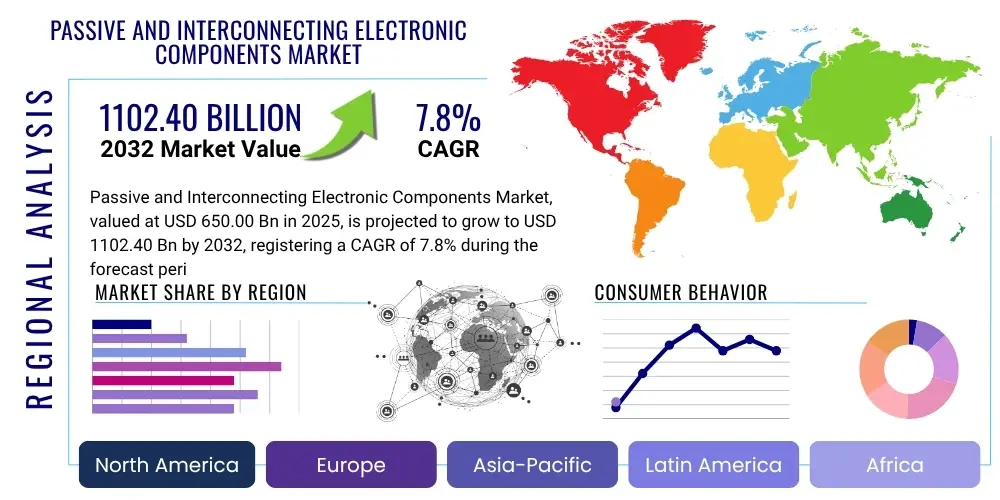

Passive and Interconnecting Electronic Components Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429746 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Passive and Interconnecting Electronic Components Market Size

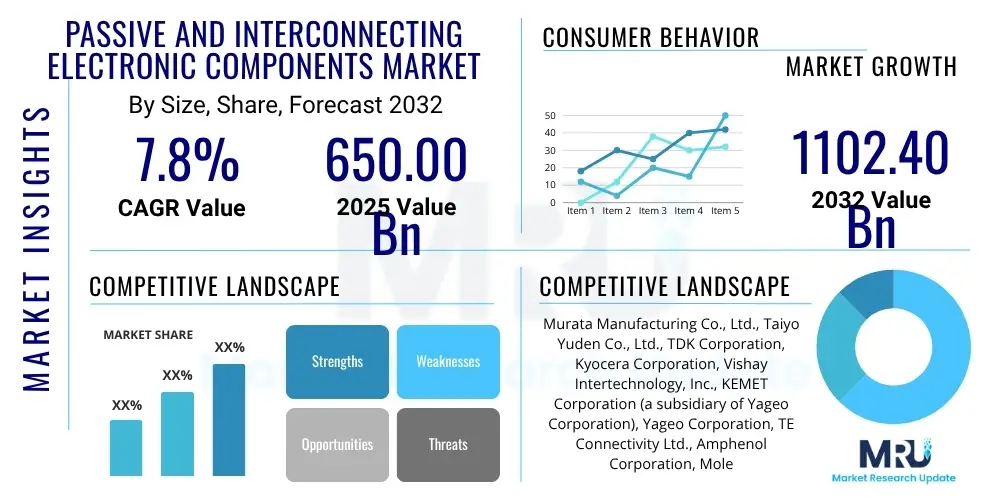

The Passive and Interconnecting Electronic Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $650.00 Billion in 2025 and is projected to reach $1102.40 Billion by the end of the forecast period in 2032.

Passive and Interconnecting Electronic Components Market introduction

Passive and interconnecting electronic components represent the fundamental building blocks of virtually all modern electronic systems, providing essential functionalities without requiring an external power source for their basic operation. This expansive market encompasses a diverse array of critical elements, including but not limited to resistors, capacitors, inductors, various types of electrical and optical connectors, sophisticated switches, relays, and the ubiquitous printed circuit boards (PCBs). These components are indispensable for managing current flow, storing electrical energy, filtering unwanted signals, providing frequency tuning, and establishing robust physical and electrical connections, thereby ensuring the stability, integrity, and efficient functioning of complex electronic circuits and assemblies.

The applications for these foundational components are extraordinarily broad, permeating nearly every sector of the global economy. Major industries that heavily rely on passive and interconnecting components include the consumer electronics segment, encompassing everything from high-volume smartphones, tablets, and laptops to advanced smart home devices, wearables, and portable gadgets, all demanding increasingly compact and high-performance solutions. The automotive industry is another colossal consumer, utilizing these components extensively in critical applications such as advanced driver-assistance systems (ADAS), sophisticated infotainment units, electric vehicle (EV) battery management systems, powertrain control, and various robust body electronics, where reliability under harsh conditions is paramount. Furthermore, industrial automation, telecommunications infrastructure (especially for 5G deployment), aerospace and defense systems, and highly sensitive medical devices represent significant high-growth application areas, each imposing stringent demands on component specifications and performance.

The inherent benefits offered by these components are manifold, contributing directly to their pervasive adoption and the market's sustained growth. These advantages include exceptional reliability, enabling prolonged operational life for electronic products; compact size, facilitating miniaturization trends and higher component density; high performance capabilities across a wide range of electrical parameters; and overall cost-effectiveness, which allows for mass production of complex electronic devices at competitive prices. The market's robust expansion is primarily driven by several overarching macroeconomic and technological trends, including the relentless global increase in demand for electronic devices across all demographics, the pervasive digitalization sweeping through every industry, the rapid deployment of advanced 5G communication networks, the accelerating global shift towards electric vehicles, and the ongoing industrial revolution propelled by the Internet of Things (IoT) and Artificial Intelligence (AI) technologies. These collective forces exert strong pressure for continuous innovation, pushing manufacturers to develop smaller, more efficient, durable, and technologically advanced passive and interconnecting components.

Passive and Interconnecting Electronic Components Market Executive Summary

The Passive and Interconnecting Electronic Components Market is currently undergoing a period of dynamic and robust growth, underpinned by a confluence of evolving business trends, distinct regional market developments, and continuous advancements across its various product segments. Broad business trends indicate a concentrated global effort towards achieving greater integration, profound miniaturization, and significantly enhanced functional density within electronic components, directly responding to the pervasive demand for smaller, yet more powerful and feature-rich electronic devices. Concurrently, there is a discernible and accelerating shift towards the adoption of sustainable manufacturing practices and the development of environmentally friendly materials, reflecting an increasing global environmental consciousness, stringent regulatory pressures, and a growing consumer preference for greener technologies. Furthermore, strategic alliances, joint ventures, mergers, and acquisitions remain prominent activities within the industry, as leading companies seek to strategically expand their product portfolios, broaden their geographical market reach, and acquire cutting-edge technological capabilities, thereby fostering a highly competitive yet profoundly innovative market environment.

From a comprehensive regional perspective, the Asia Pacific region unequivocally maintains its preeminent position as both the primary global manufacturing hub and the largest consumption market for passive and interconnecting electronic components. Countries such as China, Japan, South Korea, and Taiwan are at the vanguard of this dominance, benefitting immensely from their extensively developed electronics manufacturing ecosystems, highly efficient and resilient supply chains, substantial government support for industrial growth, and robust domestic demand for a vast array of electronic products. In contrast, North America and Europe, while representing more mature markets, are characterized by a pronounced focus on high-value, sophisticated applications within the automotive, aerospace, defense, and advanced industrial sectors, which demand components of exceptionally high reliability and cutting-edge technological sophistication. These regions also serve as critical global centers for pioneering research and development, particularly in the realm of next-generation materials and high-performance component solutions. Emerging markets in Latin America and the Middle East & Africa are demonstrating promising growth trajectories, propelled by increasing urbanization, widespread digitalization initiatives, and significant investments in essential infrastructure development.

Segment-wise, the market is defined by incessant innovation and specialized advancements. The connectors segment is experiencing transformative progress, particularly in the areas of high-speed data transmission capabilities, extreme miniaturization, and enhanced durability for operation in harsh environmental conditions, making them absolutely crucial for the rapid deployment of 5G networks and sophisticated automotive applications. Printed Circuit Boards (PCBs) are continuously evolving, transitioning towards higher layer counts, intricate flexible and rigid-flex designs, and advanced High-Density Interconnect (HDI) technologies, which are essential for accommodating the exponentially increasing component density and increasingly complex circuit layouts demanded by modern electronic devices. Passive components, including resistors, capacitors, and inductors, are significantly benefiting from groundbreaking developments in material science, leading to the creation of components that offer higher capacitance in remarkably smaller packages, vastly improved thermal stability, and superior performance characteristics at higher operating frequencies, thereby catering to the increasingly exacting requirements of advanced electronics and sophisticated power management systems.

AI Impact Analysis on Passive and Interconnecting Electronic Components Market

User inquiries regarding the profound impact of Artificial Intelligence (AI) on the Passive and Interconnecting Electronic Components Market frequently center on how AI technologies can revolutionize the design process, optimize manufacturing operations, and significantly elevate quality assurance standards within the industry. Users are particularly keen to understand if the proliferation of AI will necessitate the development of more highly integrated or uniquely specialized components tailored to support advanced AI-driven systems at the edge and within expansive data centers. A common concern revolves around how these fundamental components will cope with the unprecedented demands for ultra-high-speed data processing, minimal latency, and robust, efficient power delivery that AI workloads inherently require. There is also substantial interest in exploring how AI could enhance the resilience and predictability of the supply chain for critical electronic components, and to what extent these foundational elements play a pivotal role in enabling the broader AI ecosystem itself. Key themes consistently emerging from these discussions include the immense potential for AI to dramatically improve operational efficiencies in component production, the critical and evolving requirement for components capable of supporting the colossal computational needs of AI, and the prospective role of AI in fostering groundbreaking innovations in new material sciences specifically for advanced component development. Alongside the widespread excitement, legitimate concerns are often raised about the inherent complexity of successfully integrating sophisticated AI solutions into existing, often traditional, manufacturing workflows, the significant upfront investment required for such technological transitions, and the escalating cybersecurity implications that inevitably arise as smart factories become increasingly interconnected and intensely data-driven.

- AI-driven design automation tools are increasingly employed to meticulously optimize component layouts, accurately predict performance characteristics under a multitude of operating conditions, and significantly expedite the selection of ideal materials, ultimately leading to substantially faster prototyping and development cycles for new passive and interconnecting components.

- The strategic implementation of AI algorithms across manufacturing processes enables advanced predictive maintenance for critical production machinery, sophisticated real-time defect detection, and highly nuanced quality control, which collectively reduce waste, enhance operational efficiency, and dramatically improve product consistency for a vast array of passive and interconnecting electronic components.

- AI-powered analytics provide unparalleled enhancements in supply chain visibility, allowing for the generation of more accurate demand forecasts, proactive risk management strategies against potential disruptions, and optimized inventory levels, thereby substantially bolstering the resilience and responsiveness of the complex component supply chain in an increasingly volatile global market.

- There is a rapidly accelerating and pronounced demand for high-frequency, ultra-low-latency, and high-power density passive components, alongside advanced interconnects, that are specifically engineered to support the immense data throughput and exceptional power efficiency requirements of AI accelerators, edge computing devices, and advanced data center infrastructure.

- The innovative development of smart components, which intrinsically incorporate embedded AI capabilities, is an emerging frontier, offering advanced sensing functionalities, localized data processing, and intelligent decision-making directly at the component level, leading to the creation of more autonomous, adaptive, and highly efficient electronic systems.

- AI-assisted material discovery and advanced characterization techniques are significantly accelerating the pace of research and development for next-generation passive component materials, leading to the creation of substances with superior electrical properties, enhanced thermal management capabilities, and improved environmental sustainability profiles, continually pushing the boundaries of performance and application.

DRO & Impact Forces Of Passive and Interconnecting Electronic Components Market

The Passive and Interconnecting Electronic Components Market is dynamically shaped by a complex confluence of driving forces, inherent restraints, emergent opportunities, and overarching impact forces that collectively dictate its trajectory and evolution. Key market drivers include the pervasive and escalating growth of the consumer electronics sector, characterized by relentless innovation in product categories such as smartphones, smart wearables, and an ever-expanding ecosystem of IoT devices, all of which demand increasingly sophisticated, compact, and high-performance electronic components. The global rollout and aggressive expansion of 5G communication infrastructure significantly boosts demand for high-frequency, high-performance passive components and advanced connectors, which are indispensable for handling the substantially higher bandwidths and lower latencies inherent in 5G networks. Furthermore, the accelerating global adoption of electric vehicles (EVs) and advanced autonomous driving technologies creates a robust and urgent need for highly durable, reliable, and automotive-grade passive components and interconnects capable of withstanding harsh operating environments while ensuring critical safety and functional integrity. The ongoing digitalization of industrial sectors and the extensive proliferation of IoT devices across a myriad of industrial applications further fuel the market by requiring vast quantities of interconnected electronic solutions for sensing, control, and communication.

Despite these powerful underlying drivers, several significant restraints consistently challenge the market's growth potential. Geopolitical tensions, trade disputes, and unforeseen global events can instigate severe supply chain disruptions, directly impacting the availability and volatile pricing of critical raw materials, which are absolutely essential for the manufacturing of these components. Intense pricing pressures, exacerbated by fierce competition among numerous global manufacturers and the increasing commoditization of certain standard component types, can severely compress profit margins across the industry. Additionally, the sector faces the constant and demanding challenge of sustaining substantial research and development (R&D) investments to not only keep pace with rapid technological advancements but also to proactively anticipate and meet evolving design requirements and emerging performance benchmarks. Regulatory complexities, particularly concerning environmental standards, material sourcing transparency, and product safety certifications across different jurisdictions, add further layers of operational challenges, compelling manufacturers to continually adapt their processes and product formulations to comply with diverse and evolving global norms.

However, these inherent challenges are effectively counterbalanced by numerous lucrative and transformative opportunities that are poised to drive future market expansion. The continuous development and widespread commercialization of advanced packaging technologies, such as System-in-Package (SiP) and heterogeneous integration, offer innovative pathways to achieve even greater miniaturization and significantly enhanced functional density, thereby creating new avenues for high-value component integration and performance optimization. The integration of intelligent features directly into passive components, such as embedded sensors or integrated communication modules, opens up entirely new possibilities for developing smart systems and enhancing device capabilities with localized intelligence. Expansion into burgeoning high-growth application sectors, including advanced medical wearables, sophisticated industrial AI systems, specialized aerospace equipment, and advanced energy storage solutions, presents significant revenue streams and diversification opportunities. Moreover, a growing global focus on sustainable and green manufacturing processes, coupled with the relentless development of energy-efficient and eco-friendly components, not only addresses pressing environmental concerns but also creates a crucial competitive advantage for forward-thinking and compliant companies. The overarching impact forces influencing this market include the relentless march of technological obsolescence, which necessitates perpetual innovation cycles; stringent and evolving regulatory compliance for product safety, environmental impact, and material traceability; and an ever-increasing consumer demand for innovative, smaller, more powerful, and inherently reliable electronic devices, all of which directly shape product development roadmaps and market entry strategies.

Segmentation Analysis

The Passive and Interconnecting Electronic Components Market is meticulously segmented to provide granular and actionable insights into its diverse constituents, accurately reflecting the varied technological requirements and expansive application landscapes across the entire global electronics industry. This comprehensive segmentation approach is absolutely critical for all market participants—from manufacturers and distributors to investors and technology developers—to effectively identify specific high-growth areas, deeply understand nuanced competitive dynamics, and strategically tailor their product development roadmaps and market penetration strategies. The market’s segmentation is primarily categorized along three core dimensions: by component type, which offers a detailed breakdown of the various functional elements; by application, which illustrates the specific industry sectors and product categories where these components are utilized; and by end-use industry, which highlights the ultimate purchasers and beneficiaries of these essential electronic solutions. Each segment and its numerous sub-segments typically exhibit distinct market drivers, unique technological trends, and specialized competitive forces, underscoring the market's vast, intricate, and highly specialized nature.

The segmentation by component type is particularly crucial as it differentiates between the fundamental electronic parts, each endowed with unique electrical properties, distinct manufacturing processes, and specialized functionalities. For instance, capacitors are expertly designed to store electrical energy, resistors are engineered to precisely control current flow, and inductors are crafted to store energy within magnetic fields, each serving critical roles in circuit design. Interconnecting components, such as a wide variety of connectors and various forms of Printed Circuit Boards (PCBs), are absolutely vital for enabling stable electrical pathways and providing robust mechanical support within complex electronic assemblies. Understanding the specific demand characteristics and the trajectory of technological evolution within each individual component category—ranging from basic, high-volume chip resistors to highly advanced, multi-layer flexible PCBs—allows for a remarkably precise analysis of prevailing market trends, emergent innovation hotspots, and potential areas for strategic investment. This detailed understanding is instrumental for navigating the complexities of the market effectively.

- By Component Type:

- Resistors: These encompass a broad range including chip resistors (surface mount devices for compact designs), MELF (Metal Electrode Leadless Face) resistors, wirewound resistors for high-power dissipation, and specialized resistor networks offering integrated solutions. They are crucial for controlling current and voltage, performing signal conditioning, and regulating power within electronic circuits.

- Capacitors: This category comprises ceramic capacitors (especially multilayer ceramic capacitors or MLCCs for high-frequency applications), electrolytic capacitors (aluminum and tantalum types for energy storage), film capacitors, and supercapacitors (for high-density energy storage). They are used for filtering, timing, coupling, and energy storage in virtually all electronic systems.

- Inductors: Including power inductors (for efficient power conversion), RF inductors (for high-frequency tuning and filtering), and chip inductors (for compact board layouts). They store energy in a magnetic field and are vital for power supplies, filters, and oscillators.

- Connectors: A highly diverse category featuring board-to-board connectors, wire-to-board connectors, RF connectors (for wireless communication), fiber optic connectors (for high-speed optical data), USB connectors, power connectors, and highly specialized automotive connectors. They ensure reliable electrical, optical, and mechanical connections.

- Printed Circuit Boards (PCBs): Classified by complexity and flexibility into single-sided, double-sided, multi-layer PCBs, flexible PCBs, rigid-flex PCBs, and High-Density Interconnect (HDI) PCBs. They provide the essential mechanical support and electrical connections for all mounted electronic components.

- Switches: Encompassing tactile switches, toggle switches, rocker switches, pushbutton switches, and rotary switches. They precisely control the flow of current or signals in a circuit, serving as critical elements in user interfaces and control systems.

- Relays: Consisting of electromechanical relays and solid-state relays. They function as electrically operated switches, enabling the isolation of circuits or the control of high-power loads with a low-power control signal.

- Filters: Devices specifically designed to block unwanted frequencies or signals, crucial for maintaining electromagnetic compatibility (EMC) and ensuring signal integrity in sophisticated communication systems and sensitive power supplies.

- Antennas: Essential components for wireless communication, enabling the efficient transmission and reception of radio waves in devices such as smartphones, IoT sensors, and various networking equipment.

- Sensors: While many sensors are active components, a significant portion of integrated sensor modules heavily rely on passive components and interconnects for their proper functionality, signal conditioning, and robust connection to main processing units.

- By Application:

- Consumer Electronics: Devices such as smartphones, tablets, laptops, smart TVs, advanced home appliances, wearables, and gaming consoles, characterized by extremely high volume, rapid innovation cycles, and a continuous demand for miniaturization and cost-effectiveness.

- Automotive: Critical components for infotainment systems, advanced driver-assistance systems (ADAS), electric vehicle (EV) battery management systems, sophisticated powertrain electronics, and resilient body electronics, all requiring high reliability and environmental robustness.

- Industrial: Applications in complex factory automation, advanced robotics, precision industrial control systems, robust power supplies, smart manufacturing initiatives, and sophisticated energy management systems, demanding exceptional durability, precision, and extended operational life.

- Telecommunications: Absolutely critical for 5G infrastructure deployment, advanced network equipment (routers, switches), base stations, and expansive data centers, necessitating high-frequency, high-speed, and ultra-high-reliability components for seamless operation.

- Aerospace and Defense: Utilized in cutting-edge avionics, advanced radar systems, secure communication equipment, and precision missile guidance systems, requiring extreme reliability, harsh environment compatibility, and adherence to stringent military and aerospace certifications.

- Healthcare: Found in vital medical devices, advanced diagnostic equipment, continuous patient monitoring systems, and innovative wearable health monitors, where precision, extreme miniaturization, and biocompatibility are paramount for patient safety and efficacy.

- IT and Data Centers: Essential for high-performance servers, scalable storage systems, networking equipment, and demanding high-performance computing clusters, driving significant demand for high-speed interconnects and robust power components.

- By End-Use Industry:

- Telecommunication: Encompassing telecommunication service providers and network equipment manufacturers globally.

- Automotive: Including vehicle manufacturers (OEMs) and all their associated tier-1 and tier-2 suppliers.

- Consumer Electronics: Covering major consumer brands and their contract manufacturers.

- Industrial Electronics: Pertaining to manufacturers of industrial machinery, advanced automation systems, and diverse power solutions.

- Aerospace and Defense: Comprising prime contractors and various government defense agencies.

- Medical: Including medical device companies and specialized healthcare technology providers.

- Others: A broad category including research institutions, the energy sector, and various emerging technology sectors.

Value Chain Analysis For Passive and Interconnecting Electronic Components Market

The value chain for the Passive and Interconnecting Electronic Components Market is a highly sophisticated and multi-tiered structure, meticulously orchestrated to convert raw materials into finished electronic products for end-users across the globe. This intricate process commences with critical upstream activities that involve the rigorous procurement and initial processing of a diverse array of foundational raw materials. These include high-purity ceramics, various precious and non-precious metals such as copper, aluminum, and gold, specialized polymers and plastics, and complex chemical compounds essential for component fabrication. These raw materials undergo initial refinement, alloying, or synthesis, often by highly specialized material suppliers, before being supplied to the component manufacturers. This initial phase is characterized by an intense focus on material quality, consistent purity, and strict compliance with a growing body of environmental, social, and ethical sourcing standards, as these factors directly and profoundly impact the final component performance, reliability, and long-term sustainability. Manufacturers also engage in extensive research and development at this stage to continually optimize material properties for specific component applications, such as improving dielectric constants for advanced capacitors or enhancing electrical conductivity for high-speed interconnects, thereby ensuring the foundational supply chain for these critical inputs is both robust and highly diversified.

The core of the value chain firmly resides within the manufacturing phase, where the processed raw materials are meticulously transformed into a vast array of finished passive and interconnecting components. This involves an intricate series of complex processes such as precise deposition, advanced etching, intricate molding, precise winding, sophisticated assembly, and rigorous testing, all of which demand exceptionally high levels of precision engineering and the deployment of cutting-edge manufacturing technologies. Component manufacturers, often highly specialized and operating at massive scales, engage in the detailed design, precise fabrication, careful assembly, and exhaustive testing of their products to meet increasingly stringent industry standards and highly specific customer specifications. This critical stage also encompasses stringent quality control measures, efficient packaging, and strategic branding. The downstream segment of the value chain is primarily focused on the efficient distribution and seamless integration of these finished components into higher-level electronic assemblies and end-products. This typically involves a vast, global network of authorized distributors, independent sales agents, and direct sales teams who strategically channel the components to a diverse range of customers. These customers primarily consist of Original Equipment Manufacturers (OEMs) across all electronic device sectors, Electronic Manufacturing Services (EMS) providers who specialize in assembling products for various OEMs, and Contract Manufacturers (CMs) who handle large-scale production. Distributors, in particular, play an absolutely crucial role in managing vast inventories, providing critical technical support, and ensuring localized supply for smaller volume purchasers or those with highly diverse product needs.

The distribution channel landscape within this market is characterized by a strategic hybrid approach, encompassing both direct and indirect sales methodologies. Direct sales are particularly prevalent for high-volume orders, highly specialized or customized components, or in situations involving strategic, long-term partnerships with major OEMs. This direct approach allows for closer collaboration, bespoke solutions, and direct technical support. In contrast, indirect channels, which leverage an extensive global network of value-added distributors and resellers, are vitally important for reaching a broader and more fragmented customer base. This includes small to medium-sized enterprises (SMEs), regional manufacturers, and for providing prompt, off-the-shelf availability of standard, widely used components. These distributors add significant value through comprehensive warehousing and inventory management, efficient logistics, specialized technical sales support, and often by providing crucial design-in assistance to engineers during product development phases. The overall efficiency, responsiveness, and reliability of these intricate distribution networks are paramount in ensuring timely access to essential components, which is absolutely critical for accelerating product development cycles, maintaining uninterrupted production lines, and fostering innovation across the entire global electronics industry. This intricately connected value chain, therefore, not only emphasizes manufacturing precision and technological advancement but also robust logistics and effective market penetration to meet the diverse and dynamic demands of a rapidly evolving global market.

Passive and Interconnecting Electronic Components Market Potential Customers

The Passive and Interconnecting Electronic Components Market serves an exceptionally broad and diverse customer base, encompassing virtually every industry sector that integrates electronic functionality into its products, systems, or operational infrastructure. The most prominent segment of potential customers comprises Original Equipment Manufacturers (OEMs) spanning a vast multitude of sectors. These OEMs are the core designers, developers, and producers of finished electronic goods and complex systems, ranging from global consumer electronics giants manufacturing smartphones, laptops, and smart home appliances, to leading automotive manufacturers building highly sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and electric vehicle powertrains, as well as industrial companies developing cutting-edge automation equipment, robotics, and smart factory solutions. The precise technical specifications, stringent reliability standards, and often enormous volume requirements of these diverse OEMs largely dictate the prevailing trends and specific demands within the component market, as they seamlessly integrate these fundamental parts into their increasingly complex final products. Their relentless pursuit of innovation and differentiation directly drives the continuous need for next-generation components, consistently pushing the boundaries of performance, miniaturization, and functional integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $650.00 Billion |

| Market Forecast in 2032 | $1102.40 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Manufacturing Co., Ltd., Taiyo Yuden Co., Ltd., TDK Corporation, Kyocera Corporation, Vishay Intertechnology, Inc., KEMET Corporation (a subsidiary of Yageo Corporation), Yageo Corporation, TE Connectivity Ltd., Amphenol Corporation, Molex (a subsidiary of Koch Industries), Foxconn Technology Group (Hon Hai Precision Industry Co., Ltd.), Delta Electronics, Inc., Sumitomo Electric Industries, Ltd., Hirose Electric Co., Ltd., AVX Corporation (a subsidiary of Kyocera Corporation), Samsung Electro-Mechanics Co., Ltd., Nichicon Corporation, Panasonic Corporation, Littelfuse, Inc., Würth Elektronik GmbH & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Passive and Interconnecting Electronic Components Market Key Technology Landscape

The Passive and Interconnecting Electronic Components Market is characterized by an incredibly dynamic and rapidly evolving technological landscape, profoundly driven by the relentless pursuit of enhanced functionality, superior performance, extreme miniaturization, and improved energy efficiency across virtually all electronic applications. A core and foundational area of innovation is advanced material science, which inherently underpins the development of components with significantly improved electrical, thermal, and mechanical characteristics. This includes the pioneering of new dielectric materials for capacitors that allow for substantially higher capacitance in remarkably smaller packages, specialized metallic alloys for connectors that offer superior electrical conductivity and robust corrosion resistance, and advanced ceramic composites for inductors that provide better saturation characteristics and exceptional thermal stability, all of which are absolutely crucial for operating efficiently in high-frequency, high-power, and often harsh temperature environments. Ongoing research into novel materials with unique properties, such as those enabling greater power density, advanced electromagnetic shielding capabilities, or even self-healing characteristics, remains a top priority to meet the increasingly stringent demands of next-generation electronic devices and systems.

Regional Highlights

- Asia Pacific: This region undeniably stands as the undisputed global powerhouse for both the mass manufacturing and extensive consumption of passive and interconnecting electronic components. Countries such as China, Japan, South Korea, and Taiwan collectively house vast, advanced, and highly sophisticated electronics manufacturing ecosystems, benefiting immensely from robust government support for industrial growth, substantial ongoing investments in research and development, and immense domestic alongside export-oriented demand. The rapid proliferation of consumer electronics, the aggressive expansion of 5G infrastructure, and the booming electric vehicle market in this region are colossal drivers. The strategic presence of numerous leading global component manufacturers and a highly integrated, resilient supply chain further reinforces its dominant market position.

- North America: Characterized by a strong and unwavering emphasis on high-value, high-performance, and high-reliability applications, North America represents a absolutely critical market for advanced passive and interconnecting components. Demand is primarily and significantly fueled by the robust aerospace and defense sectors, cutting-edge advanced automotive technologies (including rapid advancements in electric vehicles and sophisticated autonomous driving systems), and the rapidly expanding high-tech industries such as IT and vast data centers. The region serves as a prominent global hub for technological innovation, consistently driving the demand for highly specialized, ultra-reliable, and avant-garde component solutions. Substantial investments in R&D, particularly in new material sciences and advanced packaging techniques, fundamentally contribute to its significant market relevance and competitive edge.

- Europe: Europe stands as a pivotal global market for precision industrial automation, high-end automotive applications (including premium and rapidly expanding electric vehicles), and advanced medical electronics. The region places a paramount emphasis on precision engineering, adherence to incredibly stringent quality standards, and strict compliance with complex regulatory frameworks, all of which collectively drive the demand for highly reliable, robust, and often customized components. Germany, France, and the UK are prominent contributing nations, boasting strong industrial bases and a significant focus on sustainable manufacturing practices. The ongoing profound digitalization of industrial processes and comprehensive smart city initiatives further stimulate consistent market growth and innovation.

- Latin America: As an emerging market with significant growth potential, Latin America is experiencing steadily increasing demand for passive and interconnecting components, primarily driven by accelerating industrialization, rapid urbanization, and a burgeoning middle class with greater access to diverse consumer electronics. Countries like Brazil and Mexico are witnessing substantial ongoing investments in automotive manufacturing capabilities and crucial telecommunications infrastructure, leading to a consistent and measurable increase in component consumption. While still in a developmental phase compared to mature markets, the region offers significant future growth potential as its electronic manufacturing capabilities continue to expand and mature.

- Middle East and Africa (MEA): This region is a developing market characterized by increasing strategic investments in vital telecommunications infrastructure, ambitious smart city projects, and the diversification of industrial sectors away from traditional oil-dependent economies. The widespread expansion of internet connectivity and the accelerating adoption of digital technologies are gradually but steadily fostering a growing demand for electronic components. While its current market share remains comparatively smaller than other regions, robust government initiatives aimed at promoting local manufacturing and driving technological advancement are unequivocally expected to spur significant future growth in component consumption across the MEA landscape.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Passive and Interconnecting Electronic Components Market.- Murata Manufacturing Co., Ltd.

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- Kyocera Corporation

- Vishay Intertechnology, Inc.

- KEMET Corporation (a subsidiary of Yageo Corporation)

- Yageo Corporation

- TE Connectivity Ltd.

- Amphenol Corporation

- Molex (a subsidiary of Koch Industries)

- Foxconn Technology Group (Hon Hai Precision Industry Co., Ltd.)

- Delta Electronics, Inc.

- Sumitomo Electric Industries, Ltd.

- Hirose Electric Co., Ltd.

- AVX Corporation (a subsidiary of Kyocera Corporation)

- Samsung Electro-Mechanics Co., Ltd.

- Nichicon Corporation

- Panasonic Corporation

- Littelfuse, Inc.

- Würth Elektronik GmbH & Co. KG

Frequently Asked Questions

What are passive and interconnecting electronic components?

Passive and interconnecting electronic components are fundamental, non-active elements critical for the functioning of all electronic circuits. Passive components, such as resistors, capacitors, and inductors, meticulously manage electrical energy without requiring an external power source to operate, while interconnecting components like connectors and Printed Circuit Boards (PCBs) provide essential electrical and mechanical pathways. They collaboratively ensure signal integrity, efficient power management, and robust physical connectivity within diverse electronic devices and complex systems.

Which industries are the major consumers of these components?

The primary consumers of passive and interconnecting components are a vast and wide array of industries including the pervasive consumer electronics sector (e.g., smartphones, laptops, smart wearables), the rapidly evolving automotive industry (e.g., electric vehicles, advanced driver-assistance systems), comprehensive industrial automation (e.g., robotics, IoT devices), extensive telecommunications (e.g., 5G infrastructure, massive data centers), specialized aerospace and defense, and the critical healthcare sector (e.g., sophisticated medical devices). Their ubiquitous and indispensable nature makes them foundational across the entire modern technological landscape.

How is miniaturization impacting the market for passive and interconnecting components?

Miniaturization is a dominant and transformative trend profoundly impacting the market, driving continuous and intensive innovation to produce significantly smaller, thinner, and lighter components without compromising their critical performance parameters. This persistent trend enables the design and manufacturing of more compact, highly portable, and aesthetically sleek electronic devices, facilitates much higher component density on Printed Circuit Boards (PCBs), and directly supports advanced integration techniques that are absolutely crucial for the ongoing evolution of the Internet of Things (IoT), wearable technology, and high-performance computing systems.

What role do these components play in 5G technology?

In 5G technology, passive and interconnecting components are absolutely critical and indispensable for enabling ultra-high-frequency signal processing, exceptionally efficient power management, and highly reliable, high-speed data transmission. High-performance capacitors, specialized inductors, and advanced RF connectors are essential for adeptly handling the significantly higher bandwidths, ultra-low latencies, and vastly increased data rates demanded by sophisticated 5G networks, a myriad of 5G-enabled devices, and advanced applications, thereby ensuring stable, robust, and efficient communication infrastructure.

What are the key growth opportunities in this market?

Key growth opportunities are primarily fueled by the accelerating global adoption of electric vehicles and sophisticated autonomous driving systems, the rapid and extensive proliferation of Internet of Things (IoT) and Artificial Intelligence (AI)-enabled devices at the edge, the continuous global rollout and strategic expansion of 5G communication networks, and the profound ongoing digitalization of industrial automation processes. Furthermore, groundbreaking advancements in material science, sophisticated advanced packaging technologies, and the innovative integration of smart features directly into components present significant avenues for substantial market expansion and sustained innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager