Polyethylene (PE) Transparent Barrier Packaging Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427994 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Polyethylene (PE) Transparent Barrier Packaging Films Market Size

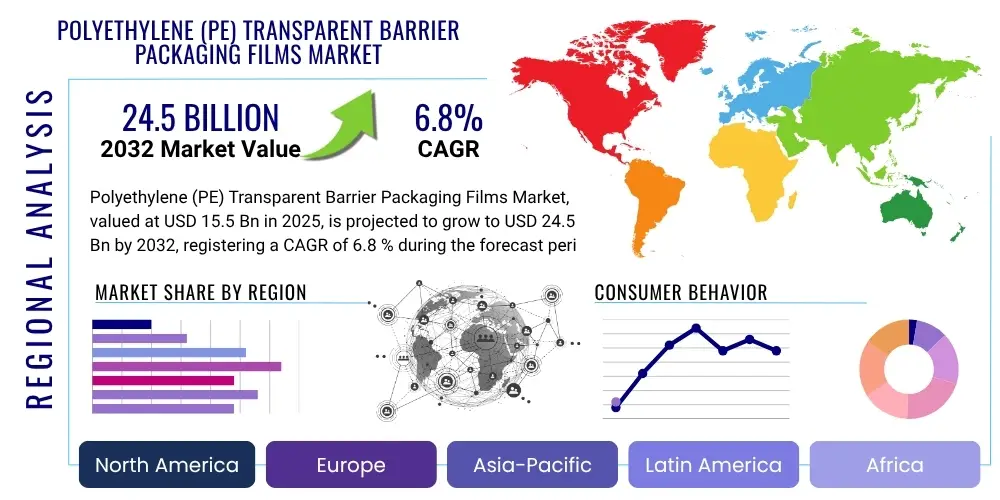

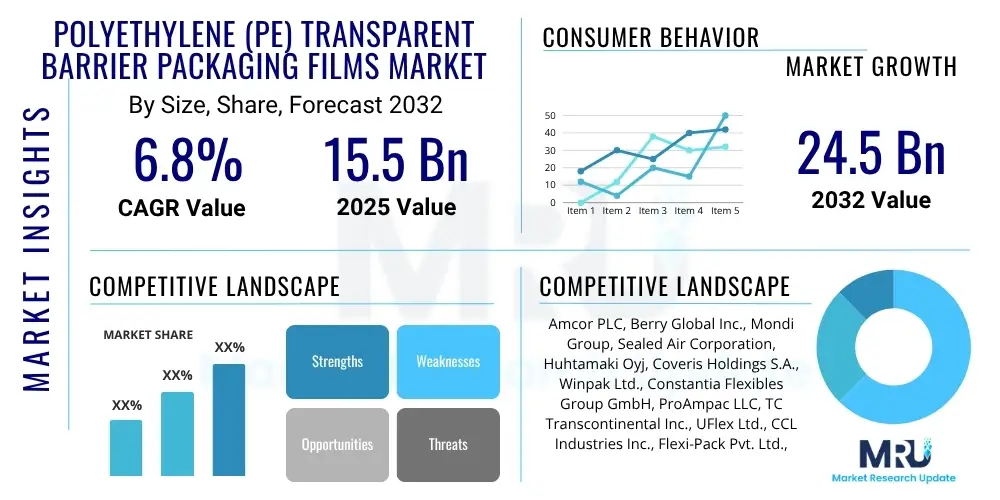

The Polyethylene (PE) Transparent Barrier Packaging Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 24.5 Billion by the end of the forecast period in 2032.

Polyethylene (PE) Transparent Barrier Packaging Films Market introduction

The Polyethylene (PE) Transparent Barrier Packaging Films market encompasses a range of flexible packaging solutions designed to extend the shelf life of products by providing superior protection against oxygen, moisture, and other external factors. These films are engineered using advanced co-extrusion and lamination technologies, often integrating barrier polymers like EVOH (Ethylene Vinyl Alcohol), PA (Polyamide), PVDC (Polyvinylidene Chloride), or inorganic coatings (e.g., SiOx) with PE as the primary structural and sealing layer. The inherent flexibility, transparency, and sealability of PE, combined with the barrier properties of other materials, create an optimal packaging solution for sensitive goods.

Major applications for PE transparent barrier films span across diverse industries, with a significant presence in food and beverages, pharmaceuticals, and personal care. In the food sector, these films are crucial for packaging fresh meat, poultry, seafood, dairy products, ready meals, and snacks, where maintaining freshness, preventing spoilage, and enhancing product visibility are paramount. For pharmaceutical products, barrier films protect sensitive medications from degradation due caused by moisture and oxygen, ensuring efficacy and extending shelf life. The demand for convenient, safe, and visually appealing packaging continues to fuel the adoption of these advanced film solutions.

The primary benefits of PE transparent barrier packaging films include extended product shelf life, reduced food waste, enhanced product visibility, and improved consumer convenience. These films offer excellent puncture resistance and formability, making them suitable for various packaging formats such as pouches, bags, and thermoformed trays. Key driving factors for market growth include the increasing global consumption of packaged and processed foods, stringent food safety regulations requiring better preservation, the expansion of the e-commerce sector necessitating robust packaging, and a growing consumer preference for convenient and sustainable packaging solutions that minimize environmental impact while maximizing product integrity.

Polyethylene (PE) Transparent Barrier Packaging Films Market Executive Summary

The Polyethylene (PE) Transparent Barrier Packaging Films market is experiencing robust growth driven by evolving consumer lifestyles and increasingly complex supply chains. Business trends indicate a strong focus on sustainable solutions, with manufacturers investing in recyclable and bio-based barrier films to meet environmental mandates and consumer demand for eco-friendly products. Automation and advanced manufacturing processes, such as multi-layer co-extrusion and innovative coating techniques, are key to improving film performance and reducing production costs. Strategic collaborations between film manufacturers, raw material suppliers, and packaging machinery providers are becoming more common to offer integrated and optimized packaging solutions to end-users across various industries.

Regionally, Asia Pacific continues to be the largest and fastest-growing market, primarily due to the expanding population, rising disposable incomes, and the rapid urbanization leading to increased consumption of packaged food and pharmaceutical products in countries like China and India. North America and Europe also maintain significant market shares, characterized by stringent food safety regulations, high adoption rates of advanced packaging technologies, and a strong emphasis on reducing food waste. Latin America, the Middle East, and Africa are emerging as promising markets, driven by improving economic conditions, a growing retail sector, and increasing awareness regarding the benefits of extended shelf life packaging, especially for perishable goods.

Segmentation trends highlight the dominance of the food and beverage sector in application, with significant growth in categories such as ready meals and fresh produce, where barrier properties are critical for preservation. By type, PE/EVOH films are gaining traction due to their superior oxygen barrier capabilities and compatibility with existing recycling streams, aligning with sustainability goals. There is also a notable shift towards thinner films that maintain comparable barrier performance, driven by cost efficiency and reduced material usage, further bolstering the market's sustainable credentials. These trends collectively underscore a dynamic market landscape focused on innovation, efficiency, and environmental responsibility.

AI Impact Analysis on Polyethylene (PE) Transparent Barrier Packaging Films Market

Common user questions regarding AI's impact on the Polyethylene (PE) Transparent Barrier Packaging Films market frequently revolve around how artificial intelligence can enhance manufacturing efficiency, optimize supply chain logistics, and contribute to the development of more sustainable and intelligent packaging solutions. Users are particularly interested in AI's role in predictive maintenance for complex co-extrusion lines, improving quality control through automated inspection systems, and streamlining R&D processes for novel barrier materials. Concerns often include the initial investment costs, data privacy, and the need for a skilled workforce to implement and manage AI-driven systems. Expectations are high for AI to lead to significant cost reductions, faster time-to-market for new products, and a stronger competitive edge for companies adopting these advanced technologies.

- AI-driven predictive maintenance optimizes machinery performance, reducing downtime and extending the lifespan of manufacturing equipment in film production.

- Automated quality control systems powered by AI can detect microscopic defects in film layers, ensuring consistent barrier performance and reducing waste.

- AI algorithms enhance supply chain efficiency by predicting demand fluctuations, optimizing inventory levels, and streamlining logistics for raw materials and finished films.

- Machine learning aids in the rapid development and testing of new barrier material formulations, accelerating innovation in sustainable and high-performance films.

- AI facilitates smart packaging solutions through embedded sensors and data analytics, enabling real-time monitoring of product freshness and integrity during transit and storage.

- Robotics integrated with AI can automate material handling, film slitting, and packaging processes, leading to higher throughput and reduced labor costs.

- AI models assist in optimizing energy consumption during film manufacturing, contributing to greener production processes and lower operational expenses.

DRO & Impact Forces Of Polyethylene (PE) Transparent Barrier Packaging Films Market

The Polyethylene (PE) Transparent Barrier Packaging Films market is profoundly influenced by a complex interplay of driving forces, inherent restraints, and emerging opportunities. A primary driver is the burgeoning global demand for processed and packaged food products, fueled by urbanization, busy lifestyles, and the expansion of the retail and e-commerce sectors. Consumers increasingly seek convenience and extended shelf life, making barrier films indispensable for maintaining product freshness, quality, and safety. Furthermore, stricter food safety regulations across various regions necessitate advanced packaging solutions that can effectively protect sensitive contents from oxygen, moisture, and other contaminants, thereby bolstering the market for high-performance barrier films. The rising awareness among consumers about food waste also contributes, as barrier packaging plays a critical role in extending product viability.

However, the market faces significant restraints that temper its growth trajectory. The volatility in raw material prices, particularly for polyethylene resins and specialized barrier polymers like EVOH or PA, can impact manufacturing costs and profit margins for film producers. Furthermore, regulatory hurdles related to the use and disposal of certain barrier materials pose challenges, especially in regions with stringent environmental policies. The competition from alternative packaging materials, such as rigid plastics, glass, or metal, though less flexible, also presents a constraint, as these alternatives might offer different trade-offs in terms of cost, barrier properties, or recyclability. Market maturity in some developed regions also leads to saturation, requiring companies to focus on innovation and differentiation.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The development of advanced, high-performance barrier films with enhanced recyclability or biodegradability presents a significant growth avenue, aligning with global sustainability initiatives and consumer preferences for eco-friendly packaging. Penetration into emerging markets, particularly in Asia Pacific, Latin America, and Africa, offers untapped potential due to their rapidly growing middle-class populations, increasing disposable incomes, and developing retail infrastructures. Technological advancements in co-extrusion, lamination, and coating techniques are enabling the production of thinner, lighter, and more cost-effective films without compromising barrier performance, thereby opening new application areas and improving overall market competitiveness. The shift towards single-material, PE-based barrier solutions that are easier to recycle is also a major opportunity.

Segmentation Analysis

The Polyethylene (PE) Transparent Barrier Packaging Films market is comprehensively segmented by various parameters to provide a detailed understanding of its dynamics, key growth areas, and market potential across different applications and product specifications. This segmentation analysis helps stakeholders identify lucrative niches, target specific customer needs, and develop tailored strategies for market penetration and expansion. The market can be broadly analyzed based on the type of barrier material integrated with PE, the primary applications where these films are utilized, and the thickness categories relevant for different product requirements. Each segment reflects unique demand drivers and competitive landscapes, offering diverse opportunities for manufacturers and suppliers.

- By Type

- PE/EVOH (Ethylene Vinyl Alcohol): Known for excellent oxygen barrier, increasingly preferred for its recyclability in PE-rich structures.

- PE/PA (Polyamide): Offers good oxygen barrier, high puncture resistance, and thermoformability, suitable for robust packaging.

- PE/PVDC (Polyvinylidene Chloride): Provides superior barrier to oxygen and moisture, traditionally used in demanding applications.

- PE/COC (Cyclic Olefin Copolymer): Enhances stiffness, transparency, and often used for retort applications.

- PE/SiOX (Silicon Oxide): Offers high transparency and barrier properties through a thin inorganic coating, suitable for clear, high-performance packaging.

- By Application

- Food & Beverages

- Meat, Poultry & Seafood: Crucial for extending shelf life and preventing spoilage due to high perishability.

- Dairy & Desserts: Protects against oxygen and moisture to maintain freshness and texture.

- Ready Meals: Enables convenience and prolongs freshness for prepared foods.

- Fruits & Vegetables: Offers modified atmosphere packaging solutions to preserve produce.

- Bakery & Confectionery: Maintains crispness and prevents staling.

- Others (e.g., Snacks, Sauces, Grains): Diverse applications requiring various barrier levels.

- Pharmaceuticals: Essential for protecting moisture-sensitive drugs and sterile medical devices.

- Personal Care & Cosmetics: Preserves product integrity and extends shelf life for creams, lotions, and wipes.

- Industrial Packaging: Used for protective packaging of industrial goods, chemicals, and components.

- Others (e.g., Agriculture, Electronics): Niche applications requiring specialized barrier protection.

- Food & Beverages

- By Thickness

- Less than 50 microns: Typically used for lighter products, sachets, and lidding films, driven by sustainability goals.

- 50 to 100 microns: Common for a wide range of food and non-food applications, balancing barrier and flexibility.

- More than 100 microns: Employed for heavy-duty applications, vacuum packaging, and products requiring exceptional puncture resistance.

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Polyethylene (PE) Transparent Barrier Packaging Films Market

The value chain for Polyethylene (PE) Transparent Barrier Packaging Films is a complex network involving several key stages, starting from raw material extraction to the final consumption of packaged goods. Upstream analysis begins with the petrochemical industry, which produces the basic polymers such as polyethylene (LDPE, LLDPE, HDPE), EVOH, PA, PVDC, and COC. These raw material suppliers, including major chemical companies, are critical as the quality, availability, and pricing of their products directly impact the cost and performance of the barrier films. Innovation in polymer science, particularly in developing high-performance resins and recycled content, is a significant factor at this stage, influencing the overall sustainability profile of the end product.

Midstream activities involve film manufacturers and converters. Film manufacturers process raw polymers through advanced techniques like co-extrusion (where multiple layers of different polymers are simultaneously extruded to form a single film) or lamination (where pre-formed films are bonded together with adhesives). Converters then take these base films and further process them through printing, slitting, and pouch-making or bag-making operations, tailoring them to specific customer requirements. This stage requires significant capital investment in specialized machinery and expertise in barrier technology to ensure the desired protective properties, transparency, and sealability of the final film. Efficiency and technological prowess at this stage are crucial for competitive advantage.

Downstream analysis focuses on the distribution channels and end-users. Finished barrier packaging films are supplied to a diverse range of end-user industries, primarily food and beverages, pharmaceuticals, and personal care. Distribution can occur through direct sales channels, where film manufacturers or converters supply directly to large industrial customers, or through indirect channels involving distributors, brokers, and wholesalers who serve smaller businesses or niche markets. The choice of distribution channel depends on the scale of the customer, the complexity of the product, and geographical reach. Effective distribution ensures timely delivery and customer satisfaction, which are vital for maintaining market share and fostering long-term relationships within the value chain. The intricate coordination between these stages is essential for market efficiency.

Polyethylene (PE) Transparent Barrier Packaging Films Market Potential Customers

Potential customers for Polyethylene (PE) Transparent Barrier Packaging Films are predominantly large-scale manufacturers and producers across various industries that require high-performance, transparent, and flexible packaging to protect their products and extend shelf life. The most significant segment of end-users are food and beverage processors, including companies involved in packaging fresh meat, poultry, seafood, dairy products, ready meals, baked goods, snacks, and confectionery. These businesses rely heavily on barrier films to maintain the freshness, nutritional value, and sensory appeal of their perishable goods, comply with stringent food safety regulations, and reduce product spoilage across their supply chains. The demand from this sector is driven by consumer preferences for convenience, longer shelf life, and the visual appeal of products through transparent packaging.

Beyond the food sector, pharmaceutical companies represent another critical segment of potential customers. Manufacturers of medications, medical devices, and other healthcare products require packaging that offers superior protection against moisture, oxygen, and light degradation to ensure drug efficacy, sterility, and patient safety. PE transparent barrier films provide the necessary protective properties, making them ideal for blister packaging, sterile wraps, and unit-dose applications. The highly regulated nature of the pharmaceutical industry means that packaging solutions must consistently meet rigorous quality standards and regulatory compliance, making reliable barrier films an indispensable component of their product delivery systems.

Furthermore, the personal care and cosmetics industry, along with various industrial packaging applications, also constitute significant potential customer bases. Personal care manufacturers use these films for packaging lotions, creams, wipes, and other beauty products, where preserving fragrance, texture, and active ingredients is paramount. In industrial applications, PE transparent barrier films protect sensitive components, chemicals, and agricultural products from environmental factors during storage and transportation. The growing e-commerce sector also drives demand across these end-user segments, as products shipped through online channels require robust, protective packaging to withstand diverse transit conditions and reach consumers in pristine condition, thereby expanding the customer landscape for these advanced film solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2032 | USD 24.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor PLC, Berry Global Inc., Mondi Group, Sealed Air Corporation, Huhtamaki Oyj, Coveris Holdings S.A., Winpak Ltd., Constantia Flexibles Group GmbH, ProAmpac LLC, TC Transcontinental Inc., UFlex Ltd., CCL Industries Inc., Flexi-Pack Pvt. Ltd., AlphaPack, Sonoco Products Company, Kuraray Co. Ltd., Mitsui Chemicals Inc., Mitsubishi Chemical Corporation, ExxonMobil Chemical Company, Dow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyethylene (PE) Transparent Barrier Packaging Films Market Key Technology Landscape

The Polyethylene (PE) Transparent Barrier Packaging Films market is characterized by a dynamic and evolving technology landscape, primarily driven by the continuous pursuit of enhanced barrier properties, improved sustainability, and cost-effectiveness. A fundamental technology is multi-layer co-extrusion, which allows for the simultaneous extrusion of several different polymer resins into a single, integrated film structure. This process is crucial for combining the excellent sealing and mechanical properties of PE with the superior barrier characteristics of materials like EVOH, PA, or PVDC, precisely controlling the thickness and placement of each layer to optimize performance. Advancements in co-extrusion dies and process controls enable the creation of increasingly complex film structures with more layers (up to 11 or even 13 layers), offering tailor-made barrier solutions for specific applications while minimizing overall film thickness.

Another significant technological advancement lies in lamination techniques, where pre-formed films are bonded together using adhesives. Solvent-based, solvent-less, and even water-based laminating adhesives are employed, with a growing trend towards solvent-less and water-based options due to environmental and safety concerns. This method provides flexibility in combining different materials that may not be compatible with co-extrusion, such as metallized films, specialty papers, or high-barrier foil. Furthermore, coating technologies, including vacuum deposition of inorganic oxides like silicon oxide (SiOx) or aluminum oxide (AlOx), are gaining traction. These ultra-thin, transparent coatings provide exceptional barrier properties against oxygen and moisture, especially for applications requiring high clarity and microwaveability, and are often applied to a PE base film, enhancing its protective capabilities.

Innovation also extends to the development of high-performance barrier polymers and modifiers themselves. Research and development efforts are focused on creating new grades of EVOH with improved flexibility and processability, novel polyamides with enhanced oxygen barrier at high humidity, and sustainable barrier materials, including bio-based polymers or those designed for improved recyclability within PE streams. This includes the development of compatibilizers that allow for easier recycling of multi-layer structures. Additionally, advanced analytical techniques and simulation software are increasingly used to predict film performance, optimize layer structures, and accelerate new product development cycles. These technological advancements collectively contribute to the market's ability to offer increasingly sophisticated, efficient, and environmentally responsible packaging solutions, addressing diverse industry demands and regulatory pressures.

Regional Highlights

- North America: This region demonstrates a mature market with high demand for convenient and safe food packaging, driven by strict food safety regulations and a well-established e-commerce sector. Innovations in sustainable and recyclable barrier films are a key focus, with strong investment in advanced manufacturing technologies and premium packaging solutions for meat, dairy, and prepared foods.

- Europe: Europe is characterized by a strong emphasis on sustainability and circular economy principles, leading to high demand for recyclable and mono-material PE barrier films. Stringent environmental regulations drive innovation in bio-based and compostable barrier solutions. The region shows robust growth in pharmaceutical and high-value food applications, alongside a consistent push for waste reduction and extended shelf life.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, propelled by rapid urbanization, increasing disposable incomes, and the expanding food processing and pharmaceutical industries in countries like China, India, and Southeast Asia. The region is a hub for both production and consumption, with a growing demand for cost-effective yet high-performance barrier packaging to cater to a massive and diverse consumer base.

- Latin America: This region is experiencing steady growth, driven by increasing consumption of packaged food and beverages, improvements in retail infrastructure, and a growing awareness of food safety and quality. Brazil and Mexico are leading markets, with a focus on adopting modern packaging technologies to enhance product preservation and extend market reach.

- Middle East & Africa (MEA): The MEA market is an emerging region with significant growth potential, attributed to economic diversification, rising disposable incomes, and increasing foreign investments. The demand for barrier packaging films is expanding, particularly in the food and pharmaceutical sectors, as countries aim to reduce spoilage and improve the quality of imported and locally produced goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyethylene (PE) Transparent Barrier Packaging Films Market.- Amcor PLC

- Berry Global Inc.

- Mondi Group

- Sealed Air Corporation

- Huhtamaki Oyj

- Coveris Holdings S.A.

- Winpak Ltd.

- Constantia Flexibles Group GmbH

- ProAmpac LLC

- TC Transcontinental Inc.

- UFlex Ltd.

- CCL Industries Inc.

- Flexi-Pack Pvt. Ltd.

- AlphaPack

- Sonoco Products Company

- Kuraray Co. Ltd.

- Mitsui Chemicals Inc.

- Mitsubishi Chemical Corporation

- ExxonMobil Chemical Company

- Dow Inc.

Frequently Asked Questions

Analyze common user questions about the Polyethylene (PE) Transparent Barrier Packaging Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using PE transparent barrier packaging films?

The main benefits include significantly extended product shelf life, superior protection against oxygen and moisture, enhanced product visibility, reduced food waste, and improved consumer convenience due to the films' flexibility and sealability.

How do PE transparent barrier films contribute to sustainability?

These films enhance sustainability by reducing food spoilage and waste. Additionally, advancements in mono-material PE-based barrier films and the integration of recycled content are making these solutions more readily recyclable, aligning with circular economy principles.

Which industries are the major consumers of these films?

The food and beverage industry is the largest consumer, particularly for perishable items like meat, dairy, and ready meals. Pharmaceuticals and personal care sectors also extensively use these films for product protection and preservation.

What are the key technological advancements driving this market?

Key advancements include multi-layer co-extrusion for complex film structures, advanced lamination techniques, and transparent inorganic coatings (like SiOx). Innovation in bio-based and high-performance barrier polymers also plays a crucial role in market growth.

What challenges does the Polyethylene (PE) Transparent Barrier Packaging Films market face?

Challenges include volatility in raw material prices, stringent regulatory hurdles concerning certain barrier materials, and intense competition from alternative packaging solutions. The need for specialized recycling infrastructure for multi-layer films also presents a significant hurdle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager