Pharmaceutical Solvent Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427518 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Pharmaceutical Solvent Market Size

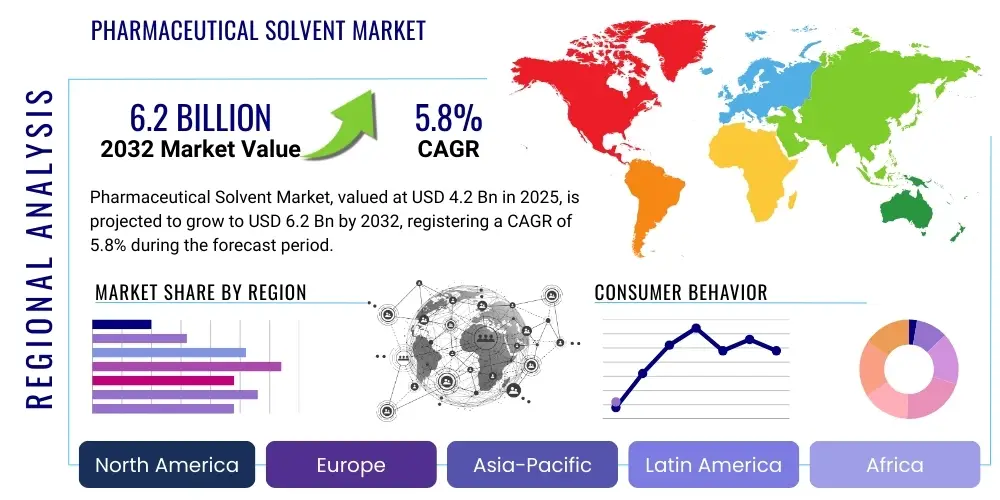

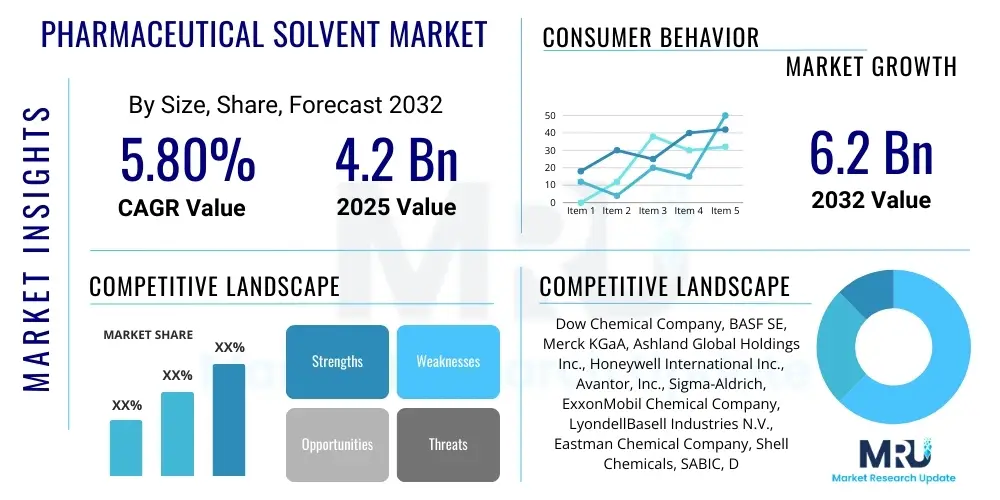

The Pharmaceutical Solvent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 4.2 Billion in 2025 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2032.

Pharmaceutical Solvent Market introduction

The pharmaceutical solvent market plays a critical role in the global pharmaceutical industry, serving as essential components in the synthesis, purification, and formulation of active pharmaceutical ingredients (APIs) and drug products. These solvents facilitate various chemical reactions, dissolve excipients, and enable the extraction of crucial compounds, making them indispensable across the drug manufacturing lifecycle. Their primary function lies in ensuring the solubility, stability, and purity of pharmaceutical substances, thereby impacting the efficacy and safety of final drug formulations.

Pharmaceutical solvents encompass a wide array of organic and inorganic chemicals, including alcohols, esters, ketones, hydrocarbons, and chlorinated solvents. Each type is selected based on its specific chemical properties, boiling point, safety profile, and regulatory compliance, ensuring optimal performance in different pharmaceutical processes. Major applications include drug synthesis, crystallization, chromatography, and the production of intermediates, where precise solvent selection is paramount for process efficiency and product quality. The benefits derived from these solvents include enhanced reaction kinetics, improved purification yields, and the ability to formulate complex drug delivery systems.

Driving factors for this market include the continuous growth of the global pharmaceutical industry, fueled by increasing prevalence of chronic diseases, a rising geriatric population, and advancements in drug discovery and development. The expanding biopharmaceutical sector, which often requires highly specific and pure solvents, further propels market demand. Additionally, growing investments in research and development activities and the emergence of new drug molecules contribute significantly to the sustained demand for pharmaceutical solvents globally.

Pharmaceutical Solvent Market Executive Summary

The global pharmaceutical solvent market is experiencing robust growth driven by the expansion of the pharmaceutical and biopharmaceutical industries, particularly in emerging economies. Key business trends indicate a strong emphasis on sustainability and green chemistry, leading to increased demand for eco-friendly and bio-based solvents. Manufacturers are focusing on developing high-purity, low-toxicity solvents to meet stringent regulatory requirements and reduce environmental impact. Furthermore, strategic collaborations and mergers among key players are common, aimed at enhancing production capabilities, expanding product portfolios, and gaining a competitive edge in a dynamic market landscape.

Regionally, Asia Pacific is emerging as a dominant market, propelled by significant growth in pharmaceutical manufacturing, increasing healthcare expenditure, and a burgeoning contract research and manufacturing services (CRAMS) sector. North America and Europe continue to hold substantial market shares, driven by established pharmaceutical industries, advanced research infrastructure, and high demand for innovative drug therapies. These regions are also at the forefront of adopting advanced solvent technologies and sustainable manufacturing practices. The shift in pharmaceutical production bases towards lower-cost regions also influences global distribution and consumption patterns.

From a segmentation perspective, the market is broadly categorized by product type, application, and end-user. Alcohols and esters remain prominent solvent types due to their versatility and cost-effectiveness, while the demand for green and bio-based solvents is rapidly increasing. In terms of applications, drug synthesis and purification represent the largest segments, underscoring the fundamental role of solvents in API production. The end-user segment is dominated by pharmaceutical and biopharmaceutical companies, with a growing contribution from contract manufacturing organizations (CMOs) and research laboratories, all seeking specialized and compliant solvent solutions for their diverse operational needs.

AI Impact Analysis on Pharmaceutical Solvent Market

Users commonly express interest in how artificial intelligence will revolutionize the selection, optimization, and synthesis processes involving pharmaceutical solvents. Key themes revolve around AIs potential to accelerate drug discovery by predicting optimal solvent systems for specific reactions, thereby reducing experimental trial-and-error. There is also significant concern regarding the integration challenges and data requirements for effective AI implementation, alongside expectations for AI to enhance process efficiency, reduce waste, and improve the environmental footprint of pharmaceutical manufacturing. Furthermore, users anticipate AIs role in ensuring compliance with evolving regulatory standards and maintaining high purity in solvent usage through advanced predictive analytics.

- AI can optimize solvent selection for chemical reactions, minimizing toxicity and environmental impact.

- Predictive modeling powered by AI can forecast solvent performance and purity profiles, improving manufacturing efficiency.

- AI-driven automation in solvent recycling and purification processes can enhance sustainability efforts.

- Machine learning algorithms can accelerate drug discovery by identifying novel solvent combinations for complex syntheses.

- AI can analyze large datasets to ensure regulatory compliance and quality control for pharmaceutical solvents.

- Enhanced supply chain management for solvents through AI-driven demand forecasting and inventory optimization.

DRO & Impact Forces Of Pharmaceutical Solvent Market

The pharmaceutical solvent market is significantly influenced by a confluence of drivers, restraints, and opportunities. Key drivers include the robust growth of the global pharmaceutical industry, fueled by an aging population and increasing prevalence of chronic diseases, which escalates demand for new drug development and manufacturing. Technological advancements in drug synthesis and purification techniques, requiring specialized and high-purity solvents, also contribute substantially to market expansion. The continuous innovation in biopharmaceutical research and the rising demand for biologics further bolster solvent consumption, as these processes often demand highly controlled and specific solvent environments.

Conversely, the market faces several restraints. Stringent environmental regulations and health safety concerns surrounding volatile organic compounds (VOCs) and hazardous solvents pose significant challenges for manufacturers, leading to increased compliance costs and a push towards greener alternatives. The high cost of developing and implementing sustainable solvent solutions, coupled with complex purification processes required to meet pharmaceutical grade standards, can also hinder market growth. Additionally, the fluctuating prices of raw materials, which are often crude oil derivatives, introduce volatility and uncertainty into the supply chain, impacting overall production costs and market stability.

Opportunities in the market primarily lie in the increasing adoption of green chemistry principles, fostering the development and use of eco-friendly, bio-based, and recyclable solvents. Research and development into novel solvent technologies, such as supercritical fluids and ionic liquids, presents avenues for innovation and market differentiation. The expansion of pharmaceutical manufacturing capacities in emerging economies, driven by lower operational costs and growing local demand, also offers significant growth prospects for solvent suppliers. Furthermore, strategic partnerships and collaborations between solvent producers and pharmaceutical companies can lead to customized solutions and secure long-term supply agreements.

Segmentation Analysis

The pharmaceutical solvent market is comprehensively segmented to reflect the diverse nature of its products and applications within the pharmaceutical industry. This segmentation helps in understanding specific market dynamics, identifying high-growth areas, and tailoring strategies for various sub-markets. Key segments include classifications by product type, which distinguishes between various chemical categories of solvents; by application, detailing the specific processes where solvents are utilized; and by end-user, identifying the primary consumers of these solvents.

- By Product Type:

- Alcohols (e.g., Ethanol, Methanol, Isopropanol)

- Esters (e.g., Ethyl Acetate, Butyl Acetate)

- Ketones (e.g., Acetone, Methyl Ethyl Ketone)

- Hydrocarbons (e.g., Toluene, Hexane)

- Chlorinated Solvents (e.g., Dichloromethane, Chloroform)

- Sulfoxides (e.g., Dimethyl Sulfoxide (DMSO))

- Ethers (e.g., Tetrahydrofuran (THF), Diethyl Ether)

- Green/Bio-based Solvents (e.g., Cyrene, Bio-ethanol, Lactic Acid Esters)

- Others (e.g., Water, Ionic Liquids, Supercritical Fluids)

- By Application:

- Drug Synthesis

- Crystallization

- Extraction

- Purification

- Chromatography

- Formulation

- Other Applications

- By End-User:

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Contract Research Organizations (CROs)

- Research and Academic Institutions

- Other Industrial Users

Pharmaceutical Solvent Market Value Chain Analysis

The value chain for the pharmaceutical solvent market begins with upstream activities involving the sourcing of raw materials, primarily petrochemicals, agricultural products, or bio-derived feedstocks. Key players in this stage include chemical producers that refine crude oil or process biomass to yield base chemicals like ethylene, propylene, and various alcohols. These raw materials undergo initial synthesis and purification steps to become bulk industrial solvents. Efficient management of these upstream processes is critical for ensuring cost-effectiveness and consistency in quality, as fluctuations in raw material prices directly impact the downstream production costs for pharmaceutical-grade solvents.

Moving downstream, these industrial solvents are then further processed and purified to meet the exacting standards required for pharmaceutical applications. This involves specialized purification techniques, rigorous quality control, and extensive testing to remove impurities and ensure compliance with pharmacopeial standards (e.g., USP, EP, JP). Manufacturers of pharmaceutical-grade solvents are the primary actors in this stage, often investing heavily in advanced purification technologies and quality assurance systems. Their role is pivotal in transforming bulk chemicals into high-ppurity products suitable for drug manufacturing processes, directly impacting the safety and efficacy of final pharmaceutical products.

The distribution channel for pharmaceutical solvents typically involves a combination of direct sales from manufacturers to large pharmaceutical companies and indirect sales through specialized distributors. Direct distribution is common for high-volume, long-term contracts, enabling close technical support and customized solutions. Indirect channels, involving chemical distributors, play a crucial role in reaching smaller pharmaceutical manufacturers, contract development and manufacturing organizations (CDMOs), and research laboratories, offering a broad portfolio of products, flexible purchasing options, and efficient logistics. Both direct and indirect channels are critical for ensuring timely delivery and broad market penetration, supporting the continuous and demanding operational needs of the pharmaceutical industry.

Pharmaceutical Solvent Market Potential Customers

Potential customers for pharmaceutical solvents primarily comprise entities engaged in various stages of drug discovery, development, and manufacturing. The largest segment of end-users includes major pharmaceutical and biopharmaceutical companies, which require significant volumes of high-purity solvents for active pharmaceutical ingredient (API) synthesis, drug formulation, and downstream processing of biologics. These companies demand solvents that meet stringent regulatory specifications, exhibit consistent quality, and often seek long-term supply agreements with reliable manufacturers to ensure uninterrupted production cycles for their diverse product portfolios.

Another significant customer base consists of Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs). These organizations offer outsourced services to pharmaceutical companies, including API manufacturing, drug product formulation, and analytical testing. As the trend of outsourcing in the pharmaceutical industry continues to grow, CMOs and CROs represent a rapidly expanding segment of solvent consumers. They often require a wide variety of solvents for different client projects and therapeutic areas, emphasizing flexibility in supply and technical support from solvent providers.

Additionally, academic and research institutions, along with specialized chemical and biotechnology companies involved in early-stage drug discovery or the development of novel compounds, also represent important potential customers. While their individual solvent volumes might be smaller compared to large-scale manufacturers, their demand for highly specialized, rare, or research-grade solvents can be crucial for innovative breakthroughs. These customers prioritize purity, availability of specific grades, and robust technical data for their experimental work and small-scale synthesis projects.

Pharmaceutical Solvent Market Key Technology Landscape

The key technology landscape in the pharmaceutical solvent market is continuously evolving, driven by the dual imperatives of enhancing efficiency and improving sustainability. A major focus is on advanced purification and recycling technologies, which are critical for producing ultra-high purity solvents required in pharmaceutical manufacturing and for minimizing waste streams. Technologies such as fractional distillation, membrane filtration, and supercritical fluid extraction are widely employed to achieve the stringent purity standards for pharmaceutical-grade solvents, ensuring that residual impurities do not affect drug efficacy or safety. Innovation in these areas allows for closed-loop systems and solvent recovery, significantly reducing operational costs and environmental impact.

Furthermore, the development and adoption of green chemistry principles are profoundly influencing the technological landscape. This includes the emergence of novel bio-based solvents derived from renewable resources, which offer reduced toxicity and improved biodegradability compared to traditional petrochemical-based solvents. Research into alternative solvent systems like ionic liquids, deep eutectic solvents, and switchable solvents is gaining traction, promising greener and more efficient reaction media with tunable properties. These technologies aim to reduce the reliance on hazardous and volatile organic compounds (VOCs), aligning with global environmental regulations and corporate sustainability goals.

Automation and process analytical technology (PAT) are also becoming increasingly integral to the pharmaceutical solvent market. Automated systems for solvent dosing, mixing, and recovery enhance precision and reduce human error in manufacturing processes. PAT tools, including spectroscopy (e.g., FTIR, Raman) and chromatography (e.g., GC, HPLC), are deployed for real-time monitoring of solvent quality, purity, and concentration during synthesis and purification. These technologies enable proactive adjustments, ensuring consistent product quality, improving process control, and facilitating compliance with Good Manufacturing Practices (GMP) and other regulatory requirements.

Regional Highlights

- North America: This region maintains a significant market share due to its well-established pharmaceutical industry, robust R&D spending, and a strong presence of major biopharmaceutical companies. Strict regulatory frameworks drive demand for high-purity and compliant solvents.

- Europe: Europe is a mature market characterized by advanced pharmaceutical manufacturing capabilities and a strong focus on sustainable chemistry. Growing adoption of green solvents and stringent environmental regulations contribute to market growth.

- Asia Pacific: Expected to be the fastest-growing region, propelled by increasing pharmaceutical production, expanding healthcare infrastructure, and the rise of contract manufacturing organizations (CMOs) in countries like China and India.

- Latin America: This region exhibits moderate growth, driven by increasing healthcare access and a developing pharmaceutical sector. Local manufacturing initiatives and growing investments contribute to demand.

- Middle East & Africa: The market here is emerging, fueled by rising healthcare expenditure, efforts to develop local pharmaceutical production capabilities, and foreign investments in the healthcare sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Solvent Market.- Dow Chemical Company

- BASF SE

- Merck KGaA

- Ashland Global Holdings Inc.

- Honeywell International Inc.

- Avantor, Inc.

- Sigma-Aldrich (part of Merck KGaA)

- ExxonMobil Chemical Company

- LyondellBasell Industries N.V.

- Eastman Chemical Company

- Shell Chemicals

- SABIC

- DuPont de Nemours, Inc.

- Celanese Corporation

- Mitsui Chemicals, Inc.

- Mitsubishi Chemical Corporation

- Solvay S.A.

- INEOS Group Holdings S.A.

- Versalis S.p.A.

- Arkema S.A.

Frequently Asked Questions

What is a pharmaceutical solvent?

A pharmaceutical solvent is a chemical substance used in the synthesis, purification, and formulation of active pharmaceutical ingredients (APIs) and drug products. It dissolves other substances to create a solution, facilitates chemical reactions, and aids in extraction and crystallization processes, ensuring the quality and efficacy of medicinal compounds.

What drives the growth of the pharmaceutical solvent market?

The markets growth is primarily driven by the expanding global pharmaceutical and biopharmaceutical industries, increasing investments in drug discovery and development, rising prevalence of chronic diseases, and the growing demand for specialty and high-purity solvents for advanced drug manufacturing processes.

What are the key types of pharmaceutical solvents?

Key types include alcohols (e.g., ethanol, methanol), esters (e.g., ethyl acetate), ketones (e.g., acetone), hydrocarbons (e.g., toluene), chlorinated solvents, sulfoxides (e.g., DMSO), and increasingly, green or bio-based solvents. The selection depends on specific application requirements and regulatory guidelines.

How do environmental regulations impact the pharmaceutical solvent market?

Environmental regulations, particularly those concerning volatile organic compounds (VOCs) and hazardous waste, significantly impact the market by driving demand for greener, less toxic, and more sustainable solvent alternatives. This encourages innovation in bio-based solvents and enhances recycling technologies to reduce environmental footprint.

Which region leads the pharmaceutical solvent market?

While North America and Europe currently hold substantial market shares due to established pharmaceutical industries, the Asia Pacific region is projected to be the fastest-growing market, driven by expanding pharmaceutical manufacturing, increasing healthcare expenditure, and growth in contract manufacturing organizations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ether Pharmaceutical Solvent Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ether Pharmaceutical Solvent Market Statistics 2025 Analysis By Application (Oral Medicine, Liniment, Injection), By Type (Diethyl Ether, Diisopropyl Ether, THF, MTBE), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Alcohols Pharmaceutical Solvent Market Statistics 2025 Analysis By Application (Liniment, Injection, Oral Medication), By Type (Ethanol, Isopropanol, Propanol, Propylene Glycol), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ester Pharmaceutical Solvent Market Statistics 2025 Analysis By Application (Liniment, Injection, Oral Medication), By Type (Acetyl Acetate, Ethyl Acetate, Butyl Acetate), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Amines Pharmaceutical Solvent Market Statistics 2025 Analysis By Application (Liniment, Injection, Oral Medication), By Type (Aniline, Diphenylamine, Methyl ethanolamine, Trimethylamine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager