Pet Food Packing Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428157 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Pet Food Packing Machine Market Size

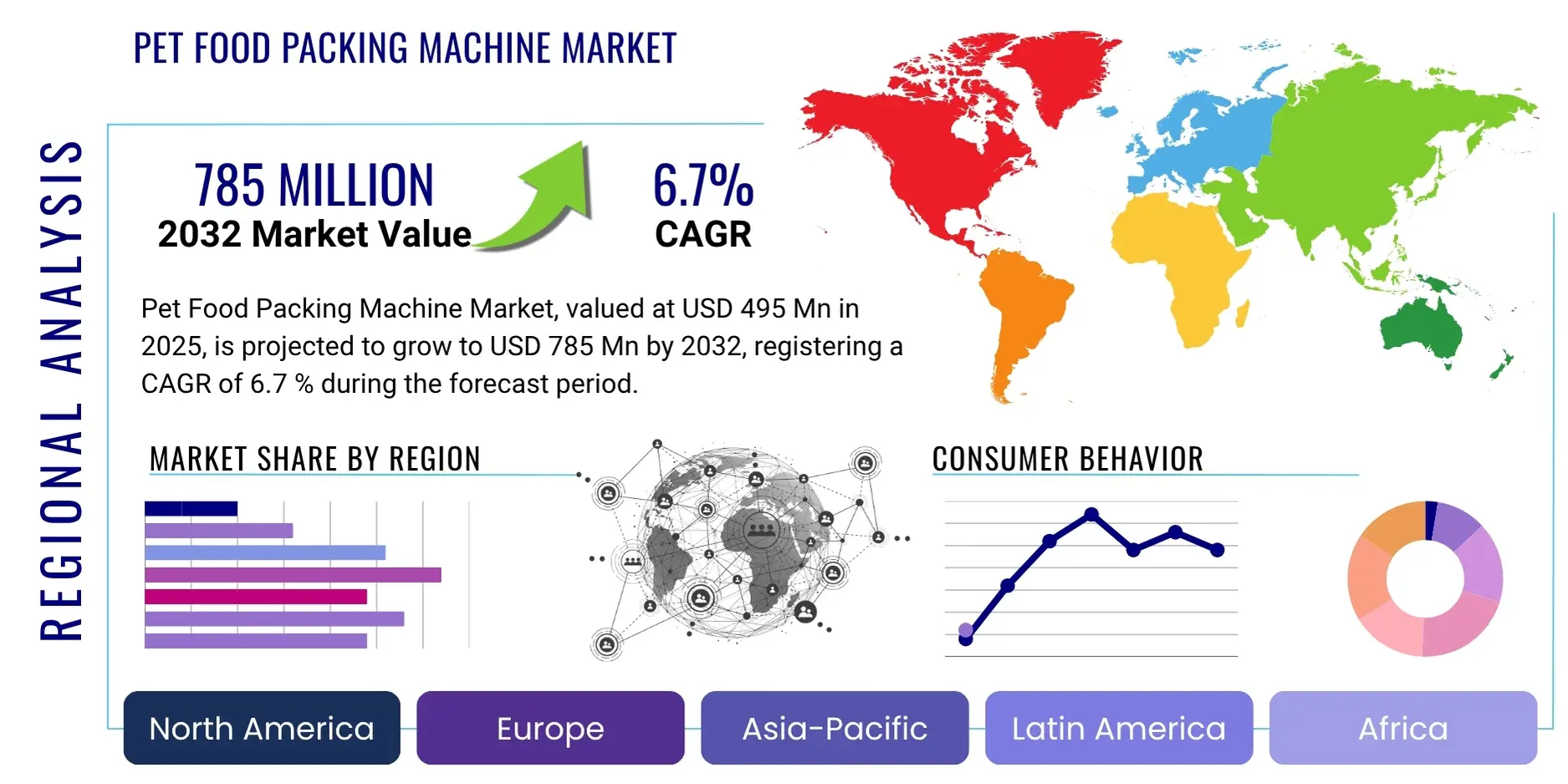

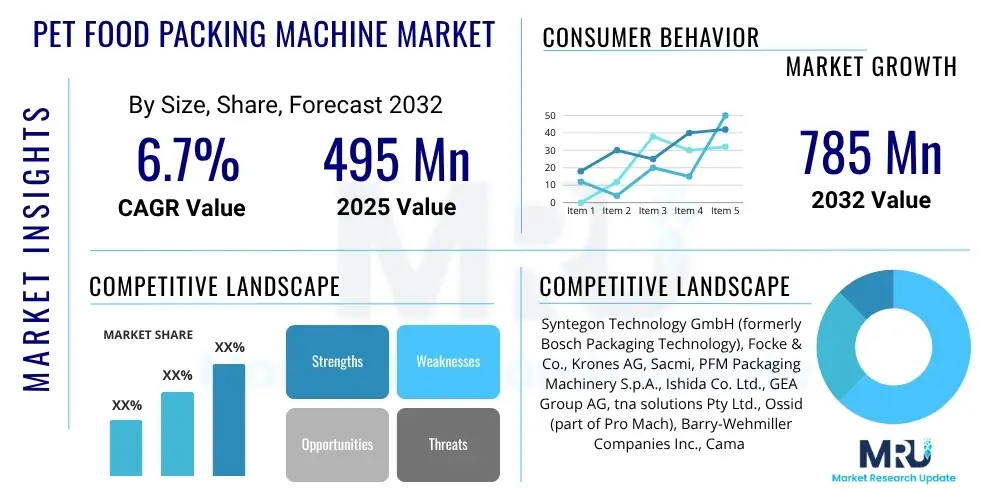

The Pet Food Packing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032. The market is estimated at USD 495 million in 2025 and is projected to reach USD 785 million by the end of the forecast period in 2032.

Pet Food Packing Machine Market introduction

The global pet food packing machine market represents a critical and dynamic segment within the broader pet care and industrial machinery industries. Its continuous expansion is intrinsically linked to the escalating global trends of pet ownership, the pervasive humanization of pets, and an ever-diversifying consumer demand for premium, specialized, and hygienically packaged pet food products. These advanced machines are meticulously engineered to handle a wide array of pet food formats, including granular dry kibble, moist wet food, delicate treats, and precise nutritional supplements, ensuring optimal product integrity, extended shelf life, and attractive presentation for the discerning pet owner. The technological spectrum of these machines is vast, encompassing everything from highly efficient vertical and horizontal form-fill-seal (FFS) systems that fabricate bags from a continuous roll of film to intricate, fully automated lines that integrate multihead weighers, precise filling mechanisms, robust sealing solutions, and automated palletizing functionalities, all designed for seamless high-volume production.

The primary and most significant application of pet food packing machines is found within sophisticated pet food manufacturing facilities, where the imperatives for high-speed operation, exceptional accuracy, and unwavering hygienic standards are paramount. These operational necessities are driven by the need to meet surging consumer demand while strictly adhering to a complex landscape of international food safety regulations and quality control benchmarks. The manifold benefits accrued from deploying state-of-the-art pet food packing machinery are substantial and far-reaching. They include drastically enhanced operational efficiency, which translates into significant reductions in labor costs and optimized resource utilization. Furthermore, they contribute to superior product quality through ultra-precise dosing, hermetic sealing that preserves freshness, and greater inherent flexibility to adapt to an evolving array of package sizes, shapes, and material compositions. Crucially, these machines play a pivotal role in maintaining stringent food safety protocols by minimizing direct human contact with the product and facilitating aseptic conditions where necessary, thereby safeguarding the health and well-being of companion animals worldwide.

Several formidable driving factors are consistently propelling the market's growth trajectory. A global surge in pet adoption rates, particularly pronounced in rapidly urbanizing and economically emerging regions, combines with a growing willingness among pet owners to invest substantially more in high-quality, nutritionally complete, and specialized pet food offerings. This 'premiumization' trend demands packaging that reflects the perceived value of the contents. Concurrently, the burgeoning e-commerce sector for pet supplies creates a compelling need for robust, protective, and aesthetically appealing packaging solutions that can withstand the rigors of transit and effectively capture consumer attention in a highly competitive online marketplace. Moreover, relentless advancements in packaging materials science, focusing on sustainability and barrier properties, alongside continuous innovations in automation and robotics technologies, are perpetually refining machine capabilities, offering pet food manufacturers improved environmental footprints, enhanced production versatility, and greater responsiveness to market shifts. The demand for flexible packaging formats like stand-up pouches and re-sealable bags also fuels innovation in machine design.

Pet Food Packing Machine Market Executive Summary

The pet food packing machine market is presently experiencing a period of dynamic and robust expansion, underpinned by several significant overarching business trends that are reshaping the industry landscape. Manufacturers within this sector are increasingly prioritizing the integration of advanced automation systems and sophisticated smart technologies, including the Internet of Things (IoT) and Artificial Intelligence (AI). This strategic shift is aimed at optimizing operational efficiency, substantially reducing unplanned downtime, and achieving significantly higher throughput rates to meet escalating global demand. A prominent trend also involves a strong movement towards more flexible packaging solutions and the adoption of sustainable packaging materials, a dual driver stemming from heightened consumer environmental consciousness and progressively stringent environmental regulations across various jurisdictions. The capability for extensive customization to accommodate diverse product types, packaging formats, and branding requirements is rapidly becoming a critical competitive differentiator, enabling pet food producers to effectively target lucrative niche markets and premium product segments.

From a comprehensive regional perspective, North America and Europe continue to represent mature and highly developed markets, characterized by an already high rate of adoption of sophisticated, fully automated packaging systems. These regions demonstrate a pronounced focus on sustainability initiatives, stringent quality assurance, and adherence to complex regulatory compliance frameworks. Consequently, the primary trend observed here is the continuous upgrading and modernization of existing machinery infrastructure to incorporate the very latest technological advancements, rather than purely new installations. In stark contrast, the Asia Pacific (APAC) region is unequivocally positioned as the fastest-growing market globally. This exponential growth is powerfully fueled by rapidly escalating rates of pet ownership, consistently rising disposable incomes among the populace, and the aggressive expansion strategies of both indigenous and international pet food brands entering these lucrative markets. Emerging economies within Latin America and the Middle East & Africa regions are also exhibiting substantial growth, albeit from a comparatively smaller installed base, driven by increasing urbanization, evolving consumer preferences, and the nascent development of local pet food manufacturing capabilities.

An in-depth analysis of market segmentation trends reveals that the dry pet food segment maintains its dominant position within the market. This sustained supremacy is attributed to the widespread consumption, convenience of storage, and longer shelf life associated with dry kibble, which consequently drives a high and consistent demand for large-capacity bagging, weighing, and form-fill-seal machines. However, it is crucial to note that the wet pet food and pet treats segments are demonstrating an accelerating growth trajectory. This accelerated expansion is stimulating significant innovation in specialized filling and sealing solutions, as well as inspiring the development of machinery capable of handling smaller, more intricately designed packaging formats that cater to perceived luxury and convenience. The level of automation employed remains a pivotal segmentation criterion, with fully automatic machines capturing a larger and expanding market share due to their superior efficiency, precision, and reduced labor requirements. Nevertheless, semi-automatic machines continue to play a vital role, particularly for smaller-scale producers, specialized batch runs, and markets with lower capital investment capacities, offering flexibility and accessibility.

AI Impact Analysis on Pet Food Packing Machine Market

The pervasive integration of Artificial Intelligence (AI) into the pet food packing machine market is fundamentally transforming traditional manufacturing paradigms, proactively addressing common user questions centered around efficiency optimization, predictive capabilities, and enhanced quality assurance. Users within the industry are increasingly eager to ascertain precisely how AI can deliver tangible reductions in operational costs, drastically minimize material waste, and significantly elevate the overall reliability and uptime of critical packaging lines. There is particularly acute interest in AI's profound role in facilitating true predictive maintenance, allowing for the anticipation and pre-emption of machine failures long before they can manifest, thereby preventing enormously costly production downtimes and subsequent revenue losses. Furthermore, inquiries frequently converge on AI's inherent capacity to intelligently optimize production parameters across a diverse spectrum of pet food types, ensuring unwavering product consistency, rapid adaptation to dynamically changing product specifications, and resilient responsiveness to fluctuations within the supply chain. The overarching and consistent theme emerging from user concerns and expectations is a clear and compelling desire for the development of smarter, increasingly autonomous, and supremely adaptable packaging operations that are fully equipped to meet the complex and continually evolving demands of a highly dynamic and competitive pet food market.

- Predictive maintenance and anomaly detection: AI algorithms analyze machine performance data to forecast potential equipment failures, enabling proactive maintenance and significantly minimizing unscheduled downtime, extending machine lifespan.

- Optimized production scheduling and resource allocation: AI systems can process vast amounts of data (e.g., demand forecasts, ingredient availability, machine status) to create highly efficient production schedules, optimize energy usage, and allocate resources more effectively.

- Advanced quality control through AI-powered vision systems: High-resolution cameras combined with AI identify packaging defects, incorrect labeling, foreign objects, or inconsistent product fill levels with unparalleled speed and accuracy, ensuring only flawless products reach consumers.

- Automated fault diagnosis and self-correction mechanisms: AI-driven diagnostics can pinpoint the root cause of operational issues quickly and, in some cases, initiate automatic adjustments or suggest corrective actions to operators, thereby reducing reliance on manual troubleshooting.

- Improved supply chain visibility and inventory management: AI tools integrate data across the supply chain, from raw material procurement to finished goods distribution, providing real-time insights for optimizing inventory levels, reducing spoilage, and enhancing logistics efficiency.

- Customization and flexibility in packaging formats: AI can analyze consumer trends and production capabilities to suggest optimal packaging designs or reconfigure machines for rapid changeovers, allowing manufacturers to respond swiftly to market demands for diverse and personalized pet food options.

DRO & Impact Forces Of Pet Food Packing Machine Market

The pet food packing machine market operates under the significant influence of a complex interplay of drivers, restraints, opportunities, and pervasive impact forces, each shaping its growth trajectory and strategic direction. Among the primary drivers, the most prominent is the consistent and expanding growth of the global pet population, coupled with the deeply entrenched and accelerating trend of pet humanization. This latter phenomenon leads directly to an increased willingness among pet owners to invest substantially more in premium, high-quality, and specialized pet nutrition, thereby stimulating demand for sophisticated and versatile packaging solutions. The escalating requirement for highly automated, efficient, and precise packaging lines to manage mass production volumes and diverse product SKUs further propels market expansion. Concurrently, the exponential growth of the e-commerce sector for pet products creates a compelling imperative for robust, protective, and visually appealing packaging, capable of withstanding the rigors of shipping and captivating online consumers, intensifying the demand for advanced machinery. Additionally, the proliferation of increasingly stringent food safety regulations and rigorous quality control standards, mandated by various governmental and industry bodies worldwide, compels pet food manufacturers to invest continuously in reliable, hygienic, and compliant packing machines that can meet and exceed these exacting requirements, reducing product recalls and ensuring consumer trust.

Despite these powerful drivers, the market faces several notable restraints that temper its growth. The most significant is the substantial initial capital investment required for acquiring state-of-the-art automated packaging machinery. This high upfront cost can serve as a considerable barrier to entry or expansion, particularly for smaller and emerging pet food producers operating with more limited budgets. Furthermore, the ongoing maintenance costs associated with these complex, high-tech machines, along with the critical need for a highly skilled technical workforce to operate, program, and service them, introduce additional financial and operational challenges. A core restraint also arises from the inherently fragmented nature of the pet food market itself, characterized by an immense variety of product types (e.g., kibble, wet, semi-moist, raw), diverse ingredients, and an ever-evolving landscape of packaging designs. This fragmentation necessitates a high degree of flexibility, adaptability, and customization in packaging machinery, which can invariably add layers of complexity and significantly increase the development and deployment costs of machine solutions. Moreover, global economic volatility, geopolitical tensions, and unpredictable supply chain disruptions can impact the timely availability of critical components and raw materials, leading to delays in machine manufacturing and delivery, thereby affecting market stability.

Conversely, significant opportunities for market expansion are continually emerging, offering fertile ground for innovation and strategic investment. Emerging economies, particularly in the Asia Pacific and Latin American regions, present substantial untapped potential as pet ownership rates surge and disposable incomes climb, leading to increased demand for locally produced and packaged pet food. A burgeoning opportunity also lies in the growing global emphasis on sustainable packaging materials and eco-friendly manufacturing processes. This trend is compelling machine manufacturers to innovate and offer advanced solutions that can efficiently handle recyclable, compostable, and reduced-plastic packaging formats, aligning with global environmental objectives and consumer preferences. The profound integration of Industry 4.0 technologies, including the Internet of Things (IoT), Artificial Intelligence (AI), advanced robotics, and cloud-based analytics, offers unprecedented avenues for creating highly intelligent, interconnected, and autonomous packaging lines. This integration promises unparalleled levels of operational efficiency, predictive insights, and data-driven decision-making. Furthermore, the increasing demand for specialized packaging tailored to niche pet segments—such as therapeutic diets for pets with specific health conditions, organic pet food, or age-specific formulations—provides lucrative opportunities for developing highly customized and specialized machinery solutions that cater to these specific market demands.

External impact forces exert a pervasive influence on the pet food packing machine market, necessitating continuous vigilance and strategic adaptation from industry stakeholders. Rapid technological advancements represent a constant force, driving innovation in machine design, efficiency, and capabilities, compelling manufacturers to continually upgrade their offerings to remain competitive. The dynamic evolution of consumer preferences, particularly towards convenience, transparency, and environmental responsibility, directly shapes packaging trends and, by extension, the demand for specific types of packing machinery. Changes in global trade policies, tariffs, and international relations can significantly impact the cost of raw materials, component sourcing, and the overall competitiveness of manufacturers operating across borders. Macroeconomic conditions, such as economic downturns or periods of prosperity, directly influence consumer spending on pets, which in turn affects the investment capacity and expansion plans of pet food producers, thereby indirectly impacting the demand for packaging machines. The intensely competitive landscape, characterized by the presence of both large multinational conglomerates and specialized regional manufacturers, continually fosters innovation, drives pricing strategies, and influences market share dynamics. Lastly, unforeseen global events, such as health crises or pandemics, can severely disrupt manufacturing operations, supply chains, and market stability, necessitating resilient business strategies.

Segmentation Analysis

The pet food packing machine market is meticulously segmented to provide a granular and comprehensive understanding of the diverse requirements and opportunities prevalent across the global industry. These critical segments typically categorize the market based on fundamental attributes such as the specific machine type, the precise form or type of pet food being packaged, the level of automation incorporated into the machinery, and the operational capacity or throughput of the systems. This detailed analytical approach is indispensable for illuminating underlying market dynamics, pinpointing specific areas of robust demand, and identifying emerging technological advancements within the sector. Such a granular understanding of segmentations offers substantial benefits to multiple stakeholders: it empowers machine manufacturers in their research and development efforts, guiding the creation of innovative and targeted product offerings; simultaneously, it assists pet food producers in making informed strategic decisions, enabling them to select the most appropriate, efficient, and cost-effective packaging solutions that align perfectly with their unique operational scale, production volumes, and extensive product portfolio. The ability to cater to niche requirements within each segment is increasingly becoming a competitive advantage.

- By Type: This segment differentiates machines based on their primary function and design.

- Form-Fill-Seal (FFS) Machines: Highly versatile machines that form bags from a roll of film, fill them with product, and then seal them. Widely used for dry pet food, offering high speed and efficiency.

- Bagging Machines: Designed specifically for filling and sealing pre-made bags or forming bags from a roll. Essential for various dry pet food and treat packaging.

- Weighing & Dosing Machines: Critical for accurate measurement of pet food, ensuring consistent product quantity and minimizing waste. Includes multihead weighers and linear weighers.

- Capping & Sealing Machines: Used primarily for wet pet food in cans or pouches, and for bottles of pet supplements, ensuring hermetic sealing and product preservation.

- Palletizing Machines: Automate the stacking of packaged products onto pallets for efficient storage and transport, crucial for high-volume operations.

- Wrapping Machines: Apply film or other materials around primary or secondary packaging for protection, bundling, or aesthetic appeal.

- Labeling Machines: Automatically apply labels to packages, providing essential product information, branding, and regulatory details.

- By Application: This segmentation highlights the specific categories of pet food products these machines are designed to handle.

- Dry Pet Food: Predominantly kibble and dry treats, requiring robust bagging, FFS, and weighing solutions.

- Wet Pet Food: Canned, pouched, or tray-packed wet food, demanding precise filling, sealing, and sterilization-compatible machinery.

- Pet Treats: A diverse category, often requiring flexible solutions for various shapes, textures, and packaging types.

- Pet Supplements: Often granular, liquid, or pill-form, requiring precise dosing and secure bottling/pouching.

- By Automation Level: This segment distinguishes machines based on human intervention required.

- Semi-Automatic: Requires significant manual input for operations like loading, monitoring, or sealing. Suitable for smaller producers or specialized batches.

- Automatic: Performs tasks with minimal human intervention, offering high speed, precision, and efficiency, ideal for large-scale operations.

- By Capacity: Categorizes machines by their output capabilities per unit of time.

- Low (Up to 30 bags/min): Suited for small-to-medium enterprises or specialized product lines.

- Medium (30-60 bags/min): Caters to a broad range of medium-sized pet food manufacturers.

- High (Above 60 bags/min): Designed for large-scale production facilities and multinational corporations with massive output requirements.

Value Chain Analysis For Pet Food Packing Machine Market

The value chain for the pet food packing machine market is a meticulously orchestrated sequence of activities that commences with intricate upstream processes involving the procurement of raw materials and highly specialized components. This foundational stage encompasses sourcing a broad array of elements, including robust metals and alloys for structural integrity, precision-engineered mechanical parts for movement and functionality, advanced electronic control systems for operational intelligence, sophisticated programmable logic controllers (PLCs) for automation, high-precision sensors for monitoring, and increasingly, complex robotic components for specialized tasks. Key suppliers at this crucial upstream juncture are typically specialized manufacturers of industrial-grade components, leading automation technology providers, and innovators in materials science. The intrinsic quality, consistent availability, and cost-effectiveness of these foundational components directly and profoundly dictate the ultimate performance, long-term reliability, and economic viability of the final pet food packing machines. Continuous innovation originating at this initial stage, for instance, advancements in energy-efficient motor designs or enhanced sensor accuracy, holds the potential to significantly augment the capabilities and appeal of the downstream machinery.

Moving further along this critical value chain, specialized machine manufacturers undertake the complex process of assembling these diverse components into fully functional, integrated pet food packing solutions. This manufacturing phase is characterized by intensive research and development (R&D) efforts, where design engineers focus on creating machines that are not only supremely efficient and hygienic but also remarkably versatile and fully compliant with the ever-evolving array of industry standards and certifications. Post-manufacturing, the sophisticated machines embark on their journey through various distribution channels to reach their eventual end-users. Distribution can often be direct, particularly for large-scale multinational pet food corporations, where machine manufacturers establish close, direct relationships with clients, offering bespoke solutions, comprehensive after-sales service, and technical support. This direct model fosters strong partnerships and facilitates tailored machinery installations. Conversely, indirect channels are also prevalent, involving a network of specialized distributors, knowledgeable agents, and expert system integrators. These intermediaries play a vital role in providing sales, installation services, and crucial after-sales support, particularly catering to smaller and medium-sized pet food manufacturers or in geographical regions where a direct manufacturing presence is economically less feasible or strategically impractical, ensuring broader market reach.

The downstream activities represent the culmination of the value chain, primarily centered around the pet food manufacturers, who are the ultimate and most significant end-users and beneficiaries of these advanced packing machines. This diverse segment includes powerful multinational pet food conglomerates, agile regional producers, and innovative niche or artisanal brands, all of whom share a common imperative: the need for supremely efficient and reliable packaging solutions to effectively bring their diverse product lines to market. These machines empower manufacturers to package dry kibble, various forms of wet food, an array of pet treats, and precise pet supplements with exceptional efficacy, thereby safeguarding product quality, extending shelf life, and ensuring strict adherence to intricate regulatory compliance across different markets. Consequently, the prosperity and continued growth of the pet food packing machine market are inextricably linked to the robust growth, dynamic trends, and overall health of the global pet food industry. Any upward trajectory in demand for pet food inevitably translates into a corresponding increase in demand for advanced packaging machinery. Furthermore, consistent and actionable feedback gathered directly from these end-users is absolutely vital for machine manufacturers, serving as an invaluable catalyst for continuous innovation, product refinement, and strategic adaptation of their offerings to meet the perpetually evolving demands and specific challenges faced by the pet food production sector.

Pet Food Packing Machine Market Potential Customers

The primary potential customers and definitive end-users of pet food packing machines constitute a diverse and expansive ecosystem within the global pet food production landscape, each with distinct needs and operational scales. At the pinnacle of this customer spectrum are the colossal multinational pet food manufacturers. These industry giants, characterized by their extensive global distribution networks and vast product portfolios, demand cutting-edge, high-capacity, fully automated, and seamlessly integrated packaging lines. Their requirements are driven by the imperative to meet colossal global consumer demand, necessitating solutions that offer unparalleled scalability, maximum operational efficiency, unwavering reliability, and robust capabilities for handling an immense variety of packaging formats, sizes, and materials, including a growing emphasis on sustainable options to meet corporate environmental goals and consumer expectations.

Beyond the behemoths, a substantial and growing customer base consists of regional and local pet food producers. These businesses, often more agile and specialized, typically operate at medium to smaller scales, focusing on specific geographical markets, unique ingredient formulations, or niche dietary requirements for pets. Their demand often gravitates towards more flexible, modular, or semi-automatic packaging solutions that can be readily adapted to accommodate shorter production runs, specialized ingredient batches, or particular local market aesthetic preferences. For these producers, the decision-making process for machinery procurement is heavily influenced by a critical balance between the initial capital investment cost and the resultant operational efficiency, alongside key considerations such as ease of maintenance, availability of local technical support, and the capability for quick product changeovers to maintain market responsiveness.

Furthermore, an increasingly significant customer segment comprises contract packaging companies and co-packers who specialize in providing outsourced packaging services specifically for the pet food industry. These firms typically manage packaging for multiple brands, ranging from startups to established companies, necessitating highly versatile and adaptable machinery. Their equipment must possess the capability to swiftly switch between an extensive array of product types, diverse bag sizes, varying fill weights, and distinct branding requirements with minimal downtime. The demand from this segment is robustly fueled by the broader trend of outsourcing within the pet food industry, as many brands strategically seek to mitigate significant capital expenditure on internal packaging infrastructure, thereby allowing them to channel resources more intently towards core competencies such as product development, innovative ingredient sourcing, and aggressive marketing and brand building efforts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 495 Million |

| Market Forecast in 2032 | USD 785 Million |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Syntegon Technology GmbH (formerly Bosch Packaging Technology), Focke & Co., Krones AG, Sacmi, PFM Packaging Machinery S.p.A., Ishida Co. Ltd., GEA Group AG, tna solutions Pty Ltd., Ossid (part of Pro Mach), Barry-Wehmiller Companies Inc., Cama Group, Arpac (part of Pro Mach), Fuji Machinery Co., Ltd., Mettler-Toledo International Inc., Yamato Scale Co., Ltd., Premier Tech, Combi Packaging Systems LLC, Viking Masek Global Packaging Technologies, Paxiom Group, Concetti S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Food Packing Machine Market Key Technology Landscape

The pet food packing machine market is defined by a highly dynamic and continuously evolving technology landscape, consistently integrating groundbreaking advancements to achieve unprecedented levels of efficiency, operational flexibility, and paramount product integrity. A foundational technological pillar anchoring this evolution is the pervasive application of advanced automation, meticulously driven by sophisticated Programmable Logic Controllers (PLCs) and intuitive Human-Machine Interfaces (HMIs). These cutting-edge systems facilitate incredibly precise control over every minute packaging parameter, enabling rapid and seamless changeovers between different product lines, and robust recipe management capabilities for an extensive array of pet food products. Furthermore, robotic systems are increasingly being deployed across various stages of the packaging line for tasks such as intricate pick-and-place operations, high-speed automated palletizing, and efficient case packing. This widespread adoption of robotics is instrumental in significantly reducing manual labor dependency, dramatically improving throughput rates, and simultaneously minimizing the risk of product damage during handling, thereby enhancing overall operational safety and consistency.

The advent and pervasive adoption of Industry 4.0 paradigms have profoundly transformed this sector, most notably through the widespread implementation of the Internet of Things (IoT). IoT sensors, meticulously embedded throughout pet food packing machines, facilitate continuous, real-time monitoring of critical operational performance metrics, granular energy consumption patterns, and crucial predictive maintenance indicators. This pervasive connectivity enables the collection and rigorous analysis of vast datasets, which, when intelligently coupled with advanced Artificial Intelligence (AI) and sophisticated machine learning algorithms, empowers manufacturers to achieve unparalleled optimization of production schedules, facilitate the early and proactive detection of potential mechanical failures, and implement significantly enhanced quality control protocols through integrated vision systems. These cutting-edge vision systems leverage high-resolution cameras in conjunction with AI-driven analytics to meticulously detect even the minutest defects in packaging materials, identify any foreign objects, or flag incorrect labeling with exceptional speed and precision, thereby ensuring that only perfectly packaged products ultimately reach the discerning market and consumer.

Beyond automation and smart connectivity, there is an incredibly strong and growing emphasis within the industry on developing and deploying packing machines that are fully compatible with an expanding array of sustainable packaging materials. This includes innovative recyclable films, fully compostable pouches, and solutions engineered to drastically reduce overall plastic content. This imperative necessitates continuous innovations in advanced sealing technologies, precise material handling mechanisms, and adaptive machine designs to ensure robust package integrity and reliable performance with these newer, often more delicate, and environmentally conscious materials. The rising demand for flexible packaging solutions, such as ergonomically designed stand-up pouches and convenient re-sealable bags, also consistently drives technological advancements, requiring machines capable of handling complex multi-layer film structures at consistently high speeds without compromising package quality. Moreover, sophisticated traceability systems, encompassing advanced RFID (Radio-Frequency Identification) technology and high-speed barcode readers, are rapidly becoming standard features. These systems are indispensable for ensuring product authenticity, facilitating efficient recall management if necessary, and guaranteeing stringent compliance with an intricate web of regulatory requirements throughout the entire supply chain, from raw material to final point of sale, fostering complete transparency and consumer trust.

Regional Highlights

- North America: This region stands as a mature and highly developed market, distinguished by its exceptionally high adoption rate of fully automated and technologically advanced packaging solutions within the pet food sector. The market here significantly benefits from substantial investments in research and development, a robust and consistently high consumer demand for premium and specialized pet food products, and the presence of exceptionally stringent food safety regulations. A key focus for manufacturers in North America is on achieving superior energy efficiency, embracing comprehensive sustainability initiatives, and seamlessly integrating smart factory concepts, including IoT and AI. The strong presence of major multinational pet food manufacturers and a well-established industrial infrastructure collectively drive continuous technological upgrades, fostering sustained innovation and maintaining a competitive edge.

- Europe: Echoing many characteristics of the North American market, Europe is a highly established and sophisticated market. It demonstrates an equally strong, if not more pronounced, emphasis on advanced automation, comprehensive sustainability practices, and rigorous adherence to the stringent European Union food safety and environmental protection standards. This region is a global leader in the development of pioneering eco-friendly packaging solutions and cutting-edge machinery designed to flawlessly handle a highly diverse range of innovative and sustainable packaging formats. The deeply ingrained trends of pet humanization, coupled with a generally high disposable income across many European nations, contribute significantly to a consistent and resilient demand for highly sophisticated pet food packing machinery, often pushing the boundaries of technological capability.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, the APAC region is experiencing unparalleled expansion, primarily driven by an exponentially burgeoning pet population, rapidly rising disposable incomes across its vast consumer base, and the accelerating pace of urbanization in key countries such as China, India, Japan, and various Southeast Asian nations. This dynamic region presents immense and diverse opportunities for both the installation of entirely new packaging lines and the strategic upgrading of existing infrastructure. There is an increasing demand for both cost-effective semi-automatic solutions, catering to the rapid growth of emerging local pet food brands, and high-end, fully automated systems, sought after by international players aggressively expanding their manufacturing and distribution footprints within these lucrative markets.

- Latin America: This is an emerging market that is experiencing substantial and accelerating growth, propelled by a confluence of factors including increasing rates of pet ownership, evolving lifestyle patterns influenced by urbanization, and the significant expansion of modern retail infrastructure. Key countries such as Brazil, Mexico, Argentina, and Chile are pivotal contributors to this market expansion, demonstrating a growing demand for packaging solutions that offer a compelling balance between cost-effectiveness and high operational efficiency. The region is witnessing a noticeable uptick in investments directed towards establishing and modernizing pet food production facilities, thereby creating fertile ground and considerable opportunities for both local and international packaging machinery manufacturers.

- Middle East and Africa (MEA): Representing a developing market, the MEA region is exhibiting steady and encouraging growth, largely influenced by rising urbanization, the increasing Westernization of consumer lifestyles, and a gradual but accelerating awareness of comprehensive pet care needs. While currently possessing a smaller overall market share compared to more mature regions, the MEA offers substantial untapped potential, particularly in countries with rapidly growing economies and an expanding middle class. Demand for pet food packing machines is anticipated to rise significantly as local pet food production capacities increase to cater to evolving consumer preferences and reduce reliance on imported pet food, driving the need for domestic packaging infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Food Packing Machine Market.- Syntegon Technology GmbH (formerly Bosch Packaging Technology)

- Focke & Co.

- Krones AG

- Sacmi

- PFM Packaging Machinery S.p.A.

- Ishida Co. Ltd.

- GEA Group AG

- tna solutions Pty Ltd.

- Ossid (part of Pro Mach)

- Barry-Wehmiller Companies Inc.

- Cama Group

- Arpac (part of Pro Mach)

- Fuji Machinery Co., Ltd.

- Mettler-Toledo International Inc.

- Yamato Scale Co., Ltd.

- Premier Tech

- Combi Packaging Systems LLC

- Viking Masek Global Packaging Technologies

- Paxiom Group

- Concetti S.p.A.

Frequently Asked Questions

What factors are primarily driving the growth of the pet food packing machine market globally?

The market's growth is predominantly propelled by several interconnected factors: a worldwide surge in pet humanization and overall pet ownership rates, the escalating consumer demand for an increasingly diverse array of premium and specialized pet food products, the explosive expansion of the e-commerce sector which necessitates robust and secure packaging for online sales, and the persistent industry-wide drive for advanced automation to significantly enhance operational efficiency and strictly comply with evolving food safety regulations across various jurisdictions.

How does the adoption of automation fundamentally impact pet food packaging operations and overall productivity?

Automation profoundly transforms pet food packaging operations by delivering substantial improvements in efficiency, drastically reducing labor costs, ensuring superior packaging accuracy and consistency, accelerating production speeds, maintaining impeccable product quality, and minimizing material waste. Furthermore, it facilitates seamless integration with other upstream and downstream production processes and is instrumental in adhering to stringent hygienic standards, which is absolutely critical for safeguarding pet food safety and preventing contamination risks.

What are the most significant technological trends currently shaping the pet food packing machine market landscape?

Key technological trends that are fundamentally reshaping this market include the comprehensive integration of Industry 4.0 paradigms, such as the Internet of Things (IoT) and Artificial Intelligence (AI) for predictive maintenance and real-time operational monitoring. Also prominent are the increasing deployment of advanced robotics for precision handling, sophisticated vision systems for meticulous quality control, and a strong push towards developing innovative machines that are fully compatible with an expanding array of sustainable and flexible packaging materials to meet evolving environmental demands and consumer preferences for eco-friendly solutions.

Which geographical region is currently projected to exhibit the most substantial growth opportunities in this market?

The Asia Pacific (APAC) region is unequivocally projected to demonstrate the most significant and dynamic growth. This impressive surge is primarily attributed to rapid urbanization trends across major economies, consistently rising disposable incomes among a growing middle class, a continuously expanding pet population base, and the aggressive expansion strategies of both indigenous and multinational pet food brands in key countries such as China, India, and various nations within Southeast Asia, leading to widespread investment in new packaging infrastructure.

What are the principal challenges that pet food packing machine manufacturers currently encounter in this market?

Manufacturers in this market face several significant challenges: the substantial initial capital investment required for advanced automated machinery, the ongoing high costs associated with maintenance and spare parts, the critical need for a highly specialized and technically proficient workforce, the inherent complexities arising from the immense diversity of pet food products and packaging formats, and the potential for disruptions within global supply chains that can impact the timely availability of essential components and raw materials for machine construction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager