Power Plants Heavy Duty Gas Turbine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430475 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Power Plants Heavy Duty Gas Turbine Market Size

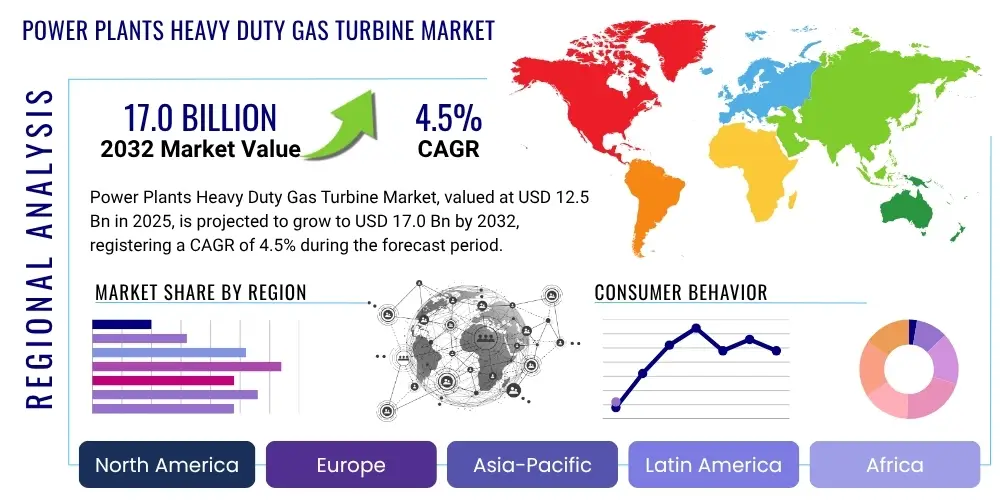

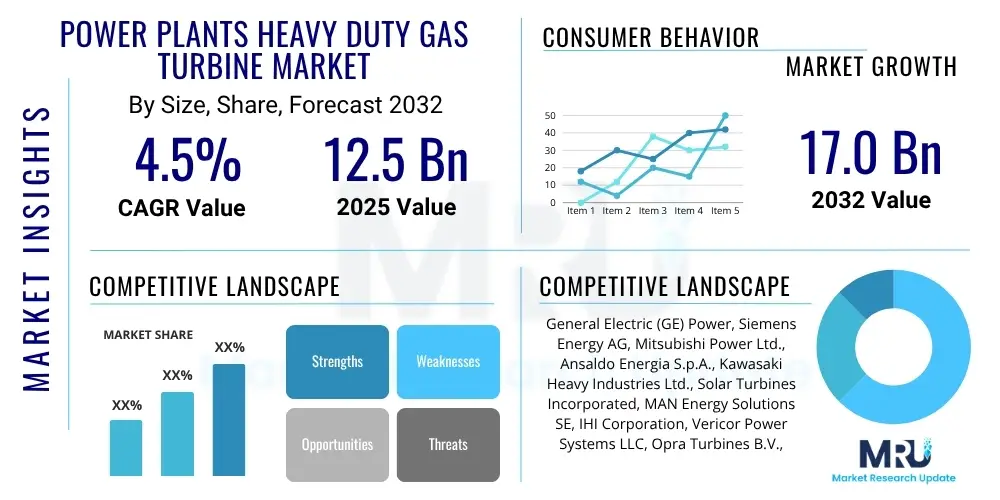

The Power Plants Heavy Duty Gas Turbine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2032. The market is estimated at USD 12.5 billion in 2025 and is projected to reach USD 17.0 billion by the end of the forecast period in 2032.

Power Plants Heavy Duty Gas Turbine Market introduction

The Power Plants Heavy Duty Gas Turbine Market encompasses the manufacturing, installation, and servicing of large-scale gas turbines primarily used for electricity generation in utility and industrial power plants. These robust machines are vital components in meeting global energy demands, offering high efficiency and operational flexibility, particularly in combined cycle power generation. The product described within this market context are industrial gas turbines engineered for continuous, high-output operations, contrasting with smaller aeroderivative turbines typically used for peaker plants or specialized applications. They are designed to operate with various fuels, predominantly natural gas, but increasingly with blends of hydrogen, reflecting a shift towards lower carbon energy solutions.

Major applications for heavy-duty gas turbines include base load power generation, industrial co-generation (Combined Heat and Power - CHP), and grid stabilization services. The benefits derived from these turbines are substantial, including rapid start-up capabilities, high thermal efficiency when integrated into combined cycle power plants (CCPPs), and relatively lower emissions compared to conventional coal-fired power plants. They provide crucial reliability and dispatchability to electricity grids, supporting the integration of intermittent renewable energy sources. This operational adaptability positions them as a critical asset in evolving energy landscapes, bridging the gap between traditional fossil fuels and a fully renewable energy future.

The market is primarily driven by the escalating global demand for electricity, particularly in rapidly industrializing economies, coupled with stringent environmental regulations pushing for cleaner energy alternatives. The abundance and relatively stable pricing of natural gas in many regions further bolster the market. Additionally, the need for enhanced grid stability and energy security, alongside the phase-out of older, less efficient power generation assets, are key factors stimulating investment in new heavy-duty gas turbine installations and modernization projects globally. Technological advancements focused on increasing efficiency and reducing emissions are continuously improving the attractiveness and competitiveness of these power generation solutions.

Power Plants Heavy Duty Gas Turbine Market Executive Summary

The Power Plants Heavy Duty Gas Turbine Market is currently experiencing dynamic shifts driven by global energy transition efforts and technological advancements. Business trends indicate a strong focus on enhancing the efficiency and flexibility of gas turbine technology, with original equipment manufacturers (OEMs) investing heavily in research and development for hydrogen co-firing capabilities and advanced combustion systems. There is also a growing emphasis on long-term service agreements and digital solutions for predictive maintenance and operational optimization, shifting the business model towards comprehensive lifecycle support rather than purely equipment sales. Market consolidation and strategic partnerships are also becoming prevalent as companies seek to leverage expertise and expand their global footprint in a competitive environment.

Regional trends reveal significant growth opportunities in Asia Pacific, propelled by industrialization, urbanization, and increasing electricity consumption, particularly in countries like China and India. North America and Europe, while mature markets, are seeing sustained demand driven by the replacement of aging infrastructure, grid modernization initiatives, and the transition away from coal-fired power. Governments in these regions are implementing policies that favor natural gas as a bridge fuel and support the development of hydrogen-ready turbine technologies. Latin America and the Middle East and Africa regions are also contributing to market expansion, fueled by expanding industrial bases, growing populations, and the need for reliable power infrastructure to support economic development, often leveraging their natural gas reserves.

Segment trends highlight the dominance of combined cycle gas turbines (CCGTs) due to their superior efficiency and lower emissions profile, making them a preferred choice for new power plant installations. There is an increasing demand for turbines with greater operational flexibility, capable of rapid ramp-up and ramp-down to complement intermittent renewable energy sources. The market is also seeing emerging interest in smaller and medium capacity turbines for distributed power generation and industrial applications, alongside continued innovation in large-scale units for utility-scale power. Fuel flexibility, particularly the ability to utilize hydrogen and synthetic fuels, is a critical evolving trend across all segments, shaping future product development and market competitiveness.

AI Impact Analysis on Power Plants Heavy Duty Gas Turbine Market

Users frequently inquire about how artificial intelligence (AI) can enhance the efficiency, reliability, and maintenance of heavy-duty gas turbines, as well as its role in optimizing power plant operations and integrating with renewable energy sources. Key themes revolve around the potential for predictive analytics to prevent failures, the use of machine learning for performance optimization, and the implications for autonomous operation and workforce skills. Users are also interested in the cybersecurity aspects of AI-driven systems and the overall economic benefits that AI can bring to the longevity and cost-effectiveness of gas turbine assets, indicating a strong expectation for AI to revolutionize various facets of power plant management.

- AI-powered predictive maintenance reduces unplanned downtime and extends asset lifecycles.

- Machine learning algorithms optimize combustion processes for higher efficiency and lower emissions.

- Real-time operational adjustments based on AI analytics improve plant performance and fuel economy.

- Smart grid integration facilitated by AI enhances demand response and renewable energy balancing.

- AI-driven anomaly detection improves safety and prevents critical equipment failures.

- Automated diagnostics and remote monitoring capabilities streamline troubleshooting and support.

- AI assists in optimizing turbine design and materials for enhanced durability and performance.

- Data analytics from sensors feed AI models to improve maintenance scheduling and spare parts management.

DRO & Impact Forces Of Power Plants Heavy Duty Gas Turbine Market

The Power Plants Heavy Duty Gas Turbine market is profoundly shaped by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the relentless growth in global electricity demand, especially from developing nations, and the imperative for energy security and grid reliability in an increasingly electrified world. The abundance of natural gas, coupled with its relatively lower carbon footprint compared to coal, positions gas turbines as a preferred technology for bridging the energy transition. Additionally, technological advancements leading to higher efficiencies and improved operational flexibility, such as combined cycle technology and rapid start-up capabilities, enhance their appeal as foundational elements of modern power grids. These factors collectively push for continuous investment and deployment of heavy-duty gas turbine solutions.

However, the market also faces significant restraints, primarily the high capital expenditure required for installing new heavy-duty gas turbine power plants, which can deter investment, particularly in regions with limited financial resources. The increasing prominence and declining costs of renewable energy sources like solar and wind power pose a competitive challenge, as they offer zero-emission power generation, albeit with intermittency issues. Environmental regulations, while sometimes favoring gas over coal, are also pushing towards even lower-carbon solutions, potentially limiting long-term investments in new fossil fuel-based infrastructure. Public opposition to new fossil fuel projects, regardless of their relative cleanliness, adds another layer of complexity, along with the geopolitical risks associated with natural gas supply chains.

Despite these challenges, substantial opportunities exist, particularly in the realm of hydrogen integration. The development of hydrogen-ready or hydrogen-capable gas turbines presents a viable pathway for deep decarbonization, positioning gas turbines as future-proof assets in a net-zero economy. The vast potential in emerging economies for new power generation capacity and the need for modernization and replacement of aging power plants in mature markets offer significant avenues for growth. Furthermore, the increasing demand for flexible power generation to complement intermittent renewables, and the growing digitalization of power plants through AI and IoT for enhanced efficiency and predictive maintenance, create new revenue streams and operational improvements. The market's resilience is further reinforced by global impact forces such as evolving energy policies, technological innovation trajectories, and long-term economic growth patterns that underscore the enduring need for reliable, dispatchable power.

Segmentation Analysis

The Power Plants Heavy Duty Gas Turbine Market is comprehensively segmented across various dimensions to provide a granular view of its structure, growth drivers, and competitive landscape. These segmentations are critical for understanding market dynamics, identifying specific demand patterns, and tailoring product development and marketing strategies. The primary segmentation criteria typically include capacity range, technological configuration, specific end-use applications, and the types of fuel consumed. Each segment reflects unique operational requirements, investment patterns, and regulatory environments, contributing differently to the overall market growth trajectory. Analyzing these segments helps stakeholders identify lucrative niches and emerging trends within the broader power generation sector.

- By Capacity

- Small (less than 60 MW)

- Medium (60 MW to 180 MW)

- Large (above 180 MW)

- By Technology

- Open Cycle Gas Turbines (OCGT)

- Combined Cycle Gas Turbines (CCGT)

- By Application

- Power Generation (Utility Scale)

- Industrial (e.g., Oil and Gas, Petrochemical, Cement)

- Cogeneration (CHP)

- By Fuel Type

- Natural Gas

- Hydrogen Blends (up to 30% hydrogen, 50% hydrogen, 100% hydrogen)

- Other Fuels (e.g., Syngas, LNG, Biogas)

Value Chain Analysis For Power Plants Heavy Duty Gas Turbine Market

The value chain for the Power Plants Heavy Duty Gas Turbine Market is extensive and complex, involving several distinct stages from raw material sourcing to end-user operation and maintenance. Upstream activities are critical and involve the procurement and processing of specialized raw materials such as high-temperature resistant superalloys, ceramics, and composite materials essential for fabricating turbine blades, combustors, and other critical components. This stage also includes the design and engineering expertise provided by specialized firms that contribute to the innovative aspects of turbine technology, focusing on aerodynamics, metallurgy, and combustion science. Component manufacturing, often outsourced or conducted by specialized divisions, forms another vital upstream link, ensuring precision and quality in every part.

The core of the value chain resides with the original equipment manufacturers (OEMs) who assemble these components into complete heavy-duty gas turbine units. These OEMs manage the entire manufacturing process, including rigorous testing and quality control. Once manufactured, the turbines are distributed through various channels. For large utility-scale projects, distribution is often direct from the OEM to the end-user or through Engineering, Procurement, and Construction (EPC) contractors who manage the entire power plant project. EPC firms play a pivotal role in integrating the gas turbine within a broader power plant infrastructure, which includes steam turbines, generators, and auxiliary systems for combined cycle operations.

Downstream activities encompass the installation, commissioning, and long-term operation and maintenance (O&M) of the gas turbines. End-users, primarily national utilities, independent power producers (IPPs), and large industrial facilities, are responsible for operating these plants to generate electricity. Post-sales services, including routine maintenance, spare parts supply, upgrades, and digital service offerings (e.g., remote monitoring, predictive analytics), constitute a significant portion of the downstream value. The distribution channel is predominantly direct or via EPC contractors for major projects, ensuring a streamlined flow from manufacturing to operation. Indirect channels may involve local distributors or agents for smaller industrial installations or specific component sales, but for the heavy-duty segment, direct OEM involvement and specialized EPC partnerships are the norm, facilitating seamless project execution and comprehensive after-sales support.

Power Plants Heavy Duty Gas Turbine Market Potential Customers

The potential customers for Power Plants Heavy Duty Gas Turbines are diverse, primarily comprising entities with significant energy generation or consumption requirements. At the forefront are national and regional utility companies and independent power producers (IPPs) who are responsible for generating and supplying electricity to residential, commercial, and industrial sectors. These organizations invest in heavy-duty gas turbines for base load power, combined cycle plants, and flexible generation to balance grid loads and integrate renewable energy sources. Their purchasing decisions are driven by factors such as efficiency, reliability, environmental compliance, and long-term operational costs, making them crucial end-users for the market.

Beyond the traditional power generation sector, large industrial facilities represent another significant customer segment. Industries such as petrochemicals, oil and gas extraction and refining, cement production, and heavy manufacturing often require substantial amounts of electricity and process heat. They utilize heavy-duty gas turbines in cogeneration (Combined Heat and Power - CHP) applications to simultaneously produce electricity and useful thermal energy, significantly enhancing energy efficiency and reducing operational costs. For these industrial players, energy security and cost predictability are paramount, making reliable on-site power generation through gas turbines an attractive proposition. The oil and gas sector, specifically, uses gas turbines for mechanical drive applications in compressors and pumps, in addition to power generation for their operations.

Governments and municipal bodies, particularly in developing economies, also act as key buyers or facilitators of large-scale power projects, often through state-owned enterprises or public-private partnerships. Their procurement is often tied to national energy policies, infrastructure development goals, and commitments to environmental sustainability. The increasing focus on grid modernization and the replacement of older, less efficient power plants further solidify the demand from these institutional customers. These end-users are not just buyers of equipment but also long-term partners for maintenance, service, and technology upgrades, highlighting the comprehensive relationship within this specialized market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 12.5 billion |

| Market Forecast in 2032 | USD 17.0 billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric (GE) Power, Siemens Energy AG, Mitsubishi Power Ltd., Ansaldo Energia S.p.A., Kawasaki Heavy Industries Ltd., Solar Turbines Incorporated, MAN Energy Solutions SE, IHI Corporation, Vericor Power Systems LLC, Opra Turbines B.V., Centrax Gas Turbines, MAPNA Group, Harbin Electric Company Limited, Bharat Heavy Electricals Limited (BHEL), Shanghai Electric Group Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Power Plants Heavy Duty Gas Turbine Market Key Technology Landscape

The Power Plants Heavy Duty Gas Turbine Market is characterized by continuous innovation in its technology landscape, driven by the dual imperatives of increasing efficiency and reducing environmental impact. A significant focus is on advanced materials science, with the development of high-temperature resistant superalloys and ceramic matrix composites (CMCs) for turbine blades and combustor components. These materials allow for higher firing temperatures, which directly translates to improved thermal efficiency and greater power output, while also enhancing durability and extending maintenance intervals. Research into advanced coatings also plays a crucial role in protecting components from corrosion and erosion in harsh operating environments, further contributing to reliability and longevity.

Another pivotal area of technological advancement is in combustion system design. OEMs are heavily investing in developing advanced low-NOx (nitrogen oxide) combustion technologies, such as Dry Low Emissions (DLE) and Dry Low NOx (DLN) systems, to meet increasingly stringent air quality regulations. Furthermore, significant research and development efforts are directed towards hydrogen-ready combustion systems, enabling gas turbines to co-fire natural gas with increasing percentages of hydrogen, eventually moving towards 100% hydrogen combustion. This capability is critical for achieving deep decarbonization goals and future-proofing gas turbine assets in a net-zero emissions energy landscape, requiring innovative burner designs and fuel injection strategies.

Digitalization and smart control systems represent a transformative aspect of the modern gas turbine technology landscape. The integration of advanced sensors, real-time data analytics, artificial intelligence (AI), and machine learning (ML) algorithms allows for predictive maintenance, remote monitoring, and optimized operational control. These digital tools improve operational flexibility, enable dynamic performance tuning, and reduce unplanned downtime by anticipating potential faults. Additive manufacturing (3D printing) is also gaining traction for producing complex turbine components with improved designs and reduced lead times, further contributing to efficiency and cost-effectiveness. These converging technologies are reshaping the design, operation, and maintenance paradigms of heavy-duty gas turbines, driving their evolution as integral components of future energy systems.

Regional Highlights

- North America: A mature market characterized by significant investments in gas turbine technology for grid modernization and the replacement of aging coal-fired power plants. The abundance of shale gas drives robust demand for natural gas-fired turbines, with increasing focus on carbon capture and hydrogen blending technologies.

- Europe: Driven by ambitious decarbonization targets and strict environmental regulations, the European market is witnessing a strong shift towards highly efficient combined cycle plants and a leading role in developing hydrogen-ready gas turbine technology. Germany and the UK are key players in this transition.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by rapid industrialization, urbanization, and escalating electricity demand, particularly in China, India, and Southeast Asian nations. Investments in new power generation capacity, often fueled by natural gas, are substantial, alongside growing interest in cleaner energy solutions.

- Latin America: This region presents considerable growth potential due to expanding industrial sectors, growing populations, and the need for reliable power infrastructure. Countries like Brazil and Mexico are investing in gas-fired power to diversify their energy mix and ensure energy security.

- Middle East and Africa (MEA): Rich in natural gas reserves, the MEA region continues to invest heavily in gas turbine power plants to meet burgeoning domestic energy demands and support economic diversification. There is an increasing focus on efficiency and integrating modern power solutions to ensure grid stability and reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Plants Heavy Duty Gas Turbine Market.- General Electric (GE) Power

- Siemens Energy AG

- Mitsubishi Power Ltd.

- Ansaldo Energia S.p.A.

- Kawasaki Heavy Industries Ltd.

- Solar Turbines Incorporated

- MAN Energy Solutions SE

- IHI Corporation

- Vericor Power Systems LLC

- Opra Turbines B.V.

- Centrax Gas Turbines

- MAPNA Group

- Harbin Electric Company Limited

- Bharat Heavy Electricals Limited (BHEL)

- Shanghai Electric Group Co. Ltd.

- NTPC Limited

- Toshiba Energy Systems & Solutions Corporation

- Hitachi Zosen Corporation

- Rolls-Royce plc

- Wartsila Corporation

Frequently Asked Questions

What are heavy-duty gas turbines and their primary use in power plants?

Heavy-duty gas turbines are industrial-grade engines designed for continuous, high-output power generation. Their primary use in power plants is to convert natural gas or other fuels into mechanical energy to drive generators, producing electricity for utility grids and large industrial facilities. They are crucial for base load power, combined cycle operations, and providing grid stability.

What are the main factors driving the growth of the Power Plants Heavy Duty Gas Turbine Market?

The market's growth is primarily driven by rising global electricity demand, especially in developing economies, the need for enhanced energy security, and the ongoing transition from coal to cleaner natural gas for power generation. Technological advancements leading to higher efficiencies, operational flexibility, and the development of hydrogen-ready turbines also contribute significantly.

How do gas turbines contribute to decarbonization efforts in the energy sector?

Gas turbines contribute to decarbonization by offering a lower-carbon alternative to coal-fired power plants. Furthermore, ongoing research and development in hydrogen co-firing and 100% hydrogen combustion technologies allow gas turbines to integrate with future net-zero energy systems, significantly reducing greenhouse gas emissions over their operational lifespan.

What is combined cycle technology and why is it important for gas turbines?

Combined Cycle Gas Turbine (CCGT) technology integrates a gas turbine with a steam turbine. The hot exhaust gases from the gas turbine are used to generate steam, which then drives a separate steam turbine to produce additional electricity. This process significantly increases the overall thermal efficiency of the power plant, making it a highly economical and environmentally beneficial configuration.

What role does Artificial Intelligence (AI) play in optimizing heavy-duty gas turbine operations?

AI plays a transformative role by enabling predictive maintenance, optimizing combustion processes for higher efficiency, and facilitating real-time operational adjustments. AI-driven analytics enhance performance, reduce downtime, improve fuel economy, and integrate gas turbines more effectively within smart grids, leading to more reliable and cost-effective power generation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager