Pathology Lab Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430772 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pathology Lab Equipment Market Size

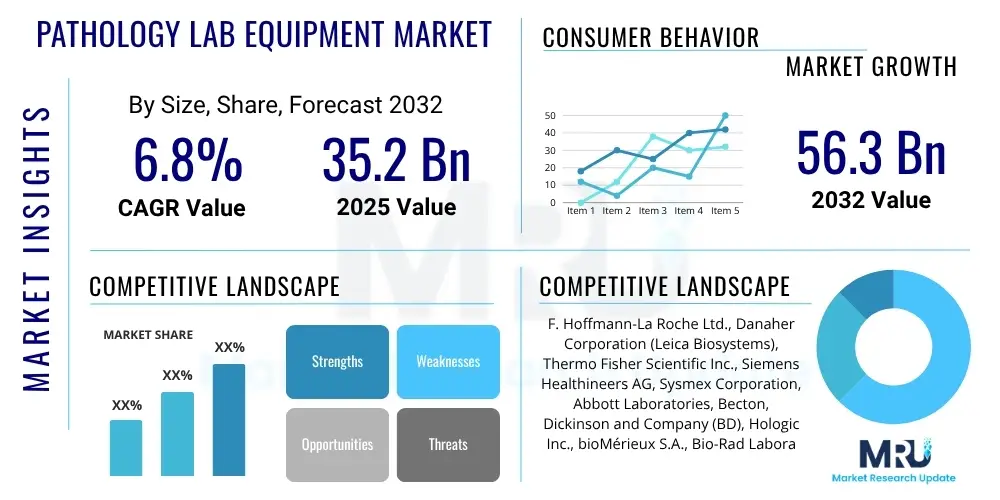

The Pathology Lab Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 35.2 billion in 2025 and is projected to reach USD 56.3 billion by the end of the forecast period in 2032.

Pathology Lab Equipment Market introduction

The Pathology Lab Equipment Market encompasses a broad range of instruments and consumables essential for the diagnosis, monitoring, and research of diseases through the analysis of tissue, blood, and other bodily fluids. This market is fundamentally driven by the escalating global prevalence of chronic diseases, the aging population, and the continuous advancements in diagnostic technologies that demand sophisticated and reliable laboratory tools. These equipment pieces are pivotal in delivering accurate and timely diagnostic results, forming the backbone of modern healthcare systems.

Products within this market include advanced microscopes, automated tissue processors, centrifuges, microtomes, immunoassay analyzers, molecular diagnostic instruments, and digital pathology systems. These tools are indispensable across various applications, from routine clinical pathology and anatomical pathology to specialized research in oncology, infectious diseases, and genetic disorders. The core benefits offered by these equipment pieces include enhanced diagnostic accuracy, increased laboratory efficiency through automation, reduced turnaround times for test results, and improved patient outcomes. The ongoing innovation in laboratory automation, digital integration, and AI-powered analytics further propels market expansion, making diagnostics more precise and accessible.

Pathology Lab Equipment Market Executive Summary

The global Pathology Lab Equipment Market is experiencing robust growth, primarily fueled by significant business trends such as the increasing adoption of automation and digitalization in laboratories, a surge in mergers and acquisitions among key market players, and a growing emphasis on personalized medicine. The demand for efficient and high-throughput diagnostic solutions is driving research and development investments, leading to the introduction of more sophisticated and integrated laboratory systems. Healthcare providers are continuously seeking solutions that improve diagnostic precision while simultaneously lowering operational costs and improving workflow efficiencies.

From a regional perspective, North America and Europe continue to hold substantial market shares due to established healthcare infrastructures, high healthcare expenditure, and advanced technological adoption. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by expanding healthcare access, rising awareness of early disease diagnosis, increasing medical tourism, and a growing number of diagnostic laboratories. Latin America, the Middle East, and Africa are also demonstrating promising growth opportunities as healthcare facilities in these regions undergo modernization and expand their diagnostic capabilities.

Segment trends indicate a strong shift towards molecular diagnostics, digital pathology, and point-of-care testing solutions, reflecting the industry's drive towards more precise, rapid, and accessible diagnostic tools. The rising incidence of chronic diseases, particularly cancer and infectious diseases, is a primary driver for the increased demand for advanced diagnostic equipment. Furthermore, the integration of artificial intelligence and machine learning is revolutionizing image analysis and data interpretation, promising to enhance diagnostic accuracy and efficiency across various pathology disciplines.

AI Impact Analysis on Pathology Lab Equipment Market

Common user inquiries regarding the impact of Artificial Intelligence on the Pathology Lab Equipment Market frequently revolve around how AI can enhance diagnostic accuracy, streamline laboratory workflows, and overcome current challenges such as pathologist shortages and diagnostic variability. Users often express concerns about data privacy, the ethical implications of AI in diagnosis, and the potential for job displacement, while simultaneously showing strong interest in AI's capabilities for predictive analytics, automated image analysis, and integration with existing diagnostic platforms. There is a palpable expectation that AI will deliver faster, more consistent, and more objective diagnostic interpretations, ultimately improving patient care outcomes.

- Enhanced diagnostic accuracy through automated image analysis of slides and biopsies.

- Increased efficiency in laboratory operations by automating repetitive tasks and prioritizing complex cases.

- Development of predictive analytics for disease progression and treatment response based on pathological data.

- Integration with digital pathology systems for seamless data management and remote consultation.

- Personalized medicine advancements by identifying subtle biomarkers through AI-driven pattern recognition.

- Reduction in inter-observer variability, leading to more standardized diagnostic reporting.

- Facilitation of drug discovery and development through accelerated biomarker identification.

- Real-time quality control and anomaly detection in laboratory processes.

DRO & Impact Forces Of Pathology Lab Equipment Market

The Pathology Lab Equipment Market is significantly influenced by a confluence of driving factors, restraints, and opportunities, collectively shaping its trajectory and competitive landscape. Key drivers include the global increase in the prevalence of chronic and infectious diseases, which necessitates advanced and rapid diagnostic tools. Furthermore, continuous technological advancements in laboratory automation, molecular diagnostics, and digital pathology are propelling market expansion by offering more precise, efficient, and integrated solutions. The rising geriatric population, prone to various age-related ailments, coupled with increasing healthcare expenditure worldwide, further stimulates the demand for sophisticated diagnostic equipment. Regulatory frameworks, while sometimes stringent, also ensure the quality and safety of these devices, fostering innovation within defined boundaries.

However, the market also faces considerable restraints, such as the high initial cost of purchasing and maintaining advanced pathology lab equipment, which can be a barrier for smaller laboratories or healthcare facilities in developing regions. The scarcity of skilled laboratory professionals capable of operating and interpreting results from complex instruments poses another significant challenge. Stringent regulatory approval processes for new devices can delay market entry and increase development costs. Additionally, the need for significant capital investment for upgrading existing infrastructure to accommodate new technologies can deter widespread adoption.

Despite these restraints, numerous opportunities are emerging, particularly from the growth in emerging economies where healthcare infrastructure is rapidly developing and access to advanced diagnostics is improving. The increasing adoption of personalized medicine and companion diagnostics presents a substantial opportunity for specialized pathology equipment. Moreover, the expanding field of point-of-care testing, which brings diagnostic capabilities closer to patients, represents a major avenue for market growth. Ongoing research and development efforts aimed at integrating artificial intelligence and machine learning into pathology diagnostics are expected to revolutionize image analysis and workflow, creating new product categories and market segments. The strategic impact forces include intensifying competition among market players, government initiatives to improve healthcare access and quality, and the rising demand for preventative healthcare, all of which dynamically influence market dynamics.

Segmentation Analysis

The Pathology Lab Equipment Market is comprehensively segmented based on various critical parameters, including product type, application, and end-user. This segmentation provides a detailed understanding of the market dynamics, allowing for targeted analysis of growth opportunities and challenges within specific categories. Each segment represents distinct demands, technological advancements, and user requirements, collectively defining the intricate structure of the global market. Understanding these segments is crucial for strategic planning and product development in the pathology industry.

- By Product Type

- Histology Equipment

- Tissue Processors

- Microtomes & Cryostats

- Stainers

- Slide Scanners

- Coverslippers

- Others (embedding centers, etc.)

- Cytology Equipment

- Centrifuges

- Liquid-Based Cytology Processors

- Automated Cell Counters

- Microscopes

- Molecular Pathology Equipment

- PCR Systems

- DNA Sequencers

- FISH Analyzers

- Mass Spectrometers

- Electrophoresis Systems

- Immunohistochemistry (IHC) Equipment

- Automated IHC Stainers

- IHC Slide Processors

- Reagent Dispensers

- Others (General Lab Equipment, LIS, etc.)

- By Application

- Disease Diagnosis

- Cancer Diagnosis

- Infectious Disease Diagnosis

- Autoimmune Disease Diagnosis

- Neurological Disease Diagnosis

- Others (cardiovascular, metabolic disorders)

- Drug Discovery & Development

- Research & Academic

- By End-User

- Hospitals

- Diagnostic Laboratories

- Academic & Research Institutes

- Biotechnology & Pharmaceutical Companies

- Contract Research Organizations (CROs)

Value Chain Analysis For Pathology Lab Equipment Market

The value chain for the Pathology Lab Equipment Market is a complex network involving several stages, starting from raw material procurement to the final end-user application, encompassing both upstream and downstream activities. Upstream activities involve the sourcing and manufacturing of specialized components and raw materials such as optical lenses, electronic circuits, robotics, precision mechanical parts, and chemical reagents. Key players at this stage include component suppliers, software developers, and specialized chemical manufacturers, all of whom contribute foundational elements to the sophisticated diagnostic instruments. The quality and availability of these components directly impact the cost-effectiveness and performance of the final pathology equipment.

Midstream in the value chain, equipment manufacturers assemble these components into finished pathology instruments, integrating complex hardware, software, and consumables into functional systems. This stage often involves significant research and development investments to ensure product innovation, adherence to regulatory standards, and competitive differentiation. Manufacturers may also specialize in particular types of equipment, such as digital pathology scanners or molecular diagnostic platforms, requiring specialized expertise and production capabilities. After manufacturing, the products move through distribution channels, which can be direct or indirect.

Downstream activities focus on reaching the end-users. Direct distribution involves manufacturers selling directly to hospitals, large diagnostic laboratory chains, or research institutions through their own sales forces, offering personalized support, installation, and training services. This approach allows for greater control over customer relationships and service quality. Indirect distribution involves working with third-party distributors, wholesalers, and value-added resellers who have established networks and local market expertise, particularly beneficial for reaching smaller labs or geographically diverse customers. These channels facilitate the delivery, installation, and ongoing maintenance of equipment. Potential customers, including hospitals, diagnostic laboratories, academic and research institutes, and biotechnology and pharmaceutical companies, represent the final stage, utilizing these instruments for patient diagnosis, research, and drug development, thus completing the value creation cycle.

Pathology Lab Equipment Market Potential Customers

The primary potential customers and end-users of pathology lab equipment are diverse entities within the healthcare and life sciences sectors, all requiring accurate and efficient diagnostic and analytical capabilities. These customers are fundamental to the widespread adoption and utilization of advanced pathology tools. Their varied operational scales and specialized needs drive demand for a broad spectrum of equipment, from routine analyzers to highly specialized molecular diagnostic platforms. Understanding their specific requirements is crucial for manufacturers to tailor products and services effectively.

Hospitals, including large multi-specialty hospitals and smaller community hospitals, form a significant customer base, relying on pathology equipment for in-house diagnosis and patient management across numerous departments. Diagnostic laboratories, ranging from independent commercial labs to hospital-affiliated labs, represent another major segment, processing a high volume of samples and often requiring automated, high-throughput systems. Academic and research institutes utilize these tools extensively for basic science research, clinical trials, and educational purposes, often at the forefront of adopting new technologies for discovery and validation. Biotechnology and pharmaceutical companies are also key buyers, employing pathology equipment in drug discovery, preclinical testing, and biomarker identification, particularly in the development of new therapies. Additionally, Contract Research Organizations (CROs) that provide research services to pharma and biotech companies also constitute important end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 35.2 billion |

| Market Forecast in 2032 | USD 56.3 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F. Hoffmann-La Roche Ltd., Danaher Corporation (Leica Biosystems), Thermo Fisher Scientific Inc., Siemens Healthineers AG, Sysmex Corporation, Abbott Laboratories, Becton, Dickinson and Company (BD), Hologic Inc., bioMérieux S.A., Bio-Rad Laboratories Inc., Agilent Technologies Inc., PerkinElmer Inc., Enzo Biochem Inc., Sakura Finetek USA Inc., Merck KGaA, QIAGEN N.V., Bio-Techne Corporation, Epredia (Thermo Fisher Scientific Brand), Tecan Group Ltd., Menarini Diagnostics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pathology Lab Equipment Market Key Technology Landscape

The Pathology Lab Equipment Market is characterized by a dynamic and rapidly evolving technology landscape, where innovation is key to enhancing diagnostic accuracy, efficiency, and accessibility. A major trend is the increasing automation across various laboratory processes, from sample preparation and staining to slide scanning and analysis. Automated systems reduce manual errors, improve reproducibility, and significantly increase throughput, addressing the growing volume of tests required. Robotics and integrated platforms are becoming standard, enabling laboratories to streamline workflows and reduce turnaround times. These advancements contribute to more consistent and reliable diagnostic outcomes, which is critical in clinical settings.

Digital pathology represents a transformative technology, involving the acquisition, management, sharing, and interpretation of pathology information in a digital environment. High-resolution whole slide scanners convert glass slides into digital images, which can then be viewed, analyzed, and shared remotely. This technology facilitates telepathology, improves consultation capabilities, and enables advanced image analysis using computational tools. Molecular diagnostics, including Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), and Fluorescence In Situ Hybridization (FISH), continue to advance, offering highly sensitive and specific detection of genetic mutations, infectious agents, and biomarkers. These molecular techniques are foundational for personalized medicine and targeted therapies. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is a game-changer, particularly in image analysis, where AI can assist in identifying subtle abnormalities, quantifying features, and even predicting disease progression, augmenting the pathologist's capabilities. Furthermore, advancements in mass spectrometry are enabling precise identification and quantification of proteins and metabolites, offering deeper insights into disease mechanisms.

Regional Highlights

- North America: This region maintains a dominant share in the Pathology Lab Equipment Market, driven by advanced healthcare infrastructure, high healthcare spending, a strong focus on research and development, and the early adoption of advanced diagnostic technologies. The presence of major market players and a high prevalence of chronic diseases also contribute to its significant market size. The United States, in particular, leads in innovation and technology adoption.

- Europe: The European market is characterized by robust healthcare systems, stringent regulatory standards that promote high-quality diagnostics, and significant government funding for healthcare research. Countries like Germany, the UK, and France are key contributors, benefiting from an aging population and increasing demand for sophisticated diagnostic tools. Collaborative research initiatives and an emphasis on preventative care also drive market growth.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market due to improving healthcare infrastructure, rising disposable incomes, increasing awareness about early disease diagnosis, and a large patient pool. Countries like China, India, and Japan are investing heavily in modernizing their diagnostic capabilities, with a growing trend towards medical tourism and expanding access to healthcare services in rural areas.

- Latin America: This region is an emerging market for pathology lab equipment, driven by increasing healthcare expenditure, improving economic conditions, and the expansion of diagnostic laboratories. Brazil and Mexico are leading the adoption of new technologies, though market growth is still somewhat constrained by budget limitations and varying regulatory landscapes.

- Middle East and Africa (MEA): The MEA market is witnessing gradual growth, supported by governmental initiatives to enhance healthcare services, rising investments in medical facilities, and the increasing prevalence of lifestyle diseases. Countries in the Gulf Cooperation Council (GCC) are particularly active in upgrading their diagnostic capabilities, attracting international healthcare providers and advanced equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pathology Lab Equipment Market.- F. Hoffmann-La Roche Ltd.

- Danaher Corporation (Leica Biosystems)

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- Sysmex Corporation

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- Hologic Inc.

- bioMérieux S.A.

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Enzo Biochem Inc.

- Sakura Finetek USA Inc.

- Merck KGaA

- QIAGEN N.V.

- Bio-Techne Corporation

- Epredia (Thermo Fisher Scientific Brand)

- Tecan Group Ltd.

- Menarini Diagnostics

Frequently Asked Questions

What are the primary drivers for growth in the Pathology Lab Equipment Market?

The market's growth is primarily driven by the increasing global prevalence of chronic and infectious diseases, rapid technological advancements in diagnostic tools, a growing aging population requiring frequent diagnostic services, and rising healthcare expenditures worldwide that support investment in advanced laboratory equipment.

How is Artificial Intelligence impacting the Pathology Lab Equipment Market?

AI is transforming the market by enhancing diagnostic accuracy through automated image analysis, improving laboratory efficiency by streamlining workflows, and enabling predictive analytics. It aids in biomarker discovery and supports personalized medicine, making diagnostics more precise and less prone to human variability.

What are the key challenges faced by the Pathology Lab Equipment Market?

Key challenges include the high initial cost of advanced equipment, which can be prohibitive for some facilities, the scarcity of skilled professionals required to operate and interpret complex diagnostic systems, and stringent regulatory approval processes that can delay market entry for innovative products.

Which geographical regions offer the most significant growth opportunities?

The Asia Pacific (APAC) region is expected to offer the most significant growth opportunities due to its rapidly improving healthcare infrastructure, increasing healthcare expenditure, rising awareness about early diagnosis, and large patient population. North America and Europe remain strong but mature markets.

What are the latest technological trends shaping the pathology lab equipment industry?

The latest trends include increasing automation across laboratory processes, widespread adoption of digital pathology for remote analysis and consultation, advancements in molecular diagnostics (like NGS), and the integration of AI/Machine Learning for enhanced image analysis and data interpretation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager