Pharmacovigilance and Drug Safety Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427951 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Pharmacovigilance and Drug Safety Software Market Size

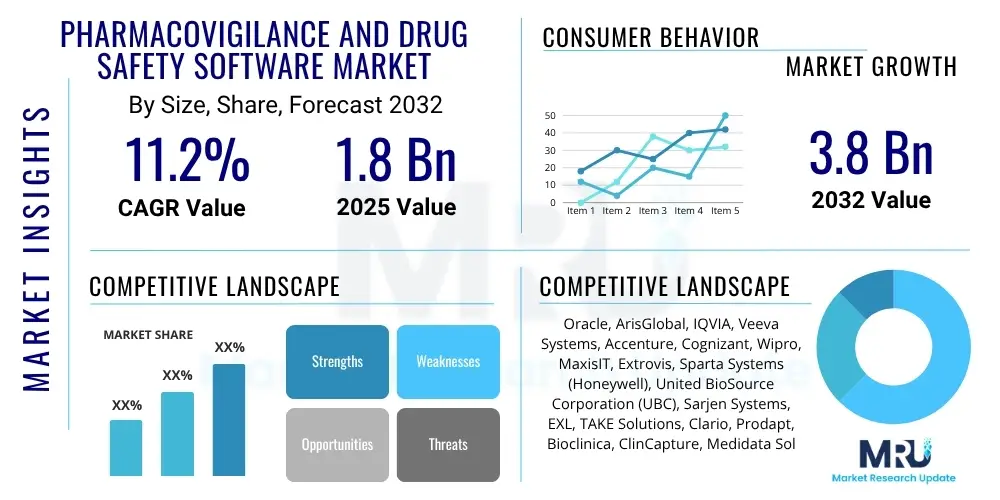

The Pharmacovigilance and Drug Safety Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% between 2025 and 2032. The market is estimated at USD 1.8 Billion in 2025 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2032. This substantial growth is driven by the increasing complexity of drug development, the escalating volume of adverse event reports, and the continuous evolution of global regulatory frameworks, necessitating advanced technological solutions for robust drug safety monitoring and management across the pharmaceutical and biotechnology industries.

Pharmacovigilance and Drug Safety Software Market introduction

The Pharmacovigilance and Drug Safety Software Market encompasses a range of technological solutions designed to manage and streamline the processes involved in detecting, assessing, understanding, and preventing adverse effects or any other drug-related problems. This software plays a critical role in ensuring patient safety throughout a drug's lifecycle, from clinical trials to post-marketing surveillance. Products within this market include specialized platforms for adverse event reporting, signal detection, risk management, data analysis, and regulatory compliance, addressing the complex requirements of pharmaceutical companies, biotechnology firms, contract research organizations (CROs), and medical device manufacturers.

Major applications of this software extend across various phases of drug development and commercialization. During preclinical and clinical trials, the software facilitates the efficient collection, processing, and analysis of safety data from study participants, ensuring compliance with research protocols and regulatory guidelines. In the post-marketing phase, it enables continuous monitoring of drug safety profiles, managing spontaneous reports, literature screening, and conducting advanced epidemiological studies. The primary benefits include enhanced data accuracy, improved operational efficiency, expedited regulatory submissions, better risk mitigation, and ultimately, superior patient outcomes by providing timely insights into potential safety concerns associated with medicinal products.

Driving factors for this market's expansion are multifaceted. The escalating number of new drug approvals and the global expansion of pharmaceutical markets inherently lead to a larger volume of safety data requiring systematic management. Simultaneously, increasingly stringent regulatory requirements imposed by health authorities worldwide, such as the FDA, EMA, and PMDA, mandate robust pharmacovigilance systems. Furthermore, the growing awareness and reporting of adverse drug reactions by healthcare professionals and patients, coupled with the imperative for pharmaceutical companies to maintain high standards of patient safety and product reputation, significantly fuel the demand for sophisticated pharmacovigilance and drug safety software solutions.

Pharmacovigilance and Drug Safety Software Market Executive Summary

The Pharmacovigilance and Drug Safety Software Market is currently experiencing robust growth, primarily propelled by several key business and regional trends. From a business perspective, there is a strong shift towards cloud-based solutions, offering greater scalability, accessibility, and cost-effectiveness compared to traditional on-premise systems. Furthermore, market players are increasingly investing in integrating artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) capabilities into their software to automate data entry, enhance signal detection, and improve the efficiency of safety data analysis. Strategic partnerships and mergers and acquisitions are also prevalent, aimed at expanding service portfolios, geographical reach, and technological prowess. This competitive landscape is driving innovation and consolidation as companies strive to offer comprehensive and integrated drug safety platforms.

Regional trends indicate North America as the dominant market, attributed to its well-established pharmaceutical industry, significant R&D investments, and stringent regulatory environment. Europe also holds a substantial share, driven by its sophisticated regulatory bodies like the European Medicines Agency (EMA) and a strong focus on patient safety initiatives. However, the Asia Pacific region is projected to exhibit the highest growth rate during the forecast period. This accelerated growth is fueled by expanding healthcare infrastructures, increasing outsourcing of pharmacovigilance activities to countries like India and China, a growing number of clinical trials, and rising governmental focus on drug safety in developing economies. Latin America, the Middle East, and Africa are also emerging as promising markets, albeit from a smaller base, due to improving healthcare access and increasing awareness of drug safety.

Segmentation trends within the market highlight the growing demand for advanced functionalities. Software for signal detection and risk management is seeing particularly high adoption as companies seek proactive approaches to identifying potential safety issues. The services segment, encompassing consulting, implementation, and maintenance, continues to be crucial for successful deployment and optimization of these complex systems. Moreover, there's a clear trend towards solutions tailored for specific end-users, with pharmaceutical companies and biotechnology firms remaining the largest consumers, followed by contract research organizations (CROs) that handle pharmacovigilance activities for multiple clients. The emphasis on real-time data processing and robust reporting capabilities to meet evolving global regulatory mandates continues to shape product development and market demand.

AI Impact Analysis on Pharmacovigilance and Drug Safety Software Market

Common user questions regarding AI's impact on the Pharmacovigilance and Drug Safety Software Market frequently center on its potential to revolutionize efficiency, accuracy, and scalability, while also raising concerns about data integrity, regulatory acceptance, and the role of human oversight. Users are keen to understand how AI can automate mundane tasks, identify subtle safety signals from vast datasets, and reduce the time and cost associated with pharmacovigilance processes. Questions often surface about AI's capacity to handle unstructured data, integrate with existing systems, and provide predictive insights into drug safety. There's also significant curiosity about the validation of AI algorithms, their interpretability for regulatory bodies, and the extent to which they can truly replace or augment human expertise. The overarching theme is a strong expectation for AI to transform pharmacovigilance from a reactive to a more proactive and intelligent discipline, provided challenges like data quality and regulatory clarity are effectively addressed.

- Automated Adverse Event Case Processing: AI and NLP can significantly automate the intake, triage, and data extraction from various sources, including unstructured text, accelerating case processing and reducing manual effort.

- Enhanced Signal Detection: Machine learning algorithms can identify subtle patterns and emerging safety signals from large volumes of data, which might be missed by traditional methods, leading to earlier detection of potential drug risks.

- Predictive Analytics for Risk Management: AI can leverage historical data to predict potential adverse drug reactions in specific patient populations or under certain conditions, enabling more proactive risk management strategies.

- Improved Literature Screening: AI-powered tools can efficiently screen vast amounts of scientific literature for relevant safety information, saving significant time and resources compared to manual review processes.

- Optimized Regulatory Compliance: AI can assist in generating accurate and compliant safety reports by cross-referencing data with regulatory guidelines, thus streamlining submission processes and reducing the risk of non-compliance.

- Data Quality and Consistency: AI can help identify inconsistencies, duplicates, and errors in safety databases, improving the overall quality and reliability of pharmacovigilance data.

- Personalized Medicine Safety: AI can analyze individual patient data to predict drug responses and potential adverse effects, contributing to the development of more personalized and safer treatment regimens.

- Resource Optimization: By automating repetitive tasks, AI allows skilled pharmacovigilance professionals to focus on complex analysis, critical decision-making, and strategic oversight, leading to better resource allocation.

DRO & Impact Forces Of Pharmacovigilance and Drug Safety Software Market

The Pharmacovigilance and Drug Safety Software Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), alongside broader Impact Forces that shape its trajectory. Key drivers fueling market expansion include the escalating volume of adverse drug event (ADE) reports globally, necessitating sophisticated systems for efficient processing and analysis. The growing complexity of the drug development pipeline, with an increasing number of novel therapies entering the market, further amplifies the need for robust safety monitoring. Additionally, the continuously evolving and increasingly stringent regulatory landscape across major health authorities worldwide mandates meticulous pharmacovigilance practices, driving pharmaceutical companies to adopt advanced software solutions to ensure compliance and avoid penalties. The globalization of clinical trials and drug markets also contributes significantly, requiring harmonized and scalable safety systems capable of managing data from diverse geographical regions and regulatory frameworks.

Conversely, several restraints pose challenges to market growth. The high initial implementation costs associated with pharmacovigilance software, particularly for smaller organizations or those in developing regions, can act as a significant barrier to adoption. Data interoperability challenges, arising from disparate data sources, legacy systems, and varied data formats, often complicate the integration of new software solutions and hinder seamless data flow. The inherent complexity of regulatory compliance across different countries and regions demands highly adaptable software, which can be challenging to develop and maintain. Furthermore, cybersecurity concerns related to sensitive patient and drug safety data require robust security features, adding to the cost and complexity of these systems. A persistent restraint is also the lack of skilled personnel capable of effectively operating and interpreting the outputs from advanced pharmacovigilance software, necessitating specialized training and expertise.

Despite these challenges, numerous opportunities exist for market participants. The rapid integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies into pharmacovigilance software offers immense potential for automating tasks, enhancing signal detection, and providing predictive analytics, thereby driving innovation and efficiency. The shift towards cloud-based solutions presents opportunities for greater scalability, accessibility, and reduced infrastructure costs, making advanced pharmacovigilance capabilities accessible to a broader range of companies. The growing adoption of big data analytics allows for deeper insights into drug safety profiles from real-world data sources. Furthermore, the increasing focus on personalized medicine and advanced therapeutic modalities will necessitate even more refined and precise safety monitoring tools. Expansion into emerging markets, where healthcare infrastructure and regulatory frameworks are developing, represents a significant growth avenue, often facilitated by strategic collaborations and partnerships. The overarching impact forces include ongoing technological advancements, particularly in data science and AI, continuous evolution of global regulatory frameworks, and an ever-increasing demand for enhanced patient safety, all collectively pushing the pharmacovigilance industry towards greater automation, integration, and intelligence.

Segmentation Analysis

The Pharmacovigilance and Drug Safety Software Market is broadly segmented based on Type, Functionality, and End-User, providing a comprehensive understanding of the diverse solutions and applications within this crucial domain. Each segment reflects specific needs and adoption patterns across the pharmaceutical and biotechnology landscape, highlighting specialized requirements for data management, analysis, and regulatory compliance. Understanding these segments is vital for stakeholders to identify market niches, tailor product offerings, and devise effective market entry and growth strategies. The evolution of these segments is closely tied to technological advancements, regulatory changes, and the shifting operational priorities of drug developers and safety monitoring entities.

- By Type

- Software (On-Premise)

- Software (Cloud-Based)

- Services (Consulting)

- Services (Implementation)

- Services (Training & Support)

- Services (Maintenance & Updates)

- By Functionality

- Adverse Event Reporting & Case Management

- Signal Detection & Management

- Risk Management & REMS

- Data Management & Analytics

- Literature Screening

- Regulatory Submission & Compliance

- Workflow Management

- Pharmacovigilance Audits & Quality Management

- By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Medical Device Manufacturers

- Business Process Outsourcing (BPO) Firms

- Academic & Research Institutions

- Government & Regulatory Agencies

Value Chain Analysis For Pharmacovigilance and Drug Safety Software Market

The value chain for the Pharmacovigilance and Drug Safety Software Market commences with upstream activities focused on research and development of core technologies. This includes innovation in areas such as artificial intelligence, machine learning, natural language processing, and big data analytics, which form the technological backbone of modern PV software. Software developers invest heavily in creating robust, scalable, and secure platforms capable of handling vast amounts of complex safety data while ensuring compliance with global regulatory standards. Upstream activities also involve sourcing and integrating various data components, such as coding dictionaries (e.g., MedDRA, WHODRUG) and regulatory intelligence databases, which are essential for the functionality of these systems. Partnerships with technology providers and research institutions are crucial at this stage to bring cutting-edge innovations to market.

Downstream activities involve the distribution, implementation, and ongoing support of the pharmacovigilance software. Distribution channels can be direct, where software vendors sell and implement their solutions directly to end-users such as pharmaceutical companies and CROs. This direct approach often involves extensive consultations, customization, and integration services tailored to the client's specific operational needs and existing IT infrastructure. Indirect distribution channels include partnerships with system integrators, value-added resellers (VARs), and strategic alliances with other healthcare technology providers. These indirect channels help expand market reach, especially in regions where direct presence might be limited. The complexity of pharmacovigilance systems necessitates comprehensive training, ongoing technical support, and regular software updates and maintenance services, which are critical downstream components ensuring client satisfaction and long-term system efficacy.

The entire value chain is characterized by a high degree of specialization and a strong emphasis on regulatory compliance and data security. Direct channels offer vendors greater control over the implementation process and direct customer relationships, enabling bespoke solutions and faster feedback loops for product enhancement. Indirect channels, while potentially offering broader market penetration, require careful management of partner relationships to maintain service quality and brand reputation. Both direct and indirect models underscore the importance of post-sale support, as pharmacovigilance software is not a one-time purchase but a continuous service that evolves with regulatory changes and technological advancements. This integrated approach, from initial R&D to sustained customer support, defines the value proposition within the Pharmacovigilance and Drug Safety Software market.

Pharmacovigilance and Drug Safety Software Market Potential Customers

The potential customers for Pharmacovigilance and Drug Safety Software are primarily organizations engaged in the development, manufacturing, and commercialization of medicinal products and medical devices, as well as those supporting these activities. The largest segment of end-users consists of pharmaceutical companies, ranging from large multinational corporations to small and medium-sized enterprises. These companies have an inherent and legally mandated responsibility to monitor the safety of their products throughout their entire lifecycle, from preclinical research through post-market surveillance. They require robust software to manage adverse event reporting, conduct signal detection, perform risk assessments, and ensure compliance with global regulatory bodies such as the FDA, EMA, and PMDA. Their complex pipelines and extensive product portfolios necessitate highly scalable and integrated pharmacovigilance solutions.

Biotechnology companies represent another significant customer base, often specializing in innovative therapies like biologics, gene therapies, and cell therapies. These cutting-edge products can have unique safety profiles and require specialized pharmacovigilance approaches, making advanced software crucial for effective monitoring and risk management. Contract Research Organizations (CROs) also form a substantial segment of potential customers, as many pharmaceutical and biotechnology firms outsource their pharmacovigilance activities to these specialized service providers. CROs need sophisticated software to efficiently manage safety data for multiple clients, ensuring adherence to diverse regulatory requirements and providing comprehensive reports. Their operational model demands highly flexible and customizable software platforms that can adapt to various study designs and client specifications.

Beyond these core sectors, medical device manufacturers are increasingly adopting pharmacovigilance-like software for post-market surveillance of devices, driven by evolving regulations like the European Medical Device Regulation (MDR) which emphasizes robust safety monitoring. Business Process Outsourcing (BPO) firms that specialize in pharmacovigilance services for life sciences companies also rely heavily on these software solutions. Additionally, academic and research institutions involved in clinical trials or drug safety research, as well as certain government and regulatory agencies responsible for public health and drug approvals, constitute potential customers seeking advanced tools for data analysis, trend identification, and regulatory oversight. The common thread among all these potential customers is the critical need for efficient, compliant, and data-driven systems to ensure patient safety and maintain regulatory integrity in the complex world of healthcare products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2032 | USD 3.8 Billion |

| Growth Rate | 11.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oracle, ArisGlobal, IQVIA, Veeva Systems, Accenture, Cognizant, Wipro, MaxisIT, Extrovis, Sparta Systems (Honeywell), United BioSource Corporation (UBC), Sarjen Systems, EXL, TAKE Solutions, Clario, Prodapt, Bioclinica, ClinCapture, Medidata Solutions, Pharmacosmos |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmacovigilance and Drug Safety Software Market Key Technology Landscape

The Pharmacovigilance and Drug Safety Software Market is characterized by a rapidly evolving technology landscape, driven by the increasing need for efficiency, accuracy, and robust data management in drug safety. Core to this landscape are advanced data management systems, which include relational databases and specialized pharmacovigilance databases designed to handle vast volumes of structured and unstructured adverse event data. These systems ensure data integrity, facilitate efficient querying, and support complex reporting requirements. Cloud computing platforms have emerged as a pivotal technology, offering scalable, secure, and accessible infrastructure for hosting pharmacovigilance applications, thereby reducing the need for significant on-premise IT investments and enabling seamless collaboration across geographically dispersed teams. The adoption of cloud-native architectures further enhances flexibility and resilience.

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the market by enabling intelligent automation and advanced analytics. Natural Language Processing (NLP) is particularly critical for extracting meaningful information from unstructured data sources such as free-text adverse event reports, clinical narratives, and scientific literature. This automation significantly reduces manual effort in case processing and data entry, improving both speed and accuracy. ML algorithms are employed for advanced signal detection, identifying subtle patterns and potential safety issues that might be overlooked by human review, thereby facilitating more proactive risk management. Predictive analytics, powered by AI, helps forecast potential adverse drug reactions and risk factors based on historical and real-world data, contributing to more informed decision-making.

Furthermore, Robotic Process Automation (RPA) is increasingly being utilized to automate repetitive, rule-based tasks within pharmacovigilance workflows, such as data reconciliation, report generation, and interaction with external systems. Integration capabilities, leveraging APIs (Application Programming Interfaces) and standardized data formats (e.g., ICH E2B), are essential for seamless interoperability between pharmacovigilance systems and other enterprise applications like Electronic Health Records (EHRs), Clinical Trial Management Systems (CTMS), and regulatory submission platforms. Business Intelligence (BI) and visualization tools are also critical, providing intuitive dashboards and reporting functionalities that allow pharmacovigilance professionals to monitor key safety metrics, identify trends, and communicate insights effectively to stakeholders and regulatory authorities. These technologies collectively contribute to a more integrated, intelligent, and efficient pharmacovigilance ecosystem.

Regional Highlights

- North America: This region holds the largest share of the Pharmacovigilance and Drug Safety Software Market, driven by the presence of a well-established pharmaceutical and biotechnology industry, substantial R&D investments, and stringent regulatory frameworks from bodies like the FDA. High adoption of advanced technologies and a significant number of ongoing clinical trials further solidify its dominance. The region benefits from a mature healthcare infrastructure and high awareness regarding patient safety.

- Europe: Europe represents a significant market share, characterized by its robust regulatory environment, including the European Medicines Agency (EMA) and national competent authorities, which enforce comprehensive pharmacovigilance guidelines. Countries like Germany, the UK, France, and Switzerland are key contributors, driven by a strong focus on patient safety, high pharmaceutical expenditure, and ongoing efforts to digitalize healthcare systems. The move towards centralized PV systems also boosts software adoption.

- Asia Pacific (APAC): This region is projected to exhibit the highest CAGR during the forecast period. Factors contributing to this rapid growth include the expanding pharmaceutical and biotechnology sectors, increasing number of clinical trials, and growing outsourcing of pharmacovigilance activities to countries like India and China. Improving healthcare infrastructure, rising disposable incomes, and increasing government initiatives to strengthen drug safety regulations are also propelling market expansion.

- Latin America: The Latin American market is experiencing steady growth, fueled by increasing investments in healthcare infrastructure, a growing pharmaceutical industry, and rising awareness of drug safety. Countries such as Brazil, Mexico, and Argentina are leading the adoption of pharmacovigilance software as they align their regulatory practices with global standards and seek to enhance public health.

- Middle East and Africa (MEA): While a smaller market, MEA is anticipated to witness considerable growth. This growth is attributed to increasing healthcare spending, government initiatives to modernize regulatory frameworks, and a rising prevalence of chronic diseases necessitating broader drug safety monitoring. The region is increasingly attracting investments in clinical research and pharmaceutical manufacturing, which in turn drives the demand for robust pharmacovigilance solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmacovigilance and Drug Safety Software Market.- Oracle Corporation

- ArisGlobal

- IQVIA

- Veeva Systems

- Accenture PLC

- Cognizant Technology Solutions Corporation

- Wipro Limited

- MaxisIT Inc.

- Extrovis

- Sparta Systems (A Honeywell Company)

- United BioSource Corporation (UBC)

- Sarjen Systems Pvt. Ltd.

- EXLService Holdings, Inc.

- TAKE Solutions Ltd.

- Clario (formerly ERT Clinical)

- Prodapt Solutions Pvt. Ltd.

- Bioclinica, Inc.

- ClinCapture

- Medidata Solutions (A Dassault Systèmes Company)

- Pharmacosmos

Frequently Asked Questions

Analyze common user questions about the Pharmacovigilance and Drug Safety Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Pharmacovigilance and Drug Safety Software?

Pharmacovigilance and Drug Safety Software comprises specialized applications designed to manage the entire lifecycle of drug safety, including collecting, processing, analyzing, and reporting adverse drug events (ADEs) to ensure patient safety and regulatory compliance for pharmaceutical products and medical devices.

Why is this software becoming increasingly crucial for pharmaceutical companies?

The software is crucial due to increasingly stringent global regulatory requirements, the rising volume and complexity of adverse event data, the need for enhanced patient safety monitoring, and the desire to automate manual processes for greater efficiency and accuracy in drug safety management.

What are the primary benefits of implementing pharmacovigilance software?

Key benefits include improved efficiency in case processing and reporting, enhanced accuracy of safety data, better detection of potential drug safety signals, streamlined regulatory submissions, reduced operational costs, and ultimately, greater assurance of patient safety and product integrity.

How is Artificial Intelligence (AI) impacting the Pharmacovigilance and Drug Safety Software Market?

AI is significantly impacting the market by automating adverse event case processing, enhancing signal detection from large datasets, enabling predictive analytics for risk management, and improving the efficiency of literature screening, leading to more proactive and intelligent pharmacovigilance.

What are the key challenges associated with adopting pharmacovigilance software?

Major challenges include high initial implementation and maintenance costs, complexities in data integration from disparate sources, ensuring interoperability with existing systems, navigating evolving global regulatory landscapes, and addressing data privacy and cybersecurity concerns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager