PCB Connector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429783 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

PCB Connector Market Size

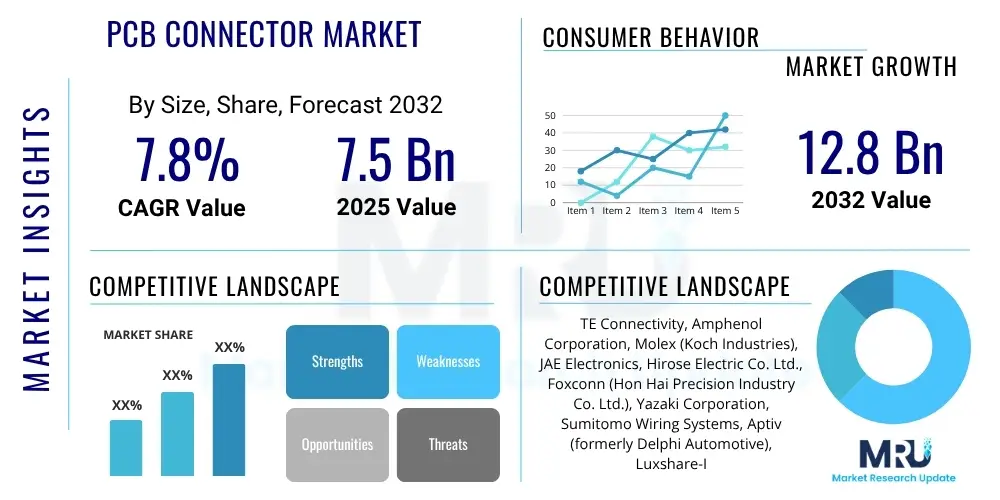

The PCB Connector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 7.5 Billion in 2025 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2032.

PCB Connector Market introduction

The PCB Connector market serves as a critical backbone for virtually all electronic devices, providing essential interfaces for power and signal transmission between printed circuit boards (PCBs) and other components or external systems. These connectors are fundamental components in enabling modularity, enhancing serviceability, and ensuring reliable electrical connections within complex electronic architectures. As electronics continue to shrink in size and increase in functionality, the demand for more advanced, compact, and high-performance PCB connectors has intensified across numerous industries globally.

PCB connectors encompass a broad range of product types, including board-to-board, wire-to-board, FPC/FFC, input/output, and power connectors, each designed for specific applications and operational requirements. They facilitate the secure and efficient transfer of data, power, and ground signals, playing a pivotal role in the overall integrity and performance of electronic systems. Key benefits derived from the use of sophisticated PCB connectors include improved signal integrity, enhanced mechanical stability, greater design flexibility, and cost-effectiveness through modular assembly and easier maintenance.

The market is primarily driven by the relentless pace of technological innovation, particularly the pervasive trend of miniaturization in electronic devices and the escalating need for high-speed data transmission capabilities. Major applications span across consumer electronics, automotive, industrial automation, telecommunications, healthcare, and aerospace. The proliferation of connected devices under the Internet of Things (IoT) paradigm, the global rollout of 5G networks, and the electrification of vehicles are significant driving forces, continually expanding the scope and complexity of PCB connector requirements.

PCB Connector Market Executive Summary

The global PCB Connector market is experiencing robust growth, propelled by sustained innovation in electronic device manufacturing and the increasing demand for high-performance and compact connectivity solutions. Business trends indicate a strong focus on developing connectors that support higher data rates, greater power densities, and enhanced environmental ruggedness, especially for applications in harsh operating conditions. Strategic collaborations, mergers, and acquisitions are prevalent as companies seek to expand their product portfolios, technological capabilities, and geographical reach, consolidating market leadership and fostering competitive advantage.

From a regional perspective, the Asia Pacific (APAC) region continues to dominate the market, largely due to its extensive electronics manufacturing base, rapid industrialization, and burgeoning consumer electronics sector. Countries like China, Japan, South Korea, and Taiwan are at the forefront of both production and consumption. North America and Europe, while representing more mature markets, exhibit strong demand for advanced, specialized connectors driven by innovation in automotive electronics, industrial automation, and advanced medical devices. Latin America and the Middle East and Africa are emerging as significant growth markets, fueled by infrastructure development and increasing technological adoption across various industries.

Segmentation trends highlight a significant shift towards board-to-board and wire-to-board connectors, driven by the modular design philosophy in modern electronics. Fine-pitch and high-density connectors are witnessing increased adoption to accommodate miniaturization and higher functionality within limited space. The automotive segment is experiencing substantial growth due to the proliferation of advanced driver-assistance systems (ADAS), infotainment systems, and electric vehicle (EV) technologies. Similarly, the demand from data centers and telecommunications infrastructure for high-speed, high-bandwidth connectors remains exceptionally strong, pushing the boundaries of connector design and material science. These trends collectively underscore a dynamic and evolving market landscape.

AI Impact Analysis on PCB Connector Market

The advent and widespread integration of Artificial Intelligence (AI) are profoundly influencing the PCB Connector market, reshaping design methodologies, manufacturing processes, and the performance demands placed on connectivity solutions. Users are increasingly concerned with how AI will necessitate new connector specifications for AI-powered hardware, particularly regarding data throughput and power delivery for high-performance computing. Common questions revolve around the implications for thermal management, the reliability of connectors in AI server environments, and whether AI can optimize connector design for specific applications, reducing development cycles and improving efficiency. There is also a keen interest in how AI might automate aspects of quality control and predictive maintenance in connector manufacturing.

The key themes emerging from user inquiries indicate a clear expectation that AI will drive demand for ultra-high-speed and high-density connectors capable of handling massive data flows between GPUs, CPUs, and memory modules in AI accelerators and data centers. Users anticipate that AI tools will revolutionize the connector design process, enabling faster iterations, more precise simulations, and the identification of optimal material compositions and geometries for specific performance requirements. Furthermore, the role of AI in enhancing manufacturing precision, defect detection, and supply chain optimization for connector production is a significant area of interest, promising improved product quality and reduced costs.

In essence, AI's influence is multi-faceted: it creates new requirements for connector performance in AI hardware, acts as a tool to accelerate and optimize connector design and manufacturing, and impacts supply chain resilience. The market anticipates significant shifts towards connectors that support next-generation AI architectures, with an emphasis on advanced thermal management, electromagnetic compatibility (EMC), and robust mechanical integrity to ensure uninterrupted operation of AI systems. The overarching expectation is that AI will be both a demanding customer and a powerful enabler within the PCB connector ecosystem.

- AI drives demand for high-speed, high-density connectors in AI accelerators and data centers.

- AI integration necessitates advanced thermal management solutions for connectors in high-power AI systems.

- AI-powered design tools enhance connector optimization, reducing development time and improving performance.

- AI contributes to predictive maintenance and quality control in PCB connector manufacturing.

- Increased demand for robust, reliable connectors to ensure uninterrupted operation of AI infrastructure.

- Development of specialized connectors for AI edge devices, balancing performance and miniaturization.

- AI impacts supply chain efficiency and resilience for connector manufacturers through demand forecasting and logistics optimization.

DRO & Impact Forces Of PCB Connector Market

The PCB Connector market is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. Key drivers include the pervasive trend of miniaturization in electronic devices, which necessitates smaller yet more functional connectors, and the escalating demand for high-speed data transfer spurred by 5G deployment, cloud computing, and advanced automotive electronics. The proliferation of IoT devices across various sectors, from smart homes to industrial automation, significantly boosts the need for reliable and compact connectivity. Furthermore, the rapid growth in electric vehicle (EV) adoption and the increasing electronic content in modern automobiles present a substantial growth catalyst for specialized, rugged PCB connectors, driving innovation in both power and signal applications.

Despite these strong growth drivers, the market faces several restraints. Intense price competition, particularly in high-volume, commoditized segments, pressures profit margins for manufacturers. The complexity of achieving standardization across diverse applications and global regions can hinder widespread adoption of new technologies and create compatibility challenges for end-users. Additionally, the significant investment required for research and development (R&D) to keep pace with evolving technological demands, coupled with strict regulatory compliance in sectors like medical and automotive, can act as barriers to entry and limit innovation for smaller players. Supply chain disruptions, as recently highlighted by global events, also pose ongoing challenges, impacting production schedules and material costs.

Opportunities for market expansion are abundant, particularly in emerging markets where industrialization and consumer electronics adoption are accelerating. The development of advanced packaging technologies, such as system-in-package (SiP) and chip-on-board (CoB), creates demand for highly integrated and miniature connectors. Sustainable and eco-friendly connector solutions, leveraging recyclable materials and energy-efficient manufacturing processes, represent a growing niche as environmental concerns gain prominence. Moreover, the increasing need for customized and application-specific connector designs offers a lucrative avenue for manufacturers capable of rapid prototyping and specialized engineering. The impact forces, including the bargaining power of both buyers (OEMs seeking cost-effective and high-performance solutions) and suppliers (raw material providers), the threat of new entrants (innovative startups), and the potential for substitute technologies (e.g., wireless connectivity), all contribute to the dynamic competitive landscape, compelling continuous innovation and strategic differentiation among market participants.

Segmentation Analysis

The PCB Connector market is intricately segmented across various dimensions to reflect the diversity of product types, application requirements, and technological advancements. Understanding these segments is crucial for market participants to identify growth opportunities, tailor product offerings, and devise effective market entry strategies. The primary segmentation criteria typically include connector type, application industry, pitch size, mounting style, and end-user market. Each segment exhibits unique growth dynamics driven by specific technological trends and market demands.

The segment by connector type often differentiates between board-to-board, wire-to-board, FPC/FFC, input/output, and power connectors, representing distinct functionalities within electronic systems. Application industry segmentation covers major sectors such as consumer electronics, automotive, industrial, telecommunications, medical, and aerospace and defense, each demanding specialized connector characteristics like ruggedness, miniaturization, or high-speed performance. Pitch size, ranging from ultra-fine pitch for compact devices to larger pitches for power applications, is another critical differentiator influencing design flexibility and signal integrity. Mounting styles, including surface mount technology (SMT) and through-hole technology (THT), cater to different manufacturing processes and mechanical requirements. These detailed segmentations allow for a granular analysis of market trends and competitive landscapes, providing a comprehensive view of the market's structure and growth potential across its diverse components.

- By Connector Type

- Board-to-Board Connectors

- Wire-to-Board Connectors

- FPC/FFC Connectors (Flexible Printed Circuit/Flexible Flat Cable)

- Input/Output (I/O) Connectors

- Power Connectors

- Memory Card Connectors

- Backplane Connectors

- Circular Connectors

- D-Sub Connectors

- USB Connectors

- RF Connectors

- By Pitch Size

- 0.4 mm and Below

- 0.5 mm - 1.0 mm

- 1.27 mm - 2.0 mm

- 2.54 mm and Above

- By Mounting Style

- Surface Mount Technology (SMT)

- Through-Hole Technology (THT)

- Press-Fit Technology

- By Application Industry

- Consumer Electronics

- Smartphones

- Tablets

- Wearables

- Laptops

- Gaming Consoles

- Home Appliances

- Automotive

- ADAS (Advanced Driver-Assistance Systems)

- Infotainment Systems

- Powertrain

- Body Electronics

- Electric Vehicle (EV) Charging

- Industrial

- Factory Automation

- Robotics

- Process Control

- Test and Measurement Equipment

- Telecommunications

- Network Infrastructure

- Data Centers

- Base Stations

- Medical Devices

- Diagnostic Equipment

- Therapeutic Devices

- Monitoring Systems

- Aerospace and Defense

- Avionics

- Communication Systems

- Radar Systems

- IT and Data Processing

- Servers

- Storage Devices

- Networking Hardware

- Consumer Electronics

- By End-User

- Original Equipment Manufacturers (OEMs)

- Contract Manufacturers (CMs) / Electronic Manufacturing Services (EMS)

- Aftermarket/Repair & Maintenance

- By Data Rate Capability

- Low-Speed (MHz range)

- Medium-Speed (GHz range, up to 10 Gbps)

- High-Speed (Beyond 10 Gbps, e.g., 25G, 50G, 100G, 400G)

Value Chain Analysis For PCB Connector Market

The value chain for the PCB Connector market is a complex ecosystem involving multiple stages, from raw material sourcing to end-user deployment, each adding value and influencing the final product's cost and performance. The upstream segment of the value chain primarily involves the suppliers of essential raw materials and basic components. These include manufacturers of various metals such as copper, brass, and alloys for contacts, and specialized plastics and polymers for housings and insulators, alongside suppliers of plating materials like gold, tin, and nickel for enhanced conductivity and corrosion resistance. The quality and availability of these raw materials directly impact the final connector's reliability and cost, making robust supplier relationships critical.

Moving downstream, the value chain encompasses connector manufacturers who design, develop, and produce the PCB connectors. This stage involves sophisticated engineering, precision molding, stamping, plating, and assembly processes. Once manufactured, these connectors are distributed to various customers through a combination of direct and indirect channels. Direct sales are often preferred for large-volume orders or highly specialized, custom solutions, where manufacturers work closely with Original Equipment Manufacturers (OEMs) or large Electronic Manufacturing Services (EMS) providers. This direct engagement allows for better technical support, customization, and long-term partnership development, ensuring that the connectors precisely meet specific application requirements.

Indirect distribution channels typically involve a network of authorized distributors, resellers, and online platforms. These channels cater to a broader range of customers, including smaller OEMs, contract manufacturers, and even research and development labs, offering a wide selection of standard connectors and providing logistical support. Distributors play a crucial role in inventory management, providing readily available stock, and offering technical advice, thus extending the reach of connector manufacturers globally. The efficiency of these distribution channels is vital for timely delivery and market penetration, especially in a rapidly evolving electronics landscape where time-to-market is a significant competitive factor. The interplay between direct and indirect sales strategies allows manufacturers to address diverse customer needs while optimizing their market coverage and operational costs.

PCB Connector Market Potential Customers

The potential customers for PCB connectors are diverse and span across nearly every sector that utilizes electronic devices, underscoring the ubiquitous nature of these components. The primary end-users and buyers are Original Equipment Manufacturers (OEMs) who integrate PCB connectors directly into their products during the manufacturing process. These OEMs range from global giants in consumer electronics like smartphone and laptop manufacturers to specialized producers of industrial automation equipment, automotive systems, and medical devices. Their purchasing decisions are driven by factors such as performance specifications, reliability, miniaturization requirements, cost-effectiveness, and compliance with industry standards and certifications.

Another significant customer segment comprises Electronic Manufacturing Services (EMS) providers and Contract Manufacturers (CMs). These companies are outsourced by OEMs to assemble electronic products and therefore require a steady supply of various PCB connectors for their production lines. Their demand is often project-based and volume-sensitive, focusing on efficient procurement, competitive pricing, and robust supply chain management. EMS/CMs play a critical role in the market by consolidating demand from multiple OEMs, influencing purchasing trends, and often advising on component selection based on their extensive manufacturing expertise and access to a broad range of suppliers.

Beyond these core manufacturing entities, other potential customers include research and development institutions, educational facilities, and smaller-scale electronic designers and hobbyists who purchase connectors for prototyping, specialized projects, or low-volume production. Additionally, the aftermarket for repair and maintenance services also generates demand for replacement connectors. The diverse requirements of these customer segments necessitate that PCB connector manufacturers offer a wide array of products, from highly customized, high-performance solutions to standardized, cost-effective options, supported by strong technical assistance and efficient distribution networks to effectively serve the broad spectrum of buyers in the electronics industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.5 Billion |

| Market Forecast in 2032 | USD 12.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Amphenol Corporation, Molex (Koch Industries), JAE Electronics, Hirose Electric Co. Ltd., Foxconn (Hon Hai Precision Industry Co. Ltd.), Yazaki Corporation, Sumitomo Wiring Systems, Aptiv (formerly Delphi Automotive), Luxshare-ICT, Samtec, Weidmüller Interface GmbH & Co. KG, Phoenix Contact GmbH & Co. KG, Harting Technology Group, Würth Elektronik GmbH & Co. KG, Binder GmbH, Lemo S.A., CUI Devices, FCI (Amphenol), Panasonic Industry. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PCB Connector Market Key Technology Landscape

The PCB Connector market is characterized by a dynamic technology landscape driven by the continuous push for higher performance, smaller form factors, and increased reliability in electronic systems. A cornerstone technology is Surface Mount Technology (SMT), which enables connectors to be directly soldered onto the PCB surface, facilitating automation in manufacturing, reducing board space, and enhancing signal integrity for high-frequency applications. This contrasts with Through-Hole Technology (THT), which remains relevant for applications requiring robust mechanical strength and higher power handling. Hybrid connectors, integrating both SMT and THT elements, are also gaining traction, offering a blend of both benefits for complex designs. Further advancements in miniaturization techniques, such as fine-pitch and ultra-fine-pitch designs, allow for higher contact density within shrinking footprints, crucial for compact portable devices and increasingly dense circuit boards.

Innovations in high-speed data transmission technologies are paramount, with connectors being engineered to support increasing data rates required by 5G, PCIe Gen5/Gen6, and future data center architectures. This involves sophisticated impedance matching, crosstalk reduction, and shielding techniques to ensure signal integrity at multi-gigabit speeds. Materials science plays a critical role, with ongoing research into advanced plastics for improved dielectric properties and high-performance metal alloys for contacts that offer superior conductivity, durability, and corrosion resistance. Press-fit technology is another key development, providing gas-tight connections without soldering, which reduces manufacturing complexity and allows for easier repair or replacement, particularly in automotive and industrial applications where reliability and serviceability are critical.

Furthermore, the technology landscape is evolving to address environmental challenges and regulatory requirements, leading to the development of eco-friendly connectors made from sustainable materials and manufactured using processes that reduce energy consumption and waste. Specialized technologies like optical connectors are emerging for applications where electromagnetic interference (EMI) is a concern or where extremely high bandwidth over longer distances is required, such as in advanced data centers and telecommunications. The integration of smart features, such as embedded sensors for monitoring connector health or providing diagnostic data, represents another frontier in innovation, enhancing the overall intelligence and reliability of connected electronic systems. These technological advancements collectively drive the market forward, enabling the creation of increasingly sophisticated and efficient electronic devices across diverse industries.

Regional Highlights

The global PCB Connector market demonstrates significant regional disparities in terms of production, consumption, and technological adoption, largely influenced by the geographical distribution of electronics manufacturing hubs, industrialization levels, and technological advancements. Each major region contributes uniquely to the market's overall dynamics, reflecting varying economic conditions, regulatory environments, and end-user demands. Understanding these regional nuances is essential for market players to develop localized strategies and capitalize on specific growth opportunities. The demand for connectors is intricately linked to the regional manufacturing output of electronic devices, which fluctuates based on global supply chains and economic policies.

Asia Pacific (APAC) stands out as the predominant region in the PCB Connector market, primarily due to the presence of major electronics manufacturing powerhouses like China, South Korea, Japan, Taiwan, and Vietnam. This region benefits from a robust ecosystem for component production and assembly, catering to the vast consumer electronics, automotive, and telecommunications sectors. Rapid urbanization, increasing disposable incomes, and widespread adoption of advanced technologies like 5G and IoT further fuel the demand for diverse connector types across APAC. The sheer volume of electronic device production in this region makes it a critical center for both supply and demand within the global market.

North America and Europe represent mature markets characterized by high technological innovation and strong demand for high-performance and specialized PCB connectors. North America's growth is driven by significant investments in aerospace and defense, medical devices, automotive electronics (especially EVs and ADAS), and advanced IT infrastructure. Europe, with its strong industrial automation, automotive, and healthcare sectors, requires robust, reliable, and often customized connectors that adhere to stringent quality and safety standards. Both regions are also at the forefront of R&D, pushing the boundaries of connector technology. Latin America and the Middle East and Africa (MEA) are emerging as significant growth areas, driven by increasing industrialization, infrastructure development, and growing consumer bases, though their market share remains comparatively smaller, they offer long-term potential for market expansion.

- North America: A hub for technological innovation, strong demand from aerospace and defense, automotive electronics (EVs, ADAS), medical devices, and data centers. Emphasis on high-performance, rugged, and reliable connectors.

- Europe: Driven by robust industrial automation, automotive manufacturing, and medical device sectors. Focus on high-quality, customized, and environmentally compliant connector solutions. Germany, France, and the UK are key markets.

- Asia Pacific (APAC): Dominant market due to extensive electronics manufacturing base (China, South Korea, Japan, Taiwan), massive consumer electronics production, and rapid adoption of 5G and IoT. Major growth driver for standard and fine-pitch connectors.

- Latin America: Emerging market with growing industrialization, infrastructure development, and increasing foreign investment in manufacturing. Brazil and Mexico are leading countries in this region.

- Middle East and Africa (MEA): Gradually growing market fueled by telecommunications infrastructure development, smart city initiatives, and diversification of economies away from oil.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PCB Connector Market.- TE Connectivity

- Amphenol Corporation

- Molex (Koch Industries)

- JAE Electronics

- Hirose Electric Co. Ltd.

- Foxconn (Hon Hai Precision Industry Co. Ltd.)

- Yazaki Corporation

- Sumitomo Wiring Systems

- Aptiv (formerly Delphi Automotive)

- Luxshare-ICT

- Samtec

- Weidmüller Interface GmbH & Co. KG

- Phoenix Contact GmbH & Co. KG

- Harting Technology Group

- Würth Elektronik GmbH & Co. KG

- Binder GmbH

- Lemo S.A.

- CUI Devices

- FCI (Amphenol)

- Panasonic Industry

Frequently Asked Questions

What is driving the growth of the PCB Connector Market?

The PCB Connector Market is primarily driven by the ongoing miniaturization of electronic devices, the widespread adoption of IoT across various industries, the global rollout of 5G networks, and the significant expansion of electronics in the automotive sector, including electric vehicles and advanced driver-assistance systems (ADAS).

Which regions are leading in the PCB Connector Market?

The Asia Pacific (APAC) region currently dominates the PCB Connector Market due to its robust electronics manufacturing ecosystem and high demand from consumer electronics and telecommunications sectors. North America and Europe also hold significant market shares, driven by technological innovation and demand from automotive, industrial, and medical applications.

What are the key technological trends impacting PCB Connectors?

Key technological trends include the development of ultra-fine pitch and high-density connectors for miniaturization, advanced materials for improved signal integrity and thermal management, increased adoption of surface mount technology (SMT), and the integration of high-speed data transmission capabilities to support next-generation communication standards.

How does AI influence the PCB Connector Market?

AI significantly influences the PCB Connector Market by driving demand for high-speed and high-density connectors for AI hardware, optimizing connector design and manufacturing processes through AI-powered tools, and enhancing quality control and predictive maintenance in production. AI also generates new applications requiring specialized, reliable connectivity solutions.

What challenges does the PCB Connector Market face?

The market faces challenges such as intense price competition, the absence of universal standardization across all applications, the need for substantial R&D investments to keep pace with technological advancements, strict regulatory compliance in specialized sectors, and ongoing risks of supply chain disruptions for raw materials and components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager