Pathology Laboratory Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428300 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Pathology Laboratory Equipment Market Size

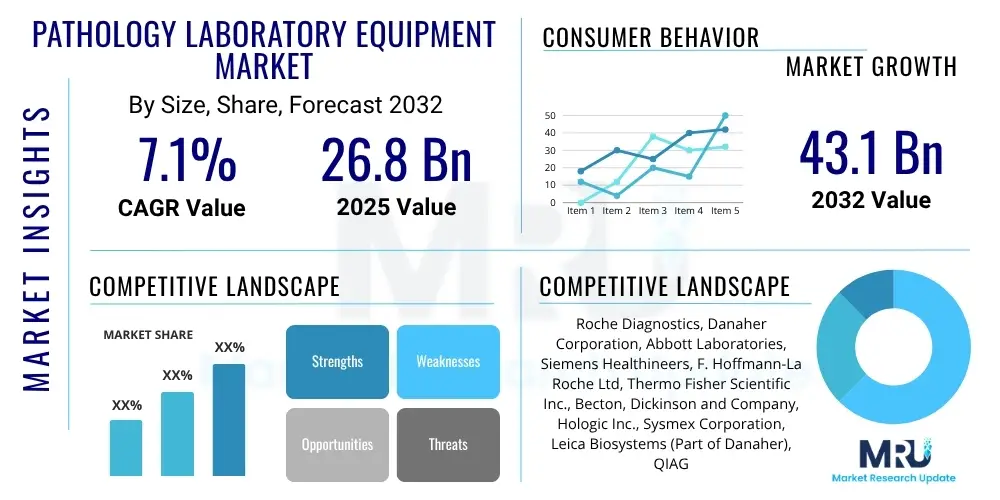

The Pathology Laboratory Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2025 and 2032. The market is estimated at USD 26.8 billion in 2025 and is projected to reach USD 43.1 billion by the end of the forecast period in 2032.

This robust growth trajectory is primarily fueled by the increasing prevalence of chronic and infectious diseases globally, which necessitates advanced diagnostic capabilities. Furthermore, technological advancements in automation, digital pathology, and molecular diagnostics are significantly enhancing the efficiency and accuracy of laboratory processes. The expanding healthcare infrastructure in emerging economies, coupled with rising healthcare expenditures and a growing geriatric population, also contributes to the sustained demand for sophisticated pathology equipment, driving market expansion over the forecast period.

Pathology Laboratory Equipment Market introduction

The Pathology Laboratory Equipment Market encompasses a broad spectrum of instruments, devices, and consumables essential for the accurate diagnosis and study of diseases in pathology laboratories. These laboratories play a pivotal role in healthcare, performing analyses on tissue samples, bodily fluids, and cells to detect abnormalities, identify pathogens, and provide crucial information for patient management and treatment planning. The products within this market range from basic microscopy and staining equipment to highly advanced automated systems for tissue processing, immunohistochemistry, molecular diagnostics, and digital imaging.

Major applications of pathology laboratory equipment span across various medical disciplines, including oncology, infectious disease diagnosis, immunology, hematology, and toxicology. In oncology, for instance, equipment is vital for biopsy processing, tumor staging, and personalized medicine approaches. The benefits derived from these technologies are substantial, enabling earlier and more precise disease detection, improving patient outcomes through tailored therapies, and enhancing laboratory workflow efficiency through automation and digital integration. Key driving factors for this market include the global rise in chronic disease incidence, an aging population, increasing awareness of early disease diagnosis, advancements in diagnostic technologies such as artificial intelligence and machine learning integration, and supportive government initiatives in healthcare infrastructure development.

The ongoing shift towards personalized medicine and companion diagnostics further intensifies the demand for highly specific and sensitive pathological analysis tools. Laboratories are continuously seeking solutions that offer higher throughput, reduced turnaround times, and improved data management capabilities. Moreover, the COVID-19 pandemic significantly accelerated innovation and adoption of molecular diagnostic equipment, highlighting the critical role of pathology labs in global health crises and cementing the need for resilient and advanced diagnostic infrastructure.

Pathology Laboratory Equipment Market Executive Summary

The Pathology Laboratory Equipment Market is experiencing dynamic growth driven by several overarching trends. Business trends indicate a strong focus on consolidation among market players through mergers and acquisitions, aimed at expanding product portfolios and geographical reach. There is also a significant push towards developing integrated solutions and automation platforms that offer end-to-end workflow optimization, reducing manual intervention and enhancing diagnostic throughput. Partnerships between technology providers and healthcare institutions are becoming more common, fostering innovation and facilitating the adoption of cutting-edge diagnostic tools.

Regional trends reveal North America and Europe as dominant markets due to advanced healthcare infrastructure, high healthcare spending, and early adoption of innovative technologies. However, the Asia Pacific region is rapidly emerging as a high-growth market, propelled by increasing healthcare investments, a large patient pool, improving diagnostic penetration, and rising awareness about early disease detection. Latin America, the Middle East, and Africa are also showing promising growth, albeit at a slower pace, driven by improving economic conditions and expanding access to healthcare services.

Segment trends highlight the growing demand for automated histology and cytology equipment, molecular diagnostics, and digital pathology solutions. The increasing complexity of disease diagnosis and the need for precision medicine are fueling the adoption of advanced molecular diagnostic platforms, including next-generation sequencing (NGS) and PCR. Furthermore, the shift towards digital pathology, characterized by whole slide imaging and AI-powered image analysis, is revolutionizing diagnostic workflows, enhancing collaboration among pathologists, and enabling remote diagnostics. Consumables and reagents also represent a significant segment, with continuous demand driven by the volume of tests performed.

AI Impact Analysis on Pathology Laboratory Equipment Market

Users frequently inquire about how Artificial Intelligence (AI) is transforming traditional pathology workflows, focusing on its ability to enhance diagnostic accuracy, reduce turnaround times, and address the growing shortage of pathologists. Common questions revolve around the types of AI technologies being integrated into laboratory equipment, such as machine learning for image analysis and deep learning for predictive diagnostics. Users are also concerned about the validation and regulatory approval processes for AI-powered devices, data security and privacy implications, and the potential for AI to augment, rather than replace, human expertise. The expectation is that AI will streamline complex analyses, automate repetitive tasks, and ultimately lead to more personalized and efficient patient care, despite initial challenges related to integration costs and algorithm training.

- Enhanced Diagnostic Accuracy: AI algorithms can detect subtle patterns and anomalies in histological slides that might be overlooked by the human eye, improving the precision in disease diagnosis, particularly for cancer grading and identification of rare conditions.

- Accelerated Workflow: Automation of image analysis, tissue screening, and report generation through AI significantly reduces the time required for diagnosis, leading to faster patient results and increased laboratory throughput.

- Digital Pathology Integration: AI is a foundational component of digital pathology, enabling automated analysis of whole slide images (WSIs), quantitative measurements, and integration with laboratory information systems (LIS).

- Resource Optimization: By automating routine tasks, AI helps optimize the utilization of skilled personnel, allowing pathologists to focus on complex cases requiring higher-level cognitive reasoning and clinical correlation.

- Personalized Medicine Support: AI assists in identifying specific biomarkers and genetic mutations from tissue samples, providing crucial insights for targeted therapies and personalized treatment plans in fields like oncology.

- Interoperability Challenges: Integrating AI solutions with existing legacy laboratory equipment and IT infrastructure presents significant technical and data standardization challenges.

- Data Security and Ethics: The extensive use of patient data for AI training and analysis raises concerns regarding data privacy, security, and ethical considerations for algorithmic decision-making.

- Training and Validation Requirements: AI models require large, diverse, and well-annotated datasets for training and rigorous validation to ensure reliability and generalizability across different patient populations and laboratory settings.

- Cost of Adoption: The initial investment in AI-powered equipment, software licenses, and necessary IT infrastructure can be substantial, posing a barrier for smaller laboratories or those with limited budgets.

- Regulatory Hurdles: AI-driven diagnostic tools face complex regulatory pathways, as agencies develop new guidelines for software as a medical device (SaMD) and ensure the safety and efficacy of autonomous diagnostic systems.

DRO & Impact Forces Of Pathology Laboratory Equipment Market

The Pathology Laboratory Equipment Market is profoundly shaped by a confluence of driving forces, inherent restraints, and emerging opportunities, all interacting to create a dynamic impact landscape. A primary driver is the accelerating global incidence of chronic diseases, including various cancers, cardiovascular conditions, and infectious diseases, which mandates a continuous demand for advanced and precise diagnostic tools. The aging global population further contributes to this demand, as elderly individuals are more susceptible to age-related pathologies requiring frequent diagnostic screening. Technological advancements, particularly in automation, molecular diagnostics, and digital imaging, act as significant catalysts, enhancing efficiency, accuracy, and throughput in laboratories. Moreover, increasing healthcare expenditure, a growing emphasis on early disease detection, and supportive government initiatives for healthcare infrastructure development globally fuel market expansion.

Despite these robust drivers, the market faces several notable restraints. The high cost associated with advanced pathology equipment and consumables, coupled with the substantial investment required for maintenance and skilled personnel, can be a significant barrier to adoption, especially in resource-constrained regions. Stringent regulatory frameworks and lengthy approval processes for new diagnostic devices often delay market entry and innovation. Furthermore, the shortage of skilled pathologists and laboratory technicians in many parts of the world limits the full utilization of sophisticated equipment and poses operational challenges. Economic downturns and budget constraints in healthcare systems can also temporarily curb purchasing decisions and market growth.

Opportunities within the market are abundant and include the burgeoning field of personalized medicine, which necessitates highly specific molecular diagnostics for tailored treatment plans. The increasing adoption of digital pathology and artificial intelligence for enhanced image analysis and workflow automation presents vast avenues for innovation and market penetration. Untapped markets in developing countries, characterized by improving healthcare infrastructure and rising awareness, offer substantial growth potential. Moreover, the development of point-of-care (POC) diagnostic devices and integrated laboratory solutions that streamline workflows and improve efficiency present lucrative prospects for market players. The ongoing trend towards telehealth and remote diagnostics, accelerated by recent global health events, further amplifies the need for digital pathology and connected diagnostic platforms.

The collective impact of these forces creates a highly competitive yet innovative market environment. Companies are compelled to invest heavily in research and development to introduce next-generation equipment that addresses the evolving needs of clinical pathology. Strategic collaborations and mergers are prevalent as firms seek to expand their technological capabilities and market reach. Regulatory compliance remains a critical consideration, guiding product development and market access. Ultimately, the market is moving towards more integrated, automated, and intelligent diagnostic solutions that promise improved patient outcomes and more efficient healthcare delivery.

Segmentation Analysis

The Pathology Laboratory Equipment Market is meticulously segmented to provide a comprehensive understanding of its diverse components, allowing for targeted analysis of market dynamics and opportunities. This segmentation primarily categorizes the market based on product type, application, end-user, and technology, reflecting the varied needs of pathology laboratories globally. Each segment plays a crucial role in disease diagnosis and research, with evolving trends driving innovation and adoption across these categories. The intricate interdependencies between these segments define the market's growth trajectory and competitive landscape, highlighting areas of high demand and emerging opportunities.

- By Product Type:

- Microscopes (Compound, Fluorescence, Digital, Electron)

- Histology & Cytology Equipment (Tissue Processors, Microtomes, Cryostats, Slide Stainers, Coverslippers, Cytocentrifuges)

- Molecular Diagnostic Equipment (PCR Machines, DNA Sequencers, Mass Spectrometers, Hybridization Instruments)

- Immunology Analyzers (ELISA Readers, Chemiluminescence Immunoassay (CLIA) Systems, Immunohistochemistry (IHC) Stainers)

- Automated & Semi-Automated Systems (Integrated Workstations, Liquid Handlers)

- Digital Pathology Scanners (Whole Slide Imagers)

- Consumables & Reagents (Antibodies, Stains, Kits, Solvents, Buffers, Glass Slides, Coverslips, Biopsy Cassettes)

- Laboratory Information Systems (LIS) & Software

- Other Equipment (Incubators, Centrifuges, Water Baths)

- By Application:

- Disease Diagnosis (Oncology, Infectious Diseases, Autoimmune Diseases, Neurological Disorders, Hematological Disorders, Gastrointestinal Diseases)

- Drug Discovery & Development

- Academic & Research Institutions

- Forensic Pathology

- By End-User:

- Hospitals & Clinics

- Diagnostic Laboratories (Independent Reference Labs, Hospital-Based Labs)

- Academic & Research Institutes

- Biotechnology & Pharmaceutical Companies

- Blood Banks

- By Technology:

- Conventional Microscopy

- Immunohistochemistry (IHC)

- In Situ Hybridization (ISH)

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Mass Spectrometry

- Flow Cytometry

- Digital Pathology (Whole Slide Imaging, AI-powered Image Analysis)

- Automation & Robotics

Value Chain Analysis For Pathology Laboratory Equipment Market

The value chain for the Pathology Laboratory Equipment Market is a complex network involving multiple stakeholders, from raw material suppliers to end-users, each adding value at different stages. The upstream segment primarily involves the sourcing and manufacturing of raw materials and components, such as optical lenses, electronic components, precision mechanical parts, and chemical reagents. Specialized suppliers provide high-grade materials that meet stringent quality and regulatory standards required for medical devices. This stage focuses on ensuring the quality, availability, and cost-effectiveness of foundational inputs that will be integrated into the final equipment. Precision engineering and material science expertise are critical at this initial phase.

Further along the value chain, the manufacturing and assembly phase transforms these components into finished pathology laboratory equipment. This involves sophisticated research and development, design, prototyping, and large-scale production of instruments such as automated tissue processors, molecular analyzers, and digital scanners. Companies invest heavily in R&D to innovate and differentiate their products, incorporating advanced technologies like AI, robotics, and advanced optics. Quality control, compliance with international medical device regulations (e.g., FDA, CE), and efficient production processes are paramount at this stage to deliver reliable and high-performance equipment. This segment is characterized by significant capital expenditure and a highly skilled workforce.

The downstream analysis focuses on distribution, sales, and post-sales support, which connect the manufacturers to the end-users. Distribution channels can be both direct and indirect. Direct channels involve manufacturers selling directly to large hospitals, university research centers, or key diagnostic laboratory networks, often through their own sales teams and service engineers. This approach allows for direct communication, customized solutions, and stronger client relationships. Indirect channels, on the other hand, rely on a network of distributors, wholesalers, and specialized medical equipment retailers who have established relationships with smaller clinics, regional labs, and international markets. These partners provide localized sales, marketing, logistics, and technical support, which is crucial for market penetration in diverse geographical areas and for reaching a broader customer base.

Post-sales support, including installation, training, maintenance, and technical assistance, is a critical component of the downstream value chain. This ensures optimal equipment performance, longevity, and user satisfaction. Effective service and support enhance customer loyalty and differentiate manufacturers in a competitive market. Furthermore, the provision of consumables and reagents, which are recurring purchases, forms a significant part of the ongoing downstream revenue stream. Efficient logistics and supply chain management are essential to ensure timely delivery of both equipment and consumables to maintain uninterrupted laboratory operations globally.

Pathology Laboratory Equipment Market Potential Customers

The primary end-users and buyers in the Pathology Laboratory Equipment Market are diverse, encompassing a wide array of healthcare institutions and research organizations that rely on accurate and timely diagnostic information. Hospitals, particularly large university hospitals, academic medical centers, and specialized cancer treatment centers, represent a significant customer segment. These institutions operate extensive pathology departments and often serve as early adopters of advanced diagnostic technologies due to their complex case loads and commitment to cutting-edge patient care and research. They require a full suite of equipment, from basic histology tools to advanced molecular diagnostic platforms, to support various clinical specialties.

Independent diagnostic laboratories and reference laboratories constitute another major customer base. These commercial entities often process a high volume of samples from various healthcare providers, including smaller clinics, physician offices, and hospitals that outsource specialized tests. Their purchasing decisions are heavily influenced by factors such as throughput, automation capabilities, cost-effectiveness, and the ability to offer a broad menu of diagnostic tests. The demand for efficiency and scalability drives their investment in highly automated systems and advanced digital pathology solutions, enabling them to handle large workloads while maintaining accuracy and rapid turnaround times.

Academic and research institutes, including universities, government research laboratories, and non-profit organizations, are also key buyers. These institutions utilize pathology equipment for fundamental research into disease mechanisms, development of new diagnostic assays, and preclinical studies. Their needs often lean towards highly specialized and flexible equipment that supports complex experimental setups, often at the forefront of technological innovation, such as advanced imaging systems, next-generation sequencers, and specialized cell analysis platforms. Biotechnology and pharmaceutical companies are increasingly investing in pathology equipment for drug discovery, development, and clinical trials, particularly for biomarker identification and companion diagnostics, which guide targeted therapy selection. Additionally, emerging end-users include forensic laboratories and veterinary pathology labs, further broadening the customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 26.8 Billion |

| Market Forecast in 2032 | USD 43.1 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche Diagnostics, Danaher Corporation, Abbott Laboratories, Siemens Healthineers, F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., Becton, Dickinson and Company, Hologic Inc., Sysmex Corporation, Leica Biosystems (Part of Danaher), QIAGEN N.V., Bio-Rad Laboratories Inc., Agilent Technologies Inc., PerkinElmer Inc., Enzo Biochem Inc., Sakura Finetek USA Inc., Koninklijke Philips N.V. (Philips Healthcare), Canon Medical Systems Corporation, Epredia (Thermo Fisher Scientific), 3DHistech Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pathology Laboratory Equipment Market Key Technology Landscape

The Pathology Laboratory Equipment Market is characterized by a rapidly evolving technological landscape, with continuous innovation aimed at enhancing diagnostic accuracy, efficiency, and throughput. One of the most significant advancements is the proliferation of automation and robotics, which are being integrated into various stages of pathology workflows, from sample preparation and tissue processing to slide staining and coverslipping. Automated systems reduce manual errors, standardize procedures, and significantly increase the speed at which samples can be processed, directly impacting laboratory productivity and turnaround times for diagnoses. These robotic solutions free up skilled technicians from repetitive tasks, allowing them to focus on more complex analyses.

Digital pathology represents another pivotal technological shift, transforming traditional glass slide-based diagnosis. This involves the digitization of entire microscope slides into high-resolution whole slide images (WSIs) using specialized scanners. Once digitized, these images can be viewed, analyzed, and shared remotely, facilitating telepathology, expert consultations, and educational activities. The integration of artificial intelligence (AI) and machine learning algorithms with digital pathology platforms is further revolutionizing image analysis. AI-powered tools can assist in detecting subtle abnormalities, quantifying biomarkers, and even predicting disease progression, augmenting the diagnostic capabilities of pathologists and improving diagnostic consistency.

Molecular diagnostics technologies are also experiencing exponential growth and integration into routine pathology. Techniques such as Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), and Fluorescence In Situ Hybridization (FISH) enable highly sensitive and specific detection of genetic mutations, infectious agents, and biomarkers at the molecular level. These technologies are crucial for personalized medicine, guiding targeted therapies in oncology, identifying genetic predispositions, and rapid pathogen identification. Advances in mass spectrometry for proteomics and metabolomics are also gaining traction, offering comprehensive molecular profiling of tissues and fluids. Furthermore, innovations in immunohistochemistry (IHC) and in situ hybridization (ISH) platforms continue to offer improved staining quality, multiplexing capabilities, and automated interpretation, essential for precise disease subtyping and prognosis.

Flow cytometry, another key technology, allows for rapid analysis of cells based on their light-scattering and fluorescent properties, crucial for hematological malignancies and immunophenotyping. The continuous development of more sensitive probes, multi-color analysis capabilities, and advanced software for data interpretation enhances its utility in pathology labs. Overall, the technological landscape is moving towards integrated, multi-modal platforms that combine various diagnostic capabilities, offering comprehensive insights from a single sample, and facilitating a more holistic understanding of disease. These advancements are not only improving the quality of diagnostics but also making pathology services more accessible and efficient globally.

Regional Highlights

- North America: This region is a dominant force in the Pathology Laboratory Equipment Market, driven by its advanced healthcare infrastructure, high healthcare expenditure, significant research and development investments, and the presence of major market players. The U.S. and Canada lead in adopting cutting-edge technologies like digital pathology and molecular diagnostics due to a high prevalence of chronic diseases and strong emphasis on personalized medicine. Stringent regulatory frameworks ensure high-quality standards for equipment, further solidifying the region's market leadership.

- Europe: Europe represents another substantial market, characterized by its well-established healthcare systems, increasing geriatric population, and a strong focus on clinical diagnostics and research. Countries like Germany, the UK, France, and Italy are key contributors, driven by government initiatives to improve diagnostic capabilities and an increasing adoption of automated laboratory solutions. The European Union's robust regulatory environment (e.g., IVDR) significantly impacts product development and market access.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market during the forecast period. This growth is fueled by improving healthcare infrastructure, rising healthcare expenditure, a large patient population, and increasing awareness regarding early disease diagnosis in emerging economies like China, India, Japan, and South Korea. Government initiatives to expand access to healthcare and a growing medical tourism sector also contribute to the region's rapid expansion. The adoption of advanced pathology equipment is steadily increasing due to local manufacturing capabilities and rising foreign investments.

- Latin America: This region presents promising growth opportunities, driven by increasing healthcare access, economic development, and a rising prevalence of chronic diseases. Countries such as Brazil, Mexico, and Argentina are witnessing expanding investments in healthcare infrastructure and diagnostic services. While growth may be slower compared to APAC, the increasing demand for modern diagnostic tools and an improving regulatory landscape are expected to propel market expansion.

- Middle East and Africa (MEA): The MEA market is gradually expanding, primarily due to growing healthcare investments, increasing awareness about advanced diagnostic techniques, and improving medical facilities in countries like Saudi Arabia, UAE, and South Africa. Strategic partnerships between international manufacturers and local distributors are crucial for market penetration in this region, addressing the varying levels of healthcare development and infrastructure. Challenges include limited healthcare budgets in some areas and varying regulatory environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pathology Laboratory Equipment Market.- Roche Diagnostics

- Danaher Corporation

- Abbott Laboratories

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company

- Hologic Inc.

- Sysmex Corporation

- Leica Biosystems (Part of Danaher)

- QIAGEN N.V.

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Enzo Biochem Inc.

- Sakura Finetek USA Inc.

- Koninklijke Philips N.V. (Philips Healthcare)

- Canon Medical Systems Corporation

- Epredia (Thermo Fisher Scientific)

- 3DHistech Ltd.

Frequently Asked Questions

Analyze common user questions about the Pathology Laboratory Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Pathology Laboratory Equipment Market?

The market is primarily driven by the increasing global prevalence of chronic and infectious diseases, a growing aging population, continuous technological advancements in automation and molecular diagnostics, and rising healthcare expenditures worldwide. These factors collectively boost the demand for precise and efficient diagnostic tools.

How is digital pathology transforming diagnostic workflows?

Digital pathology is revolutionizing workflows by enabling the digitization of glass slides into whole slide images (WSIs), allowing for remote viewing, analysis, and sharing. This facilitates telepathology, improves collaboration among pathologists, and integrates artificial intelligence for enhanced image analysis and quantitative measurements, ultimately increasing efficiency and accuracy.

What is the impact of Artificial Intelligence (AI) on pathology laboratory equipment?

AI is significantly impacting pathology by enhancing diagnostic accuracy through automated image analysis, accelerating workflow by automating repetitive tasks, and aiding in personalized medicine by identifying subtle biomarkers. It augments human capabilities, addressing challenges like pathologist shortages and improving diagnostic consistency.

Which regions are leading the Pathology Laboratory Equipment Market, and why?

North America and Europe currently lead the market due to their advanced healthcare infrastructures, high healthcare spending, and early adoption of innovative diagnostic technologies. The Asia Pacific region is rapidly emerging as a high-growth market, driven by increasing healthcare investments and a large patient pool.

What are the major challenges faced by the Pathology Laboratory Equipment Market?

Key challenges include the high cost of advanced equipment, stringent regulatory approval processes for new devices, the global shortage of skilled pathologists and laboratory technicians, and the complexities of integrating new technologies with existing legacy systems. Economic fluctuations can also influence purchasing decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager