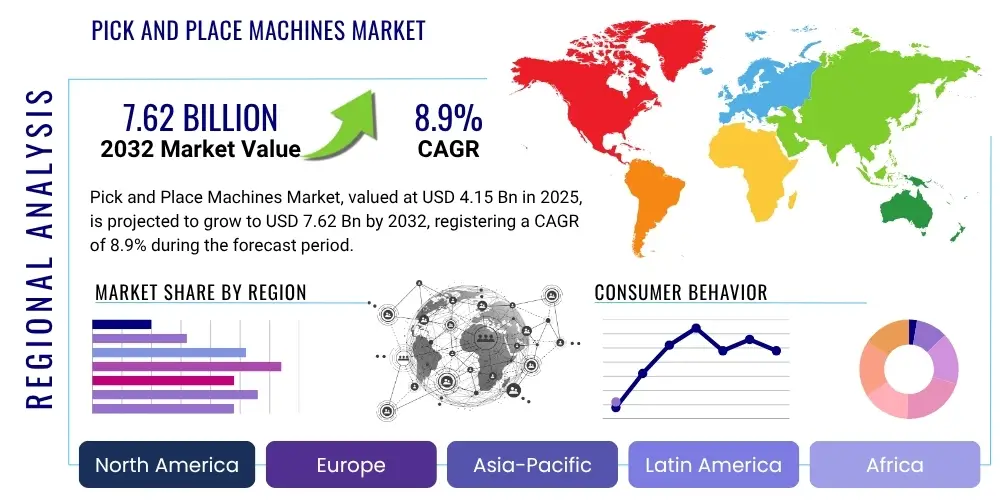

Pick and Place Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430064 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Pick and Place Machines Market Size

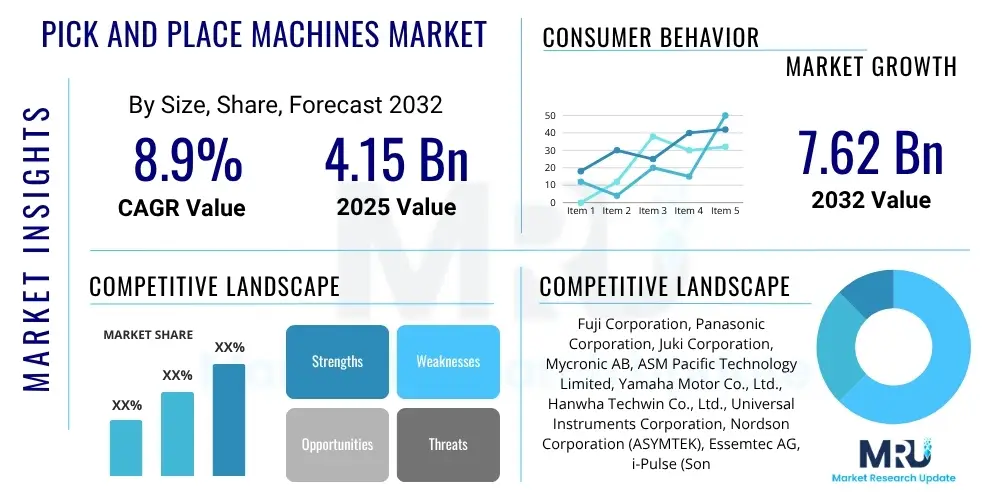

The Pick and Place Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2032. The market is estimated at USD 4.15 Billion in 2025 and is projected to reach USD 7.62 Billion by the end of the forecast period in 2032.

Pick and Place Machines Market introduction

Pick and Place machines are highly sophisticated robotic systems critical for high-speed, precise assembly in various manufacturing processes, primarily in surface mount technology (SMT) for electronics. These machines are designed to automatically pick up electronic components, often microscopic, from feeders and place them onto printed circuit boards (PCBs) or other substrates with extreme accuracy and speed. They form the backbone of modern automated production lines, ensuring consistent quality and enabling the mass production of complex electronic devices. Their role extends beyond simple component placement, encompassing vision inspection, alignment, and data logging, making them indispensable in today's advanced manufacturing landscape.

The core product in this market includes a range of machines from compact desktop units to large, multi-gantry systems capable of processing thousands of components per hour. Major applications span across consumer electronics, automotive electronics, medical devices, telecommunications infrastructure, and industrial controls, where the demand for miniaturization, higher component density, and flawless assembly is paramount. Benefits derived from the adoption of these machines are numerous, including significantly increased production throughput, enhanced placement accuracy, reduced manufacturing costs per unit, and improved product reliability. They also address the challenge of handling increasingly smaller and more delicate components that are difficult or impossible to manage manually, thereby facilitating complex product designs and faster time-to-market.

Key driving factors for the Pick and Place Machines Market include the relentless growth of the global electronics industry, driven by rising demand for smartphones, wearable technology, IoT devices, and advanced automotive electronics. Furthermore, the increasing adoption of Industry 4.0 initiatives and smart factory concepts globally fuels the demand for automation solutions that integrate seamlessly with broader manufacturing ecosystems. The continuous push for miniaturization of electronic components, coupled with escalating labor costs in traditional manufacturing regions, further compels manufacturers to invest in these advanced automated assembly systems. This transition ensures operational efficiency, cost-effectiveness, and the ability to meet stringent quality standards required by modern technological advancements.

Pick and Place Machines Market Executive Summary

The Pick and Place Machines Market is experiencing dynamic growth, characterized by significant technological advancements and expanding application across diverse industries. Business trends indicate a strong focus on integration capabilities, with manufacturers developing machines that offer seamless compatibility with existing production lines, along with modular designs for scalability and flexibility. There is a discernible shift towards offering comprehensive solutions that include advanced software for optimization, predictive maintenance, and real-time process monitoring, rather than just standalone hardware. Strategic partnerships and mergers among machine manufacturers and software providers are also becoming prevalent, aiming to create integrated ecosystems that enhance operational efficiency and data-driven decision-making for end-users. The market is also witnessing increased competition, driving innovation in machine speed, accuracy, and versatility to cater to varying production requirements.

Regional trends highlight Asia Pacific as the dominant market, primarily due to its robust electronics manufacturing base, particularly in countries like China, Japan, South Korea, and Taiwan, which serve as global hubs for electronic component and device production. The region benefits from lower manufacturing costs, extensive supply chain networks, and significant investments in smart factory initiatives. North America and Europe are also experiencing steady growth, driven by advanced manufacturing capabilities, increasing automation in high-value industries like automotive and medical devices, and a focus on reshoring manufacturing activities to enhance supply chain resilience. Emerging economies in Latin America and the Middle East and Africa are showing nascent but promising growth, fueled by industrialization and rising demand for consumer electronics, prompting local manufacturers to upgrade their production capabilities.

Segmentation trends reveal a sustained demand for high-speed, multi-functional pick and place machines capable of handling a wide array of component sizes and types, from ultra-small 01005 chips to large connectors. The software segment, particularly for optimization and analytics, is gaining significant traction, enabling manufacturers to maximize machine utilization and minimize downtime. In terms of application, consumer electronics continue to be a major revenue generator, while the automotive electronics sector is emerging as a critical growth engine, propelled by the increasing complexity of in-vehicle infotainment systems, ADAS (Advanced Driver-Assistance Systems), and electric vehicle components. The market is also seeing a specialized demand for machines tailored for medical device manufacturing, where precision and reliability are paramount, and for telecommunications equipment, driven by the rollout of 5G infrastructure requiring high-density PCB assembly.

AI Impact Analysis on Pick and Place Machines Market

User inquiries concerning AI's influence on Pick and Place Machines frequently revolve around expectations for enhanced precision, improved operational efficiency, and the potential for autonomous decision-making in manufacturing environments. Users are keen to understand how AI can address common challenges such as defect detection, machine downtime, and optimizing complex placement sequences. Key themes emerging from these questions include the integration of AI for predictive maintenance to minimize unscheduled stoppages, leveraging machine learning for adaptive component handling to improve placement accuracy, and utilizing AI-powered vision systems for faster and more reliable quality control. There is also significant interest in how AI can simplify programming, reduce setup times, and enable greater flexibility for rapidly changing product lines, ultimately translating into lower operational costs and higher production yields.

Artificial intelligence is fundamentally transforming Pick and Place machine capabilities by introducing a new level of intelligence and adaptability into automated assembly. AI-powered vision systems, for instance, can analyze component characteristics and placement fiducials with unprecedented speed and accuracy, far surpassing traditional algorithms. This capability significantly reduces errors related to component orientation, polarity, and precise alignment on the PCB, even with extremely small or irregularly shaped components. Furthermore, AI algorithms can learn from vast datasets of past operations, including successful placements and error instances, to continuously refine their performance. This learning capability allows machines to adapt to variations in component quality, substrate characteristics, and environmental conditions, leading to a more robust and reliable manufacturing process. The integration of AI also facilitates real-time defect detection and classification, allowing for immediate corrective actions and preventing the propagation of faults down the production line, thus enhancing overall product quality.

Beyond precision and defect detection, AI is crucial in optimizing the operational efficiency and predictive capabilities of Pick and Place machines. Machine learning models can analyze sensor data from various machine components (e.g., motors, cameras, nozzles) to predict potential mechanical failures before they occur. This enables proactive maintenance scheduling, minimizing unscheduled downtime and extending the operational lifespan of the equipment. Furthermore, AI can optimize placement paths and sequences, intelligently managing multiple component feeders and nozzle changes to reduce non-productive movements and maximize throughput. This dynamic optimization is particularly beneficial in high-mix, low-volume production scenarios where rapid changeovers and adaptive programming are essential. The ability of AI to analyze complex production data, identify bottlenecks, and suggest improvements empowers manufacturers to achieve higher levels of automation, reduce manual intervention, and gain a competitive edge in fast-evolving markets, making production lines smarter and more responsive.

- Enhanced placement precision and accuracy through advanced vision processing and adaptive algorithms.

- Predictive maintenance capabilities, minimizing downtime by anticipating equipment failures.

- Optimized component placement sequences and path planning, improving throughput and efficiency.

- Real-time defect detection and classification, reducing manufacturing errors and improving quality control.

- Adaptive learning for handling variations in components and production conditions.

- Reduced programming complexity and faster setup times for new product lines.

- Improved yield rates and lower operational costs through intelligent resource management.

- Integration with broader smart factory ecosystems for centralized control and data analysis.

DRO & Impact Forces Of Pick and Place Machines Market

The Pick and Place Machines Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating demand for automation across the global manufacturing sector, particularly within the electronics industry, as companies strive for higher efficiency, precision, and cost reduction. The pervasive trend of miniaturization in electronic components and products, such as smartphones, wearables, and IoT devices, necessitates the use of highly accurate automated placement solutions that human operators cannot match. Furthermore, the increasing adoption of Industry 4.0 initiatives and smart factory concepts, emphasizing interconnected and intelligent manufacturing systems, fuels the demand for advanced Pick and Place machines equipped with enhanced connectivity, data analytics, and real-time monitoring capabilities. The rising labor costs in many industrial regions also push manufacturers towards automating assembly processes to maintain competitiveness.

However, the market also faces considerable restraints. The substantial initial capital investment required for high-precision Pick and Place machines can be a significant barrier for smaller manufacturers or those in developing regions. The technical complexity involved in operating, programming, and maintaining these sophisticated machines demands a skilled workforce, which can be challenging to acquire and retain, leading to operational bottlenecks. Furthermore, the rapid pace of technological obsolescence, where newer, more efficient models are constantly introduced, requires continuous investment in upgrades, potentially impacting the return on investment for businesses. The integration challenges with existing legacy systems, differing communication protocols, and the need for significant infrastructure changes also pose hurdles to widespread adoption, particularly for companies not starting with a greenfield setup.

Despite these restraints, the market presents significant opportunities for growth and innovation. The expansion of manufacturing capabilities in emerging economies, coupled with their increasing consumption of electronic goods, opens new geographic markets for Pick and Place machine manufacturers. The growing trend towards customization and high-mix, low-volume production creates a demand for flexible and modular machines that can adapt quickly to diverse product requirements. Advances in robotics, vision systems, and artificial intelligence offer avenues for developing even more intelligent, autonomous, and efficient machines, enhancing their capabilities beyond traditional placement tasks. Furthermore, the increasing focus on sustainable manufacturing practices encourages the development of energy-efficient machines with reduced material waste, aligning with environmental regulations and corporate social responsibility goals, thus creating new market niches and competitive advantages for innovative providers.

Segmentation Analysis

The Pick and Place Machines Market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation allows for precise analysis of market trends, consumer preferences, technological advancements, and regional variations, offering valuable insights for strategic planning and investment decisions. The market is primarily categorized by Type, Head Type, Speed, Application, and End-Use Industry, reflecting the varied technological capacities and operational requirements of different manufacturing environments. Each segment contributes uniquely to the market's overall growth, with specific demand drivers and competitive landscapes. Understanding these distinct segments helps stakeholders identify key growth areas, address specific customer needs, and develop targeted product offerings that cater to specialized market demands, ranging from high-volume consumer electronics production to precision medical device assembly.

- By Type

- Automatic Pick and Place Machines: These machines operate fully autonomously, handling component feeding, placement, and vision inspection without manual intervention. They are prevalent in high-volume, continuous production lines, offering maximum throughput and minimal human error.

- Semi-Automatic Pick and Place Machines: These require some manual intervention, typically for component loading or program setup, but automate the core placement process. They are suitable for medium-volume production or specialized tasks where flexibility and human oversight are desired.

- Manual Pick and Place Machines: Primarily used for prototyping, low-volume production, or repair work, these machines rely heavily on human operation for component placement. While slower, they offer maximum flexibility and lower initial cost.

- By Head Type

- Single-Head Machines: Equipped with one placement head, these are generally simpler, more cost-effective, and suitable for lower-volume or less complex assembly tasks. They offer precision for specific component types.

- Multi-Head Machines: Featuring multiple placement heads operating simultaneously, these machines are designed for high-speed, high-volume production, significantly increasing throughput by placing several components concurrently. They are often found in advanced SMT lines.

- By Speed

- Low-Speed Machines: Characterized by slower placement rates, typically used for prototyping, small batch production, or handling large/unusual components where speed is less critical than precision and flexibility.

- Medium-Speed Machines: Offering a balance between speed and precision, these machines cater to a broader range of applications and production volumes, serving as a versatile solution for many manufacturers.

- High-Speed Machines: Designed for maximum throughput, these machines are essential in large-scale production facilities, especially in consumer electronics, where components are placed at very high rates per hour.

- By Application

- Consumer Electronics: Includes manufacturing of smartphones, tablets, laptops, smart TVs, and wearable devices. This segment is a major driver due to continuous innovation and high production volumes.

- Automotive: Encompasses assembly of ECUs, infotainment systems, ADAS modules, and components for electric vehicles, demanding high reliability and stringent quality.

- Medical Devices: Covers production of intricate medical electronics, diagnostic equipment, and implantable devices, where precision and sterile manufacturing processes are paramount.

- Telecommunications: Involves assembly of network equipment, base stations, and optical modules for 5G infrastructure and other communication technologies.

- Industrial: Includes control systems, power electronics, sensors, and robotics components used in various industrial automation applications.

- Aerospace & Defense: Focuses on high-reliability, mission-critical electronic assemblies for avionics, military communication systems, and defense technologies.

- By End-Use Industry

- Electronics Manufacturing Services (EMS): Companies that provide manufacturing services to OEMs. They require flexible, high-capacity machines to handle diverse product portfolios for multiple clients.

- Original Equipment Manufacturers (OEMs): Companies that design and manufacture their own products. They invest in Pick and Place machines for in-house production, demanding machines tailored to their specific product lines.

Value Chain Analysis For Pick and Place Machines Market

The value chain for the Pick and Place Machines Market is a complex ecosystem involving several key stages, from raw material sourcing to end-user deployment and post-sales support. Upstream activities primarily involve the sourcing and manufacturing of critical components and sub-systems that constitute a Pick and Place machine. This includes precision robotics components such as gantry systems, robotic arms, and motion control mechanisms, along with advanced vision systems comprising high-resolution cameras, lighting modules, and image processing software. Key suppliers in this segment also provide highly accurate feeders, nozzles, vacuum pumps, and specialized software for machine control, programming, and optimization. The quality and availability of these specialized components directly impact the performance, reliability, and cost-effectiveness of the final Pick and Place machine. Strong relationships with these upstream suppliers are crucial for manufacturers to maintain innovation and supply chain resilience, especially given the global nature of electronic component sourcing.

Midstream in the value chain, Pick and Place machine manufacturers integrate these diverse components into complete, functional systems. This stage involves sophisticated design, engineering, assembly, calibration, and rigorous testing to ensure machines meet specified performance criteria for speed, accuracy, and reliability. Downstream activities involve the distribution channel, which can be direct or indirect. Direct channels involve manufacturers selling directly to large Original Equipment Manufacturers (OEMs) or Electronics Manufacturing Services (EMS) providers, often with bespoke solutions and dedicated support teams. Indirect channels leverage a network of distributors, system integrators, and value-added resellers (VARs) who provide localized sales, technical support, and sometimes integration services to a broader range of customers, including small and medium-sized enterprises (SMEs). These partners play a vital role in market penetration and providing local expertise.

The final stage involves the end-users who deploy these machines in their production facilities for various applications. This encompasses pre-sales consulting, installation, commissioning, operator training, and ongoing technical support and maintenance. Effective post-sales service is a critical differentiator, as machine uptime and operational efficiency are paramount for manufacturers. Value chain optimization focuses on enhancing efficiency, reducing lead times, and improving collaboration among all stakeholders to deliver innovative, high-performance solutions to the market. The interconnectedness of this value chain, from component suppliers to end-user support, underscores the collaborative effort required to sustain and advance the Pick and Place Machines market, highlighting the importance of robust supply chain management, technological partnerships, and customer-centric service offerings.

Pick and Place Machines Market Potential Customers

The primary potential customers and end-users of Pick and Place machines span across a wide spectrum of manufacturing industries, all united by the need for high-precision, high-speed automated assembly of electronic components. The largest segment of buyers consists of Electronics Manufacturing Services (EMS) providers, which are contract manufacturers that produce electronic assemblies for various Original Equipment Manufacturers (OEMs). These companies require highly flexible and versatile Pick and Place machines that can handle diverse product portfolios, rapid changeovers, and varying production volumes for multiple clients across different sectors, making them key drivers for advanced, multi-functional machine demand.

Original Equipment Manufacturers (OEMs) also represent a substantial customer base, particularly those with significant in-house production capabilities. This includes major players in the consumer electronics sector, such as smartphone and computing device manufacturers, automotive electronics companies producing sophisticated infotainment systems and ADAS modules, and medical device manufacturers creating complex diagnostic and therapeutic equipment. These OEMs often seek customized solutions that integrate seamlessly with their proprietary manufacturing processes and product specifications, prioritizing precision, reliability, and throughput tailored to their specific, high-volume product lines. Their investment decisions are heavily influenced by the ability of these machines to improve product quality, reduce assembly costs, and accelerate time-to-market for innovative products.

Beyond these dominant segments, other significant buyers include manufacturers in the telecommunications industry, involved in assembling network infrastructure components for 5G and fiber optic systems; industrial electronics companies building control systems, power supplies, and automation equipment; and aerospace and defense contractors requiring highly reliable and rugged electronic assemblies for critical applications. Research and development institutions, as well as academic laboratories, also purchase these machines for prototyping and advanced materials research, albeit in smaller volumes. The common denominator among all these potential customers is the indispensable requirement for precise, efficient, and scalable automated assembly solutions to meet the intricate demands of modern electronic manufacturing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.15 Billion |

| Market Forecast in 2032 | USD 7.62 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fuji Corporation, Panasonic Corporation, Juki Corporation, Mycronic AB, ASM Pacific Technology Limited, Yamaha Motor Co., Ltd., Hanwha Techwin Co., Ltd., Universal Instruments Corporation, Nordson Corporation (ASYMTEK), Essemtec AG, i-Pulse (Sony Manufacturing Systems Corporation), Assembleon (now Kulicke & Soffa), BTU International (Amtech Group), Koki Technics Co., Ltd., Europlacer (Blakell Europlacer Ltd.), Autotronik SMT GmbH, DDM Novastar, Seika Corporation, SIPLACE (now ASM Assembly Systems), Evest Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pick and Place Machines Market Key Technology Landscape

The Pick and Place Machines market is driven by a sophisticated array of interconnected technologies that continuously evolve to meet the demands for higher precision, speed, and flexibility in electronic assembly. Central to these machines are advanced robotics systems, predominantly gantry-style robots and SCARA (Selective Compliance Assembly Robot Arm) robots, which provide the high-speed linear and rotational movements required for rapid component placement. These robotic platforms are complemented by highly precise motion control systems, often utilizing linear motors and high-resolution encoders, to ensure sub-micron level accuracy and repeatability. The integration of these mechanical components with sophisticated electrical control systems allows for precise coordination of movements, critical for handling delicate and tiny electronic components without damage or misalignment.

Vision systems represent another cornerstone technology, crucial for the intelligent operation of Pick and Place machines. Modern machines incorporate advanced high-resolution cameras, often with multiple lenses and varying illumination techniques, to perform critical tasks such as fiducial recognition, component centering, polarity detection, and post-placement inspection. These vision systems leverage sophisticated image processing algorithms, increasingly incorporating artificial intelligence and machine learning, to accurately identify components, compensate for board distortions, and verify placement accuracy in real-time. This reduces setup time, minimizes errors, and enables the handling of a wider variety of component types and sizes. The software landscape is equally vital, encompassing CAD/CAM integration for direct program generation from design files, intuitive user interfaces for operational control, and data analytics tools for process optimization, defect tracking, and predictive maintenance.

Beyond core robotics and vision, the market also relies on specialized technologies like advanced component feeders that ensure precise and reliable delivery of components, often incorporating smart features for automatic replenishment and error detection. Nozzle technology, including vacuum, mechanical, and specialized gripping nozzles, is continually refined to handle the increasing diversity and fragility of components. Furthermore, the increasing integration of IoT (Internet of Things) capabilities enables machines to connect, communicate, and share data within a smart factory ecosystem, facilitating remote monitoring, centralized control, and predictive analytics. This interconnectedness allows for optimization across the entire production line, enhancing overall equipment effectiveness (OEE) and providing valuable insights into manufacturing processes, pushing towards fully autonomous and adaptive production environments.

Regional Highlights

- Asia Pacific (APAC): This region dominates the Pick and Place Machines Market, largely driven by countries like China, Japan, South Korea, and Taiwan, which are global manufacturing hubs for electronics. China, in particular, leads in both production and consumption, fueled by massive investments in smart factories and advanced manufacturing. Japan and South Korea contribute significantly through technological innovation and the presence of major electronics corporations. The region's large population, increasing disposable income, and rising demand for consumer electronics, automotive electronics, and telecommunication equipment further solidify its market leadership. Strategic government initiatives supporting industrial automation also play a crucial role.

- North America: The North American market is characterized by robust demand from high-value industries such as automotive electronics, aerospace and defense, and medical devices. The region's focus on technological advancement, research and development, and advanced manufacturing practices drives the adoption of highly sophisticated and specialized Pick and Place machines. Reshoring manufacturing activities and increasing automation to combat rising labor costs also contribute to steady market growth. The presence of leading technology companies and a strong emphasis on Industry 4.0 adoption further stimulate demand for integrated and AI-powered solutions.

- Europe: Europe represents a mature yet growing market for Pick and Place machines, with Germany, France, and the UK being key contributors. The region excels in advanced manufacturing, particularly in the automotive, industrial automation, and medical technology sectors. Strict quality standards and a strong focus on high-precision engineering drive the demand for reliable and accurate machines. European manufacturers are also at the forefront of implementing sustainable manufacturing practices and developing energy-efficient automation solutions. The emphasis on smart factory initiatives and digitalization supports the continuous upgrade of assembly lines.

- Latin America: The Pick and Place Machines Market in Latin America is in a nascent stage but shows promising growth potential. Countries like Mexico and Brazil are experiencing increased industrialization and foreign investment in electronics manufacturing, particularly due to their proximity to North American markets and growing domestic demand. The market is driven by the need to modernize existing manufacturing infrastructure and adopt automation to improve competitiveness and production efficiency. While still smaller than other regions, rising economic development and a growing consumer base for electronic products are expected to fuel future market expansion.

- Middle East and Africa (MEA): The MEA region is emerging as a market for Pick and Place machines, primarily driven by economic diversification efforts, increasing government investments in industrial infrastructure, and a growing consumer base for electronic devices. Countries such as UAE, Saudi Arabia, and South Africa are leading the adoption of advanced manufacturing technologies to establish local production capabilities and reduce reliance on imports. The increasing penetration of telecommunications infrastructure and automotive assembly also contributes to the gradual growth of the market, though it currently represents the smallest share compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pick and Place Machines Market.- Fuji Corporation

- Panasonic Corporation

- Juki Corporation

- Mycronic AB

- ASM Pacific Technology Limited

- Yamaha Motor Co., Ltd.

- Hanwha Techwin Co., Ltd.

- Universal Instruments Corporation

- Nordson Corporation (ASYMTEK)

- Essemtec AG

- i-Pulse (Sony Manufacturing Systems Corporation)

- Assembleon (now Kulicke & Soffa)

- BTU International (Amtech Group)

- Koki Technics Co., Ltd.

- Europlacer (Blakell Europlacer Ltd.)

- Autotronik SMT GmbH

- DDM Novastar

- Seika Corporation

- SIPLACE (now ASM Assembly Systems)

- Evest Corporation

Frequently Asked Questions

What is a Pick and Place machine and how does it work?

A Pick and Place machine is an automated robotic device used in surface mount technology (SMT) to pick up electronic components from feeders and place them onto printed circuit boards (PCBs) or other substrates with high precision and speed. It typically uses a vacuum nozzle or mechanical grippers to pick components, a vision system for accurate alignment, and a robotic arm to precisely place them according to a programmed pattern. This automation ensures efficient and reliable assembly of electronic devices.

What are the primary applications of Pick and Place machines?

Pick and Place machines are predominantly used in the manufacturing of electronic products across various industries. Key applications include consumer electronics (smartphones, laptops, smart TVs), automotive electronics (ECUs, ADAS modules), medical devices (diagnostic equipment, implantable electronics), telecommunications infrastructure (5G components, network equipment), and industrial controls. They are essential for any high-volume, high-precision electronic assembly process.

How does AI impact the performance of Pick and Place machines?

AI significantly enhances Pick and Place machine performance by improving precision, efficiency, and predictive capabilities. AI-powered vision systems offer superior component recognition and alignment, reducing placement errors. Machine learning algorithms enable predictive maintenance, minimizing downtime by anticipating component failures. AI also optimizes placement paths and sequences, leading to higher throughput and adaptability to diverse production requirements. This results in greater accuracy, reduced operational costs, and improved product quality.

What factors drive the growth of the Pick and Place Machines Market?

Key drivers for the Pick and Place Machines Market include the continuous growth of the global electronics industry, driven by rising demand for advanced consumer devices and IoT. The trend towards miniaturization of electronic components necessitates automated precision assembly. Furthermore, increasing adoption of Industry 4.0 and smart factory initiatives, coupled with rising labor costs globally, fuels the demand for automation solutions that enhance efficiency and reduce manufacturing expenses.

What are the main challenges faced by the Pick and Place Machines Market?

The Pick and Place Machines Market faces challenges such as the high initial capital investment required for these sophisticated machines, which can be a barrier for smaller manufacturers. Technical complexity in operation and maintenance demands a skilled workforce, often leading to a labor shortage. Rapid technological advancements also pose a challenge, as machines can quickly become obsolete, necessitating continuous upgrades and investments. Integrating these advanced systems with existing legacy infrastructure also presents a significant hurdle for many companies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager