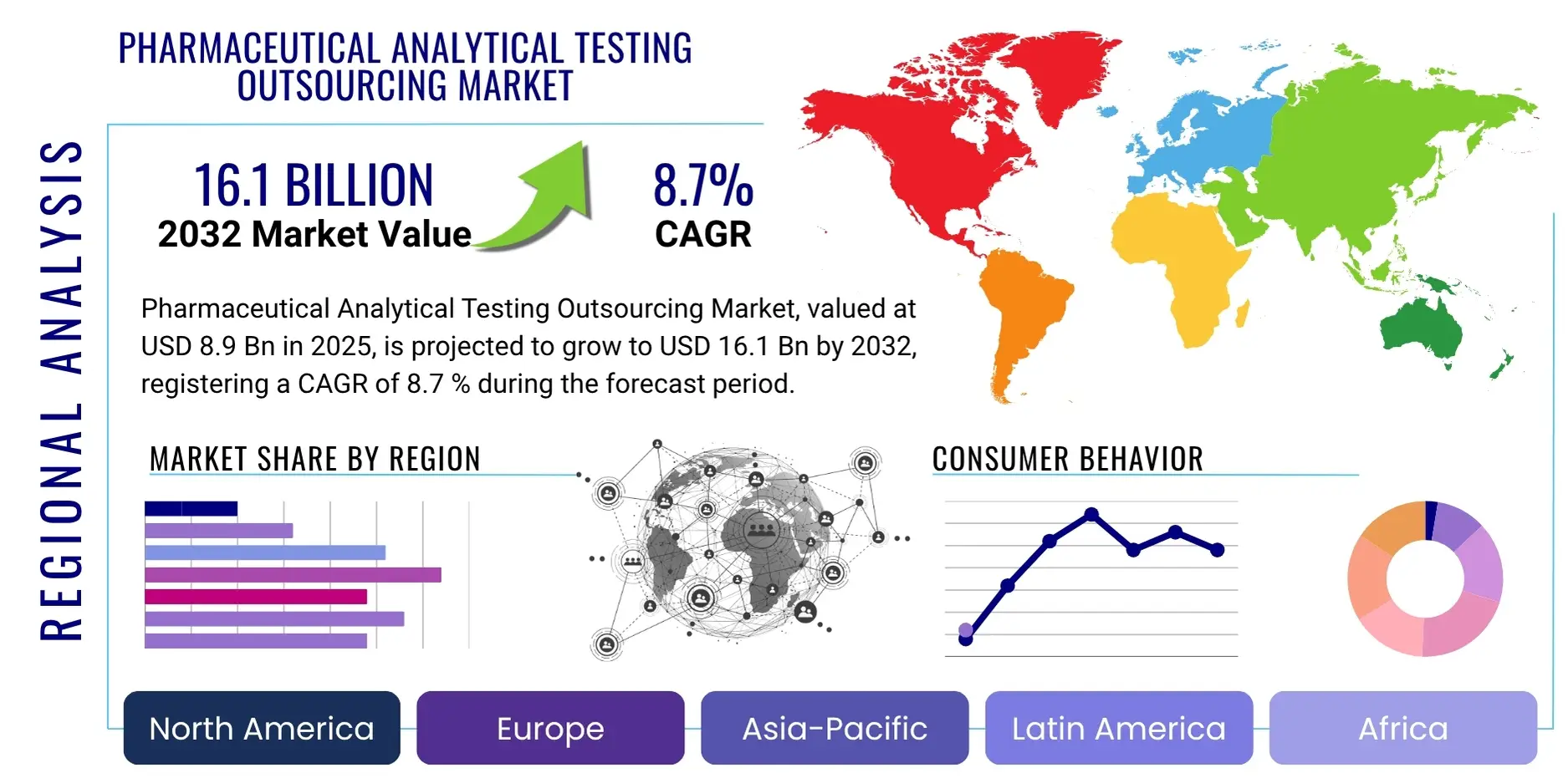

Pharmaceutical Analytical Testing Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428134 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Pharmaceutical Analytical Testing Outsourcing Market Size

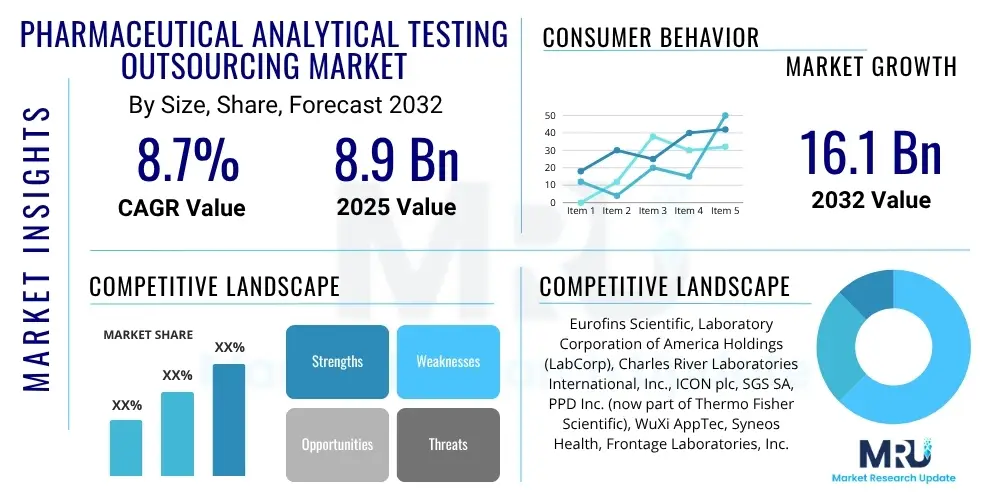

The Pharmaceutical Analytical Testing Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2032. The market is estimated at USD 8.9 Billion in 2025 and is projected to reach USD 16.1 Billion by the end of the forecast period in 2032.

Pharmaceutical Analytical Testing Outsourcing Market introduction

The Pharmaceutical Analytical Testing Outsourcing Market encompasses the provision of specialized analytical services by third-party contract research organizations (CROs) or contract development and manufacturing organizations (CDMOs) to pharmaceutical and biopharmaceutical companies. These services are crucial across all stages of drug development, from discovery and preclinical research to clinical trials and commercial manufacturing, ensuring product quality, safety, and efficacy. The scope includes a wide array of tests, such as physicochemical characterization, bioanalytical testing, stability studies, impurity profiling, and microbiological analysis, all performed under stringent regulatory guidelines.

The primary benefit of outsourcing these critical analytical functions lies in the ability of pharmaceutical companies to access advanced technologies, specialized expertise, and scalable resources without significant capital investment in infrastructure or personnel. This strategic approach enables companies to streamline their R&D processes, accelerate time-to-market for new drugs, and focus internal resources on core competencies. Outsourcing also helps mitigate operational costs, provides flexibility in managing fluctuating workloads, and ensures compliance with evolving global regulatory standards, which are becoming increasingly complex.

Several driving factors propel the growth of this market. A surge in R&D spending by pharmaceutical and biotechnology companies, particularly in areas like biologics and gene therapies, generates a greater demand for sophisticated analytical support. The increasing complexity of drug molecules and the stringent regulatory environment requiring comprehensive data for drug approval further necessitate specialized testing services. Moreover, the growing trend of pharmaceutical companies focusing on core competencies and divesting non-core activities continues to fuel the adoption of outsourcing models for analytical testing, recognizing the value added by specialized external partners.

Pharmaceutical Analytical Testing Outsourcing Market Executive Summary

The Pharmaceutical Analytical Testing Outsourcing Market is experiencing robust expansion, driven by several overarching business trends. Pharmaceutical and biopharmaceutical companies are increasingly adopting outsourcing strategies to enhance operational efficiency, reduce costs, and accelerate drug development timelines. This shift is particularly evident in the biologics and biosimilars sector, where complex analytical techniques are often required, necessitating access to specialized external expertise and cutting-edge instrumentation. The rising prevalence of chronic diseases and the subsequent increase in new drug approvals further contribute to the demand for comprehensive analytical testing throughout the drug lifecycle, from early-stage development to post-market surveillance. Moreover, the globalization of drug development and manufacturing means that outsourcing partners capable of navigating diverse regulatory landscapes and providing services across multiple regions are highly valued, indicating a move towards more integrated and globalized outsourcing relationships.

Regional trends highlight significant growth opportunities across various geographies. North America and Europe continue to dominate the market due to the presence of a large number of established pharmaceutical companies, robust R&D investments, and stringent regulatory frameworks that mandate extensive analytical testing. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by increasing healthcare expenditure, a growing pool of skilled scientific professionals, lower operating costs, and supportive government initiatives promoting biopharmaceutical manufacturing and research. Latin America, the Middle East, and Africa are also witnessing gradual growth, driven by expanding healthcare infrastructure and rising demand for pharmaceutical products, leading to increased investment in drug development activities.

Segmentation trends reveal significant insights into market dynamics. By service type, bioanalytical testing and method development & validation segments are expected to show accelerated growth, reflecting the increasing complexity of new drug modalities and the critical need for precise analytical methods. The end-use segment is primarily driven by pharmaceutical and biopharmaceutical companies, while contract research organizations (CROs) and contract manufacturing organizations (CMOs) also represent substantial portions of demand, often collaborating with specialized analytical testing providers. Furthermore, the market is segmented by drug type, encompassing both small molecules and large molecules, with large molecules (biologics) exhibiting a higher growth trajectory due to their intricate nature requiring sophisticated analytical characterization. The phase of development also delineates market demand, with preclinical and clinical phase testing dominating the outsourcing landscape, essential for regulatory submissions and product launch.

AI Impact Analysis on Pharmaceutical Analytical Testing Outsourcing Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Pharmaceutical Analytical Testing Outsourcing Market often revolve around how AI can enhance efficiency, reduce costs, improve data accuracy, and potentially redefine the role of human analysts. Users frequently inquire about AI's capabilities in areas such as predictive analytics for stability studies, automated impurity detection, optimized experimental design, and accelerated data interpretation from complex analytical techniques like mass spectrometry and chromatography. There is also significant interest in AI's role in quality control and assurance, particularly concerning its ability to identify anomalies and ensure compliance, along with concerns about data security, validation of AI algorithms in a regulated environment, and the need for new skill sets among outsourcing providers. Users seek to understand if AI will lead to job displacement or job evolution, emphasizing the desire for increased throughput and reliability in analytical services while maintaining human oversight.

- Enhanced Data Interpretation and Pattern Recognition: AI algorithms can swiftly process vast datasets generated by analytical instruments, identifying subtle patterns, anomalies, and correlations that human analysts might overlook, leading to faster and more accurate conclusions in areas like impurity profiling, metabolomics, and proteomics. This capability significantly streamlines the review process for complex analytical results.

- Predictive Modeling for Stability and Formulation: AI can leverage historical data to predict drug product stability under various conditions and optimize formulation parameters. This allows outsourcing providers to offer more efficient stability testing programs, reducing the number of costly, long-duration experiments and accelerating product development timelines.

- Automation and Robotics Integration: The integration of AI with laboratory automation and robotics can lead to fully automated analytical workflows, from sample preparation to data acquisition and preliminary analysis. This reduces manual errors, increases throughput, and allows human experts to focus on complex problem-solving and strategic insights rather than repetitive tasks, boosting overall laboratory efficiency.

- Improved Quality Control and Assurance: AI-powered systems can continuously monitor analytical processes, detect deviations from specifications in real-time, and flag potential quality issues before they escalate. This proactive approach to quality control minimizes batch failures, ensures regulatory compliance, and enhances the reliability of outsourced analytical data, building greater trust in service providers.

- Optimized Experimental Design and Method Development: AI can assist in designing more efficient and robust analytical experiments by simulating various conditions and predicting optimal parameters for method development and validation. This reduces the number of iterations required, saving time and resources in developing new analytical methods for novel drug entities and complex matrices.

- Regulatory Compliance and Documentation: AI can aid in generating comprehensive documentation and ensuring adherence to regulatory guidelines by automating data logging, audit trail generation, and report writing. This reduces the administrative burden associated with compliance and helps outsourcing partners maintain meticulous records required for regulatory submissions, streamlining the approval process.

- Personalized Medicine Support: For precision and personalized medicine, AI can analyze complex biological samples with high dimensionality, helping to identify biomarkers and predict patient responses. This opens new avenues for specialized analytical testing outsourcing that caters to the unique demands of individualized therapies, requiring advanced data processing and interpretation capabilities.

- Resource Optimization and Forecasting: AI can optimize resource allocation within analytical laboratories by forecasting demand for specific tests, scheduling equipment maintenance, and managing inventory. This leads to more efficient operations, reduced downtime, and improved turnaround times for clients, making outsourcing services more competitive and reliable.

DRO & Impact Forces Of Pharmaceutical Analytical Testing Outsourcing Market

The Pharmaceutical Analytical Testing Outsourcing Market is significantly influenced by a confluence of drivers, restraints, and opportunities, collectively forming its impact forces. One primary driver is the relentless increase in research and development (R&D) expenditure by pharmaceutical and biotechnology companies globally. As the drug pipeline expands, especially with complex biologics, gene therapies, and biosimilars, the demand for specialized analytical services for characterization, stability, and quality control escalates. Companies are increasingly recognizing the cost-effectiveness and expertise offered by outsourcing partners, enabling them to focus internal resources on core drug discovery and clinical development activities. Furthermore, the burgeoning need to comply with stringent and ever-evolving global regulatory requirements, such as those set by the FDA, EMA, and other agencies, necessitates meticulous analytical testing, often beyond the scope of in-house capabilities, thus propelling outsourcing adoption.

However, the market also faces notable restraints. Concerns regarding intellectual property (IP) protection and data confidentiality remain a significant hurdle for many pharmaceutical companies considering outsourcing sensitive analytical work. Ensuring the security of proprietary information when collaborating with third-party providers requires robust contractual agreements and trust, which can sometimes be perceived as a risk. Additionally, the challenge of maintaining consistent quality standards across different outsourcing partners and managing the complexity of diverse regulatory frameworks across various geographical locations can be daunting. The intricate nature of coordinating projects with external vendors, coupled with potential communication gaps, may sometimes lead to delays or inefficiencies, posing a restraint on further market expansion for certain companies.

Despite these challenges, substantial opportunities exist within the market, driven by technological advancements and emerging therapeutic areas. The growing adoption of advanced analytical techniques, such as high-resolution mass spectrometry, nuclear magnetic resonance (NMR), and advanced chromatographic methods, creates niches for specialized outsourcing providers who can invest in and master these cutting-edge technologies. The increasing focus on personalized medicine and companion diagnostics also presents new analytical testing requirements, opening up novel service offerings. Furthermore, the expansion into emerging markets, particularly in Asia Pacific, Latin America, and the Middle East, offers significant growth potential as these regions invest more in healthcare infrastructure and pharmaceutical manufacturing. Partnerships and strategic alliances between large pharmaceutical companies and specialized analytical CROs are also emerging as a key opportunity to leverage expertise and resources efficiently, fostering innovation and market penetration.

Segmentation Analysis

The Pharmaceutical Analytical Testing Outsourcing Market is strategically segmented to provide a detailed understanding of its diverse components, offering insights into varying service demands, end-user needs, and product types. This comprehensive segmentation allows market participants to identify key growth areas, tailor their service offerings, and optimize market penetration strategies. The primary segmentation dimensions include service type, drug type, end-use, and phase of development, each revealing distinct market dynamics and growth drivers. Understanding these segments is crucial for both outsourcing providers seeking to specialize and pharmaceutical companies looking for optimal partners to fulfill their specific analytical testing requirements, ranging from early-stage research to commercial product release.

- By Service Type:

- Bioanalytical Testing:

- Pharmacokinetics (PK)

- Pharmacodynamics (PD)

- Immunogenicity Testing

- Biomarker Analysis

- Cell-based Assays

- Method Development & Validation:

- Analytical Method Development

- Method Validation (ICH guidelines)

- Method Transfer

- Stability Testing:

- Accelerated Stability

- Long-term Stability

- Photostability

- Forced Degradation Studies

- Raw Material Testing

- Microbiological Testing:

- Sterility Testing

- Endotoxin Testing

- Microbial Limit Testing

- Bioburden Testing

- Extractables & Leachables Testing

- Impurity Profiling & Characterization

- Quality Control (QC) Testing

- Physical Characterization

- Others (e.g., Dissolution Testing, Release Testing)

- Bioanalytical Testing:

- By Drug Type:

- Small Molecules

- Large Molecules (Biologics)

- Monoclonal Antibodies

- Recombinant Proteins

- Vaccines

- Gene and Cell Therapies

- By End-Use:

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Contract Manufacturing Organizations (CMOs)

- Academic & Research Institutes

- By Phase of Development:

- Discovery & Preclinical Phase

- Clinical Phase I

- Clinical Phase II

- Clinical Phase III

- Commercial & Post-Approval Phase

Value Chain Analysis For Pharmaceutical Analytical Testing Outsourcing Market

The value chain for the Pharmaceutical Analytical Testing Outsourcing Market involves a complex interplay of various stakeholders, starting from raw material suppliers to the ultimate end-users. At the upstream end, key players include suppliers of analytical instruments, reagents, consumables, and specialized software that are essential for conducting sophisticated tests. These suppliers provide the foundational tools and materials without which outsourced analytical services cannot be performed efficiently or effectively. The quality and availability of these upstream components directly impact the capabilities and turnaround times of analytical testing providers. Furthermore, technology developers who create novel analytical platforms and AI-driven data analysis tools also constitute a crucial upstream component, continuously pushing the boundaries of what is possible in drug analysis.

In the midstream of the value chain are the core analytical testing outsourcing providers themselves, encompassing specialized contract research organizations (CROs), contract development and manufacturing organizations (CDMOs) with analytical capabilities, and independent analytical testing laboratories. These entities are responsible for acquiring, maintaining, and operating the advanced equipment, employing highly skilled scientific personnel, and developing robust quality management systems. Their primary function is to perform a wide range of analytical services, from bioanalytical testing to method validation and stability studies, under strict regulatory compliance. These providers serve as the vital link between the drug developers' needs and the complex technical execution of analytical requirements, often acting as strategic partners rather than mere service providers, offering expert consultation and interpretation of results.

The downstream segment of the value chain primarily consists of the end-users of these services, predominantly pharmaceutical companies, biotechnology companies, and increasingly, smaller virtual pharma firms. These clients receive the analytical data, reports, and certifications, which are critical for their drug development programs, regulatory submissions, and commercial release activities. The distribution channel for these services is largely direct, involving contractual agreements and project management between the outsourcing provider and the client. Indirect channels may exist through larger CROs or CDMOs that subcontract specialized analytical tasks to smaller, niche providers, but the direct client-provider relationship remains paramount. Effective communication, data security, and timely delivery of results are crucial at this stage to ensure the successful progression of drug candidates through the development pipeline and eventual market approval, solidifying the importance of a well-integrated and transparent value chain.

Pharmaceutical Analytical Testing Outsourcing Market Potential Customers

The potential customers for the Pharmaceutical Analytical Testing Outsourcing Market are predominantly organizations engaged in the discovery, development, and manufacturing of pharmaceutical and biopharmaceutical products. At the forefront are large pharmaceutical and biopharmaceutical companies that frequently outsource analytical testing to manage fluctuating workloads, access specialized expertise, and optimize their operational expenditures. These companies, with extensive drug pipelines and global operations, require consistent, high-quality analytical support across various therapeutic areas and development phases. They leverage outsourcing to gain flexibility, accelerate project timelines, and ensure compliance with diverse international regulatory standards, making external analytical partners an integral part of their R&D and manufacturing ecosystems. The increasing complexity of new drug modalities, such as gene and cell therapies, further drives these large players to seek external specialized capabilities.

Mid-sized pharmaceutical and biotechnology companies represent another significant segment of potential customers. These companies often have more limited in-house analytical capabilities and capital resources compared to their larger counterparts. Outsourcing allows them to access state-of-the-art analytical technologies and a broader range of scientific expertise without the prohibitive costs of acquiring and maintaining such infrastructure internally. For many mid-sized players, external analytical testing providers are essential for navigating the intricate regulatory landscape and progressing their drug candidates efficiently through preclinical and clinical development, thereby leveling the playing field with larger competitors. They rely on outsourcing to validate their drug products, ensuring safety and efficacy while managing their budget effectively and focusing their internal teams on core innovation.

Furthermore, emerging biotech startups and virtual pharmaceutical companies form a rapidly growing customer base. These agile entities often operate with lean internal teams and rely heavily on external partners for nearly all aspects of drug development, including comprehensive analytical testing. Outsourcing analytical services is not merely a convenience but a strategic imperative for them, enabling them to bring innovative therapies from concept to clinic without significant upfront investment in laboratory infrastructure or extensive scientific staff. Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) also frequently act as customers, particularly when they need to supplement their own analytical capabilities or require specialized testing that falls outside their core competencies. Academic and government research institutions, while smaller in volume, also utilize these services for specialized research projects, ensuring broad demand across the pharmaceutical R&D spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 8.9 Billion |

| Market Forecast in 2032 | USD 16.1 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eurofins Scientific, Laboratory Corporation of America Holdings (LabCorp), Charles River Laboratories International, Inc., ICON plc, SGS SA, PPD Inc. (now part of Thermo Fisher Scientific), WuXi AppTec, Syneos Health, Frontage Laboratories, Inc., Pharmaceutical Product Development, LLC (PPD), Intertek Group plc, Toxikon Corporation, Pace Analytical Services, LLC, Almac Group, Catalent, Inc., Recro Pharma, Inc., Lonza Group, Albany Molecular Research Inc. (AMRI - now Curia Global, Inc.), Absorption Systems (now part of Pharmaron), Celerion |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Analytical Testing Outsourcing Market Key Technology Landscape

The Pharmaceutical Analytical Testing Outsourcing Market is characterized by a dynamic and continuously evolving technology landscape, where advanced analytical instruments and methodologies play a pivotal role in ensuring the quality, safety, and efficacy of pharmaceutical products. High-performance liquid chromatography (HPLC) and ultra-high-performance liquid chromatography (UHPLC) remain foundational techniques for separation and quantification, but continuous advancements in detectors and column chemistries enhance their sensitivity and resolution. Mass spectrometry (MS), particularly high-resolution mass spectrometry (HRMS) like Q-TOF and Orbitrap, coupled with chromatographic techniques, is crucial for complex impurity profiling, metabolomics, proteomics, and detailed characterization of large molecules, providing unparalleled specificity and structural information critical for biologics development.

Nuclear magnetic resonance (NMR) spectroscopy is another indispensable tool, offering detailed structural elucidation of both small and large molecules, and is increasingly utilized for quantitation of active pharmaceutical ingredients (APIs) and excipients, as well as for identifying unknown impurities. Capillary electrophoresis (CE) and immunoassays, including ELISA and cell-based assays, are essential for bioanalytical testing, particularly for the quantification of drugs and metabolites in biological matrices, and for assessing immunogenicity in biopharmaceutical development. The increasing demand for biologics necessitates specialized techniques such as size exclusion chromatography (SEC), dynamic light scattering (DLS), and circular dichroism (CD) to characterize protein aggregation, stability, and higher-order structure, which are critical quality attributes for these complex therapeutics.

Beyond instrumentational advancements, the integration of automation, robotics, and laboratory information management systems (LIMS) is transforming outsourced analytical testing. Automated sample preparation and robotic handling reduce human error, increase throughput, and improve reproducibility, crucial for high-volume testing. LIMS and electronic laboratory notebooks (ELN) streamline data management, ensure data integrity, and facilitate compliance with regulatory requirements such as 21 CFR Part 11. Furthermore, the burgeoning application of bioinformatics and chemometrics, often powered by Artificial Intelligence (AI) and Machine Learning (ML) algorithms, is revolutionizing data interpretation, enabling predictive modeling for stability studies, and facilitating the rapid identification of complex patterns in analytical datasets, thereby enhancing the efficiency and intelligence of outsourced analytical services.

Regional Highlights

- North America: North America, particularly the United States, holds a dominant share in the Pharmaceutical Analytical Testing Outsourcing Market, driven by its robust pharmaceutical and biotechnology industry, substantial R&D investments, and a stringent regulatory environment. The presence of numerous leading pharmaceutical companies and innovative biotech startups necessitates extensive analytical testing, often outsourced to specialized CROs. Furthermore, the region is a hub for advanced research in novel drug modalities, such as gene and cell therapies, which require sophisticated and specialized analytical support, boosting the demand for high-end outsourcing services. Significant healthcare expenditure and a strong focus on quality and compliance also contribute to sustained market growth.

- Europe: Europe represents another major market for pharmaceutical analytical testing outsourcing, characterized by a well-established pharmaceutical industry, significant R&D spending, and a comprehensive regulatory framework led by the European Medicines Agency (EMA). Countries like Germany, the UK, France, and Switzerland are key contributors, hosting both large pharmaceutical corporations and numerous specialized analytical testing providers. The region's emphasis on quality manufacturing, biosimilar development, and expanding biologics pipelines fuels the demand for outsourced services, particularly for method development, validation, and stability studies. Collaborative initiatives between academia and industry further promote innovation and the adoption of outsourced analytical solutions.

- Asia Pacific (APAC): The Asia Pacific region is projected to exhibit the highest growth rate in the Pharmaceutical Analytical Testing Outsourcing Market. This growth is primarily attributed to rising healthcare expenditure, a rapidly expanding pharmaceutical manufacturing base, increasing R&D activities, and a growing number of clinical trials in countries like China, India, Japan, and South Korea. The availability of skilled scientific talent at competitive costs, coupled with supportive government policies promoting pharmaceutical and biotechnological industries, makes APAC an attractive destination for outsourcing analytical services. Both local and international pharmaceutical companies are increasingly leveraging APAC-based analytical CROs for cost-effective and efficient testing solutions, especially for early-stage development and commercial product release.

- Latin America: The Latin American market for pharmaceutical analytical testing outsourcing is experiencing steady growth, driven by increasing investments in healthcare infrastructure, expanding local pharmaceutical production, and a rising prevalence of chronic diseases. Countries such as Brazil, Mexico, and Argentina are leading this growth, with governments focusing on enhancing access to medicines and promoting local drug development. While still smaller than North America or Europe, the region offers potential for outsourcing providers due to emerging pharmaceutical markets and a growing demand for quality control and bioanalytical services. International companies are also exploring opportunities to tap into this developing market.

- Middle East and Africa (MEA): The Middle East and Africa region is witnessing gradual development in the pharmaceutical analytical testing outsourcing market. Growth is influenced by increasing healthcare spending, government initiatives to diversify economies and enhance local pharmaceutical manufacturing capabilities, particularly in countries like Saudi Arabia, UAE, and South Africa. While still in nascent stages, the region's rising population, increasing burden of non-communicable diseases, and efforts to improve drug quality and safety standards are creating new opportunities for specialized analytical testing services. Challenges remain in terms of regulatory harmonization and infrastructure, but the potential for long-term growth is evident as healthcare systems evolve.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Analytical Testing Outsourcing Market.- Eurofins Scientific

- Laboratory Corporation of America Holdings (LabCorp)

- Charles River Laboratories International, Inc.

- ICON plc

- SGS SA

- PPD Inc. (now part of Thermo Fisher Scientific)

- WuXi AppTec

- Syneos Health

- Frontage Laboratories, Inc.

- Pharmaceutical Product Development, LLC (PPD)

- Intertek Group plc

- Toxikon Corporation

- Pace Analytical Services, LLC

- Almac Group

- Catalent, Inc.

- Recro Pharma, Inc.

- Lonza Group

- Albany Molecular Research Inc. (AMRI - now Curia Global, Inc.)

- Absorption Systems (now part of Pharmaron)

- Celerion

Frequently Asked Questions

What is pharmaceutical analytical testing outsourcing?

Pharmaceutical analytical testing outsourcing involves delegating specialized analytical services, essential for drug development and manufacturing, to external third-party contract research organizations (CROs) or contract development and manufacturing organizations (CDMOs). These services encompass a wide range of tests, including physicochemical characterization, bioanalytical testing, stability studies, and impurity profiling, crucial for ensuring drug quality, safety, and regulatory compliance throughout the entire lifecycle of a pharmaceutical product, from early-stage research to post-market surveillance. It allows pharmaceutical companies to access advanced technologies and expertise efficiently.

Why do pharmaceutical companies outsource analytical testing?

Pharmaceutical companies outsource analytical testing primarily to access specialized expertise, advanced technologies, and scalable resources without significant capital investment. This strategy helps reduce operational costs, accelerate drug development timelines, and allows companies to focus their internal resources on core competencies like drug discovery. Outsourcing also aids in navigating complex global regulatory requirements, mitigating risks, and managing fluctuating testing demands efficiently, ensuring high-quality data generation and faster market entry for new therapies. It provides flexibility and a competitive edge in a rapidly evolving industry.

What are the key benefits of outsourcing pharmaceutical analytical services?

The key benefits of outsourcing pharmaceutical analytical services include significant cost savings by avoiding large investments in equipment and specialized staff, access to cutting-edge technologies and scientific expertise that may not be available in-house, and accelerated project timelines due to efficient workflows and dedicated resources. It also enhances flexibility in managing workload fluctuations, improves compliance with stringent global regulatory standards, and allows pharmaceutical companies to concentrate on their core innovation, thereby increasing efficiency and overall productivity in drug development and manufacturing processes.

What are the primary challenges in the pharmaceutical analytical testing outsourcing market?

The primary challenges in the pharmaceutical analytical testing outsourcing market include ensuring robust intellectual property (IP) protection and data security when collaborating with third-party providers. Maintaining consistent quality standards across different outsourcing partners and navigating diverse global regulatory frameworks also pose significant hurdles. Other challenges involve managing complex project coordination, potential communication gaps that could lead to delays, and the need for rigorous vendor qualification and auditing processes to ensure reliability and compliance with pharmaceutical industry standards and client expectations. Establishing trust and transparency is crucial to overcome these obstacles.

How is AI impacting the pharmaceutical analytical testing outsourcing market?

AI is profoundly impacting the pharmaceutical analytical testing outsourcing market by enhancing efficiency, accuracy, and predictability. It enables advanced data interpretation and pattern recognition from complex analytical instruments, improving impurity detection and metabolomics. AI facilitates predictive modeling for drug stability and formulation optimization, reducing experimental time. Furthermore, AI integration with automation and robotics increases throughput and reduces manual errors. It also strengthens quality control, assists in optimized experimental design, and streamlines regulatory documentation, positioning AI as a transformative force for service providers to offer more intelligent and expedited analytical solutions. This leads to faster drug development and improved quality assurance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager