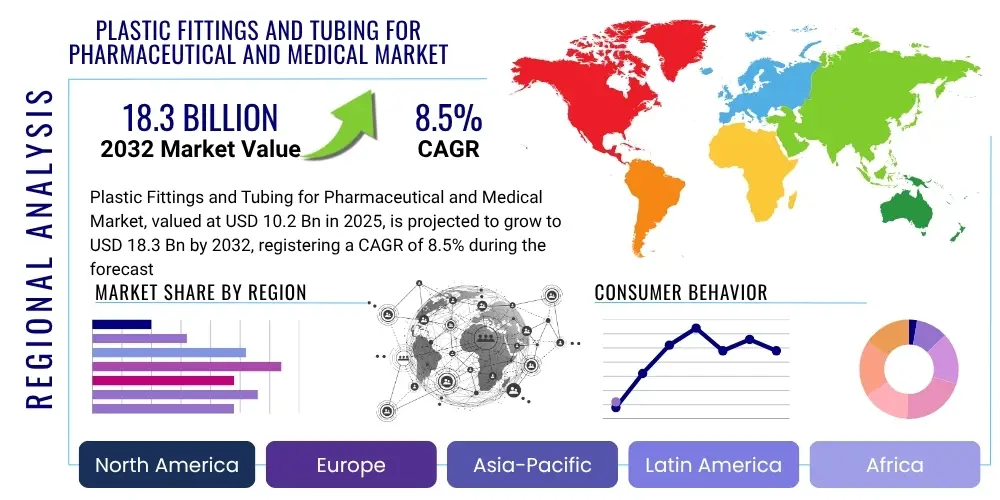

Plastic Fittings and Tubing for Pharmaceutical and Medical Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429887 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Plastic Fittings and Tubing for Pharmaceutical and Medical Market Size

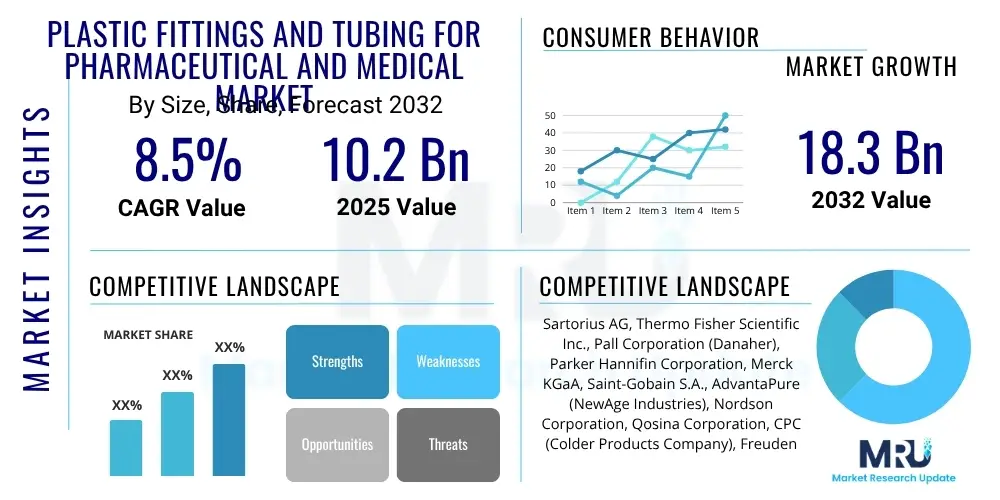

The Plastic Fittings and Tubing for Pharmaceutical and Medical Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at $10.2 Billion in 2025 and is projected to reach $18.3 Billion by the end of the forecast period in 2032.

Plastic Fittings and Tubing for Pharmaceutical and Medical Market introduction

The Plastic Fittings and Tubing for Pharmaceutical and Medical Market encompasses a wide array of specialized polymer components crucial for fluid management in sensitive and regulated environments. These products, ranging from flexible tubing to rigid connectors, adapters, and valves, are designed to ensure sterility, chemical inertness, and precise control over liquid and gas flow in pharmaceutical manufacturing, medical device assembly, diagnostic procedures, and research laboratories. Their primary benefits include cost-effectiveness, disposability to prevent cross-contamination, superior chemical resistance, and flexibility for diverse applications, thereby enhancing operational efficiency and patient safety. The market growth is primarily driven by the robust expansion of the biopharmaceutical sector, the increasing adoption of single-use bioprocessing technologies, stringent regulatory demands for material purity and system integrity, and the global imperative to manage chronic diseases and an aging population, which fuels demand for advanced medical solutions.

Plastic Fittings and Tubing for Pharmaceutical and Medical Market Executive Summary

The Plastic Fittings and Tubing for Pharmaceutical and Medical Market is experiencing dynamic growth, propelled by sustained innovation and strategic shifts in healthcare and life sciences. Key business trends indicate a strong move towards single-use systems, which reduce cleaning validation costs and contamination risks, alongside a rising demand for customized solutions that cater to specific bioprocessing and medical device requirements. Advanced material science is also playing a pivotal role, with a focus on enhancing biocompatibility, chemical resistance, and sterilization compatibility. Regional trends highlight North America and Europe as mature markets characterized by significant R&D investments and stringent regulatory frameworks, fostering continuous product development and high adoption rates. Conversely, the Asia Pacific region is emerging as a high-growth hub, driven by expanding healthcare infrastructure, increasing pharmaceutical manufacturing capabilities, and a growing patient base. Segment trends reveal robust expansion in the biopharmaceutical manufacturing sector, particularly for biologics and vaccines, where precise fluid handling is critical. The medical devices and diagnostics segments also show consistent growth, fueled by technological advancements and the escalating need for efficient and safe patient care. Overall, the market is positioned for substantial expansion, underpinned by technological progress, evolving healthcare demands, and strategic regional investments.

AI Impact Analysis on Plastic Fittings and Tubing for Pharmaceutical and Medical Market

User inquiries regarding AI's influence on the Plastic Fittings and Tubing for Pharmaceutical and Medical Market primarily revolve around its potential to optimize manufacturing processes, enhance quality control, streamline supply chain logistics, and support personalized medicine initiatives. Key themes center on the ability of AI to improve precision, reduce waste, predict maintenance needs, and facilitate faster product development cycles. Users are keen to understand how AI can ensure the integrity and sterility of these critical components, especially in high-volume production and complex bioprocessing environments, while also addressing concerns about data security and the integration costs of such advanced systems. The expectation is that AI will drive efficiency gains and higher product quality, ultimately leading to safer and more effective medical and pharmaceutical applications.

- AI-driven predictive maintenance for manufacturing equipment reduces downtime.

- Enhanced quality control through AI-powered visual inspection systems identifies defects in tubing and fittings.

- Optimized inventory management and supply chain logistics using AI algorithms to forecast demand and manage stock.

- Accelerated material research and development for novel polymer formulations with improved properties.

- Personalized medicine implications driving demand for customized, AI-designed fluidic pathways.

- Process optimization in biopharmaceutical manufacturing through AI-guided flow control and monitoring.

DRO & Impact Forces Of Plastic Fittings and Tubing for Pharmaceutical and Medical Market

The Plastic Fittings and Tubing for Pharmaceutical and Medical Market is significantly influenced by a confluence of drivers, restraints, opportunities, and broader impact forces that shape its growth trajectory. Key drivers include the exponential growth in biopharmaceutical research and development, particularly in biologics and vaccines, which heavily rely on sterile and chemically inert fluid management components. The accelerating adoption of single-use technologies in bioprocessing is also a major catalyst, as these systems inherently require extensive plastic fittings and tubing to mitigate cross-contamination risks and reduce validation efforts. Furthermore, the rising prevalence of chronic diseases globally and an aging population are driving increased demand for medical devices and diagnostic procedures, directly fueling the need for high-quality plastic components. Stringent regulatory frameworks, such as those imposed by the FDA and EMA, mandate the use of biocompatible and sterilizable materials, which plastic solutions often meet effectively, thereby reinforcing their market position.

Conversely, the market faces several restraints. Volatility in the prices of raw materials, such as various polymers, can impact manufacturing costs and profit margins. Growing environmental concerns regarding plastic waste and sustainability are pushing for greener alternatives or enhanced recycling programs, posing a challenge to conventional plastic usage. Technical complexities related to ensuring universal chemical compatibility and sterilization stability across a wide range of pharmaceutical media and medical applications also represent hurdles. Opportunities for growth lie in the development and adoption of advanced sustainable materials, the expansion into rapidly developing emerging markets with growing healthcare needs, and the continuous innovation in aseptic connection technologies and customized solutions tailored for specific therapeutic areas. Impact forces, such as global health crises like pandemics, can dramatically shift demand, accelerating the need for rapid production of vaccines and therapeutics, while ongoing technological advancements in polymer science and manufacturing processes continually redefine product capabilities and market expectations. The evolving regulatory landscape and geopolitical dynamics also play a role in shaping supply chains and market access, influencing strategic decisions of key players.

Segmentation Analysis

The Plastic Fittings and Tubing for Pharmaceutical and Medical Market is intricately segmented across various dimensions, reflecting the diverse applications and specific requirements within the healthcare and life sciences sectors. Understanding these segments is crucial for market participants to identify niche opportunities, tailor product offerings, and develop targeted marketing strategies. The primary segmentation categories include product type, material, application, end-use, and usability, each offering unique insights into market dynamics and growth potential. This detailed analysis allows for a comprehensive understanding of the market landscape and informs strategic decision-making for manufacturers, distributors, and end-users alike.

- By Product Type

- Tubing

- Silicone Tubing

- Thermoplastic Elastomer (TPE) Tubing

- Polyvinyl Chloride (PVC) Tubing

- Polyether Ether Ketone (PEEK) Tubing

- Polytetrafluoroethylene (PTFE) Tubing

- Polypropylene (PP) Tubing

- Polycarbonate (PC) Tubing

- Other Advanced Polymer Tubing

- Fittings

- Connectors (Quick Disconnects, Barbed, Threaded)

- Adapters

- Valves (Check Valves, Pinch Valves, Stopcocks)

- Clamps

- Manifolds

- Other Flow Control Components

- Tubing

- By Material

- Polyvinyl Chloride (PVC)

- Silicone

- Thermoplastic Elastomer (TPE)

- Polytetrafluoroethylene (PTFE)

- Polyether Ether Ketone (PEEK)

- Polypropylene (PP)

- Polycarbonate (PC)

- Others (e.g., Polyethylene (PE), Ethylene Vinyl Acetate (EVA))

- By Application

- Biopharmaceutical Manufacturing

- Upstream Processing

- Downstream Processing

- Fill and Finish Operations

- Medical Devices

- Surgical Devices

- Diagnostic Devices

- Drug Delivery Systems

- Catheters and IV Systems

- Diagnostics

- Research & Laboratories

- Drug Delivery

- Biopharmaceutical Manufacturing

- By End-Use

- Pharmaceutical Companies

- Biotechnology Companies

- Hospitals & Clinics

- Diagnostic Laboratories

- Contract Manufacturing Organizations (CMOs)

- By Usability

- Single-use

- Reusable

Value Chain Analysis For Plastic Fittings and Tubing for Pharmaceutical and Medical Market

The value chain for Plastic Fittings and Tubing for the Pharmaceutical and Medical Market is a complex ecosystem, commencing with the meticulous sourcing of raw materials and culminating in the delivery of critical components to end-users. The upstream segment primarily involves the production of specialized polymer resins and additives by chemical companies. These raw material suppliers must adhere to stringent quality and purity standards to ensure the final plastic products are biocompatible, chemically inert, and capable of withstanding various sterilization methods, meeting the rigorous demands of pharmaceutical and medical applications. Key considerations at this stage include sourcing medical-grade polymers like PVC, silicone, TPE, PTFE, and PEEK, which often require extensive qualification and certification processes.

Moving downstream, these raw materials are then transformed by specialized manufacturers into various forms of tubing and fittings through processes such as extrusion, injection molding, and assembly in controlled environments. These manufacturers are responsible for designing products that meet precise specifications for fluid dynamics, pressure resistance, and connection integrity, often developing custom solutions for complex bioprocessing or medical device applications. Quality assurance and regulatory compliance are paramount throughout the manufacturing process, involving extensive testing for extractables and leachables, sterility, and structural integrity. The distribution channel then plays a crucial role in bridging the gap between manufacturers and end-users. This involves a mix of direct sales channels, where manufacturers engage directly with large pharmaceutical or biotechnology companies, and indirect channels, which utilize specialized medical and laboratory distributors. These distributors often provide value-added services such as inventory management, technical support, and logistical solutions, catering to a broader range of customers, including smaller research labs, hospitals, and contract manufacturing organizations.

The distinction between direct and indirect distribution is critical. Direct sales facilitate deep relationships with key accounts, allowing for bespoke product development and close technical collaboration. Indirect channels, on the other hand, provide broader market reach, particularly for standardized products and to geographically dispersed or smaller-scale customers. The efficiency and reliability of both upstream supply and downstream distribution networks are vital for ensuring timely delivery of these essential components, which directly impacts the operational continuity and patient safety in the pharmaceutical and medical sectors. Disruptions at any point in this chain can have significant consequences, underscoring the importance of robust supplier qualification, meticulous manufacturing control, and resilient distribution strategies.

Plastic Fittings and Tubing for Pharmaceutical and Medical Market Potential Customers

The potential customers for Plastic Fittings and Tubing in the Pharmaceutical and Medical Market represent a diverse and expanding group of entities, all operating within highly regulated and critical environments where fluid handling integrity is paramount. These end-users are primarily driven by the need for reliable, sterile, and chemically compatible components to ensure the safety, efficacy, and quality of their products and services. The primary buyers include pharmaceutical companies, which utilize these components extensively in drug manufacturing processes, from R&D to large-scale production, particularly in bioprocessing applications for biologics, vaccines, and cell therapies.

Biotechnology companies form another significant customer segment, relying on these plastic solutions for their upstream and downstream bioprocessing workflows, media transfer, and bioreactor connections. The demand from this sector is rapidly growing due to the innovation in novel therapeutics and gene therapies. Hospitals and clinics also represent a substantial customer base, where plastic tubing and fittings are indispensable for patient care applications such as IV administration, dialysis, respiratory support, and surgical procedures. The need for disposable, sterile, and flexible components to prevent hospital-acquired infections and ensure precise medication delivery is a key driver for this segment. Diagnostic laboratories, encompassing both clinical and research facilities, frequently purchase these products for various assays, sample preparation, and analytical instrumentation, where consistent flow and minimal contamination are essential for accurate results.

Furthermore, contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) are increasingly significant purchasers. As the pharmaceutical and biotechnology industries outsource more of their manufacturing and development activities, CMOs and CDMOs require vast quantities of high-quality plastic fittings and tubing to support their clients' diverse production needs. Medical device manufacturers integrate these components directly into their products, ranging from simple catheters to complex diagnostic equipment and implantable devices, demanding materials that meet stringent biocompatibility and performance specifications. The collective needs of these varied end-users underscore the critical role these plastic components play across the entire spectrum of healthcare and life sciences, driving continuous demand and innovation in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $10.2 Billion |

| Market Forecast in 2032 | $18.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sartorius AG, Thermo Fisher Scientific Inc., Pall Corporation (Danaher), Parker Hannifin Corporation, Merck KGaA, Saint-Gobain S.A., AdvantaPure (NewAge Industries), Nordson Corporation, Qosina Corporation, CPC (Colder Products Company), Freudenberg Group, Cole-Parmer, Eldon James Corporation, OptiPure, Swagelok Company, Zeus Industrial Products, Inc., Masterflex (Cole-Parmer), PEXCO LLC, West Pharmaceutical Services, Inc., W. L. Gore & Associates |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Fittings and Tubing for Pharmaceutical and Medical Market Key Technology Landscape

The Plastic Fittings and Tubing for Pharmaceutical and Medical Market is continually evolving, driven by advancements in polymer science, manufacturing processes, and aseptic connection technologies, all aimed at enhancing product performance, safety, and efficiency. One critical technological area is the development of advanced polymer formulations. This includes new generations of thermoplastic elastomers (TPEs) that offer improved chemical resistance, flexibility, and weldability compared to traditional materials, facilitating easier integration into single-use systems. High-performance polymers like PEEK and PTFE are gaining traction for applications requiring extreme chemical inertness, high temperature resistance, and durability, especially in critical process lines or in medical devices for long-term patient contact. Innovations in material science are also focusing on reducing extractables and leachables, which are crucial for maintaining the purity of pharmaceutical products and preventing adverse patient reactions.

Another significant technological advancement lies in aseptic connection technologies. The move towards single-use bioprocessing has spurred the development of sterile connectors and disconnects that allow for fluid transfer in an open-air environment without compromising sterility. Technologies such as sterile welding, which creates a robust and contamination-free connection between tubing segments, and quick-connect fittings with ergonomic designs and foolproof mechanisms, are becoming standard. These innovations significantly reduce the risk of contamination, improve process efficiency, and minimize the need for labor-intensive cleaning and sterilization validation. Furthermore, the integration of smart technologies, such as sensors embedded within tubing or fittings, is emerging, allowing for real-time monitoring of flow rates, pressure, and even the detection of particulate matter, providing enhanced process control and safety feedback.

Manufacturing technologies are also undergoing transformation. Precision extrusion techniques are enabling the production of tubing with tighter tolerances, smoother interior surfaces, and multi-lumen configurations, catering to complex medical device designs. Additive manufacturing, or 3D printing, is beginning to play a role, particularly in rapid prototyping and the creation of highly customized fittings and manifolds for specific laboratory or niche medical applications, offering unprecedented design flexibility and accelerated development cycles. Surface modification technologies, which enhance the lubricity, antimicrobial properties, or cell-repellent characteristics of plastic surfaces, are also being explored to improve performance in various biomedical contexts. These technological advancements collectively contribute to a market that is increasingly sophisticated, offering highly specialized and high-performance solutions essential for the advanced needs of the pharmaceutical and medical industries.

Regional Highlights

- North America: As a dominant market, North America, particularly the United States, leads in pharmaceutical R&D, biopharmaceutical manufacturing, and advanced medical device production. The region benefits from significant investments in healthcare infrastructure, a strong presence of key market players, and stringent regulatory standards that drive demand for high-quality, compliant plastic components. The early adoption of single-use technologies in bioprocessing is a major factor, supported by a mature healthcare system and a high prevalence of chronic diseases.

- Europe: Europe represents a significant market with a robust pharmaceutical and biotechnology sector, particularly in Germany, France, and the UK. The region is characterized by strong regulatory frameworks and a focus on innovation, especially in advanced materials and aseptic connection technologies. The growing geriatric population and increasing demand for personalized medicine are further contributing to market expansion, with a rising emphasis on sustainable plastic solutions.

- Asia Pacific (APAC): The Asia Pacific market is poised for the fastest growth, driven by rapid expansion in healthcare infrastructure, increasing government spending on healthcare, and a burgeoning pharmaceutical manufacturing industry, particularly in China and India. The rising prevalence of lifestyle diseases, improving economic conditions, and growing accessibility to advanced medical treatments are key factors. The region is also becoming a hub for contract manufacturing, boosting demand for reliable plastic fittings and tubing.

- Latin America: This region is an emerging market for plastic fittings and tubing, experiencing growth due to increasing investments in healthcare, improving access to medical technologies, and a rising focus on pharmaceutical production, especially in Brazil and Mexico. While still developing, the market offers significant potential as healthcare infrastructure continues to modernize and expand across the continent.

- Middle East and Africa (MEA): The MEA market is currently nascent but shows promising growth, fueled by government initiatives to diversify economies, enhance healthcare services, and reduce reliance on imports. Countries like Saudi Arabia and UAE are investing heavily in establishing local pharmaceutical manufacturing capabilities and modernizing hospitals, which will progressively increase the demand for essential plastic components for medical and pharmaceutical applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Fittings and Tubing for Pharmaceutical and Medical Market.- Sartorius AG

- Thermo Fisher Scientific Inc.

- Pall Corporation (Danaher)

- Parker Hannifin Corporation

- Merck KGaA

- Saint-Gobain S.A.

- AdvantaPure (NewAge Industries)

- Nordson Corporation

- Qosina Corporation

- CPC (Colder Products Company)

- Freudenberg Group

- Cole-Parmer

- Eldon James Corporation

- OptiPure

- Swagelok Company

- Zeus Industrial Products, Inc.

- Masterflex (Cole-Parmer)

- PEXCO LLC

- West Pharmaceutical Services, Inc.

- W. L. Gore & Associates

Frequently Asked Questions

What are the primary drivers for the Plastic Fittings and Tubing for Pharmaceutical and Medical Market?

The market is primarily driven by the robust growth of the biopharmaceutical sector, increasing adoption of single-use systems, stringent regulatory requirements, and the rising global prevalence of chronic diseases.

What is the role of single-use technology in this market?

Single-use technology is critical as it minimizes contamination risks, reduces cleaning validation costs, and enhances operational flexibility, especially in biopharmaceutical manufacturing and laboratory settings.

Which regions show the most significant growth opportunities for plastic fittings and tubing?

The Asia Pacific region is projected to exhibit the fastest growth, driven by expanding healthcare infrastructure, increasing pharmaceutical manufacturing, and rising patient populations in countries like China and India.

What are the key material types used for these products?

Common materials include PVC, Silicone, Thermoplastic Elastomer (TPE), PTFE, PEEK, Polypropylene, and Polycarbonate, each selected for specific properties like flexibility, chemical resistance, and biocompatibility.

How do regulatory standards impact the Plastic Fittings and Tubing for Pharmaceutical and Medical Market?

Regulatory standards, such as those from FDA and EMA, profoundly impact the market by enforcing strict requirements for material purity, biocompatibility, sterilization compatibility, and traceability, thereby driving demand for certified, high-quality products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager