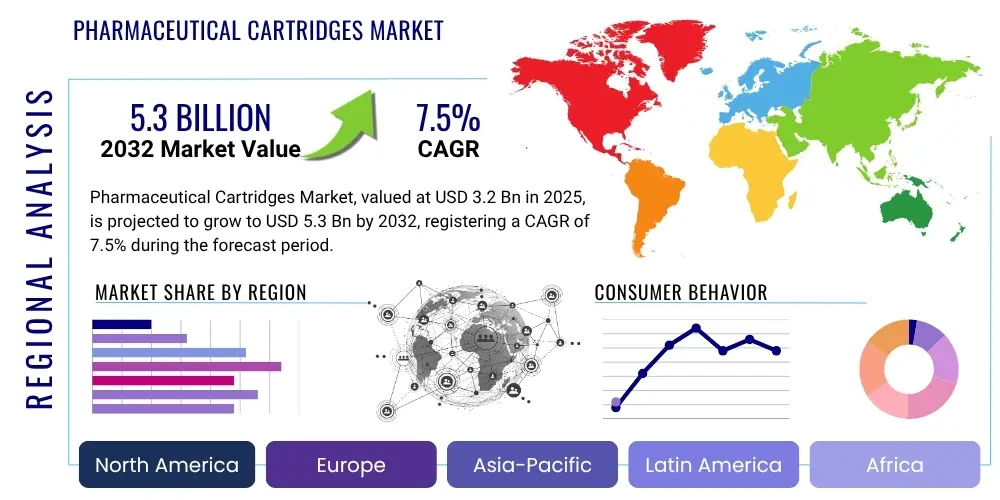

Pharmaceutical Cartridges Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431280 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pharmaceutical Cartridges Market Size

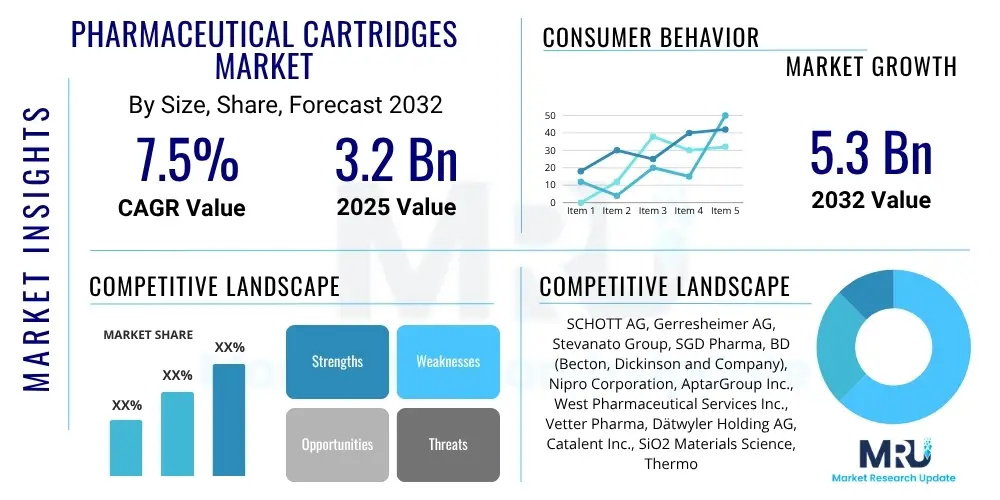

The Pharmaceutical Cartridges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at USD 3.2 Billion in 2025 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2032.

Pharmaceutical Cartridges Market introduction

The pharmaceutical cartridges market is a vital segment within the broader pharmaceutical packaging industry, focusing on specialized primary packaging solutions for injectable medications. These cartridges are typically cylindrical glass or plastic containers, designed for precise and accurate dosing of liquid drug formulations. They are sealed at one end with a rubber stopper or plunger and at the other with a crimped cap, often featuring a septa for needle penetration.

Major applications for pharmaceutical cartridges span a wide array of therapeutic areas, including the administration of insulin for diabetes management, dental anesthetics, growth hormones, and various biologics. Their primary benefit lies in enhancing patient convenience and safety, particularly for self-administration, by providing pre-filled, ready-to-use drug delivery systems like pen injectors and auto-injectors. This streamlined approach minimizes dosing errors, reduces the risk of contamination, and simplifies the overall medication process for both healthcare professionals and patients.

Key driving factors propelling the growth of this market include the escalating global prevalence of chronic diseases such as diabetes, autoimmune disorders, and various hormonal deficiencies, which necessitate long-term or frequent injectable therapies. The increasing shift towards self-administration and home-care settings further boosts demand for user-friendly and reliable drug delivery devices that utilize these cartridges. Moreover, the robust growth in the biologics and biosimilars market, coupled with advancements in material science and manufacturing technologies, continues to expand the utility and adoption of pharmaceutical cartridges.

Pharmaceutical Cartridges Market Executive Summary

The Pharmaceutical Cartridges Market is experiencing dynamic growth, propelled by evolving healthcare needs and technological advancements. Business trends indicate a strong emphasis on automation in manufacturing processes to ensure high precision and sterility, alongside a growing focus on sustainable packaging materials and designs. Strategic collaborations between cartridge manufacturers and pharmaceutical companies are becoming more prevalent, aiming to integrate innovative packaging solutions earlier in the drug development pipeline. The market is also seeing increasing investment in advanced barrier technologies to extend drug shelf life and protect sensitive formulations.

Regionally, North America and Europe continue to dominate the market due to well-established healthcare infrastructures, high healthcare expenditure, and a strong presence of key pharmaceutical and biotechnology companies. However, the Asia Pacific region is rapidly emerging as a significant growth hub, driven by improving healthcare access, increasing prevalence of chronic diseases, and a burgeoning generic and biosimilar manufacturing sector. Latin America and the Middle East & Africa are also showing promising growth, albeit from a smaller base, as healthcare facilities and patient awareness improve.

Segment-wise, glass cartridges, particularly Type I borosilicate glass, currently hold the largest share due to their proven chemical inertness and stability, making them ideal for sensitive drug formulations. However, plastic cartridges, especially those made from cyclic olefin polymer (COP) and cyclic olefin copolymer (COC), are gaining traction owing to their enhanced break resistance, lighter weight, and design flexibility, catering to the growing demand for user-friendly devices. The market is also witnessing a surge in demand for prefilled cartridges, which offer superior convenience and reduce medication errors, positioning them as a key growth segment for the forecast period.

AI Impact Analysis on Pharmaceutical Cartridges Market

Users frequently inquire about how artificial intelligence (AI) can enhance the manufacturing efficiency and quality control of pharmaceutical cartridges, seeking to understand the practical applications of AI in this specific domain. There is a keen interest in whether AI can contribute to more personalized or adaptive drug delivery systems that rely on cartridges. Additionally, concerns are often raised regarding the data security implications and the regulatory hurdles associated with integrating AI into a highly regulated industry like pharmaceuticals. The overarching theme is an expectation that AI will bring about significant operational improvements and open new avenues for innovation, while also necessitating careful consideration of implementation challenges and ethical guidelines.

- AI-driven predictive maintenance optimizes manufacturing equipment uptime, reducing costly unplanned stoppages and improving production efficiency for cartridge lines.

- Automated visual inspection systems, powered by AI, enhance quality control by accurately detecting minute defects in cartridges at high speeds, surpassing human capabilities.

- AI algorithms assist in optimizing material selection and design for cartridges, predicting the long-term stability and compatibility of new materials with various drug formulations.

- Supply chain optimization using AI helps forecast demand for cartridges, manage inventory levels, and streamline logistics, ensuring timely delivery and minimizing waste.

- AI supports accelerated research and development by analyzing vast datasets to identify optimal cartridge configurations for novel drug compounds, reducing time-to-market.

DRO & Impact Forces Of Pharmaceutical Cartridges Market

The pharmaceutical cartridges market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and inherent impact forces. A primary driver is the accelerating prevalence of chronic diseases globally, such as diabetes and autoimmune disorders, which necessitates regular and often self-administered injectable medications, directly increasing the demand for pre-filled cartridges and pen devices. Concurrently, the robust expansion of the biologics and biosimilars market, characterized by sensitive large-molecule drugs requiring sterile and stable primary packaging, further fuels market growth. Moreover, the continuous push towards patient convenience and safety in drug administration, including the development of user-friendly auto-injectors and smart devices, underscores the importance of reliable cartridge technology.

However, the market also faces considerable restraints. The pharmaceutical industry is subject to extremely stringent regulatory frameworks across different geographies, demanding rigorous testing, validation, and compliance for all packaging components, including cartridges. This regulatory complexity can prolong product development cycles and increase associated costs. Furthermore, the high initial capital investment required for establishing advanced manufacturing facilities for pharmaceutical cartridges, especially for specialized materials and sterile production, acts as a barrier for new entrants. For glass cartridges, the inherent risk of breakage during transportation or handling, though mitigated by advancements, remains a concern for some sensitive applications.

Despite these challenges, significant opportunities abound. Emerging economies, particularly in Asia Pacific and Latin America, present vast untapped potential as healthcare infrastructure improves and access to modern medicines expands. Innovation in advanced materials, such as high-performance plastics (e.g., COC, COP) offering superior barrier properties and break resistance, provides avenues for market differentiation and caters to evolving drug requirements. The development of 'smart cartridges' integrated with IoT sensors for dose tracking, adherence monitoring, and temperature control represents a transformative opportunity, aligning with the broader trend of digital health and personalized medicine. The market is also impacted by external forces such as rapid technological advancements in manufacturing and materials science, shifting regulatory landscapes towards patient-centric packaging, and fluctuations in global healthcare expenditure influencing pharmaceutical R&D and adoption rates.

Segmentation Analysis

The pharmaceutical cartridges market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation helps in analyzing market trends, identifying key growth areas, and understanding the specific needs of various stakeholders. The market is primarily categorized based on the material used for manufacturing, the type of cartridge, the application area of the drugs they contain, and the end-user industries.

Analyzing these segments reveals critical insights into market preferences and technological shifts. For instance, while glass cartridges maintain a stronghold due to their long-standing reliability and inertness, the increasing adoption of advanced plastic cartridges signals a move towards improved durability and patient safety. Similarly, the dominance of certain therapeutic applications reflects global disease burdens and the prevalent modes of drug delivery. Understanding these segmentations is crucial for strategic planning, product development, and market entry strategies for companies operating within or looking to enter this vital sector.

- By Material:

- Glass Cartridges

- Type I Borosilicate Glass

- Type II Glass

- Type III Glass

- Plastic Cartridges

- Cyclic Olefin Polymer (COP)

- Cyclic Olefin Copolymer (COC)

- Polypropylene (PP)

- Others (e.g., Polycarbonate)

- Glass Cartridges

- By Type:

- Standard Cartridges

- Prefilled Cartridges

- By Application:

- Diabetes (Insulin)

- Autoimmune Diseases

- Pain Management

- Dental Anesthetics

- Growth Hormones

- Anticoagulants

- Vaccines

- Others (e.g., Cardiology, Oncology)

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Hospitals & Clinics

- Research Laboratories

- Compounding Pharmacies

Value Chain Analysis For Pharmaceutical Cartridges Market

The value chain for the pharmaceutical cartridges market begins with upstream activities focused on the procurement and processing of raw materials. This segment primarily involves suppliers of high-quality glass tubing, specifically Type I borosilicate glass, which is the industry standard for its chemical inertness and thermal shock resistance. For plastic cartridges, the upstream chain includes manufacturers of specialized polymer resins such as cyclic olefin polymer (COP), cyclic olefin copolymer (COC), and medical-grade polypropylene (PP). Additionally, suppliers of rubber stoppers, plungers, and aluminum caps, along with their respective sealing components, are critical upstream partners, ensuring these primary packaging components meet stringent pharmaceutical-grade specifications.

Moving downstream, the value chain progresses through the manufacturing of the cartridges themselves, which involves highly specialized and automated processes to ensure sterility, dimensional precision, and defect-free production. After manufacturing, these cartridges are supplied to pharmaceutical and biotechnology companies, as well as Contract Manufacturing Organizations (CMOs). These entities are responsible for the sterile filling of the cartridges with various drug formulations, assembly with plungers and caps, and subsequent integration into drug delivery devices like pen injectors, auto-injectors, or dental syringes. The final stage involves the distribution of the filled and assembled drug delivery systems to end-users such as hospitals, clinics, pharmacies, and ultimately, patients.

Distribution channels for pharmaceutical cartridges are primarily direct and indirect. Large pharmaceutical companies often engage in direct procurement relationships with cartridge manufacturers to ensure consistent supply, adherence to specifications, and to facilitate custom designs. Indirect channels involve specialized distributors who cater to smaller pharmaceutical companies, CMOs, and research laboratories, offering a wider range of standard cartridge products and providing logistical support. Both channels prioritize stringent quality control, secure transportation, and adherence to cold chain requirements where necessary, highlighting the critical nature of maintaining product integrity throughout the entire supply chain.

Pharmaceutical Cartridges Market Potential Customers

The primary potential customers and end-users of pharmaceutical cartridges are pharmaceutical and biotechnology companies globally. These entities rely heavily on cartridges for packaging their injectable drug formulations, particularly for sensitive biologics, biosimilars, insulin products, and various specialty medications that require precise dosing and sterile delivery. As drug pipelines increasingly focus on parenteral administration, the demand from these companies for advanced and reliable cartridge solutions continues to expand, driven by requirements for drug stability, patient convenience, and regulatory compliance.

Another significant segment of potential customers includes Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). These organizations provide specialized services, including fill-finish operations for pharmaceutical products, to pharma and biotech companies that may lack in-house manufacturing capabilities or seek to outsource production. CMOs are major buyers of pharmaceutical cartridges as they handle the aseptic filling and packaging of a vast array of injectable drugs for multiple clients, making them crucial intermediaries in the value chain.

Furthermore, healthcare providers such as hospitals, clinics, and specialized treatment centers represent indirect but vital customers. While they may not directly purchase empty cartridges, their demand for pre-filled drug delivery devices (e.g., insulin pens, dental anesthetic syringes) drives the upstream procurement decisions of pharmaceutical companies. Research laboratories and academic institutions also constitute potential customers, albeit on a smaller scale, requiring cartridges for drug development, clinical trials, and formulation studies. Lastly, compounding pharmacies that prepare customized sterile injectables may also procure cartridges for specific patient needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2032 | USD 5.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCHOTT AG, Gerresheimer AG, Stevanato Group, SGD Pharma, BD (Becton, Dickinson and Company), Nipro Corporation, AptarGroup Inc., West Pharmaceutical Services Inc., Vetter Pharma, Dätwyler Holding AG, Catalent Inc., SiO2 Materials Science, Thermo Fisher Scientific Inc., Datwyler Pharma Packaging, Hindustan Syringes & Medical Devices Ltd., Corning Incorporated, RPC Group (Berry Global Inc.), Baxter International Inc., Owen Mumford Ltd., Nuova Ompi (Stevanato Group) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Cartridges Market Key Technology Landscape

The pharmaceutical cartridges market is continuously evolving, driven by significant technological advancements aimed at improving drug stability, patient safety, and manufacturing efficiency. One crucial area of innovation is in advanced manufacturing processes, which leverage automation, robotics, and artificial intelligence (AI) for precision engineering of cartridges. This includes highly sophisticated fill-finish lines that ensure aseptic conditions, minimize particle contamination, and achieve extremely accurate dosing volumes. Robotic inspection systems are also becoming standard, utilizing computer vision and AI algorithms to detect even microscopic defects in glass or plastic, far surpassing the capabilities of traditional manual or semi-automated methods.

Another key technology involves breakthroughs in material science, particularly the development of enhanced barrier technologies. For glass cartridges, this includes inner surface treatments and coatings that reduce drug-container interaction, prevent delamination, and minimize tungsten contamination, thereby extending the shelf life of sensitive drug formulations. In plastic cartridges, innovations focus on advanced polymer formulations, such as high-purity cyclic olefin copolymers (COC) and cyclic olefin polymers (COP), which offer superior chemical resistance, oxygen barrier properties, and break resistance compared to traditional plastics. These materials are critical for biologics and other sensitive drugs that cannot tolerate exposure to certain elements.

Furthermore, the integration of smart packaging technologies is beginning to reshape the landscape. This involves embedding cartridges with features like RFID tags, NFC chips, or other sensors that enable dose tracking, adherence monitoring, temperature control, and authenticity verification. These "smart cartridges" can communicate with patient applications or healthcare systems, providing valuable data for personalized medicine and improving patient outcomes. Such innovations not only enhance the functionality and safety of drug delivery but also contribute to supply chain integrity and patient engagement, representing a forward-looking technological frontier in the pharmaceutical cartridges market.

Regional Highlights

- North America: This region consistently holds a dominant share in the pharmaceutical cartridges market, primarily driven by a robust pharmaceutical and biotechnology industry, high healthcare expenditure, and a significant prevalence of chronic diseases requiring injectable therapies. The region benefits from substantial investments in research and development, leading to the early adoption of advanced drug delivery systems and cutting-edge cartridge technologies. The presence of major pharmaceutical companies and key cartridge manufacturers further solidifies its leading position.

- Europe: Europe represents another key market, characterized by stringent regulatory standards, an aging population, and a strong focus on healthcare innovation. Countries like Germany, France, and the UK are pivotal, showcasing high demand for high-quality, sterile pharmaceutical cartridges. The region is a hub for biosimilar manufacturing and advanced medical device development, which consistently fuels the market for both glass and advanced plastic cartridge solutions.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate during the forecast period, driven by rapidly expanding healthcare infrastructure, increasing disposable incomes, and a large patient pool. Emerging economies such as China and India are witnessing a surge in generic and biosimilar drug production, coupled with a rising awareness of advanced drug delivery methods. Government initiatives to improve healthcare access and a growing focus on self-administration are key factors contributing to this region's accelerated market expansion.

- Latin America: This region demonstrates steady growth in the pharmaceutical cartridges market, fueled by improving healthcare access, increasing healthcare expenditure, and a growing demand for advanced medical treatments. Countries like Brazil and Mexico are leading the adoption of modern drug delivery systems, although the market size remains smaller compared to North America and Europe. Investment in local manufacturing capabilities and the expansion of chronic disease management programs are expected to sustain market growth.

- Middle East and Africa (MEA): The MEA region is an emerging market for pharmaceutical cartridges, driven by increasing government investments in healthcare infrastructure, a rising prevalence of non-communicable diseases, and efforts to reduce reliance on imported pharmaceuticals. While starting from a relatively smaller base, growing awareness and improved access to advanced medical treatments are gradually boosting the demand for sterile injectable packaging solutions in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Cartridges Market.- SCHOTT AG

- Gerresheimer AG

- Stevanato Group

- SGD Pharma

- BD (Becton, Dickinson and Company)

- Nipro Corporation

- AptarGroup Inc.

- West Pharmaceutical Services Inc.

- Vetter Pharma

- Dätwyler Holding AG

- Catalent Inc.

- SiO2 Materials Science

- Thermo Fisher Scientific Inc.

- Datwyler Pharma Packaging

- Hindustan Syringes & Medical Devices Ltd.

- Corning Incorporated

- Berry Global Inc. (RPC Group)

- Baxter International Inc.

- Owen Mumford Ltd.

- Nuova Ompi (Stevanato Group)

Frequently Asked Questions

What are pharmaceutical cartridges and their primary use?

Pharmaceutical cartridges are sterile, pre-filled cylindrical containers, typically made of glass or plastic, designed for precise dosing and delivery of injectable liquid medications through devices like pens or auto-injectors. Their primary use is to facilitate safe, accurate, and convenient self-administration or professional injection of drugs such as insulin, dental anesthetics, and biologics.

What materials are commonly used for pharmaceutical cartridges?

The most common material for pharmaceutical cartridges is Type I borosilicate glass due to its high chemical inertness and stability, making it ideal for sensitive drug formulations. Advanced plastics such as cyclic olefin polymer (COP) and cyclic olefin copolymer (COC) are also increasingly used, offering benefits like enhanced break resistance, lighter weight, and design flexibility.

How does the growth of biologics impact the pharmaceutical cartridges market?

The rapid growth of the biologics and biosimilars market significantly boosts the demand for pharmaceutical cartridges. Biologic drugs are often sensitive and require precise, sterile primary packaging that minimizes drug-container interaction, making high-quality glass or advanced plastic cartridges the preferred choice for their storage and administration.

What are the key advantages of prefilled pharmaceutical cartridges?

Prefilled pharmaceutical cartridges offer several key advantages, including enhanced patient convenience by being ready-to-use, reduced risk of medication errors through pre-measured doses, and improved safety by minimizing contamination during drug preparation. They also simplify drug administration for healthcare professionals and support self-injection therapies.

What role does automation play in pharmaceutical cartridge manufacturing?

Automation plays a critical role in pharmaceutical cartridge manufacturing by ensuring high precision, sterility, and efficiency. Automated systems are used for forming, washing, siliconizing, and inspecting cartridges, as well as for aseptic filling and sealing. This minimizes human intervention, reduces contamination risks, and allows for large-scale, consistent production meeting stringent quality standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager