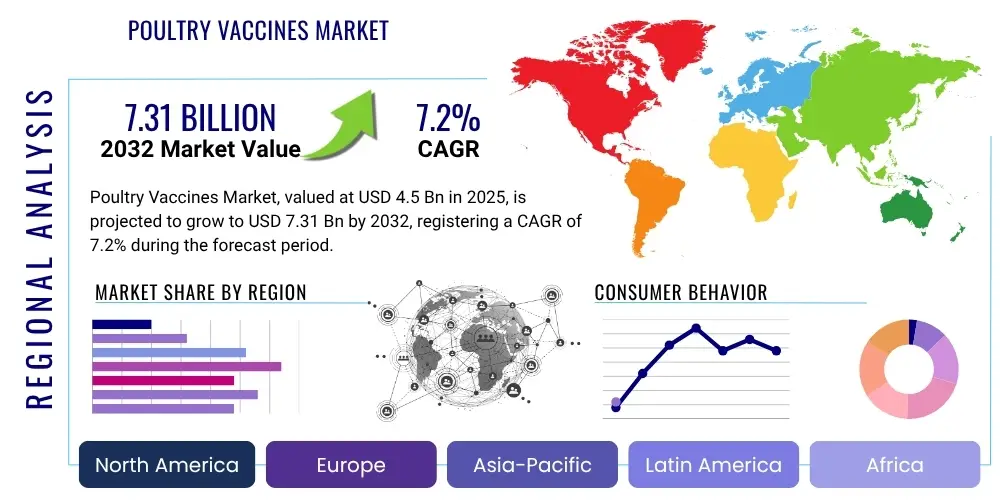

Poultry Vaccines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431252 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Poultry Vaccines Market Size

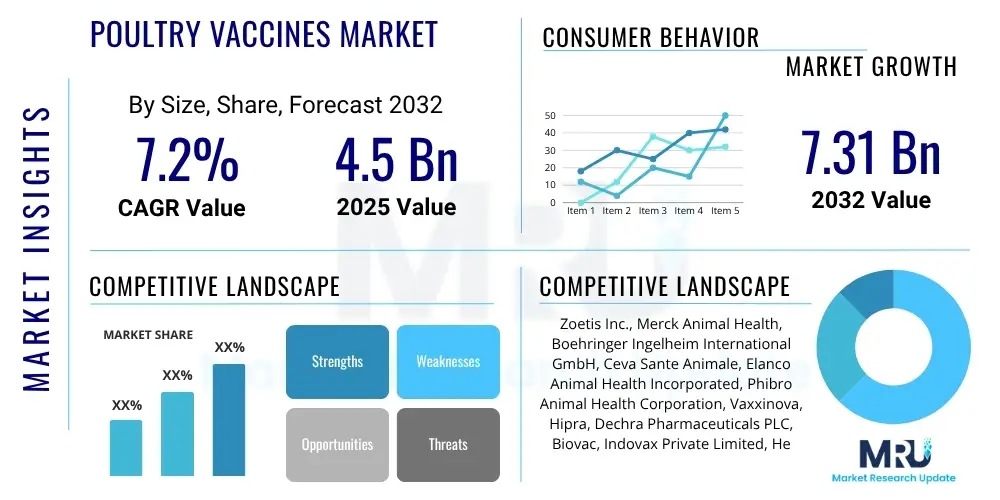

The Poultry Vaccines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at $4.5 Billion in 2025 and is projected to reach $7.31 Billion by the end of the forecast period in 2032.

Poultry Vaccines Market introduction

The Poultry Vaccines Market is a foundational pillar of global animal health, instrumental in maintaining the productivity and sustainability of the vast poultry industry. These specialized biological preparations are designed to stimulate robust immunity in avian populations against a spectrum of prevalent and emerging infectious diseases, including viral, bacterial, and parasitic pathogens. The primary aim is to significantly reduce the incidence of outbreaks, mitigate mortality rates, and enhance the overall health and welfare of chickens, turkeys, ducks, and other poultry species, thereby ensuring food security and economic stability for producers across the globe. The relentless evolutionary pressure of pathogens and the constant threat of highly transmissible diseases necessitate continuous innovation and a resilient vaccine supply chain to protect commercial and backyard flocks alike.

Products within this critical market segment encompass a diverse range of vaccine technologies, each tailored to specific immunological responses and disease profiles. Traditional vaccine types include live attenuated vaccines, which use weakened forms of pathogens to elicit strong, long-lasting immunity, often mimicking natural infection, and inactivated vaccines, which contain killed pathogens and are considered safer but typically require multiple doses to achieve protective immunity. The market is also increasingly characterized by advanced biotechnological solutions such as recombinant vaccines, which leverage genetic engineering to express specific antigenic proteins, and subunit vaccines, which utilize purified components of pathogens. These innovations offer enhanced safety, specificity, and efficacy. Major applications of poultry vaccines are widespread, targeting economically devastating diseases such as Newcastle Disease (ND), Infectious Bronchitis (IB), Infectious Bursal Disease (IBD, commonly known as Gumboro disease), Avian Influenza (AI), Marek's Disease, and Fowl Pox, among others. The preventative approach provided by vaccination is critical for disease management.

The benefits derived from effective poultry vaccination programs are multifaceted and extend beyond mere disease prevention. They include a substantial reduction in the reliance on antimicrobial agents, directly contributing to the global fight against antimicrobial resistance, improved feed conversion ratios, enhanced meat and egg production yields, and ultimately, greater operational profitability for poultry businesses. Furthermore, vaccination programs play a vital role in safeguarding public health by controlling zoonotic diseases that can transmit from animals to humans. The market's growth is predominantly driven by several macroeconomic and industry-specific factors: the burgeoning global demand for poultry meat and eggs, fueled by population growth and changing dietary preferences; the persistent and costly threat of endemic and emerging poultry diseases requiring constant vigilance; the increasing adoption of stringent biosecurity measures by commercial farms; and proactive government initiatives alongside supportive regulatory frameworks aimed at promoting animal health, welfare, and food safety standards. These interwoven dynamics underscore the Poultry Vaccines Market's indispensable role in modern agriculture.

Poultry Vaccines Market Executive Summary

The Poultry Vaccines Market is experiencing dynamic shifts, driven by evolving business trends, significant regional expansion, and distinct segment-specific developments. In terms of business trends, the market is characterized by a notable trend towards consolidation, with larger pharmaceutical and animal health companies acquiring smaller, innovative biotech firms to expand their vaccine portfolios and technological capabilities. There is an increasing focus on research and development (R&D) into novel vaccine platforms, including next-generation recombinant and subunit vaccines that offer improved efficacy, safety, and ease of administration. Furthermore, the integration of digital health solutions, such as remote monitoring and data analytics for vaccination program optimization, is gaining traction. Sustainability and ethical animal welfare practices are also shaping business strategies, prompting demand for vaccines that reduce stress and improve overall flock health, minimizing environmental impact. Strategic partnerships and collaborations between vaccine manufacturers, research institutions, and diagnostic companies are becoming more prevalent, aiming to accelerate product development and market access for advanced solutions.

Regionally, the market exhibits varied growth trajectories. Asia Pacific (APAC) is emerging as the fastest-growing region, primarily due to its large and expanding poultry populations, increasing per capita consumption of poultry products, and a growing awareness of animal health and disease prevention. Countries like China, India, and Brazil in Latin America are witnessing substantial investments in commercial poultry farming, subsequently boosting vaccine demand. North America and Europe, while mature markets, continue to contribute significantly through their advanced research capabilities, stringent regulatory standards, and consistent demand for high-quality animal protein. These regions are also at the forefront of adopting innovative vaccine technologies and biosecurity protocols. The Middle East and Africa (MEA) present considerable growth opportunities, driven by rising disposable incomes, urbanization, and the need to enhance local food production capacities, though these regions often face unique challenges related to vaccine storage and distribution infrastructure, particularly the maintenance of a reliable cold chain.

Within the market's segments, live attenuated vaccines currently hold a dominant share, primarily due to their cost-effectiveness and ability to induce robust, long-lasting immunity. However, the demand for more advanced recombinant and subunit vaccines is steadily increasing, driven by their enhanced safety profiles, reduced side effects, and ability to target specific antigens with greater precision. This shift reflects a broader industry move towards more sophisticated and tailored disease prevention strategies. In terms of disease application, vaccines for highly prevalent and economically significant diseases such as Newcastle Disease, Infectious Bronchitis, and Avian Influenza continue to constitute the largest market share, but there is also growing attention on vaccines for emerging and re-emerging pathogens. The end-user segment sees broilers and layers as the primary consumers, though vaccination in breeders and other poultry types is also crucial. The overall trend indicates a move towards comprehensive, multi-disease vaccination programs and increased adoption of in-ovo vaccination techniques for improved efficiency and early protection.

AI Impact Analysis on Poultry Vaccines Market

User questions regarding the impact of Artificial Intelligence (AI) on the Poultry Vaccines Market frequently revolve around how AI can enhance vaccine development, improve disease surveillance, optimize vaccination protocols, and address logistical challenges. Common concerns include the accuracy of AI predictions for disease outbreaks, the ethical implications of data privacy in animal health, the cost of AI integration for smaller poultry operations, and the overall reliability of AI-driven decisions in complex biological systems. Users are keen to understand if AI can truly accelerate the notoriously long and expensive vaccine R&D cycle and if it can provide practical, actionable insights for farmers and veterinarians. There is also significant interest in AI's role in personalizing vaccination strategies and optimizing resource allocation. The overarching theme is an expectation that AI will bring greater efficiency, precision, and proactive capabilities to poultry health management, but with underlying questions about its practical implementation and trustworthiness within existing frameworks.

- AI accelerates vaccine discovery by analyzing genomic and proteomic data to identify novel vaccine candidates and predict antigenicity, significantly shortening the R&D timeline.

- Predictive analytics powered by AI enables early detection and forecasting of disease outbreaks by integrating epidemiological data, environmental factors, and animal health records, facilitating timely vaccination interventions.

- AI optimizes vaccination schedules and routes of administration by considering flock-specific data, environmental conditions, and immune status, leading to more efficient and effective disease control.

- Improved diagnostics through AI-driven image analysis and rapid test interpretation enhances the accuracy and speed of identifying pathogens, allowing for targeted vaccine responses.

- AI-enabled supply chain management for vaccines ensures optimal storage, distribution, and inventory levels, minimizing wastage and maintaining vaccine efficacy, particularly critical for cold chain requirements.

- Facilitates precision poultry farming by integrating vaccination data with production metrics, allowing farmers to assess vaccine impact on growth rates, feed conversion, and overall flock performance.

- Supports the development of personalized or precision vaccinology approaches by tailoring vaccine choices and dosages based on genetic predispositions, specific farm conditions, and local pathogen strains.

DRO & Impact Forces Of Poultry Vaccines Market

The Poultry Vaccines Market is significantly shaped by a confluence of drivers, restraints, and opportunities, which together constitute the critical impact forces influencing its trajectory. Primary drivers include the relentless global surge in poultry meat and egg consumption, driven by population growth, urbanization, and the cost-effectiveness of poultry products as a primary protein source. This increased demand necessitates larger and more intensive poultry farming operations, which are inherently more susceptible to disease outbreaks, thereby amplifying the need for preventative vaccination. Furthermore, the rising incidence of economically devastating and zoonotic poultry diseases, such as Avian Influenza and Newcastle Disease, constantly fuels the demand for effective vaccines. Technological advancements in vaccine development, including recombinant DNA technology and subunit vaccines, offer safer and more efficacious solutions, further propelling market expansion. Government initiatives promoting animal health, biosecurity, and food safety standards, along with financial support for vaccination programs, also act as significant market stimulants, driving widespread adoption of preventative health measures.

Conversely, several restraints pose challenges to market growth and development. High research and development costs associated with discovering, testing, and bringing new vaccines to market represent a substantial barrier, often requiring significant investment over extended periods. The stringent regulatory approval processes in various countries, designed to ensure vaccine safety and efficacy, can be time-consuming and costly, delaying market entry for innovative products. Maintaining an uninterrupted cold chain for vaccine storage and distribution, particularly in remote or developing regions, presents a persistent logistical challenge, as temperature excursions can compromise vaccine potency. Public perception issues, including consumer concerns about the use of vaccines in food animals and the potential for residual effects, although largely unfounded, can create market resistance. Furthermore, the complexity of administering vaccines to large flocks, alongside the emergence of new pathogen strains that may render existing vaccines less effective, demands continuous R&D investment and adaptation, impacting the overall market dynamics.

Despite these restraints, substantial opportunities exist for market expansion and innovation. Emerging markets in Asia Pacific, Latin America, and Africa, characterized by rapidly growing poultry industries and increasing commercialization of farming practices, offer vast untapped potential for vaccine manufacturers. The development of novel vaccine platforms, such as CRISPR-based vaccines, mRNA vaccines, and plant-derived vaccines, promises to revolutionize efficacy, safety, and production scalability. The trend towards personalized or precision vaccination, leveraging genetic sequencing and farm-specific data to tailor vaccine regimens, represents a significant growth avenue. Strategic collaborations between vaccine developers, diagnostic companies, and academic institutions can accelerate innovation, improve disease surveillance, and streamline market access. The increasing focus on reducing antibiotic use in animal agriculture also positions vaccines as a critical tool in managing animal health and combating antimicrobial resistance, thus creating a strong demand pull. Collectively, these drivers, restraints, and opportunities create a dynamic landscape where innovation and strategic adaptation are crucial for sustained success.

Segmentation Analysis

The Poultry Vaccines Market is intricately segmented across various dimensions, including vaccine type, disease type, technology, route of administration, and end-user, providing a granular view of market dynamics and catering to diverse needs within the global poultry industry. Understanding these segments is crucial for stakeholders to identify specific growth areas, develop targeted products, and implement effective market entry strategies. Each segment reflects unique demand patterns, technological preferences, and operational considerations of poultry producers and health authorities worldwide. The segmentation allows for a detailed analysis of competitive landscapes, regulatory impacts, and regional adoption rates, informing strategic business decisions and guiding future research and development investments. The market's complexity underscores the need for tailored solutions that address the specific challenges and opportunities within each defined category.

- By Vaccine Type:

- Live Attenuated Vaccines

- Inactivated Vaccines

- Recombinant Vaccines

- Subunit Vaccines

- Toxoid Vaccines

- Others (e.g., DNA Vaccines, Vector Vaccines)

- By Disease Type:

- Newcastle Disease (ND)

- Infectious Bronchitis (IB)

- Infectious Bursal Disease (IBD Gumboro)

- Avian Influenza (AI)

- Marek's Disease (MD)

- Fowl Pox

- Avian Encephalomyelitis

- Mycoplasma Gallisepticum

- Salmonella

- Coccidiosis

- Others (e.g., E. coli, Coryza)

- By Technology:

- Traditional Vaccines

- Genetic Engineering Based Vaccines

- By Route of Administration:

- Injection (Subcutaneous, Intramuscular)

- Ocular

- Oral (Drinking Water, Spray)

- In-ovo

- Nasal

- By End-User/Animal Type:

- Broiler

- Layer

- Breeder

- Turkeys

- Ducks

- Other Poultry (e.g., Geese, Quail)

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Poultry Vaccines Market

The value chain for the Poultry Vaccines Market is a complex ecosystem beginning with intensive research and development (R&D) and raw material procurement, extending through manufacturing and stringent quality control, and culminating in distribution to end-users. The upstream analysis involves critical stages such as basic research, antigen discovery, strain selection, and the sourcing of high-quality raw materials, including specific pathogen-free (SPF) eggs, cell culture media, adjuvants, and excipients. Research institutions, universities, and specialized biotech companies play a pivotal role in these initial phases, providing foundational scientific knowledge and innovative biological components. The efficiency and reliability of these upstream suppliers directly impact the quality and cost-effectiveness of the final vaccine products. Manufacturers must also secure a consistent supply of these specialized inputs to maintain production schedules and meet market demand, often necessitating long-term contracts and robust supplier qualification processes to ensure product integrity and safety.

Downstream activities in the value chain primarily focus on bringing the manufactured vaccines to the end-users – poultry farmers and integrators. This involves a sophisticated network of distribution channels designed to handle the often strict cold chain requirements for vaccine storage and transport, preserving their efficacy from the production facility to the point of administration. Key players in this downstream segment include wholesale distributors, specialized veterinary pharmaceutical distributors, regional sales offices of vaccine manufacturers, and ultimately, veterinarians who play a crucial role in prescribing and often administering vaccines. The effectiveness of these distribution channels is paramount in ensuring timely access to vaccines, especially during disease outbreaks, and in reaching diverse customer bases, from large commercial poultry operations to smaller, independent farms. Strong logistical capabilities, including refrigerated transport and secure storage facilities, are indispensable for maintaining product integrity and market penetration across varied geographical landscapes.

Distribution channels in the Poultry Vaccines Market operate through both direct and indirect models. Large vaccine manufacturers often engage in direct sales to major poultry integrators and government animal health programs, establishing direct relationships for bulk purchases and tailored solutions. This direct approach allows for better control over pricing, service, and technical support. Concurrently, an extensive indirect distribution network relies on third-party veterinary distributors and wholesalers who possess established logistical capabilities and deep penetration into local markets. These intermediaries facilitate access for smaller and medium-sized poultry farms, veterinary clinics, and feed mills, extending the reach of vaccine products across a broader customer base. The choice between direct and indirect channels often depends on market maturity, geographical coverage needs, and the scale of the customer base. Effective management of both direct and indirect channels, coupled with comprehensive training and technical support for distributors, is essential for maximizing market share and ensuring vaccine efficacy through proper handling and administration. This dual approach optimizes market access and client servicing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.5 Billion |

| Market Forecast in 2032 | $7.31 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces | >|

| Segments Covered | >|

| Key Companies Covered | Zoetis Inc., Merck Animal Health, Boehringer Ingelheim International GmbH, Ceva Sante Animale, Elanco Animal Health Incorporated, Phibro Animal Health Corporation, Vaxxinova, Hipra, Dechra Pharmaceuticals PLC, Biovac, Indovax Private Limited, Hester Biosciences Limited, Venky's India, Tecnovax, ImmuCell Corporation, KM Biologics Co., Ltd., Ringpu Bio-Pharmacy Co., Ltd., Chengdu Tech-Bank Biological Products Co., Ltd., China Animal Husbandry Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Poultry Vaccines Market Key Technology Landscape

The Poultry Vaccines Market is characterized by a rapidly evolving technological landscape, continuously driven by the need for more effective, safer, and cost-efficient solutions to combat a diverse array of avian diseases. Traditional vaccine technologies, such as live attenuated and inactivated vaccines, remain foundational, offering broad protection and established efficacy. However, ongoing advancements focus on refining these methods, for example, through improved attenuation strategies for live vaccines or more potent adjuvants for inactivated formulations to enhance immune responses. Significant strides are being made in molecular biology and biotechnology, which are enabling the development of next-generation vaccines with superior characteristics. Recombinant DNA technology stands out, allowing for the precise expression of immunogenic proteins from pathogens in a non-pathogenic vector or host, leading to safer and more specific vaccines that cannot revert to virulence. This approach is particularly valuable for diseases with highly variable strains or those where live vaccines pose a risk.

Further technological innovations include the development of subunit vaccines, which utilize only specific parts of the pathogen to induce an immune response, minimizing adverse reactions and simplifying production processes. Viral vector vaccines, employing harmless viruses to deliver genetic material encoding protective antigens, are also gaining traction for their ability to elicit strong cellular and humoral immunity. The landscape is also embracing advanced adjuvant technology, where novel compounds are used to boost the immune response to vaccines, allowing for lower antigen doses or fewer administrations. Beyond the vaccines themselves, significant technological progress is observed in diagnostic tools that support vaccine efficacy, such as advanced PCR assays, ELISA kits, and biosensors for rapid pathogen detection and serological monitoring. These diagnostic innovations are crucial for confirming vaccine take, identifying breakthrough infections, and guiding strategic vaccination programs, moving towards a more data-driven approach to poultry health management.

Emerging technologies like mRNA vaccines, already proven in human health, are beginning to be explored for poultry applications, offering potential benefits such as rapid development, scalability, and potent immune stimulation. Similarly, CRISPR-based gene editing is being investigated for engineering both host resistance and novel vaccine candidates. The integration of artificial intelligence and machine learning is also transforming the vaccine landscape, particularly in areas like predictive epidemiology, accelerated antigen discovery, and optimization of vaccine production and delivery schedules. In-ovo vaccination, a technology enabling mass vaccination of embryos inside the egg, has revolutionized large-scale poultry farming by providing early, consistent, and stress-free immunity. This method significantly improves efficiency and ensures broad flock protection from hatch. These collective technological advancements signify a dynamic shift towards precision vaccinology, offering tailored, highly effective, and sustainable solutions that are vital for the economic viability and biosecurity of the global poultry industry in the face of evolving disease threats.

Regional Highlights

- North America: A mature and technologically advanced market characterized by high biosecurity standards, robust regulatory frameworks, and significant investment in R&D by major animal health companies. The region leads in the adoption of innovative vaccine technologies, particularly recombinant and in-ovo vaccination methods, driven by large-scale commercial poultry operations and a strong emphasis on disease prevention to maintain food safety and export markets.

- Europe: Exhibits stringent animal welfare standards and a strong focus on reducing antibiotic use, which drives demand for effective preventative vaccines. The market is supported by advanced veterinary infrastructure and extensive research initiatives. However, regulatory complexities and public scrutiny over vaccine ingredients or animal treatment can influence market dynamics, favoring highly safe and efficacious products.

- Asia Pacific (APAC): The fastest-growing region, fueled by an enormous and rapidly expanding poultry industry, particularly in countries like China, India, and Indonesia. Increasing per capita consumption of poultry products, commercialization of farming practices, and a rising awareness of disease prevention strategies are key drivers. The region presents significant opportunities for market penetration but also faces challenges related to cold chain logistics and diverse regulatory environments.

- Latin America: Demonstrates strong growth due to increasing commercialization of poultry farming, particularly in Brazil and Mexico, coupled with a rising demand for animal protein. The region is highly susceptible to disease outbreaks, making vaccination a critical component of poultry health management. Economic development and government support for disease control programs are boosting vaccine adoption rates.

- Middle East & Africa (MEA): An emerging market with considerable potential, driven by efforts to enhance local food security and modernize agricultural practices. The region faces significant challenges from endemic poultry diseases and requires improved infrastructure for vaccine storage and distribution. However, growing investments in the poultry sector and international aid programs for animal health are creating new opportunities for vaccine manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Poultry Vaccines Market.- Zoetis Inc.

- Merck Animal Health

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Elanco Animal Health Incorporated

- Phibro Animal Health Corporation

- Vaxxinova

- Hipra

- Dechra Pharmaceuticals PLC

- Biovac

- Indovax Private Limited

- Hester Biosciences Limited

- Venky's India

- Tecnovax

- ImmuCell Corporation

- KM Biologics Co., Ltd.

- Ringpu Bio-Pharmacy Co., Ltd.

- Chengdu Tech-Bank Biological Products Co., Ltd.

- China Animal Husbandry Industry Co., Ltd.

- Qingdao Yebio Bioengineering Co., Ltd.

Frequently Asked Questions

What are the primary types of poultry vaccines available in the market?

The primary types of poultry vaccines include live attenuated vaccines (using weakened pathogens), inactivated vaccines (using killed pathogens), and advanced options like recombinant vaccines (genetically engineered to express specific antigens) and subunit vaccines (using purified pathogen components).

How are poultry vaccines typically administered to large flocks?

Poultry vaccines are administered through various methods suitable for mass application, including drinking water, coarse spray, ocular (eye drop), subcutaneous injection, intramuscular injection, and in-ovo vaccination (injecting into the egg before hatch).

What key factors are driving the growth of the Poultry Vaccines Market?

Key growth drivers include rising global demand for poultry products, increased incidence of economically significant and zoonotic poultry diseases, continuous technological advancements in vaccine development, and growing emphasis on biosecurity and animal health by governments and producers.

What are the main challenges faced by manufacturers in the Poultry Vaccines Market?

Major challenges include high R&D costs, stringent regulatory approval processes, the necessity for maintaining a strict cold chain during distribution, and the continuous emergence of new pathogen strains requiring constant vaccine adaptation.

How does technological advancement impact the efficacy and safety of poultry vaccines?

Technological advancements, such as recombinant DNA technology and subunit vaccines, significantly enhance vaccine efficacy by providing more targeted and robust immune responses, while improving safety profiles by reducing the risk of reversion to virulence or adverse reactions compared to traditional methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager