Pet Food Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428650 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Pet Food Packaging Market Size

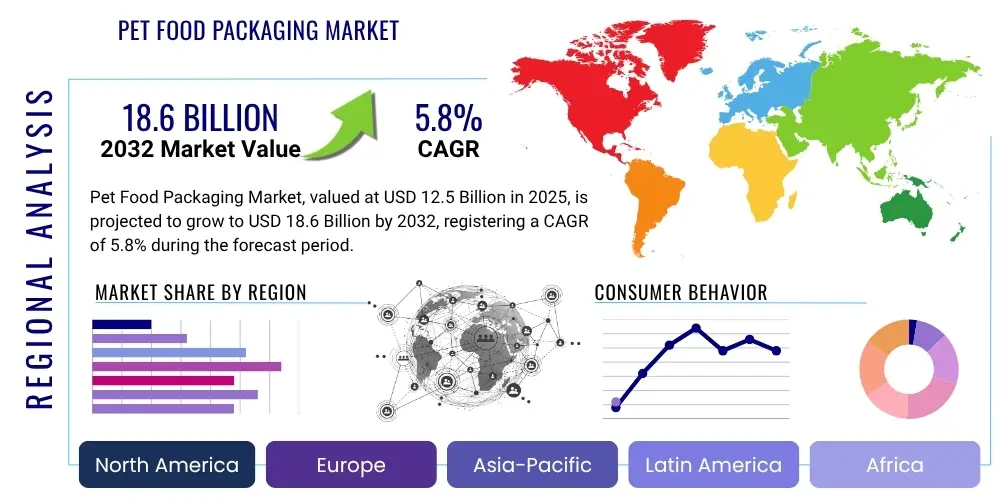

The Pet Food Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 12.5 Billion in 2025 and is projected to reach USD 18.6 Billion by the end of the forecast period in 2032.

Pet Food Packaging Market introduction

The Pet Food Packaging Market stands as an indispensable segment within the expansive pet care industry, critically focused on safeguarding, preserving, and presenting pet food products to a discerning consumer base. This specialized market encompasses a wide spectrum of packaging materials and formats, meticulously engineered to protect the nutritional integrity and palatability of various pet food types, including dry kibble, wet food, semi-moist options, and an array of treats. Packaging solutions are selected based on several crucial criteria such as the product's moisture content, oxygen sensitivity, required shelf life, brand positioning, and the ever-growing emphasis on environmental sustainability, ensuring optimal product performance from manufacturing to the pet's bowl.

The product description for pet food packaging ranges from highly functional flexible pouches and multi-layer bags to robust rigid plastic containers, metal cans, and innovative paper-based alternatives, each tailored to specific applications. Major applications span across packaging for canine diets, feline nutrition, avian feeds, aquatic pet foods, and sustenance for small mammals, reflecting the diverse global pet population. Key benefits include extended product freshness, enhanced consumer convenience through features like resealable closures, easy-pour spouts, and portion control options, alongside crucial protection against physical damage and contamination. Furthermore, high-quality packaging serves as a powerful marketing tool, attracting consumers through vibrant graphics, clear nutritional labeling, and messages that resonate with the human-animal bond.

Driving factors for the substantial growth of this market are deeply intertwined with global pet ownership trends, particularly the increasing humanization of pets where animals are considered integral family members, leading to a demand for premium, specialized, and often gourmet pet food. The exponential growth of e-commerce platforms has also created a significant impetus, requiring packaging that is not only durable for shipping but also aesthetically appealing for online presentation and unboxing experiences. Additionally, escalating consumer awareness regarding pet health and nutrition, coupled with continuous advancements in sustainable packaging materials and manufacturing technologies, are collectively propelling market expansion and innovation. Regulatory compliance surrounding food safety and material integrity also plays a pivotal role in shaping market dynamics and driving product development.

Pet Food Packaging Market Executive Summary

The Pet Food Packaging Market is poised for significant expansion, underpinned by a confluence of evolving consumer demands, technological advancements, and a heightened focus on sustainability across the global pet care industry. Current business trends indicate a pronounced shift towards premiumization, with pet owners increasingly opting for high-quality, specialized, and health-focused pet food varieties. This trend necessitates sophisticated packaging solutions that offer superior barrier properties, extended shelf life, and attractive aesthetics to justify higher price points and communicate product value effectively. Concurrently, the proliferation of direct-to-consumer (DTC) models and online retail channels is reshaping traditional supply chains, driving demand for packaging that is resilient to logistical challenges, lightweight, and capable of enhancing the online shopping and unboxing experience. Innovation in packaging design, material science, and manufacturing efficiency is central to maintaining competitive advantage in this dynamic landscape.

From a regional perspective, North America and Europe currently represent the largest and most mature markets, characterized by high rates of pet ownership, substantial disposable incomes, and stringent regulatory frameworks that encourage innovation in safe and sustainable packaging. These regions are at the forefront of adopting advanced packaging technologies and eco-friendly materials, driven by strong consumer environmental consciousness and corporate social responsibility initiatives. The Asia Pacific region is rapidly emerging as a primary growth engine, propelled by burgeoning middle-class populations, increasing urbanization, and a notable surge in pet adoption across countries like China, India, and Japan. This demographic shift is fueling significant investments in local pet food manufacturing and packaging infrastructure, creating new opportunities for market participants.

Analysis of market segments reveals that flexible packaging, particularly in the form of stand-up pouches, multi-layer bags, and films, continues to dominate the market share due to its inherent advantages in cost-effectiveness, design versatility, and consumer convenience features such as resealable closures. This segment is also experiencing the fastest growth, largely attributable to ongoing advancements in material science that enable improved barrier protection and lighter weight solutions. Rigid plastic packaging, metal cans, and paper-based solutions also maintain significant market shares, continuously innovating to meet specific product preservation needs and sustainability targets. Across all segments, the overarching trend points towards the development and adoption of packaging solutions that are recyclable, compostable, or incorporate recycled content, aligning with global efforts to foster a circular economy within the packaging industry.

AI Impact Analysis on Pet Food Packaging Market

The integration of Artificial Intelligence (AI) into the Pet Food Packaging Market is generating considerable interest among industry stakeholders, with common user questions frequently exploring how this technology can revolutionize various facets of operations. Users are keenly interested in AI's capacity to enhance the efficiency of packaging production lines, optimize supply chain logistics from raw material procurement to final product delivery, and significantly improve quality control processes through automated inspection systems. Furthermore, there's a strong expectation that AI can drive innovations in sustainable packaging design by predicting material performance and consumer preferences, and personalize marketing efforts to a granular level. Key concerns often revolve around the substantial initial investment required for AI implementation, the complexities associated with integrating AI into legacy systems, and the ethical considerations pertaining to data privacy and potential workforce displacement. Despite these challenges, there is a clear anticipation that AI will unlock new levels of operational efficiency, cost reduction, and market responsiveness, fundamentally transforming the competitive landscape.

- AI-powered predictive analytics enable highly accurate demand forecasting, minimizing overproduction and material waste.

- Automated quality inspection systems using computer vision identify packaging defects at unprecedented speeds and precision.

- AI algorithms optimize packaging design for material efficiency, structural integrity, and recyclability, promoting sustainability.

- Robotics integrated with AI enhance manufacturing automation, increasing throughput and reducing labor costs in packaging facilities.

- Supply chain management benefits from AI-driven route optimization, real-time tracking, and inventory control, improving logistics efficiency.

- AI facilitates personalized packaging experiences through data analysis, tailoring designs and promotions to individual consumer segments.

- Intelligent sensors in packaging, analyzed by AI, can monitor product freshness and integrity, offering enhanced food safety and traceability.

- Predictive maintenance for packaging machinery, leveraging AI, reduces downtime and extends equipment lifespan.

DRO & Impact Forces Of Pet Food Packaging Market

The Pet Food Packaging Market is propelled by a robust set of drivers, primarily centered on the escalating trend of pet humanization, where pets are increasingly viewed as integral family members, leading to a heightened demand for premium, specialized, and nutritionally advanced pet food. This societal shift necessitates packaging that not only protects superior ingredients but also visually communicates quality and brand story effectively. The phenomenal growth of e-commerce as a dominant retail channel further accelerates demand, as packaging must be durable enough to withstand complex logistics, lightweight for cost efficiency, and aesthetically pleasing to ensure a positive unboxing experience, often serving as the initial physical touchpoint for online brands. Additionally, the continuous expansion of the global pet population and rising disposable incomes in emerging economies are creating a broader consumer base for packaged pet food, fueling overall market expansion.

However, the market also contends with significant restraints. Volatile raw material prices, particularly for plastics, metals, and paper pulp, pose a consistent challenge, impacting manufacturing costs, profit margins, and subsequently, the pricing of finished packaging products. The global push towards sustainability, while a strong driver for innovation, also acts as a restraint due to the higher initial costs associated with developing and implementing eco-friendly materials and processes, which can be prohibitive for some manufacturers. Furthermore, increasingly stringent food safety regulations and environmental compliance standards, especially concerning barrier properties, material composition, and recyclability, demand continuous investment in research and development, often leading to complex production processes and extended lead times for new product launches.

Opportunities within the market are vast and primarily reside in the realm of sustainable packaging innovations, including the development of easily recyclable mono-material solutions, bioplastics derived from renewable resources, and compostable films that address environmental concerns. The integration of smart packaging technologies, such as QR codes for enhanced traceability, NFC tags for interactive consumer engagement, and sensors for real-time freshness monitoring, presents a significant avenue for differentiation and value addition. These technologies not only enhance product safety but also allow brands to build deeper connections with consumers. The impact forces created by these drivers, restraints, and opportunities foster a highly dynamic and competitive environment, compelling market players to continuously innovate in material science, design functionality, and operational efficiency to meet evolving consumer expectations and regulatory mandates, ultimately shaping the future trajectory of the pet food packaging industry.

Segmentation Analysis

The Pet Food Packaging Market is meticulously segmented across various crucial parameters, including material type, packaging type, animal type, and distribution channel. This comprehensive segmentation provides a robust framework for analyzing market dynamics, identifying specific growth pockets, and understanding the diverse requirements of different product categories and end-users within the global pet care industry. By dissecting the market along these lines, stakeholders gain invaluable insights into consumer preferences, technological trends, and regional specificities, enabling them to formulate precise product development strategies, optimize manufacturing processes, and target marketing efforts effectively. The granular nature of this analysis underscores the complexity and breadth of packaging solutions required to serve an increasingly sophisticated pet food market, which demands solutions ranging from basic functionality to premium aesthetic and environmental performance.

Understanding these segments is paramount for both established market leaders and emerging innovators. For instance, the choice of material type significantly impacts barrier properties, cost, and recyclability, while packaging type determines convenience and shelf appeal. Differentiating by animal type allows manufacturers to tailor solutions for species-specific dietary needs and consumer purchasing habits. Analyzing distribution channels highlights the critical role of e-commerce versus traditional retail, influencing packaging resilience and presentation. This multi-dimensional approach to segmentation not only reveals current market shares and growth rates but also forecasts future trends, such as the accelerating shift towards sustainable and digitally integrated packaging solutions, which are becoming non-negotiable for environmentally conscious consumers and technologically forward brands.

- By Material Type:

- Plastic:

- Flexible Plastic (e.g., films, laminates, stand-up pouches, multi-layer bags)

- Rigid Plastic (e.g., tubs, bottles, containers, pails)

- Paper and Paperboard (e.g., cartons, boxes, multi-wall paper bags)

- Metal (e.g., aluminum cans, steel cans)

- Other Materials (e.g., glass jars for premium wet foods, specialty composites)

- Plastic:

- By Packaging Type:

- Bags (e.g., multi-wall bags, woven polypropylene bags for large volumes of dry food)

- Pouches (e.g., stand-up pouches with zippers, flat pouches for treats or single servings, retort pouches for wet food)

- Cans (e.g., metal cans for wet food, often with easy-open lids)

- Boxes/Cartons (e.g., paperboard cartons for dry food, treats, or supplementary mixes)

- Trays (e.g., plastic trays with lidding film for wet or semi-moist single servings)

- Other (e.g., tubs for moist food, rolls for automatic packaging lines)

- By Animal Type:

- Dogs (largest segment, extensive range of dry, wet, and treat packaging)

- Cats (significant segment, strong demand for wet food pouches and cans, specialized dry food bags)

- Fish (small, but specialized demand for flake and pellet packaging, often plastic jars or pouches)

- Birds (packaging for seeds, pellets, and treats, typically plastic bags or cartons)

- Other Small Animals (e.g., rabbits, hamsters, guinea pigs; specific packaging for hay, pellets, and specialized mixes)

- By Distribution Channel:

- Supermarkets and Hypermarkets (traditional retail, high volume, emphasis on shelf appeal)

- Specialty Pet Stores (focus on premium and niche brands, requiring distinctive, often smaller-batch packaging)

- Online Retail (rapidly growing, requires robust, lightweight, and e-commerce-friendly packaging for shipping)

- Other (e.g., veterinary clinics for therapeutic diets, convenience stores, farm supply stores for bulk pet food)

Value Chain Analysis For Pet Food Packaging Market

The value chain for the Pet Food Packaging Market is a complex and interconnected network, commencing with upstream activities dominated by raw material suppliers. These critical suppliers provide foundational components such as various plastic resins (e.g., polyethylene, polypropylene, PET), paper pulp, aluminum, steel, and specialty chemicals for inks, adhesives, and barrier coatings. The quality and cost of these raw materials directly influence the properties, performance, and final price of the packaging solutions. Innovations at this initial stage, particularly in sustainable and recycled content materials, are paramount for future market direction, requiring strong partnerships between packaging converters and raw material producers to ensure a steady supply of advanced components.

Midstream activities involve the packaging converters and manufacturers who transform raw materials into finished or semi-finished packaging products. This stage includes processes such as extrusion, lamination, printing (flexographic, rotogravure, digital), bag and pouch making, can manufacturing, and container molding. These manufacturers employ sophisticated machinery and advanced technologies to produce a wide array of packaging formats, ensuring they meet the specific technical requirements for barrier protection, product safety, and aesthetic appeal mandated by pet food brands. Their capabilities in customization, rapid prototyping, and efficient production cycles are key competitive differentiators, catering to diverse client needs from global enterprises to small, artisanal producers.

Downstream, the manufactured packaging solutions are distributed to pet food manufacturers, who then undertake filling, sealing, and labeling operations. This stage is crucial for ensuring the integrity and shelf life of the pet food product. The distribution channel from packaging converters to pet food manufacturers can be direct, especially for large-volume orders and customized solutions, fostering close collaboration in design and technical specifications. Alternatively, indirect channels, involving distributors or brokers, serve to aggregate smaller orders or provide specialized inventory management services. The final leg of the value chain involves the distribution of the packaged pet food products to various retail outlets, including supermarkets, specialty pet stores, and increasingly, direct-to-consumer online platforms. The demands of these varied distribution methods, particularly the unique logistical requirements of e-commerce, significantly influence packaging design, emphasizing durability, lightweight construction, and ease of handling throughout the supply chain.

Pet Food Packaging Market Potential Customers

The primary potential customers and end-users within the Pet Food Packaging Market are diverse and multifaceted, predominantly encompassing a wide spectrum of pet food manufacturers globally. This includes large multinational corporations that produce a vast array of pet food brands across different segments, as well as medium-sized regional players focusing on specific niches or geographies. Additionally, the growing number of artisanal and premium pet food brands, often emphasizing natural or organic ingredients, represents a significant customer segment with distinct packaging requirements that prioritize aesthetics, sustainability, and small-batch flexibility. Private label manufacturers, producing pet food for major retailers under their own brand names, also constitute a substantial customer base, often seeking cost-effective yet reliable and visually appealing packaging solutions.

Beyond traditional pet food producers, emerging market players such as direct-to-consumer (DTC) pet food companies and online-only retailers are becoming increasingly vital potential customers. These entities often bypass conventional brick-and-mortar distribution, relying heavily on packaging that can withstand the rigors of individual parcel shipping while simultaneously creating an impactful unboxing experience for the end consumer. Their focus is often on lightweight, durable, and aesthetically superior packaging that reinforces brand identity in a competitive online environment. Furthermore, specialized veterinary diet manufacturers, producing therapeutic or prescription pet foods, require highly secure and compliant packaging that ensures product efficacy and meets stringent health regulations, representing another distinct customer segment.

Ultimately, the entire ecosystem involved in bringing pet nutrition to consumers, from ingredient suppliers to co-packers and even raw material processors for pet treats, can be considered indirect potential customers due to their influence on packaging specifications and requirements. The evolving preferences of pet owners, who are increasingly informed and demand transparency, sustainability, and convenience, indirectly shape the demands placed on pet food packaging manufacturers. These end-consumers, through their purchasing decisions, effectively drive the needs of the immediate buyers (pet food manufacturers), compelling them to invest in packaging that aligns with current trends and offers perceived value, thereby making the pet owner an influential force in the market's customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 12.5 Billion |

| Market Forecast in 2032 | USD 18.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Mondi Group, Berry Global Inc., Huhtamaki Oyj, Sealed Air Corporation, Sonoco Products Company, Coveris Holdings SA, ProAmpac, Constantia Flexibles Group GmbH, Ardagh Group S.A., Crown Holdings Inc., Silgan Holdings Inc., Winpak Ltd., Pactiv Evergreen Inc., TC Transcontinental Inc., Printpack, Inc., Gualapack S.p.A., Schur Flexibles Group, RPC Group (now part of Berry Global), AptarGroup Inc., Smurfit Kappa Group, DS Smith Plc, Greif, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Food Packaging Market Key Technology Landscape

The Pet Food Packaging Market is characterized by a dynamic and evolving technological landscape, driven by the dual imperatives of product preservation and environmental sustainability, alongside enhanced consumer convenience. A cornerstone of current technology involves advanced multi-layer co-extrusion and lamination techniques, which are crucial for creating high-barrier flexible films and pouches. These technologies enable the precise layering of different polymers and barrier materials, such as EVOH or metallized films, to effectively protect pet food from external elements like oxygen, moisture, and light, thereby extending shelf life and maintaining nutritional quality, especially vital for delicate wet foods and nutrient-rich dry kibble. Continuous innovation in these areas aims to achieve superior barrier performance with reduced material thickness.

Another significant technological advancement lies in flexible packaging manufacturing, particularly the development of retortable pouches that allow for in-pack sterilization of wet pet food, offering a lightweight and convenient alternative to traditional metal cans. The widespread adoption of stand-up pouches with various re-closable features, including press-to-close zippers and slider mechanisms, has dramatically improved consumer convenience by facilitating easy opening, dispensing, and storage, while simultaneously preventing product spoilage. Additionally, advanced printing technologies, such as high-definition flexography, rotogravure, and increasingly, digital printing, are enabling pet food brands to achieve vibrant, high-impact graphics and intricate designs on packaging, enhancing shelf appeal and brand recognition, with digital printing specifically supporting faster turnaround times and cost-effective small-batch production for niche markets.

On the sustainability front, significant technological efforts are focused on developing mono-material solutions that simplify recycling processes by eliminating the need for complex material separation. This includes the creation of all-polyethylene or all-polypropylene barrier films. Furthermore, the market is seeing the emergence of bioplastics derived from renewable resources and innovative compostable packaging films that break down in industrial composting facilities, addressing growing environmental concerns. Active and intelligent packaging technologies, such as oxygen scavengers, moisture absorbers, and integrating QR codes or Near Field Communication (NFC) tags, are also gaining traction. These technologies enhance product safety by monitoring conditions, provide real-time traceability, and enable interactive consumer engagement, collectively pushing the boundaries of what pet food packaging can achieve in terms of functionality, safety, and environmental responsibility.

Regional Highlights

- North America: This region stands as a dominant force in the Pet Food Packaging Market, primarily driven by exceptionally high rates of pet ownership, coupled with a pervasive culture of pet humanization that translates into significant consumer spending on premium and specialized pet food products. The United States and Canada lead the charge, demanding advanced, convenient, and increasingly sustainable packaging solutions. Innovation here is often spurred by robust regulatory frameworks concerning food safety and environmental impact, pushing manufacturers towards high-barrier flexible packaging and rigid containers with enhanced features. The mature e-commerce infrastructure further drives demand for durable and logistics-friendly packaging.

- Europe: Characterized by a highly mature market, Europe boasts stringent regulatory standards for both pet food safety and environmental protection, making it a critical hub for sustainable packaging innovation. Countries like Germany, the United Kingdom, and France are at the forefront of adopting recyclable, compostable, and eco-friendly packaging materials. Consumer awareness regarding environmental issues is exceptionally strong, compelling pet food brands and packaging manufacturers to prioritize circular economy principles. Flexible packaging, particularly pouches with advanced barrier properties, and metal cans for wet food, remain popular choices, continually evolving to meet demanding eco-design criteria.

- Asia Pacific (APAC): Emerging as the fastest-growing region, the APAC market is experiencing a profound transformation, fueled by burgeoning middle-class populations, rapid urbanization, and a notable surge in pet adoption across key economies such as China, India, and Japan. This demographic and socioeconomic shift is creating immense opportunities for growth in the pet food packaging sector, necessitating both basic, cost-effective solutions for mass-market products and sophisticated, premium packaging for high-end offerings. Significant investments in local manufacturing capabilities and the expansion of modern retail channels, including online platforms, are accelerating demand across a diverse range of packaging types and materials.

- Latin America: This region is experiencing steady and consistent growth in the pet food packaging market, primarily driven by increasing pet ownership rates and a developing middle class that is gradually increasing discretionary spending on pet care. Brazil and Mexico are the most significant markets, showing a growing demand for economical yet functional packaging solutions that ensure product freshness and extend shelf life. Concurrently, there is a rising interest in premium pet food segments, leading to an increased adoption of more sophisticated packaging formats, including multi-layer flexible films and convenient re-sealable options, as consumer preferences align with global trends.

- Middle East and Africa (MEA): While still considered a nascent market compared to other regions, MEA is exhibiting gradual yet promising growth in the pet food packaging sector. This expansion is largely influenced by increasing urbanization, evolving

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pet Food Packaging Market Size Report By Type (Paper & Paperboard, Flexible Plastic, Rigid Plastic, Metal, Others), By Application (Dry Food, Wet Food, Chilled & Frozen Food, Pet Freats, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pet Food Packaging Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Paper and Paperboard, Flexible Plastic, Rigid Plastic), By Application (Dry Food, Wet Food, Chilled and Frozen Food), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager