Payment Orchestration Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429364 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Payment Orchestration Platform Market Size

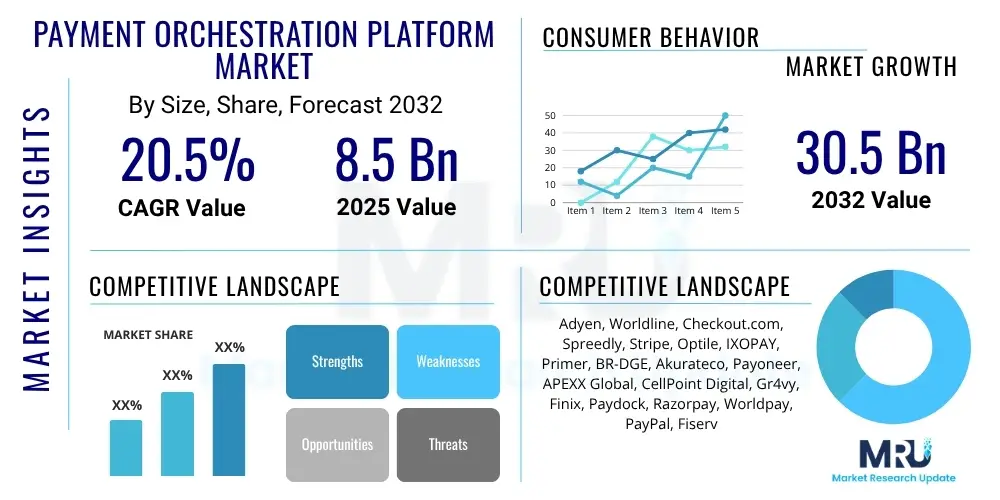

The Payment Orchestration Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2025 and 2032. The market is estimated at USD 8.5 Billion in 2025 and is projected to reach USD 30.5 Billion by the end of the forecast period in 2032.

Payment Orchestration Platform Market introduction

The Payment Orchestration Platform market is experiencing robust growth driven by the increasing complexity of global digital payments, the rapid expansion of e-commerce, and the continuous need for merchants to optimize their payment processing infrastructure. Payment orchestration platforms (POPs) serve as a critical middleware layer that intelligently routes transactions through multiple payment service providers (PSPs), gateways, and financial institutions, providing a unified interface for managing diverse payment flows. These platforms are designed to enhance operational efficiency, reduce costs, mitigate fraud risks, and ensure compliance with various regional and international payment regulations, ultimately empowering businesses to offer seamless payment experiences to their customers worldwide.

The core functionality of a payment orchestration platform includes dynamic transaction routing, intelligent fraud detection and prevention, comprehensive reporting and analytics, and consolidated reconciliation across disparate payment systems. Its major applications span across various industries, including retail and e-commerce, travel and hospitality, digital content and subscriptions, gaming, and financial services, enabling businesses of all sizes to manage complex payment ecosystems with greater agility. By centralizing payment operations, POPs offer significant benefits such as improved conversion rates, enhanced customer experience, greater payment flexibility, and increased resilience through diversified payment options, which are paramount in today's competitive digital landscape.

Key driving factors propelling the market's expansion include the escalating volume of cross-border e-commerce transactions, necessitating sophisticated routing and currency management capabilities. Furthermore, the proliferation of alternative payment methods, such as digital wallets and Buy Now Pay Later (BNPL) options, compels merchants to adopt solutions that can seamlessly integrate these diverse payment types. The rising demand for enhanced security measures and compliance with evolving data protection regulations like PCI DSS and GDPR also reinforces the value proposition of payment orchestration platforms, positioning them as indispensable tools for modern businesses navigating the intricacies of global digital commerce.

Payment Orchestration Platform Market Executive Summary

The Payment Orchestration Platform market is undergoing significant transformation, characterized by several key business, regional, and segment trends that highlight its dynamic evolution. Business trends indicate a strong emphasis on seamless, frictionless payment experiences, driving demand for platforms offering advanced features like smart routing, comprehensive fraud management, and deep analytics. The market is seeing increased adoption by mid-market enterprises and large corporations alike, as they seek to navigate the complexities of international trade, manage multiple payment partners, and reduce operational overheads. A notable trend is the move towards API-first solutions, enabling greater flexibility and customization for merchants integrating these platforms into their existing tech stacks, coupled with a growing interest in embedded finance capabilities offered by POPs.

Regionally, North America and Europe continue to be dominant markets, driven by technological maturity, high digital payment adoption rates, and stringent regulatory environments such as PSD2 in Europe, which necessitates sophisticated compliance tools. However, the Asia Pacific (APAC) region is emerging as a high-growth market, propelled by rapid e-commerce expansion, increasing internet penetration, and a burgeoning mobile-first consumer base. Latin America and the Middle East and Africa (MEA) are also exhibiting promising growth, albeit from a smaller base, fueled by digital transformation initiatives, increasing financial inclusion, and the adoption of modern payment infrastructure to support growing online economies. These regions present significant opportunities for market players to expand their footprint and cater to diverse local payment preferences.

From a segmentation perspective, the market is witnessing a strong shift towards cloud-based deployment models due to their scalability, flexibility, and reduced infrastructure costs, making them particularly appealing to businesses of varying sizes. The component segment is seeing robust growth in platform services, which offer a full suite of orchestration capabilities, beyond just basic gateway connectivity. Furthermore, end-user industries like e-commerce and retail remain the largest consumers, but there is an increasing penetration into other sectors such as travel, healthcare, and subscription services, which benefit immensely from optimized payment flows and enhanced customer journey management. The continuous innovation in fraud detection and real-time analytics solutions embedded within orchestration platforms is also a key segment trend, addressing critical merchant pain points.

AI Impact Analysis on Payment Orchestration Platform Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Payment Orchestration Platform market frequently center on enhanced fraud detection, optimized transaction routing, and personalized customer experiences. There is a strong expectation that AI will significantly bolster the predictive capabilities of these platforms, moving beyond rule-based systems to identify and mitigate sophisticated fraud attempts in real-time. Users also question how AI can lead to more efficient and cost-effective payment processing by dynamically selecting the best payment gateway based on factors like success rates, latency, and transaction fees. Furthermore, the potential for AI to personalize payment options and optimize checkout flows for individual customers is a recurring theme, highlighting a desire for improved conversion rates and customer satisfaction. Concerns often revolve around the ethical implications of AI, data privacy, and the need for explainable AI models to maintain transparency and trust in automated decision-making processes.

The integration of AI and Machine Learning (ML) is transforming payment orchestration platforms by providing intelligent automation and advanced analytical capabilities that were previously unattainable. AI algorithms can analyze vast datasets of transactional information, customer behavior, and fraud patterns to identify anomalies with unprecedented accuracy, thereby dramatically improving the effectiveness of fraud prevention mechanisms. This shift from reactive to proactive fraud management is a significant value add, minimizing financial losses for merchants and enhancing consumer confidence. Additionally, AI-powered dynamic routing algorithms can learn and adapt to optimize payment success rates by considering real-time performance metrics of various payment gateways, card networks, and local bank processing times. This ensures that transactions are always directed through the most reliable and cost-effective channels available, maximizing revenue and operational efficiency for businesses.

Beyond fraud and routing, AI is also instrumental in enhancing the overall customer journey and operational intelligence within payment orchestration. AI-driven insights can predict customer preferences for payment methods, tailor checkout experiences, and even proactively resolve potential payment issues before they impact the consumer. For instance, AI can identify payment failures due to transient issues and automatically re-route or retry transactions, improving completion rates. From an operational standpoint, AI tools within POPs can provide predictive analytics on payment trends, identify bottlenecks in the payment flow, and offer actionable recommendations for process improvements. This allows businesses to make data-driven decisions, anticipate market changes, and continuously refine their payment strategies to stay competitive and compliant in an ever-evolving digital commerce landscape, while also addressing user concerns about data utility and actionable insights.

- Enhanced fraud detection and prevention through real-time anomaly detection and predictive analytics.

- Optimized transaction routing using machine learning to maximize success rates and minimize processing costs.

- Personalized payment experiences based on customer behavior and preferences.

- Automated reconciliation and dispute management processes for operational efficiency.

- Predictive analytics for market trends, payment gateway performance, and potential bottlenecks.

- Improved compliance monitoring by identifying unusual transaction patterns that may indicate regulatory breaches.

- Reduced false positives in fraud alerts, leading to fewer legitimate transactions being declined.

- Adaptability to new payment methods and evolving fraud tactics.

DRO & Impact Forces Of Payment Orchestration Platform Market

The Payment Orchestration Platform market is significantly influenced by a confluence of drivers, restraints, and opportunities, all shaped by overarching impact forces. Key drivers include the exponential growth of global e-commerce, which mandates solutions capable of handling diverse payment methods and currencies across multiple geographies. The increasing complexity of the payment ecosystem, characterized by a proliferation of payment service providers, gateways, and local regulations, compels merchants to adopt orchestration platforms for simplified management. Furthermore, the persistent threat of online payment fraud and the need for robust security measures, coupled with stringent regulatory compliance requirements like PCI DSS and GDPR, drive the demand for sophisticated fraud detection and data management capabilities inherent in POPs. Businesses are actively seeking to improve conversion rates and customer experience by offering seamless, localized payment options, which POPs are uniquely positioned to deliver, thus fueling market expansion.

Despite these strong drivers, the market faces several restraints that could impede its growth. High initial integration costs and the technical complexity involved in migrating existing payment infrastructures to a new orchestration platform can deter smaller businesses or those with legacy systems. Concerns around data security and privacy, particularly when processing sensitive customer financial information through third-party platforms, remain a significant apprehension for potential adopters. Additionally, the challenge of vendor lock-in, where switching providers might be costly and disruptive, along with the steep learning curve associated with implementing and managing sophisticated payment orchestration features, can act as barriers to entry and adoption. The availability of in-house solutions or simpler, less comprehensive payment gateway aggregators also presents a competitive restraint, particularly for businesses with less complex payment needs.

Opportunities within the Payment Orchestration Platform market are substantial and diverse. The burgeoning growth in emerging markets, especially in Asia Pacific, Latin America, and Africa, represents vast untapped potential for companies to establish localized payment ecosystems and cater to rapidly digitalizing economies. The continuous advancements in artificial intelligence and machine learning present significant opportunities for enhancing fraud detection, optimizing routing, and personalizing payment experiences. Furthermore, the increasing adoption of headless commerce architectures and embedded finance models creates new avenues for POPs to integrate deeper into business operations, offering more holistic financial solutions. The exploration of blockchain technology for secure and transparent cross-border payments also holds promise for future innovation, positioning orchestration platforms at the forefront of evolving payment landscapes. The ongoing shift towards subscription-based business models and the need for recurring payment management further solidifies market opportunities.

Segmentation Analysis

The Payment Orchestration Platform market is segmented across various dimensions including components, deployment models, organization sizes, and end-user industries, reflecting the diverse needs and operational scales of businesses adopting these advanced payment solutions. This comprehensive segmentation provides a granular view of market dynamics, revealing where demand is strongest and how different types of businesses are leveraging orchestration capabilities to optimize their payment ecosystems. Understanding these segments is crucial for market participants to tailor their offerings, develop targeted strategies, and address specific pain points of their clientele, ranging from small and medium-sized enterprises (SMEs) to large multinational corporations.

- By Component:

- Platform

- Services (Professional Services, Managed Services)

- By Deployment Model:

- Cloud-based

- On-premise

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-User Industry:

- Retail and E-commerce

- Travel and Hospitality

- Online Gaming and Gambling

- Financial Services

- Digital Content and Subscriptions

- Logistics and Transportation

- Healthcare

- Others (Education, Government)

- By Payment Method:

- Cards (Credit, Debit)

- Digital Wallets

- Bank Transfers

- Alternative Payment Methods (BNPL, Cryptocurrencies)

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Payment Orchestration Platform Market

The value chain for the Payment Orchestration Platform market is intricate, involving several key stages from technology development to end-user consumption, each contributing to the overall value proposition. At the upstream end, the value chain begins with core technology providers who supply the foundational infrastructure, APIs, and microservices necessary for building orchestration platforms. This includes cloud computing providers, data analytics solution developers, AI/ML algorithm specialists, and security protocol developers. These upstream partners are critical in enabling the scalability, intelligence, and security features that define modern payment orchestration, ensuring platforms can integrate diverse payment gateways, fraud tools, and compliance engines seamlessly. Without robust foundational technologies, the advanced capabilities of POPs would not be feasible, highlighting the importance of continuous innovation and collaboration at this stage.

Moving downstream, the value chain encompasses the development and deployment of the payment orchestration platforms themselves, followed by their distribution to end-users. Platform developers build the core software, integrate various third-party services, and ensure functionality like dynamic routing, fraud management, and reconciliation. The distribution channels are primarily direct sales, where POP vendors engage directly with large enterprises and mid-market businesses, offering customized solutions and ongoing support. Additionally, indirect channels involve partnerships with other payment service providers, system integrators, and e-commerce platforms who embed or resell orchestration capabilities as part of their broader offerings. This dual distribution approach ensures market reach across different customer segments, from those requiring bespoke implementations to those seeking bundled solutions within a larger ecosystem. Marketing and customer support services are also integral at this stage, focusing on educating potential clients about the benefits and complexities of payment orchestration.

The final stage of the value chain involves the end-users—merchants and enterprises—who implement and utilize payment orchestration platforms to manage their payment operations. Their feedback and evolving needs drive innovation back up the chain, influencing product development and feature enhancements. Post-implementation support, training, and ongoing optimization services provided by POP vendors are crucial for ensuring customer satisfaction and maximizing the platform's utility. This continuous loop of feedback and improvement solidifies the long-term relationships between vendors and users. The efficiency of the entire value chain is pivotal in delivering a comprehensive, secure, and flexible payment solution that addresses the multifaceted challenges faced by businesses in the rapidly evolving global digital commerce landscape, from initial technology sourcing to sustained customer value realization.

Payment Orchestration Platform Market Potential Customers

The potential customer base for Payment Orchestration Platforms is expansive and diverse, primarily encompassing any business engaged in online transactions that seeks to optimize its payment processes, enhance customer experience, and navigate the complexities of global digital commerce. E-commerce retailers, ranging from small online boutiques to large multinational marketplaces, represent a significant segment. These businesses constantly strive to improve conversion rates, reduce cart abandonment, and offer localized payment options to a global customer base. POPs enable them to integrate various payment methods, manage fraud effectively, and route transactions intelligently to ensure high success rates, directly impacting their top-line revenue and operational efficiency.

Beyond traditional e-commerce, the travel and hospitality industry stands as a major end-user. Airlines, hotels, online travel agencies, and booking platforms handle high volumes of cross-border transactions, often requiring complex currency conversions and compliance with diverse regional regulations. Payment orchestration platforms provide the necessary tools to streamline these intricate payment flows, mitigate fraud risks associated with high-value transactions, and offer flexible payment options to travelers worldwide. Similarly, digital content providers, subscription services, and online gaming platforms benefit immensely from POPs by optimizing recurring billing, reducing churn due to payment failures, and ensuring seamless monetization across different geographies and user segments, thereby securing stable revenue streams and enhancing user engagement.

Financial services, including fintech companies, banks, and neo-banks, are also increasingly adopting payment orchestration platforms to modernize their infrastructure, enhance their offerings, and comply with evolving regulatory frameworks such as PSD2. These institutions leverage POPs to manage vast transaction volumes, integrate new payment technologies, and provide advanced services to their corporate clients. Moreover, businesses operating in specialized sectors like logistics, transportation, and even healthcare, which increasingly involve online payments for services or products, find value in orchestration for secure, efficient, and compliant transaction processing. Ultimately, any enterprise grappling with multiple payment gateways, fraud concerns, global expansion ambitions, or a drive to significantly improve their payment operations stands as a prime candidate for adopting a Payment Orchestration Platform, highlighting its broad applicability across the modern digital economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 8.5 Billion |

| Market Forecast in 2032 | USD 30.5 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adyen, Worldline, Checkout.com, Spreedly, Stripe, Optile, IXOPAY, Primer, BR-DGE, Akurateco, Payoneer, APEXX Global, CellPoint Digital, Gr4vy, Finix, Paydock, Razorpay, Worldpay, PayPal, Fiserv |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Payment Orchestration Platform Market Key Technology Landscape

The technological landscape underpinning the Payment Orchestration Platform market is rapidly evolving, driven by the need for greater efficiency, security, and flexibility in processing digital payments. Core to these platforms are Application Programming Interfaces (APIs) and microservices architectures, which enable seamless integration with numerous payment gateways, fraud detection tools, and other third-party services. This API-first approach allows for modular development and rapid deployment of new features, ensuring that platforms can adapt quickly to changing market demands and emerging payment methods. Cloud computing infrastructure, primarily public and private cloud services, provides the essential scalability, reliability, and global reach required to handle vast transaction volumes and ensure high availability for merchants operating across different time zones and geographies, making it a fundamental component of modern POPs.

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly vital technologies within payment orchestration. AI/ML algorithms are leveraged for advanced fraud detection, moving beyond static rule sets to identify complex patterns and anomalies in real-time, thereby reducing false positives and improving security. These technologies also power intelligent transaction routing, dynamically optimizing payment flows based on real-time success rates, processing fees, and network latency to ensure the highest possible authorization rates. Furthermore, tokenization and encryption are standard security technologies employed to protect sensitive payment data, ensuring compliance with industry standards like PCI DSS and safeguarding customer information throughout the transaction lifecycle. These layers of security are non-negotiable for maintaining trust and preventing data breaches within the payment ecosystem.

Real-time analytics and big data processing capabilities are another critical aspect of the technology landscape. Payment orchestration platforms collect and analyze immense volumes of transaction data, providing merchants with actionable insights into payment performance, customer behavior, and fraud trends. This enables data-driven decision-making for optimizing business strategies and improving operational efficiency. Emerging technologies such as blockchain, while still nascent in widespread adoption for payment orchestration, hold significant promise for enhancing transparency, security, and speed in cross-border payments. The continuous integration of these advanced technologies ensures that Payment Orchestration Platforms remain at the forefront of payment innovation, providing robust, secure, and highly efficient solutions for the challenges of global digital commerce.

Regional Highlights

- North America: This region stands as a mature yet highly innovative market for Payment Orchestration Platforms. Characterized by high digital payment adoption, sophisticated e-commerce infrastructure, and a strong presence of key technology providers and solution developers, North America continues to drive advancements in payment orchestration. The demand is fueled by large enterprises and a growing segment of mid-market businesses seeking to consolidate payment operations, enhance fraud prevention, and expand cross-border capabilities. Regulatory stability and a competitive landscape encourage continuous innovation in features such as AI-driven optimization and seamless integration with diverse financial services, ensuring the region remains a pivotal hub for market development and technological leadership.

- Europe: The European market for Payment Orchestration Platforms is significantly influenced by a complex regulatory environment, most notably the Revised Payment Services Directive (PSD2), which promotes open banking and enhanced security. This regulatory push drives demand for platforms that can ensure compliance, manage Strong Customer Authentication (SCA), and facilitate access to a multitude of local payment methods across the continent. With a diverse array of national payment preferences and a highly fragmented banking landscape, European businesses increasingly rely on POPs to streamline operations, reduce processing costs, and offer tailored payment experiences to customers in different countries. The emphasis on data privacy and consumer protection further underscores the need for robust and compliant orchestration solutions.

- Asia Pacific (APAC): The APAC region is recognized as the fastest-growing market for Payment Orchestration Platforms, driven by a booming e-commerce sector, rapid urbanization, increasing internet penetration, and a substantial mobile-first consumer base. Countries like China, India, and Southeast Asian nations are experiencing exponential growth in digital payments, often leapfrogging traditional payment infrastructure. This creates a strong need for POPs that can handle diverse local payment methods, manage high transaction volumes, and support cross-border commerce effectively. The fragmented regulatory landscape and varying digital payment adoption rates across the region also make orchestration crucial for businesses aiming to expand and succeed in this dynamic and competitive market.

- Latin America: This region is experiencing significant digital transformation and a rapid shift towards online commerce, making it a promising market for Payment Orchestration Platforms. Increasing smartphone penetration, growing financial inclusion initiatives, and a burgeoning entrepreneurial ecosystem are driving the adoption of digital payments. Businesses in Latin America often face challenges such as high fraud rates, varying local payment methods, and economic volatility, making POPs essential for secure transaction processing, optimized routing to improve authorization rates, and diversified payment options. The market is characterized by a strong demand for solutions that can address specific regional complexities while facilitating international trade and local market entry.

- Middle East & Africa (MEA): The MEA region presents a market with immense untapped potential for Payment Orchestration Platforms. Governments across the Gulf Cooperation Council (GCC) countries are investing heavily in digital infrastructure and e-commerce initiatives, fostering a conducive environment for digital payments. Similarly, parts of Africa are witnessing significant growth in mobile money and digital payment adoption. Businesses in MEA seek POPs to manage cross-border transactions, access global payment networks, mitigate fraud, and comply with evolving regional financial regulations. The focus on economic diversification and the expansion of online services, coupled with a young, tech-savvy population, are key factors contributing to the growing demand for sophisticated payment orchestration solutions in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Payment Orchestration Platform Market.- Adyen

- Worldline

- Checkout.com

- Spreedly

- Stripe

- Optile

- IXOPAY

- Primer

- BR-DGE

- Akurateco

- Payoneer

- APEXX Global

- CellPoint Digital

- Gr4vy

- Finix

- Paydock

- Razorpay

- Worldpay

- PayPal

- Fiserv

Frequently Asked Questions

What is a Payment Orchestration Platform?

A Payment Orchestration Platform (POP) is a technology layer that unifies and manages a business's entire payment ecosystem by intelligently routing transactions across multiple payment service providers, gateways, and financial institutions. It optimizes payment flows, enhances fraud prevention, and centralizes reporting for improved efficiency and flexibility.

How does a Payment Orchestration Platform benefit merchants?

Merchants benefit from increased conversion rates through optimized routing and diverse payment options, reduced operational costs by consolidating payment management, enhanced fraud detection, simplified compliance with global regulations, and greater resilience through fallback payment options. It ultimately leads to better customer experiences and higher revenue.

What are the key features to look for in a Payment Orchestration Platform?

Key features include dynamic transaction routing, advanced fraud detection and prevention, centralized reporting and analytics, unified reconciliation, support for multiple payment methods and currencies, PCI DSS compliance, tokenization, and robust API integration capabilities for seamless connectivity with existing systems.

How do Payment Orchestration Platforms handle fraud?

POPs handle fraud through integrated, intelligent tools that leverage AI and machine learning. They analyze transaction data in real-time, identify suspicious patterns, and can block or flag fraudulent transactions before they are processed. This proactive approach significantly reduces financial losses and enhances security beyond traditional rule-based systems.

What is the future outlook for the Payment Orchestration Platform market?

The future outlook is robust, driven by the continued growth of e-commerce, increasing complexity of global payments, and the adoption of emerging technologies like AI/ML. The market is expected to expand significantly as businesses seek to optimize payment processes, enhance customer experience, and navigate evolving regulatory landscapes, particularly in high-growth regions like APAC.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager