Position Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428109 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Position Sensor Market Size

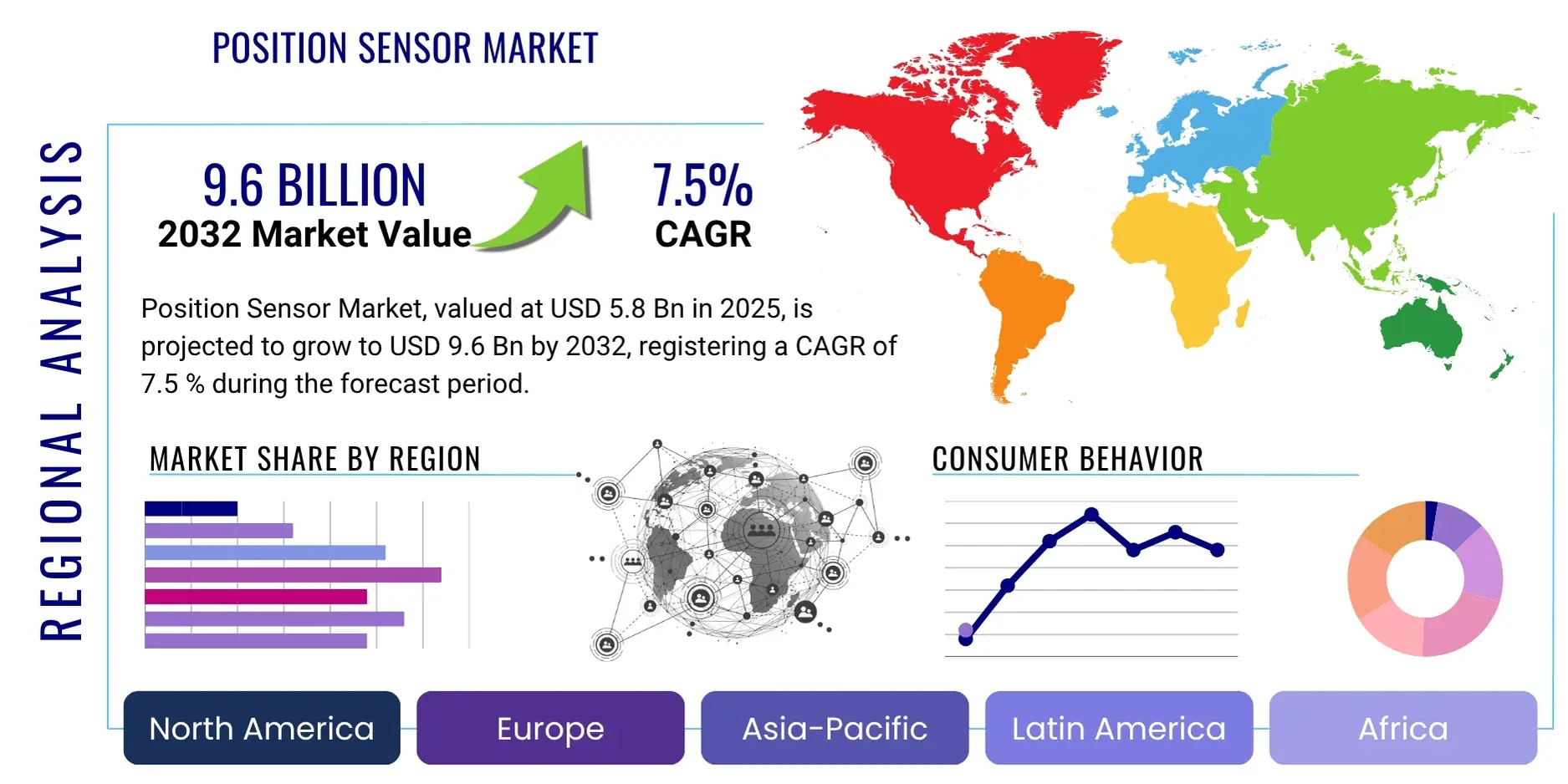

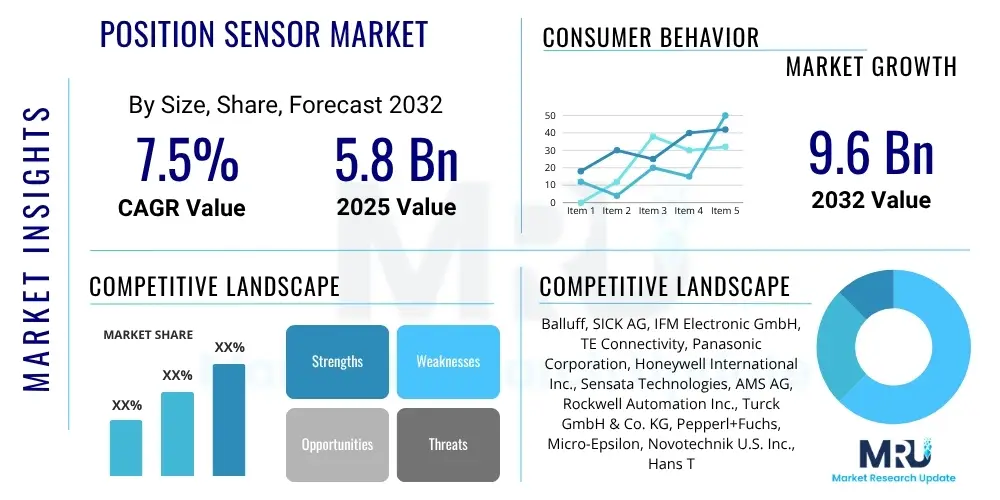

The Position Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at USD 5.8 billion in 2025 and is projected to reach USD 9.6 billion by the end of the forecast period in 2032. This substantial growth is driven by the increasing demand for automation across diverse industries, the rapid evolution of smart manufacturing, and the integration of advanced sensor technologies into automotive and consumer electronics applications. The market expansion reflects a global pivot towards precision control and enhanced operational efficiency, underscoring the critical role position sensors play in modern industrial and technological landscapes.

Position Sensor Market introduction

The Position Sensor Market is characterized by the development and deployment of devices designed to measure either linear or angular position. These sensors are fundamental components in a myriad of systems, providing real-time data essential for control, automation, and safety. Product descriptions typically highlight their ability to convert physical position into electrical signals, enabling accurate feedback for machinery, robotics, and human-machine interfaces. Major applications span industrial automation, where they are critical for machine tool precision and robotic arm control; automotive systems, for throttle position, steering angle, and suspension control; and aerospace & defense, ensuring precise control surfaces and landing gear operation. The primary benefits include enhanced precision, improved efficiency, increased safety, and reduced operational costs. Key driving factors encompass the burgeoning adoption of Industry 4.0 paradigms, the electrification of vehicles, the growing demand for medical devices, and the continuous innovation in sensor miniaturization and wireless capabilities.

Position Sensor Market Executive Summary

The global Position Sensor Market is experiencing robust growth fueled by several converging business, regional, and segment trends. Business trends indicate a strong move towards integrated smart sensor solutions, often incorporating AI and IoT functionalities, which enhances data processing capabilities and predictive maintenance. Strategic partnerships and mergers among sensor manufacturers and automation solution providers are becoming commonplace to offer comprehensive systems. Regionally, Asia Pacific is emerging as the fastest-growing market, driven by its expansive manufacturing base, rapid industrialization in countries like China and India, and significant investments in automotive and consumer electronics sectors. North America and Europe continue to hold substantial market shares due to advanced industrial infrastructure and high adoption rates of automation technologies. Segment trends highlight significant growth in inductive and magnetic sensor technologies due to their durability and non-contact operation, while applications in robotics, electric vehicles, and medical devices are witnessing accelerated demand. The shift towards non-contact sensing methods and digital outputs is also a prominent trend, catering to the increasing need for reliability and ease of integration into complex digital control systems.

AI Impact Analysis on Position Sensor Market

Common user questions regarding AI's impact on the Position Sensor Market frequently revolve around how artificial intelligence can enhance sensor performance, enable predictive maintenance, and facilitate more autonomous operations. Users are keen to understand the implications of AI on data processing from position sensors, particularly in filtering noise, identifying patterns, and driving proactive decision-making. There are also concerns about the complexity of integrating AI algorithms with existing sensor infrastructures and the security implications of such connected, intelligent systems. Expectations are high for AI to transform raw sensor data into actionable insights, improving system reliability, optimizing industrial processes, and paving the way for advanced self-learning automation platforms. The core theme is the transition from passive data collection to intelligent, context-aware sensing, where AI acts as the brain interpreting and utilizing the rich information provided by position sensors for unprecedented levels of control and efficiency.

- AI enables predictive maintenance by analyzing sensor data patterns to anticipate equipment failures, significantly reducing downtime and maintenance costs.

- Enhanced data interpretation: AI algorithms can process vast amounts of position sensor data, identifying subtle anomalies and trends that human operators might miss, leading to higher precision and reliability.

- Adaptive control systems: AI allows position sensors to contribute to self-optimizing systems that can adjust operations in real-time based on environmental changes or performance metrics.

- Advanced robotics and autonomous vehicles: AI empowers position sensors to provide the critical spatial awareness needed for sophisticated navigation, object avoidance, and precise manipulation in robotic and autonomous applications.

- Edge AI processing: Integrating AI directly into sensor units or local gateways reduces latency and bandwidth requirements, enabling faster decision-making and improved responsiveness at the operational front.

- Personalized and intuitive interfaces: AI can tailor sensor feedback and control mechanisms to specific user needs or operational contexts, making complex systems more accessible and efficient.

- Improved anomaly detection: Machine learning models trained on sensor data can detect unusual deviations from normal operation more effectively, enhancing safety and security in critical applications.

DRO & Impact Forces Of Position Sensor Market

The Position Sensor Market is shaped by a dynamic interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. Key drivers include the escalating demand for industrial automation and robotics across manufacturing, logistics, and process industries, driven by the pursuit of operational efficiency and cost reduction. The rapid growth of the automotive sector, particularly the surge in electric vehicles (EVs) and autonomous driving technologies, heavily relies on advanced position sensing for crucial functions like steering, braking, and motor control. Opportunities abound in emerging applications such as augmented reality (AR) and virtual reality (VR) devices, smart agriculture, and advanced medical diagnostics, where precise spatial awareness is paramount. However, the market faces significant restraints, including the high initial cost of advanced position sensor systems, which can deter adoption in price-sensitive markets, and the technical complexities associated with integrating these sensors into legacy systems. Moreover, the vulnerability of certain sensor types to harsh environmental conditions, electromagnetic interference, or vibrations presents ongoing challenges. Regulatory standards for safety and reliability, while crucial, can also impose stringent design and testing requirements. The overall impact forces emphasize a market in constant innovation, balancing the benefits of precision and automation with the challenges of cost, integration, and environmental robustness, pushing manufacturers towards more resilient, compact, and intelligent sensor solutions.

Segmentation Analysis

The Position Sensor Market is comprehensively segmented across various dimensions, including type, technology, application, and output, providing a granular view of market dynamics and growth opportunities. This segmentation is crucial for understanding specific industry needs, technological preferences, and the diverse end-user landscapes that collectively drive market expansion. Each segment reflects unique operational requirements and technological advancements, from the fundamental distinction between linear and rotary measurement to the specialized demands of different industrial applications and preferred output protocols. Analyzing these segments helps stakeholders identify niche markets, tailor product development, and formulate targeted strategies to capitalize on specific growth vectors within the broader position sensor ecosystem.

- By Type:

- Linear Position Sensor: Measures displacement along a single axis, essential for machine tools, hydraulic cylinders, and robotics.

- Rotary Position Sensor: Measures angular displacement or rotation, critical for motor control, steering systems, and robotic joints.

- Angular Position Sensor: A specific category of rotary sensors designed for precise angle measurement, often used in aerospace and high-precision machinery.

- By Technology:

- Photoelectric Position Sensor: Utilizes light beams for detection, offering high precision in clean environments.

- Inductive Position Sensor: Non-contact sensors detecting metallic objects, robust and immune to dirt and dust.

- Capacitive Position Sensor: Detects metallic and non-metallic objects, sensitive to material properties.

- Magnetic Position Sensor (Hall Effect, Magneto-resistive): Based on magnetic field changes, highly durable and suitable for harsh environments.

- Potentiometric Position Sensor: Contact-based sensors, offering a cost-effective solution for linear and rotary measurements.

- Eddy Current Position Sensor: Non-contact sensors detecting metal objects by induced eddy currents, ideal for high-speed applications and harsh conditions.

- Ultrasonic Position Sensor: Uses sound waves to detect objects and measure distance, suitable for challenging environments with dust or moisture.

- Fiber Optic Position Sensor: Offers high immunity to EMI, suitable for hazardous environments and remote sensing.

- By Application:

- Industrial Automation: Critical for robotics, machine tools, material handling, and process control systems.

- Automotive: Used in throttle position, steering angle, suspension, gear position, and brake pedal sensing.

- Aerospace & Defense: Essential for flight control surfaces, landing gear, engine systems, and missile guidance.

- Healthcare: Integrated into medical imaging equipment, robotic surgery systems, and prosthetic devices.

- Consumer Electronics: Found in camera focus, gaming controllers, and various smart home devices.

- Robotics: Provides feedback for joint articulation, end-effector positioning, and overall robot kinematics.

- Packaging: Ensures precise control in filling, sealing, and labeling machinery.

- Process Control: Monitors and controls various parameters in chemical, pharmaceutical, and food processing plants.

- By Output:

- Analog Output: Provides a continuous voltage or current signal proportional to the measured position.

- Digital Output (IO-Link, Ethernet/IP, PROFINET, CANopen, SSI): Offers discrete signals or serialized data, enabling direct integration into digital control networks and smart factories.

Value Chain Analysis For Position Sensor Market

The value chain for the Position Sensor Market is a complex network spanning raw material suppliers to end-user integration, reflecting a sophisticated manufacturing and distribution ecosystem. Upstream analysis reveals reliance on specialized material providers for magnetic alloys, semiconductor components, advanced plastics, and precision metals, all crucial for sensor fabrication. Research and development activities, often involving partnerships with academic institutions, are paramount in this phase to innovate new sensing principles and miniaturization techniques. Midstream, the manufacturing process involves precision engineering, micro-fabrication, and stringent quality control, converting raw materials and components into finished sensor products. This stage also includes the integration of advanced electronics and software for signal processing and output. Downstream analysis focuses on the distribution channels, which are typically diverse, encompassing direct sales to large original equipment manufacturers (OEMs), indirect sales through industrial distributors, system integrators, and specialized sales agents catering to niche markets. Direct channels are preferred for high-volume, customized solutions, ensuring close collaboration with clients for specific application requirements. Indirect channels leverage extensive networks to reach a broader customer base, offering off-the-shelf and standard product lines. The robustness of this value chain is critical for ensuring efficient production, timely delivery, and effective market penetration, with an increasing emphasis on resilient supply chains and localized manufacturing to mitigate geopolitical and logistical risks.

Position Sensor Market Potential Customers

The Position Sensor Market caters to an incredibly diverse base of potential customers and end-users, reflecting the ubiquitous need for precise motion and spatial feedback across modern industries. The primary end-users are original equipment manufacturers (OEMs) in sectors such as industrial machinery, automotive manufacturing, aerospace, and medical device production, who integrate these sensors as critical components within their larger systems. Industrial automation companies and system integrators represent another significant customer segment, purchasing sensors to build and deploy complex automated lines, robotics, and process control solutions for their own clients. Automotive Tier 1 suppliers are also major buyers, utilizing position sensors in engine management, transmission systems, and advanced driver-assistance systems (ADAS). Furthermore, customers in emerging fields like renewable energy (for wind turbine pitch control), logistics and warehousing (for automated guided vehicles, AGVs), and consumer electronics (for haptic feedback and device control) are rapidly expanding their adoption. The healthcare sector, including manufacturers of diagnostic equipment, surgical robots, and prosthetics, relies on position sensors for critical functions requiring high accuracy and reliability. This wide array of buyers, ranging from large multinational corporations to specialized small and medium-sized enterprises (SMEs), underscores the foundational importance of position sensors in driving technological advancement and operational efficiency across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2032 | USD 9.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Balluff, SICK AG, IFM Electronic GmbH, TE Connectivity, Panasonic Corporation, Honeywell International Inc., Sensata Technologies, AMS AG, Rockwell Automation Inc., Turck GmbH & Co. KG, Pepperl+Fuchs, Micro-Epsilon, Novotechnik U.S. Inc., Hans Turck GmbH & Co. KG, WayCon Positionsmesstechnik GmbH, Contrinex AG, Baumer Group, Omron Corporation, Keyence Corporation, Renishaw plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Position Sensor Market Key Technology Landscape

The Position Sensor Market's technological landscape is characterized by continuous innovation aimed at enhancing precision, durability, miniaturization, and integration capabilities. Modern position sensors leverage a diverse range of principles, including magnetic (Hall Effect, magnetoresistive, giant magnetoresistance GMR), inductive, capacitive, optical, and ultrasonic technologies, each offering distinct advantages for specific applications. The trend towards non-contact sensing is dominant, driven by the need for increased longevity, reduced wear and tear, and suitability for harsh environments where traditional potentiometric sensors might fail. There is significant development in integrating these sensors with advanced microelectronics, leading to smart sensors that incorporate on-board signal conditioning, compensation for environmental factors, and digital communication protocols like IO-Link, EtherCAT, and PROFINET. This integration facilitates seamless connectivity within industrial IoT (IIoT) and Industry 4.0 frameworks, enabling real-time data exchange and remote diagnostics. Furthermore, innovations in material science are leading to more robust and temperature-stable sensor elements, while advancements in packaging technologies are allowing for smaller, more versatile form factors. The adoption of new manufacturing techniques, such as MEMS (Micro-Electro-Mechanical Systems) technology, is also contributing to the production of highly integrated and cost-effective sensor solutions. These technological advancements collectively support the market's trajectory towards more intelligent, reliable, and networked position sensing capabilities.

Regional Highlights

- North America: This region maintains a significant share in the Position Sensor Market, primarily driven by its robust automotive sector, extensive industrial automation, and substantial investments in aerospace and defense. The United States, in particular, leads in research and development, fostering innovation in sensor technologies for advanced manufacturing and autonomous systems. The demand for high-precision sensors in robotics and medical devices also contributes significantly to market growth here.

- Europe: Europe is a mature market for position sensors, characterized by strong manufacturing industries in Germany, Italy, and France. The region is at the forefront of Industry 4.0 adoption, with a high demand for integrated sensor solutions that support smart factories and intelligent automation. The automotive industry, especially the shift towards electric and hybrid vehicles, is a key driver, alongside strict regulatory standards that encourage the use of reliable and high-performance sensors.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the Position Sensor Market. Countries like China, Japan, South Korea, and India are witnessing rapid industrialization, massive investments in manufacturing infrastructure, and a booming automotive sector. The rising adoption of automation in diverse industries, coupled with government initiatives to promote smart manufacturing, fuels the demand for position sensors. The presence of numerous electronics and consumer goods manufacturers further accelerates market expansion.

- Latin America: This region is experiencing steady growth, largely influenced by the expansion of its automotive production, mining activities, and the gradual adoption of industrial automation. Brazil and Mexico are key contributors, driven by foreign investments in manufacturing and increasing local demand for technologically advanced solutions. The market here is characterized by a growing awareness of the benefits of precision sensing in improving operational efficiency.

- Middle East and Africa (MEA): The MEA region is a nascent but rapidly developing market for position sensors. Growth is primarily spurred by significant investments in infrastructure development, oil and gas exploration, and the diversification of economies away from traditional sectors. Countries like Saudi Arabia and UAE are increasingly adopting automation technologies in industrial processes and smart city initiatives, creating new opportunities for position sensor manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Position Sensor Market.- Balluff GmbH

- SICK AG

- IFM Electronic GmbH

- TE Connectivity Ltd.

- Panasonic Corporation

- Honeywell International Inc.

- Sensata Technologies Holding plc

- AMS AG

- Rockwell Automation Inc.

- Turck GmbH & Co. KG

- Pepperl+Fuchs SE

- Micro-Epsilon Messtechnik GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Position Sensor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of position sensors and their applications?

Position sensors are primarily categorized into linear and rotary types. Linear position sensors, such as LVDTs or potentiometers, measure displacement along a straight line and are crucial for applications like machine tools, hydraulic cylinders, and packaging machinery. Rotary position sensors, including encoders and Hall effect sensors, measure angular displacement or rotation, vital for motor control, robotics, steering systems, and industrial valves. Their wide array of applications underscores their fundamental role in automation and control across numerous industries.

How do environmental factors impact position sensor performance and reliability?

Environmental factors significantly affect position sensor performance and longevity. High temperatures can cause material degradation or signal drift, while extreme cold may impact component elasticity. Dust, moisture, and corrosive chemicals can lead to sensor damage or false readings, necessitating robust IP ratings. Electromagnetic interference (EMI) can disrupt sensor signals, particularly for non-contact inductive or magnetic types. Manufacturers address these challenges by developing sensors with ruggedized casings, non-contact technologies, and advanced shielding, ensuring reliable operation in harsh industrial conditions.

What role do position sensors play in the advancement of Industry 4.0 and IoT?

Position sensors are foundational to Industry 4.0 and the Internet of Things (IoT) by providing critical real-time data on the physical state and movement of machinery. In smart factories, they enable precise control of robotic arms, automated guided vehicles (AGVs), and production lines, feeding data into analytics platforms for process optimization, predictive maintenance, and quality control. With digital outputs and communication protocols like IO-Link, modern position sensors facilitate seamless integration into networked systems, driving the intelligence and autonomy central to Industry 4.0 paradigms. They are essential for creating digital twins and achieving highly efficient, interconnected manufacturing environments.

What are the key technological advancements driving growth in the Position Sensor Market?

Key technological advancements driving market growth include the increasing adoption of non-contact sensing technologies like inductive, magnetic (Hall Effect, GMR), and optical sensors, offering enhanced durability and reduced wear. Miniaturization and integration of micro-electronics enable smaller form factors and on-board signal processing. The development of digital output interfaces (e.g., IO-Link, EtherCAT) supports seamless integration into modern industrial networks. Furthermore, advancements in material science and packaging contribute to greater robustness and reliability in harsh environments, while the incorporation of AI and machine learning at the edge enhances data interpretation and predictive capabilities, transforming raw sensor data into actionable intelligence.

Which industries are the major consumers of position sensors and why?

The major consumers of position sensors are the industrial automation, automotive, and aerospace & defense industries. Industrial automation relies heavily on these sensors for precise control of robotics, CNC machines, and assembly lines to improve efficiency and safety. The automotive sector utilizes them for critical functions like throttle position, steering angle, and suspension control, with demand rapidly increasing due to electric vehicles (EVs) and autonomous driving systems. In aerospace & defense, position sensors ensure accurate operation of flight control surfaces, landing gear, and weapon systems, where reliability and precision are paramount for operational safety and mission success. Emerging sectors like healthcare and consumer electronics also show significant growth in adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Two Dimensional Optical Position Sensor Market Size Report By Type (.), By Application (Aerospace and Defense, Consumer Electronics, Automotive, Healthcare, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- One Dimensional Optical Position Sensor Market Size Report By Type (Online channel, Offline channel), By Application (Aerospace & Defence, Automotive, Consumer electronics, Healthcare, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Multiaxial Optical Position Sensor Market Size Report By Type (Linear Position Sensors, Rotary Positions Sensors), By Application (Machine Tools, Robotics, Motion Systems, Material Handling, Test Equipment, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Ultrasonic Position Sensor Market Size Report By Type (Discrete Ultrasonic Position Sensor, Continuous Ultrasonic Position Sensor), By Application (Industrial, Healthcare, Food & Beverage, Automotive, Others (Petroleum, Military, etc.)), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Optical Position Sensor Market Size Report By Type (One Dimensional, TwoDimensional, Multi Axial), By Application (Automotive, Aerospace and Defence, Healthcare, Consumer Electronics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager