Plant-Based Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429896 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Plant-Based Packaging Market Size

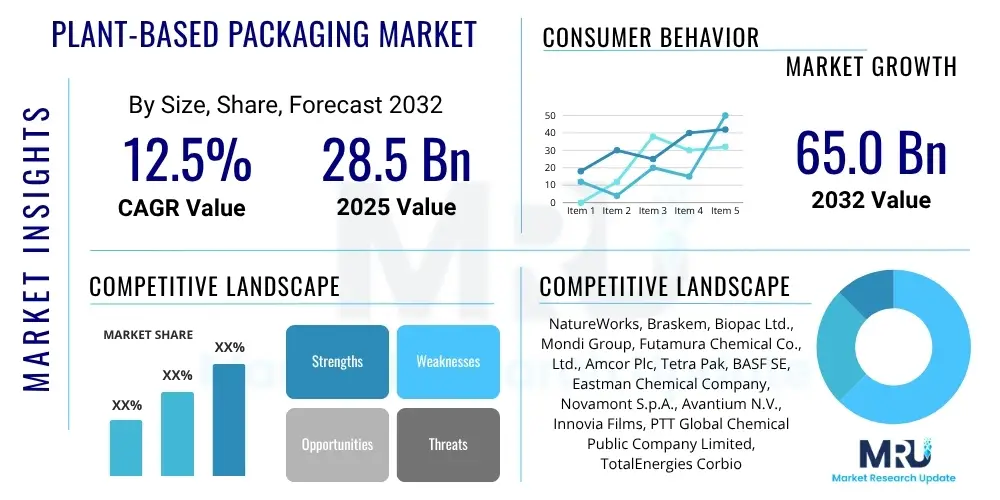

The Plant-Based Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 28.5 billion in 2025 and is projected to reach USD 65.0 billion by the end of the forecast period in 2032.

Plant-Based Packaging Market introduction

The Plant-Based Packaging Market represents a pivotal shift in the global packaging industry, moving towards sustainable alternatives derived from renewable biological resources rather than finite fossil fuels. This innovative sector encompasses a wide array of materials, including bioplastics like Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), and starch-based polymers, as well as cellulose and lignin derivatives. These materials are engineered to offer comparable functionality to conventional plastics while providing significant environmental advantages such, as reduced carbon footprint, lower energy consumption during production, and improved end-of-life scenarios like industrial composting or enhanced recyclability. The market's rapid expansion is intrinsically linked to global efforts to combat climate change, mitigate plastic pollution, and foster a more circular economy, where resources are kept in use for as long as possible.

Products within this market are incredibly diverse, ranging from rigid containers and bottles made from bio-PET or PLA, to flexible films and pouches utilizing starch or cellulose-based blends, and even molded pulp products derived from agricultural waste. Each material type possesses distinct properties, catering to specific application requirements concerning barrier protection, transparency, durability, and cost-effectiveness. Major applications span critical consumer sectors. The food and beverage industry is a leading adopter, using these materials for everything from dairy products and fresh produce to ready-to-eat meals and bottled beverages. Beyond edibles, the cosmetics and personal care sector leverages plant-based solutions for sleek, eco-friendly containers, while pharmaceutical companies integrate them for primary and secondary packaging of medications and health supplements. Furthermore, general consumer goods and industrial packaging are increasingly exploring these sustainable options to align with evolving market demands and corporate sustainability mandates.

The fundamental benefits driving the widespread adoption of plant-based packaging are multifaceted. Environmentally, they contribute to a significant reduction in greenhouse gas emissions and a decreased dependency on petroleum resources, aligning with global climate goals. Many plant-based options are biodegradable or compostable, offering viable solutions to the pervasive plastic waste crisis, particularly in regions with adequate composting infrastructure. Economically, as manufacturing processes mature and economies of scale are achieved, these materials are becoming increasingly competitive. Key driving factors propelling this market forward include escalating consumer environmental consciousness, which translates into purchasing decisions favoring sustainable brands, and increasingly stringent governmental regulations, such as bans on single-use plastics and mandates for bio-based or compostable content. Additionally, profound corporate sustainability commitments by global brands, coupled with continuous technological advancements in bio-material science, are making plant-based packaging not just an ethical choice but a strategic business imperative, further accelerating its market growth and innovation.

Plant-Based Packaging Market Executive Summary

The Plant-Based Packaging Market is undergoing an impressive growth trajectory, primarily fueled by a confluence of global environmental pressures, shifting consumer values towards sustainability, and proactive regulatory interventions. Current business trends highlight a significant escalation in research and development, with major players investing heavily in discovering novel biopolymers and enhancing the performance characteristics of existing ones, particularly in areas like barrier properties and heat resistance. The market is also witnessing a surge in strategic collaborations and partnerships, linking raw material providers with biopolymer manufacturers, packaging converters, and large multinational brand owners. These alliances are crucial for de-risking investments, sharing expertise, and scaling up production capacities efficiently, ultimately accelerating market penetration and the commercialization of innovative plant-based packaging solutions across diverse industries.

Regional dynamics play a vital role in shaping the market landscape. Europe and North America currently lead in terms of market maturity and adoption, driven by progressive environmental policies, well-developed waste management infrastructures that support bio-packaging, and a highly environmentally conscious consumer base. Countries like Germany, France, and the UK in Europe, and the United States and Canada in North America, are actively implementing policies to reduce plastic waste and promote circular economy principles, thereby creating a fertile ground for plant-based packaging innovations. The Asia Pacific region, encompassing economic powerhouses like China, India, and Japan, is emerging as the fastest-growing market. This growth is spurred by rapid industrial expansion, increasing disposable incomes, and a rising awareness of environmental degradation, leading to significant investments in bio-plastic production and consumption, particularly in the fast-moving consumer goods (FMCG) and e-commerce sectors.

Analysis of market segments reveals distinct patterns and growth areas. Flexible plant-based packaging, including films, sachets, and pouches, is experiencing robust growth due to its versatility, lightweight nature, and suitability for various product types, especially within the food and beverage industry for items like snacks, confectionery, and fresh produce. Rigid plant-based packaging, which includes bottles, trays, and jars made from materials like bio-PET and PLA, continues to innovate, focusing on improved structural integrity and extended shelf-life capabilities, critical for dairy, beverages, and personal care products. The food and beverage sector remains the dominant application segment, consistently driving demand for plant-based solutions to align with both health and sustainability trends. There is also a notable expansion into non-food applications such as cosmetics, pharmaceuticals, and industrial packaging, where the perceived green credentials and functional advancements of plant-based materials offer significant competitive advantages and resonate strongly with modern brand values.

AI Impact Analysis on Plant-Based Packaging Market

User inquiries frequently highlight an intense curiosity regarding the transformative potential of artificial intelligence within the plant-based packaging industry, primarily focusing on how AI can fundamentally reshape innovation, efficiency, and sustainability. Key themes emerging from these questions involve the utilization of AI for accelerating the discovery and development of novel bio-materials with superior properties, optimizing complex biomanufacturing processes to reduce costs and environmental impact, and enhancing supply chain transparency and resilience. There is also significant interest in AI's capacity to predict material performance, facilitate smarter recycling and composting strategies, and personalize packaging design to meet evolving consumer preferences. The overarching expectation is that AI will serve as a powerful enabler, bridging current technological gaps and propelling plant-based packaging towards widespread commercial viability and optimal ecological effectiveness.

Artificial intelligence is poised to exert a profound influence across the entire lifecycle of plant-based packaging, from initial material conception to end-of-life management. In the realm of material science, AI algorithms can process vast datasets of chemical structures and experimental results, predicting the optimal composition for new biopolymers that possess desired attributes such as improved barrier properties, mechanical strength, or biodegradability rates. This predictive capability dramatically shortens research cycles and reduces the need for extensive physical prototyping, accelerating the introduction of advanced plant-based solutions. Furthermore, AI-driven process optimization tools can monitor and control fermentation or polymerization reactions in real-time, fine-tuning parameters to maximize yield, minimize energy consumption, and ensure consistent quality in the production of bio-plastics, thereby making the manufacturing process more efficient and cost-effective.

Beyond material development and production, AI's impact extends into the supply chain, quality assurance, and circular economy initiatives. AI-powered analytics can optimize the sourcing of sustainable feedstocks, predict demand fluctuations, and streamline logistics to reduce carbon emissions associated with transportation. In quality control, machine vision systems integrated with AI can rapidly detect defects in packaging during manufacturing, ensuring higher product standards and reducing waste. Critically, AI will be instrumental in improving end-of-life solutions; advanced sorting robots equipped with AI can accurately identify and separate different types of plant-based packaging from mixed waste streams, significantly enhancing the efficiency and purity of recycling and composting processes. This capability is vital for overcoming one of the current major restraints to plant-based packaging adoption, fostering true circularity and maximizing the environmental benefits of these innovative materials.

- AI-driven material discovery and optimization: Accelerates the identification and development of novel biopolymers with enhanced functional properties (e.g., barrier, strength).

- Manufacturing process optimization: Increases efficiency, reduces energy consumption, and minimizes waste in biopolymer production through predictive analytics and real-time control.

- Supply chain transparency and efficiency: Enhances sustainable feedstock sourcing, optimizes logistics, and improves traceability throughout the value chain.

- Predictive quality control and defect detection: Utilizes machine learning for real-time monitoring, ensuring consistent product quality and reducing manufacturing flaws.

- Advanced waste management and sorting: Implements AI-powered robotic systems to precisely identify and separate plant-based packaging for improved recycling and composting.

- Personalized packaging design: Leverages AI to analyze consumer data and create customized, sustainable packaging solutions that meet specific market demands.

- Lifecycle assessment optimization: Provides data-driven insights to model and reduce the environmental impact of plant-based packaging from cradle to grave.

DRO & Impact Forces Of Plant-Based Packaging Market

The Plant-Based Packaging Market is intricately shaped by a dynamic interplay of propelling drivers, inherent restraints, and opportune prospects, all underscored by significant impact forces from political, economic, social, technological, environmental, and legal (PESTEL) factors. A primary driver is the escalating global environmental consciousness, with consumers actively seeking products encased in sustainable packaging. This consumer shift is strongly complemented by stringent governmental regulations worldwide, including outright bans on single-use plastics and mandates for bio-based or compostable alternatives, pushing industries towards greener solutions. Furthermore, significant corporate sustainability commitments from multinational brands, aiming to reduce their carbon footprint and enhance brand image, are accelerating the adoption of plant-based packaging. Continuous technological advancements in bio-material science, leading to improved performance characteristics and reduced production costs, are making these alternatives increasingly competitive and viable across a broader range of applications, thereby providing a powerful impetus for market growth and innovation.

Despite the strong growth drivers, the market faces several formidable restraints that temper its expansion. One significant challenge is the relatively higher production cost of plant-based polymers compared to conventional petroleum-based plastics, primarily due to nascent technologies, smaller production scales, and the complex supply chains for renewable feedstocks. Performance limitations, particularly regarding barrier properties against moisture, oxygen, and UV light, can restrict the application of certain plant-based materials for sensitive products like food, potentially affecting shelf life and product safety. Moreover, the fragmented and often underdeveloped infrastructure for industrial composting and mechanical recycling of specific bio-plastics in many regions creates confusion for consumers and hinders effective end-of-life management, leading to potential landfill disposal even for intended compostable items. Variability in raw material availability, influenced by agricultural cycles and competition with food crops, also poses supply chain risks and can impact pricing stability, presenting complex sustainability dilemmas for producers.

Amidst these challenges, substantial opportunities exist for market stakeholders. Emerging economies, particularly in the Asia Pacific region, represent vast untapped markets with rapidly growing populations and increasing environmental awareness, offering fertile ground for new investments and market penetration. Continuous innovation in bio-material science is leading to the development of next-generation biopolymers with superior performance capabilities, addressing current limitations and expanding application scope into previously inaccessible sectors. Strategic collaborations and cross-industry partnerships along the entire value chain, from feedstock suppliers to waste management companies, are crucial for fostering a truly circular economy for plant-based packaging, enabling shared knowledge and infrastructure development. Additionally, the integration of advanced functionalities, such as smart packaging features (e.g., freshness indicators, anti-counterfeit measures) into plant-based substrates, presents unique value propositions, further enhancing their appeal and utility while establishing new benchmarks for sustainable and intelligent packaging solutions in a competitive global market.

Segmentation Analysis

The Plant-Based Packaging Market is intricately segmented across various dimensions to offer a comprehensive and granular perspective on its structure, dynamics, and growth potential. This detailed segmentation is indispensable for stakeholders to precisely identify market niches, understand the competitive landscape, and formulate highly targeted strategies for product development and market entry. The market's primary classifications include segmentation by material type, which differentiates between the diverse renewable resources utilized; by application, detailing the end-use sectors consuming these packaging solutions; by packaging type, categorizing based on physical form like rigid or flexible; and by end-use industry, providing insights into specific business sectors' adoption patterns. Each segment is influenced by a unique set of market drivers, regulatory pressures, and consumer preferences, resulting in distinct growth trajectories and varying levels of market maturity, underscoring the necessity for a nuanced analytical approach to capture the market's full complexity.

An in-depth understanding of these market segments reveals critical trends and opportunities. For instance, within the material segment, the rapid advancements in Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHA) biopolymers are expanding their use beyond traditional applications, offering enhanced barrier properties and processability. The application segmentation highlights the food and beverage industry as the unequivocal leader in adoption, driven by stringent food safety standards and an intense focus on consumer-facing sustainability. Conversely, the pharmaceutical and industrial sectors are demonstrating significant, albeit slower, growth as they meticulously evaluate material performance for specialized requirements. The distinction between rigid and flexible packaging types further clarifies market demand, with flexible formats gaining traction due to their lightweight nature and reduced material usage, while rigid options continue to innovate in durability and aesthetic appeal for premium products. This multi-dimensional segmentation allows for a precise evaluation of market forces, enabling businesses to strategically position themselves within the plant-based packaging ecosystem and leverage emerging trends effectively.

- By Material

- Starch Based: Derived from corn, potato, or tapioca starch, often used for films, foam, and loose-fill packaging. Benefits include biodegradability and compostability.

- Cellulose Based: Sourced from wood pulp or agricultural residues, including cellophane, paperboard, and molded pulp. Offers renewability and often recyclability.

- Polylactic Acid (PLA): A versatile bioplastic made from fermented plant starches (e.g., corn, sugarcane). Used for clear rigid packaging, films, and bottles due to its transparency and processability.

- Polyhydroxyalkanoates (PHA): Biodegradable polyesters produced by bacteria from organic feedstocks. Known for excellent barrier properties and marine degradability, suitable for high-performance applications.

- Bio-Polyethylene Terephthalate (Bio-PET): Chemically identical to conventional PET but partially or fully derived from plant-based monoethylene glycol. Used for bottles and rigid containers, offering recyclability with existing PET streams.

- Lignin Based: Extracted from wood and plant cell walls, a byproduct of the paper industry. Explored for its strength, UV resistance, and potential as a filler or matrix in composites.

- Others (e.g., PBS, PCL): Includes Polybutylene Succinate (PBS), Polycaprolactone (PCL), and other emerging biopolymers offering specific properties like enhanced flexibility or quicker degradation rates for niche applications.

- By Application

- Food & Beverages: Dominant segment, including packaging for fresh produce, dairy, ready meals, bottled water, snacks, and confectionery, driven by consumer safety and sustainability demands.

- Cosmetics & Personal Care: Encompasses packaging for lotions, shampoos, makeup, and perfumes, where brand image and eco-friendliness are crucial marketing differentiators.

- Pharmaceutical: Used for primary and secondary packaging of medications, health supplements, and medical devices, requiring high standards of hygiene and material integrity.

- Consumer Goods: Broad category including packaging for electronics, household cleaners, toys, and textiles, where brands seek sustainable alternatives to traditional plastics.

- Industrial: Applications such as protective packaging, bulk containers, and components for manufacturing, focusing on durability and supply chain efficiency.

- Others: Includes niche applications in agriculture (e.g., mulch films), automotive components, and specialized packaging solutions for various unique market needs.

- By Type

- Rigid Packaging: Includes bottles, jars, trays, and clamshells, offering structural integrity and protection for products, often made from PLA, Bio-PET, or molded pulp.

- Flexible Packaging: Comprises films, pouches, bags, and wrappers, valued for their lightweight nature, material efficiency, and versatility across a range of product formats, often using starch-based or cellulose films.

- By End-Use Industry

- Food Service: Packaging for restaurants, cafes, and catering, including disposable cups, plates, cutlery, and takeaway containers.

- Consumer Retail: Packaging for products sold directly to consumers in supermarkets, department stores, and online platforms.

- Healthcare: Packaging for pharmaceutical products, medical devices, and hospital supplies, prioritizing sterility and compliance.

- Industrial: Packaging used in manufacturing, logistics, and bulk transport for components, raw materials, and finished goods.

- Personal Care: Specific to packaging for beauty, hygiene, and wellness products, often requiring aesthetic appeal and chemical resistance.

Value Chain Analysis For Plant-Based Packaging Market

The value chain for the Plant-Based Packaging Market is a multi-tiered system that begins with the highly specialized upstream processes of raw material sourcing and biopolymer production. At the foundational level, agricultural suppliers cultivate and harvest biomass feedstocks such as corn, sugarcane, potatoes, or wood pulp. These renewable resources are then processed by biotechnology and chemical companies into intermediate bio-based monomers or directly into biopolymers like Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), or starch-based compounds. This upstream segment is characterized by significant research and development investments aimed at improving yield efficiency, reducing cultivation footprints, and optimizing the conversion processes to lower costs and enhance the sustainability credentials of the base materials. Key players here focus on enzymatic reactions, fermentation technologies, and advanced polymerization techniques, which are crucial for defining the performance characteristics and environmental impact of the subsequent packaging products.

Moving downstream, the value chain encompasses packaging converters and manufacturers who acquire these biopolymers and transform them into diverse packaging formats. This critical stage involves a range of sophisticated manufacturing processes, including extrusion for films and sheets, injection molding for rigid components, thermoforming for trays, and blow molding for bottles. These manufacturers continuously innovate in process optimization to ensure that plant-based materials can be efficiently processed into high-quality, functional packaging that meets specific industry requirements, such as barrier properties, mechanical strength, and aesthetic appeal. The finished plant-based packaging products are then supplied to a broad spectrum of brand owners, often large multinational corporations in the food and beverage, personal care, pharmaceutical, and consumer goods sectors. These distribution channels typically include a mix of direct sales contracts for major clients and indirect distribution through wholesalers, distributors, and agents to reach smaller businesses and specialized markets, ensuring widespread availability and market penetration for plant-based solutions.

The final, yet equally crucial, stages of the value chain involve the end-use by consumers and the subsequent post-consumer waste management. Consumers interact directly with the packaged products, and their disposal behavior significantly impacts the realization of environmental benefits, making clear labeling and consumer education paramount. For plant-based packaging to genuinely contribute to a circular economy, robust and accessible infrastructure for collection, sorting, industrial composting, and mechanical or chemical recycling is essential. This often requires collaborative efforts across the entire value chain, involving packaging producers, brand owners, retailers, and public or private waste management companies. These partnerships aim to develop standardized collection systems, invest in advanced sorting technologies, and establish efficient recycling and composting facilities. The success of both direct and indirect value creation in this market hinges on the effective closing of the loop, ensuring that valuable plant-based resources are either returned to the biosphere as nutrients or reintegrated into production cycles, minimizing waste and maximizing resource efficiency.

Plant-Based Packaging Market Potential Customers

The Plant-Based Packaging Market targets a broad and expanding base of potential customers across virtually all sectors involved in product packaging, united by a growing imperative for sustainability. Food and beverage companies represent the largest and most dynamic customer segment. This includes major multinational corporations, local food producers, and food service providers, all under pressure to adopt eco-friendly packaging for everything from fresh produce, dairy, and meat alternatives to beverages, snacks, and ready meals. The drivers here are multifactorial: intense consumer demand for greener choices, strict food safety regulations that must be met by sustainable materials, and the strategic advantage of demonstrating environmental responsibility to enhance brand loyalty and market share in a highly competitive landscape. Plant-based solutions offer crucial benefits in extending shelf life while fulfilling environmental pledges.

Beyond the food sector, the personal care and cosmetics industry constitutes another significant customer segment. Brands in this space, known for their emphasis on natural ingredients and ethical sourcing, find plant-based packaging a natural extension of their brand philosophy. Customers include manufacturers of shampoos, conditioners, lotions, soaps, and makeup, which frequently require packaging that is not only visually appealing but also resistant to various chemical compositions and aligned with sustainable aesthetics. Pharmaceutical companies are increasingly exploring plant-based options for both primary (direct contact) and secondary (outer) packaging for over-the-counter drugs, health supplements, and medical devices. Their stringent requirements for material purity, safety, and regulatory compliance demand robust, well-tested plant-based solutions that can guarantee product integrity while contributing to corporate social responsibility goals. The rapidly expanding e-commerce sector is also a prime customer, seeking lightweight, durable, and environmentally responsible packaging to reduce shipping costs and minimize its vast environmental footprint from package waste.

Furthermore, general consumer goods manufacturers, spanning electronics, home care products, textiles, and toys, are actively seeking plant-based packaging to align with evolving consumer values and global environmental directives. Industrial sectors also represent a growing customer base, particularly for protective packaging, bulk containers, and components where biodegradability or renewable sourcing can offer a significant competitive and environmental advantage. Ultimately, any organization that packages a product, from global conglomerates to small and medium-sized enterprises (SMEs), and is committed to reducing its environmental impact, meeting regulatory mandates, or enhancing its brand's green credentials, is a potential customer for plant-based packaging. This widespread applicability underscores the market's vast potential for continued growth and innovation as sustainability transitions from a niche concern to a universal business imperative, driving demand across all packaged goods categories globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 28.5 Billion |

| Market Forecast in 2032 | USD 65.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NatureWorks, Braskem, Biopac Ltd., Mondi Group, Futamura Chemical Co., Ltd., Amcor Plc, Tetra Pak, BASF SE, Eastman Chemical Company, Novamont S.p.A., Avantium N.V., Innovia Films, PTT Global Chemical Public Company Limited, TotalEnergies Corbion, Arkema S.A., Rodenburg Biopolymers B.V., Kruger Inc., Stora Enso Oyj, Smurfit Kappa Group Plc, WestRock Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plant-Based Packaging Market Key Technology Landscape

The Plant-Based Packaging Market is fundamentally driven by a dynamic and continually advancing technology landscape, which is crucial for transforming renewable biomass into high-performance, sustainable packaging solutions. A foundational element of this landscape involves sophisticated biopolymer synthesis technologies. This includes advanced fermentation processes, where microorganisms convert sugars from plant feedstocks into biopolymers like Polyhydroxyalkanoates (PHA) or Polylactic Acid (PLA) monomers. Chemical synthesis routes are also pivotal for creating bio-based equivalents of traditional plastics, such as bio-Polyethylene Terephthalate (bio-PET), utilizing plant-derived ethylene glycol. Continuous innovation in these synthesis methods focuses on improving yield, reducing energy input, enhancing scalability, and lowering production costs, making bio-based materials more competitive and environmentally friendly at a commercial scale, thereby expanding their market applicability and fostering sustainable material innovation.

Further along the production pipeline, the market relies heavily on optimized processing and conversion technologies. Traditional plastics manufacturing techniques like extrusion, injection molding, thermoforming, and blow molding have been adapted and refined to handle the unique rheological and thermal properties of various plant-based polymers. Innovations in this area include specialized equipment and process parameters designed to prevent material degradation, enhance melt strength, and achieve precise dimensional stability for diverse packaging formats, from thin films to complex rigid containers. Furthermore, advanced coating and lamination technologies are critical for improving the functional performance of plant-based packaging. These technologies apply bio-based or biodegradable barrier layers to materials, significantly enhancing their resistance to moisture, oxygen, and grease, which is essential for preserving the freshness and extending the shelf life of food and other sensitive products, addressing a key challenge for many early-generation bioplastics.

The technological landscape also encompasses cutting-edge advancements such as nanotechnology and smart packaging integration. Nanomaterials, often derived from cellulose or chitin, are being incorporated into biopolymer matrices to create bio-nanocomposites that offer superior mechanical strength, improved gas barrier properties, and enhanced thermal stability. This allows for thinner, lighter, and more robust plant-based packaging solutions. Moreover, the emergence of smart packaging, which integrates sensors, indicators, and RFID tags into plant-based substrates, is revolutionizing how products are monitored throughout the supply chain and how consumers interact with packaging. These technologies enable real-time freshness tracking, anti-counterfeiting measures, and enhanced recyclability information, adding significant value beyond mere containment. Overall, the continuous evolution in material science, processing techniques, and integrated digital technologies is transforming plant-based packaging from a niche product into a mainstream, high-performance, and intelligently sustainable solution, poised for widespread adoption across all sectors.

Regional Highlights

The Plant-Based Packaging Market exhibits diverse growth patterns and levels of maturity across different global regions, largely influenced by local environmental policies, consumer awareness, and economic development. North America, particularly the United States and Canada, stands as a significant market, propelled by a highly eco-conscious consumer base and substantial corporate commitments towards sustainability. Major food and beverage, personal care, and pharmaceutical companies in the region are actively transitioning to plant-based packaging to meet both internal sustainability goals and external pressures from environmentally aware consumers and regulatory bodies. The region benefits from robust research and development investments aimed at improving material performance and developing new bio-based solutions, positioning it as a key hub for innovation and commercialization in the plant-based packaging sector.

Europe continues to be a global leader in the adoption and innovation of plant-based packaging, driven by some of the most stringent and comprehensive environmental regulations worldwide. Countries such as Germany, France, the UK, Italy, and the Nordic nations are at the forefront, implementing ambitious targets for plastic waste reduction, promoting circular economy principles, and investing heavily in infrastructure for industrial composting and recycling of bio-based materials. The European Green Deal and various national strategies actively encourage the use of sustainable packaging alternatives, leading to a high penetration of plant-based films, containers, and molded pulp products across diverse industries. This regulatory push, combined with a deeply ingrained cultural emphasis on environmental protection, ensures a consistently strong and expanding market for plant-based packaging solutions throughout the continent.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, characterized by its sheer market size, rapid industrialization, and evolving environmental consciousness. Countries like China, India, Japan, South Korea, and Australia are witnessing escalating concerns over plastic pollution and increasing governmental support for sustainable alternatives. This has led to significant investments in bio-plastic manufacturing capacities and a burgeoning demand for plant-based packaging, particularly within the booming e-commerce, food delivery, and FMCG sectors. While infrastructure for waste management of bio-materials is still developing in some parts of APAC, the immense scale of consumption and production, coupled with a strategic shift towards green technologies, positions the region for substantial growth. Latin America and the Middle East and Africa (MEA) represent emerging markets, where rising awareness of environmental issues and gradual policy changes are driving initial adoption, particularly in urban areas and for export-oriented industries seeking to meet international sustainability standards.

- North America: Leading market with high consumer awareness, strong corporate sustainability initiatives, and significant R&D investments in the US and Canada, driving innovation in diverse applications like food and personal care.

- Europe: Dominant in market adoption, spurred by stringent environmental regulations (e.g., EU Green Deal), advanced recycling and composting infrastructures, and proactive governmental support for bio-based industries across Germany, France, UK, Italy, and Nordic countries.

- Asia Pacific (APAC): Fastest-growing region, characterized by rapid economic expansion, increasing environmental concerns, massive manufacturing capabilities, and burgeoning demand in China, India, Japan, and South Korea, particularly for e-commerce and FMCG.

- Latin America: Emerging market demonstrating increasing adoption of plant-based solutions in countries like Brazil and Mexico, influenced by global sustainability trends and developing local regulations aiming to reduce plastic waste.

- Middle East and Africa (MEA): Nascent market with growing potential, driven by rising environmental consciousness, new government initiatives in sustainable development, and increasing demand from the hospitality and food sectors in countries like UAE and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plant-Based Packaging Market.- NatureWorks

- Braskem

- Biopac Ltd.

- Mondi Group

- Futamura Chemical Co., Ltd.

- Amcor Plc

- Tetra Pak

- BASF SE

- Eastman Chemical Company

- Novamont S.p.A.

- Avantium N.V.

- Innovia Films

- PTT Global Chemical Public Company Limited

- TotalEnergies Corbion

- Arkema S.A.

- Rodenburg Biopolymers B.V.

- Kruger Inc.

- Stora Enso Oyj

- Smurfit Kappa Group Plc

- WestRock Company

Frequently Asked Questions

What precisely defines plant-based packaging?

Plant-based packaging is broadly defined as packaging materials manufactured wholly or significantly from renewable biomass sources, such as starches, cellulose, or plant oils, rather than derived from petroleum. Its core distinction lies in its biological origin, aiming to reduce environmental impact and foster sustainability through its lifecycle.

What are the key environmental benefits associated with plant-based packaging?

The primary environmental benefits include a notable reduction in greenhouse gas emissions during production, decreased reliance on finite fossil resources, and often superior end-of-life options. Many types are biodegradable or compostable in industrial settings, offering a tangible solution to plastic pollution and contributing to a more circular economy.

What are the significant hurdles facing the widespread adoption of plant-based packaging?

Significant hurdles include relatively higher production costs compared to established petroleum plastics, limitations in barrier properties that affect product shelf life, and the underdeveloped or inconsistent infrastructure required for industrial composting and recycling of specific bio-materials across various regions globally.

How does plant-based packaging contribute to a circular economy model?

Plant-based packaging supports a circular economy by using renewable resources as raw materials, minimizing the extraction of virgin fossil resources. When properly managed through industrial composting or recycling, these materials can return valuable nutrients to the earth or be reintegrated into new production cycles, effectively closing the loop and reducing waste.

Which specific sectors are currently leading the adoption of plant-based packaging solutions?

The food and beverage industry is the foremost adopter, driven by strong consumer demand for sustainable options and regulatory pressures. Other rapidly growing sectors include personal care and cosmetics, pharmaceuticals, and consumer goods, all leveraging plant-based solutions to enhance brand image and meet evolving environmental standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager