Peer to Peer Lending Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431221 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Peer to Peer Lending Market Size

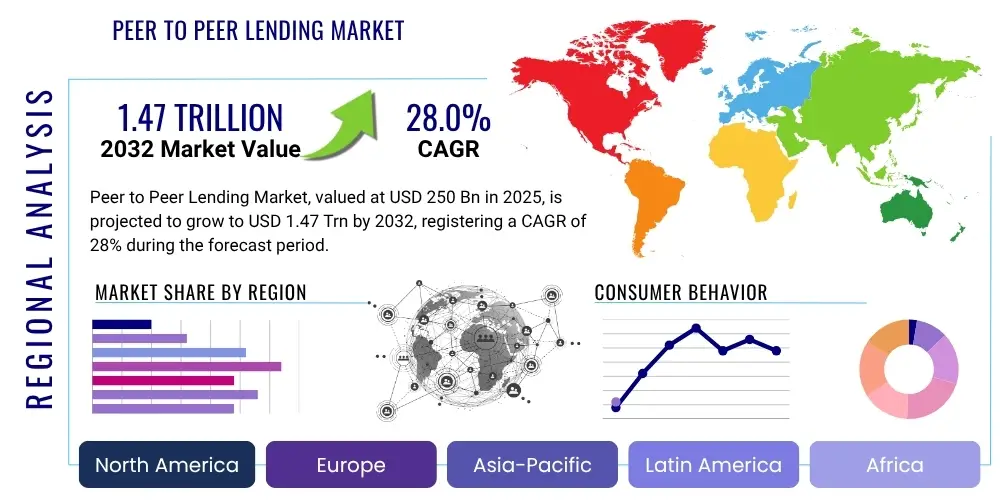

The Peer to Peer Lending Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28% between 2025 and 2032. The market is estimated at $250 Billion in 2025 and is projected to reach $1.47 Trillion by the end of the forecast period in 2032.

Peer to Peer Lending Market introduction

The Peer to Peer Lending market represents a transformative segment within the financial technology (FinTech) industry, facilitating direct lending and borrowing between individuals or businesses without the intermediation of traditional financial institutions like banks. This innovative model leverages online platforms to connect lenders, who seek higher returns on their investments, with borrowers, who are often looking for more flexible terms, quicker access to funds, or lower interest rates than conventional avenues. The core product offering encompasses a variety of loan types, including personal loans, small business loans, real estate loans, and even student loans, all managed through sophisticated digital interfaces that streamline the application, credit assessment, and funding processes.

Major applications of peer to peer lending span a broad spectrum of financial needs, from consolidating high-interest debt and financing personal events to providing crucial capital for burgeoning small and medium-sized enterprises (SMEs) and funding property development projects. Key benefits driving the market's expansion include increased financial accessibility for underserved populations, competitive interest rates for borrowers, and attractive returns for lenders. Moreover, the inherent efficiency of online platforms often translates to faster loan approvals and reduced administrative overhead compared to legacy banking systems. The market is primarily driven by the ongoing digitalization of financial services, growing consumer dissatisfaction with traditional banking complexities, and a global push for greater financial inclusion, making capital more readily available to a wider demographic.

Peer to Peer Lending Market Executive Summary

The Peer to Peer Lending market is undergoing rapid evolution, marked by significant business trends that prioritize digital innovation, regulatory compliance, and diversified product portfolios. Key among these trends is the increasing sophistication of credit assessment models, often leveraging artificial intelligence and big data analytics to enhance risk management and improve loan origination efficiency. Furthermore, platforms are increasingly specializing in specific loan types or borrower segments, moving beyond general consumer lending to target niche markets such as real estate, agricultural finance, or supply chain finance, thereby broadening the market's reach and resilience. Strategic partnerships with traditional financial institutions and technology providers are also becoming more common, fostering hybrid models that blend the strengths of both worlds, offering enhanced credibility and operational scale.

Regionally, the market exhibits diverse growth patterns. North America and Europe continue to be dominant forces, driven by mature FinTech ecosystems, high digital adoption rates, and a strong investor base. However, the Asia Pacific region, particularly countries like China and India, is emerging as a critical growth engine, fueled by vast unbanked populations, rapid smartphone penetration, and supportive government initiatives promoting financial inclusion through digital channels. Latin America and the Middle East and Africa (MEA) are also showing promising potential, albeit with varying degrees of regulatory development and infrastructure challenges. Each region presents unique opportunities and regulatory hurdles that influence market entry strategies and growth trajectories for P2P lending platforms.

Segmentation trends within the Peer to Peer Lending market highlight a dynamic shift towards diversification and specialization. Consumer lending remains a cornerstone, with personal loans for debt consolidation, home improvements, and education continuing to represent a substantial portion of loan originations. Simultaneously, the small and medium-sized enterprise (SME) lending segment is experiencing robust growth, as businesses find P2P platforms an agile alternative to traditional bank loans for working capital, expansion, and equipment finance. Real estate P2P lending, particularly for bridging loans and development finance, is another rapidly expanding segment, attracting both retail and institutional investors seeking tangible asset-backed returns. This increasing segmentation underscores the market's adaptability and its capability to address a wide array of financial needs, contributing to its sustained growth trajectory.

AI Impact Analysis on Peer to Peer Lending Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize credit risk assessment, enhance fraud detection capabilities, and personalize lending products within the Peer to Peer Lending market. There is significant interest in AI's role in automating operational processes, thereby reducing costs and improving efficiency, as well as its potential to offer more competitive rates through superior predictive analytics. However, user questions also reflect concerns regarding the ethical implications of AI algorithms in lending, particularly concerning bias, transparency, and data privacy. Expectations are high for AI to create more inclusive financial systems while simultaneously demanding robust regulatory oversight to prevent algorithmic discrimination and ensure fair lending practices across all borrower segments.

- AI-powered credit scoring: Utilizes machine learning to analyze vast datasets, including alternative data sources, for more accurate and comprehensive borrower risk assessment, potentially reaching individuals overlooked by traditional models.

- Enhanced fraud detection: AI algorithms can identify subtle patterns and anomalies in transaction data and application forms, significantly improving the speed and accuracy of fraud prevention.

- Personalized loan offerings: AI enables platforms to tailor loan products, interest rates, and repayment schedules to individual borrower profiles, optimizing for both borrower satisfaction and lender returns.

- Operational automation: Automation of routine tasks such as loan application processing, KYC (Know Your Customer) checks, and customer service through chatbots, leading to reduced operational costs and faster service delivery.

- Predictive analytics for market trends: AI tools analyze market data to forecast lending trends, interest rate movements, and default risks, helping platforms and investors make more informed decisions.

- Risk management and portfolio optimization: AI supports dynamic monitoring of loan portfolios, enabling real-time adjustments to risk parameters and optimizing investment strategies for lenders.

- Improved regulatory compliance: AI can assist in monitoring transactions and borrower behavior to ensure adherence to evolving financial regulations, thereby reducing compliance burdens and risks.

DRO & Impact Forces Of Peer to Peer Lending Market

The Peer to Peer Lending market is propelled by a confluence of powerful drivers, notably the widespread adoption of digital technologies and the increasing demand for financial inclusion for individuals and small businesses underserved by traditional banking. The convenience, speed, and often lower costs associated with P2P platforms attract a growing user base, as borrowers seek competitive rates and simplified application processes, while lenders are drawn by the potential for higher returns compared to conventional investment vehicles. These factors collectively contribute to the market's expansion, fostering a more accessible and efficient lending ecosystem that challenges established financial paradigms.

However, the market also faces significant restraints, primarily stemming from regulatory uncertainties that vary across different jurisdictions, creating a complex and sometimes unpredictable operating environment. Credit risk remains a perpetual challenge, as P2P platforms often cater to borrowers with less established credit histories, requiring sophisticated risk assessment and management strategies. The potential for platform defaults or large-scale loan defaults, coupled with concerns regarding data security and fraudulent activities, can erode investor and borrower confidence. Economic downturns, which typically lead to higher default rates and reduced lending capacity, also pose a substantial threat to the market's stability and growth trajectory, necessitating robust contingency planning and transparent risk disclosures.

Opportunities for growth are abundant within the Peer to Peer Lending market, particularly in emerging economies where traditional financial infrastructure is less developed, presenting a vast untapped market for alternative lending solutions. The specialization into niche lending segments, such as green finance, educational loans, or healthcare financing, allows platforms to cater to specific needs and attract dedicated investor pools. Furthermore, the integration of advanced technologies like blockchain for enhanced transparency and security, alongside sophisticated data analytics for hyper-personalization, offers avenues for significant innovation and competitive differentiation. These opportunities, when strategically pursued, can enable platforms to carve out distinct market positions and capture substantial value. The overall impact forces shaping the market include rapidly evolving technological advancements, dynamic regulatory frameworks that either enable or constrain growth, and prevailing macroeconomic conditions that influence credit demand and risk appetite.

Segmentation Analysis

The Peer to Peer Lending market is primarily segmented across various dimensions to cater to diverse financial needs and operational models. These segmentations provide a granular view of the market structure, allowing platforms to specialize and target specific borrower and lender demographics. The key segmentation criteria typically include the type of loan offered, the end-user or borrower category, the model of the P2P platform, and geographical regions. Understanding these distinct segments is crucial for analyzing market dynamics, identifying growth opportunities, and formulating effective business strategies for both existing and new market entrants. Each segment exhibits unique demand characteristics, risk profiles, and competitive landscapes, contributing to the overall complexity and vibrancy of the market.

- By Loan Type:

- Personal Loans (Debt consolidation, home improvement, medical expenses, education)

- Business Loans (Working capital, expansion, equipment finance, invoice financing)

- Real Estate Loans (Bridging loans, development finance, buy-to-let mortgages)

- Student Loans (Tuition fees, living expenses)

- Auto Loans (Vehicle purchase, refinancing)

- By End-User/Borrower:

- Individuals (Consumers, small entrepreneurs)

- Small and Medium-sized Enterprises (SMEs)

- Corporates (Larger businesses seeking alternative financing)

- By Operating Model:

- Marketplace Lending (Platforms connect borrowers directly with individual or institutional lenders)

- Balance Sheet Lending (Platforms lend from their own balance sheet)

- Hybrid Models (Combination of marketplace and balance sheet lending)

- By Technology Used:

- AI and Machine Learning platforms

- Blockchain-enabled platforms

- Traditional Web-based platforms

- By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Peer to Peer Lending Market

The value chain of the Peer to Peer Lending market is characterized by several distinct stages, beginning with upstream activities that focus on technology development and data sourcing, extending through the core platform operations, and culminating in downstream services delivered to borrowers and lenders. Upstream analysis involves entities that provide the foundational infrastructure and intelligence for P2P platforms. This includes financial technology solution providers that develop sophisticated lending software, credit scoring algorithms, and fraud detection systems, as well as data aggregators and credit bureaus that supply crucial borrower information. These upstream partners are essential for building robust, secure, and efficient lending platforms capable of scaling operations and managing risk effectively. They contribute significantly to the platform's ability to automate processes and make informed lending decisions, forming the bedrock of the entire P2P ecosystem.

The core of the P2P lending value chain resides within the platform itself, which acts as the primary distribution channel, directly connecting capital providers with capital seekers. These platforms manage the entire loan lifecycle, from borrower application and verification (KYC/AML) to credit assessment, loan approval, funding, servicing, and collections. The direct nature of these platforms means that they largely bypass traditional banking infrastructure, offering a more streamlined and often faster process. This direct interaction is a defining characteristic, as platforms leverage their digital presence to reach a broad base of both individual and institutional lenders, as well as a diverse pool of borrowers. The efficiency and user experience offered by these platforms are critical for attracting and retaining participants in the ecosystem.

Downstream analysis focuses on the end-users and the ultimate beneficiaries of the P2P lending process. These primarily include individual borrowers seeking personal loans, small and medium-sized enterprises (SMEs) in need of business capital, and real estate developers looking for project financing. On the other side, downstream participants also include lenders and investors, ranging from retail individuals seeking higher returns to institutional investors, hedge funds, and family offices looking to diversify their portfolios into alternative asset classes. The distribution channel is predominantly direct, with borrowers and lenders interacting directly through the platform's website or mobile application. While the primary model is direct, some platforms may engage in indirect partnerships with financial advisors or wealth management firms that introduce clients as lenders or borrowers, expanding their reach without compromising the direct peer-to-peer connection at the core of their operations.

Peer to Peer Lending Market Potential Customers

The Peer to Peer Lending market serves a broad and diverse base of potential customers, spanning both borrowers and lenders, each with distinct financial needs and objectives. On the borrower side, the primary end-users include individuals seeking flexible and often more affordable financing options for personal expenses such as debt consolidation, home improvements, medical emergencies, or educational pursuits. These individuals often find P2P platforms more accessible than traditional banks, especially if they have limited credit history or face stringent lending criteria from conventional lenders. Small and Medium-sized Enterprises (SMEs) represent another significant customer segment, as they frequently struggle to secure timely and adequate funding from banks for working capital, expansion, or inventory purchases. P2P business loans offer them a nimble and often more competitive alternative, crucial for their growth and operational stability in a dynamic economic landscape.

Beyond individuals and SMEs, real estate developers and investors also constitute a vital customer group, utilizing P2P platforms for bridging loans, development finance, or commercial property acquisitions, especially when traditional mortgage providers are hesitant or too slow. The appeal for these professional borrowers lies in the speed of funding and the flexibility of loan structures available through specialized real estate P2P platforms. On the lending side, potential customers are investors, ranging from retail individuals looking to earn higher interest rates on their savings than those offered by traditional bank accounts, to sophisticated institutional investors, family offices, and wealth management firms seeking to diversify their investment portfolios with alternative credit assets. These investors are drawn by the potential for attractive risk-adjusted returns and the ability to choose specific loan types or borrower profiles that align with their investment strategies, making the Peer to Peer Lending market a robust ecosystem for capital allocation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $250 Billion |

| Market Forecast in 2032 | $1.47 Trillion |

| Growth Rate | 28% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LendingClub, Prosper Marketplace, Zopa, Funding Circle, RateSetter, SoFi, Upstart, Avant, Kabbage (now Kabbage from American Express), OnDeck, Mintos, Bondora, Twino, PeerBerry, Estateguru, CrowdStreet, Sharestates, LendingPoint, Earnest, Best Egg |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peer to Peer Lending Market Key Technology Landscape

The Peer to Peer Lending market heavily relies on a sophisticated technology landscape to facilitate its operations, enhance efficiency, and manage inherent risks. Central to this landscape are advanced data analytics and artificial intelligence (AI) and machine learning (ML) algorithms. These technologies are extensively employed for robust credit scoring, allowing platforms to assess borrower risk more accurately by analyzing vast datasets, including traditional financial information, alternative data sources like utility payments or social media activity, and behavioral patterns. This enables platforms to offer loans to a broader spectrum of borrowers, including those with limited credit history, while simultaneously optimizing interest rates and minimizing default risks for lenders. The precision offered by AI/ML is crucial for competitive differentiation and effective portfolio management.

Another pivotal technology shaping the P2P lending space is blockchain, which offers enhanced transparency, security, and immutability for loan contracts and transaction records. By leveraging distributed ledger technology, platforms can create a more trustworthy environment, reducing the potential for fraud and disputes, and streamlining verification processes. While not universally adopted, blockchain's potential for automating smart contracts for loan disbursements and repayments is a significant area of innovation, promising to further reduce operational costs and increase transactional efficiency. Furthermore, cloud computing infrastructure provides the scalability and flexibility necessary for P2P platforms to manage large volumes of data and transactions, ensuring high availability and rapid deployment of new features without substantial upfront hardware investments.

The integration of Application Programming Interfaces (APIs) is also fundamental, enabling seamless connectivity between P2P platforms and external services such as bank accounts, payment gateways, identity verification providers, and even other FinTech applications. This interoperability allows for a more integrated and user-friendly experience, automating various stages of the loan process and enhancing data exchange securely. Big data analytics tools are utilized not only for credit assessment but also for identifying market trends, optimizing marketing campaigns, and personalizing user experiences for both borrowers and lenders. Collectively, these technological advancements form the backbone of the modern Peer to Peer Lending market, driving its innovation, improving its resilience, and expanding its reach across global financial ecosystems.

Regional Highlights

- North America: The United States remains a dominant force, characterized by a mature P2P market, significant technological innovation, and a robust investor base. Canada also shows steady growth, driven by digital adoption and demand for alternative financing.

- Europe: The UK is a pioneer with established platforms and a supportive regulatory framework, while countries like Germany and France are experiencing rapid expansion as awareness grows and regulatory clarity improves. Continental Europe benefits from cross-border lending and a strong investor appetite for diversification.

- Asia Pacific (APAC): This region is a hotbed of P2P activity, particularly in China and India, driven by vast underserved populations, high mobile penetration, and supportive government policies promoting digital finance. Australia and Southeast Asian nations are also witnessing significant growth and innovation.

- Latin America: Emerging as a high-growth potential region, driven by increasing internet penetration, a large unbanked population, and a pressing need for accessible credit solutions. Regulatory frameworks are still evolving but show promise for further market development.

- Middle East and Africa (MEA): While still nascent, the MEA region is experiencing growth in P2P lending, particularly in countries with developing FinTech ecosystems. The demand for sharia-compliant finance and financial inclusion initiatives are key drivers in this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peer to Peer Lending Market.- LendingClub

- Prosper Marketplace

- Zopa

- Funding Circle

- RateSetter

- SoFi

- Upstart

- Avant

- Kabbage (now Kabbage from American Express)

- OnDeck

- Mintos

- Bondora

- Twino

- PeerBerry

- Estateguru

- CrowdStreet

- Sharestates

- LendingPoint

- Earnest

- Best Egg

Frequently Asked Questions

What is Peer to Peer Lending?

Peer to Peer (P2P) lending is a method of debt financing that allows individuals or businesses to obtain loans directly from other individuals or institutional investors, without the need for a traditional financial institution as an intermediary. Online platforms facilitate these transactions, managing the loan matching, servicing, and risk assessment processes.

How does Peer to Peer Lending differ from traditional bank loans?

P2P lending generally offers more flexible terms, potentially lower interest rates for borrowers, and higher returns for lenders compared to traditional banks. It often features faster approval processes and broader accessibility, particularly for individuals and small businesses underserved by conventional financial institutions, due to its online-only, platform-based model.

What are the main risks associated with investing in Peer to Peer Lending?

Key risks for lenders include borrower default, platform insolvency, and liquidity risk, as P2P loans are typically not covered by government deposit insurance schemes. Regulatory changes and economic downturns can also impact returns and increase default rates. Diligent research into borrower creditworthiness and platform stability is crucial for investors.

Is Peer to Peer Lending regulated?

Yes, Peer to Peer Lending is regulated, though the scope and stringency of regulations vary significantly by country and jurisdiction. Regulatory bodies aim to protect both borrowers and lenders, ensuring fair practices, transparency, and financial stability. Compliance with anti-money laundering (AML) and know-your-customer (KYC) laws is standard across most operational platforms.

What role does technology play in the growth of the P2P lending market?

Technology, particularly AI, machine learning, and big data analytics, is fundamental to P2P lending, enabling efficient credit scoring, fraud detection, and automated loan processing. Blockchain technology is also gaining traction for enhancing transparency and security. These technological advancements drive efficiency, reduce costs, and expand market access, fueling the sector's rapid growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager