricanes and wildfires. Europe is witnessing growth primarily driven by regulatory support for climate resilience and innovative solutions for energy and urban infrastructure, alongside strong insurtech development. Asia Pacific, particularly countries like China, India, and Japan, presents substantial opportunities due to large populations, high exposure to natural disasters, and increasing government initiatives to mitigate economic losses. Latin America and the Middle East & Africa are emerging markets, with growing recognition of parametric solutions for disaster relief and agricultural stability, albeit with challenges related to data infrastructure and regulatory clarity.

AI Impact Analysis on Parametric Insurance Market

User inquiries concerning AI's influence on parametric insurance frequently explore how AI can elevate prediction accuracy, accelerate claims processing, and enable the creation of more sophisticated and tailored products. There is considerable interest in AI's capacity to mitigate basis risk and ensure the fairness and transparency of automated triggers. Concerns often center on data privacy, the potential for algorithmic bias, and the imperative for robust validation of AI models to sustain trust in automated systems. Users also question the integration challenges of AI with existing insurance infrastructure and the specialized skill sets necessary to effectively leverage these advanced technologies.

- AI significantly enhances data analysis capabilities, processing vast datasets from satellites, IoT sensors, and weather stations to improve trigger accuracy and reduce basis risk.

- Predictive analytics powered by AI allows for more precise risk modeling and dynamic pricing, leading to fairer premiums and better-tailored policies.

- Automated claims processing through AI algorithms ensures instantaneous payouts upon trigger activation, drastically reducing settlement times and administrative costs.

- AI facilitates the development of novel parametric products by identifying complex correlations between events and losses, enabling coverage for previously uninsurable risks.

- Machine learning models can continuously learn and adapt to changing environmental patterns and risk profiles, maintaining the relevance and effectiveness of parametric triggers over time.

- AI assists in anomaly detection within trigger data, contributing to risk integrity and transparency in the claims verification process.

- The integration of AI with blockchain technology promises enhanced transparency and immutability of trigger data and policy terms, bolstering trust in automated payouts.

DRO & Impact Forces Of Parametric Insurance Market

The Parametric Insurance Market is shaped by a confluence of accelerating drivers, persistent restraints, and significant opportunities, all contributing to dynamic impact forces. Drivers include the increasing frequency and severity of climate events, the rapid advancements in data collection and analytics technologies, and the inherent transparency and speed of parametric payouts. Restraints encompass the ongoing challenge of basis risk, limited awareness among potential policyholders, and the need for robust regulatory frameworks. Opportunities stem from expanding into emerging markets, developing customized solutions for new perils, and integrating with advanced digital platforms. These forces collectively propel the market forward while demanding continuous innovation and strategic adaptation from stakeholders.

Driving forces primarily revolve around the undeniable impact of global climate change. As extreme weather events become more common and intense, traditional indemnity insurance often struggles to provide timely and adequate coverage, creating a clear demand for swift, predefined payouts. Concurrently, the explosion of accurate and real-time data from sources like satellite imagery, IoT devices, and meteorological stations provides the foundational infrastructure necessary for reliable parametric triggers. The inherent simplicity and efficiency of parametric solutions, particularly their rapid claims settlement, appeal to a market increasingly seeking immediate financial relief and reduced administrative burdens, driving adoption across various industries.

However, the market faces significant hurdles. Basis risk, the discrepancy between the insured's actual loss and the policy payout, remains a key concern and requires sophisticated modeling and transparent communication. A lack of widespread understanding of how parametric products function, especially compared to conventional insurance, hinders adoption, necessitating extensive educational efforts from insurers and brokers. Furthermore, the regulatory landscape is still evolving, with some jurisdictions lacking specific guidelines for parametric products, which can impede market entry and product innovation. Despite these challenges, vast opportunities exist in tailoring parametric solutions for emerging risks such as cyber attacks, supply chain disruptions, and health pandemics, as well as expanding into developing regions highly vulnerable to natural disasters but traditionally underserved by conventional insurance models.

Segmentation Analysis

The Parametric Insurance Market is broadly segmented based on peril type, end-user industry, deployment model, and geographical region, reflecting the diverse applications and specific needs of policyholders. This segmentation helps in understanding the market's intricate structure, identifying niche opportunities, and tailoring product offerings to various customer groups. Each segment exhibits distinct growth patterns influenced by risk exposure, technological readiness, and economic development, allowing for a detailed analysis of market dynamics and strategic positioning for market participants. The interplay between these segments defines the evolving landscape of parametric risk transfer and innovation.

- By Peril Type:

- Natural Catastrophes: Covers risks such as hurricanes, earthquakes, floods, droughts, and wildfires, representing a foundational segment due to increasing climate volatility and associated economic losses.

- Agricultural Risks: Focuses on weather-related events impacting crop yields or livestock, including excessive rainfall, drought, frost, and heat stress, crucial for food security.

- Cyber Risks: An emerging segment offering protection against specific cyber incidents, for example, predefined downtime after a DDoS attack, or data breach volume exceeding a threshold, rather than complex damage assessment.

- Travel & Leisure: Provides payouts triggered by specific conditions affecting travel plans, such as flight delays exceeding a set duration, extreme weather at a destination, or predefined event cancellations.

- Energy & Utilities: Covers risks like grid disruptions from extreme weather or power outages based on measurable parameters, ensuring operational continuity.

- Others: Includes bespoke solutions for supply chain disruptions, health pandemic triggers based on infection rates, or specific event-driven business interruption scenarios tailored to unique client needs.

- By End User:

- Commercial Enterprises: Businesses seeking protection against various perils impacting their operations, revenue, or infrastructure, including manufacturing, retail, and logistics sectors, enhancing their financial resilience.

- Agriculture Sector: Farmers, agricultural cooperatives, and food processors relying on weather-dependent operations, ensuring stability against climate variability.

- Government & Public Sector: Municipalities, state governments, and international aid organizations requiring rapid funds for disaster relief, public infrastructure recovery, and humanitarian assistance.

- Individuals: Personal insurance for homeowners in high-risk zones, travelers, and event organizers seeking simplified, quick-payout coverage for specific, verifiable events.

- Utilities & Infrastructure: Companies managing critical infrastructure like power grids, water systems, and transportation networks, protecting against operational disruptions.

- By Deployment Model:

- Standalone Policies: Independent parametric insurance contracts designed for specific risks, offering targeted and flexible coverage.

- Embedded Policies: Parametric coverage seamlessly integrated into existing products or services, such as travel bookings or smart home devices, enhancing customer value.

- Bundled Solutions: Parametric components offered alongside traditional indemnity policies to enhance overall coverage, providing comprehensive risk management.

- By Region:

- North America: Leading market driven by technological adoption, high disaster exposure, and mature insurance infrastructure, particularly in the U.S. and Canada.

- Europe: Growth fueled by climate resilience initiatives, innovative insurtech, and supportive regulatory environments across countries like the UK, Germany, and France.

- Asia Pacific: Fastest-growing region due to high vulnerability to natural disasters, increasing awareness, and government-backed schemes in nations like Japan, China, and India.

- Latin America: Emerging market with increasing adoption, particularly in agriculture and disaster relief, often supported by international organizations and public-private partnerships.

- Middle East & Africa: Developing market with potential in drought insurance and protection against extreme heat events, driven by climate adaptation efforts and nascent digital infrastructure.

Value Chain Analysis For Parametric Insurance Market

The value chain for the Parametric Insurance Market is distinct from traditional insurance, emphasizing data accuracy, advanced modeling, and efficient distribution. It typically begins with upstream activities focused on data acquisition and sophisticated risk modeling, moving through product development and underwriting, and culminating in efficient claims processing and diverse distribution channels. Direct and indirect channels play crucial roles, with insurtech platforms often acting as vital intermediaries or direct-to-customer providers. This chain is highly reliant on cutting-edge technology and strategic partnerships, enabling the seamless flow of information and swift execution of policy agreements and payouts.

Upstream activities are foundational, involving the meticulous collection and validation of vast amounts of environmental, economic, and behavioral data. This critical data is sourced from diverse origins such as satellites, weather stations, IoT sensors, seismic monitors, and other specialized third-party providers. Dedicated data analytics firms and meteorological agencies are key upstream partners, supplying the precise, verifiable data required for robust trigger definition and parameter calibration. Following rigorous data acquisition, advanced modeling techniques and actuarial science transform this raw data into sophisticated risk models, which are crucial for setting appropriate thresholds and equitable premium structures. This phase often involves collaboration with academic institutions and specialized consulting firms to develop and validate highly sophisticated algorithms that effectively minimize basis risk.

Downstream, the value chain concentrates on product design, innovative underwriting, efficient distribution, and streamlined claims management. Insurers and specialized insurtech companies collaborate to develop highly customized parametric products, often in partnership with brokers and corporate clients to meet specific needs. Distribution channels are varied, including direct sales to large corporations and governments, strategic partnerships with traditional insurance brokers and agents, and increasingly, direct-to-consumer models facilitated by advanced digital platforms. The claims process is significantly streamlined: once a predefined trigger event is independently verified by an authorized data source, payouts are automatically initiated through smart contracts, bypassing traditional loss adjustment procedures. This unparalleled efficiency is a core differentiator, dramatically reducing administrative costs and ensuring rapid liquidity for policyholders, which is a major driver for widespread market adoption and customer satisfaction.

Parametric Insurance Market Potential Customers

Potential customers for parametric insurance span a wide array of entities, ranging from large multinational corporations and national governments to individual farmers and small businesses, all seeking efficient and transparent risk transfer solutions. These end-users are typically characterized by their exposure to measurable and frequent risks, their critical need for rapid financial liquidity post-event, and sometimes, their difficulty in obtaining adequate coverage through traditional indemnity insurance due to assessment complexities or high administrative costs. The growing recognition of climate change impacts and the increasing digitization across industries are significantly expanding the customer base for these innovative and responsive products.

In the commercial sector, large corporations involved in energy, manufacturing, logistics, and hospitality are prime candidates. They frequently face significant business interruption risks from natural disasters or supply chain disruptions where traditional loss assessment can be protracted and complex. Parametric solutions offer them predictable and rapid cash injections, which are crucial for ensuring business continuity and minimizing financial fallout, enabling swift recovery and operational stability. Small and medium-sized enterprises (SMEs) also represent a substantial and often underserved market, particularly those in agricultural or tourism-dependent regions, who often lack the extensive resources for traditional loss documentation and strongly prefer straightforward, rapid claim settlements that support their resilience.

The public sector, including national governments, municipalities, and disaster relief organizations, forms another critical customer segment. They utilize parametric insurance to protect public infrastructure, fund immediate humanitarian aid, and manage budgetary impacts from large-scale natural catastrophes, ensuring societal stability. For instance, sovereign risk pools employing parametric triggers can provide swift financial support to member countries after an earthquake or hurricane, facilitating rapid recovery efforts. Furthermore, individual consumers, particularly homeowners in high-risk zones or travelers seeking protection against specific event-related disruptions, are increasingly targeted with simplified parametric products. The agricultural sector remains a cornerstone, with farmers requiring robust protection against specific weather events that directly affect crop yields, making them ideal candidates for rainfall or temperature-triggered policies that offer timely financial support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2032 | USD 67.5 Billion |

| Growth Rate | 24.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AXA XL, Swiss Re, Munich Re, Arbol, Descartes Underwriting, FloodFlash, CelsiusPro, Liberty Mutual, Mitsui Sumitomo Insurance, Tokio Marine Kiln, Chubb, Sompo International, New Energy Risk, Jupiter Intelligence, Demex, Skytek, Blink Parametric, Global Parametrics, Etherisc, WorldCover. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Parametric Insurance Market Key Technology Landscape

The technological landscape of the Parametric Insurance Market is rapidly evolving, driven by advancements in data science, artificial intelligence, and digital platforms. Key technologies include sophisticated data acquisition systems, advanced geospatial analytics, and machine learning algorithms for precise trigger definition and risk modeling. Blockchain technology is also gaining traction for enhancing transparency and automating claims settlements. These technologies collectively enable the high degree of accuracy, speed, and efficiency that defines parametric insurance, significantly differentiating it from traditional indemnity models and expanding its applicability across various sectors and emerging risks.

At the forefront are data acquisition and processing technologies. Satellite imagery, sourced from government agencies like Copernicus and Landsat, as well as private constellations, provides broad-scale, verifiable data on weather events, land use changes, and natural disaster impacts. Internet of Things (IoT) sensors, strategically deployed in agricultural fields, urban infrastructure, or remote areas, offer hyper-local, real-time data crucial for highly granular and accurate parametric triggers. These diverse and voluminous data streams are then processed using big data analytics platforms, often powered by robust cloud computing infrastructure, to extract meaningful insights and create robust, verifiable risk parameters. The reliability, accessibility, and precision of this data are paramount for minimizing basis risk and ensuring the effectiveness and trustworthiness of parametric policies.

Advanced analytical tools and artificial intelligence form the intelligence layer of parametric insurance. Machine learning algorithms are increasingly employed for predictive modeling, refining trigger thresholds, and assessing the precise correlation between specific parameters and actual losses. This not only improves pricing accuracy but also facilitates the development of entirely new product offerings tailored to complex risk scenarios. Geospatial information systems (GIS) are critical for accurately mapping risk exposure, defining precise policy coverage areas, and visualizing trigger event impacts in real-time. Furthermore, blockchain technology is being actively explored and implemented to create immutable smart contracts that automatically execute payouts once trigger conditions are met, enhancing transparency, trust, and further streamlining the claims process. Digital platforms and robust APIs facilitate seamless integration between data providers, insurers, and policyholders, enabling efficient policy issuance, management, and real-time communication.

Regional Highlights

The global Parametric Insurance Market exhibits significant regional variations, influenced by differing levels of climate risk exposure, technological infrastructure, regulatory maturity, and economic development. North America and Europe currently represent the most established markets, characterized by advanced data analytics capabilities, a high awareness of innovative risk transfer mechanisms, and proactive climate adaptation strategies. Asia Pacific is emerging as a critical growth engine, driven by its acute vulnerability to natural disasters and increasing government initiatives to bolster resilience and financial protection. Latin America and the Middle East & Africa are nascent but promising markets, particularly for agricultural and disaster relief applications, though they face challenges related to data availability and institutional frameworks that are gradually being addressed.

North America holds a dominant share, largely due to its susceptibility to high-frequency, high-impact events like hurricanes along the Gulf Coast, devastating wildfires in the West, and prolonged droughts in agricultural regions. The presence of sophisticated data infrastructure, strong insurtech innovation, and a mature insurance market with a progressive willingness to adopt new products underpins this leadership. Major corporations and government entities in the U.S. and Canada are significant adopters, utilizing parametric solutions for property protection, business interruption coverage, and swift disaster recovery funding. Supportive regulatory environments and the continuous integration of advanced climate science into risk modeling also contribute significantly to the region's robust market development and expansion.

Europe is another strong contender, propelled by a proactive stance on climate change adaptation, stringent environmental regulations, and a vibrant ecosystem of innovative insurance providers. Countries such as the UK, Germany, and France are leading in the development and adoption of parametric solutions for critical energy infrastructure, urban resilience projects, and agricultural risks, benefiting from robust scientific research. The region benefits substantially from robust satellite programs and data sharing initiatives that provide highly reliable triggers. Asia Pacific is anticipated to be the fastest-growing region, with countries like Japan, China, India, and Australia facing significant risks from typhoons, floods, and seismic activity. Government-backed schemes and international aid organizations are instrumental in fostering market development, particularly for protecting vulnerable communities and essential agricultural sectors. Latin America and MEA, while currently smaller, are experiencing increasing interest due to severe climate impacts and the immense potential for parametric insurance to offer accessible and rapid protection in underserved areas.

- North America: Market leader, high adoption in catastrophe-prone areas (e.g., U.S. Gulf Coast for hurricanes, California for wildfires), driven by advanced technology and high awareness.

- Europe: Strong growth in climate resilience, energy sector, and urban planning; notable activity in UK, Germany, France leveraging robust data infrastructure and supportive regulations.

- As

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager