Phosphate Conversion Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428600 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Phosphate Conversion Coatings Market Size

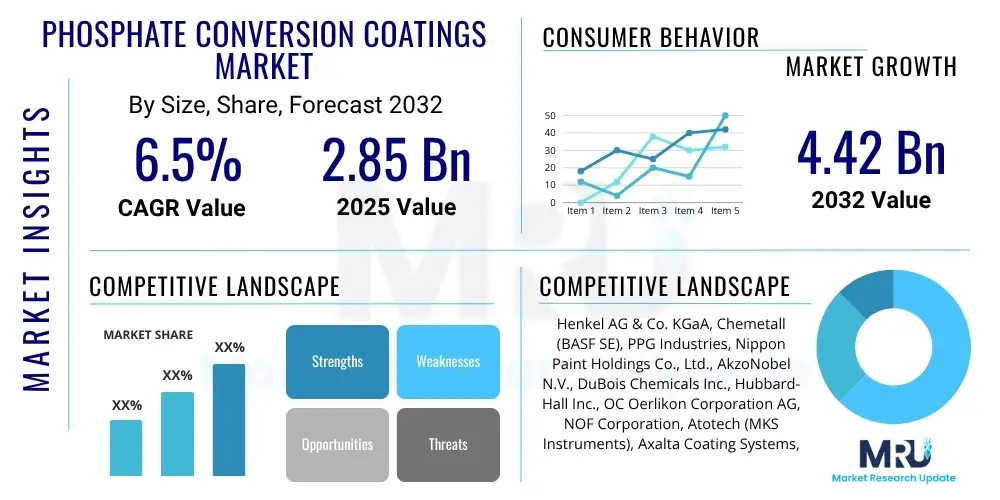

The Phosphate Conversion Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at $2.85 billion in 2025 and is projected to reach $4.42 billion by the end of the forecast period in 2032.

Phosphate Conversion Coatings Market introduction

The Phosphate Conversion Coatings market encompasses a vital segment within the broader surface treatment industry, primarily focused on enhancing the durability and performance of various metallic substrates. These coatings are formed by a chemical reaction between the metal surface and a phosphoric acid solution containing specific metal ions like zinc, iron, manganese, or calcium. This process creates a thin, crystalline layer that is integral to the substrate, offering superior adhesion for subsequent organic coatings, improved corrosion resistance, and enhanced anti-friction properties.

Key applications of phosphate conversion coatings span across numerous industrial sectors, including automotive manufacturing for chassis and body components, general industrial machinery for wear resistance and paint adhesion, and the military and aerospace sectors for robust corrosion protection. The benefits derived from these coatings are substantial, ranging from extending the lifespan of treated parts to reducing maintenance costs and ensuring optimal performance in harsh environments. The market's growth is predominantly driven by the escalating demand from these end-use industries, particularly within the automotive and general manufacturing sectors, where stringent quality and durability standards necessitate advanced surface treatment solutions.

Furthermore, the continuous innovation in formulation chemistry, including the development of chrome-free and low-temperature phosphate processes, contributes significantly to market expansion. These advancements address growing environmental concerns and operational efficiency requirements, making phosphate conversion coatings a preferred choice for preparing metal surfaces. The inherent versatility and cost-effectiveness of these coatings, coupled with their proven track record in diverse applications, solidify their indispensable role in modern industrial processes, supporting a wide array of manufacturing needs from consumer goods to heavy machinery.

Phosphate Conversion Coatings Market Executive Summary

The Phosphate Conversion Coatings market is currently experiencing robust growth, primarily fueled by the accelerating expansion of the automotive industry and the steady demand from general manufacturing and heavy machinery sectors. Business trends indicate a strong focus on developing more environmentally sustainable formulations, such as chrome-free and low-temperature phosphate solutions, to comply with evolving regulations and enhance operational efficiency for manufacturers. The market is also seeing increased investment in automation and advanced process control technologies to optimize coating application and ensure consistent quality, reflecting a broader trend towards smart manufacturing practices.

Regionally, Asia Pacific continues to emerge as a dominant force, driven by rapid industrialization, burgeoning automotive production, and significant infrastructure development in countries like China, India, and Southeast Asian nations. North America and Europe, while more mature markets, exhibit stable demand, characterized by a preference for high-performance and specialty coatings that meet stringent environmental and performance standards. These regions are also leading in research and development, particularly in innovative coating technologies and sustainable practices, which influences global market trends. The Middle East and Africa, alongside Latin America, are showing promising growth potential, supported by increasing investments in manufacturing capabilities and infrastructure projects.

In terms of segmentation, zinc phosphate coatings remain a cornerstone due to their superior corrosion resistance and paint adhesion properties, especially within the automotive sector. However, iron phosphate coatings are gaining traction for their cost-effectiveness and simpler application processes, making them popular in general industrial applications. End-user segments such as automotive, general industrial, and heavy machinery are the primary revenue generators, with continuous innovation in coating types tailored to specific application requirements further driving segment-specific growth. The overall market trajectory is poised for sustained expansion, underpinned by technological advancements and persistent demand for enhanced surface protection across diverse industries.

AI Impact Analysis on Phosphate Conversion Coatings Market

Users frequently inquire about how Artificial Intelligence will revolutionize traditional manufacturing processes like phosphate conversion coatings, specifically focusing on process optimization, quality control, and environmental compliance. Key themes revolve around the potential for AI to enhance efficiency, reduce waste, and improve the consistency of coating applications. There is a strong expectation that AI will provide predictive capabilities for maintenance, enable real-time adjustments to chemical baths, and automate defect detection. Concerns often include the initial investment costs, the complexity of integrating AI into existing infrastructure, and the need for a skilled workforce capable of managing AI-driven systems. Users anticipate that AI will ultimately lead to higher quality, more sustainable, and cost-effective coating solutions, ensuring the long-term viability and competitiveness of the industry.

- AI for real-time process control and optimization of bath parameters, reducing chemical consumption.

- Predictive maintenance of coating lines and equipment, minimizing downtime and operational costs.

- Enhanced quality control through AI-powered vision systems for automated defect detection and classification.

- AI-driven material discovery and formulation optimization for novel phosphate coating chemistries.

- Improved environmental compliance through intelligent waste management and effluent treatment systems.

- Supply chain optimization for raw materials used in phosphate coating solutions.

- Personalized coating recommendations based on substrate, application, and environmental conditions.

- Data analytics for identifying trends in coating performance and customer requirements.

DRO & Impact Forces Of Phosphate Conversion Coatings Market

The Phosphate Conversion Coatings market is propelled by a confluence of robust drivers, notably the consistent expansion of the automotive industry, which relies heavily on these coatings for corrosion protection and paint adhesion on vehicle bodies and components. The broader manufacturing sector, encompassing appliances, electronics, and heavy machinery, also contributes significantly to demand, seeking durable and cost-effective surface treatments. Furthermore, increasing urbanization and infrastructure development globally necessitate protective coatings for construction materials and equipment, thereby boosting market growth. However, this growth is met with certain restraints, primarily the rising environmental regulations concerning the discharge of heavy metals and wastewater generated by traditional phosphating processes. These regulations push manufacturers towards more environmentally friendly alternatives, which can sometimes involve higher initial investment or different performance characteristics, posing a challenge to established practices.

Opportunities within the market largely stem from the ongoing advancements in sustainable coating technologies. The development and adoption of chrome-free, nickel-free, and low-temperature phosphate formulations present significant growth avenues, addressing both environmental concerns and energy efficiency needs. Moreover, the increasing demand for high-performance coatings in niche applications, such as aerospace and military, where extreme durability and specific protective properties are paramount, offers specialized market opportunities. Emerging economies in Asia Pacific and Latin America, with their rapidly industrializing manufacturing bases and growing consumer markets, also represent fertile ground for market expansion as these regions adopt more sophisticated surface treatment technologies to meet international standards.

The impact forces at play in this market are complex and interconnected. Technological advancements, particularly in nanotechnology and smart coatings, are driving innovation, leading to products with enhanced performance attributes like improved corrosion resistance and better adhesion. Economic shifts, including global manufacturing output and trade policies, directly influence demand from end-use industries. Regulatory pressures, especially those related to environmental protection and worker safety, act as both a restraint and a driver, pushing the industry towards more sustainable practices while potentially increasing operational costs. Competitive intensity from alternative coating technologies, such as electroplating, powder coatings, and various organic coatings, continuously pressures phosphate coating manufacturers to innovate and differentiate their offerings, maintaining a balance between cost-effectiveness and performance.

Segmentation Analysis

The Phosphate Conversion Coatings market is extensively segmented based on several key parameters including the type of coating, the application method, and the end-use industry. This segmentation provides a granular view of the market dynamics, revealing specific growth drivers and competitive landscapes within each category. Understanding these segments is crucial for stakeholders to identify target markets, develop tailored product offerings, and formulate effective market penetration strategies, aligning with the diverse needs of various industrial applications for surface protection and enhancement.

- By Type:

- Zinc Phosphate Coatings

- Iron Phosphate Coatings

- Manganese Phosphate Coatings

- Calcium Phosphate Coatings

- Others (e.g., Nickel Phosphate)

- By Application Method:

- Immersion Phosphating

- Spray Phosphating

- Wipe Phosphating

- Electro-phosphating

- By End-Use Industry:

- Automotive

- General Industrial (Appliances, Furniture, Consumer Goods)

- Heavy Machinery

- Aerospace

- Military & Defense

- Construction

- Electronics

- Others (e.g., Medical Devices, Oil & Gas)

- By Substrate:

- Steel

- Galvanized Steel

- Aluminum

- Other Non-ferrous Metals

Value Chain Analysis For Phosphate Conversion Coatings Market

The value chain for the Phosphate Conversion Coatings market begins with the upstream suppliers of raw materials, which are critical for the formulation of conversion coating solutions. These typically include phosphoric acid, various metal salts (zinc, iron, manganese, nickel), accelerators (nitrites, peroxides), surfactants, and other additives that influence the coating's performance and application characteristics. The quality and availability of these raw materials directly impact the cost and final properties of the phosphate coating solutions. Key suppliers in this segment focus on ensuring consistent quality, competitive pricing, and adherence to chemical purity standards, as these factors are foundational to the entire value chain.

Moving downstream, these raw materials are processed and formulated by chemical manufacturers into ready-to-use phosphate conversion coating products. These manufacturers invest significantly in research and development to create innovative formulations that offer improved corrosion resistance, better adhesion, and more environmentally friendly profiles (e.g., chrome-free, low-temperature processes). Their distribution channels are diverse, including direct sales to large industrial end-users, or indirect sales through specialized distributors and chemical suppliers who possess the logistical capabilities and technical expertise to serve a broader customer base, including smaller businesses that may not have direct relationships with major chemical producers.

The final stage of the value chain involves the end-users who apply these coatings to various metallic substrates. This includes major industries such as automotive, general industrial manufacturing, aerospace, and construction. Application can be performed in-house by large manufacturers with dedicated surface treatment lines or outsourced to specialized job shops that provide coating services. The effectiveness of the entire value chain is measured by the ability of these coatings to deliver enhanced product durability, improved aesthetics, and superior performance, ultimately benefiting the end product and contributing to its market competitiveness. Direct channels facilitate closer collaboration and customization, while indirect channels provide wider market reach and support for diverse operational scales.

Phosphate Conversion Coatings Market Potential Customers

The primary potential customers for phosphate conversion coatings are diverse industrial entities that require robust surface treatment solutions for metallic components. These coatings are essential for industries focused on manufacturing products that demand high levels of corrosion resistance, improved paint adhesion, or enhanced wear properties. The automotive sector stands as a paramount consumer, utilizing these coatings extensively for car bodies, engine parts, and under-the-hood components to ensure longevity and aesthetic quality. This industry's rigorous performance standards and high production volumes make it a significant and stable market for phosphate conversion coating suppliers.

Beyond automotive, the general industrial manufacturing sector forms another substantial customer base. This includes manufacturers of household appliances (e.g., refrigerators, washing machines), furniture, industrial machinery, and electrical enclosures. These customers seek cost-effective solutions to protect their metal products from rust and to prepare surfaces optimally for subsequent painting or powder coating, thereby extending product life and improving market appeal. The varied needs within this segment often drive demand for different types of phosphate coatings, from zinc phosphate for maximum protection to iron phosphate for simpler, more economical applications.

Furthermore, specialized industries such as aerospace, military and defense, and heavy machinery manufacturers represent high-value potential customers. In these sectors, components often operate in extreme environments, necessitating superior protection against corrosion, abrasion, and fatigue. The construction industry also utilizes these coatings for structural steel components and fasteners, ensuring durability in exposed conditions. As industrialization continues globally, particularly in emerging economies, the pool of potential customers is expected to expand, driven by increasing manufacturing output and the growing adoption of advanced surface treatment technologies to meet global quality standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2.85 billion |

| Market Forecast in 2032 | $4.42 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Chemetall (BASF SE), PPG Industries, Nippon Paint Holdings Co., Ltd., AkzoNobel N.V., DuBois Chemicals Inc., Hubbard-Hall Inc., OC Oerlikon Corporation AG, NOF Corporation, Atotech (MKS Instruments), Axalta Coating Systems, AHC Oberflächentechnik GmbH, Freiburger Chemische Fabrik GmbH, SurTec International GmbH, The Sherwin-Williams Company, KYZEN Corporation, Metal Finishing Technologies, Inc., Birchwood Technologies, McGean-Rohco Inc., Solvay S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phosphate Conversion Coatings Market Key Technology Landscape

The technology landscape for the Phosphate Conversion Coatings market is continuously evolving, driven by the need for improved performance, enhanced environmental compliance, and greater operational efficiency. Traditional immersion and spray phosphating remain prevalent, offering proven methods for applying a uniform coating. However, significant advancements are being made in developing more sophisticated formulations and application techniques. One crucial area of innovation is in chrome-free phosphate coatings, which utilize alternative metal ions or organic additives to achieve similar or superior corrosion resistance and paint adhesion without the environmental hazards associated with hexavalent chromium, thus addressing stringent regulatory demands and increasing sustainability.

Furthermore, research and development efforts are focused on low-temperature phosphating processes, which enable energy savings during application, reducing operational costs for end-users. These technologies are particularly attractive for large-scale industrial operations where energy consumption is a significant concern. Nanotechnology is also playing an increasingly important role, with the incorporation of nanoparticles and advanced additives into phosphate baths. These innovations aim to create finer, more uniform crystalline structures, leading to enhanced barrier properties, improved adhesion, and superior overall coating performance, especially for demanding applications in automotive and aerospace.

Beyond the chemical formulations, the technology landscape also encompasses advancements in process control and automation. Modern coating lines integrate sophisticated sensors, real-time monitoring systems, and increasingly, AI-driven algorithms to precisely control bath parameters such as concentration, temperature, and pH. This ensures consistent coating quality, minimizes waste, and optimizes chemical usage, leading to more efficient and reliable operations. The synergy between advanced chemistry and smart manufacturing technologies defines the cutting edge of the phosphate conversion coatings market, pushing the boundaries of what these essential surface treatments can achieve in terms of performance, cost-effectiveness, and environmental responsibility.

Regional Highlights

- North America: A mature market with stable demand, driven by the robust automotive and aerospace industries. Focus on high-performance and environmentally compliant coatings.

- Europe: Characterized by stringent environmental regulations, prompting innovation in chrome-free and low-VOC phosphate formulations. Germany and France are key contributors due to strong manufacturing bases.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, expanding automotive production, and significant infrastructure development in China, India, and Japan. High demand for cost-effective and efficient coating solutions.

- Latin America: Emerging market with growing manufacturing activities, particularly in Brazil and Mexico. Increasing adoption of advanced surface treatment technologies to meet quality standards.

- Middle East and Africa (MEA): Gradually expanding market, supported by investments in infrastructure, automotive manufacturing, and defense sectors. Opportunities for specialized corrosion protection solutions in harsh climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phosphate Conversion Coatings Market.- Henkel AG & Co. KGaA

- Chemetall (BASF SE)

- PPG Industries

- Nippon Paint Holdings Co., Ltd.

- AkzoNobel N.V.

- DuBois Chemicals Inc.

- Hubbard-Hall Inc.

- OC Oerlikon Corporation AG

- NOF Corporation

- Atotech (MKS Instruments)

- Axalta Coating Systems

- AHC Oberflächentechnik GmbH

- Freiburger Chemische Fabrik GmbH

- SurTec International GmbH

- The Sherwin-Williams Company

- KYZEN Corporation

- Metal Finishing Technologies, Inc.

- Birchwood Technologies

- McGean-Rohco Inc.

- Solvay S.A.

Frequently Asked Questions

What are phosphate conversion coatings used for?

Phosphate conversion coatings are primarily used to enhance corrosion resistance, improve paint adhesion, and provide anti-friction or wear resistance properties to metallic surfaces in various industrial applications.

What types of phosphate coatings are available?

Common types include zinc phosphate for superior corrosion and paint adhesion, iron phosphate for cost-effective general-purpose protection, and manganese phosphate for wear resistance and lubrication.

Which industries are the largest consumers of these coatings?

The automotive industry is the largest consumer, followed by general industrial manufacturing (appliances, machinery), heavy machinery, and defense, all seeking enhanced metal protection.

Are there environmentally friendly alternatives to traditional phosphate coatings?

Yes, the market is actively developing chrome-free, nickel-free, and low-temperature phosphate formulations to meet stringent environmental regulations and improve energy efficiency.

How does AI impact the phosphate conversion coatings market?

AI impacts the market by optimizing process control, enabling predictive maintenance, enhancing quality control through automated inspection, and assisting in the discovery of new coating formulations, leading to more efficient and sustainable operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager