PCB Manufacturing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430332 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

PCB Manufacturing Equipment Market Size

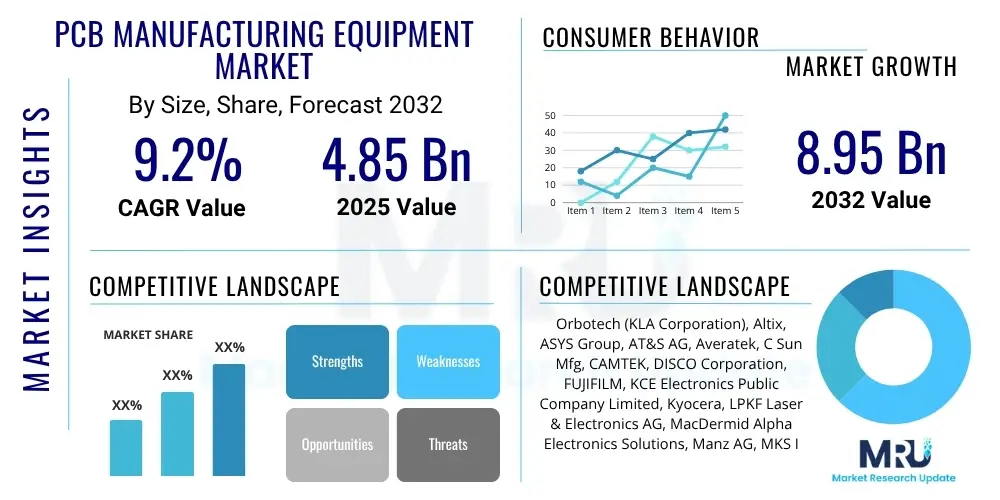

The PCB Manufacturing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2025 and 2032. The market is estimated at $4.85 Billion in 2025 and is projected to reach $8.95 Billion by the end of the forecast period in 2032.

PCB Manufacturing Equipment Market introduction

The PCB Manufacturing Equipment Market is a critical and highly specialized sector providing the foundational machinery and sophisticated systems necessary for the production of Printed Circuit Boards (PCBs). PCBs are the backbone of virtually all modern electronic devices, serving as platforms for electrically connecting and mechanically supporting electronic components through conductive pathways etched onto non-conductive substrates. This market encompasses an extensive range of equipment, including highly precise systems for imaging, drilling, plating, etching, lamination, and testing. Each piece of equipment is engineered for specific functions, ensuring the intricate patterns and multi-layered structures required for today's high-performance electronics can be fabricated with extreme accuracy, reliability, and efficiency. The continuous evolution of electronics demands equipment that can handle increasingly complex designs, finer line widths, and higher aspect ratios, pushing the boundaries of manufacturing capabilities.

The applications for PCB manufacturing equipment are remarkably diverse and pervasive across numerous high-growth industries. These include consumer electronics, ranging from smartphones and laptops to wearable technology; the rapidly expanding telecommunications sector, particularly for 5G infrastructure and data centers; the transformative automotive industry, driven by electric vehicles (EVs), advanced driver-assistance systems (ADAS), and infotainment systems; the stringent aerospace and defense sectors requiring robust and reliable boards for critical applications; and the innovative medical devices industry, demanding miniaturized and highly dependable PCBs for diagnostic and therapeutic equipment. Furthermore, industrial automation, robotics, and smart factory initiatives heavily rely on advanced PCBs, broadening the market's reach. The principal benefits of investing in cutting-edge PCB manufacturing equipment are multifold, including significant improvements in production speed, enhanced manufacturing accuracy to meet stringent tolerance requirements, substantial reductions in material waste through optimized processes, and the indispensable capability to produce advanced PCB types such as High-Density Interconnect (HDI), flexible, and rigid-flex boards. These benefits collectively lead to superior product quality, reduced time-to-market for electronic innovations, and a stronger competitive position for PCB fabricators.

Several pivotal driving factors underpin the robust growth trajectory of this market. Foremost among these is the relentless global expansion of the electronics industry, characterized by continuous innovation and the proliferation of electronic devices into almost every aspect of daily life and industry. Rapid technological advancements in nascent fields like Artificial Intelligence (AI), the Internet of Things (IoT), and the widespread rollout of 5G networks are creating unprecedented demand for high-performance, complex PCBs, thereby stimulating investment in advanced manufacturing equipment. The automotive industry's accelerating shift towards electrification and autonomous driving features necessitates a substantial increase in electronic content per vehicle, further bolstering demand for specialized and reliable PCBs and the machinery to produce them. Additionally, the ongoing global trend towards industrial automation and smart manufacturing paradigms, often referred to as Industry 4.0, encourages manufacturers to upgrade their facilities with sophisticated, automated PCB production lines to enhance efficiency, reduce labor costs, and improve overall operational resilience.

PCB Manufacturing Equipment Market Executive Summary

The global PCB Manufacturing Equipment Market is poised for substantial expansion, underpinned by a dynamic interplay of evolving business strategies, distinct regional growth patterns, and specialized segment-specific advancements. Current business trends indicate a profound industry-wide commitment to adopting automation, digitalization, and the principles of Industry 4.0. Manufacturers are increasingly integrating advanced robotics, sophisticated sensor technology, and data analytics into their production lines to achieve higher levels of operational efficiency, greater precision, and reduced manufacturing costs. This drive towards smart factories is fostering significant investments in next-generation equipment that offers enhanced connectivity and real-time process monitoring. Furthermore, a strong emphasis on research and development is evident, with companies continually innovating to introduce more precise, higher-throughput, and environmentally sustainable equipment solutions. Strategic collaborations, mergers, and acquisitions remain key tactics for market players aiming to consolidate competitive positions, broaden their technology portfolios, and penetrate new or emerging geographical markets, reflecting a highly competitive yet opportunity-rich landscape.

From a regional perspective, Asia Pacific continues its unparalleled dominance as the epicentre of global electronics manufacturing. Countries such as China, Taiwan, South Korea, and Japan host a vast network of PCB fabrication facilities and a robust supply chain, driven by substantial foreign and domestic investments in new production capacities. This region benefits from a massive consumer base for electronic products and strong governmental support for the manufacturing sector. North America and Europe, while exhibiting mature markets, are experiencing steady and qualitative growth, propelled by intensive R&D activities, the early adoption of cutting-edge manufacturing technologies, and increasing demand from high-value sectors such as aerospace, defense, medical devices, and advanced automotive electronics. Latin America, along with the Middle East and Africa, represents promising emerging markets. Their growth is gradually accelerating due to ongoing industrialization, increasing digitalization initiatives, and developing domestic electronics assembly capabilities, attracting gradual but steady investment in modern PCB manufacturing infrastructure.

Analyzing segment trends reveals a distinct shift towards equipment capable of producing advanced PCB types. There is a surging demand for machinery that can handle High-Density Interconnect (HDI) PCBs, characterized by finer lines, smaller vias, and higher connection densities, essential for miniaturized and high-performance electronic devices. Similarly, the production of flexible and rigid-flex PCBs, critical for wearables, medical implants, and certain automotive applications, is driving demand for specialized equipment. Within the product categories, the drilling and mechanical processing segment, alongside imaging and plating technologies, are undergoing continuous innovation to meet increasingly stringent precision and throughput requirements. Automation and robotics in both the assembly and testing phases are seeing substantial uptake, optimizing efficiency and ensuring rigorous quality control. Furthermore, a growing global emphasis on environmental sustainability and stricter regulatory frameworks are influencing equipment design, fostering demand for solutions that minimize energy consumption, reduce waste, and utilize eco-friendly materials and processes.

AI Impact Analysis on PCB Manufacturing Equipment Market

Users frequently express considerable interest in understanding the transformative impact of Artificial Intelligence (AI) across the entire spectrum of PCB manufacturing equipment. Common user inquiries often focus on how AI can be leveraged to significantly optimize production lines, enhance the accuracy and speed of quality control processes, enable sophisticated predictive maintenance to minimize downtime, and accelerate the iterative design and prototyping cycles for complex PCBs. There is a strong curiosity regarding AI's capability to intelligently streamline intricate manufacturing operations, drastically reduce the incidence of human errors, and facilitate adaptive manufacturing processes that can dynamically respond to real-time production conditions and material variations. However, alongside these high expectations, users also raise pertinent concerns about the substantial initial capital investments required for AI integration, the critical need for a highly skilled workforce proficient in managing and maintaining AI-driven systems, and the crucial implications surrounding data security and intellectual property protection within interconnected manufacturing environments. Despite these challenges, the overarching sentiment is one of strong anticipation, expecting AI to deliver unparalleled improvements in efficiency, precision, cost-effectiveness, and overall operational intelligence throughout the PCB manufacturing value chain.

- AI driven predictive maintenance utilizes machine learning algorithms to analyze sensor data from equipment, accurately forecasting potential failures before they occur, thereby extending machinery lifespan and dramatically reducing unscheduled downtime for enhanced productivity.

- AI powered visual inspection systems, leveraging advanced computer vision, significantly improve the speed and accuracy of defect detection on PCBs, ensuring superior quality assurance by identifying microscopic flaws that might be missed by traditional methods.

- AI optimizes various process parameters in real-time within equipment like plating baths or etching chambers, dynamically adjusting variables to enhance yield, maintain consistency across batches, and reduce material waste.

- AI assists in the design optimization and rapid prototyping of highly complex PCBs, using generative design techniques and simulation to explore vast design spaces, identify optimal layouts, and accelerate the development cycle.

- AI enables intelligent automation of assembly and testing processes, allowing robotic systems to perform intricate component placement and rigorous functional testing with greater precision and adaptability to varying product specifications.

- AI facilitates deep data analysis of production metrics, identifying subtle patterns and correlations that lead to improved operational efficiency, better resource allocation, and more informed strategic decision-making across the manufacturing floor.

- AI enhances supply chain management for PCB manufacturing by predicting future material needs, optimizing inventory levels, and improving logistics, thereby minimizing delays and reducing costs associated with material procurement and delivery.

- AI can personalize manufacturing processes for bespoke or small-batch PCB production, enabling equipment to reconfigure quickly for different designs without extensive manual setup.

DRO & Impact Forces Of PCB Manufacturing Equipment Market

The PCB Manufacturing Equipment Market is profoundly influenced by a complex interplay of driving forces that propel its growth, inherent restraints that moderate its expansion, abundant opportunities for strategic advancement, and various impact forces that continuously reshape its dynamics. A primary driver is the relentless and expansive growth of the global electronics industry, which continues to permeate new sectors and applications. This growth is synergistically fueled by escalating consumer demand for increasingly sophisticated smart devices, the proliferation of Internet of Things (IoT) applications across residential and industrial domains, the expansive global rollout of 5G telecommunications infrastructure, and the transformative evolution of the electric vehicle (EV) market. Each of these macro trends necessitates higher volumes of complex, high-performance PCBs, consequently stimulating significant investment in state-of-the-art manufacturing equipment capable of producing these advanced boards with greater precision and efficiency. Furthermore, continuous technological advancements within the electronics sector, particularly in areas like High-Density Interconnect (HDI) PCBs, flexible and rigid-flex boards, and advanced packaging solutions, directly translate into a need for more sophisticated and specialized equipment, acting as a powerful market stimulant. The overarching global trend towards industrial automation and the widespread adoption of Industry 4.0 principles, which emphasize interconnected and intelligent manufacturing systems, further encourage manufacturers to upgrade their existing facilities with modern, automated PCB production lines to enhance productivity, reduce labor costs, and improve overall operational resilience.

Despite these powerful drivers, the market faces several formidable restraints that can impede its growth. One of the most significant barriers is the exceptionally high initial capital expenditure required to acquire advanced PCB manufacturing equipment. This substantial upfront investment can be prohibitive for smaller manufacturing entities or new market entrants, effectively limiting competition and market penetration. The inherent complexity and the rapid pace of technological evolution within the electronics industry also pose a restraint, as equipment can become obsolete relatively quickly, necessitating continuous and costly research and development investments from equipment manufacturers to remain competitive. This cycle places a financial burden on both equipment producers and end-users. Furthermore, the stringent and evolving environmental regulations pertaining to waste disposal, hazardous material usage, and energy consumption in manufacturing processes add layers of compliance costs and operational complexities, requiring continuous adaptation in equipment design and operational practices. Geopolitical uncertainties, including international trade disputes, tariffs, and disruptions to global supply chains—exacerbated by events such as pandemics or regional conflicts—can severely impact the availability and pricing of critical raw materials and components, leading to production delays and increased costs for both equipment manufacturers and PCB fabricators, thereby acting as a significant market impediment.

Opportunities within the PCB Manufacturing Equipment Market are abundant and diverse, offering fertile ground for strategic growth and innovation. Emerging economies, particularly in Southeast Asia, India, and parts of Latin America, represent significant untapped potential. These regions are undergoing rapid industrialization and seeing substantial growth in domestic electronics manufacturing and assembly, creating a burgeoning demand for modern PCB production infrastructure. The accelerating adoption of advanced packaging technologies, such as system-in-package (SiP) and chip-on-board (CoB), alongside the increasing demand for highly specialized PCBs for niche, high-reliability applications—including implantable medical devices, critical aerospace systems, and military-grade electronics—presents lucrative avenues for equipment manufacturers capable of delivering highly precise and customized solutions. Moreover, the global imperative for environmental sustainability is driving an opportunity for developing and commercializing more energy-efficient equipment, technologies that minimize hazardous waste generation, and processes that align with circular economy principles, offering a distinct competitive advantage. Impact forces such as the rapid rate of technological obsolescence, which continuously pushes for next-generation equipment, the persistent global shortage of highly skilled labor necessary to operate and maintain sophisticated machinery, and intense competitive pressures among key market players continually influence market dynamics, forcing companies to innovate, differentiate, and strategically position themselves. Additionally, a growing geopolitical trend towards supply chain diversification and localized manufacturing, driven by desires for national security and economic resilience, is creating new opportunities and shifting geographical priorities for equipment providers.

Segmentation Analysis

The PCB Manufacturing Equipment market is meticulously segmented across various crucial dimensions, primarily encompassing product type, application, PCB type, and automation level. This comprehensive segmentation methodology is indispensable for providing a granular, multi-faceted perspective of the market's intricate dynamics. It enables a detailed comprehension of specific demand patterns, technological preferences, and prevailing trends across diverse industrial verticals and geographical landscapes. The product type segmentation is particularly vital, as it delineates equipment based on its specialized function at each stage of the complex PCB fabrication process, from initial material preparation and imaging to final testing and inspection. Application-based segmentation, on the other hand, illuminates the end-use industries whose relentless demand for electronic components directly drives the need for sophisticated PCB manufacturing capabilities. Furthermore, segmenting by PCB type acknowledges the increasing diversification of board technologies, such as rigid, flexible, and high-density interconnect (HDI) PCBs, each requiring unique manufacturing solutions. The automation level segment reflects the ongoing industry shift towards more integrated and autonomous production lines, a key component of the Industry 4.0 paradigm.

- Product Type

- Drilling and Mechanical Processing Equipment: Includes CNC drilling machines, routing machines, and V-cut machines for precise board shaping and hole creation.

- Imaging Equipment: Comprises direct imaging (DI) systems, screen printers, and exposure units for transferring circuit patterns onto substrates.

- Plating Equipment: Covers electroplating and electroless plating lines for depositing copper and other metals onto circuit traces and vias.

- Etching and Developing Equipment: Includes chemical etching machines, stripping machines, and developing units to define circuit patterns.

- Lamination Equipment: Involves multi-layer presses and vacuum lamination systems for bonding multiple layers of PCB materials.

- Testing and Inspection Equipment: Features Automated Optical Inspection (AOI), Automated X-ray Inspection (AXI), electrical testers, and flying probe testers for quality control.

- Assembly Equipment: Includes pick-and-place machines, reflow ovens, and soldering systems, though sometimes considered downstream, critical for integrated solutions.

- Surface Treatment Equipment: Systems for cleaning, etching, and coating PCB surfaces for enhanced adhesion and reliability.

- Application

- Consumer Electronics: Smartphones, tablets, laptops, wearables, home appliances.

- Telecommunications: 5G infrastructure, network equipment, data centers, base stations.

- Automotive: Electric vehicles (EVs), ADAS, infotainment systems, engine control units.

- Aerospace and Defense: Avionics, missile guidance systems, radar, communication systems.

- Medical Devices: Diagnostic imaging, patient monitoring, implantable devices, surgical tools.

- Industrial Electronics: Automation systems, robotics, power supplies, test and measurement equipment.

- Others: Smart grid, energy management, smart city infrastructure, research and development.

- PCB Type

- Rigid PCBs: Standard, inflexible circuit boards used in a wide range of devices.

- Flexible PCBs: Boards designed to flex and bend, ideal for compact or movable applications.

- Rigid-Flex PCBs: Combine rigid and flexible board technologies for complex, space-constrained designs.

- High-Density Interconnect (HDI) PCBs: Feature micro-vias, fine lines, and high circuit density for miniaturization.

- Advanced Packaging Substrates: Boards designed for chip packaging, including interposers and multi-chip modules.

- Automation Level

- Manual/Semi-Automatic Equipment: Requires significant human intervention; common in smaller shops or prototyping.

- Fully Automatic Equipment: Integrated systems with minimal human interaction, prevalent in large-scale production.

- Smart/AI-Integrated Equipment: Advanced automatic systems with AI for optimization, predictive maintenance, and adaptive manufacturing.

Value Chain Analysis For PCB Manufacturing Equipment Market

The comprehensive value chain for the PCB Manufacturing Equipment Market commences with a critical upstream analysis, focusing on the intricate network of raw material and component suppliers. This foundational stage involves a diverse array of providers, including manufacturers of precision mechanical parts such as bearings, motors, and robotic arms, which are essential for the physical construction and movement of the equipment. It also encompasses suppliers of sophisticated optical components, including lenses, lasers, and camera systems vital for imaging and inspection machinery, alongside providers of high-performance electronic controls, sensors, and embedded software that govern equipment operations. Specialized materials like industrial-grade metals (e.g., stainless steel, aluminum), polymers for housing and protective elements, and unique chemical compounds for plating or etching processes are also sourced upstream. The quality, reliability, and consistent availability of these diverse upstream inputs are paramount, directly influencing the performance, durability, and cost-effectiveness of the final PCB manufacturing equipment. Establishing robust, long-term strategic relationships with these specialized suppliers is therefore crucial for equipment manufacturers to ensure supply chain stability, control procurement costs, and foster collaborative innovation in component technology, enabling the development of next-generation machinery.

Further along the value chain, the core activities reside with the PCB manufacturing equipment producers themselves. These companies are at the heart of the market, engaging in intensive research and development (R&D) to innovate and refine their product offerings, followed by meticulous design, engineering, precision manufacturing, assembly, and rigorous testing of complex machinery. Many equipment manufacturers specialize in particular segments, such as highly advanced laser drilling systems, state-of-the-art direct imaging (DI) solutions, or sophisticated automated optical inspection (AOI) systems, while others offer integrated, end-to-end production line solutions. Their core competency lies in delivering robust, high-precision, and highly reliable equipment that not only meets but anticipates the evolving demands of PCB fabricators for greater miniaturization, higher layer counts, and tighter tolerances. The midstream stage is characterized by significant capital investment in advanced manufacturing facilities, a highly skilled workforce, and continuous intellectual property development. Post-production, the downstream analysis focuses on the efficient distribution channels responsible for connecting these sophisticated equipment manufacturers with their ultimate end-users, the PCB fabrication houses.

The distribution channels for PCB manufacturing equipment can be broadly categorized into direct and indirect models, each serving specific market segments and strategic objectives. Direct channels typically involve equipment manufacturers selling directly to large-scale, enterprise-level PCB fabricators through their proprietary global sales teams, extensive service networks, and regional offices. This direct engagement often entails providing highly customized equipment solutions, comprehensive installation services, extensive operator training, and ongoing, critical after-sales support, including maintenance, spare parts, and technical troubleshooting. Such direct relationships are common for high-value, complex machinery where close collaboration and direct manufacturer expertise are essential. Conversely, indirect channels leverage a network of authorized distributors, specialized resellers, and system integrators. These partners are instrumental in reaching a broader customer base, particularly small to medium-sized PCB manufacturers or clients situated in regions where the direct presence of equipment manufacturers may be limited. Indirect partners often provide crucial localized services such as sales and marketing, technical support, equipment integration with existing production lines, and local maintenance, overcoming language barriers and logistical challenges. The strategic choice between direct and indirect distribution, or often a hybrid approach, depends on factors such as market maturity, geographical reach requirements, the technical complexity of the equipment, and the desired level of customer engagement and support.

PCB Manufacturing Equipment Market Potential Customers

The primary and most significant segment of potential customers for PCB Manufacturing Equipment comprises dedicated PCB fabrication houses, commonly referred to as PCB manufacturers or fabricators. These entities represent the direct end-users and principal buyers of the specialized machinery integral to creating printed circuit boards. This diverse group encompasses a wide spectrum of operations, from global multinational corporations operating highly automated, large-volume mega-factories to small and medium-sized enterprises (SMEs) that specialize in niche markets, rapid prototyping, or small-batch, high-mix production. Regardless of their scale, all these fabricators require a comprehensive suite of equipment to produce various types of PCBs, including single-sided, double-sided, multi-layer, High-Density Interconnect (HDI), flexible, and rigid-flex boards, each tailored for specific performance and application needs. Their purchasing decisions are intricately influenced by a multitude of factors, such as anticipated production volumes, the required level of precision for their target markets, the specific technological capabilities of the equipment (e.g., ability to process fine lines or micro-vias), their overall budget constraints, and the imperative to comply with stringent industry standards, certifications, and evolving environmental regulations, all of which dictate the type and sophistication of equipment they procure.

Beyond the traditional PCB fabricators, other substantial segments of potential customers include Original Equipment Manufacturers (OEMs) who opt to operate in-house PCB production lines. These OEMs choose vertical integration for various strategic reasons, such as maintaining stringent control over their supply chain, protecting proprietary board designs, or ensuring specific quality and reliability standards that external suppliers might not consistently meet. Companies in industries requiring extremely high security or highly specialized electronic systems, like defense contractors or critical infrastructure providers, often fall into this category. Additionally, research and development (R&D) institutions, academic universities with advanced engineering departments, and government defense agencies represent another important segment of buyers. These organizations typically invest in PCB manufacturing equipment for purposes such as experimental prototyping, advanced materials testing, small-batch production of highly specialized or cutting-edge electronic systems, and educational initiatives for future engineers and technicians. Their purchasing criteria often prioritize flexibility, precision for novel designs, and research-grade capabilities over high-volume throughput.

Furthermore, Contract Manufacturers (CMs) and Electronics Manufacturing Services (EMS) providers constitute a rapidly growing segment of potential customers. These companies offer comprehensive electronic product assembly, testing, and often design services to various clients. To enhance their service offerings and provide vertically integrated solutions, many CMs and EMS providers are increasingly investing in their own PCB manufacturing capabilities. This strategic expansion allows them to control more of the production process, reduce lead times, improve cost efficiencies, and offer a more comprehensive suite of services, thereby increasing their attractiveness to clients seeking a single-source solution for their electronic product development and manufacturing needs. This group of customers evaluates equipment based on its ability to support a wide range of product types, flexibility for quick changeovers, scalability, and integration with their existing assembly and testing lines, all while meeting diverse client requirements and maintaining competitive pricing structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.85 Billion |

| Market Forecast in 2032 | $8.95 Billion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Orbotech (KLA Corporation), Altix, ASYS Group, AT&S AG, Averatek, C Sun Mfg, CAMTEK, DISCO Corporation, FUJIFILM, KCE Electronics Public Company Limited, Kyocera, LPKF Laser & Electronics AG, MacDermid Alpha Electronics Solutions, Manz AG, MKS Instruments, Mitsubishi Electric Corporation, Mycronic AB, NITTO DENKO CORPORATION, TTM Technologies, Universal Instruments Corporation, Hitachi High-Tech Corporation, SCHMID Group, V-TEK, Inc., Nordson Corporation, Panasonic Corporation, Han's Laser Technology Industry Group Co., Ltd. |

| Regions Covered | North America (U.S., Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Taiwan, Southeast Asia, Rest of APAC), Latin America (Brazil, Argentina, Rest of Latin America), Middle East, and Africa (MEA) (GCC Countries, South Africa, Rest of MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PCB Manufacturing Equipment Market Key Technology Landscape

The PCB Manufacturing Equipment market is characterized by an exceptionally dynamic and continuously evolving technological landscape, driven relentlessly by the increasing demand for higher precision, greater throughput, enhanced miniaturization, and improved reliability in electronic components. Central to this evolution are advanced laser drilling and cutting systems, which represent a significant leap forward from traditional mechanical drilling. These laser systems enable the creation of micro-vias, blind and buried vias, and intricate patterns with sub-micron accuracy, which are absolutely crucial for the production of High-Density Interconnect (HDI) PCBs and advanced packaging substrates. The precision offered by laser technology minimizes material stress and allows for the fabrication of complex multi-layer designs that were previously unachievable. Direct imaging (DI) technology has also emerged as a pivotal advancement, largely superseding conventional photolithography for exposing resist. Utilizing high-resolution UV lasers or advanced LED light sources, DI systems offer significantly faster processing speeds, superior image resolution, reduced reliance on expensive photomasks, and greater flexibility for quick design changes, thereby enhancing manufacturing agility and reducing operational costs. Furthermore, sophisticated electroplating and chemical etching processes are under constant refinement, employing advanced chemical formulations and precise process controls to achieve perfectly uniform copper deposition, fine line definition, and superior adhesion across various exotic substrate materials.

Automation and advanced robotics are playing an increasingly indispensable role in the modern PCB manufacturing equipment landscape, integrating individual machines into highly sophisticated, fully automated production lines. This integration aims to minimize human intervention, drastically reduce the potential for errors, and substantially increase overall manufacturing efficiency and consistency. This comprehensive automation includes highly precise automated material handling systems that transport panels between different process stages, advanced robotic cells that perform intricate assembly tasks, and state-of-the-art automated optical inspection (AOI) and automated X-ray inspection (AXI) systems. These inspection systems are capable of performing rapid, non-contact, and exceptionally accurate defect detection, identifying even microscopic flaws that are imperceptible to the human eye, thereby ensuring rigorous quality control throughout the production cycle. Moreover, continuous advancements in lamination press technology provide much tighter control over critical parameters such as temperature, pressure, and vacuum, which are fundamental for successfully bonding multiple layers of PCB materials, especially for high-layer-count and thin-core constructions. These innovations collectively enable manufacturers to meet the stringent demands of next-generation electronic devices that are becoming smaller, more powerful, and increasingly complex in their internal architecture.

The integration of artificial intelligence (AI) and machine learning (ML) algorithms is rapidly emerging as a transformative technology, marking a new era in the PCB manufacturing equipment market. AI applications are particularly prominent in areas such as predictive maintenance, where algorithms analyze real-time sensor data from machinery to accurately forecast potential equipment failures, enabling proactive maintenance schedules that extend asset lifespan and significantly reduce unscheduled downtime. In process optimization, AI systems can dynamically adjust manufacturing parameters, such as etching times or plating current densities, in real-time to maintain optimal conditions, leading to improved yield rates and enhanced product consistency. Furthermore, AI-powered systems are enhancing advanced quality control by recognizing subtle patterns indicative of impending defects, even before they fully manifest, enabling early intervention. The adoption of the Industrial Internet of Things (IIoT) facilitates pervasive data collection from all pieces of equipment on the factory floor, creating a rich data environment. This data, when analyzed by AI and ML, enables greater operational intelligence, allowing equipment to self-monitor, adapt to process variations, and even self-correct minor anomalies, moving towards a vision of truly autonomous and self-optimizing manufacturing lines. This holistic approach leverages data for continuous improvement, pushing the boundaries of what is possible in precision electronics manufacturing.

Regional Highlights

- Asia Pacific (APAC): This region unequivocally dominates the global PCB Manufacturing Equipment Market, primarily due to its status as the world's leading hub for electronics manufacturing. Countries such as China, Taiwan, South Korea, and Japan host an immense concentration of major PCB fabrication facilities and a robust, integrated supply chain ecosystem. The market here is driven by substantial domestic and foreign direct investments in new production capacities, a massive and growing consumer base for a wide array of electronic products, and proactive governmental support policies that foster manufacturing growth through incentives and infrastructure development. The relentless expansion of smart devices, 5G infrastructure, and electric vehicle production in this region fuels continuous demand for advanced PCB manufacturing equipment.

- North America: Exhibiting significant and steady growth, North America's market for PCB manufacturing equipment is primarily propelled by its strong emphasis on technological innovation and a robust demand from high-reliability sectors. The aerospace and defense, medical device, and advanced automotive electronics industries in the U.S. and Canada require highly sophisticated and durable PCBs, driving investment in cutting-edge manufacturing capabilities. The region benefits from substantial research and development activities, a focus on implementing advanced manufacturing techniques, and the adoption of Industry 4.0 and smart factory initiatives aimed at boosting domestic production efficiency and competitiveness.

- Europe: The European market demonstrates consistent growth, largely fueled by its thriving automotive industry's accelerating transition towards electrification and autonomous driving technologies, alongside strong industrial automation and control sectors. Countries like Germany, France, and the United Kingdom are key contributors, known for their precision engineering and stringent quality requirements for specialized PCBs used in high-value applications. There is a growing regional emphasis on developing environmentally sustainable manufacturing processes and equipment, aligning with stringent European Union regulations and corporate social responsibility goals, which in turn drives innovation in eco-friendly production solutions.

- Latin America: As an emerging market, Latin America is experiencing gradual growth in the PCB manufacturing equipment sector, albeit from a smaller base compared to established regions. Key countries such as Mexico and Brazil are witnessing increasing industrialization, a rise in domestic electronics assembly operations, and growing foreign direct investments in manufacturing. The market expansion is supported by regional efforts to develop local manufacturing capabilities, reduce reliance on imports, and cater to a burgeoning consumer electronics demand within the continent. Infrastructure development projects and digitalization initiatives further contribute to the demand for electronic components and thus, the equipment to produce them.

- Middle East and Africa (MEA): The MEA region represents a nascent but promising market with significant growth potential. Its expansion is largely driven by ongoing infrastructure development projects, increasing digitalization efforts across various sectors, and economic diversification strategies aimed at reducing dependence on oil and gas. There is a growing adoption of consumer electronics, significant investments in telecommunications infrastructure, and emerging industrial sectors, particularly in the GCC countries and South Africa, all of which necessitate an increasing supply of PCBs and, consequently, the associated manufacturing equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PCB Manufacturing Equipment Market.- Orbotech (KLA Corporation)

- Altix

- ASYS Group

- AT&S AG

- Averatek

- C Sun Mfg

- CAMTEK

- DISCO Corporation

- FUJIFILM

- KCE Electronics Public Company Limited

- Kyocera

- LPKF Laser & Electronics AG

- MacDermid Alpha Electronics Solutions

- Manz AG

- MKS Instruments

- Mitsubishi Electric Corporation

- Mycronic AB

- NITTO DENKO CORPORATION

- TTM Technologies

- Universal Instruments Corporation

- Hitachi High-Tech Corporation

- SCHMID Group

- V-TEK, Inc.

- Nordson Corporation

- Panasonic Corporation

- Han's Laser Technology Industry Group Co., Ltd.

- Giga-Tronics Incorporated

Frequently Asked Questions

What is driving the growth of the PCB Manufacturing Equipment Market?

The market growth is primarily driven by the escalating global demand for advanced electronics, including smartphones, IoT devices, 5G infrastructure deployment, and electric vehicles. This surge in electronic content is coupled with continuous technological advancements in PCB designs, such as high-density interconnect (HDI) and flexible boards, which necessitate more sophisticated and precise manufacturing processes and equipment to meet evolving industry standards and consumer expectations.

How does AI impact PCB manufacturing equipment and processes?

AI significantly impacts PCB manufacturing equipment by enabling advanced capabilities such as predictive maintenance, where machine learning algorithms analyze operational data to anticipate potential failures, thereby minimizing downtime. AI also optimizes production parameters in real-time for higher yield and consistency, enhances defect detection through intelligent vision systems, and accelerates design and prototyping processes. This leads to increased efficiency, improved quality, and reduced operational costs across the entire manufacturing workflow.

Which region holds the largest market share in the PCB Manufacturing Equipment Market and why?

Asia Pacific (APAC) holds the largest market share due to its established position as the global hub for electronics manufacturing. The region benefits from a high concentration of major PCB fabrication facilities, a robust and integrated supply chain, significant government support for the manufacturing sector, and a large consumer base for electronic products, particularly in countries like China, Taiwan, Japan, and South Korea, which continuously drive demand for advanced equipment.

What are the key technological advancements shaping the PCB manufacturing equipment landscape?

Key technological advancements include the widespread adoption of laser drilling and direct imaging (DI) systems for high precision and efficiency, the integration of advanced automation and robotics for streamlined production lines, sophisticated electroplating and chemical etching techniques for finer feature definition, and the emerging integration of Artificial Intelligence and Machine Learning for process optimization, predictive maintenance, and enhanced quality control, all contributing to superior product outcomes.

Who are the primary end-users and buyers of PCB manufacturing equipment?

The primary end-users and buyers of PCB manufacturing equipment are dedicated PCB fabrication houses, ranging from large multinational corporations to specialized small and medium-sized enterprises. Additionally, Original Equipment Manufacturers (OEMs) with in-house production capabilities, research and development institutions, universities, and Electronics Manufacturing Services (EMS) providers seeking vertical integration also represent significant customer segments, each requiring equipment tailored to their specific production volumes, precision needs, and technological requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager