Pectin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430050 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Pectin Market Size

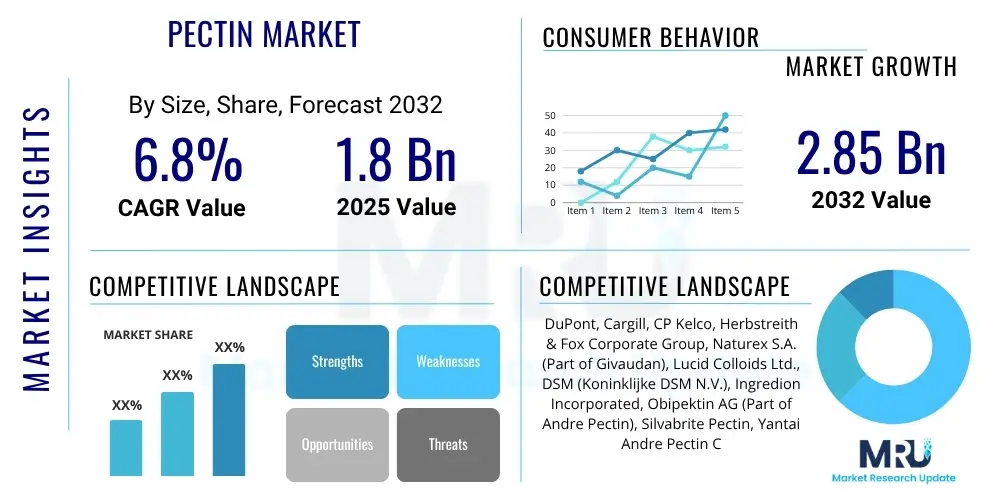

The Pectin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 1.8 Billion in 2025 and is projected to reach USD 2.85 Billion by the end of the forecast period in 2032.

Pectin Market introduction

Pectin, a naturally occurring heteropolysaccharide found in the cell walls of most plants, is primarily extracted from citrus peels, apples, and sugar beets. It functions as a versatile gelling agent, thickener, and stabilizer, making it an indispensable ingredient across various industries. This natural product is highly valued for its ability to form gels in acidic conditions in the presence of sugar, a characteristic that defines its extensive utility.

The product’s primary applications span the food and beverage industry, where it is a cornerstone in the production of jams, jellies, preserves, fruit preparations, and dairy products like yogurts and desserts. Beyond culinary uses, pectin is increasingly recognized for its benefits in the pharmaceutical and cosmetic sectors as an excipient, drug delivery agent, and emulsifier. Its natural origin and functional properties align perfectly with the growing consumer demand for clean label products and plant-based ingredients.

Several factors are driving the pectin market's expansion, including the robust growth of the global processed food and beverage industry, increasing consumer awareness regarding the health benefits of dietary fiber, and the shift towards natural food additives. The inherent versatility of pectin, coupled with ongoing research into novel applications and sustainable sourcing, further solidifies its position as a key ingredient in modern product development.

Pectin Market Executive Summary

The pectin market is experiencing robust growth driven by evolving consumer preferences for natural ingredients and the expansion of the food and beverage sector. Key business trends include significant investment in research and development to optimize extraction processes and explore new sources, alongside a strategic focus on sustainable production practices to meet environmental and ethical consumer demands. There is also a notable consolidation among major players, aiming to enhance supply chain efficiency and product innovation, while smaller, specialized firms continue to thrive by offering niche pectin types or customized solutions. The market is also witnessing a trend towards functional pectin, tailored for specific textures and health benefits, catering to the burgeoning functional food and nutraceutical segments.

Regionally, the Asia Pacific market is poised for the most significant expansion, fueled by rapid urbanization, increasing disposable incomes, and the burgeoning growth of its food processing and pharmaceutical industries. Europe and North America, while mature markets, continue to demonstrate steady demand, largely driven by the strong clean label movement and innovation in health-conscious products. Latin America and the Middle East and Africa represent emerging growth opportunities, with increasing industrialization and adoption of Western dietary habits stimulating demand for processed foods and, consequently, pectin. Supply chain resilience in these regions is becoming a critical differentiator for market participants.

Segmentation trends highlight the dominance of High Methoxyl (HM) Pectin in traditional applications like jams and jellies, while Low Methoxyl (LM) Pectin is gaining traction in dairy and fruit preparations due to its ability to gel without high sugar content. Citrus pectin remains the leading source owing to its abundant availability and favorable functional properties, but there is growing interest and investment in alternative sources such as apple, sugar beet, and sunflower pectin to diversify supply chains and cater to specific product requirements. The application segment sees the food and beverage industry as the primary consumer, though pharmaceutical and personal care applications are exhibiting accelerated growth due to pectin's biocompatibility and versatility in formulation.

AI Impact Analysis on Pectin Market

Common user questions regarding AI's impact on the pectin market frequently center on how artificial intelligence can enhance efficiency, quality, and sustainability across the value chain. Users are keen to understand AI's potential in optimizing raw material sourcing, predicting market demand, refining extraction processes, ensuring consistent product quality, and fostering innovation in new pectin applications. The overarching themes include concerns about cost reduction through automation, the acceleration of R&D for novel pectin types, improved supply chain resilience, and the ability to meet increasingly complex regulatory and consumer demands for natural and sustainably produced ingredients. Stakeholders are exploring how AI can offer predictive insights, automate complex analyses, and contribute to a more agile and responsive pectin industry.

- AI can optimize raw material sorting and quality assessment, improving yield and reducing waste during pectin extraction.

- Predictive analytics powered by AI can forecast demand fluctuations and raw material availability, enhancing supply chain management and inventory optimization.

- AI-driven process control systems can fine-tune extraction parameters (e.g., pH, temperature, time) for improved pectin yield and quality consistency.

- Machine learning algorithms can accelerate the discovery and characterization of new pectin sources and modified pectin structures for novel applications.

- Automated quality control using AI and computer vision can ensure that pectin batches meet stringent specifications, minimizing human error.

- AI can identify and analyze consumer trends, helping manufacturers develop customized pectin solutions for specific market needs (e.g., clean label, sugar-reduced).

DRO & Impact Forces Of Pectin Market

The pectin market is propelled by a confluence of robust drivers, notably the escalating consumer preference for natural food additives over synthetic alternatives, a trend heavily influenced by the clean label movement. The continuous expansion of the global food and beverage industry, particularly in segments like processed fruits, dairy, and confectionery, underpins a steady and increasing demand for pectin as a vital gelling and stabilizing agent. Furthermore, growing scientific evidence highlighting the health benefits of dietary fiber, including those offered by pectin, contributes significantly to its uptake in functional food and nutraceutical applications, driving market growth.

However, the market faces significant restraints that could impede its growth trajectory. The inherent volatility in the prices of raw materials, primarily citrus peels and apple pomace, which are agricultural by-products, presents a challenge for manufacturers in maintaining stable production costs. This is compounded by the seasonal availability of these raw materials, which necessitates careful supply chain planning and inventory management. Additionally, the availability of alternative hydrocolloids and gelling agents, such as guar gum, carrageenan, and various starches, offers competition, prompting pectin manufacturers to continually innovate and differentiate their products based on performance and natural appeal.

Despite these challenges, numerous opportunities exist for market expansion. Research and development into novel and underutilized pectin sources, such as sunflower heads, sugar beet pulp, and potato pulp, could diversify the supply base and reduce reliance on traditional sources. The burgeoning demand from emerging economies, characterized by rapidly developing food processing sectors and increasing disposable incomes, presents significant untapped potential. Furthermore, technological advancements in extraction and modification processes are enabling the creation of pectin variants with tailored functionalities, opening doors to new applications in pharmaceuticals, personal care, and specialized food products, including those catering to personalized nutrition trends. These technological innovations are critical impact forces shaping the market's future, alongside global climate patterns affecting raw material harvests and evolving international trade policies which can influence supply chain dynamics.

Segmentation Analysis

The pectin market is comprehensively segmented by source, type, and application, reflecting the diverse origins and functional properties of pectin, as well as its extensive utility across various industries. This granular segmentation allows for a detailed understanding of market dynamics, identifying key growth areas and niche opportunities. Each segment represents distinct market characteristics driven by raw material availability, processing technologies, and specific end-user requirements, providing a nuanced perspective on the market's structure and competitive landscape.

Analyzing these segments reveals shifts in consumer preferences and technological advancements. For instance, the demand for specific pectin types is often dictated by desired textural properties in food products or the release profiles in pharmaceutical formulations. Understanding these segment behaviors is crucial for manufacturers to tailor their product offerings and marketing strategies effectively, ensuring alignment with industry needs and maximizing market penetration. The interplay between source, type, and application segments defines the market's overall trajectory and innovation pathways.

- Source:

- Citrus Pectin

- Apple Pectin

- Sugar Beet Pectin

- Other Sources (e.g., Sunflower, Potato, Carrot, etc.)

- Type:

- High Methoxyl (HM) Pectin

- Low Methoxyl (LM) Pectin

- Application:

- Food and Beverage

- Jams, Jellies, and Preserves

- Dairy Products (Yogurts, Fermented Milks, Desserts)

- Confectionery (Gummies, Candies, Fruit Chews)

- Beverages (Fruit Juices, Smoothies, Drinkable Yogurts)

- Baked Goods and Fillings

- Fruit Preparations

- Other Food Applications (Sauces, Dressings, Spreads)

- Pharmaceuticals and Personal Care

- Drug Delivery Systems (Controlled Release)

- Cosmetics (Emulsifiers, Stabilizers, Thickeners)

- Nutraceuticals (Dietary Fiber Supplements)

- Other Applications (e.g., Textiles, Industrial, Edible Coatings)

- Food and Beverage

Value Chain Analysis For Pectin Market

The value chain for the pectin market commences with extensive upstream analysis, focusing on the sourcing and procurement of raw materials. This primarily involves the by-products of the fruit processing industry, such as citrus peels from juice production and apple pomace from cider or juice manufacturing. Key considerations at this stage include the quality, availability, seasonality, and cost-effectiveness of these agricultural wastes. Robust relationships with fruit processors are crucial to ensure a consistent and high-quality supply, forming the bedrock of pectin production. Effective logistics for transporting these bulky raw materials to processing plants is also a critical component of the upstream segment.

Following the extraction and purification of pectin, the value chain progresses to downstream analysis, which involves the processing, formulation, and distribution of the final pectin product to various end-user industries. This stage includes refining pectin into specific grades (e.g., HM Pectin, LM Pectin) suitable for different applications, packaging, and quality assurance. The distribution channel is multifaceted, comprising both direct and indirect routes. Large-scale food and pharmaceutical manufacturers often engage in direct procurement from major pectin producers, establishing long-term supply agreements. This direct relationship allows for customized product specifications and direct technical support, fostering strong partnerships.

Conversely, indirect distribution channels are vital for reaching smaller manufacturers, specialized product developers, and markets with complex logistical requirements. This involves leveraging a network of distributors, agents, and ingredient suppliers who manage warehousing, smaller-batch deliveries, and localized technical assistance. These intermediaries play a crucial role in market penetration and broadening the reach of pectin manufacturers, especially in fragmented markets or those with specific regulatory nuances. Both direct and indirect distribution strategies are essential for a comprehensive market presence, ensuring that pectin reaches its diverse customer base efficiently and effectively.

Pectin Market Potential Customers

The pectin market caters to a broad spectrum of end-users and buyers across multiple industries, primarily driven by its unique gelling, thickening, and stabilizing properties. In the food and beverage sector, key potential customers include manufacturers of jams, jellies, and fruit preserves, where pectin is indispensable for achieving the desired texture and set. Dairy companies utilize pectin for stabilizing yogurts, fruit preparations, and desserts, preventing syneresis and improving mouthfeel. Confectionery producers, particularly those making gummies, fruit candies, and certain baked goods, rely on pectin for its texture-forming capabilities and ability to create a clear, firm gel. Beverage manufacturers also incorporate pectin into fruit juices and drinkable yogurts for body and stability. Beyond these traditional segments, the burgeoning market for plant-based and vegan products is increasingly turning to pectin as a natural, animal-free gelling agent, expanding its customer base significantly.

Outside of food applications, the pharmaceutical industry represents a significant and growing customer segment for pectin. Here, pectin is valued for its biocompatibility, biodegradability, and non-toxicity, making it suitable for drug delivery systems, particularly in controlled-release formulations and as a component in oral dosage forms. Its ability to form gels in the acidic conditions of the stomach makes it ideal for enteric coatings and gastro-resistant capsules. Cosmetic companies are another expanding customer base, using pectin as a natural emulsifier, thickener, and stabilizer in various personal care products, including lotions, creams, and hair care formulations, aligning with the clean beauty trend. Furthermore, the nutraceutical sector uses pectin as a source of dietary fiber in supplements, targeting digestive health and cholesterol management, appealing to health-conscious consumers. This diverse array of end-users underscores pectin's versatility and its critical role in various industrial applications, constantly expanding its reach into new product categories and formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2032 | USD 2.85 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Cargill, CP Kelco, Herbstreith & Fox Corporate Group, Naturex S.A. (Part of Givaudan), Lucid Colloids Ltd., DSM (Koninklijke DSM N.V.), Ingredion Incorporated, Obipektin AG (Part of Andre Pectin), Silvabrite Pectin, Yantai Andre Pectin Co. Ltd., Jinfeng Pectin Co. Ltd., Pomona's Universal Pectin, AEP Colloids, Krishna Pectin Pvt. Ltd., Florida Food Products, Hainan Jinhui Pectin Co., Ltd., Palsgaard A/S, Wintrust Flavors & Ingredients |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pectin Market Key Technology Landscape

The pectin market's technological landscape is continuously evolving, driven by the need for more efficient, sustainable, and versatile extraction and modification methods. Traditional extraction technologies primarily involve acid hydrolysis, where raw materials like citrus peels are treated with hot dilute acids to solubilize pectin, followed by precipitation using alcohol or metal salts. While effective, this method can be energy-intensive and may lead to degradation of pectin macromolecules. Consequently, there is ongoing research and development into optimizing these parameters to improve yield and maintain higher quality, aiming for greener chemical processes and reduced environmental impact.

Emerging technologies are focused on enzymatic extraction, which utilizes specific enzymes to break down plant cell walls and release pectin. This method offers several advantages, including milder operating conditions, reduced chemical usage, and the potential to produce pectin with tailored functional properties by controlling enzyme specificity. Membrane separation technologies, such as ultrafiltration and microfiltration, are increasingly being employed for pectin purification and concentration, offering more efficient and environmentally friendly alternatives to traditional precipitation methods. These technologies enhance the purity of the final product and reduce processing costs, contributing to higher-value pectin derivatives.

Furthermore, modification technologies are crucial for expanding pectin's applications by altering its molecular structure to achieve specific functional characteristics. Amidation and esterification are established methods used to produce Low Methoxyl (LM) Pectin and amidated pectin, respectively, which exhibit different gelling behaviors (e.g., calcium-dependent gelling). Advanced analytical techniques, including High-Performance Liquid Chromatography (HPLC), Gel Permeation Chromatography (GPC), and various spectroscopic methods, are indispensable for quality control, characterizing pectin's molecular weight, degree of esterification, and purity. These technological advancements collectively contribute to the production of diverse pectin types, meeting the evolving demands of industries seeking natural, functional, and clean label ingredients with precise performance attributes.

Regional Highlights

- North America: This region represents a mature and stable market for pectin, characterized by high consumer awareness regarding health and wellness, driving demand for natural and clean label ingredients. The United States and Canada are key contributors, with robust food processing industries and a strong inclination towards functional foods and beverages. Innovation in plant-based alternatives and sugar-reduced products further fuels pectin consumption.

- Europe: Europe stands as a leading market for pectin, largely due to stringent food regulations promoting natural ingredients and a well-established food and beverage industry, particularly in countries like Germany, France, and the Netherlands. The region is a hub for pectin research and development, with a strong focus on sustainable sourcing and the production of specialized pectin types for diverse applications, including organic and non-GMO varieties.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for pectin, primarily driven by rapid urbanization, increasing disposable incomes, and the burgeoning expansion of the food processing, pharmaceutical, and personal care industries, especially in China, India, and Southeast Asian countries. The rising adoption of Western dietary patterns and a growing middle-class population contribute significantly to the demand for processed foods and, consequently, pectin.

- Latin America: This region exhibits significant growth potential, with increasing industrialization and modernization of the food sector in countries like Brazil, Mexico, and Argentina. The rising consumption of processed foods, coupled with a growing awareness of natural food additives, positions Latin America as an emerging market for pectin, offering opportunities for both local production and imports.

- Middle East and Africa (MEA): The MEA region is an evolving market for pectin, with demand primarily influenced by demographic growth, increasing food imports, and the gradual development of local food processing capabilities. While smaller in market share compared to other regions, rising investments in the food and beverage industry and a shift towards healthier food options present future growth prospects for pectin.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pectin Market.- DuPont

- Cargill, Incorporated

- CP Kelco (A JM Huber Company)

- Herbstreith & Fox Corporate Group

- Naturex S.A. (Part of Givaudan)

- Lucid Colloids Ltd.

- DSM (Koninklijke DSM N.V.)

- Ingredion Incorporated

- Obipektin AG (Part of Andre Pectin)

- Silvabrite Pectin

- Yantai Andre Pectin Co. Ltd.

- Jinfeng Pectin Co. Ltd.

- Pomona's Universal Pectin

- AEP Colloids

- Krishna Pectin Pvt. Ltd.

- Florida Food Products

- Hainan Jinhui Pectin Co., Ltd.

- Palsgaard A/S

- Wintrust Flavors & Ingredients

Frequently Asked Questions

What is pectin and what are its primary uses?

Pectin is a natural polysaccharide found in plant cell walls, primarily extracted from citrus peels and apples. Its primary uses are as a gelling agent, thickener, and stabilizer in foods like jams, jellies, dairy products, and confectionery, as well as in pharmaceuticals and cosmetics.

What are the main types of pectin and how do they differ?

The two main types are High Methoxyl (HM) Pectin and Low Methoxyl (LM) Pectin. HM Pectin requires high sugar and acid for gelling, while LM Pectin (including amidated LM Pectin) gels in the presence of calcium ions and low sugar concentrations, offering versatility for various applications.

Which industries are the largest consumers of pectin?

The food and beverage industry is the largest consumer, especially segments producing jams, jellies, fruit preparations, dairy products, and confectionery. The pharmaceutical and personal care sectors are also significant and growing consumers of pectin.

What factors are driving the growth of the pectin market?

Key drivers include rising consumer demand for natural and clean label ingredients, the expansion of the global processed food industry, increasing awareness of pectin's health benefits as a dietary fiber, and innovations in its applications across various sectors.

What are the key challenges faced by pectin manufacturers?

Manufacturers face challenges such as volatility in raw material prices (citrus peels, apple pomace), seasonal availability of these materials, stringent regulatory requirements, and competition from alternative gelling agents and hydrocolloids.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Amylopectin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Citrus Pectin Market Size Report By Type (High methoxyl pectin (DM >50), Low methoxyl pectin (DM), By Application (.), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pectin Market Size Report By Type (High Methoxyl (HM) Pectin, Low Methoxyl (LMC) Pectin, Amidated low Methoxyl (LMA) Pectin), By Application (Food Industry, Pharmaceutical Industry, Cosmetic Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Lemon Pectin Market Statistics 2025 Analysis By Application (Food, Medicine), By Type (High Methoxyl, Low Methoxyl), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager